Global Orthopaedic Trauma Fixation Devices Market Size, Trends & Analysis – Forecasts to 2026 By Product (Internal Fixators [Intramedullary Nail, Intramedullary Screw, and Plate & Screw System], and External Fixators [Circular Fixators, Unilateral Fixators, and Hybrid Fixators]), By Site (Lower Extremities [Hip & Pelvic, Lower Leg, Knee, Foot and Ankle, and Thigh] and Upper Extremities [Hand & Wrist, Shoulder, Elbow, and Arm]), By End-Use (Orthopaedic Centres, Ambulatory Surgical Centres, and Hospitals), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

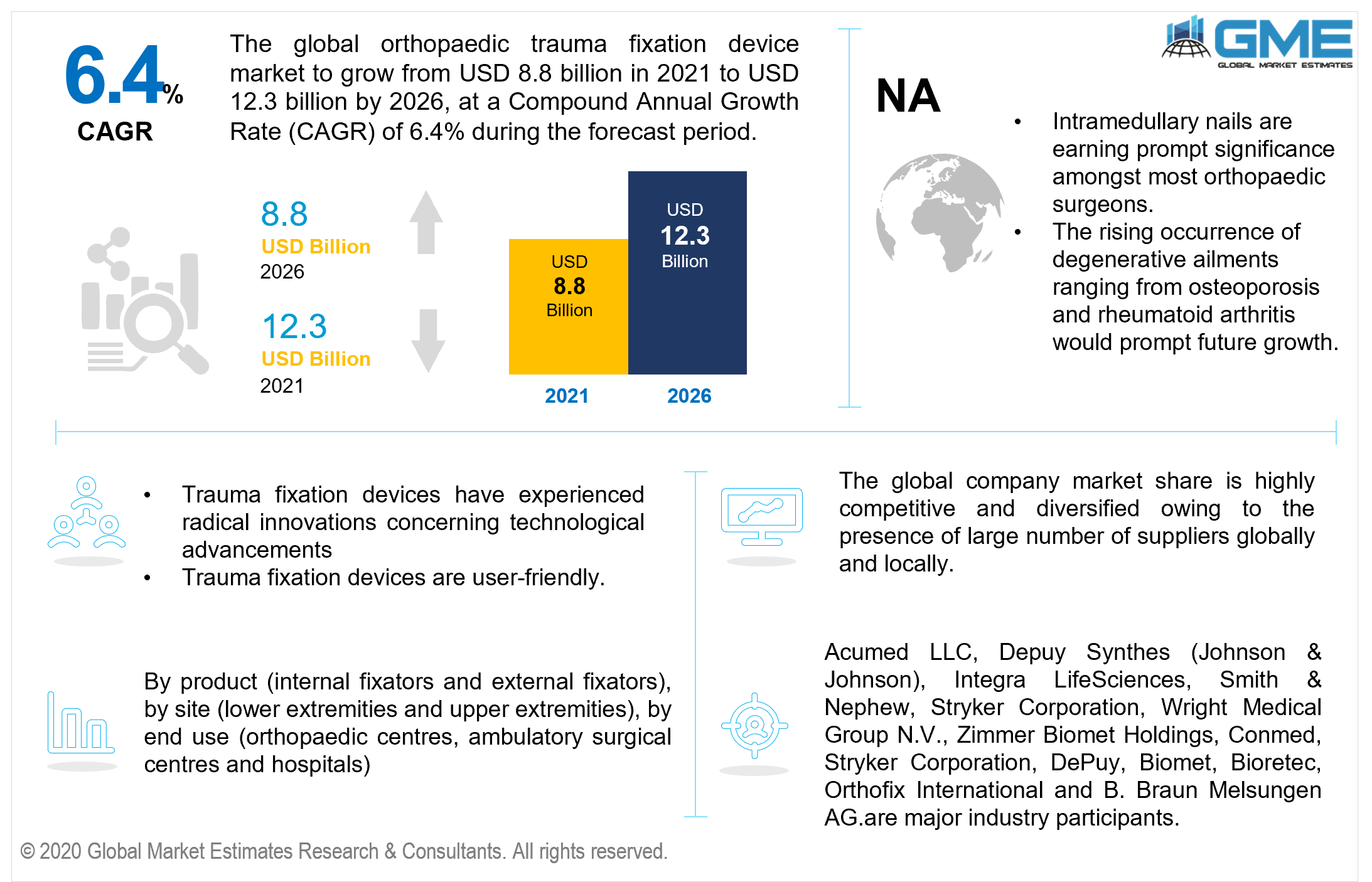

The global orthopaedic trauma fixation devices market is valued at USD 8.8 billion in 2021 and is expected to reach USD 12.3 billion by 2026 with a projected CAGR of 6.4% for the forecast timeline of 2021-2026.

As per a report by the World Health Organization (WHO), around 1.25 million individuals die yearly owing to transit collisions and crashes. Furthermore, around 30-40 million people suffer either from wounds or physical injury in transit-related crashes and collisions. Traffic collisions are perceived as one of the chief causes of death and physical damage. Consequently, the growing recurrence of road collisions and injuries has been a major stimulant for the business expansion of trauma fixation devices.

Furthermore, over the years, trauma fixation devices have experienced radical innovations concerning technological advancements coupled with user-friendliness. To elucidate, technologically superior stocks like drug-eluting implants, bioresorbable implants, and nano-coated machines have significantly accelerated business development.

Nonetheless, the COVID-19 pandemic has severely affected the global markets with all the segments observing a notable decline during 2020. The health sector has been one of the most affected sectors amidst the pandemic owing to the significant burden on the healthcare resources to accommodate the fight against COVID-19. The system sustained vital reorganisation with several surgical procedures being put on hold and deferred due to the non-essential nature of the medical treatment. These factors have decreased the demand for orthopaedic trauma fixation devices during the pandemic.

Relatively, the trauma fixation devices market was not majorly impacted as trauma fixation tools are frequently employed in emergencies. Certain machines are utilised for several orthopaedic ailments like fractures and injuries that need urgent therapeutic care. As the major populace resided indoors, due to social-distancing and quarantine protocols, the incidents of indoor shock and trauma increased which has offset the decline in road accidents.

Nevertheless, certain market impediments like scarcity of qualified and proficient experts to administer tech-savvy intricate designs and complex mechanical systems would limit the market expansion of trauma fixation devices during the forecast period.

The orthopaedic trauma fixation devices market is classified into various segments based on the product, such as internal fixators and external fixators.

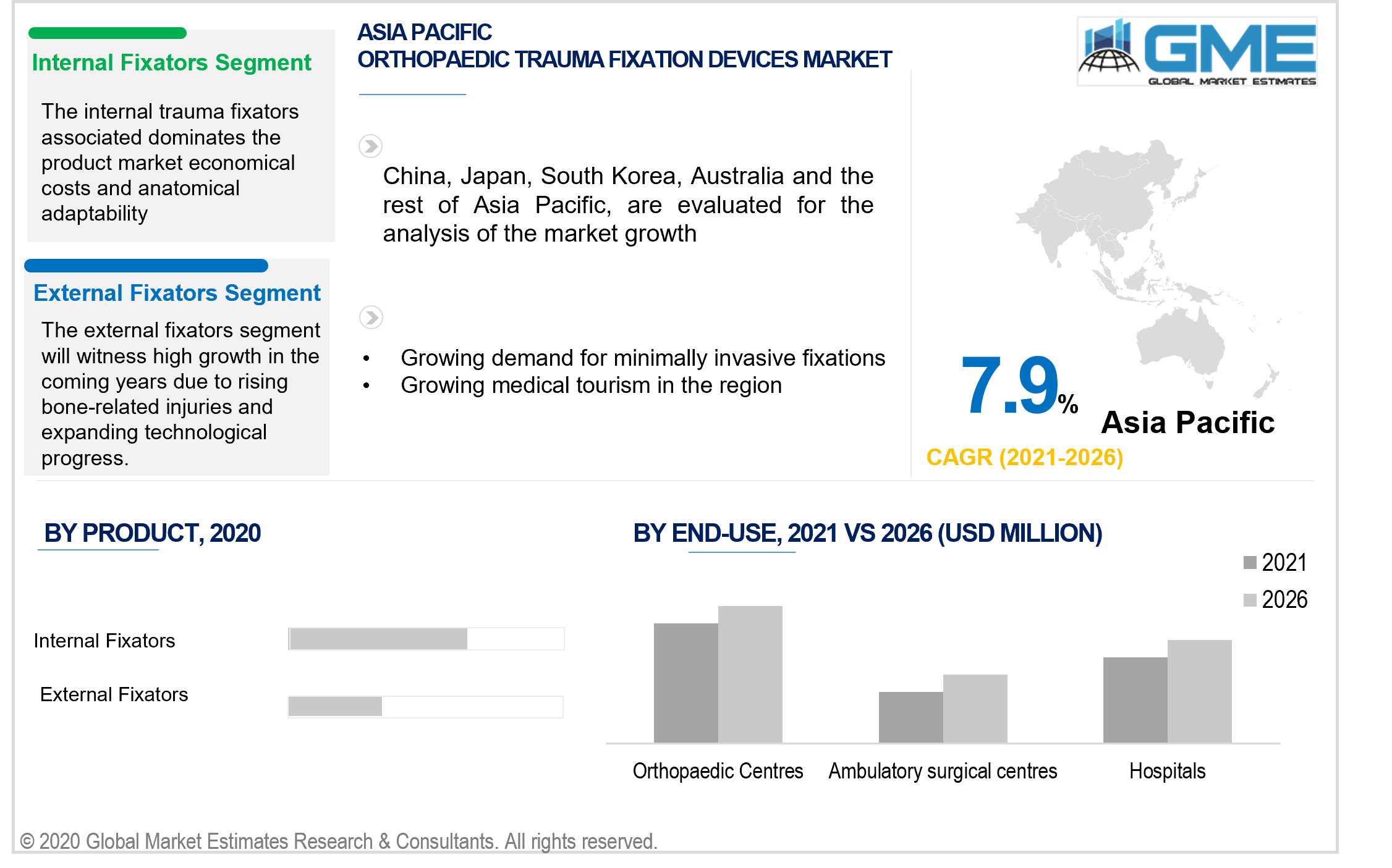

Nonetheless, the internal fixators segment is anticipated to hold the dominant share of the market during the forecast period. The market value of internal fixators has been gauged to be at USD 5.6 billion in 2021, driven by the greater demand for internal trauma fixators as it is more economical and offers greater anatomical adaptability. Furthermore, complementary compensation strategies will result in greater demand for internal fixators, ultimately concluding the expanded approval during orthopaedic operations. The internal fixators possess 80% of the revenue in terms of products. The market domination by internal fixators is expected to decline in the coming years owing to the rising demand for circular and hybrid fixators.

The circular and hybrid fixators are anticipated to be the chief sub-segments that would be accountable for the optimistic growth outlooks for the external fixators segment. Conversely, during the forecast timeline from 2021 to 2026, the internal fixators segment will undergo nearly more distinct growth at a CAGR of over 8.6%. The external fixator division is anticipated to register a growth of about 5.2% driven by the growing use of external trauma fixation tools, increasing persistence of bone-related injuries that require adjustment, aid and expanding technological progress.

The orthopaedic trauma fixation devices market is classified into lower extremities and upper extremities segments based on the site of treatment.

The lower extremities vertical has exceeded the market share of about USD 5.7 billion in 2021. The rapid demand for orthopaedic trauma fixation devices market for lower extremities is caused by the growing incidences of bone degenerative diseases such as osteoporosis, osteoarthritis, etc. These diseases cause counteraction within the joints and eventually decreases the bone strength pointing to prompt damages and a more distinguished demand for the fixation devices.

The upper extremities segment has endured about half of the market share steered by the increasing frequency of injuries and the soaring number of geriatric population. Consequently, the expanding predominance of orthopaedic diseases will further expand the market.

The orthopaedic trauma fixation devices market is classified into orthopaedic centres, ambulatory surgical centres and hospitals based on the end-use.

Orthopaedic centres for trauma fixation methods are poised to grow at a CAGR of more than 5.7% between 2021 and 2026. The major growth of the orthopaedic centres is observed in the developed economies of North America and Europe. Nonetheless, people favour orthopaedic centres over any other arrangements for orthopaedic procedures due to the availability of modern amenities to tackle the injury.

The hospitals’ segment has reported for about 40% of the market share led by the growing recurrence of sport-related injuries and rising number of traffic accidents. Further, in emerging economies like India, the booming number of multispecialty medical centres dispensing suitable trauma therapies and availability of economical treatments at public health care centres would steer the market for orthopaedic trauma fixation devices to greater heights.

Based on region, the orthopaedic trauma fixation devices market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa (MEA). As per the regional outlook, North America currently holds a major proportion of the revenue at around 48% with more than USD 6.4 billion. Further, Western Europe will emerge as the second-largest market inducing demand for orthopaedic trauma devices. The APAC region will register the highest growth rate over the forecast period. China along with Japan are recognised to develop at the most accelerated speed across the projected timeline. The North American region is presently observing the much anticipated sturdy trade of hybrid plates and screws and is forecasted to persist during the following decade. Recently in the North American industry, intramedullary nails are earning prompt significance amongst most orthopaedic surgeons, due to their rising reputation as an ideal device for performing anatomies. Further, the U.S industry is bestowed with prime market players like Johnson and Johnson, Stryker Corporation, etc., which extensively steer the demand. Moreover, the rising occurrence of degenerative ailments ranging from osteoporosis and rheumatoid arthritis would prompt a favourable trajectory over the forecast timeline. According to the National Osteoporosis Foundation, around 44 million Americans suffer from deficient bone density and around 10 million Americans endure osteoporosis, hence swelling the regional development.

In the context of the expanding market in the developing Asian economies, India accounts to steer the market with its growing medical tourism and China accounts to nudge the growth with the rising inclination for minimally invasive fixation. Japan's market is foreseen to expand at a CAGR of around 7.8% on account of the growing geriatric population vulnerable to physical accidents and several degenerative orthopaedic ailments. Further, promising steps adopted by the Japan Medical Devices Manufacturers Association to encourage the extension and distribution of a plethora of medical instruments has been a principal stimulant for the expansion of Japan’s orthopaedic trauma devices industry. Additionally, technological progress in trauma fixation devices would further nudge the market progress during the forecast period.

Acumed LLC, Depuy Synthes (Johnson & Johnson), Integra LifeSciences, Smith & Nephew, Stryker Corporation, Wright Medical Group N.V., Zimmer Biomet Holdings, Conmed, Stryker Corporation, DePuy, Biomet, Bioretec, Orthofix International and B. Braun Melsungen AG, among others are the key players in the orthopaedic trauma fixation devices market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Orthopaedic Trauma Fixation Devices Industry Overview, 2021-2026

2.1.1 Product Overview

2.1.2 Site Overview

2.1.3 End-User Overview

2.1.4 Regional Overview

Chapter 3 Orthopaedic Trauma Fixation Devices Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.2 Industry Challenges

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Site Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Orthopaedic Trauma Fixation Devices Market, By Product

4.1 Product Outlook

4.2 External Fixators

4.2.1 Market Size, By Region, 2021-2026 (USD Billion)

4.3 Internal Fixators

4.3.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 5 Orthopaedic Trauma Fixation Devices Market, By Site

5.1 Site Outlook

5.2 Lower Extremities

5.2.1 Market Size, By Region, 2021-2026 (USD Billion)

5.3 Upper Extremities

5.3.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 6 Orthopaedic Trauma Fixation Devices Market, By End-User

6.1 End-Use Outlook

6.2 Hospitals

6.2.1 Market Size, By Region, 2021-2026 (USD Billion)

6.3 Ambulatory Surgical Centres

6.3.1 Market Size, By Region, 2021-2026 (USD Billion)

6.4 Orthopaedic Centres

6.4.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 7 Orthopaedic Trauma Fixation Devices Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2021-2026 (USD Billion)

7.2.2 Market Size, By Product, 2021-2026 (USD Billion)

7.2.3 Market Size, By Site, 2021-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Product, 2021-2026 (USD Billion)

7.2.4.2 Market Size, By Site, 2021-2026 (USD Billion)

7.2.4.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Product, 2021-2026 (USD Billion)

7.2.7.2 Market Size, By Site, 2021-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2021-2026 (USD Billion)

7.3.2 Market Size, By Product, 2021-2026 (USD Billion)

7.3.3 Market Size, By Site, 2021-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Product, 2021-2026 (USD Billion)

7.3.6.2 Market Size, By Site, 2021-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Product, 2021-2026 (USD Billion)

7.3.7.2 Market Size, By Site, 2021-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Product, 2021-2026 (USD Billion)

7.3.7.2 Market Size, By Site, 2021-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Product, 2021-2026 (USD Billion)

7.3.9.2 Market Size, By Site, 2021-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Product, 2021-2026 (USD Billion)

7.3.10.2 Market Size, By Site, 2021-2026 (USD Billion)

7.3.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Product, 2021-2026 (USD Billion)

7.3.11.2 Market Size, By Site, 2021-2026 (USD Billion)

7.3.11.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2021-2026 (USD Billion)

7.4.2 Market Size, By Product, 2021-2026 (USD Billion)

7.4.3 Market Size, By Site, 2021-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Product, 2021-2026 (USD Billion)

7.4.6.2 Market Size, By Site, 2021-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Product, 2021-2026 (USD Billion)

7.4.7.2 Market Size, By Site, 2021-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Product, 2021-2026 (USD Billion)

7.4.7.2 Market Size, By Site, 2021-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Product, 2021-2026 (USD Billion)

7.4.9.2 Market size, By Site, 2021-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Product, 2021-2026 (USD Billion)

7.4.10.2 Market Size, By Site, 2021-2026 (USD Billion)

7.4.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2021-2026 (USD Billion)

7.5.2 Market Size, By Product, 2021-2026 (USD Billion)

7.5.3 Market Size, By Site, 2021-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Product, 2021-2026 (USD Billion)

7.5.6.2 Market Size, By Site, 2021-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Product, 2021-2026 (USD Billion)

7.5.7.2 Market Size, By Site, 2021-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Product, 2021-2026 (USD Billion)

7.5.7.2 Market Size, By Site, 2021-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2021-2026 (USD Billion)

7.6.2 Market Size, By Product, 2021-2026 (USD Billion)

7.6.3 Market Size, By Site, 2021-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Product, 2021-2026 (USD Billion)

7.6.6.2 Market Size, By Site, 2021-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Product, 2021-2026 (USD Billion)

7.6.7.2 Market Size, By Site, 2021-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Product, 2021-2026 (USD Billion)

7.6.7.2 Market Size, By Site, 2021-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2021

8.2 Acumed LLC

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Depuy Synthes (Johnson & Johnson)

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Integra LifeSciences

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Smith & Nephew

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Stryker Corporation

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Wright Medical Group N.V.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Zimmer Biomet Holdings

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Conmed

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Stryker Corporation

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 DePuy

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Biomet

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Bioretec

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Orthofix International

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

8.15 B. Braun Melsungen AG

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Info Graphic Analysis

The Global Orthopaedic Trauma Fixation Devices Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Orthopaedic Trauma Fixation Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS