Global Oilfield Surfactants Market Size, Trends & Analysis - Forecasts to 2026 By Product (Anionic, Non-Ionic, Cationic, Amphoteric, Silicone), By Source (Synthetic, Bio-Based), By Application (Stimulation Flowback/ Fluid Recovery, Enhanced Oil Recovery, Foamers, Drilling Surfactants, Rig Wash Solutions/Cleaners, Wetting Agents, Surface Active Materials, Emulsion Breakers, Non-Emulsifiers, Spacers), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

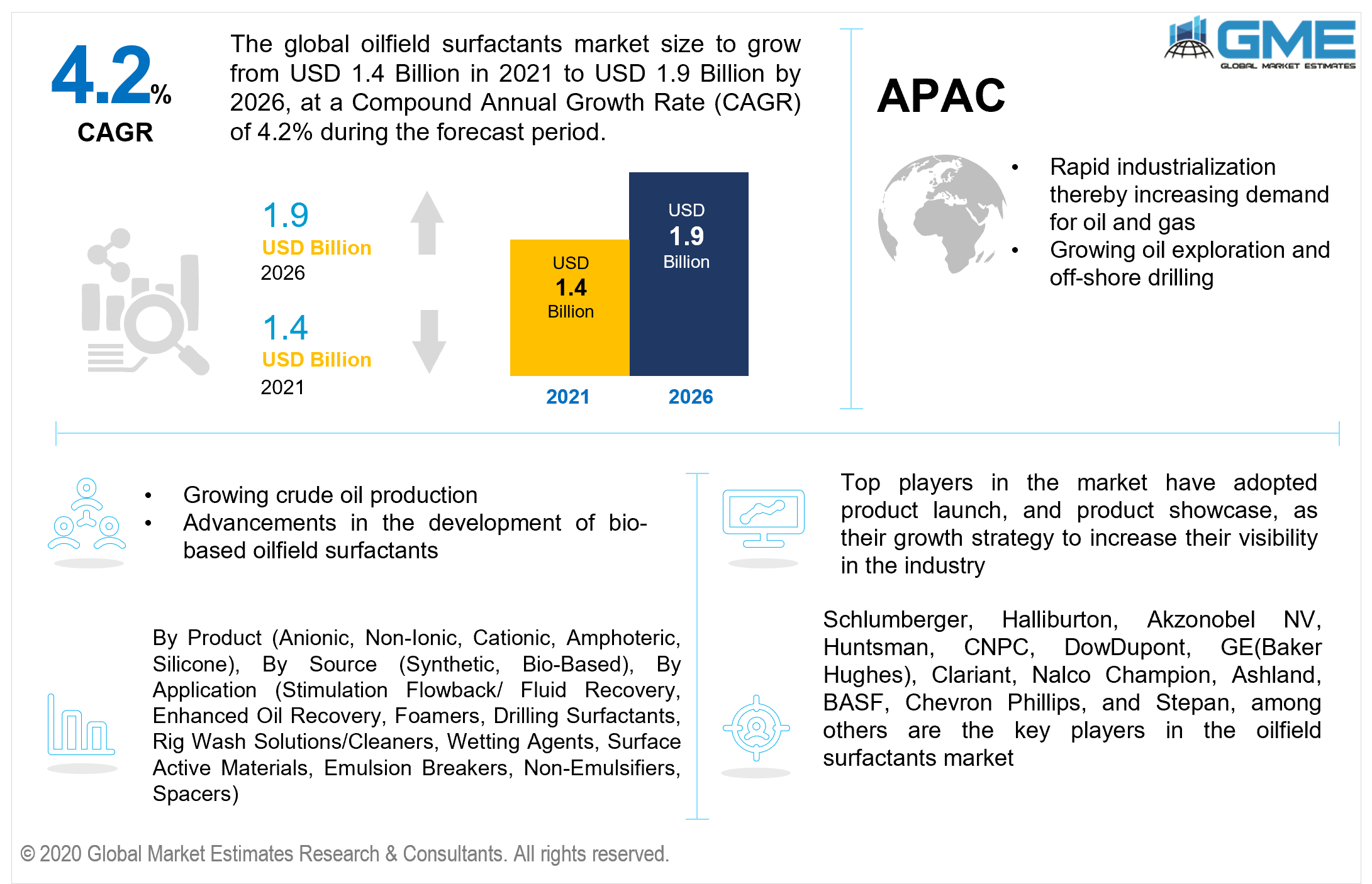

The global oilfield surfactants market is projected to grow from USD 1.4 billion in 2021 to USD 1.9 billion by 2026 at a CAGR value of 4.2% from 2021 to 2026.

Surfactants are capable of reducing the surface tension between interfaces of water and oil or water and air. Surfactants have been beneficial to the oil & gas industry. Surfactants have found multiple uses in the oil and gas industry, especially in oilfields to improve crude oil recovery efficiencies. Research has shown that oilfield surfactants can improve the recovery rate of crude oil by 10~20%.

Increased reliance on surfactants in oil exploration across various nations has been one of the major drivers of the market. The growing crude oil production has been a major contributor to the growth of the market. Collectively, over 100.60 million barrels of crude oil were produced per day in 2019, growing from over 98.1 million barrels per day in 2018, according to statistics from BP.

Oilfield surfactants have a wide range of applications in almost every stage of crude oil production such as drilling, production, refining, enhanced oil recovery, and stimulation in the oil and gas industry, which has increased the demand for these surfactants. The oilfield surfactants market has been restrained by the growing environmental concerns surrounding the use of non-renewable energy sources as it leaves large carbon footprints. The growing demand for renewable energy resources and plans by the government to eliminate its dependence on oil and gas are also expected to have an impact on the demand for these surfactants during the forecast period. Global surfactant & oilfield chemicals manufacturers have been focusing on the development of bio-based surfactants to reduce the harmful environmental impact of conventional oilfield surfactants.

The COVID-19 pandemic has had heavy repercussions on the surfactant oil and gas industry. Initial lockdowns across the globe saw crude oil prices fell drastically lows as the world stood still. The surfactant industry has been slowly recovering since 2020, as crude oil production rose and is envisaged to continue its recovery during the forecast period of 2021 to 2026. GME’s oilfield surfactants market report provides further insights into the drivers, opportunities, and restraints affecting oilfield surfactant industries.

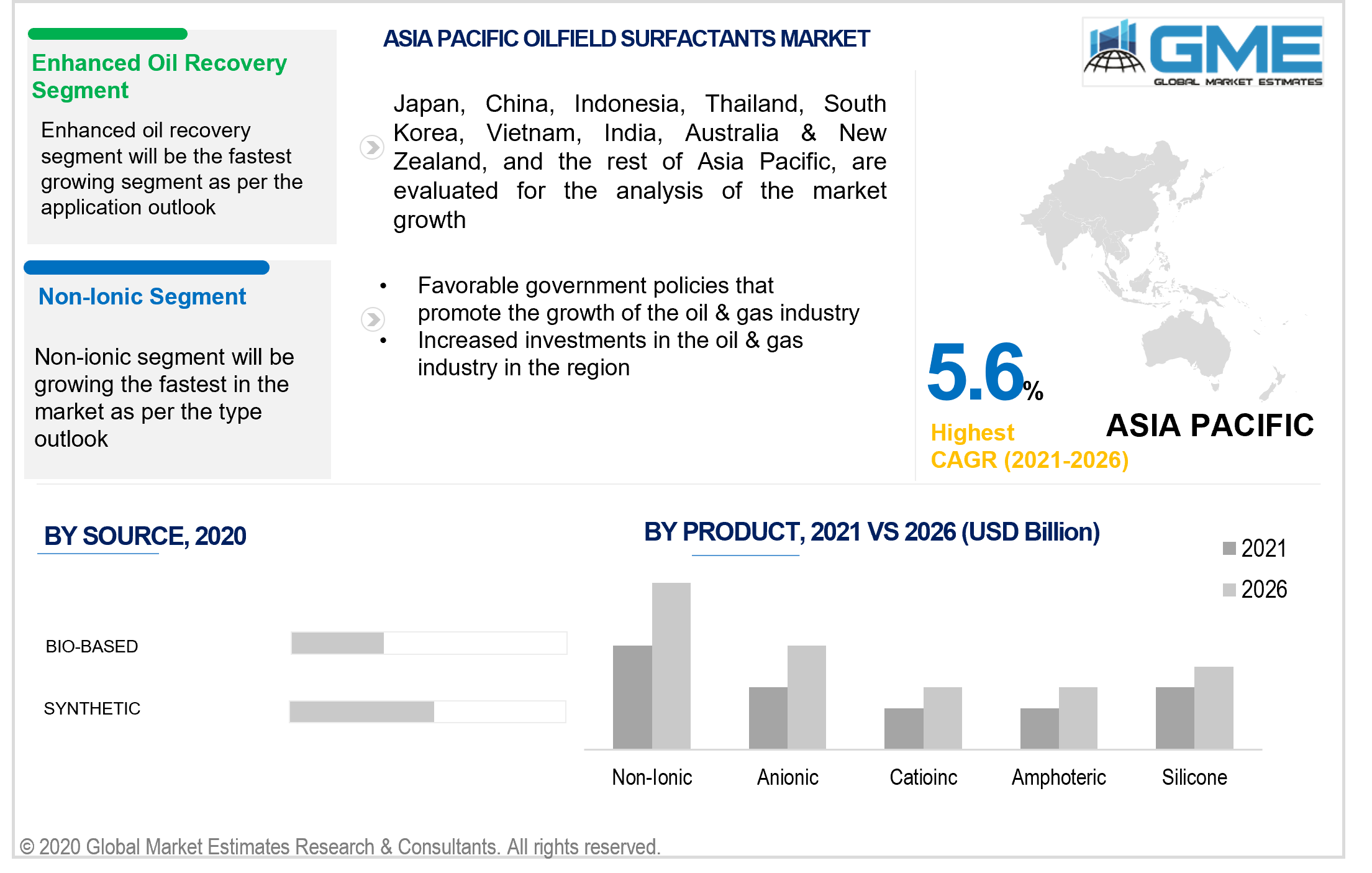

Based on the products available, the market can be segmented into anionic, non-ionic, cationic, amphoteric, and silicone. The market is dominated by the non-ionic segment. The growing oil exploration by oil and gas companies in developing nations has been the major factor that has been instrumental for the growth of the non-ionic segment. These surfactants are beneficial in the emulsification of fluids and are cheaper than other forms of surfactants. These factors are expected to have a positive impact on the growth of the non-ionic segment and contribute to this segment becoming the fastest-growing segment.

Based on the source from which these surfactants are produced, the market can be segmented into synthetic and bio-based segments. The synthetic segment is expected to hold the dominant share of the market during the forecast period. Synthetic surfactants are cheaper to manufacture and show better results compared to bio-based surfactants. The bio-based segment is expected to show better growth rates than the synthetic segment during the forecast period. The bio-based segment has been driven by increasing government regulations that have forced oil & gas companies to reduce their carbon footprint. The reduced toxicity, biodegradability, and longer shelf lives of bio-based surfactants compared to synthetic surfactants are expected to positively impact the growth of the bio-based segment.

Based on the applications of oilfield surfactants, the market can be segmented into stimulation flowback/ fluid recovery, enhanced oil recovery, foamers, wetting agents, emulsion breakers, non-emulsifiers, spacers, among other segments. The enhanced oil recovery segment is envisaged to hold the lion’s share of the market. Growing off-shore drilling projects across the Asia Pacific, North America, and the Middle East are expected to have a positive impact on the growth of the oil recovery segment resulting in this segment becoming the fastest-growing segment. The industrial development and growing energy requirements in these regions are expected to have a positive impact on the growth of the enhanced oil recovery segment.

Based on region, the market can be broken into various regions such as North America, Europe, Central & South America, Middle East & Africa and Asia Pacific regions. The North American region is expected to be the dominant segment in the market during the forecast period. North America is one of the largest crude oil-producing regions in the world. The United States produced over 19 percent of the world’s total crude oil production in 2020, and the country has been the top oil producer in the world over the past six years (as of 2021). Canada is also one of the top five producers of crude oil in the world. The large presence of the oil & gas industry in the region has been one of the major contributors to the dominance of this segment.

APAC region is envisaged to log significantly greater growth rates than the other regions during the forecast period followed by the Middle East and North Africa. Growing industrial manufacturing sector and the large demand for energy combined with favorable policies for the oil & gas industry in various countries in the region is expected to have a significantly positive impact on the demand for oilfield surfactants in the region.

Schlumberger, Halliburton, Akzonobel NV, Huntsman, CNPC, DowDupont, GE (Baker Hughes), Clariant, Nalco Champion, Ashland, BASF, Chevron Phillips, and Stepan, among others are the key players in the oilfield surfactants market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Oilfield Surfactants Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Source Overview

2.1.3 Product Overview

2.1.4 Application Overview

2.1.6 Regional Overview

Chapter 3 Oilfield Surfactants Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing energy requirement due to rapid industrialization

3.3.2 Industry Challenges

3.3.2.1 Rising environmental concerns and the growing need to reduce carbon footprint

3.4 Prospective Growth Scenario

3.4.1 Source Growth Scenario

3.4.2 Product Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Oilfield Surfactants Market, By Source

4.1 Source Outlook

4.2 Synthetic

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Bio-Based

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Oilfield Surfactants Market, By Product

5.1 Product Outlook

5.2 Anionic

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Cationic

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Amphoteric

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Non-Ionic

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Silicone

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Oilfield Surfactants Market, By Application

6.1 Stimulation Flowback/ Fluid Recovery

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Enhanced Oil Recovery

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Foamers

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Drilling Surfactants

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Rig Wash Solutions/Cleaners

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

6.6 Wetting Agents

6.6.1 Market Size, By Region, 2020-2026 (USD Billion)

6.7 Surface Active Materials

6.7.1 Market Size, By Region, 2020-2026 (USD Billion)

6.8 Emulsion Breakers

6.8.1 Market Size, By Region, 2020-2026 (USD Billion)

6.9 Non-Emulsifiers

6.9.1 Market Size, By Region, 2020-2026 (USD Billion)

6.10 Spacers

6.10.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Oilfield Surfactants Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Source, 2020-2026 (USD Billion)

7.2.3 Market Size, By Product, 2020-2026 (USD Billion)

7.2.4 Market Size, By Application, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Source, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Product, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Source, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Source, 2020-2026 (USD Billion)

7.3.3 Market Size, By Product, 2020-2026 (USD Billion)

7.3.4 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Source, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Source, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Source, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Source, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Source, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Source, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Source, 2020-2026 (USD Billion)

7.4.3 Market Size, By Product, 2020-2026 (USD Billion)

7.4.4 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Source, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Source, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Source, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Source, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Product, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Source, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Source, 2020-2026 (USD Billion)

7.5.3 Market Size, By Product, 2020-2026 (USD Billion)

7.5.4 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Source, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Source, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Source, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Source, 2020-2026 (USD Billion)

7.6.3 Market Size, By Product, 2020-2026 (USD Billion)

7.6.4 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Source, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Source, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Source, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Schlumberger

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Halliburton

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Akzonobel NV

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Huntsman

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 CNPC

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 DowDupont

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 GE(Baker Hughes)

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Clariant

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Nalco Champion

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Oilfield Surfactants Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Oilfield Surfactants Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS