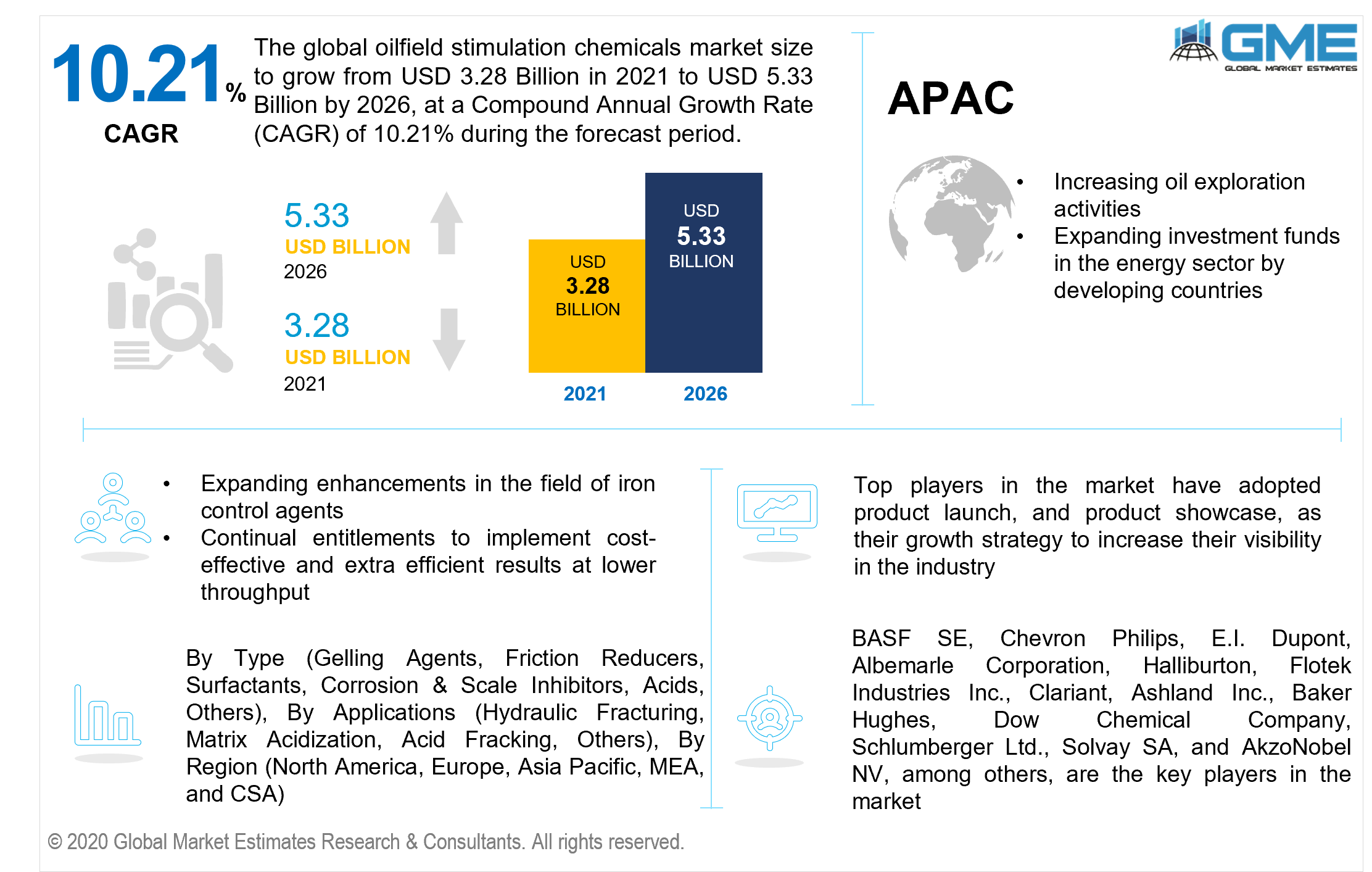

Global Oilfield Stimulation Chemicals Market Size, Trends & Analysis - Forecasts to 2026 By Type (Gelling Agents, Friction Reducers, Surfactants, Corrosion & Scale Inhibitors, Acids, Others), By Applications (Hydraulic Fracturing, Matrix Acidization, Acid Fracking, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); Competitive Landscape, End-User Landscape, Company Market Share Analysis & Competitor Analysis

The global oilfield stimulation chemicals market is estimated to be valued at USD 3.28 billion in 2021 and is projected to reach USD 5.33 billion by 2026 at a CAGR of 10.21%. The global oilfield stimulation chemicals market is expanding rapidly. This advancement can be ascribed to factors including the prospect for enhancements in the field of iron control agents, entitlements to implement cost-effective and extra efficient results at lower throughput, and deploying groundbreaking goods and services in the global oilfield stimulation chemicals market.

The oilfield services industry outlook demonstrates that significant advancements in shale oil and gas manufacturing are the principal driver of market development. Besides that, its significant perks in the fracturing and acid treatment processes are assumed to drive up demand for these additives. Increasing ecological considerations during well stimulation, and also restrictive government laws and rules, have the potential to alter market intricacies throughout the forecast period.

The oilfield market report indicates that a few stimulation chemical compounds restrict the ability to drill at profundity, which could stifle market expansion. Consequently, constant chemical research & development to overcome the benefits could result in profitable ventures by the end of the forecast period. As an example, breakthroughs in iron stabilizer agents that offer improved outcomes while remaining cost-effective can increase demand for oil stimulation chemicals.

According to the comprehensive analysis, the oil field services industry report indicates that skyrocketing demand for onshore implementations will support the overall market growth. The market for oilfield services is foreseen to be driven by considerations including an increment in demand for sophisticated technology, techniques, and devices to improve the productivity of discovery and manufacturing operations in onshore and offshore regions.

Significant implications from oilfield services industry analysis are that numerous key players are offering a wide range of high-quality oilfield chemicals for a myriad range of applications, including drilling, cementing, stimulation, and production additives. These high demand chemicals empower the customer base to maximize valuation in their oilfield operational activities and improve cumulative well productivity.

Leakage in the oil and gas industry could severely impede the market growth. To decrease the ecological effect, government agencies and private organizations are emphasizing the use of renewable/green energies. Government incentives and campaigns to use electric vehicles and implement solar panels, for example, can limit market expansion. However, the oilfield stimulation chemical market has a bright future, with prospects for hydraulic fracturing, matrix treatments, and acid fracking. Increased oil output and increased deep mining activities are the primary expansion enablers for the oilfield services market.

Oil market research suggests that increasing the quantity and length of wells drilled necessitates wider amounts of oilfield liquids and an expanding clamor for oilfield chemicals, notably those that are used in drilling and completion operations. Unorthodox drilling operations continue to dominate, driving requirements for stimulation chemicals. During the forecast period, a surging requirement for petroleum-based fuel from the automotive industry is presumed to drive market demand.

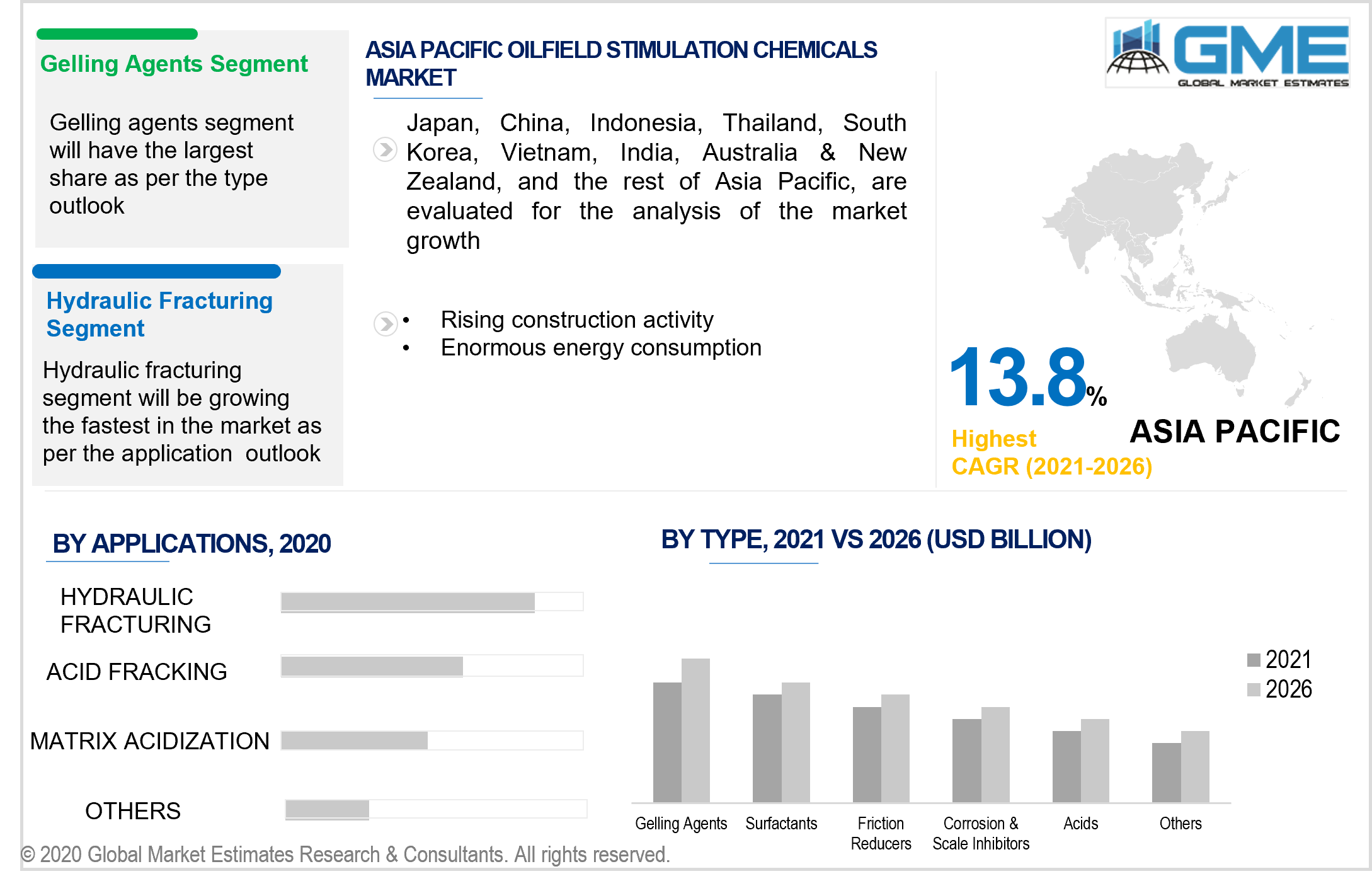

Depending on the type, the market is categorized as gelling agents, friction reducers, surfactants, corrosion & scale inhibitors, acids, and others. Gelling agents are foreseen to predominate. Gelling agents serve as the launching point for the majority of conventional crosslinker fluid mechanisms. These gelling agents, when combined with other materials, offer fluid loss autonomy, viscosity regulation, and proppant hauling capability.

Gelling agents guarantee that proppants are placed correctly during hydraulic fracturing. They produce effective rheology for matrix stimulation treatments when combined with acids. The provision of a wide spectrum of premium brands that are congruent gelling operatives for acid-based fluids commonly used in acid fracturing is increasing, which is eventually aiding in the supremacy of this market segment.

Depending on the application, the market is categorized as hydraulic fracturing, matrix acidization, acid fracking, and others. Hydraulic fracturing is foreseen to predominate. Hydraulic fracturing, often regarded as fracking, utilizes water pressure to develop fissures in-depth underground shale rock structures in order to discharge natural gas and oil. Breakthroughs in fracking and horizontal drilling advancements have liberated multitudes of natural gas and barrels of oil, while also creating a myriad of job opportunities and generating massive volumes of economic operation. This shale energy revolution has elevated America to the world's leading manufacturer of natural gas and oil, resulting in reduced energy rates for customers in a safer, greener, and more trustworthy manner.

North America is expected to persist as the world's largest regional market. The increase in oil and gas exploration operations, especially in the United States and Canada, is boosting this region's market advancement. The vast imperative for power in North America will continue to incentivize the development of its vast unorthodox power sources, predominantly natural fuel.

The energy sector in the area is a well-established and sophisticated category as a result of its expanding implementations in the workover & attainment and manufacturing sectors, and its clamor is also dependent on the proportion of active wells in numerous reservoirs. The inclusion of massive onshore and offshore reservoirs is a significant driving determinant for the market in this region. The exploration of shale gas reservoirs in North America provides additional expansion prospects for the overall market.

During the forecast period, the Asia Pacific region's market is assumed to grow at a phenomenal rate. Construction activity is presumed to increase, as are sizeable investment funds in the energy sector by developing countries such as India and China. China's enormous energy consumption will commence propelling the country's exploration and advancement of its vast unconventional energy resources, particularly natural fuel.

BASF SE, Chevron Philips, E.I. Dupont, Albemarle Corporation, Halliburton, Flotek Industries Inc., Clariant, Ashland Inc., Baker Hughes, Dow Chemical Company, Schlumberger Ltd., Solvay SA, and AkzoNobel NV, among others, are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Oilfield Stimulation Chemicals Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Applications Overview

2.1.4 Regional Overview

Chapter 3 Global Oilfield Stimulation Chemicals Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Elevating Production of Crude Oil

3.3.1.2 Increasing Deep Drilling Operations

3.3.2 Industry Challenges

3.3.2.1 Low Cost of Crude Oil

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Applications Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Oilfield Stimulation Chemicals Market, By Type

4.1 Type Outlook

4.2 Gelling Agents

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Friction Reducers

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.2 Surfactants

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Corrosion & Scale Inhibitors

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.2 Acids

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Others

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Global Oilfield Stimulation Chemicals Market, By Applications

5.1 Applications Outlook

5.2 Hydraulic Fracturing

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Matrix Acidization

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Acid Fracking

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

5.5 Others

5.5.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Global Oilfield Stimulation Chemicals Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Billion)

6.2.2 Market Size, By Type, 2019-2026 (USD Billion)

6.2.3 Market Size, By Applications, 2019-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.2.4.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.2.5.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Billion)

6.3.2 Market Size, By Type, 2019-2026 (USD Billion)

6.3.3 Market Size, By Applications, 2019-2026 (USD Billion)

6.3.4 Germany

6.2.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.2.4.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.5.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.6.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.7.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.8.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.9.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Billion)

6.4.2 Market Size, By Type, 2019-2026 (USD Billion)

6.4.3 Market Size, By Applications, 2019-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.4.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.5.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.6.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.7.2 Market size, By Applications, 2019-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.8.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Billion)

6.5.2 Market Size, By Type, 2019-2026 (USD Billion)

6.5.3 Market Size, By Applications, 2019-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.5.4.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.5.5.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2019-2026 (USD Billion)

6.5.6.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Billion)

6.6.2 Market Size, By Type, 2019-2026 (USD Billion)

6.6.3 Market Size, By Applications, 2019-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.6.4.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.6.5.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2019-2026 (USD Billion)

6.6.6.2 Market Size, By Applications, 2019-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 BASF SE

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Chevron Philips

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 E.I. Dupont

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Albemarle Corporation

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Halliburton

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Flotek Industries Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Clariant

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Ashland Inc.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Baker Hughes

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Dow Chemical Company

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Schlumberger Ltd.

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Solvay SA

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 AkzoNobel NV

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Other Companies

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

The Global Oilfield Stimulation Chemicals Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Oilfield Stimulation Chemicals Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS