Global Peripheral Vascular Devices Market Size, Trends & Analysis - Forecasts to 2026 By Device Type (Peripheral Vascular Stents, Peripheral Transluminal Angioplasty (PTA) Balloon Catheters, Peripheral Transluminal Angioplasty (PTA) Guidewires, Atherectomy Devices, Embolic Protection Devices, Inferior Vena Cava Filters, and Other Device Types), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

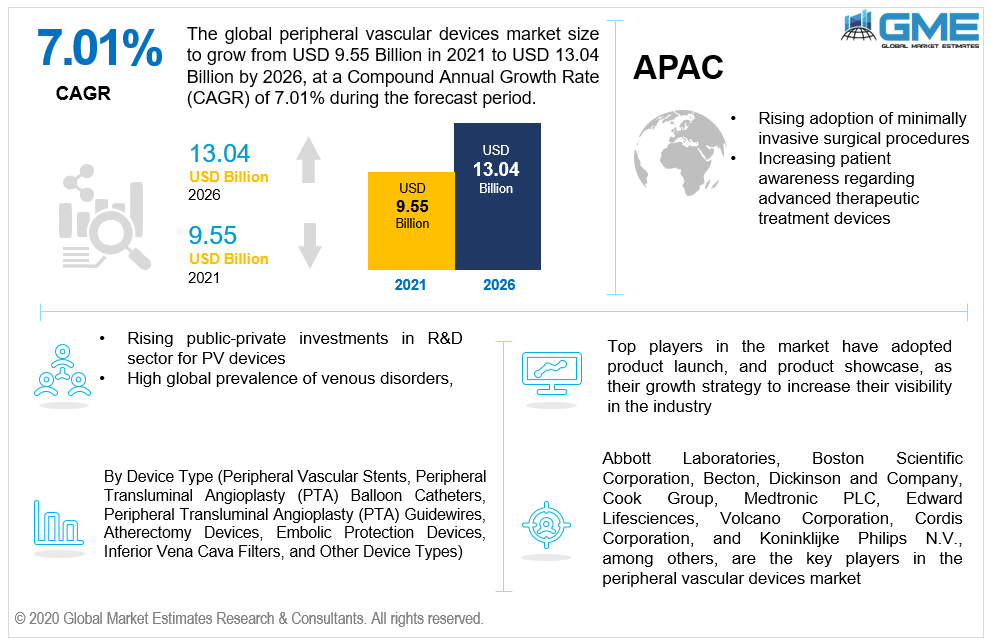

The global peripheral vascular devices market is projected to grow from USD 9.55 billion in 2021 and is expected to reach USD 13.04 billion by 2026 at a CAGR of 7.01% from 2021 to 2026. A build-up of plaque causes constriction or obstruction in the coronary arteries, which then results in peripheral arterial disease (PAD). If this condition is left unchecked, it can lead to cell death, or cell apoptosis, cardiovascular stroke, aneurysms, and kidney damage.

As per the National Institute of Health, PAD affects 1 out of every 20 Americans who fall in the age group of 50 and above. As per NIH, this disease affects around 8-12 million individuals in the United States, particularly that are over the age of 50 years or above every year.

Peripheral vascular disorders are estimated to affect more than 200 million people worldwide. As per World Health Organization (WHO), the number of individuals above the age of 50 in the world would double to 1.2 trillion by 2050, while the number of individuals age 80 and more will quadruple to 428 million.

With the rising geriatric population, PAD is projected to become more prevalent in the world. Hence, the rising prevalence of peripheral arterial disease and increasing number of lifestyle disorders, will drive the peripheral arterial disease market. Other parameters, such as the growing need for minimally invasive surgical procedures, particularly for peripheral arterial disease, lifestyle modification, rising geriatric population, and technical advancements in the field of peripheral vascular devices, have analyzed to support the peripheral vascular device market.

The global peripheral vascular devices market is likely to be driven by the increased global prevalence of venous disorders, such as CVI (Chronic Venous Insufficiency), and rising demand for minimally invasive endovascular procedures, with faster recovery time, less scarring, and a lower chance of infection post-surgery. Furthermore, the increasing incidence of disease caused by heavy liquor, nicotine, and tobacco consumption, is predicted to enhance peripheral vascular device market demand by increasing the incidences of cardiac arrest, blood coagulation, and other arterial illnesses.

The COVID-19 epidemic had a short-term impact on the peripheral vascular devices market. In several nations around the world, the outbreak of the pandemic resulted in severe lockdowns and restrictions. Supply networks were interrupted, and production facilities were slowed as a result of the restrictions and lockdowns. Insufficient supply of surgical resources, and delayed medical device procurement, caused the peripheral vascular devices market to grow negatively. As a result, the market for peripheral vascular devices was harmed to an extent.

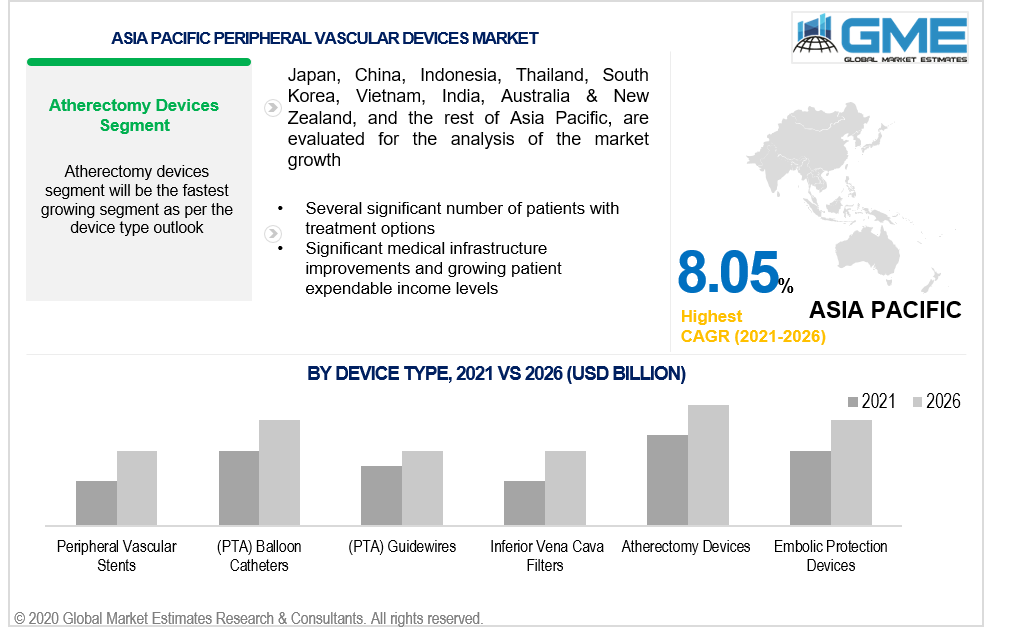

Based on the device type, the market is segmented into peripheral vascular stents, peripheral transluminal angioplasty (PTA) balloon catheters, peripheral transluminal angioplasty (PTA) guidewires, atherectomy devices, embolic protection devices, inferior vena cava filters, and other device types.

The atherectomy devices segment are anticipated to witness the largest share in the peripheral vascular devices market during the forecast period. Due to the sheer high popularity of atherosclerosis, high rate of obesity, and high prevalence of lifestyle-related ailments, the atherectomy devices segment is likely to dominate the entire peripheral vascular devices market.

According to International Journal of Medicine, plaque rupture is responsible for over 75% of myocardial infarctions in males aged 45 and up, and the rate is expected to rise. Furthermore, the rising prevalence of cardiovascular illnesses, which leads to high morbidity and mortality, is likely to boost the market for peripheral vascular devices in atherectomy devices.

During the forecast period, the embolic protection devices segment is expected to grow at the fastest rate. Growing investments in research & developmental projects, rapid regulatory approvals for peripheral vascular devices, and rising investments in the manufacturing of PV devices by private and public organizations are all adding to the peripheral vascular devices market's growth.

'

'

As per the geographical analysis, the peripheral vascular devices market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

The North America (the United States, Canada, and Mexico) region will have a dominant share in the peripheral vascular devices market from 2021 to 2026, due to factors such as the increased occurrence of arterial illnesses, high prevalence of geriatric population, and the significant presence of industry players have helped the North America dominate the global the peripheral vascular devices market. As per the International Journal of Epidemiology, around 610,000 individuals in the United States die each year from one or more cardiac disorders. In addition, every year, nearly 735,000 people in the United States have had a atleast single heart attack in their life span.

The Asia Pacific region is expected to grow the fastest during forecast period of 2021 to 2026. The major factors supporting the growth are the increasing adoption of minimally invasive surgical procedures, increasing patient awareness regarding advanced PV devices, and rising public-private investments in Asian medical fraternity for launching therapeutic devices. Due to the presence of significant number of patients, Asia-Pacific is likely to be the most lucrative regional market.

Abbott Laboratories, Boston Scientific Corporation, Becton, Dickinson and Company, Cook Group, Medtronic PLC, Edward Lifesciences, Volcano Corporation, Cordis Corporation, and Koninklijke Philips N.V., among others, are the key players in the peripheral vascular devices market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Peripheral Vascular Devices Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Device Type Overview

2.1.3 Regional Overview

Chapter 3 Peripheral Vascular Devices Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology advancement in peripheral vascular devices

3.3.2 Industry Challenges

3.3.2.1 High price of the PV devices and non-supportive reimbursement scenario

3.4 Prospective Growth Scenario

3.4.1 Device Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Peripheral Vascular Devices Market, By Device Type

4.1 Device Type Outlook

4.2 Peripheral Vascular Stents

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Peripheral Transluminal Angioplasty (PTA) Balloon Catheters

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Peripheral Transluminal Angioplasty (PTA) Guidewires

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Atherectomy Devices

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Embolic Protection Devices

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Inferior Vena Cava Filters

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

4.8 Other Device Types

4.8.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Peripheral Vascular Devices Market, By Region

5.1 Regional outlook

5.2 North America

5.2.1 Market Size, By Country 2020-2026 (USD Billion)

5.2.2 Market Size, By Device Type, 2020-2026 (USD Billion)

5.2.4 U.S.

5.2.4.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.2.5 Canada

5.2.5.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.3 Europe

5.3.1 Market Size, By Country 2020-2026 (USD Billion)

5.3.2 Market Size, By Device Type, 2020-2026 (USD Billion)

5.3.4 Germany

5.3.4.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.3.5 UK

5.3.5.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.3.6 France

5.3.6.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.3.7 Italy

5.3.7.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.3.8 Spain

5.3.8.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.3.9 Russia

5.3.9.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.4 Asia Pacific

5.4.1 Market Size, By Country 2020-2026 (USD Billion)

5.4.2 Market Size, By Device Type, 2020-2026 (USD Billion)

5.4.4 China

5.4.4.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.4.5 India

5.4.5.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.4.6 Japan

5.4.6.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.4.7 Australia

5.4.7.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.4.8 South Korea

5.4.8.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.5 Latin America

5.5.1 Market Size, By Country 2020-2026 (USD Billion)

5.5.4 Brazil

5.5.4.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.5.5 Mexico

5.5.5.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.5.6 Argentina

5.5.6.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.6 MEA

5.6.1 Market Size, By Country 2020-2026 (USD Billion)

5.6.2 Market Size, By Device Type, 2020-2026 (USD Billion)

5.6.4 Saudi Arabia

5.6.4.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.6.5 UAE

5.6.5.1 Market Size, By Device Type, 2020-2026 (USD Billion)

5.6.6 South Africa

5.6.6.1 Market Size, By Device Type, 2020-2026 (USD Billion)

Chapter 6 Company Landscape

6.1 Competitive Analysis, 2020

6.2 Abbott Laboratories

6.2.1 Company Overview

6.2.2 Financial Analysis

6.2.3 Strategic Positioning

6.2.4 Info Graphic Analysis

6.3 Boston Scientific Corporation

6.3.1 Company Overview

6.3.2 Financial Analysis

6.3.3 Strategic Positioning

6.3.4 Info Graphic Analysis

6.4 Becton

6.4.1 Company Overview

6.4.2 Financial Analysis

6.4.3 Strategic Positioning

6.4.4 Info Graphic Analysis

6.5 Dickinson and Company

6.5.1 Company Overview

6.5.2 Financial Analysis

6.5.3 Strategic Positioning

6.5.4 Info Graphic Analysis

6.6 Cook Group

6.6.1 Company Overview

6.6.2 Financial Analysis

6.6.3 Strategic Positioning

6.6.4 Info Graphic Analysis

6.7 Medtronic PLC

6.7.1 Company Overview

6.7.2 Financial Analysis

6.7.3 Strategic Positioning

6.7.4 Info Graphic Analysis

6.8 Edward Lifesciences

6.8.1 Company Overview

6.8.2 Financial Analysis

6.8.3 Strategic Positioning

6.8.4 Info Graphic Analysis

6.9 Volcano Corporation

6.9.1 Company Overview

6.9.2 Financial Analysis

6.9.3 Strategic Positioning

6.9.4 Info Graphic Analysis

6.10 Other Companies

6.10.1 Company Overview

6.10.2 Financial Analysis

6.10.3 Strategic Positioning

6.10.4 Info Graphic Analysis

The Global Peripheral Vascular Devices Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Peripheral Vascular Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS