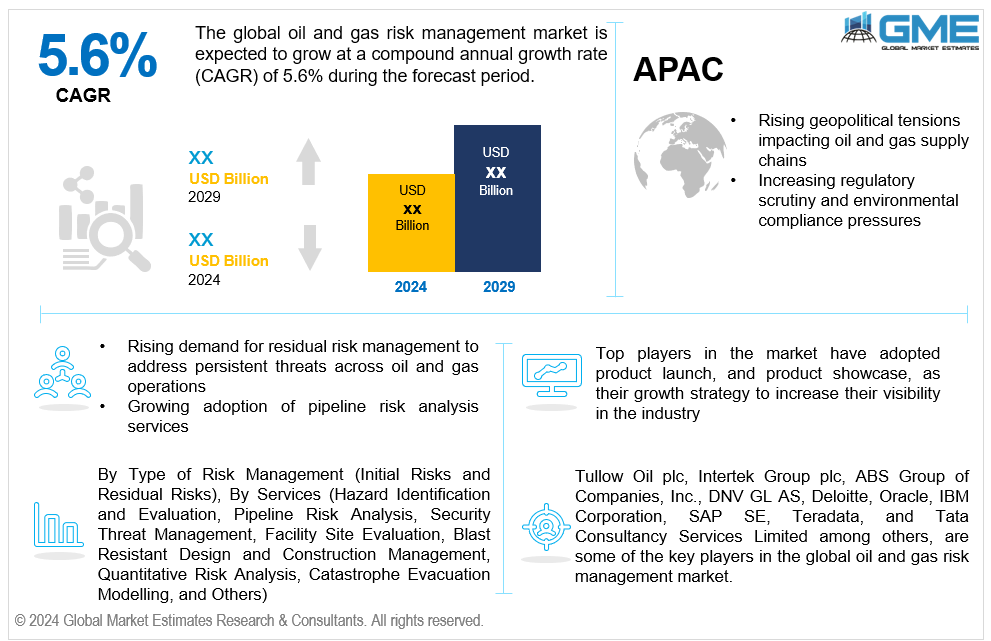

Global Oil and Gas Risk Management Market Size, Trends & Analysis - Forecasts to 2029 By Type of Risk Management (Initial Risks and Residual Risks), By Services (Hazard Identification and Evaluation, Pipeline Risk Analysis, Security Threat Management, Facility Site Evaluation, Blast Resistant Design and Construction Management, Quantitative Risk Analysis, Catastrophe Evacuation Modelling, and Others), By Application (Onshore and Offshore), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global oil and gas risk management market is estimated to exhibit a CAGR of 5.6% from 2024 to 2029.

The primary factors propelling the market growth are the rising geopolitical tensions impacting oil and gas supply chains and the increasing regulatory scrutiny and environmental compliance pressures. As political instability, trade disputes, and regional conflicts increase, oil and gas companies face heightened risks in securing and transporting resources across borders. Disruptions to supply chains can lead to delays, increased operational costs, and potential shortages, forcing companies to implement comprehensive risk management strategies. For instance, companies rely more heavily on advanced risk assessment tools, real-time monitoring, and security threat management to mitigate potential impacts from sudden political shifts or embargoes. Additionally, the need for enhanced pipeline risk analysis and contingency planning is growing as companies strive to maintain operational continuity amidst fluctuating trade policies. This proactive approach to identifying, evaluating, and mitigating geopolitical risks is essential for safeguarding assets and ensuring reliable delivery, making geopolitical risk management an increasingly vital part of oil and gas operations globally.

Rising demand for residual risk management to address persistent threats across oil and gas operations and the growing adoption of pipeline risk analysis services are expected to support market growth. Aging pipelines, environmental regulations, and the rise in pipeline expansions necessitate precise and proactive risk assessments to prevent costly incidents like leaks, ruptures, and contamination. Pipeline risk analysis services provide oil and gas companies with the tools to evaluate the condition and vulnerabilities of their pipelines in real time, allowing for early detection of faults and strategic planning for maintenance. These services often employ advanced technologies like predictive analytics, sensors, and geographic information systems (GIS), which help operators identify high-risk areas and prioritize intervention. As regulations tighten and pipeline failure costs rise, investment in risk analysis services has become essential to meet compliance standards, protect the environment, and ensure uninterrupted fuel supply.

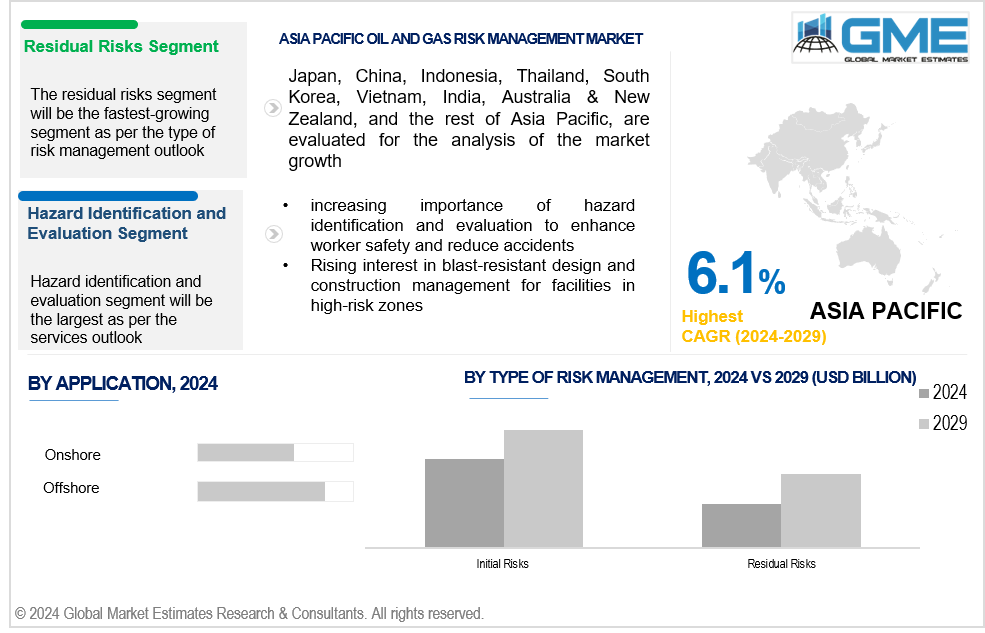

The increasing importance of hazard identification and evaluation to enhance worker safety and reduce accidents and the rising interest in blast-resistant design and construction management for facilities in high-risk zones propel market growth. Oil and gas operations involve hazardous processes with potential risks from toxic gases, high-pressure systems, and flammable materials, making comprehensive hazard evaluation crucial to preventing accidents and safeguarding personnel. By implementing advanced hazard identification tools and evaluation protocols, companies can proactively detect potential threats before they escalate, minimizing operational downtime and liability costs. This proactive approach includes detailed site assessments, regular safety audits, and real-time monitoring technologies, which allow companies to identify high-risk areas and develop targeted safety measures. As industry regulations become more stringent and companies aim to maintain a positive safety record, investment in hazard identification and evaluation solutions has surged, ultimately reducing accidents, protecting workers, and driving demand in the oil and gas risk management market.

As digital operations expand, cybersecurity threats grow, creating an opportunity for risk management providers to offer tailored cybersecurity solutions that protect oil and gas infrastructure, mitigate data breaches, and safeguard valuable operational data from cyber threats. Additionally, predictive maintenance using data analytics presents an opportunity to reduce equipment failure rates, optimize asset lifespans, and minimize downtime, significantly enhancing operational efficiency and reducing risk within oil and gas infrastructure.

However, the complex regulatory environment and resistance to technological adoption impede market growth.

The initial risks residual risks segment is expected to hold the largest share of the market over the forecast period. Initial risk management is crucial for preemptively identifying and addressing potential safety hazards, reducing the likelihood of accidents, and ensuring a safe operational environment, which is a priority for oil and gas companies.

The residual risks segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Real-time surveillance of residual hazards is made possible by the emergence of sophisticated monitoring techniques like AI and IoT sensors. This technology-driven growth is prompting companies to adopt more sophisticated methods to manage ongoing risks throughout the asset lifecycle.

The hazard identification and evaluation (HIE) segment is expected to hold the largest share of the market over the forecast period. To reduce risks associated with safety, environmental impact, and regulatory compliance, companies in the oil and gas industry place a high priority on detecting possible hazards prior to starting operations. HIE is critical for both onshore and offshore operations, making it a highly essential service for ensuring operational safety and efficiency.

The pipeline risk analysis segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. With the growing need to ensure pipeline integrity, prevent leaks, and mitigate environmental hazards, demand for specialized risk analysis services is rising. The integration of advanced technologies like AI and IoT to monitor pipeline conditions in real-time is further driving this growth, especially in regions with aging pipeline networks or expansive new pipeline projects.

The offshore segment is expected to hold the largest share of the market over the forecast period. The need to mitigate risks related to harsh environmental conditions, deep-water exploration, equipment failure, and safety concerns makes offshore risk management crucial. Companies in this segment invest heavily in advanced risk management services, including hazard identification, pipeline risk analysis, and environmental risk assessments to ensure safe and compliant operations in offshore environments.

The onshore segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. As oil and gas companies expand operations into new territories, they face heightened risks related to environmental regulations, security threats, and worker safety. The increasing adoption of digital technologies and automation to mitigate these risks is further contributing to the rapid growth of onshore risk management services.

North America is expected to be the largest region in the global market. North America has an extensive pipeline infrastructure for transporting oil and gas, and ensuring the safety and integrity of these pipelines is crucial. The need for pipeline risk analysis, monitoring, and maintenance services is a major driver of the risk management market in the region.

Asia Pacific is anticipated to witness rapid growth during the forecast period. As oil and gas fields in the Asia Pacific mature, the need to manage residual risks associated with aging infrastructure becomes more important. The increasing focus on asset integrity, maintenance, and repair to prevent failures and accidents is fueling the demand for risk management solutions in the region.

Tullow Oil plc, Intertek Group plc, ABS Group of Companies, Inc., DNV GL AS, Deloitte, Oracle, IBM Corporation, SAP SE, Teradata, and Tata Consultancy Services Limited among others, are some of the key players in the global oil and gas risk management market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL OIL AND GAS RISK MANAGEMENT MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL OIL AND GAS RISK MANAGEMENT MARKET, BY TYPE OF RISK MANAGEMENT

4.1 Introduction

4.2 Oil and Gas Risk Management Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Initial Risks

4.4.1 Initial Risks Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Residual Risks

4.5.1 Residual Risks Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL OIL AND GAS RISK MANAGEMENT MARKET, BY SERVICES

5.1 Introduction

5.2 Oil and Gas Risk Management Market: Services Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Hazard Identification and Evaluation

5.4.1 Hazard Identification and Evaluation Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Pipeline Risk Analysis

5.5.1 Pipeline Risk Analysis Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Security Threat Management

5.6.1 Security Threat Management Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Facility Site Evaluation

5.7.1 Facility Site Evaluation Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Blast Resistant Design and Construction Management

5.8.1 Blast Resistant Design and Construction Management Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Quantitative Risk Analysis

5.9.1 Quantitative Risk Analysis Market Estimates and Forecast, 2021-2029 (USD Million)

5.10 Catastrophe Evacuation Modelling

5.10.1 Catastrophe Evacuation Modelling Market Estimates and Forecast, 2021-2029 (USD Million)

5.11 Others

5.11.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL OIL AND GAS RISK MANAGEMENT MARKET, BY APPLICATION

6.1 Introduction

6.2 Oil and Gas Risk Management Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Onshore

6.4.1 Onshore Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Offshore

6.5.1 Offshore Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL OIL AND GAS RISK MANAGEMENT MARKET, BY REGION

7.1 Introduction

7.2 North America Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Type of Risk Management

7.2.2 By Services

7.2.3 By Application

7.2.4 By Country

7.2.4.1 U.S. Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Type of Risk Management

7.2.4.1.2 By Services

7.2.4.1.3 By Application

7.2.4.2 Canada Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Type of Risk Management

7.2.4.2.2 By Services

7.2.4.2.3 By Application

7.2.4.3 Mexico Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Type of Risk Management

7.2.4.3.2 By Services

7.2.4.3.3 By Application

7.3 Europe Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Type of Risk Management

7.3.2 By Services

7.3.3 By Application

7.3.4 By Country

7.3.4.1 Germany Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Type of Risk Management

7.3.4.1.2 By Services

7.3.4.1.3 By Application

7.3.4.2 U.K. Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Type of Risk Management

7.3.4.2.2 By Services

7.3.4.2.3 By Application

7.3.4.3 France Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Type of Risk Management

7.3.4.3.2 By Services

7.3.4.3.3 By Application

7.3.4.4 Italy Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Type of Risk Management

7.3.4.4.2 By Services

7.2.4.4.3 By Application

7.3.4.5 Spain Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Type of Risk Management

7.3.4.5.2 By Services

7.2.4.5.3 By Application

7.3.4.6 Netherlands Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Type of Risk Management

7.3.4.6.2 By Services

7.2.4.6.3 By Application

7.3.4.7 Rest of Europe Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Type of Risk Management

7.3.4.7.2 By Services

7.2.4.7.3 By Application

7.4 Asia Pacific Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Type of Risk Management

7.4.2 By Services

7.4.3 By Application

7.4.4 By Country

7.4.4.1 China Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Type of Risk Management

7.4.4.1.2 By Services

7.4.4.1.3 By Application

7.4.4.2 Japan Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Type of Risk Management

7.4.4.2.2 By Services

7.4.4.2.3 By Application

7.4.4.3 India Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Type of Risk Management

7.4.4.3.2 By Services

7.4.4.3.3 By Application

7.4.4.4 South Korea Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Type of Risk Management

7.4.4.4.2 By Services

7.4.4.4.3 By Application

7.4.4.5 Singapore Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Type of Risk Management

7.4.4.5.2 By Services

7.4.4.5.3 By Application

7.4.4.6 Malaysia Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Type of Risk Management

7.4.4.6.2 By Services

7.4.4.6.3 By Application

7.4.4.7 Thailand Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Type of Risk Management

7.4.4.7.2 By Services

7.4.4.7.3 By Application

7.4.4.8 Indonesia Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Type of Risk Management

7.4.4.8.2 By Services

7.4.4.8.3 By Application

7.4.4.9 Vietnam Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Type of Risk Management

7.4.4.9.2 By Services

7.4.4.9.3 By Application

7.4.4.10 Taiwan Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Type of Risk Management

7.4.4.10.2 By Services

7.4.4.10.3 By Application

7.4.4.11 Rest of Asia Pacific Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Type of Risk Management

7.4.4.11.2 By Services

7.4.4.11.3 By Application

7.5 Middle East and Africa Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Type of Risk Management

7.5.2 By Services

7.5.3 By Application

7.5.4 By Country

7.5.4.1 Saudi Arabia Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Type of Risk Management

7.5.4.1.2 By Services

7.5.4.1.3 By Application

7.5.4.2 U.A.E. Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Type of Risk Management

7.5.4.2.2 By Services

7.5.4.2.3 By Application

7.5.4.3 Israel Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Type of Risk Management

7.5.4.3.2 By Services

7.5.4.3.3 By Application

7.5.4.4 South Africa Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Type of Risk Management

7.5.4.4.2 By Services

7.5.4.4.3 By Application

7.5.4.5 Rest of Middle East and Africa Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Type of Risk Management

7.5.4.5.2 By Services

7.5.4.5.2 By Application

7.6 Central and South America Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Type of Risk Management

7.6.2 By Services

7.6.3 By Application

7.6.4 By Country

7.6.4.1 Brazil Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Type of Risk Management

7.6.4.1.2 By Services

7.6.4.1.3 By Application

7.6.4.2 Argentina Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Type of Risk Management

7.6.4.2.2 By Services

7.6.4.2.3 By Application

7.6.4.3 Chile Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Type of Risk Management

7.6.4.3.2 By Services

7.6.4.3.3 By Application

7.6.4.4 Rest of Central and South America Oil and Gas Risk Management Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Type of Risk Management

7.6.4.4.2 By Services

7.6.4.4.3 By Application

8 COMPETITIVE LANDSCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Tullow Oil plc

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Intertek Group plc

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 ABS Group of Companies, Inc.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 DNV GL AS

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Deloitte

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 ORACLE

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 IBM Corporation

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 SAP SE

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Teradata

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Tata Consultancy Services Limited

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

2 Initial Risks Market, By Region, 2021-2029 (USD Million)

3 Residual Risks Market, By Region, 2021-2029 (USD Million)

4 Global Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

5 Hazard Identification and Evaluation Market, By Region, 2021-2029 (USD Million)

6 Pipeline Risk Analysis Market, By Region, 2021-2029 (USD Million)

7 Security Threat Management Market, By Region, 2021-2029 (USD Million)

8 Facility Site Evaluation Market, By Region, 2021-2029 (USD Million)

9 Blast Resistant Design and Construction Management Market, By Region, 2021-2029 (USD Million)

10 Quantitative Risk Analysis Market, By Region, 2021-2029 (USD Million)

11 Catastrophe Evacuation Modelling Market, By Region, 2021-2029 (USD Million)

12 Others Market, By Region, 2021-2029 (USD Million)

13 Global Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

14 Onshore Market, By Region, 2021-2029 (USD Million)

15 Offshore Market, By Region, 2021-2029 (USD Million)

16 Regional Analysis, 2021-2029 (USD Million)

17 North America Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

18 North America Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

19 North America Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

20 North America Oil and Gas Risk Management Market, By Country, 2021-2029 (USD Million)

21 U.S Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

22 U.S Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

23 U.S Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

24 Canada Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

25 Canada Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

26 Canada Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

27 Mexico Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

28 Mexico Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

29 Mexico Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

30 Europe Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

31 Europe Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

32 Europe Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

33 Europe Oil and Gas Risk Management Market, By Country 2021-2029 (USD Million)

34 Germany Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

35 Germany Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

36 Germany Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

37 U.K Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

38 U.K Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

39 U.K Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

40 France Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

41 France Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

42 France Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

43 Italy Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

44 Italy Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

45 Italy Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

46 Spain Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

47 Spain Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

48 Spain Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

49 Netherlands Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

50 Netherlands Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

51 Netherlands Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

52 Rest Of Europe Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

53 Rest Of Europe Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

54 Rest of Europe Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

55 Asia Pacific Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

56 Asia Pacific Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

57 Asia Pacific Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

58 Asia Pacific Oil and Gas Risk Management Market, By Country, 2021-2029 (USD Million)

59 China Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

60 China Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

61 China Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

62 India Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

63 India Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

64 India Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

65 Japan Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

66 Japan Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

67 Japan Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

68 South Korea Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

69 South Korea Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

70 South Korea Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

71 malaysia Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

72 malaysia Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

73 malaysia Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

74 Thailand Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

75 Thailand Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

76 Thailand Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

77 Indonesia Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

78 Indonesia Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

79 Indonesia Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

80 Vietnam Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

81 Vietnam Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

82 Vietnam Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

83 Taiwan Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

84 Taiwan Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

85 Taiwan Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

86 Rest of Asia Pacific Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

87 Rest of Asia Pacific Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

88 Rest of Asia Pacific Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

89 Middle East and Africa Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

90 Middle East and Africa Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

91 Middle East and Africa Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

92 Middle East and Africa Oil and Gas Risk Management Market, By Country, 2021-2029 (USD Million)

93 Saudi Arabia Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

94 Saudi Arabia Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

95 Saudi Arabia Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

96 UAE Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

97 UAE Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

98 UAE Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

99 Israel Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

100 Israel Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

101 Israel Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

102 South Africa Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

103 South Africa Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

104 South Africa Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

105 Rest of Middle East and Africa Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

106 Rest of Middle East and Africa Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

107 Rest of Middle East and Africa Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

108 Central and South America Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

109 Central and South America Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

110 Central and South America Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

111 Central and South America Oil and Gas Risk Management Market, By Country, 2021-2029 (USD Million)

112 Brazil Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

113 Brazil Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

114 Brazil Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

115 Argentina Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

116 Argentina Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

117 Argentina Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

118 Chile Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

119 Chile Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

120 Chile Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

121 Rest of Central and South America Oil and Gas Risk Management Market, By Type of Risk Management, 2021-2029 (USD Million)

122 Rest of Central and South America Oil and Gas Risk Management Market, By Services, 2021-2029 (USD Million)

123 Rest of Central and South America Oil and Gas Risk Management Market, By Application, 2021-2029 (USD Million)

124 Tullow Oil plc: Products & Services Offering

125 Intertek Group plc: Products & Services Offering

126 ABS Group of Companies, Inc.: Products & Services Offering

127 DNV GL AS: Products & Services Offering

128 Deloitte: Products & Services Offering

129 ORACLE: Products & Services Offering

130 IBM Corporation: Products & Services Offering

131 SAP SE: Products & Services Offering

132 Teradata, Inc: Products & Services Offering

133 Tata Consultancy Services Limited: Products & Services Offering

134 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Oil and Gas Risk Management Market Overview

2 Global Oil and Gas Risk Management Market Value From 2021-2029 (USD Million)

3 Global Oil and Gas Risk Management Market Share, By Type of Risk Management (2023)

4 Global Oil and Gas Risk Management Market Share, By Services (2023)

5 Global Oil and Gas Risk Management Market Share, By Application (2023)

6 Global Oil and Gas Risk Management Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Oil and Gas Risk Management Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Oil and Gas Risk Management Market

11 Impact Of Challenges On The Global Oil and Gas Risk Management Market

12 Porter’s Five Forces Analysis

13 Global Oil and Gas Risk Management Market: By Type of Risk Management Scope Key Takeaways

14 Global Oil and Gas Risk Management Market, By Type of Risk Management Segment: Revenue Growth Analysis

15 Initial Risks Market, By Region, 2021-2029 (USD Million)

16 Residual Risks Market, By Region, 2021-2029 (USD Million)

17 Global Oil and Gas Risk Management Market: By Services Scope Key Takeaways

18 Global Oil and Gas Risk Management Market, By Services Segment: Revenue Growth Analysis

19 Hazard Identification and Evaluation Market, By Region, 2021-2029 (USD Million)

20 Pipeline Risk Analysis Market, By Region, 2021-2029 (USD Million)

21 Security Threat Management Market, By Region, 2021-2029 (USD Million)

22 Facility Site Evaluation Market, By Region, 2021-2029 (USD Million)

23 Blast Resistant Design and Construction Management Market, By Region, 2021-2029 (USD Million)

24 Quantitative Risk Analysis Market, By Region, 2021-2029 (USD Million)

25 Catastrophe Evacuation Modelling Market, By Region, 2021-2029 (USD Million)

26 Others Market, By Region, 2021-2029 (USD Million)

27 Global Oil and Gas Risk Management Market: By Application Scope Key Takeaways

28 Global Oil and Gas Risk Management Market, By Application Segment: Revenue Growth Analysis

29 Onshore Market, By Region, 2021-2029 (USD Million)

30 Offshore Market, By Region, 2021-2029 (USD Million)

31 Regional Segment: Revenue Growth Analysis

32 Global Oil and Gas Risk Management Market: Regional Analysis

33 North America Oil and Gas Risk Management Market Overview

34 North America Oil and Gas Risk Management Market, By Type of Risk Management

35 North America Oil and Gas Risk Management Market, By Services

36 North America Oil and Gas Risk Management Market, By Application

37 North America Oil and Gas Risk Management Market, By Country

38 U.S. Oil and Gas Risk Management Market, By Type of Risk Management

39 U.S. Oil and Gas Risk Management Market, By Services

40 U.S. Oil and Gas Risk Management Market, By Application

41 Canada Oil and Gas Risk Management Market, By Type of Risk Management

42 Canada Oil and Gas Risk Management Market, By Services

43 Canada Oil and Gas Risk Management Market, By Application

44 Mexico Oil and Gas Risk Management Market, By Type of Risk Management

45 Mexico Oil and Gas Risk Management Market, By Services

46 Mexico Oil and Gas Risk Management Market, By Application

47 Four Quadrant Positioning Matrix

48 Company Market Share Analysis

49 Tullow Oil plc: Company Snapshot

50 Tullow Oil plc: SWOT Analysis

51 Tullow Oil plc: Geographic Presence

52 Intertek Group plc: Company Snapshot

53 Intertek Group plc: SWOT Analysis

54 Intertek Group plc: Geographic Presence

55 ABS Group of Companies, Inc.: Company Snapshot

56 ABS Group of Companies, Inc.: SWOT Analysis

57 ABS Group of Companies, Inc.: Geographic Presence

58 DNV GL AS: Company Snapshot

59 DNV GL AS: Swot Analysis

60 DNV GL AS: Geographic Presence

61 Deloitte: Company Snapshot

62 Deloitte: SWOT Analysis

63 Deloitte: Geographic Presence

64 ORACLE: Company Snapshot

65 ORACLE: SWOT Analysis

66 ORACLE: Geographic Presence

67 IBM Corporation : Company Snapshot

68 IBM Corporation : SWOT Analysis

69 IBM Corporation : Geographic Presence

70 SAP SE: Company Snapshot

71 SAP SE: SWOT Analysis

72 SAP SE: Geographic Presence

73 Teradata, Inc.: Company Snapshot

74 Teradata, Inc.: SWOT Analysis

75 Teradata, Inc.: Geographic Presence

76 Tata Consultancy Services Limited: Company Snapshot

77 Tata Consultancy Services Limited: SWOT Analysis

78 Tata Consultancy Services Limited: Geographic Presence

79 Other Companies: Company Snapshot

80 Other Companies: SWOT Analysis

81 Other Companies: Geographic Presence

The Global Oil and Gas Risk Management Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Oil and Gas Risk Management Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS