Global Opacifiers Market Size, Trends & Analysis - Forecasts to 2026 By Type (Zircon, Opaque Polymers, Zinc Oxide, Arsenic Trioxide, Cerium Oxide, Antimony Trioxide, Tin Oxide, Titanium Dioxide), By Application (Paints & Coatings, Inks, Personal Care, Home Care, Paper, Fibers, Ceramics, Plastics, Glass, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

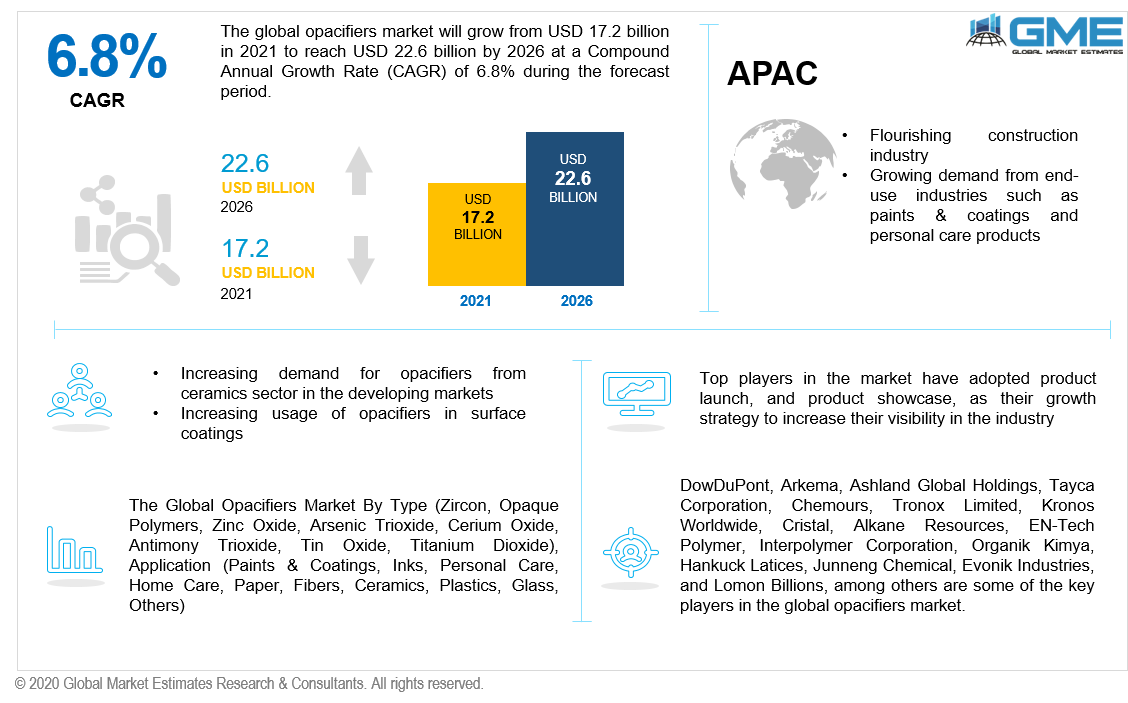

The global opacifiers market will grow from USD 17.2 billion in 2021 to reach USD 22.6 billion in 2026, with a CAGR of 6.8% during the forecast period. The rising demand for opacifiers from numerous end-use industries such as personal care, healthcare, pharmaceuticals and ceramics is expected to drive market growth during the forecast period. Opacifiers are additives that are used to make transparent items opaque. The process of transforming a transparent material into an opaque material with the help of opacifiers involves three mechanisms: thermal expansion, crystallization, and suspended micro-bubbles. Tin oxide and zircon opacifiers are two of the most prevalent opacifiers.

The flourishing pharmaceutical industry globally is expected to drive market growth during the forecast period. Moreover, increasing product launch activities and a rising number of local players are also anticipated to push the market. The other factors boosting the growth of opacifiers trends in 2021 include developments in the latest technologies to improve coating performance and increasing application area of opacifiers. Moreover, the flourishing cosmetics and personal use industry, augment of nanotechnology into the production process and rising research and development expenditure by opacifiers manufacturers are some of the factors supporting the growth of the opacifiers market. A rising number of research activities related to the latest opacifier technology by top market players will support the market growth. For instance, some of the key manufacturers of the market such as DowDuPont, Arkema, and Tronox are working relentlessly on creating EVOQUE pre-composite polymer technology, which is made entirely of acrylic and provides superior wet and dry hiding efficiency as well as enhanced performance properties for opaque polymers.

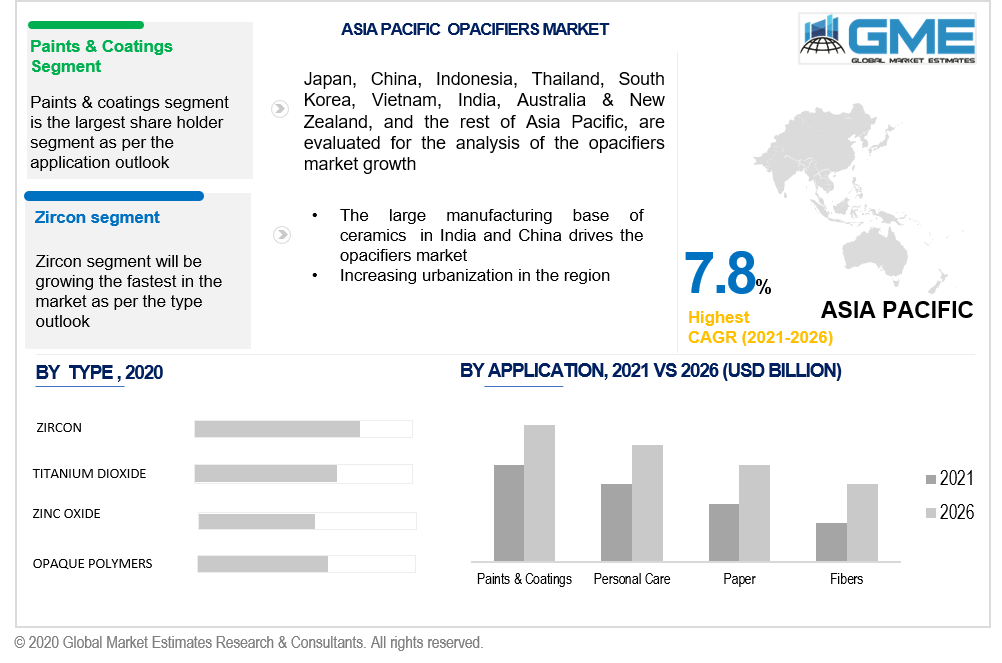

The type of opacifier segment is categorized into zircon, opaque polymers, zinc oxide, arsenic trioxide, cerium oxide, antimony trioxide, tin oxide, and titanium dioxide. Titanium dioxide is expected to hold the lion’s share from 2021 to 2026. In surfactant-based formulations, titanium dioxide provides whiteness and brightness. The flourishing end-use sectors such as plastics, paints, and coatings, and personal care is boosting demand for titanium dioxide. Growing demand for personal care products, an increase in the number of demand from the pharmaceutical sector, rapidly changing lifestyles, and increasing awareness of cleanliness and skin-care products are driving the market expansion especially in the personal care industry. The market for titanium dioxide opacifiers is also being driven by an increase in consumer expenditure on premium personal care products.

Furthermore, the zircon opacifier is expected to be the fastest-growing segment in terms of volume and revenue during the forecast period. Zircon opacifier finds its application in the ceramics industry. One of the major reasons for this segment to grow rapidly is the increasing nuclear power stations and the growing usage of surface coatings.

Paints & coatings, inks, personal care, home care, paper, fibers, ceramics, plastics, glass, and other applications are the major segments of the opacifiers market. The paints & coatings segment is expected to hold the largest market share in terms of revenue from 2021 to 2026. The flourishing paint industry, increasing construction projects across developing regions, rapidly rising urbanization, and rising purchasing power of the developing country’s population are some of the factors expected to fuel the opacifier market growth from 2021-2026 for paints & coatings segment.

As per the geographical analysis, the opacifiers market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The largest share of the North American region is mainly due to the presence of key competitors in the U.S. market, strong economic growth, and increasing adoption of opacifiers in most of the end-user sectors. Moreover, the growing government frameworks along with the rising healthcare infrastructure are some of the factors supporting the growth of the opacifiers market in the U.S. during the forecast period.

Furthermore, the Asia Pacific region will grow with the highest CAGR rate in the market. Rising construction activities, increasing R&D investments in the paints & coatings, and personal care products industry, changing lifestyle, and rising disposable income will impact the opacifier market size in the APAC region positively. Another aspect driving this region's development in the opacifiers market is its increasing economy and rapidly rising population. The rising population in developing countries will certainly demand an increase in the use of opacifiers through end products. The Asia-Pacific region will account for more than 25% of worldwide beauty and personal care sales. Due to the Japanese and South Korean innovation in beauty products, as well as rising demand from the Chinese market, the production of personal care goods in the region is expected to increase the demand for opacifiers in the upcoming years (2022-2026).

DowDuPont, Arkema, Ashland Global Holdings, Tayca Corporation, Chemours, Tronox Limited, Kronos Worldwide, Cristal, Alkane Resources, EN-Tech Polymer, Interpolymer Corporation, Organik Kimya, Hankuck Latices, Junneng Chemical, Evonik Industries, and Lomon Billions, among others are some of the key players in the global opacifiers market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2019, Tronox Limited successfully acquired the titanium dioxide business of Cristal, and this way Tronox increased its market presence.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Opacifiers Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.1 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Opacifiers Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing demand for ceramics in the developing markets

3.3.2 Industry Challenges

3.3.2.1 Increasing raw material price post COVID-19 augmentation

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Opacifiers Market, By Type

4.1 Type Outlook

4.2 Titanium Dioxide

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Zircon

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Opaque Polymers

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Antimony Trioxide

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Zinc Oxide

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Arsenic Trioxide

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

4.8 Cerium Oxide

4.8.1 Market Size, By Region, 2020-2026 (USD Billion)

4.9 Tin Oxide

4.9.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Opacifiers Market, By Application

5.1 Application Outlook

5.2 Paints & Coatings

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Plastics

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Paper

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Inks

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Ceramics

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

5.7 Personal Care

5.7.1 Market Size, By Region, 2020-2026 (USD Billion)

5.8 Home Care

5.8.1 Market Size, By Region, 2020-2026 (USD Billion)

5.9 Fibers

5.9.1 Market Size, By Region, 2020-2026 (USD Billion)

5.10 Glass

5.10.1 Market Size, By Region, 2020-2026 (USD Billion)

5.11 Others

5.11.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Global Opacifiers Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Type, 2020-2026 (USD Billion)

6.2.3 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Type, 2020-2026 (USD Billion)

6.3.3 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Type, 2020-2026 (USD Billion)

6.4.3 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Type, 2020-2026 (USD Billion)

6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Type, 2020-2026 (USD Billion)

6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 DowDuPont

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 InfoGraphic Analysis

7.3 Arkema.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 InfoGraphic Analysis

7.4 Ashland Global Holdings

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 InfoGraphic Analysis

7.5 Tayca Corporation

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 InfoGraphic Analysis

7.6 Tronox Limited

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 InfoGraphic Analysis

7.7 Kronos Worldwide

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 InfoGraphic Analysis

7.8 Cristal

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 InfoGraphic Analysis

7.9 En-Tech Polymer

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 InfoGraphic Analysis

7.10 Alkane Resources

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 InfoGraphic Analysis

7.11 Chemours

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 InfoGraphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 InfoGraphic Analysis

The Global Opacifiers Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Opacifiers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS