Global Peptide Synthesis Market Size, Trends & Analysis - Forecasts to 2028 By Product (Equipment, Reagents & Consumables, and Others), By Technology (Solid Phase Peptide Synthesis (SPPS), Liquid Phase Peptide Synthesis (LPPS), and Hybrid Technology), By Application (Therapeutics, Diagnosis, and Research), By End-use (Pharmaceutical & Biotechnology Companies, Contract Development & Manufacturing Organization (CDMO)/Contract Research Organization (CRO), and Academic & Research Institutes), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

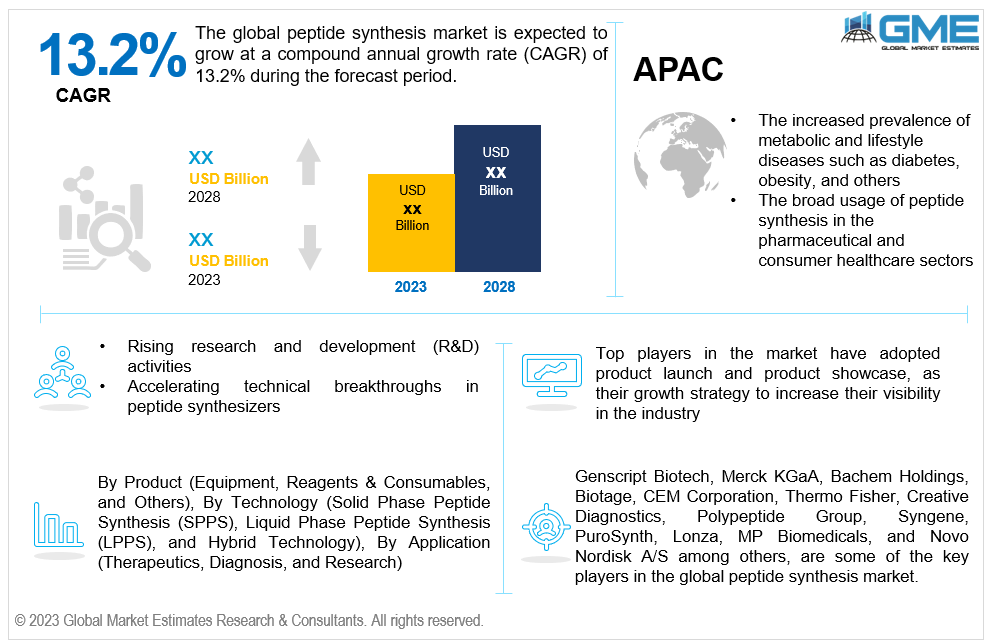

The global peptide synthesis market is estimated to exhibit a CAGR of 13.2% from 2023 to 2028.

The increasing prevalence of metabolic and lifestyle diseases such as diabetes, obesity, and others, and the broad usage of peptide synthesis in the pharmaceutical and consumer healthcare sectors are the main drivers of market growth. Based on hereditary variables, environmental effects, and individual behaviors, lifestyle diseases can vary significantly from person to person. Peptide-based medicines enable a more individualized approach to therapy since they can be customized to a person's unique needs. This necessitates using sophisticated peptide synthesis methods to create unique peptides for every patient, which raises the demand for peptide synthesis products and services. For instance, 537 million adults (20-79 years old) worldwide had diabetes in 2021, accounting for around 1 in 10 people, according to the International Diabetes Federation. Additionally, 541 million people were found to have impaired glucose tolerance (IGT), which puts them at a high risk of acquiring type 2 diabetes. As a result, it is projected that the rising number of people with diabetes would increase demand for peptide drugs and boost market growth.

During the forecast period, it is anticipated that rising research and development (R&D) activities and accelerating technical breakthroughs in peptide synthesizers are expected to drive the market growth. Potential therapeutic targets, including peptide targets, are validated in research and development processes. To evaluate their effectiveness and safety in lab settings, peptides must be synthesized as part of the validation procedure. A recent development in this field is the statement made by ISSAR Pharma in April 2021 on the licensing of their peptide-based New Chemical Entities (NCEs), which have attained the pre-investigational new drug (IND) filing stage and been granted a United States patent.

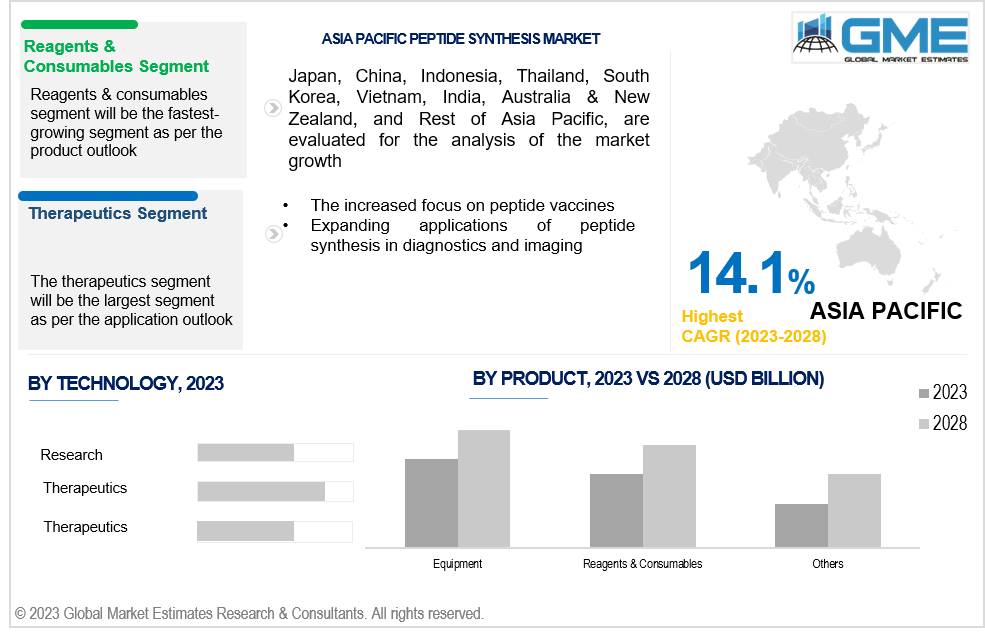

The increasing focus on peptide vaccines and expanding applications of peptide synthesis in diagnostics and imaging are propelling the market growth. Targeting cancer-specific indicators or receptors is possible with peptides. Imaging agents based on peptides can identify and classify tumors, follow metastasis, and assess the efficacy of cancer therapies. As the importance of cancer detection and personalized therapy increases, there is an increasing need for customized peptide synthesis for imaging applications.

Peptides can be used to develop treatments for orphan diseases and rare genetic disorders such as cystic fibrosis, Duchenne muscular dystrophy, haemophilia, and others. The opportunity to create and manufacture peptide-based therapies aimed at these disorders is made possible by expanding the market for peptide synthesis. To meet unmet medical requirements, market players can focus on creating and synthesizing peptides that target specific molecular targets linked to rare disorders. Additionally, the peptide synthesis industry has an opportunity to develop personalized peptide medicines that fit unique patient traits, such as genetic mutations or protein expression patterns, due to genomics, proteomics, and bioinformatics advancements.

The equipment segment is expected to hold the largest share of the market during the forecast period. The development of cutting-edge peptide synthesis equipment has significantly aided in the segment's rapid growth. For instance, MIT researchers introduced new equipment in February 2017 that allows quicker peptide synthesis than other synthesis techniques. This automated system can combine amino acids in around 37 seconds, making it possible to synthesize a large number of unique peptides in a shorter period of time.

The reagents & consumables segment is expected to be the fastest-growing segment in the market from 2023-2028. This is due to the growing use of peptides in therapeutics, the frequent purchase of reagents rather than equipment for peptide synthesis, and the availability of a large variety of peptide synthesis reagents in the market.

The liquid phase peptide synthesis (LPPS) segment is expected to hold the largest share of the market. LPPS is a flexible method that is used to create peptides with a variety of lengths and complexities. Short and long peptides, linear and cyclic structures, and changes such as post-translational modifications (PTMs) can be used with it. Additionally, LPPS frequently produces very pure peptides, essential for several applications, such as manufacturing and studying therapeutic peptides. The generation of pure peptides is facilitated by the method's simplicity and compatibility with purifying procedures.

The solid phase peptide synthesis (SPPS) segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The segment growth is attributed to rising demand for peptide therapeutics and growing biotechnology and biopharmaceutical sectors. The solid phase peptide synthesis allows for the automated production of synthetic peptide APIs. It is employed in the production of epitope-specific antibodies, mapping of antibody epitopes, investigation of enzyme binding sites, creation of new peptide- or protein-mimetic compounds, and synthesis of whole enzymes.

The therapeutics segment is expected to hold the largest share of the market. Due to their high selectivity, low toxicity, and ability to target specific cell types, peptides are becoming a potential treatment for many diseases. Peptide therapies treat many diseases like diabetes, cancer, and neurological issues. As a consequence of developments in peptide synthesis technology, the use of peptides in treatments is projected to increase significantly during the forecast period.

The research segment is anticipated to be the fastest-growing segment in the market from 2023-2028. In scientific research, peptides are significantly used, particularly in pharmacology, molecular biology, and biochemistry. Peptides are used in medication development, cell signalling pathways, and protein-protein interaction research. As researchers aim to develop novel therapies using peptides, the utilization of peptides in research is anticipated to rise.

The pharmaceutical & biotechnology companies segment is expected to hold the largest share of the market during the forecast period. Rapid technical improvements in peptide synthesizers and a robust pipeline of peptide therapies in the pharmaceutical and biotechnology industries are expected to drive the segment growth. For instance, the article "Advances in oral peptide drug nanoparticles for diabetes mellitus treatment" published in Science Direct in 2022 stated that oral administration of peptide pharmaceuticals is a promising technique for treating diabetes mellitus. Due to its simplicity and high patient compliance, oral administration of peptide medications is discovered to be a feasible technique for the treatment of diabetes mellitus in comparison to parenteral administration methods.

The contract development & manufacturing organization (CDMO)/contract research organization (CRO) segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The segment growth is attributed to the rising need for these organizations' specialized expertise, cost-effectiveness, and efficient procedures in peptide-related research, development, and manufacture.

North America is expected to be the largest region in the market. The dominance is due to increased sedentary lives, obesity, and a lack of a healthy diet and regular exercise, which leads to chronic illnesses like diabetes in the United States and necessitates effective treatment. According to the International Diabetic Federation's 2021 report, the North America and Caribbean (NAC) region had a regional prevalence of 14.6% diabetes among those aged 20 to 29. 193,000 children and teenagers in this area have type 1 diabetes, which is the second-highest number.

Asia Pacific is predicted to witness rapid growth during the forecast period. The region's peptide synthesis market is expected to grow due to rising awareness of innovative peptide medicines, increased peptide therapy activities by major players, and rising healthcare spending. For instance, in 2019, AstraZeneca launched a new global R&D center, AI innovation center and announced a joint investment fund with China International Capital Corporation Limited (CICC) to underpin the next growth phase and support healthcare transformation in China.

Genscript Biotech, Merck KGaA, Bachem Holdings, Biotage, CEM Corporation, Thermo Fisher, Creative Diagnostics, Polypeptide Group, Syngene, PuroSynth, Lonza, MP Biomedicals, and Novo Nordisk A/S among others, are some of the key players operating in the global peptide synthesis market.

Please note: This is not an exhaustive list of companies profiled in the report.

Market participants are launching new goods and establishing partnerships, alliances, and collaborations. To provide precise immuno-oncology therapies, GenScript introduced a Neoantigen Specific Peptide Synthesis Service in April 2020. Neoantigens are novel peptides exclusively present in tumor cells and not in healthy tissue, in contrast to well-established targets like tumor-associated antigens.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL PEPTIDE SYNTHESIS MARKET, BY PRODUCT

4.2 Peptide Synthesis Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Equipment Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5.1 Reagents & Consumables Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL PEPTIDE SYNTHESIS MARKET, BY TECHNOLOGY

5.2 Peptide Synthesis Market: Technology Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Solid Phase Peptide Synthesis (SPPS)

5.4.1 Solid Phase Peptide Synthesis (SPPS) Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5 Liquid Phase Peptide Synthesis (LPPS)

5.5.1 Liquid Phase Peptide Synthesis (LPPS) Market Estimates and Forecast, 2020-2028 (USD Billion)

5.6.1 Hybrid Technology Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL PEPTIDE SYNTHESIS MARKET, BY APPLICATION

6.2 Peptide Synthesis Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Therapeutics Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.1 Diagnosis Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.1 Research Market Estimates and Forecast, 2020-2028 (USD Billion)

7 GLOBAL PEPTIDE SYNTHESIS MARKET, BY END-USE

7.2 Peptide Synthesis Market: End-use Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4 Pharmaceutical & Biotechnology Companies

7.5 Contract Development & Manufacturing Organization (CDMO)/Contract Research Organization (CRO)

7.6 Academic & Research Institutes

7.6.1 Academic & Research Institutes Market Estimates and Forecast, 2020-2028 (USD Billion)

8 GLOBAL PEPTIDE SYNTHESIS MARKET, BY REGION

8.2 North America Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.1 U.S. Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.2 Canada Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.3 Mexico Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3 Europe Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.1 Germany Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.3 France Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.4 Italy Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.5 Spain Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.6 Netherlands Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.7 Rest of Europe Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4 Asia Pacific Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.1 China Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.2 Japan Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.3 India Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.4 South Korea Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.5 Singapore Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.6 Malaysia Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.7 Thailand Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.8 Indonesia Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.9 Vietnam Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.10 Taiwan Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5 Middle East and Africa Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.1 Saudi Arabia Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.2 U.A.E. Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.3 Israel Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.4 South Africa Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.1 Brazil Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.2 Argentina Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.3 Chile Peptide Synthesis Market Estimates and Forecast, 2020-2028 (USD Billion)

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.4.1.1 Business Description & Financial Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2.1 Business Description & Financial Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3.1 Business Description & Financial Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4.1 Business Description & Financial Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5.1 Business Description & Financial Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 Thermo Fisher Scientific, Inc.

9.4.6.1 Business Description & Financial Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7.1 Business Description & Financial Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8.1 Business Description & Financial Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9.1 Business Description & Financial Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10.1 Business Description & Financial Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11.1 Business Description & Financial Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10.1.2 Market Scope & Segmentation

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.4 Discussion Guide for Primary Participants

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Peptide Synthesis Market, By Product, 2020-2028 (USD Mllion)

2 Equipment Market, By Region, 2020-2028 (USD Mllion)

3 Reagents & Consumables Market, By Region, 2020-2028 (USD Mllion)

4 Others Market, By Region, 2020-2028 (USD Mllion)

5 Global Peptide Synthesis Market, By Technology, 2020-2028 (USD Mllion)

6 Solid Phase Peptide Synthesis (SPPS) Market, By Region, 2020-2028 (USD Mllion)

7 Liquid Phase Peptide Synthesis (LPPS) Market, By Region, 2020-2028 (USD Mllion)

8 Hybrid Technology Market, By Region, 2020-2028 (USD Mllion)

9 Global Peptide Synthesis Market, By Application, 2020-2028 (USD Mllion)

10 Therapeutics Market, By Region, 2020-2028 (USD Mllion)

11 Diagnosis Market, By Region, 2020-2028 (USD Mllion)

12 Research Market, By Region, 2020-2028 (USD Mllion)

13 Global Peptide Synthesis Market, By END-USE, 2020-2028 (USD Mllion)

14 Pharmaceutical & Biotechnology Companies Market, By Region, 2020-2028 (USD Mllion)

15 Contract Development & Manufacturing Organization (CDMO)/Contract Research Organization (CRO) Market, By Region, 2020-2028 (USD Mllion)

16 Academic & Research Institutes Market, By Region, 2020-2028 (USD Mllion)

17 Regional Analysis, 2020-2028 (USD Mllion)

18 North America Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

19 North America Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

20 North America Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

21 North America Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

22 North America Peptide Synthesis Market, By Country, 2020-2028 (USD Billion)

23 U.S Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

24 U.S Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

25 U.S Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

26 U.S Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

27 Canada Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

28 Canada Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

29 Canada Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

30 CANADA Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

31 Mexico Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

32 Mexico Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

33 Mexico Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

34 mexico Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

35 Europe Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

36 Europe Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

37 Europe Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

38 europe Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

39 Germany Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

40 Germany Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

41 Germany Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

42 germany Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

43 UK Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

44 UK Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

45 UK Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

46 U.kPeptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

47 France Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

48 France Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

49 France Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

50 france Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

51 Italy Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

52 Italy Peptide Synthesis Market, By T Technology Type, 2020-2028 (USD Billion)

53 Italy Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

54 italy Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

55 Spain Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

56 Spain Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

57 Spain Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

58 spain Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

59 Rest Of Europe Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

60 Rest Of Europe Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

61 Rest of Europe Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

62 REST OF EUROPE Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

63 Asia Pacific Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

64 Asia Pacific Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

65 Asia Pacific Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

66 asia Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

67 Asia Pacific Peptide Synthesis Market, By Country, 2020-2028 (USD Billion)

68 China Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

69 China Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

70 China Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

71 china Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

72 India Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

73 India Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

74 India Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

75 india Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

76 Japan Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

77 Japan Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

78 Japan Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

79 japan Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

80 South Korea Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

81 South Korea Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

82 South Korea Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

83 south korea Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

84 Middle East and Africa Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

85 Middle East and Africa Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

86 Middle East and Africa Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

87 MIDDLE EAST AND AFRICA Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

88 Middle East and Africa Peptide Synthesis Market, By Country, 2020-2028 (USD Billion)

89 Saudi Arabia Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

90 Saudi Arabia Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

91 Saudi Arabia Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

92 saudi arabia Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

93 UAE Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

94 UAE Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

95 UAE Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

96 uae Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

97 Central and South America Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

98 Central and South America Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

99 Central and South America Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

100 CENTRAL AND SOUTH AMERICA Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

101 Central and South America Peptide Synthesis Market, By Country, 2020-2028 (USD Billion)

102 Brazil Peptide Synthesis Market, By Product, 2020-2028 (USD Billion)

103 Brazil Peptide Synthesis Market, By Technology, 2020-2028 (USD Billion)

104 Brazil Peptide Synthesis Market, By Application, 2020-2028 (USD Billion)

105 brazil Peptide Synthesis Market, By End-use, 2020-2028 (USD Billion)

106 Genscript Biotech: Products & Services Offering

107 Merck KGaA: Products & Services Offering

108 Bachem Holdings: Products & Services Offering

109 Biotage: Products & Services Offering

110 CEM Corporation: Products & Services Offering

111 THERMO FISHER: Products & Services Offering

112 Creative Diagnostics : Products & Services Offering

113 Polypeptide Group: Products & Services Offering

114 Syngene, Inc: Products & Services Offering

115 PuroSynth: Products & Services Offering

116 Other Companies: Products & Services Offering

LIST OF FIGURES

1 GLOBAL PEPTIDE SYNTHESIS MARKET OVERVIEW

2 GLOBAL PEPTIDE SYNTHESIS MARKET VALUE FROM 2020-2028 (USD MLLION)

3 GLOBAL PEPTIDE SYNTHESIS MARKET SHARE, BY PRODUCT (2022)

4 GLOBAL PEPTIDE SYNTHESIS MARKET SHARE, BY TECHNOLOGY (2022)

5 GLOBAL PEPTIDE SYNTHESIS MARKET SHARE, BY APPLICATION (2022)

6 GLOBAL PEPTIDE SYNTHESIS MARKET SHARE, BY END-USE (2022)

7 GLOBAL PEPTIDE SYNTHESIS MARKET, BY REGION (ASIA PACIFIC MARKET)

8 TECHNOLOGICAL TRENDS IN GLOBAL PEPTIDE SYNTHESIS MARKET

9 FOUR QUADRANT COMPETITOR POSITIONING MATRIX

10 IMPACT OF MACRO & MICRO INDICATORS ON THE MARKET

11 IMPACT OF KEY DRIVERS ON THE GLOBAL PEPTIDE SYNTHESIS MARKET

12 IMPACT OF CHALLENGES ON THE GLOBAL PEPTIDE SYNTHESIS MARKET

13 PORTER’S FIVE FORCES ANALYSIS

14 GLOBAL PEPTIDE SYNTHESIS MARKET: BY PRODUCT SCOPE KEY TAKEAWAYS

15 GLOBAL PEPTIDE SYNTHESIS MARKET, BY PRODUCT SEGMENT: REVENUE GROWTH ANALYSIS

16 EQUIPMENT MARKET, BY REGION, 2020-2028 (USD MLLION)

17 REAGENTS & CONSUMABLES MARKET, BY REGION, 2020-2028 (USD MLLION)

18 OTHERS MARKET, BY REGION, 2020-2028 (USD MLLION)

19 GLOBAL PEPTIDE SYNTHESIS MARKET: BY TECHNOLOGY SCOPE KEY TAKEAWAYS

20 GLOBAL PEPTIDE SYNTHESIS MARKET, BY TECHNOLOGY SEGMENT: REVENUE GROWTH ANALYSIS

21 SOLID PHASE PEPTIDE SYNTHESIS (SPPS) MARKET, BY REGION, 2020-2028 (USD MLLION)

22 LIQUID PHASE PEPTIDE SYNTHESIS (LPPS) MARKET, BY REGION, 2020-2028 (USD MLLION)

23 HYBRID TECHNOLOGY MARKET, BY REGION, 2020-2028 (USD MLLION)

24 GLOBAL PEPTIDE SYNTHESIS MARKET: BY APPLICATION SCOPE KEY TAKEAWAYS

25 GLOBAL PEPTIDE SYNTHESIS MARKET, BY APPLICATION SEGMENT: REVENUE GROWTH ANALYSIS

26 THERAPEUTICS MARKET, BY REGION, 2020-2028 (USD MLLION)

27 DIAGNOSIS MARKET, BY REGION, 2020-2028 (USD MLLION)

28 RESEARCH MARKET, BY REGION, 2020-2028 (USD MLLION)

29 GLOBAL PEPTIDE SYNTHESIS MARKET: BY END-USE SCOPE KEY TAKEAWAYS

30 GLOBAL PEPTIDE SYNTHESIS MARKET, BY END-USE SEGMENT: REVENUE GROWTH ANALYSIS

31 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES MARKET, BY REGION, 2020-2028 (USD MLLION)

32 CONTRACT DEVELOPMENT & MANUFACTURING ORGANIZATION (CDMO)/CONTRACT RESEARCH ORGANIZATION (CRO) MARKET, BY REGION, 2020-2028 (USD MLLION)

33 ACADEMIC & RESEARCH INSTITUTES MARKET, BY REGION, 2020-2028 (USD MLLION)

34 REGIONAL SEGMENT: REVENUE GROWTH ANALYSIS

35 GLOBAL PEPTIDE SYNTHESIS MARKET: REGIONAL ANALYSIS

36 NORTH AMERICA PEPTIDE SYNTHESIS MARKET OVERVIEW

37 NORTH AMERICA PEPTIDE SYNTHESIS MARKET, BY PRODUCT

38 NORTH AMERICA PEPTIDE SYNTHESIS MARKET, BY TECHNOLOGY

39 NORTH AMERICA PEPTIDE SYNTHESIS MARKET, BY APPLICATION

40 NORTH AMERICA PEPTIDE SYNTHESIS MARKET, BY END-USE

41 NORTH AMERICA PEPTIDE SYNTHESIS MARKET, BY COUNTRY

42 U.S. PEPTIDE SYNTHESIS MARKET, BY PRODUCT

43 U.S. PEPTIDE SYNTHESIS MARKET, BY TECHNOLOGY

44 U.S. PEPTIDE SYNTHESIS MARKET, BY APPLICATION

45 U.S. PEPTIDE SYNTHESIS MARKET, BY END-USE

46 CANADA PEPTIDE SYNTHESIS MARKET, BY PRODUCT

47 CANADA PEPTIDE SYNTHESIS MARKET, BY TECHNOLOGY

48 CANADA PEPTIDE SYNTHESIS MARKET, BY APPLICATION

49 CANADA PEPTIDE SYNTHESIS MARKET, BY END-USE

50 MEXICO PEPTIDE SYNTHESIS MARKET, BY PRODUCT

51 MEXICO PEPTIDE SYNTHESIS MARKET, BY TECHNOLOGY

52 MEXICO PEPTIDE SYNTHESIS MARKET, BY APPLICATION

53 MEXICO PEPTIDE SYNTHESIS MARKET, BY END-USE

54 FOUR QUADRANT POSITIONING MATRIX

55 COMPANY MARKET SHARE ANALYSIS

56 GENSCRIPT BIOTECH: COMPANY SNAPSHOT

57 GENSCRIPT BIOTECH: SWOT ANALYSIS

58 GENSCRIPT BIOTECH: GEOGRAPHIC PRESENCE

59 MERCK KGAA: COMPANY SNAPSHOT

60 MERCK KGAA: SWOT ANALYSIS

61 MERCK KGAA: GEOGRAPHIC PRESENCE

62 BACHEM HOLDINGS: COMPANY SNAPSHOT

63 BACHEM HOLDINGS: SWOT ANALYSIS

64 BACHEM HOLDINGS: GEOGRAPHIC PRESENCE

65 BIOTAGE: COMPANY SNAPSHOT

66 BIOTAGE: SWOT ANALYSIS

67 BIOTAGE: GEOGRAPHIC PRESENCE

68 CEM CORPORATION: COMPANY SNAPSHOT

69 CEM CORPORATION: SWOT ANALYSIS

70 CEM CORPORATION: GEOGRAPHIC PRESENCE

71 THERMO FISHER: COMPANY SNAPSHOT

72 THERMO FISHER: SWOT ANALYSIS

73 THERMO FISHER: GEOGRAPHIC PRESENCE

74 CREATIVE DIAGNOSTICS : COMPANY SNAPSHOT

75 CREATIVE DIAGNOSTICS : SWOT ANALYSIS

76 CREATIVE DIAGNOSTICS : GEOGRAPHIC PRESENCE

77 POLYPEPTIDE GROUP: COMPANY SNAPSHOT

78 POLYPEPTIDE GROUP: SWOT ANALYSIS

79 POLYPEPTIDE GROUP: GEOGRAPHIC PRESENCE

80 SYNGENE, INC.: COMPANY SNAPSHOT

81 SYNGENE, INC.: SWOT ANALYSIS

82 SYNGENE, INC.: GEOGRAPHIC PRESENCE

83 PUROSYNTH: COMPANY SNAPSHOT

84 PUROSYNTH: SWOT ANALYSIS

85 PUROSYNTH: GEOGRAPHIC PRESENCE

86 OTHER COMPANIES: COMPANY SNAPSHOT

87 OTHER COMPANIES: SWOT ANALYSIS

88 OTHER COMPANIES: GEOGRAPHIC PRESENCE

The Global Peptide Synthesis Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Peptide Synthesis Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS