Global Orthopedic Contract Manufacturing Market Size, Trends & Analysis - Forecasts to 2026 By Product Type (Implants, Instruments, Cases, Trays), By Service (Forging/Casting, Hip Machining & Finishing, Knee Machining & Finishing, Spine & Trauma, Instrument Machining & Finishing, Coating, Ceramics, Others), By End-User (Hospitals, Specialty Clinics, Others), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

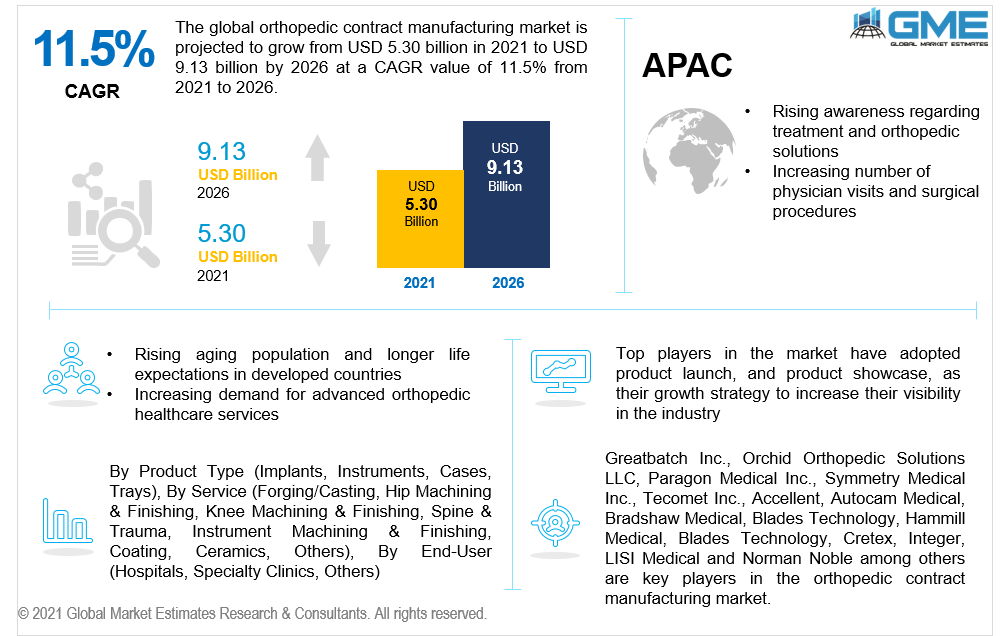

The global orthopedic contract manufacturing market is projected to grow from USD 5.30 billion in 2021 to USD 9.13 billion by 2026 at a CAGR value of 11.5% from 2021 to 2026.

The key factors driving the growth of the orthopedic contract manufacturing market is the rapid growth of the medical device industry especially in the developing regions, increasing chronic disease prevalence, rising life expectancy, and the increasing number of geriatric population. Furthermore, technological advancement has prompted end users to overhaul or update their manufacturing systems. As this is a costly process, they look to contract manufacturing.

Owing to rising aging population and the rise of musculoskeletal disorders caused by obesity and sedentary lifestyles, the global market is expected to experience substantial expansion during the forecast period. The rising demand for 3D printing technologies and robot-assisted operations are likely to have a significant impact on the market, resulting in increased surgery accessibility. Shortly, minimally invasive surgical procedures and novel biodegradable implants will also boost the importance of orthopedic devices and propel the market growth.

Furthermore, the healthcare industry's fierce rivalry forces these businesses to rethink their marketing strategies and look for new chances in product design, development, and manufacturing. As a result, most orthopedic device makers have turned to specialized service providers like contract manufacturing organizations for help (CMOS).

In addition to this, the COVID-19 outbreak has also accelerated the adoption of advanced diagnostics and patient care devices for better treatment management.

Medical device contract manufacturing refers to the process by which a company manufactures medical equipment or parts of medical equipments for medical instruments which will be then distributed by contractors to all the developing and developed countries across the globe. Medical device contract manufacturers specialize in a particular process or activity and can offer advice based on their manufacturing knowledge. Customers, clients, and manufacturers of medical devices can benefit from services such as product innovation, process verification and validation, procurement, or highly specialized production, and distribution. They also handle the supply and delivery of goods to the final customer.

Due to the sheer global financial crisis, the orthopedic industry has seen a considerable drop in its global revenue. Hence, using business process outsourcing services to reduce operational, management, and infrastructure expenses have shown to be a successful strategy. As a strategy to cut capital expenditure and labor costs, medical device businesses are boosting their outsourcing activities.

However, market growth is impeded by the growing consolidation in the medical devices market. Top players, to develop their manufacturing capabilities to save costs, focus on the acquisition of smaller players and CMOs themselves. This may affect the overall pace of market growth.

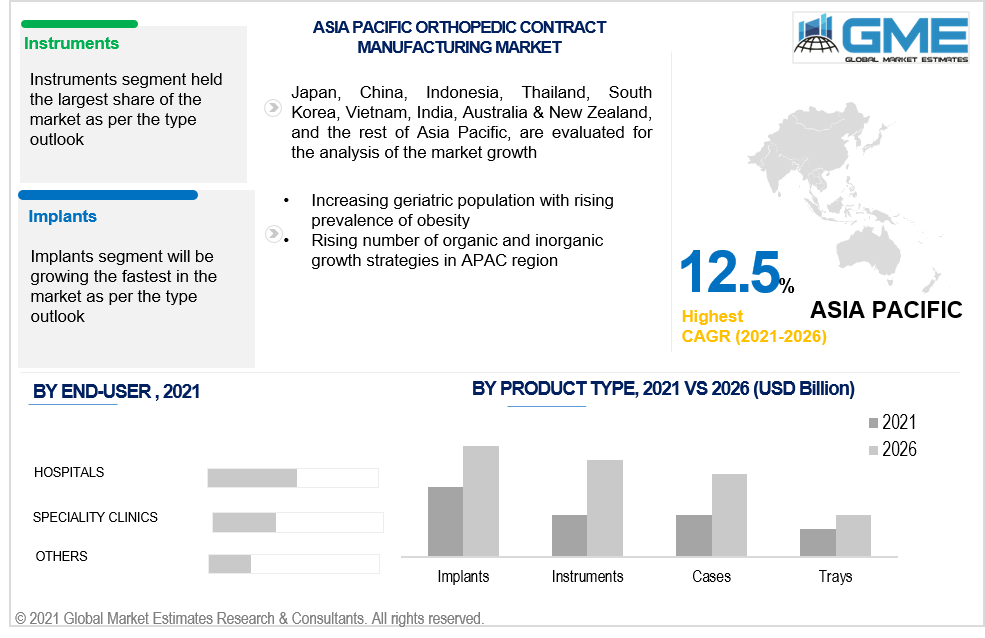

Implants, instruments, cases, trays are the type of products in the orthopedic contract manufacturing market.

During the forecast period, instruments segment is expected to be the largest segment of the orthopedic contract manufacturing market. Instruments are single tool or an entire system that aids the surgeon, operating room team, and healthcare system in securing the implant in the patient for the best potential outcome. The surge is due to the increasing number of medical devices manufacturers especially the orthopedic manufacturers, and rising adoption of latest orthopedic operating room devices.

Based on services the market is segmented into forging/casting, hip machining & finishing, knee machining & finishing, spine & trauma, instrument machining & finishing, coating, ceramics, and others. The instrument machining & finishing segment is expected to grow the fastest in the market.

The increasing adoption of orthopedic contract manufacturing services in the medical device industry, growth in the overall medical devices market, and instrument machining & finishing capabilities are the major factors responsible for the large share of this segment.

Based on end-user, the market is split into three segments: hospitals, specialty clinics, others.

Patients with musculoskeletal and other medical conditions rely heavily on orthopedic and medical equipment to improve their bone and muscle health. Because of the aging baby boomer generation and the rise in the number of overweight and obese population, the need for orthopedic and medical alert devices is rapidly expanding. The hospital segment is growing due to the increased incidence of orthopedic disorders such as degenerative bone disease clubbed with the growing elderly population and rising patient admission.

Hospitals are upgrading their gadgets as more people become aware of the availability of novel medical and orthopedic technologies. The acceptance of orthopedic and other surgeries has also been aided by reimbursement for treatment costs. These variables enable hospitals and clinicians to seek out more modern, higher-priced devices, increasing manufacturers' overall income.

North America held the largest share in the global orthopaedic contract manufacturing market in 2020. Because of the rising demand for improved orthopedic devices and the rise in healthcare spending, the region is expected to account for the largest proportion of the global orthopedic contract manufacturing market during the forecast period. The orthopedic contract manufacturing industry in Europe is expected to rise in response to an aging population's medical needs and an increase in the number of procedures. Due to benefits such as low labor costs and low overhead costs, Asian countries such as China, Japan, and India have become attractive markets for orthopedic contract manufacturing industry.

Orchid Orthopedic Solutions LLC, Greatbatch Inc., Symmetry Medical Inc, Paragon Medical Inc., Accellent, Tecomet Inc., Bradshaw Medical, LISI Medical, Autocam Medical, Blades Technology, Hammill Medical, Blades Technology, Cretex, Integer, and Norman Noble among others are key players in the orthopedic contract manufacturing market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Orthopedic Contract Manufacturing Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Service Overview

2.1.4 End-User Overview

2.1.5 Application Overview

2.1.6 Regional Overview

Chapter 3 Orthopedic Contract Manufacturing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technological advancements in the orthopedic medical devices

3.3.2 Industry Challenges

3.3.2.1 Lack of awareness regarding advanced medical infrastructure and automated orthopedic instruments in 3rd world nations

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Service Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Orthopedic Contract Manufacturing Market, By Type

4.1 Type Outlook

4.2 Implants

4.2.1 Market Size, By Region, 2021-2026 (USD Billion)

4.3 Instruments

4.3.1 Market Size, By Region, 2021-2026 (USD Billion)

4.4 Cases

4.4.1 Market Size, By Region, 2021-2026 (USD Billion)

4.5 Trays

4.5.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 5 Orthopedic Contract Manufacturing Market, By Service

5.1 Service Outlook

5.2 Forging/Casting

5.2.1 Market Size, By Region, 2021-2026 (USD Billion)

5.3 Hip Machining & Finishing

5.3.1 Market Size, By Region, 2021-2026 (USD Billion)

5.4 Knee Machining & Finishing

5.4.1 Market Size, By Region, 2021-2026 (USD Billion)

5.5 Spine & Trauma

5.5.1 Market Size, By Region, 2021-2026 (USD Billion)

5.6 Instrument Machining & Finishing

5.6.1 Market Size, By Region, 2021-2026 (USD Billion)

5.7 Coating

5.7.1 Market Size, By Region, 2021-2026 (USD Billion)

5.8 Ceramics

5.8.1 Market Size, By Region, 2021-2026 (USD Billion)

5.9 Others

5.9.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 6 Orthopedic Contract Manufacturing Market, By End-User

6.1 Hospitals

6.1.1 Market Size, By Region, 2021-2026 (USD Billion)

6.2 Specialty Clinics

6.2.1 Market Size, By Region, 2021-2026 (USD Billion)

6.3 Others

6.3.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 8 Orthopedic Contract Manufacturing Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2021-2026 (USD Billion)

7.2.2 Market Size, By Type, 2021-2026 (USD Billion)

7.2.3 Market Size, By Service, 2021-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Type, 2021-2026 (USD Billion)

7.2.5.2 Market Size, By Service, 2021-2026 (USD Billion)

7.2.5.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2021-2026 (USD Billion)

7.2.6.2 Market Size, By Service, 2021-2026 (USD Billion)

7.2.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.2.6 Mexico

7.2.7.1 Market Size, By Type, 2021-2026 (USD Billion)

7.2.7.2 Market Size, By Service, 2021-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2021-2026 (USD Billion)

7.3.2 Market Size, By Type, 2021-2026 (USD Billion)

7.3.3 Market Size, By Service, 2021-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.5 Russia

7.3.5.1 Market Size, By Type, 2021-2026 (USD Billion)

7.3.5.2 Market Size, By Service, 2021-2026 (USD Billion)

7.3.5.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Type, 2021-2026 (USD Billion)

7.3.6.2 Market Size, By Service, 2021-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Type, 2021-2026 (USD Billion)

7.3.7.2 Market Size, By Service, 2021-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Type, 2021-2026 (USD Billion)

7.3.7.2 Market Size, By Service, 2021-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Type, 2021-2026 (USD Billion)

7.3.9.2 Market Size, By Service, 2021-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Type, 2021-2026 (USD Billion)

7.3.10.2 Market Size, By Service, 2021-2026 (USD Billion)

7.3.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2021-2026 (USD Billion)

7.4.2 Market Size, By Type, 2021-2026 (USD Billion)

7.4.3 Market Size, By Service, 2021-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.5 South Korea

7.4.5.1 Market Size, By Type, 2021-2026 (USD Billion)

7.4.5.2 Market Size, By Service, 2021-2026 (USD Billion)

7.4.5.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Type, 2021-2026 (USD Billion)

7.4.6.2 Market Size, By Service, 2021-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Type, 2021-2026 (USD Billion)

7.4.7.2 Market Size, By Service, 2021-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Type, 2021-2026 (USD Billion)

7.4.7.2 Market Size, By Service, 2021-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Type, 2021-2026 (USD Billion)

7.4.9.2 Market size, By Service, 2021-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2021-2026 (USD Billion)

7.5.2 Market Size, By Type, 2021-2026 (USD Billion)

7.5.3 Market Size, By Service, 2021-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.5.5 Argentina

7.5.5.1 Market Size, By Type, 2021-2026 (USD Billion)

7.5.5.2 Market Size, By Service, 2021-2026 (USD Billion)

7.5.5.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Type, 2021-2026 (USD Billion)

7.5.6.2 Market Size, By Service, 2021-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2021-2026 (USD Billion)

7.6.2 Market Size, By Type, 2021-2026 (USD Billion)

7.6.3 Market Size, By Service, 2021-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.6.5 South Africa

7.6.5.1 Market Size, By Type, 2021-2026 (USD Billion)

7.6.5.2 Market Size, By Service, 2021-2026 (USD Billion)

7.6.5.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type, 2021-2026 (USD Billion)

7.6.6.2 Market Size, By Service, 2021-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Type, 2021-2026 (USD Billion)

7.6.7.2 Market Size, By Service, 2021-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2021

8.2 Greatbatch Inc.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Orchid Orthopaedic Solutions LLC

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Paragon Medical Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Symmetry Medical Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Tecomet Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Accellent

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Autocam Medical

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Bradshaw Medical

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Blades Technology

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Hammill Medical

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Cretex

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Integer

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 LISI Medical

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

8.15 Other Companies

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Info Graphic Analysis

The Global Orthopedic Contract Manufacturing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Orthopedic Contract Manufacturing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS