Global Oxygen Scavenger Market Size, Trends & Analysis - Forecasts to 2026 By Type (Inorganic Oxygen Scavengers, Organic Oxygen Scavengers), By End-User (Food & Beverage, Pharmaceutical, Power, Oil & Gas, Chemical, Pulp & Paper), By Region (By Region North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

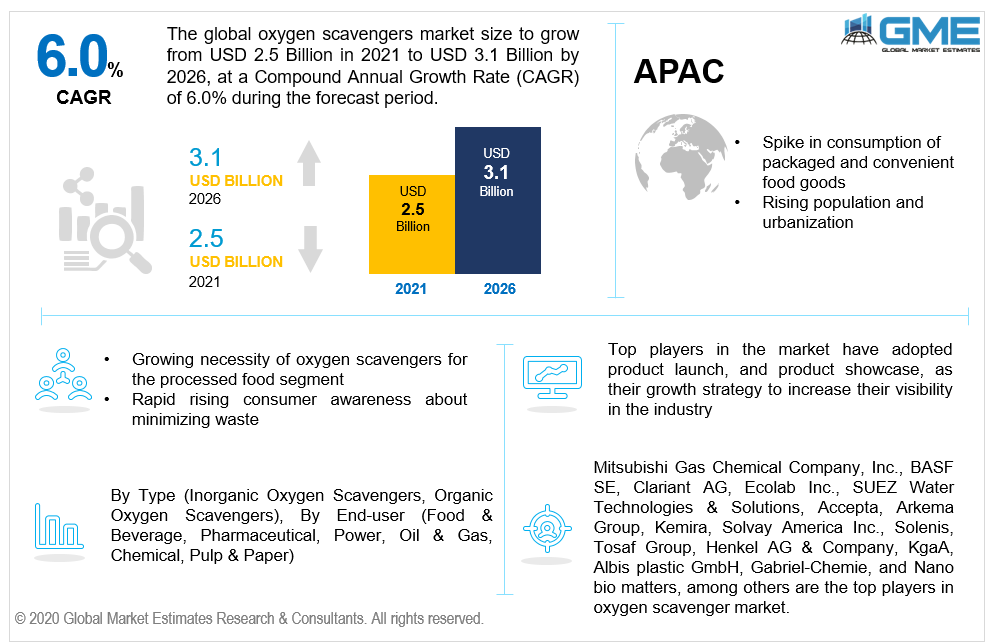

The global oxygen scavenger market is projected to grow from USD 2.5 billion in 2021 and is expected to reach USD 3.1 billion by 2026 at a CAGR of 6.0% from 2021 to 2026.

Oxygen scavengers substantially prevent oxidative damage in a wide range of food constituents, including oils and fats to prevent food spoilage, plant and muscle pigments and fragrances to prevent discoloration and loss of aroma, and nutritive elements like vitamins to minimize nutritional benefit loss.

The growing necessity of oxygen scavengers for the processed food segment is fueling the market growth. Additionally, rising consumer awareness about minimizing waste owing to unsanitary and inadequate packing is propelling the oxygen scavenger market growth.

Aerobic bacteria and food spoilage microorganisms, degradation and tartness of conjugated fats and oils, the redox of vitamins A, C, and E, and the non-enzymatic colouring of fresh vegetables and fruits are inhibited by oxygen scavengers. The usage of oxygen scavengers aims to improve the health of products. These reasons are further boosting the global market.

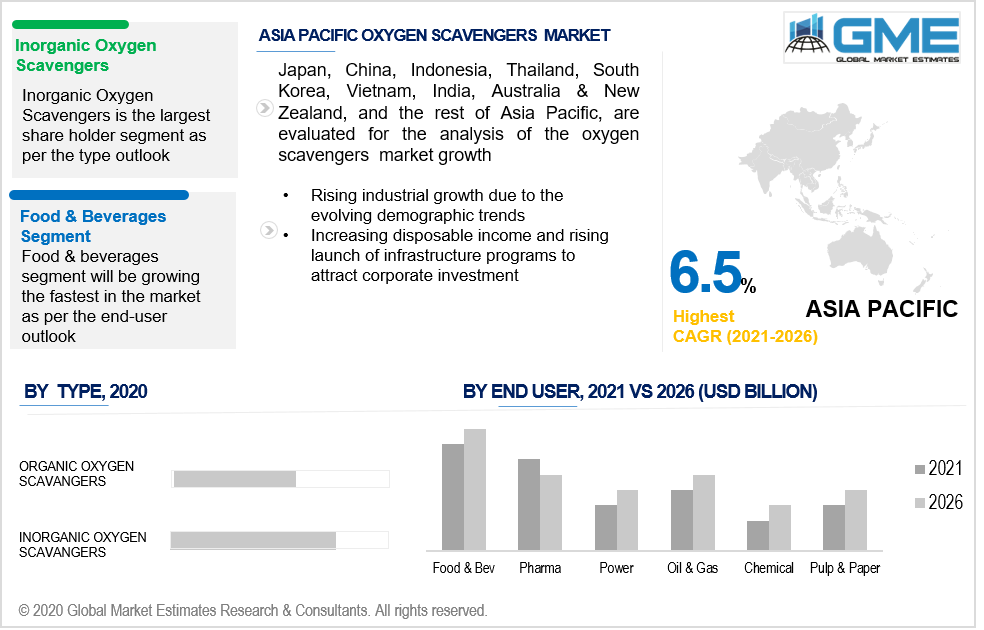

Based on type, the market is segmented into inorganic oxygen scavengers and organic oxygen scavengers. Inorganic and organic oxygen scavengers are used to minimize biochemical oxygen demand and safeguard devices from oxidation in water material handling like boiler water systems and effluent systems. However, during the forecast period, the demand for inorganic oxygen scavengers is estimated to be the largest owing to superior quality and storage stability in packaging applications and is demanded extensively by the food and beverage industries. They are used to minimize biochemical oxygen demand and safeguard devices from oxidation in water material handling like boiler water systems and effluent systems.

Based on end-user, the market is segmented into food & beverage, pharmaceutical, power, oil & gas, chemical, pulp & paper. The market for food & beverage segment is predicted to have the largest share in the market during the forecast period. This is attributable to rising demand for higher-quality packaged foods, an increase in demand for convenient meals, a reduction in food waste, and greater urbanization in emerging nations. These chemicals keep processed foods fresher for longer periods and extend the shelf life of the items. Additionally, an increase in disposable income and the expansion of the middle-class population are generating demand for oxygen scavengers in the food and beverage industry.

Oxygen scavengers are increasingly being used in oil & gas industries as well during the forecast period. It is a fact that metals corrode when exposed to a damp atmosphere and oxygen. As a result, oxygen scavengers are widely utilized as corrosion inhibitors in oil and gas production plants, boilers, and the metallurgical industry. They are also used for the conservation of historic artworks that deteriorate long-term exposure to oxygen, as well as the restoration of the solderability of electrical devices and electronic equipment.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America.

The North American region is expected to hold the lion’s share of the global revenue generated in the market. The region is predicted to have the largest share owing to rising demand for packaged nutritious, fresh, and premium items, increasing number of pharmaceutical packaging and oil & gas players in the U.S., as well as increasing demand for packaged food products.

The Asia Pacific region is anticipated to be the fastest-growing region in the market primarily due to the region's expanding economies, such as India, China, Indonesia, Malaysia, Singapore, Vietnam, and Thailand, where consumption of packaged and convenient food goods is increasing rapidly. Additionally, rising population and urbanization are driving the market. Furthermore, the region's demand for oxygen scavengers is rising due to rapid industrial growth due to the evolving demographic trends, such as better living standards.

Mitsubishi Gas Chemical Company, Inc., BASF SE, Clariant AG, Ecolab Inc., SUEZ Water Technologies & Solutions, Accepta, Arkema Group, Kemira, Solvay America Inc., Solenis, Tosaf Group, Henkel AG & Company, KgaA, Albis plastic GmbH, Gabriel-Chemie, and Nano bio matters, among others are the top players in oxygen scavenger market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Oxygen Scavengers Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 End-User Overview

2.1.4 Regional Overview

Chapter 3 Oxygen Scavengers Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising consumer awareness about minimizing waste owing to unsanitary and inadequate packaging

3.3.2 Industry Challenges

3.3.2.1 Rising need for UV light to drive the scavenging process

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Oxygen Scavengers Market, By Type

4.1 Type Outlook

4.2 Inorganic Oxygen Scavengers

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Organic Oxygen Scavengers

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Oxygen Scavengers Market, By End-User

5.1 End-User Outlook

5.2 Food & Beverage

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Pharmaceutical

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Power

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Oil & Gas

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Chemical

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

5.7 Pulp & Paper

5.7.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Oxygen Scavengers Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Type, 2020-2026 (USD Million)

6.2.3 Market Size, By End-User, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.2.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.2.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Type, 2020-2026 (USD Million)

6.3.3 Market Size, By End-User, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.6.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.7.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.8.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.9.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Type, 2020-2026 (USD Million)

6.4.3 Market Size, By End-User, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.6.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.7.2 Market size, By End-User, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.8.2 Market Size, By End-User, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Type, 2020-2026 (USD Million)

6.5.3 Market Size, By End-User, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.5.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.5.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.5.6.2 Market Size, By End-User, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Type, 2020-2026 (USD Million)

6.6.3 Market Size, By End-User, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.6.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.6.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.6.6.2 Market Size, By End-User, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Mitsubishi Gas Chemical Company, Inc

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Infographic Analysis

7.3 BASF SE

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Infographic Analysis

7.4 Clariant AG

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Infographic Analysis

7.5 Ecolab Inc

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Infographic Analysis

7.6 SUEZ Water Technologies & Solutions

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Infographic Analysis

7.7 Accepta

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Infographic Analysis

7.8 Arkema Group, Kemira

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Infographic Analysis

7.9 Kemira

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Infographic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Infographic Analysis

The Global Oxygen Scavenger Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Oxygen Scavenger Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS