Global Peptides and Heparin Market Size, Trends & Analysis - Forecasts to 2029 By Type (Insulin, Teriparatide, Liraglutide, Leuprolide, Exenatide, Calcitonin, Enaxaparin Sodium, and Heparin Sodium), By Application (Diabetes, Infectious Diseases, Cancer, and Osteoporosis), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

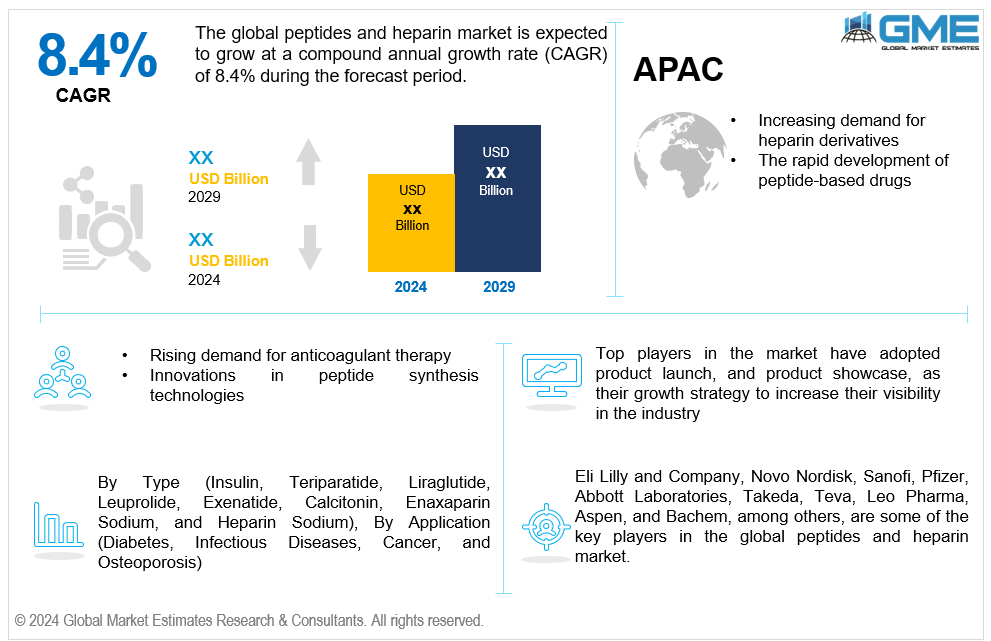

The global peptides and heparin market is estimated to exhibit a CAGR of 8.4% from 2024 to 2029.

The primary factors propelling the market growth are the increasing demand for heparin derivatives and the rapid development of peptide-based drugs. Advances in peptide drug discovery are identifying new therapeutic candidates with high specificity and efficacy, particularly in areas like oncology and metabolic disorders. This progress fuels peptide therapeutics development, enhancing the pipeline of drugs targeting various medical conditions with precision. The growing market for peptide pharmaceuticals reflects their increasing adoption in clinical practice, offering effective treatments with minimal side effects. Additionally, innovations in peptide drug manufacturing are streamlining production processes, reducing costs, and improving the scalability of peptide drug production. These advancements collectively boost the market, meeting the rising demand for advanced therapies and expanding the applications of peptide-based drugs in modern medicine. For instance, according to the National Library of Medicine, peptide pharmaceuticals held a 5% share of the global pharmaceutical industry in 2022, valued at USD 42.05 billion.

The rising demand for anticoagulant therapy and the innovations in peptide synthesis technologies are expected to support the market growth. The heparin sodium market is expanding due to its critical role in preventing and treating blood clots during surgeries and dialysis. However, the need for heparin alternatives is also rising, driven by concerns over heparin-induced thrombocytopenia (HIT), a serious side effect that necessitates safer anticoagulant options. A comprehensive heparin market analysis highlights these trends, showing increased investment in traditional heparin and innovative substitutes. Additionally, the introduction of heparin biosimilars offers cost-effective solutions, maintaining therapeutic efficacy while reducing healthcare expenses. These factors collectively enhance the market dynamics, ensuring a steady supply of anticoagulants to meet the rising demand driven by an aging population and the increasing prevalence of cardiovascular diseases.

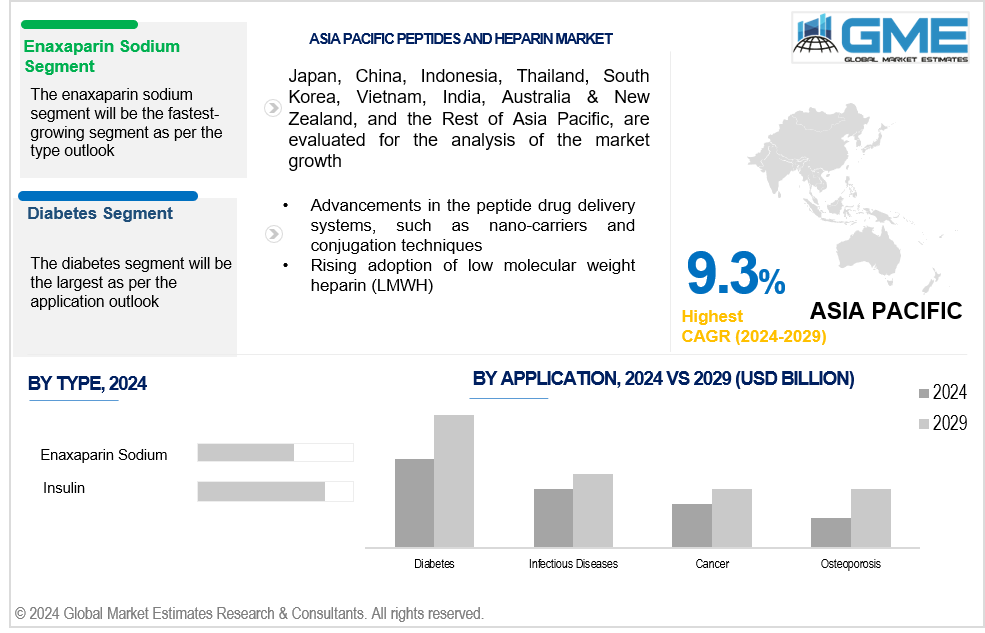

Advancements in the peptide drug delivery systems, such as nano-carriers and conjugation techniques, along with the rising adoption of low molecular weight heparin (LMWH), propel market growth. Innovative developments in peptide-based vaccines enhance targeted drug delivery, improve therapeutic outcomes, and expand peptide drug applications. Concurrently, the growing use of heparin anticoagulant therapy is boosting the demand for high-quality heparin products, which is crucial for effective blood clot prevention. The peptide hormone market is also witnessing substantial growth due to the increased application of peptide hormones in treating endocrine disorders. Furthermore, stringent heparin quality control measures ensure the safety and efficacy of heparin products, thus fostering market growth.

New developments in drug delivery technologies, including targeted distribution and sustained-release formulations, improve the effectiveness and lessen adverse effects of peptide and heparin treatments and open up new business opportunities. Additionally, personalized medicine, which targets specific biochemical pathways in various disorders, is becoming increasingly popular. This development opens up opportunities for customized peptide therapeutics.

However, stringent regulatory requirements and the availability of alternative treatments, including small molecule drugs and newer biologics, may impede market growth.

The insulin segment is expected to hold the largest share of the market over the forecast period. Diabetes, especially type 2 diabetes, is becoming more prevalent worldwide. The growing number of diabetic patients greatly fuels the demand for insulin products, as insulin is a crucial therapy for the disease. Furthermore, regulatory bodies throughout the globe acknowledge the vital significance of insulin and frequently offer accelerated review and approval procedures for novel insulin products and formulations, hence promoting market penetration and growth.

The enaxaparin sodium segment is expected to be the fastest-growing segment in the market from 2024 to 2029. When patients undergo different surgical operations, such as orthopedic and abdominal surgeries, enoxaparin sodium is frequently used as a prophylactic measure against blood clots. Worldwide surgical rates are increasing, which is driving up demand for enoxaparin.

The diabetes segment is expected to hold the largest share of the market over the forecast period. Globally, there has been a significant emphasis on diabetes awareness and preventive initiatives, resulting in higher screening and diagnosis rates. The need for diabetes management drugs, such as insulin and antidiabetic peptides, is rising in tandem with the number of people receiving diabetes diagnoses.

The osteoporosis segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Therapeutics for osteoporosis have advanced significantly, with new peptide-based medications that target bone production and metabolism being developed. The market is growing due to these novel therapeutics' superior effectiveness and safety characteristics over conventional medications.

North America is expected to be the largest region in the global market. Chronic diseases, including diabetes, heart disease, and cancer, are quite widespread in North America. Peptides and heparin are extensively used to treat these disorders, propelling the market growth.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The Asia Pacific region's nations are making significant investments in R&D, which is resulting in advances in drug discovery and development technology. The development of novel peptide and heparin formulations and delivery methods is propelling the market's growth in the region.

Eli Lilly and Company, Novo Nordisk, Sanofi, Pfizer, Abbott Laboratories, Takeda, Teva, Leo Pharma, Aspen, and Bachem, among others, are some of the key players in the global peptides and heparin market.

Please note: This is not an exhaustive list of companies profiled in the report.

In November 2023, Eli Lilly and Company's ZepboundTM (tirzepatide) injectable was approved by the U.S. Food and Drug Administration (FDA) to treat obesity. This is the first and only medication of its type that activates both GLP-1 (glucagon-like peptide-1) and GIP (glucose-dependent insulinotropic polypeptide) hormone receptors.

In November 2023, Novo Nordisk announced that it will invest around USD 6 billion to increase the production of peptides at its Kalundborg, Denmark, facility. The focus of the project will be active pharmaceutical ingredients (APIs), such as semaglutide, which is an API found in the weight-loss medication Wegovy and the type 2 diabetes medication Ozempic.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL PEPTIDES AND HEPARIN MARKET, BY Type

4.1 Introduction

4.2 Peptides and Heparin Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Insulin

4.4.1 Insulin Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Teriparatide

4.5.1 Teriparatide Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Liraglutide

4.6.1 Liraglutide Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Leuprolide

4.7.1 Leuprolide Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Exenatide

4.8.1 Exenatide Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Calcitonin

4.9.1 Calcitonin Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Enaxaparin Sodium

4.10.1 Enaxaparin Sodium Market Estimates and Forecast, 2021-2029 (USD Million)

4.11 Heparin Sodium

4.11.1 Heparin Sodium Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL PEPTIDES AND HEPARIN MARKET, BY APPLICATION

5.1 Introduction

5.2 Peptides and Heparin Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Diabetes

5.4.1 Diabetes Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Infectious Diseases

5.5.1 Infectious Diseases Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Cancer

5.6.1 Cancer Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Osteoporosis

5.7.1 Osteoporosis Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL PEPTIDES AND HEPARIN MARKET, BY REGION

6.1 Introduction

6.2 North America Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Type

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Type

6.2.3.1.2 By Application

6.2.3.2 Canada Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Type

6.2.3.2.2 By Application

6.2.3.3 Mexico Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Type

6.2.3.3.2 By Application

6.3 Europe Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Type

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Type

6.3.3.1.2 By Application

6.3.3.2 U.K. Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Type

6.3.3.2.2 By Application

6.3.3.3 France Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Type

6.3.3.3.2 By Application

6.3.3.4 Italy Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Type

6.3.3.4.2 By Application

6.3.3.5 Spain Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Type

6.3.3.5.2 By Application

6.3.3.6 Netherlands Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.4 Asia Pacific Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Type

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Type

6.4.3.1.2 By Application

6.4.3.2 Japan Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Type

6.4.3.2.2 By Application

6.4.3.3 India Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Type

6.4.3.3.2 By Application

6.4.3.4 South Korea Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Type

6.4.3.4.2 By Application

6.4.3.5 Singapore Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Type

6.4.3.5.2 By Application

6.4.3.6 Malaysia Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.7 Thailand Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.8 Indonesia Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Type

6.4.3.7.2 By Application

6.4.3.9 Vietnam Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Type

6.4.3.8.2 By Application

6.4.3.10 Taiwan Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Type

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Type

6.4.3.11.2 By Application

6.5 Middle East and Africa Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Type

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Type

6.5.3.1.2 By Application

6.5.3.2 U.A.E. Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Type

6.5.3.2.2 By Application

6.5.3.3 Israel Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Type

6.5.3.3.2 By Application

6.5.3.4 South Africa Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Type

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Type

6.5.3.5.2 By Application

6.6 Central and South America Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Type

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Type

6.6.3.1.2 By Application

6.6.3.2 Argentina Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Type

6.6.3.2.2 By Application

6.6.3.3 Chile Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

6.6.3.3 Rest of Central and South America Peptides and Heparin Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Eli Lilly and Company

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Novo Nordisk

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Sanofi

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Pfizer

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Abbott Laboratories

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 TAKEDA

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Teva

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Leo Pharma

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Aspen

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Bachem

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

2 Insulin Market, By Region, 2021-2029 (USD Mllion)

3 Teriparatide Market, By Region, 2021-2029 (USD Mllion)

4 Liraglutide Market, By Region, 2021-2029 (USD Mllion)

5 Leuprolide Market, By Region, 2021-2029 (USD Mllion)

6 Exenatide Market, By Region, 2021-2029 (USD Mllion)

7 Calcitonin Market, By Region, 2021-2029 (USD Mllion)

8 Enaxaparin Sodium Market, By Region, 2021-2029 (USD Mllion)

9 Heparin Sodium Market, By Region, 2021-2029 (USD Mllion)

10 Global Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

11 Diabetes Market, By Region, 2021-2029 (USD Mllion)

12 Infectious Diseases Market, By Region, 2021-2029 (USD Mllion)

13 Cancer Market, By Region, 2021-2029 (USD Mllion)

14 Osteoporosis Market, By Region, 2021-2029 (USD Mllion)

15 Regional Analysis, 2021-2029 (USD Mllion)

16 North America Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

17 North America Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

18 North America Peptides and Heparin Market, By COUNTRY, 2021-2029 (USD Mllion)

19 U.S. Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

20 U.S. Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

21 Canada Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

22 Canada Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

23 Mexico Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

24 Mexico Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

25 Europe Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

26 Europe Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

27 EUROPE Peptides and Heparin Market, By COUNTRY, 2021-2029 (USD Mllion)

28 Germany Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

29 Germany Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

30 U.K. Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

31 U.K. Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

32 France Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

33 France Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

34 Italy Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

35 Italy Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

36 Spain Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

37 Spain Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

38 Netherlands Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

39 Netherlands Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

40 Rest Of Europe Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

41 Rest Of Europe Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

42 Asia Pacific Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

43 Asia Pacific Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

44 ASIA PACIFIC Peptides and Heparin Market, By COUNTRY, 2021-2029 (USD Mllion)

45 China Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

46 China Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

47 Japan Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

48 Japan Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

49 India Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

50 India Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

51 South Korea Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

52 South Korea Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

53 Singapore Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

54 Singapore Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

55 Thailand Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

56 Thailand Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

57 Malaysia Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

58 Malaysia Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

59 Indonesia Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

60 Indonesia Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

61 Vietnam Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

62 Vietnam Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

63 Taiwan Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

64 Taiwan Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

65 Rest of APAC Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

66 Rest of APAC Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

67 Middle East and Africa Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

68 Middle East and Africa Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

69 MIDDLE EAST & AFRICA Peptides and Heparin Market, By COUNTRY, 2021-2029 (USD Mllion)

70 Saudi Arabia Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

71 Saudi Arabia Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

72 UAE Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

73 UAE Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

74 Israel Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

75 Israel Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

76 South Africa Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

77 South Africa Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

78 Rest Of Middle East and Africa Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

79 Rest Of Middle East and Africa Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

80 Central and South America Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

81 Central and South America Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

82 CENTRAL AND SOUTH AMERICA Peptides and Heparin Market, By COUNTRY, 2021-2029 (USD Mllion)

83 Brazil Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

84 Brazil Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

85 Chile Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

86 Chile Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

87 Argentina Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

88 Argentina Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

89 Rest Of Central and South America Peptides and Heparin Market, By Type, 2021-2029 (USD Mllion)

90 Rest Of Central and South America Peptides and Heparin Market, By Application, 2021-2029 (USD Mllion)

91 Eli Lilly and Company: Products & Services Offering

92 Novo Nordisk: Products & Services Offering

93 Sanofi: Products & Services Offering

94 Pfizer: Products & Services Offering

95 Abbott Laboratories: Products & Services Offering

96 TAKEDA: Products & Services Offering

97 Teva: Products & Services Offering

98 Leo Pharma: Products & Services Offering

99 Aspen, Inc: Products & Services Offering

100 Bachem: Products & Services Offering

101 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Peptides and Heparin Market Overview

2 Global Peptides and Heparin Market Value From 2021-2029 (USD Mllion)

3 Global Peptides and Heparin Market Share, By Type (2023)

4 Global Peptides and Heparin Market Share, By Application (2023)

5 Global Peptides and Heparin Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Peptides and Heparin Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Peptides and Heparin Market

10 Impact Of Challenges On The Global Peptides and Heparin Market

11 Porter’s Five Forces Analysis

12 Global Peptides and Heparin Market: By Type Scope Key Takeaways

13 Global Peptides and Heparin Market, By Type Segment: Revenue Growth Analysis

14 Insulin Market, By Region, 2021-2029 (USD Mllion)

15 Teriparatide Market, By Region, 2021-2029 (USD Mllion)

16 Liraglutide Market, By Region, 2021-2029 (USD Mllion)

17 Leuprolide Market, By Region, 2021-2029 (USD Mllion)

18 Exenatide Market, By Region, 2021-2029 (USD Mllion)

19 Calcitonin Market, By Region, 2021-2029 (USD Mllion)

20 Enaxaparin Sodium Market, By Region, 2021-2029 (USD Mllion)

21 Heparin Sodium Market, By Region, 2021-2029 (USD Mllion)

22 Global Peptides and Heparin Market: By Application Scope Key Takeaways

23 Global Peptides and Heparin Market, By Application Segment: Revenue Growth Analysis

24 Diabetes Market, By Region, 2021-2029 (USD Mllion)

25 Infectious Diseases Market, By Region, 2021-2029 (USD Mllion)

26 Cancer Market, By Region, 2021-2029 (USD Mllion)

27 Osteoporosis Market, By Region, 2021-2029 (USD Mllion)

28 Regional Segment: Revenue Growth Analysis

29 Global Peptides and Heparin Market: Regional Analysis

30 North America Peptides and Heparin Market Overview

31 North America Peptides and Heparin Market, By Type

32 North America Peptides and Heparin Market, By Application

33 North America Peptides and Heparin Market, By Country

34 U.S. Peptides and Heparin Market, By Type

35 U.S. Peptides and Heparin Market, By Application

36 Canada Peptides and Heparin Market, By Type

37 Canada Peptides and Heparin Market, By Application

38 Mexico Peptides and Heparin Market, By Type

39 Mexico Peptides and Heparin Market, By Application

40 Four Quadrant Positioning Matrix

41 Company Market Share Analysis

42 Eli Lilly and Company: Company Snapshot

43 Eli Lilly and Company: SWOT Analysis

44 Eli Lilly and Company: Geographic Presence

45 Novo Nordisk: Company Snapshot

46 Novo Nordisk: SWOT Analysis

47 Novo Nordisk: Geographic Presence

48 Sanofi: Company Snapshot

49 Sanofi: SWOT Analysis

50 Sanofi: Geographic Presence

51 Pfizer: Company Snapshot

52 Pfizer: Swot Analysis

53 Pfizer: Geographic Presence

54 Abbott Laboratories: Company Snapshot

55 Abbott Laboratories: SWOT Analysis

56 Abbott Laboratories: Geographic Presence

57 TAKEDA: Company Snapshot

58 TAKEDA: SWOT Analysis

59 TAKEDA: Geographic Presence

60 Teva : Company Snapshot

61 Teva : SWOT Analysis

62 Teva : Geographic Presence

63 Leo Pharma: Company Snapshot

64 Leo Pharma: SWOT Analysis

65 Leo Pharma: Geographic Presence

66 Aspen, Inc.: Company Snapshot

67 Aspen, Inc.: SWOT Analysis

68 Aspen, Inc.: Geographic Presence

69 Bachem: Company Snapshot

70 Bachem: SWOT Analysis

71 Bachem: Geographic Presence

72 Other Companies: Company Snapshot

73 Other Companies: SWOT Analysis

74 Other Companies: Geographic Presence

The Global Peptides and Heparin Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Peptides and Heparin Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS