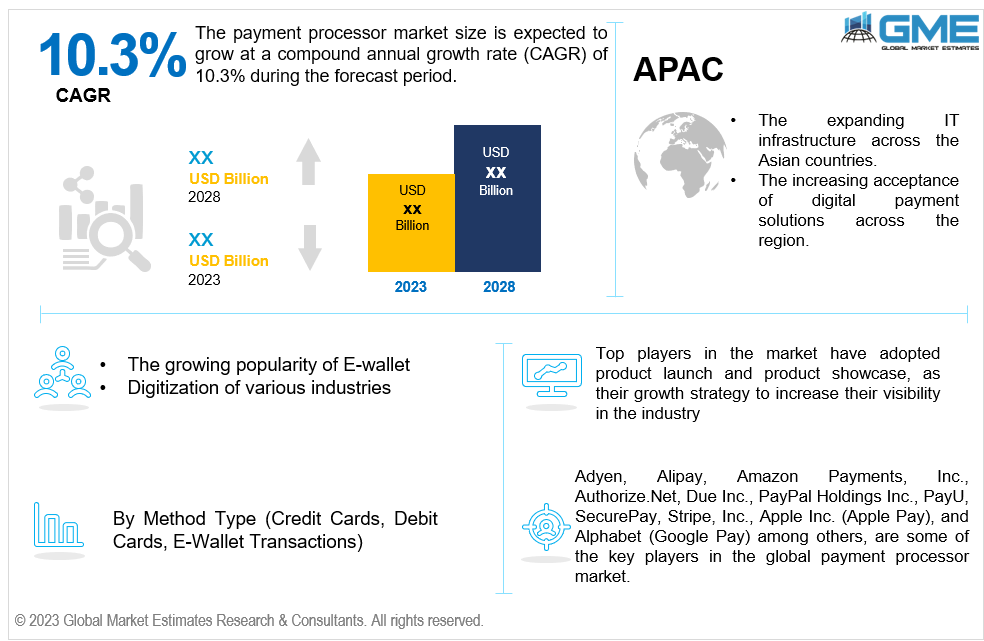

Global Payment Processor Market Size, Trends & Analysis - Forecasts to 2028 By Method Type (Credit Cards, Debit Cards, E-Wallet Transactions), By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End-user Analysis

The global payment processor market is estimated to exhibit a CAGR of 10.3% from 2023 to 2028. With expanding digitization across the globe, the payment processing industry has emerged as a crucial element of the global economy. As a result, market players continue to provide advanced solution to facilitate the safe transfer of payments between buyers and sellers both online and offline in addition to providing a range of value-added services to their customers. The abundance of options and the continual advancement of technology in the payment processing space has resulted in the significant growth of payment processor market.

The payments sector is continuously evolving to meet the demands of both businesses and customers, and success in this dynamic environment depends on staying up to date on the most recent developments.

The financial institutions have played a crucial role in the success of this market by accelerating and advancing digital payment mode. Advent of digital payment has effectively bridged the gap between businesses and customers, enabling smooth and secure transactions. As a result, payment processors continue to enhance their service offering to keep pace with the shifting demands of businesses and customers.

Also, the popularity of mobile payments is anticipated to grow remarkably in the payments sector. Worldwide adoption of mobile payment apps like PayPal, PayU, Apple pay, and Alipay is rising because they provide a quick and safe way to do business while on the go. The merchants that accept mobile payments can reach a larger clientele and offer a smooth purchasing experience across many channels.

As security technology advance, new security service provider options are becoming available in these apps. In order to fully capitalize the immense potential for e-wallet products and services, market players need to develop a knowledgeable and comprehensive approach.

As a result, the financial institutions are engaged in R&D of cutting-edge fraud detection and prevention technology to offer cutting-edge payment solutions, strengthening transaction security, and investigating partnerships with fintech firms. This strategic alliance between financial institutions and fintech firms is anticipated to greatly favor the market growth during the forecast period.

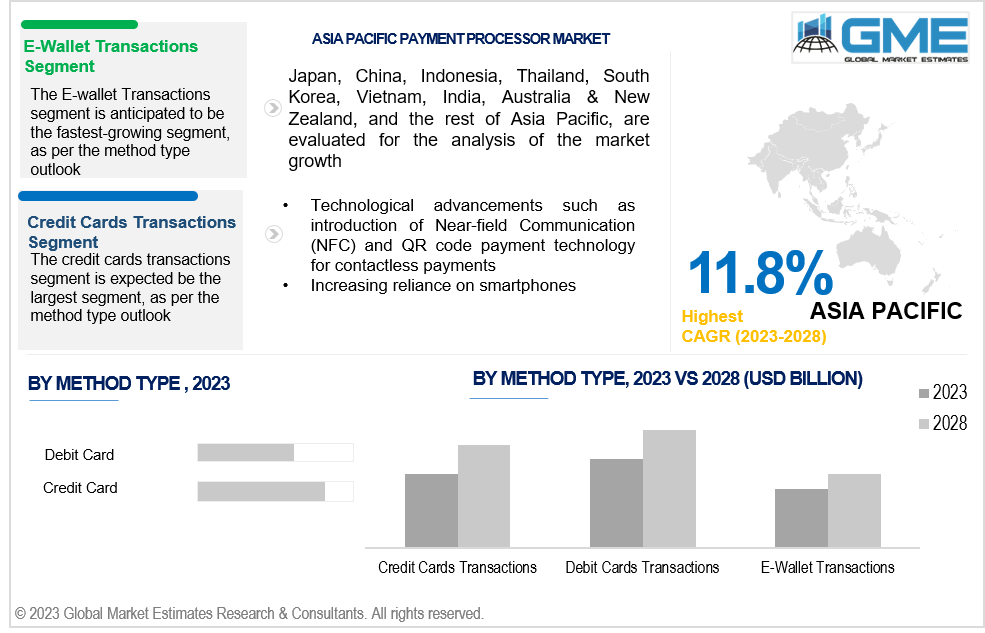

The credit card segment accounted for the largest revenue share in 2022 market. Companies are frequently embracing credit card processing solutions owing to its ability to integrate key company information, such as orders, shipping and invoicing, and inventory level, with their enterprise resource planning (ERP) systems, allowing their operations to run more smoothly.

Moreover, penetration of credit card in terms of usage and availability is increasing notably across the globe. Out of all the credit card networks, Visa is the most commonly used credit card network. Until the second quarter of 2022, there were 369 million Visa credit cards issued in the United States, and 865 million worldwide. This depicts the widespread usage of credit card as alternative payment mode.

However, e-wallet is expected to grow at the lucrative CAGR during the forecast period. Post COVID-19 pandemic, the use of e-wallets has skyrocketed in terms of usage. By 2020, digital wallets were recognized to surpass other payment methods such as credit cards, debit cards, bank transfers, and cash; for e-commerce and point-of sale payments. This trend is expected to continue in the coming years.

E-wallets are being quickly adopted by everyone, including consumers and businesses, expanding market access for new goods and services. E-wallet apps are gaining great traction among consumers given its accessibility and ease. This has eliminated the requirement for in-person account opening and created seamless P2P payment possibilities, simplifying many of the complexity of traditional financial services. Moreover, innovative in-app services can be offered by digital wallets for any unmet consumer or merchant demand.

North America captured the maximum revenue share in the 2022 payment processor market. The increasing acceptance of digital payment solutions across North America merchants coupled with presence of a substantial technology providers has contributed to the dominance of this region. Furthermore, the market players continue to invest heavily for innovation and new product developments in the U.S. market.

For instance, in February 2022, Apple, Inc. introduced Tap to Pay on iPhone. This will allow U.S.-based merchants including small businesses to large retailers to use their iPhone for seamless and secured acceptance of Apple Pay, contactless credit and debit cards, and other digital wallets through a tap to their iPhone. This is expected to greatly benefit the U.S. payment processor market in the coming years. More than 90% of U.S. merchants already accept Apple Pay, and with this new feature, almost every company, large or small, will be able to let customers use iPhone Tap to Pay.

On the other hand, Asia Pacific market is anticipated to grow at the fastest CAGR during the forecast period. The expanding IT infrastructure across the Asian countries has accelerated the adoption of smartphones and internet services, thereby spurring the adoption of alternative payment methods, such as e-wallets and bank transfers.

In July 2023, Payment Asia, a payment solutions provider, launched first AI-powered comprehensive processing service. This service comprises automated merchant onboarding and account assignment, AI customer assistance, and an auto accounting system. With this, Payment Asia became the first company in the country to offer comprehensive suite of automated payment services.

Adyen, Alipay, Amazon Payments, Inc., Authorize.Net, Due Inc., PayPal Holdings Inc., PayU, SecurePay, Stripe, Inc., Apple Inc. (Apple Pay), and Alphabet (Google Pay), among others are some of the key players operating in the global payment processor market.

Please note: This is not an exhaustive list of companies profiled in the report.

With growing popularity of digital payment processing solutions across the globe, the market is anticipated to witness several new market entries. For instance, in May 2023, Finix commenced its operation as a payment’s processor. With this, the company is directly linked to all major U.S. card networks including Discover, Visa, Mastercard, and American Express.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL PAYMENT PROCESSOR MARKET, BY APPLICATION

4.2 Payment Processor Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2027

4.4.1 Credit Cards Transactions Market Estimates and Forecast, 2020-2027 (USD Million)

4.5.1 Debit Cards Transactions Market Estimates and Forecast, 2020-2027 (USD Million)

4.6.1 E-Wallet Transactions Market Estimates and Forecast, 2020-2027 (USD Million)

5 GLOBAL PAYMENT PROCESSOR MARKET, BY REGION

5.2 North America Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.2.2.1 U.S. Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.2.2.2 Canada Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.2.2.3 Mexico Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.3 Europe Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.3.2.1 Germany Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.3.2.2 U.K. Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.3.2.3 France Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.3.2.4 Italy Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.3.2.5 Spain Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.3.2.6 Netherlands Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.3.2.7 Rest of Europe Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.4 Asia Pacific Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.4.2.1 China Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.4.2.2 Japan Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.4.2.3 India Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.4.2.4 South Korea Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.4.2.5 Singapore Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.4.2.6 Malaysia Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.4.2.7 Thailand Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.4.2.7 Indonesia Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.4.2.9 Vietnam Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.4.2.10 Taiwan Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.5 Middle East & Africa Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.5.2.1 Saudi Arabia Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.5.2.2 U.A.E. Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.5.2.3 Israel Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.5.2.4 South Africa Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.6 Central & South America Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.6.2.1 Brazil Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.6.2.2 Argentina Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

5.6.2.3 Chile Payment Processor Market Estimates and Forecast, 2020-2027 (USD Million)

6.1 Company Market Share Analysis

6.2 Four Quadrant Positioning Matrix

6.4.1.1 Business Description & Financial Analysis

6.4.1.3 Products & Services Offered

6.4.1.4 Strategic Alliances between Business Partners

6.4.2.1 Business Description & Financial Analysis

6.4.2.3 Products & Services Offered

6.4.2.4 Strategic Alliances between Business Partners

6.4.3.1 Business Description & Financial Analysis

6.4.3.3 Products & Services Offered

6.4.3.4 Strategic Alliances between Business Partners

6.4.4.1 Business Description & Financial Analysis

6.4.4.3 Products & Services Offered

6.4.4.4 Strategic Alliances between Business Partners

6.4.5.1 Business Description & Financial Analysis

6.4.5.3 Products & Services Offered

6.4.5.4 Strategic Alliances between Business Partners

6.4.6.1 Business Description & Financial Analysis

6.4.6.3 Products & Services Offered

6.4.6.4 Strategic Alliances between Business Partners

6.4.7.1 Business Description & Financial Analysis

6.4.7.3 Products & Services Offered

6.4.7.4 Strategic Alliances between Business Partners

6.4.7.1 Business Description & Financial Analysis

6.4.7.3 Products & Services Offered

6.4.7.4 Strategic Alliances between Business Partners

6.4.9.1 Business Description & Financial Analysis

6.4.9.3 Products & Services Offered

6.4.9.4 Strategic Alliances between Business Partners

6.4.10.1 Business Description & Financial Analysis

6.4.10.3 Products & Services Offered

6.4.10.4 Strategic Alliances between Business Partners

6.4.11.1 Business Description & Financial Analysis

6.4.11.3 Products & Services Offered

6.4.11.4 Strategic Alliances between Business Partners

7.1.2 Market Scope & Segmentation

7.2.1.2 GMEs Internal Data Repository

7.2.1.3 Secondary Resources & Third Party Perspectives

7.2.1.4 Company Information Sources

7.2.2.1 Various Type of Respondents for Primary Interviews

7.2.2.2 Number of Interviews Conducted throughout the Research Process

7.2.2.4 Discussion Guide for Primary Participants

7.2.3.1 Expert Panels Across 30+ Industry

7.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

7.3.1.1 Macro-Economic Indicators Considered

7.3.1.2 Micro-Economic Indicators Considered

7.3.2.1 Company Share Analysis Approach

7.3.2.2 Estimation of Potential Product Sales

7.4.2 Time Series, Cross Sectional & Panel Data Analysis

7.5.1 Inhouse AI Based Real Time Analytics Tool

7.5.2 Output From Desk & Primary Research

7.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Payment Processor Market, By Method, 2020-2028 (USD Million)

2 CREDIT CARDS Transactions Market, By Region, 2020-2028 (USD Million)

3 DEBIT CARDS Transactions Market, By Region, 2020-2028 (USD Million)

4 E-Wallet Transactions Market, By Region, 2020-2028 (USD Million)

5 Regional Analysis, 2020-2028 (USD Million)

6 North America Payment Processor Market, By Method, 2020-2028 (USD Million)

7 U.S. Payment Processor Market, By Method, 2020-2028 (USD Million)

8 Canada Payment Processor Market, By Method, 2020-2028 (USD Million)

9 Mexico Payment Processor Market, By Method, 2020-2028 (USD Million)

10 Europe Payment Processor Market, By Method, 2020-2028 (USD Million)

11 Germany Payment Processor Market, By Method, 2020-2028 (USD Million)

12 U.K. Payment Processor Market, By Method, 2020-2028 (USD Million)

13 France Payment Processor Market, By Method, 2020-2028 (USD Million)

14 Italy Payment Processor Market, By Method, 2020-2028 (USD Million)

15 Spain Payment Processor Market, By Method, 2020-2028 (USD Million)

16 Netherlands Payment Processor Market, By Method, 2020-2028 (USD Million)

17 Rest Of Europe Payment Processor Market, By Method, 2020-2028 (USD Million)

18 Asia Pacific Payment Processor Market, By Method, 2020-2028 (USD Million)

19 China Payment Processor Market, By Method, 2020-2028 (USD Million)

20 Japan Payment Processor Market, By Method, 2020-2028 (USD Million)

21 India Payment Processor Market, By Method, 2020-2028 (USD Million)

22 South Korea Payment Processor Market, By Method, 2020-2028 (USD Million)

23 Singapore Payment Processor Market, By Method, 2020-2028 (USD Million)

24 Thailand Payment Processor Market, By Method, 2020-2028 (USD Million)

25 Malaysia Payment Processor Market, By Method, 2020-2028 (USD Million)

26 Indonesia Payment Processor Market, By Method, 2020-2028 (USD Million)

27 Vietnam Payment Processor Market, By Method, 2020-2028 (USD Million)

28 Taiwan Payment Processor Market, By Method, 2020-2028 (USD Million)

29 Rest of APAC Payment Processor Market, By Method, 2020-2028 (USD Million)

30 Middle East & Africa Payment Processor Market, By Method, 2020-2028 (USD Million)

31 Saudi Arabia Payment Processor Market, By Method, 2020-2028 (USD Million)

32 UAE Payment Processor Market, By Method, 2020-2028 (USD Million)

33 Israel Payment Processor Market, By Method, 2020-2028 (USD Million)

34 South Africa Payment Processor Market, By Method, 2020-2028 (USD Million)

35 Rest Of Middle East & Africa Payment Processor Market, By Method, 2020-2028 (USD Million)

36 Central & South America Payment Processor Market, By Method, 2020-2028 (USD Million)

37 Brazil Payment Processor Market, By Method, 2020-2028 (USD Million)

38 Chile Payment Processor Market, By Method, 2020-2028 (USD Million)

39 Argentina Payment Processor Market, By Method, 2020-2028 (USD Million)

40 Rest Of Central & South America Payment Processor Market, By Method, 2020-2028 (USD Million)

41 Adyen: Products & Services Offering

42 Alipay: Products & Services Offering

43 Amazon Payments, Inc.: Products & Services Offering

44 Authorize.Net: Products & Services Offering

45 Due Inc: Products & Services Offering

46 THE ANDHRA PETROCHEMICALS LIMITED: Products & Services Offering

47 PayU : Products & Services Offering

48 SecurePay: Products & Services Offering

49 Stripe, Inc., Inc: Products & Services Offering

50 Apple Pay: Products & Services Offering

51 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Payment Processor Market Overview

2 Global Payment Processor Market Value From 2020-2028 (USD Million)

3 Global Payment Processor Market Share, By Method (2022)

4 Global Payment Processor Market, By Region (Asia Pacific Market)

5 Technological Trends In Global Payment Processor Market

6 Four Quadrant Competitor Positioning Matrix

7 Impact Of Macro & Micro Indicators On The Market

8 Impact Of Key Drivers On The Global Payment Processor Market

9 Impact Of Challenges On The Global Payment Processor Market

10 Porter’s Five Forces Analysis

11 Global Payment Processor Market: By Method Scope Key Takeaways

12 Global Payment Processor Market, By Method Segment: Revenue Growth Analysis

13 Credit Cards Transactions Market, By Region, 2020-2028 (USD Million)

14 Debit Cards Transactions Market, By Region, 2020-2028 (USD Million)

15 E-Wallet Transactions Market, By Region, 2020-2028 (USD Million)

16 Regional Segment: Revenue Growth Analysis

17 Global Payment Processor Market: Regional Analysis

18 North America Payment Processor Market Overview

19 North America Payment Processor Market, By Method

20 North America Payment Processor Market, By Country

21 U.S. Payment Processor Market, By Method

22 Canada Payment Processor Market, By Method

23 Mexico Payment Processor Market, By Method

24 Four Quadrant Positioning Matrix

25 Company Market Share Analysis

26 Adyen: Company Snapshot

27 Adyen: SWOT Analysis

28 Adyen: Geographic Presence

29 Alipay: Company Snapshot

30 Alipay: SWOT Analysis

31 Alipay: Geographic Presence

32 Amazon Payments, Inc.: Company Snapshot

33 Amazon Payments, Inc.: SWOT Analysis

34 Amazon Payments, Inc.: Geographic Presence

35 Authorize.Net: Company Snapshot

36 Authorize.Net: Swot Analysis

37 Authorize.Net: Geographic Presence

38 Due Inc: Company Snapshot

39 Due Inc: SWOT Analysis

40 Due Inc: Geographic Presence

41 PayPal Holdings Inc.: Company Snapshot

42 PayPal Holdings Inc.: SWOT Analysis

43 PayPal Holdings Inc.: Geographic Presence

44 PayU : Company Snapshot

45 PayU : SWOT Analysis

46 PayU : Geographic Presence

47 SecurePay: Company Snapshot

48 SecurePay: SWOT Analysis

49 SecurePay: Geographic Presence

50 Stripe, Inc., Inc.: Company Snapshot

51 Stripe, Inc., Inc.: SWOT Analysis

52 Stripe, Inc., Inc.: Geographic Presence

53 Apple Pay: Company Snapshot

54 Apple Pay: SWOT Analysis

55 Apple Pay: Geographic Presence

56 Other Companies: Company Snapshot

57 Other Companies: SWOT Analysis

58 Other Companies: Geographic Presence

The Global Payment Processor Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Payment Processor Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS