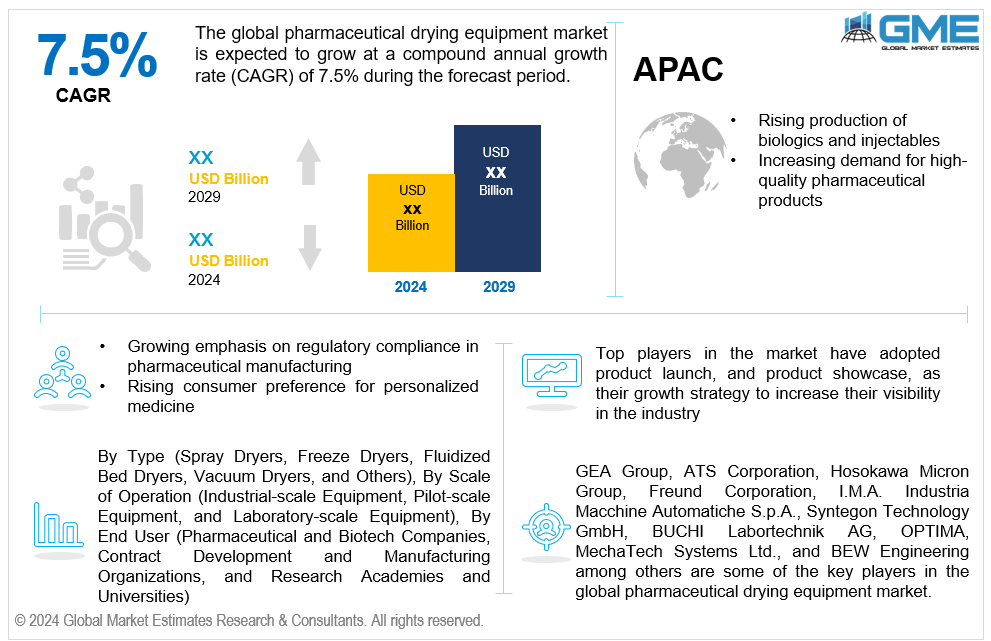

Global Pharmaceutical Drying Equipment Market Size, Trends & Analysis - Forecasts to 2029 By Type (Spray Dryers, Freeze Dryers, Fluidized Bed Dryers, Vacuum Dryers, and Others), By Scale of Operation (Industrial-scale Equipment, Pilot-scale Equipment, and Laboratory-scale Equipment), By End User (Pharmaceutical and Biotech Companies, Contract Development and Manufacturing Organizations, and Research Academies and Universities), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global pharmaceutical drying equipment market is estimated to exhibit a CAGR of 7.5% from 2024 to 2029.

The primary factors propelling the market growth are the rising production of biologics and injectables and the increasing demand for high-quality pharmaceutical products. To preserve their stability, effectiveness, and shelf life, biologics—such as vaccines, monoclonal antibodies, and gene therapies—frequently need very specialized drying procedures. Drying technologies such as lyophilization (freeze-drying) are essential for preserving the potency of biologics by removing moisture without compromising the active ingredients. Similarly, injectables, which are increasingly used in the treatment of chronic diseases and cancer, demand precise drying techniques to ensure the sterility and stability of the final product. The growing production of these complex drug forms necessitates advanced pharmaceutical drying equipment that can handle delicate compounds with minimal degradation. As the biologics and injectables market continues to expand, pharmaceutical companies are investing in cutting-edge drying technologies to meet regulatory standards and ensure product quality, further fueling the demand for sophisticated drying solutions in the industry.

The market is anticipated to grow as a result of the increased focus on regulatory compliance in pharmaceutical manufacturing and the growing consumer preference for personalized treatment. Strict regulations are imposed for the production, quality assurance, and safety of pharmaceutical products by regulatory agencies like the World Health Organization (WHO), the European Medicines Agency (EMA), and the U.S. Food and Drug Administration (FDA). To preserve the consistency, potency, and safety of their products, pharmaceutical businesses are frequently compelled by these rules to keep exact control over the drying process. Drying equipment, such as lyophilizers and vacuum dryers, must meet these regulatory standards by offering accurate temperature control, uniform moisture removal, and traceable process validation. As the industry faces increasing scrutiny, manufacturers are compelled to adopt advanced drying technologies that provide documented compliance with Good Manufacturing Practices (GMP) and other regulatory requirements. The need for traceability, reproducibility, and validation in pharmaceutical processes drives the demand for state-of-the-art drying equipment capable of meeting these evolving regulatory standards, thus propelling market growth.

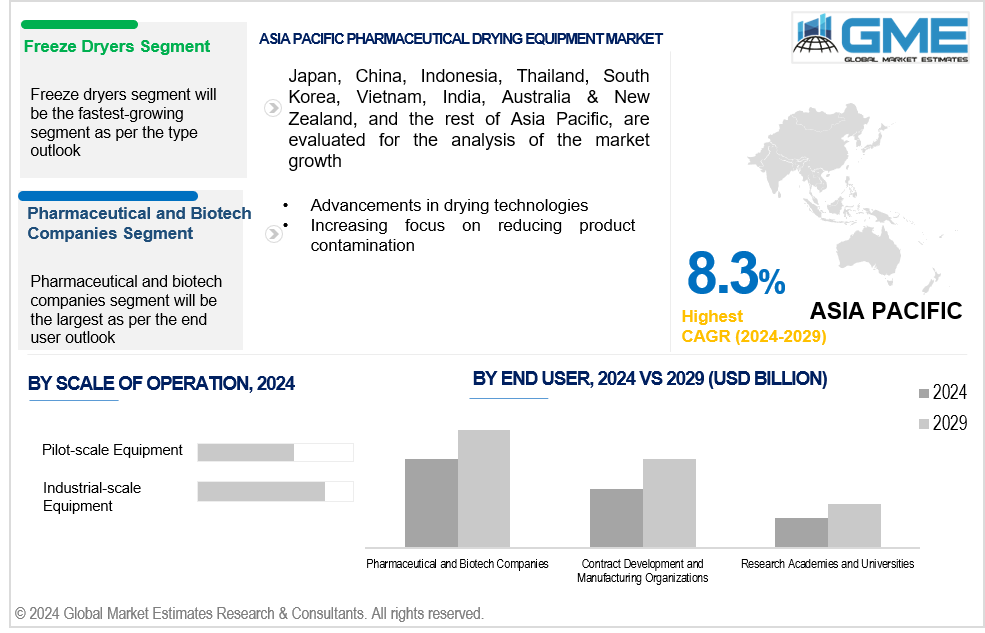

Advancements in drying technologies coupled with the increasing focus on reducing product contamination propel market growth. Modern drying techniques, such as spray drying, freeze-drying (lyophilization), and vacuum drying, offer improved control over critical parameters like temperature, pressure, and humidity, ensuring better product quality and consistency. These innovations allow pharmaceutical manufacturers to handle complex formulations, such as biologics and injectables, which require careful moisture removal to preserve stability and efficacy. Process control and regulatory compliance are also enhanced by the incorporation of automation and real-time monitoring capabilities. As pharmaceutical companies seek to meet increasing production demands while maintaining product integrity, these advancements in drying technologies are driving the market for advanced drying equipment solutions.

With the rise of contract manufacturing organizations (CMOs) and outsourcing in the pharmaceutical industry, there's an opportunity for drying equipment suppliers to provide scalable, flexible solutions that meet the varying needs of different clients and production volumes. Additionally, the growing interest in advanced therapies, such as gene and cell-based treatments, presents an opportunity for the drying equipment market to offer specialized solutions that maintain the integrity of these complex therapies during production and storage.

However, the high initial capital investment and limited customization for specific applications can impede market growth.

The spray dryers segment is expected to hold the largest share of the market over the forecast period. Spray dryers are well-suited for processing complex drug formulations, including biologics and biologically derived compounds. Their ability to produce consistent particle sizes and preserve the active ingredients in sensitive formulations makes them a preferred choice, particularly for injectables and other high-value products.

The freeze dryers segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Freeze drying preserves the active ingredients in heat-sensitive pharmaceuticals, such as vaccines, proteins, and monoclonal antibodies. This preservation capability is vital for ensuring product stability, shelf life, and efficacy, particularly for high-value biologic drugs, driving the rapid growth of the freeze dryer segment.

The industrial-scale equipment segment is expected to hold the largest share of the market over the forecast period. Industrial-scale drying equipment is designed to meet strict regulatory standards, such as GMP (Good Manufacturing Practices), ensuring that large volumes of pharmaceutical products are dried consistently and meet safety, quality, and potency requirements. This makes them an essential tool for large pharmaceutical manufacturers.

The pilot-scale equipment segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Pilot-scale equipment is highly flexible and can be customized to handle a variety of drug formulations in small batches. This makes it ideal for testing different formulations, including biologics, vaccines, and new drug delivery systems, supporting the growing need for specialized and small-batch pharmaceutical production.

The pharmaceutical and biotech companies segment is expected to hold the largest share of the market over the forecast period. New drug delivery methods including biologic injectables and controlled-release formulations are being heavily invested in by pharmaceutical and biotech companies. Drying equipment, especially for smaller batches and experimental formulations, is essential for R&D efforts in creating innovative and effective drug delivery systems.

The contract development and manufacturing organizations (CDMOs) segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. CDMOs handle a range of pharmaceutical products, including complex formulations like injectables, oral solids, and personalized medicines. Drying equipment must be adaptable to different product requirements, making CDMOs a major driver of the demand for advanced drying technologies that can accommodate various pharmaceutical formulations.

North America is expected to be the largest region in the global market. The need for vaccines, biologics, and other sophisticated medicine formulations has significantly increased in North America. These products require advanced drying technologies to maintain their stability during production. This growing demand for biologics and vaccines fuels the pharmaceutical drying equipment market in North America.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The Asia Pacific region is witnessing rapid growth in the biopharmaceutical industry, driven by increasing demand for biologics and biosimilars. As these products require specialized drying processes like lyophilization and spray drying, the need for advanced pharmaceutical drying equipment is expected to grow significantly in the region.

GEA Group, ATS Corporation, Hosokawa Micron Group, Freund Corporation, I.M.A. Industria Macchine Automatiche S.p.A., Syntegon Technology GmbH, BUCHI Labortechnik AG, OPTIMA, MechaTech Systems Ltd., and BEW Engineering among others, are some of the key players in the global pharmaceutical drying equipment market.

Please note: This is not an exhaustive list of companies profiled in the report.

In July 2024, The GEA Group made significant changes to advance the sustainability of pharmaceutical freeze-drying. GEA showcased the most recent advancements in freeze-drying technology at ACHEMA 2024 in Frankfurt/Main, which aids in streamlining manufacturing procedures, minimizing environmental effects, and conserving energy.

In June 2024, Syntegon acquired Azbil Telstar, formerly a division of Japan's Azbil Corporation, to grow its pharmaceutical manufacturing and packaging business.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL PHARMACEUTICAL DRYING EQUIPMENT MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL PHARMACEUTICAL DRYING EQUIPMENT MARKET, BY TYPE

4.1 Introduction

4.2 Pharmaceutical Drying Equipment Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Spray Dryers

4.4.1 Spray Dryers Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Freeze Dryers

4.5.1 Freeze Dryers Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Fluidized Bed Dryers

4.6.1 Fluidized Bed Dryers Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Vacuum Dryers

4.7.1 Vacuum Dryers Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Others

4.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL PHARMACEUTICAL DRYING EQUIPMENT MARKET, BY SCALE OF OPERATION

5.1 Introduction

5.2 Pharmaceutical Drying Equipment Market: Scale of Operation Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Industrial-scale Equipment

5.4.1 Industrial-scale Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Pilot-scale Equipment

5.5.1 Pilot-scale Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Laboratory-scale Equipment

5.6.1 Laboratory-scale Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL PHARMACEUTICAL DRYING EQUIPMENT MARKET, BY END USER

6.1 Introduction

6.2 Pharmaceutical Drying Equipment Market: End User Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Pharmaceutical and Biotech Companies

6.4.1 Pharmaceutical and Biotech Companies Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Contract Development and Manufacturing Organizations

6.5.1 Contract Development and Manufacturing Organizations Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Research Academies and Universities

6.6.1 Research Academies and Universities Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL PHARMACEUTICAL DRYING EQUIPMENT MARKET, BY REGION

7.1 Introduction

7.2 North America Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Type

7.2.2 By Scale of Operation

7.2.3 By End User

7.2.4 By Country

7.2.4.1 U.S. Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Type

7.2.4.1.2 By Scale of Operation

7.2.4.1.3 By End User

7.2.4.2 Canada Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Type

7.2.4.2.2 By Scale of Operation

7.2.4.2.3 By End User

7.2.4.3 Mexico Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Type

7.2.4.3.2 By Scale of Operation

7.2.4.3.3 By End User

7.3 Europe Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Type

7.3.2 By Scale of Operation

7.3.3 By End User

7.3.4 By Country

7.3.4.1 Germany Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Type

7.3.4.1.2 By Scale of Operation

7.3.4.1.3 By End User

7.3.4.2 U.K. Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Type

7.3.4.2.2 By Scale of Operation

7.3.4.2.3 By End User

7.3.4.3 France Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Type

7.3.4.3.2 By Scale of Operation

7.3.4.3.3 By End User

7.3.4.4 Italy Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Type

7.3.4.4.2 By Scale of Operation

7.2.4.4.3 By End User

7.3.4.5 Spain Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Type

7.3.4.5.2 By Scale of Operation

7.2.4.5.3 By End User

7.3.4.6 Netherlands Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Type

7.3.4.6.2 By Scale of Operation

7.2.4.6.3 By End User

7.3.4.7 Rest of Europe Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Type

7.3.4.7.2 By Scale of Operation

7.2.4.7.3 By End User

7.4 Asia Pacific Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Type

7.4.2 By Scale of Operation

7.4.3 By End User

7.4.4 By Country

7.4.4.1 China Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Type

7.4.4.1.2 By Scale of Operation

7.4.4.1.3 By End User

7.4.4.2 Japan Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Type

7.4.4.2.2 By Scale of Operation

7.4.4.2.3 By End User

7.4.4.3 India Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Type

7.4.4.3.2 By Scale of Operation

7.4.4.3.3 By End User

7.4.4.4 South Korea Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Type

7.4.4.4.2 By Scale of Operation

7.4.4.4.3 By End User

7.4.4.5 Singapore Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Type

7.4.4.5.2 By Scale of Operation

7.4.4.5.3 By End User

7.4.4.6 Malaysia Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Type

7.4.4.6.2 By Scale of Operation

7.4.4.6.3 By End User

7.4.4.7 Thailand Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Type

7.4.4.7.2 By Scale of Operation

7.4.4.7.3 By End User

7.4.4.8 Indonesia Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Type

7.4.4.8.2 By Scale of Operation

7.4.4.8.3 By End User

7.4.4.9 Vietnam Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Type

7.4.4.9.2 By Scale of Operation

7.4.4.9.3 By End User

7.4.4.10 Taiwan Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Type

7.4.4.10.2 By Scale of Operation

7.4.4.10.3 By End User

7.4.4.11 Rest of Asia Pacific Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Type

7.4.4.11.2 By Scale of Operation

7.4.4.11.3 By End User

7.5 Middle East and Africa Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Type

7.5.2 By Scale of Operation

7.5.3 By End User

7.5.4 By Country

7.5.4.1 Saudi Arabia Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Type

7.5.4.1.2 By Scale of Operation

7.5.4.1.3 By End User

7.5.4.2 U.A.E. Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Type

7.5.4.2.2 By Scale of Operation

7.5.4.2.3 By End User

7.5.4.3 Israel Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Type

7.5.4.3.2 By Scale of Operation

7.5.4.3.3 By End User

7.5.4.4 South Africa Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Type

7.5.4.4.2 By Scale of Operation

7.5.4.4.3 By End User

7.5.4.5 Rest of Middle East and Africa Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Type

7.5.4.5.2 By Scale of Operation

7.5.4.5.2 By End User

7.6 Central and South America Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Type

7.6.2 By Scale of Operation

7.6.3 By End User

7.6.4 By Country

7.6.4.1 Brazil Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Type

7.6.4.1.2 By Scale of Operation

7.6.4.1.3 By End User

7.6.4.2 Argentina Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Type

7.6.4.2.2 By Scale of Operation

7.6.4.2.3 By End User

7.6.4.3 Chile Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Type

7.6.4.3.2 By Scale of Operation

7.6.4.3.3 By End User

7.6.4.4 Rest of Central and South America Pharmaceutical Drying Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Type

7.6.4.4.2 By Scale of Operation

7.6.4.4.3 By End User

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 GEA Group

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 ATS Corporation

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Hosokawa Micron Group

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Freund Corporation

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 I.M.A. Industria Macchine Automatiche S.p.A.

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 SYNTEGON TECHNOLOGY GMBH

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 BUCHI Labortechnik AG

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 OPTIMA

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 MechaTech Systems Ltd.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 BEW Engineering

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

2 Spray Dryers Market, By Region, 2021-2029 (USD Million)

3 Freeze Dryers Market, By Region, 2021-2029 (USD Million)

4 Fluidized Bed Dryers Market, By Region, 2021-2029 (USD Million)

5 Vacuum Dryers Market, By Region, 2021-2029 (USD Million)

6 Others Market, By Region, 2021-2029 (USD Million)

7 Global Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

8 Industrial-scale Equipment Market, By Region, 2021-2029 (USD Million)

9 Pilot-scale Equipment Market, By Region, 2021-2029 (USD Million)

10 Laboratory-scale Equipment Market, By Region, 2021-2029 (USD Million)

11 Global Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

12 Pharmaceutical and Biotech Companies Market, By Region, 2021-2029 (USD Million)

13 Contract Development and Manufacturing Organizations Market, By Region, 2021-2029 (USD Million)

14 Research Academies and Universities Market, By Region, 2021-2029 (USD Million)

15 Regional Analysis, 2021-2029 (USD Million)

16 North America Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

17 North America Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

18 North America Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

19 North America Pharmaceutical Drying Equipment Market, By Country, 2021-2029 (USD Million)

20 U.S Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

21 U.S Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

22 U.S Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

23 Canada Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

24 Canada Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

25 Canada Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

26 Mexico Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

27 Mexico Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

28 Mexico Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

29 Europe Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

30 Europe Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

31 Europe Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

32 Europe Pharmaceutical Drying Equipment Market, By Country 2021-2029 (USD Million)

33 Germany Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

34 Germany Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

35 Germany Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

36 U.K Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

37 U.K Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

38 U.K Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

39 France Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

40 France Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

41 France Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

42 Italy Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

43 Italy Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

44 Italy Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

45 Spain Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

46 Spain Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

47 Spain Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

48 Netherlands Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

49 Netherlands Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

50 Netherlands Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

51 Rest Of Europe Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

52 Rest Of Europe Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

53 Rest of Europe Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

54 Asia Pacific Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

55 Asia Pacific Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

56 Asia Pacific Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

57 Asia Pacific Pharmaceutical Drying Equipment Market, By Country, 2021-2029 (USD Million)

58 China Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

59 China Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

60 China Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

61 India Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

62 India Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

63 India Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

64 Japan Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

65 Japan Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

66 Japan Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

67 South Korea Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

68 South Korea Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

69 South Korea Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

70 malaysia Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

71 malaysia Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

72 malaysia Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

73 Thailand Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

74 Thailand Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

75 Thailand Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

76 Indonesia Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

77 Indonesia Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

78 Indonesia Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

79 Vietnam Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

80 Vietnam Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

81 Vietnam Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

82 Taiwan Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

83 Taiwan Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

84 Taiwan Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

85 Rest of Asia Pacific Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

86 Rest of Asia Pacific Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

87 Rest of Asia Pacific Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

88 Middle East and Africa Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

89 Middle East and Africa Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

90 Middle East and Africa Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

91 Middle East and Africa Pharmaceutical Drying Equipment Market, By Country, 2021-2029 (USD Million)

92 Saudi Arabia Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

93 Saudi Arabia Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

94 Saudi Arabia Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

95 UAE Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

96 UAE Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

97 UAE Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

98 Israel Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

99 Israel Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

100 Israel Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

101 South Africa Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

102 South Africa Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

103 South Africa Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

104 Rest of Middle East and Africa Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

105 Rest of Middle East and Africa Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

106 Rest of Middle East and Africa Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

107 Central and South America Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

108 Central and South America Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

109 Central and South America Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

110 Central and South America Pharmaceutical Drying Equipment Market, By Country, 2021-2029 (USD Million)

111 Brazil Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

112 Brazil Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

113 Brazil Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

114 Argentina Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

115 Argentina Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

116 Argentina Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

117 Chile Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

118 Chile Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

119 Chile Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

120 Rest of Central and South America Pharmaceutical Drying Equipment Market, By Type, 2021-2029 (USD Million)

121 Rest of Central and South America Pharmaceutical Drying Equipment Market, By Scale of Operation, 2021-2029 (USD Million)

122 Rest of Central and South America Pharmaceutical Drying Equipment Market, By End User, 2021-2029 (USD Million)

123 GEA Group: Products & Services Offering

124 ATS Corporation: Products & Services Offering

125 Hosokawa Micron Group: Products & Services Offering

126 Freund Corporation: Products & Services Offering

127 I.M.A. Industria Macchine Automatiche S.p.A.: Products & Services Offering

128 SYNTEGON TECHNOLOGY GMBH: Products & Services Offering

129 BUCHI Labortechnik AG: Products & Services Offering

130 OPTIMA: Products & Services Offering

131 MechaTech Systems Ltd., Inc: Products & Services Offering

132 BEW Engineering: Products & Services Offering

133 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Pharmaceutical Drying Equipment Market Overview

2 Global Pharmaceutical Drying Equipment Market Value From 2021-2029 (USD Million)

3 Global Pharmaceutical Drying Equipment Market Share, By Type (2023)

4 Global Pharmaceutical Drying Equipment Market Share, By Scale of Operation (2023)

5 Global Pharmaceutical Drying Equipment Market Share, By End User (2023)

6 Global Pharmaceutical Drying Equipment Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Pharmaceutical Drying Equipment Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Pharmaceutical Drying Equipment Market

11 Impact Of Challenges On The Global Pharmaceutical Drying Equipment Market

12 Porter’s Five Forces Analysis

13 Global Pharmaceutical Drying Equipment Market: By Type Scope Key Takeaways

14 Global Pharmaceutical Drying Equipment Market, By Type Segment: Revenue Growth Analysis

15 Spray Dryers Market, By Region, 2021-2029 (USD Million)

16 Freeze Dryers Market, By Region, 2021-2029 (USD Million)

17 Fluidized Bed Dryers Market, By Region, 2021-2029 (USD Million)

18 Vacuum Dryers Market, By Region, 2021-2029 (USD Million)

19 Others Market, By Region, 2021-2029 (USD Million)

20 Global Pharmaceutical Drying Equipment Market: By Scale of Operation Scope Key Takeaways

21 Global Pharmaceutical Drying Equipment Market, By Scale of Operation Segment: Revenue Growth Analysis

22 Industrial-scale Equipment Market, By Region, 2021-2029 (USD Million)

23 Pilot-scale Equipment Market, By Region, 2021-2029 (USD Million)

24 Laboratory-scale Equipment Market, By Region, 2021-2029 (USD Million)

25 Global Pharmaceutical Drying Equipment Market: By End User Scope Key Takeaways

26 Global Pharmaceutical Drying Equipment Market, By End User Segment: Revenue Growth Analysis

27 Pharmaceutical and Biotech Companies Market, By Region, 2021-2029 (USD Million)

28 Contract Development and Manufacturing Organizations Market, By Region, 2021-2029 (USD Million)

29 Research Academies and Universities Market, By Region, 2021-2029 (USD Million)

30 Regional Segment: Revenue Growth Analysis

31 Global Pharmaceutical Drying Equipment Market: Regional Analysis

32 North America Pharmaceutical Drying Equipment Market Overview

33 North America Pharmaceutical Drying Equipment Market, By Type

34 North America Pharmaceutical Drying Equipment Market, By Scale of Operation

35 North America Pharmaceutical Drying Equipment Market, By End User

36 North America Pharmaceutical Drying Equipment Market, By Country

37 U.S. Pharmaceutical Drying Equipment Market, By Type

38 U.S. Pharmaceutical Drying Equipment Market, By Scale of Operation

39 U.S. Pharmaceutical Drying Equipment Market, By End User

40 Canada Pharmaceutical Drying Equipment Market, By Type

41 Canada Pharmaceutical Drying Equipment Market, By Scale of Operation

42 Canada Pharmaceutical Drying Equipment Market, By End User

43 Mexico Pharmaceutical Drying Equipment Market, By Type

44 Mexico Pharmaceutical Drying Equipment Market, By Scale of Operation

45 Mexico Pharmaceutical Drying Equipment Market, By End User

46 Four Quadrant Positioning Matrix

47 Company Market Share Analysis

48 GEA Group: Company Snapshot

49 GEA Group: SWOT Analysis

50 GEA Group: Geographic Presence

51 ATS Corporation: Company Snapshot

52 ATS Corporation: SWOT Analysis

53 ATS Corporation: Geographic Presence

54 Hosokawa Micron Group: Company Snapshot

55 Hosokawa Micron Group: SWOT Analysis

56 Hosokawa Micron Group: Geographic Presence

57 Freund Corporation: Company Snapshot

58 Freund Corporation: Swot Analysis

59 Freund Corporation: Geographic Presence

60 I.M.A. Industria Macchine Automatiche S.p.A.: Company Snapshot

61 I.M.A. Industria Macchine Automatiche S.p.A.: SWOT Analysis

62 I.M.A. Industria Macchine Automatiche S.p.A.: Geographic Presence

63 SYNTEGON TECHNOLOGY GMBH: Company Snapshot

64 SYNTEGON TECHNOLOGY GMBH: SWOT Analysis

65 SYNTEGON TECHNOLOGY GMBH: Geographic Presence

66 BUCHI Labortechnik AG : Company Snapshot

67 BUCHI Labortechnik AG : SWOT Analysis

68 BUCHI Labortechnik AG : Geographic Presence

69 OPTIMA: Company Snapshot

70 OPTIMA: SWOT Analysis

71 OPTIMA: Geographic Presence

72 MechaTech Systems Ltd., Inc.: Company Snapshot

73 MechaTech Systems Ltd., Inc.: SWOT Analysis

74 MechaTech Systems Ltd., Inc.: Geographic Presence

75 BEW Engineering: Company Snapshot

76 BEW Engineering: SWOT Analysis

77 BEW Engineering: Geographic Presence

78 Other Companies: Company Snapshot

79 Other Companies: SWOT Analysis

80 Other Companies: Geographic Presence

The Global Pharmaceutical Drying Equipment Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Pharmaceutical Drying Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS