Global Oncology Sequencing Market Size, Trends & Analysis - Forecasts to 2027 By Technology (Whole-Genome Sequencing, Exome Sequencing, Targeted Sequencing, RNA Sequencing), By Product (Instruments & Platforms, Reagents & Other Consumables), By Application (Clinical and Research), By Indication (Breast Cancer, Ovarian Cancer, Prostate Cancer, Lung Cancer, Colorectal Cancer, Melanoma, Cervical Cancer, Others), By End-use (Pharmaceutical & Biotechnology Company, Academic & Government Research Institutes, and Others), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

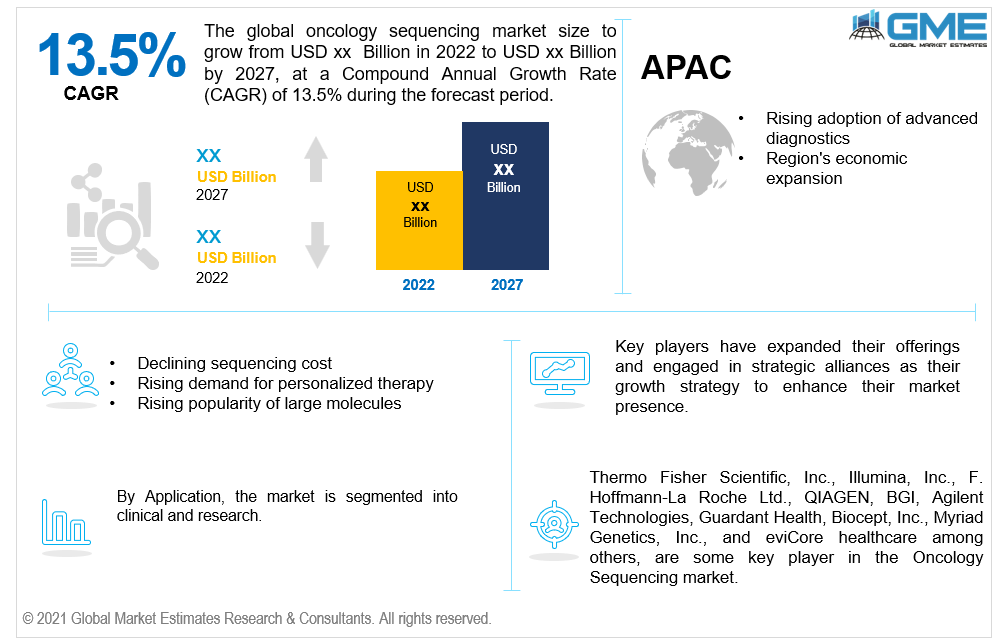

The global oncology sequencing market is projected to grow at a CAGR value of 13.5% from 2022 to 2027. Constant development in high throughput sequencing and ancillary workflows has significantly expanded the implementation of genome sequencing in cancer-related research and development. This has also led to remarkable advances in the understanding of the mutational profiles and other cancer-specific alterations of tumor genomes in the scientific community. The high efficiency of this technology over other conventional technologies in cancer management including diagnostics as well as therapy development is driving the market revenue.

Breakthroughs and notable innovations in oncology have remarkably improved patient outcomes across the globe. Huge R&D investment in cancer biology across academia and industry is driving innovations in the space. Furthermore, oncology is recognized as a focus area for the major pharmaceutical companies in the current scenario. Market expansion of oncology is expected to remarkably support the growth of this market as this technology has proven its efficiency in cancer biology.

Plummeting sequencing cost has significantly driven the genetic studies alongside the development of innovative advanced high throughput tests. These tests are aimed at early detection of the tumor as well as eligibility evaluation of novel targeted therapies. With the decline in cost and considering the technological benefit of NGS, market players are shifting their focus from conventional technologies to NGS for the development of advanced tests with the capability to detect tumor progression in the early stage, thus improving patient outcomes.

The supply chain disruption caused due to Covid-19 has led to shortages of critical raw materials and other solutions required to carry out cancer research across the globe. Thus, many countries have taken definite measurements in order to mitigate the impact of raw material shortages such as domestic manufacturing of reagents and equipment. This not only help overcome the trade barriers, but also ensure product quality and market stability. Several companies have reported decline in their revenue growth from 2019 to 2020 due to decline in volume and tests, delayed product approval, and halt in R&D programs.

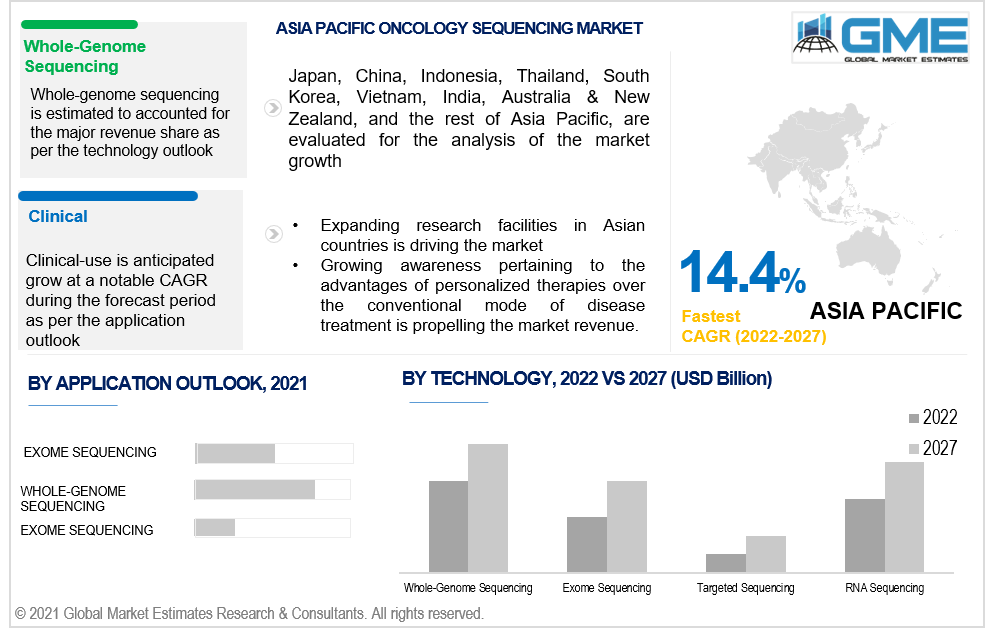

Whole-genome sequencing dominated the 2021 market because it offers a comprehensive strategy for tumor investigation. This technology delivers a thorough view of changes that are specific to tumor DNA samples. This help comparative analysis between diseased DNA and normal DNA. Thus, whole-genome sequencing is well-suited for comparing tumor vs. normal samples and thus facilitating the discovery of novel cancer driver mutations.

However, its utility in clinical care is limited due to certain challenges. This has accelerated the application of targeted gene capture panels by commercial vendors and academic institutions for clinical-grade cancer genomic screening. Targeted panels are considered the most commonly employed technology type by academic institutions. On the other hand, whole-exome and transcriptome (RNASeq) sequencing are being increasingly utilized for investigational cancer research.

Consumables accounted for the major share in the oncology sequencing market in 2021 in terms of revenue share. This high share of the consumables can be attributed to the presence of a broad range of reagents and kits for all stages of library assembly, including enrichment, adaptor ligation, amplification, and quality control. The majority of these solutions have streamlined and simplified workflows, ready-to-use components, and support for low-input and formalin-fixed specimens.

Also, the segment is anticipated to maintain its dominance throughout the forecast period with the highest CAGR. This growth is driven by the ongoing release of reagents and kits to make WGS inexpensive and more accessible. Furthermore, in December 2021, Twist Bioscience Corporation announced the launch of a 96-Plex library prep kit for low pass high throughput NGS technology. Such ongoing developments are spurring segment growth.

Breast cancer and lunch cancer are recognized as the two key shareholder segments in the 2021 market and are expected to maintain this trend throughout the forecast period. The highest prevalence of these cancer types and increasing investment in R&D programs for novel therapies have contributed to the estimated segment shares.

In January 2022, Illumina announced multi-year strategic alliance with Agendia to advance decentralized oncology testing using NGS technology for breast cancer and deliver improved and relevant insights to patients across the globe. Both companies aimed to the development of NGS-based in vitro diagnostic (IVD) tests for breast cancer testing. These initiatives are anticipated to play a vital role in the growth of this oncology sequencing market for breast cancer segment.

Currently, research application has dominated the market owing to the high penetration of NGS in research settings. New sequencing technologies based on NGS principles continue to be developed for use in the research setting, thereby driving segment revenue. By identifying novel transcripts and fusion genes, NGS has transformed the study of the tumor transcriptome.

Moreover, using deconvolution algorithms to determine the number of different cell types from a mixed cell population, whole transcriptome sequencing provides novel insights into the tumor microenvironment. These factors are driving the segment’s growth.

On the other hand, clinical applications are anticipated to register the fastest growth owing to the increasing interest of diagnostic manufacturers in NGS technology. Moreover, NGS technology is being adopted in clinical oncology to expand personalized treatment of cancer to further improve patient care and outcome.

Due to the widespread use of Sanger technology and NGS in academic and institutional research initiatives, the academic research segment dominated the market for oncology sequencing in 2021. Furthermore, increased financing and investment initiatives boost demand for sequencing products in these settings, thereby contributing to the higher revenue share.

Pharmaceutical & biotechnology companies are anticipated to emerge as the key source of lucrative revenue generation in the forecast period owing to the rising investment in the development of advanced diagnostics and novel therapies for cancer management. For instance, in May 2022, Illumina announced the addition of a companion diagnostic to its TruSight Oncology (TSO) comprehensive test, a CE-marked in vitro diagnostic test. Similarly, in August 2020, Quest Diagnostics announced the development of automated NGS technology to advance AncestryHealth, a new direct-to-consumer genetic test launched by Ancestry. These developments help foment the segment growth in terms of revenue.

North America (the United States, Canada, and Mexico) dominated the global oncology sequencing market in 2021 owing to the presence of a substantial number of genome centers with installed sequencers in the U.S. Furthermore. presence of an effective regulatory structure in the region that reviews the approval and safe implementation of sequencing-based genetic tests and related technologies has also propelled revenue growth in this region.

Asian markets such as India and China are expected to emerge as lucrative sources of revenue during the forecast period. This can be attributed to the low prices of NGS-based tests in China as compared to the tests in the U.S. Moreover, Asian laboratories continue to make focused attempts to meet the standard guidelines established by regulatory agencies for the accreditation of NGS platforms.

Thermo Fisher Scientific, Inc., Illumina, Inc., F. Hoffmann-La Roche Ltd., QIAGEN, BGI, Agilent Technologies, Guardant Health, Biocept, Inc., Myriad Genetics, Inc., and eviCore healthcare among others, are some key players operating the in the Oncology Sequencing Market.

Please note: This is not an exhaustive list of companies profiled in the report.

The key players are making focused attempts to enhance their market presence in the life science industry. New product development, merger, and acquisitions, and licensing deals are some of the key strategies undertaken by these companies to sustain the rising market competition.

For instance, in August 2021, the Department of Pathology at New York Langone Health will use Philips Genomics Workspace (previously part of the IntelliSpace Precision Medicine Platform) to integrate into their electronic medical record system, according to Royal Philips. This will allow the industry's largest cancer sequencing test to be developed, allowing patients with cancer to make more confident treatment decisions and care routes.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Technology Outlook

2.3 Application Outlook

2.4 End-use Outlook

2.5 Regional Outlook

Chapter 3 Global Oncology Sequencing Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Oncology Sequencing Market

3.4 Metric Data on Life Science Industry

3.5 Market Dynamic Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Oncology Sequencing Market: Technology Trend Analysis

4.1 Technology: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Whole-Genome Sequencing

4.2.1 Market Estimates & Forecast Analysis of Whole-Genome Sequencing Segment, By Region, 2019-2027 (USD Million)

4.3 Whole Exome Sequencing

4.3.1 Market Estimates & Forecast Analysis of Whole Exome Sequencing Segment, By Region, 2019-2027 (USD Million)

4.4 Targeted Sequencing

4.4.1 Market Estimates & Forecast Analysis of Targeted Sequencing Segment, By Region, 2019-2027 (USD Million)

4.5 RNA Sequencing

4.5.1 Market Estimates & Forecast Analysis of RNA Sequencing Segment, By Region, 2019-2027 (USD Million)

Chapter 5 Oncology Sequencing Market: Application Trend Analysis

5.1 Application: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Research

5.2.1 Market Estimates & Forecast Analysis of Research Segment, By Region, 2019-2027 (USD Million)

5.3 Clinical

5.3.1 Market Estimates & Forecast Analysis of Clinical Segment, By Region, 2019-2027 (USD Million)

Chapter 6 Oncology Sequencing Market: Product Trend Analysis

6.1 Product: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

6.2 Instruments & Platforms

6.2.1 Market Estimates & Forecast Analysis of Instruments & Platforms Segment, By Region, 2019-2027 (USD Million)

6.3 Reagents & Other Consumables

6.3.1 Market Estimates & Forecast Analysis of Reagents & Other Consumables Segment, By Region, 2019-2027 (USD Million)

6.4 Others

6.4.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Million)

Chapter 7 Oncology Sequencing Market: Indication Trend Analysis

7.1 Indication: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

7.2 Breast Cancer

7.2.1 Market Estimates & Forecast Analysis of Breast Cancer Segment, By Region, 2019-2027 (USD Million)

7.3 Ovarian Cancer

7.3.1 Market Estimates & Forecast Analysis of Ovarian Cancer Segment, By Region, 2019-2027 (USD Million)

7.4 Prostate Cancer

7.4.1 Market Estimates & Forecast Analysis of Prostate Cancer Segment, By Region, 2019-2027 (USD Million)

7.5 Lung Cancer

7.5.1 Market Estimates & Forecast Analysis of Lung Cancer Segment, By Region, 2019-2027 (USD Million)

7.6 Colorectal Cancer

7.6.1 Market Estimates & Forecast Analysis of Colorectal Cancer Segment, By Region, 2019-2027 (USD Million)

7.7 Melanoma Cancer

7.7.1 Market Estimates & Forecast Analysis of Melanoma Cancer Segment, By Region, 2019-2027 (USD Million)

7.8 Cervical Cancer

7.8.1 Market Estimates & Forecast Analysis of Cervical Cancer Segment, By Region, 2019-2027 (USD Million)

7.9 Other Cancer Types

7.9.1 Market Estimates & Forecast Analysis of Other Cancer Types Segment, By Region, 2019-2027 (USD Million)

Chapter 8 Oncology Sequencing Market: End-use Trend Analysis

8.1 End-use: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

8.2 Pharmaceutical & Biotechnology Companies

8.2.1 Market Estimates & Forecast Analysis of Pharmaceutical & Biotechnology Companies Segment, By Region, 2019-2027 (USD Million)

8.3 Academic & Government Research Institutes

8.3.1 Market Estimates & Forecast Analysis of Academic & Government Research Institutes Segment, By Region, 2019-2027 (USD Million)

8.4 Others

8.4.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Million)

Chapter 9 Oncology Sequencing Market, By Region

9.1 Regional outlook

9.2 North America

9.2.1 Market Size, By Country 2022-2027 (USD Million)

9.2.2 Market Size, By Technology, 2022-2027 (USD Million)

9.2.3 Market Size, By Product, 2022-2027 (USD Million)

9.2.4 Market Size, By Indication, 2022-2027 (USD Million)

9.2.5 Market Size, By Application, 2022-2027 (USD Million)

9.2.6 Market Size, By End-use, 2022-2027 (USD Million)

9.2.7 U.S.

9.2.7.1 Market Size, By Technology, 2022-2027 (USD Million)

9.2.7.2 Market Size, By Product, 2022-2027 (USD Million)

9.2.7.3 Market Size, By Indication, 2022-2027 (USD Million)

9.2.7.4 Market Size, By Application, 2022-2027 (USD Million)

9.2.7.5 Market Size, By End-use, 2022-2027 (USD Million)

9.2.8 Canada

9.2.8.1 Market Size, By Technology, 2022-2027 (USD Million)

9.2.8.2 Market Size, By Product, 2022-2027 (USD Million)

9.2.8.3 Market Size, By Indication, 2022-2027 (USD Million)

9.2.8.4 Market Size, By Application, 2022-2027 (USD Million)

9.2.8.5 Market Size, By End-use, 2022-2027 (USD Million)

9.2.9 Mexico

9.2.9.1 Market Size, By Technology, 2022-2027 (USD Million)

9.2.9.2 Market Size, By Product, 2022-2027 (USD Million)

9.2.9.3 Market Size, By Indication, 2022-2027 (USD Million)

9.2.9.4 Market Size, By Application, 2022-2027 (USD Million)

9.2.9.5 Market Size, By End-use, 2022-2027 (USD Million)

9.3 Europe

9.3.1 Market Size, By Country 2022-2027 (USD Million)

9.3.2 Market Size, By Technology, 2022-2027 (USD Million)

9.3.3 Market Size, By Product, 2022-2027 (USD Million)

9.3.4 Market Size, By Indication, 2022-2027 (USD Million)

9.3.5 Market Size, By Application, 2022-2027 (USD Million)

9.3.6 Market Size, By End-use, 2022-2027 (USD Million)

9.3.7 Germany

9.3.7.1 Market Size, By Technology, 2022-2027 (USD Million)

9.3.7.2 Market Size, By Product, 2022-2027 (USD Million)

9.3.7.3 Market Size, By Indication, 2022-2027 (USD Million)

9.3.7.4 Market Size, By Application, 2022-2027 (USD Million)

9.3.7.5 Market Size, By End-use, 2022-2027 (USD Million)

9.3.8 UK

9.3.8.1 Market Size, By Technology, 2022-2027 (USD Million)

9.3.8.2 Market Size, By Product, 2022-2027 (USD Million)

9.3.8.3 Market Size, By Indication, 2022-2027 (USD Million)

9.3.8.4 Market Size, By Application, 2022-2027 (USD Million)

9.3.8.5 Market Size, By End-use, 2022-2027 (USD Million)

9.3.9 France

9.3.9.1 Market Size, By Technology, 2022-2027 (USD Million)

9.3.9.2 Market Size, By Product, 2022-2027 (USD Million)

9.3.9.3 Market Size, By Indication, 2022-2027 (USD Million)

9.3.9.4 Market Size, By Application, 2022-2027 (USD Million)

9.3.9.5 Market Size, By End-use, 2022-2027 (USD Million)

9.3.10 Italy

9.3.10.1 Market Size, By Technology, 2022-2027 (USD Million)

9.3.10.2 Market Size, By Product, 2022-2027 (USD Million)

9.3.10.3 Market Size, By Indication, 2022-2027 (USD Million)

9.3.10.4 Market Size, By Application, 2022-2027 (USD Million)

9.3.10.5 Market Size, By End-use, 2022-2027 (USD Million)

9.4 Asia Pacific

9.4.1 Market Size, By Country 2022-2027 (USD Million)

9.4.2 Market Size, By Technology, 2022-2027 (USD Million)

9.4.3 Market Size, By Product, 2022-2027 (USD Million)

9.4.4 Market Size, By Indication, 2022-2027 (USD Million)

9.4.5 Market Size, By Application, 2022-2027 (USD Million)

9.4.6 Market Size, By End-use, 2022-2027 (USD Million)

9.4.7 China

9.4.7.1 Market Size, By Technology, 2022-2027 (USD Million)

9.4.7.2 Market Size, By Product, 2022-2027 (USD Million)

9.4.7.3 Market Size, By Indication, 2022-2027 (USD Million)

9.4.7.4 Market Size, By Application, 2022-2027 (USD Million)

9.4.7.5 Market Size, By End-use, 2022-2027 (USD Million)

9.4.8 India

9.4.8.1 Market Size, By Technology, 2022-2027 (USD Million)

9.4.8.2 Market Size, By Product, 2022-2027 (USD Million)

9.4.8.3 Market Size, By Indication, 2022-2027 (USD Million)

9.4.8.4 Market Size, By Application, 2022-2027 (USD Million)

9.4.8.5 Market Size, By End-use, 2022-2027 (USD Million)

9.4.9 Japan

9.4.9.1 Market Size, By Technology, 2022-2027 (USD Million)

9.4.9.2 Market Size, By Product, 2022-2027 (USD Million)

9.4.9.3 Market Size, By Indication, 2022-2027 (USD Million)

9.4.9.4 Market Size, By Application, 2022-2027 (USD Million)

9.4.9.5 Market Size, By End-use, 2022-2027 (USD Million)

9.5 MEA

9.5.1 Market Size, By Country 2022-2027 (USD Million)

9.5.2 Market Size, By Technology, 2022-2027 (USD Million)

9.5.3 Market Size, By Product, 2022-2027 (USD Million)

9.5.4 Market Size, By Indication, 2022-2027 (USD Million)

9.5.5 Market Size, By Application, 2022-2027 (USD Million)

9.5.6 Market Size, By End-use, 2022-2027 (USD Million)

9.5.7 Saudi Arabia

9.5.7.1 Market Size, By Technology, 2022-2027 (USD Million)

9.5.7.2 Market Size, By Product, 2022-2027 (USD Million)

9.5.7.3 Market Size, By Indication, 2022-2027 (USD Million)

9.5.7.4 Market Size, By Application, 2022-2027 (USD Million)

9.5.7.5 Market Size, By End-use, 2022-2027 (USD Million)

9.5.8 UAE

9.5.8.1 Market Size, By Technology, 2022-2027 (USD Million)

9.5.8.2 Market Size, By Product, 2022-2027 (USD Million)

9.5.8.3 Market Size, By Indication, 2022-2027 (USD Million)

9.5.8.4 Market Size, By Application, 2022-2027 (USD Million)

9.5.8.5 Market Size, By End-use, 2022-2027 (USD Million)

9.5.9 South Africa

9.5.9.1 Market Size, By Technology, 2022-2027 (USD Million)

9.5.9.2 Market Size, By Product, 2022-2027 (USD Million)

9.5.9.3 Market Size, By Indication, 2022-2027 (USD Million)

9.5.9.4 Market Size, By Application, 2022-2027 (USD Million)

9.5.9.5 Market Size, By End-use, 2022-2027 (USD Million)

Chapter 10 Company Landscape

10.1 Competitive Analysis, 2022

10.2 F. Hoffmann-La Roche Ltd

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Initiatives

10.2.4 Product Benchmarking

10.3 Thermo Fisher Scientific, Inc.

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Initiatives

10.3.4 Product Benchmarking

10.4 Illumina, Inc.

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Initiatives

10.4.4 Product Benchmarking

10.5 QIAGEN

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Initiatives

10.5.4 Product Benchmarking

10.6 BGI

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Initiatives

10.6.4 Product Benchmarking

10.7 Agilent Technologies

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Initiatives

10.7.4 Product Benchmarking

10.8 Guardant Health

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Initiatives

10.10.4 Product Benchmarking

10.9 Biocept, Inc.

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Strategic Initiatives

10.9.4 Product Benchmarking

10.10 Myriad Genetics, Inc.

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Initiatives

10.10.4 Product Benchmarking

10.11 EviCore healthcare

10.11.1 Company Overview

10.11.2 Financial Analysis

10.11.3 Strategic Initiatives

10.11.4 Product Benchmarking

10.12 Other Players

10.12.1 Company Overview

10.12.2 Financial Analysis

10.12.3 Strategic Initiatives

10.12.4 Product Benchmarking

List of Tables

1 Technological advancements in oncology sequencing market

2 Global oncology sequencing market: Key market drivers

3 Global oncology sequencing market: Key market challenges

4 Global oncology sequencing market: Key market opportunities

5 Global oncology sequencing market: Key market restraints

6 Global oncology sequencing market estimates & forecast analysis, 2019-2027 (USD Million)

7 Global oncology sequencing market, by technology, 2019-2027 (USD Million)

8 Whole-genome sequencing: Global oncology sequencing market, by region, 2019-2027 (USD Million)

9 Exome sequencing: Global oncology sequencing market, by region, 2019-2027 (USD Million)

10 Targeted sequencing: Global oncology sequencing market, by region, 2019-2027 (USD Million)

11 Exome sequencing: Global oncology sequencing market, by region, 2019-2027 (USD Million)

12 Global oncology sequencing market, by application, 2019-2027 (USD Million)

13 Research oncology sequencing: Global oncology sequencing market, by region, 2019-2027 (USD Million)

14 Clinical oncology sequencing: Global oncology sequencing market, by region, 2019-2027 (USD Million)

15 Global oncology sequencing market, by product, 2019-2027 (USD Million)

16 Instruments & platforms: Global oncology sequencing market, by region, 2019-2027 (USD Million)

17 Reagents & other consumables: Global oncology sequencing market, by region, 2019-2027 (USD Million)

18 Global oncology sequencing market, by indication, 2019-2027 (USD Million)

19 Breast cancer: Global oncology sequencing market, by region, 2019-2027 (USD Million)

20 Ovarian Cancer: Global oncology sequencing market, by region, 2019-2027 (USD Million)

21 Prostate Cancer: Global oncology sequencing market, by region, 2019-2027 (USD Million)

22 Lung Cancer: Global oncology sequencing market, by region, 2019-2027 (USD Million)

23 Colorectal Cancer: Global oncology sequencing market, by region, 2019-2027 (USD Million)

24 Melanoma: Global oncology sequencing market, by region, 2019-2027 (USD Million)

25 Cervical Cancer: Global oncology sequencing market, by region, 2019-2027 (USD Million)

26 Others: Global oncology sequencing market, by region, 2019-2027 (USD Million)

27 Global oncology sequencing market, by end-use, 2019-2027 (USD Million)

28 Pharmaceutical & biotechnology companies: Global oncology sequencing market, by region, 2019-2027 (USD Million)

29 Academic & Government Research Institutes: Global oncology sequencing market, by region, 2019-2027 (USD Million)

30 Others: Global oncology sequencing market, by region, 2019-2027 (USD Million)

31 Regional analysis: Global oncology sequencing market, by region, 2019-2027 (USD Million)

32 North America: Oncology sequencing market, by technology, 2019-2027 (USD Million)

33 North America: Oncology sequencing market, by application, 2019-2027 (USD Million)

34 North America: Oncology sequencing market, by product, 2019-2027 (USD Million)

35 North America: Oncology sequencing market, by indication, 2019-2027 (USD Million)

36 North America: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

37 North America: Oncology sequencing market, by country, 2019-2027 (USD Million)

38 U.S.: Oncology sequencing market, by technology, 2019-2027 (USD Million)

39 U.S.: Oncology sequencing market, by application, 2019-2027 (USD Million)

40 U.S.: Oncology sequencing market, by product, 2019-2027 (USD Million)

41 U.S.: Oncology sequencing market, by indication, 2019-2027 (USD Million)

42 U.S.: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

43 Canada: Oncology sequencing market, by technology, 2019-2027 (USD Million)

44 Canada: Oncology sequencing market, by application, 2019-2027 (USD Million)

45 Canada: Oncology sequencing market, by product, 2019-2027 (USD Million)

46 Canada: Oncology sequencing market, by indication, 2019-2027 (USD Million)

47 Canada: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

48 Mexico: Oncology sequencing market, by technology, 2019-2027 (USD Million)

49 Mexico: Oncology sequencing market, by application, 2019-2027 (USD Million)

50 Mexico: Oncology sequencing market, by product, 2019-2027 (USD Million)

51 Mexico: Oncology sequencing market, by indication, 2019-2027 (USD Million)

52 Mexico: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

53 Europe: Oncology sequencing market, by technology, 2019-2027 (USD Million)

54 Europe: Oncology sequencing market, by application, 2019-2027 (USD Million)

55 Europe: Oncology sequencing market, by product, 2019-2027 (USD Million)

56 Europe: Oncology sequencing market, by indication, 2019-2027 (USD Million)

57 Europe: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

58 Europe: Oncology sequencing market, by country, 2019-2027 (USD Million)

59 Germany: Oncology sequencing market, by technology, 2019-2027 (USD Million)

60 Germany: Oncology sequencing market, by application, 2019-2027 (USD Million)

61 Germany: Oncology sequencing market, by product, 2019-2027 (USD Million)

62 Germany: Oncology sequencing market, by indication, 2019-2027 (USD Million)

63 Germany: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

64 UK: Oncology sequencing market, by technology, 2019-2027 (USD Million)

65 UK: Oncology sequencing market, by application, 2019-2027 (USD Million)

66 UK: Oncology sequencing market, by product, 2019-2027 (USD Million)

67 UK: Oncology sequencing market, by indication, 2019-2027 (USD Million)

68 UK: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

69 France: Oncology sequencing market, by technology, 2019-2027 (USD Million)

70 France: Oncology sequencing market, by application, 2019-2027 (USD Million)

71 France: Oncology sequencing market, by product, 2019-2027 (USD Million)

72 France: Oncology sequencing market, by indication, 2019-2027 (USD Million)

73 France: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

74 Italy: Oncology sequencing market, by technology, 2019-2027 (USD Million)

75 Italy: Oncology sequencing market, by application, 2019-2027 (USD Million)

76 Italy: Oncology sequencing market, by product, 2019-2027 (USD Million)

77 Italy: Oncology sequencing market, by indication, 2019-2027 (USD Million)

78 Italy: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

79 Spain: Oncology sequencing market, by technology, 2019-2027 (USD Million)

80 Spain: Oncology sequencing market, by application, 2019-2027 (USD Million)

81 Spain: Oncology sequencing market, by product, 2019-2027 (USD Million)

82 Spain: Oncology sequencing market, by indication, 2019-2027 (USD Million)

83 Spain: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

84 Rest of Europe: Oncology sequencing market, by technology, 2019-2027 (USD Million)

85 Rest of Europe: Oncology sequencing market, by application, 2019-2027 (USD Million)

86 Rest of Europe: Oncology sequencing market, by product, 2019-2027 (USD Million)

87 Rest of Europe: Oncology sequencing market, by indication, 2019-2027 (USD Million)

88 Rest of Europe: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

89 Asia Pacific: Oncology sequencing market, by technology, 2019-2027 (USD Million)

90 Asia Pacific: Oncology sequencing market, by application, 2019-2027 (USD Million)

91 Asia Pacific: Oncology sequencing market, by product, 2019-2027 (USD Million)

92 Asia Pacific: Oncology sequencing market, by indication, 2019-2027 (USD Million)

93 Asia Pacific: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

94 Asia Pacific: Oncology sequencing market, by country, 2019-2027 (USD Million)

95 China: Oncology sequencing market, by technology, 2019-2027 (USD Million)

96 China: Oncology sequencing market, by application, 2019-2027 (USD Million)

97 China: Oncology sequencing market, by product, 2019-2027 (USD Million)

98 China: Oncology sequencing market, by indication, 2019-2027 (USD Million)

99 China: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

100 India: Oncology sequencing market, by technology, 2019-2027 (USD Million)

101 India: Oncology sequencing market, by application, 2019-2027 (USD Million)

102 India: Oncology sequencing market, by product, 2019-2027 (USD Million)

103 India: Oncology sequencing market, by indication, 2019-2027 (USD Million)

104 India: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

105 Japan: Oncology sequencing market, by technology, 2019-2027 (USD Million)

106 Japan: Oncology sequencing market, by application, 2019-2027 (USD Million)

107 Japan: Oncology sequencing market, by product, 2019-2027 (USD Million)

108 Japan: Oncology sequencing market, by indication, 2019-2027 (USD Million)

109 Japan: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

110 South Korea: Oncology sequencing market, by technology, 2019-2027 (USD Million)

111 South Korea: Oncology sequencing market, by application, 2019-2027 (USD Million)

112 South Korea: Oncology sequencing market, by product, 2019-2027 (USD Million)

113 South Korea: Oncology sequencing market, by indication, 2019-2027 (USD Million)

114 South Korea: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

115 Middle East & Africa: Oncology sequencing market, by technology, 2019-2027 (USD Million)

116 Middle East & Africa: Oncology sequencing market, by application, 2019-2027 (USD Million)

117 Middle East & Africa: Oncology sequencing market, by product, 2019-2027 (USD Million)

118 Middle East & Africa: Oncology sequencing market, by indication, 2019-2027 (USD Million)

119 Middle East & Africa: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

120 Middle East & Africa: Oncology sequencing market, by country, 2019-2027 (USD Million)

121 Saudi Arabia: Oncology sequencing market, by technology, 2019-2027 (USD Million)

122 Saudi Arabia: Oncology sequencing market, by application, 2019-2027 (USD Million)

123 Saudi Arabia: Oncology sequencing market, by product, 2019-2027 (USD Million)

124 Saudi Arabia: Oncology sequencing market, by indication, 2019-2027 (USD Million)

125 Saudi Arabia: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

126 South Africa: Oncology sequencing market, by technology, 2019-2027 (USD Million)

127 South Africa: Oncology sequencing market, by application, 2019-2027 (USD Million)

128 South Africa: Oncology sequencing market, by product, 2019-2027 (USD Million)

129 South Africa: Oncology sequencing market, by indication, 2019-2027 (USD Million)

130 South Africa: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

131 Central & South America: Oncology sequencing market, by technology, 2019-2027 (USD Million)

132 Central & South America: Oncology sequencing market, by application, 2019-2027 (USD Million)

133 Central & South America: Oncology sequencing market, by product, 2019-2027 (USD Million)

134 Central & South America: Oncology sequencing market, by indication, 2019-2027 (USD Million)

135 Central & South America: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

136 Central & South America: Oncology sequencing market, by country, 2019-2027 (USD Million)

137 Brazil: Oncology sequencing market, by technology, 2019-2027 (USD Million)

138 Brazil: Oncology sequencing market, by application, 2019-2027 (USD Million)

139 Brazil: Oncology sequencing market, by product, 2019-2027 (USD Million)

140 Brazil: Oncology sequencing market, by indication, 2019-2027 (USD Million)

141 Brazil: Oncology sequencing market, by end-use, 2019-2027 (USD Million)

142 Thermo Fisher Scientific, Inc.: Products offered

143 Illumina, Inc.: Products offered

144 F. Hoffmann-La Roche Ltd.: Products offered

145 QIAGEN: Products offered

146 BGI: Products offered

147 Agilent Technologies: Products offered

148 Guardant Health: Products offered

149 Biocept, Inc.: Products offered

150 Myriad Genetics, Inc.: Products offered

151 eviCore healthcare: Products offered:

List of Figures

1. Global oncology sequencing market segmentation & research scope

2. Primary research partners and local informers

3. Primary research process

4. Primary research approaches

5. Primary research responses

6. Global oncology sequencing market: penetration & growth prospect mapping

7. Global oncology sequencing market: value chain analysis

8. Global oncology sequencing market drivers

9. Global oncology sequencing market restraints

10. Global oncology sequencing market opportunities

11. Global oncology sequencing market challenges

12. Key oncology sequencing market manufacturer analysis

13. Global oncology sequencing market: porter’s five forces analysis

14. Pestle analysis & impact analysis

15. Thermo Fisher Scientific, Inc.: Company snapshot

16. Thermo Fisher Scientific, Inc.: SWOT analysis

17. Illumina, Inc.: Company snapshot

18. Illumina, Inc.: SWOT analysis

19. F. Hoffmann-La Roche Ltd.: Company snapshot

20. F. Hoffmann-La Roche Ltd.: SWOT analysis

21. QIAGEN: Company snapshot

22. QIAGEN: SWOT analysis

23. BGI: Company snapshot

24. BGI: SWOT analysis

25. Agilent Technologies: Company snapshot

26. Agilent Technologies: SWOT analysis

27. Guardant Health: Company snapshot

28. Guardant Health: SWOT analysis

29. Biocept, Inc.: Company snapshot

30. Biocept, Inc.: SWOT analysis

31. Myriad Genetics, Inc.: Company snapshot

32. Myriad Genetics, Inc.: SWOT analysis

33. EviCore healthcare: Company snapshot

34. EviCore healthcare: SWOT analysis

The Global Oncology Sequencing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Oncology Sequencing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS