Global Pharmaceutical Raw Material Testing & Analytics Market Size, Trends & Analysis - Forecasts to 2027 By Pharmaceutical Type (Small Molecules, Large Molecules), By Service (Physicochemical Properties Testing, Identity & Purity Testing), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

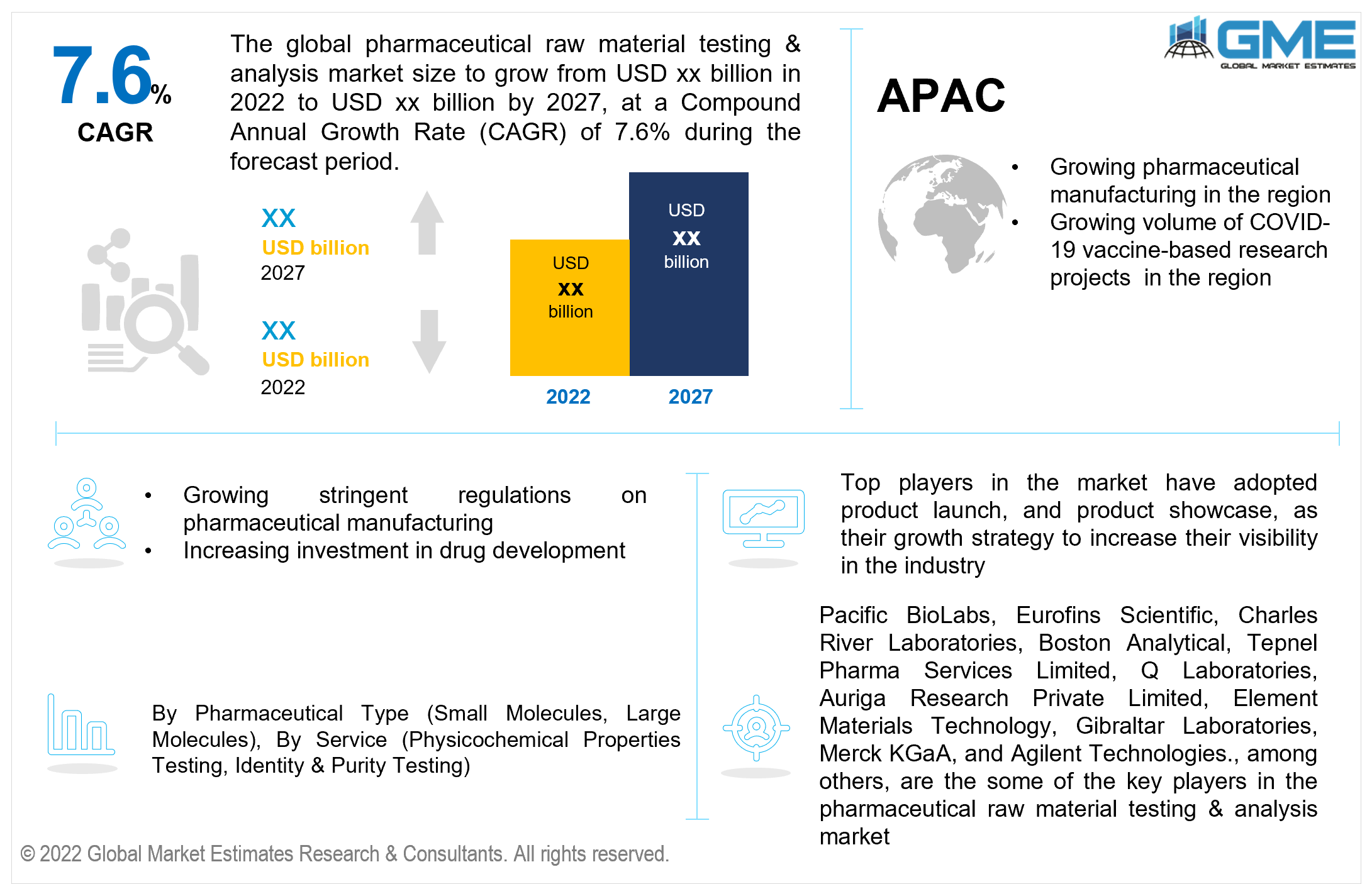

The Global Pharmaceutical Raw Material Testing & Analytics Market is projected to grow at a CAGR value of 7.6% from 2022 to 2027.

Before it may be utilized in any manufacturing process or formulation, any raw material or active pharmaceutical component must meet the standards established in government laws such as the FDA's 21 CFR 211.84. Raw material testing verifies the material's authenticity and integrity, verifying that the correct product was received and that it complies with the specifications set forth for its intended purpose.

Most outsourcing laboratories support raw material drug testing across the entire development lifecycle from the research and development of pharmaceutical products to large-scale manufacturing. These laboratories are equipped to provide specification and characterization testing for vendor qualification and release of active pharmaceutical ingredients.

Pharmaceutical raw material testing & analytics is being determined by several factors, including enhanced attention to regulatory compliance, safety, and quality of raw materials, a growing number of end-users, and the greater flexibility and savings of outsourcing.

The pharmaceutical sector works with a wide range of raw materials, and a single product can contain hundreds of different chemicals. In-house testing facilities and capabilities for all chemicals and products are generally difficult, if not impossible, for a pharmaceutical producer.

Even if all of the facilities are accessible in-house, there is always a limit to the capacity available, therefore it's critical to have a reliable external laboratory that can analyze pharmaceutical raw materials before they're released and utilized to make pharmaceutical products.

Other reasons, such as the growing requirement for higher standards of quality and safety of pharmaceutical drugs, as well as changing laws for in vivo and in vitro tests, are projected to drive the pharmaceutical raw material testing and analytics outsourcing market further. The Chinese government’s planned improvement in generic medication quality, steps to clear the backlog of drug development, and improving support for innovative drug R&D to be able to compete with the leading pharmaceutical manufacturing companies. The demand for raw material testing is predicted to rise as a result of these reasons, ensuring high-quality products.

The market for pharmaceutical raw material testing and analytics is expected to develop due to the cost savings associated with outsourcing raw material testing and approvals in the pharmaceutical sector. The growing demand for raw material testing is aided by faster and trustworthy insights provided by outsourcing companies leading to greater efficiency in pharmaceutical drug development. The need for raw material testing services is directly proportional to the growing innovation in the development of new pharmaceuticals. Companies are seeking to outsource raw material testing services due to market demands, pricing concerns, and launch to market. The overall number of pharmaceuticals in development climbed to over 18,000 molecules in 2021 from over 17,000 molecules in 2020, according to the Pharma Intelligence Report of 2022. These numbers demonstrate the growing potential for raw material testing stemming from the increasing innovation in pharmaceutical drug production.

The market is expected to be hampered by the growing shortage of skilled professionals capable of running complex laboratory equipment. The highly classified nature of pharmaceutical development will restrain the growth of the market as the chances of leaks and theft of intellectual property can increase.

The COVID-19 pandemic has seen the demand for pharmaceutical development grow extensively. Increasing investment in vaccine development and the development of new pharmaceuticals capable of preventing the spread of COVID-19 is expected to increase the demand for pharmaceutical raw material testing and analytics. The increased investment has led to the growing demand for pharmaceutical raw material testing and analytics outsourcing services.

The conflict between Russia and Ukraine will have a significant impact on the demand for PCR tests in both countries. The presence of Russian hostiles in Ukraine has hampered the ability of Ukrainian outsourcing agencies to provide their services to clients outside of Ukraine and within Ukraine. Suspension of research activities in the country has also hampered the raw material testing and analytics market in the country. Companies across the globe are voluntarily restricting trade activities with Russia which will hamper the demand for raw material testing outsourcing services in Russia.

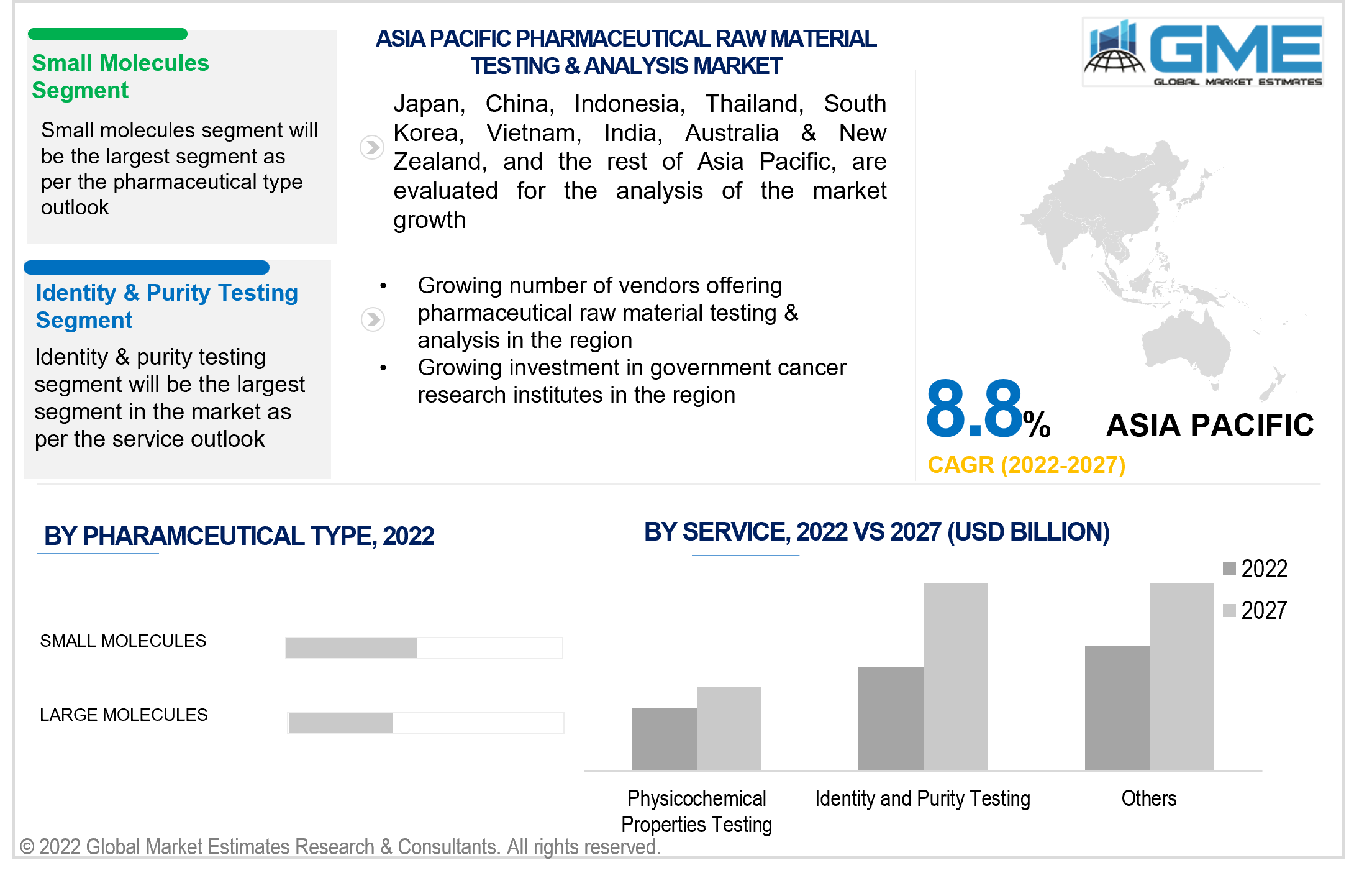

The small molecules segment is expected to be the largest pharmaceutical raw material testing & analytics market segment based on the type. The majority of the pharmaceutical products that are currently being developed or are being developed are small molecules. The heavy demand for small molecules has led to the domination of this segment in the market. Because of their small size, they are easily ingested in the gastrointestinal tract, where active ingredients are absorbed into the bloodstream and can move elsewhere in the body.

The large molecules segment is expected to be the fastest-growing segment in the market. Large molecules utilized in pharmaceutical manufacturing are often proteins with therapeutic effects. Growing investment in COVID-19 vaccine development has led to an increase in the demand for large molecule testing.

The identity and purity testing segment are expected to be the most prominent market segment based on the service. Pharmaceutical raw material testing & analytics is often carried out to ensure the quality and standard of raw materials and to ensure the necessary purity standards are maintained. The availability of varying purity standards and increased cost with purity has led to the domination of the identity and purity testing segment.

The physicochemical properties segment is expected to be the fastest-growing segment in the pharmaceutical raw material testing & analytics market, based on the service.

North America (the United States, Canada, and Mexico) will dominate the Pharmaceutical Raw Material Testing & Analytics market from 2022 to 2027. Growing investment in COVID-19 vaccine development within the United Stated and the presence of large key players in the North American region have led to the domination of the North American region in the pharmaceutical raw material testing & analytics market.

The United States is expected to have the lion's share in the North American pharmaceutical raw material testing & analytics market. This is attributed to the greater demand for outsourcing services in the region stemming from an increase in research workload.

However, the Asia-Pacific region is expected to be the fastest-growing region in the pharmaceutical raw material testing & analytics market during the forecast period. The rapid growth of the pharmaceutical manufacturing industry in the region, the growing investment in pharmaceutical manufacturing, and the growing number of pharmaceutical testing outsourcing services are expected to result in the rapid growth of the pharmaceutical raw material testing & analytics market in the APAC region.

China is expected to hold the largest share in the Asia Pacific pharmaceutical raw material testing & analytics market. Favorable government regulations that support local manufacturing of novel drugs and increasing protection for brand pharmaceuticals are expected to drive the raw material testing and analytics industry in China.

Pacific BioLabs, Eurofins Scientific, Charles River Laboratories, Boston Analytical, Tepnel Pharma Services Limited, SGS SA, STERIS, Intertek Group plc, Pace Analytical Life Sciences, PPD Inc., Q Laboratories, Auriga Research Private Limited, Element Materials Technology, Nelson Laboratories, LLC, Catalent, Inc., Avomeen Analytical Services, BioSpectra, Gibraltar Laboratories, Merck KGaA, and Agilent Technologies., among others, are the some of the key players in the pharmaceutical raw material testing & analytics market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources: Annual Reports, Investor Presentation, Press Release, SEC Filling, Company Blogs & Website

1.3.4.2 Secondary Data Sources: World Health Organization, USFDA, National Cancer Institute, American Cancer Society, CDC, WCRF, and the Global Cancer Observatory, among others

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.6.1 Model Details

1.6.1.1 Top-Down Approach

1.6.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Pharmaceutical Type Outlook

2.3 Service Outlook

2.4 Regional Outlook

Chapter 3 Global Pharmaceutical Raw Material Testing & Analytics Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Pharmaceutical Raw Material Testing & Analytics Market

3.4 Metric Data on Pharmaceutical Raw Material Testing & Analytics Industry

3.5 Market Driver Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Pharmaceutical Raw Material Testing & Analytics Market: Pharmaceutical Type Trend Analysis

4.1 Pharmaceutical Type: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Small Molecules

4.2.1 Market Estimates & Forecast Analysis of Small Molecules Segment, By Region, 2019-2027 (USD Billion)

4.3 Large Molecules

4.3.1 Market Estimates & Forecast Analysis of Large Molecules Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Pharmaceutical Raw Material Testing & Analytics Market: Service Trend Analysis

5.1 Service: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Physicochemical Properties Testing

5.2.1 Market Estimates & Forecast Analysis of Physicochemical Properties Testing Segment, By Region, 2019-2027 (USD Billion)

5.3 Identity and Purity Testing

5.3.1 Market Estimates & Forecast Analysis of Identity and Purity Testing Segment, By Region, 2019-2027 (USD Billion)

5.4 Others

5.4.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Pharmaceutical Raw Material Testing & Analytics Market, By Region

6.1 Regional Outlook

6.2 North America

6.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.2.2 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.2.3 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.2.5 U.S.

6.2.5.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.2.5.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.2.6 Canada

6.2.6.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.2.6.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.5.7 Mexico

6.5.5.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.5.5.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.3 Europe

6.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.3.2 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.3.3 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.3.5 Germany

6.3.5.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.3.5.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.3.6 UK

6.3.6.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.3.6.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.3.7 France

6.3.7.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.3.7.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.3.8 Russia

6.3.8.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.3.8.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.3.9 Italy

6.3.9.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.3.9.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.3.10 Spain

6.3.10.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.3.10.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.3.11 Rest of Europe

6.3.11.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.3.11.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.4.2 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.4.5 China

6.4.5.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.4.5.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.4.6 India

6.4.6.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.4.6.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.4.7 Japan

6.4.7.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.4.7.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.4.8 Australia

6.4.8.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.4.8.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.4.9 South Korea

6.4.9.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.4.9.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.3.10 Rest of Asia Pacific

6.3.10.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.3.10.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.5 Central & South America

6.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.5.2 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.5.3 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.5.5 Brazil

6.5.5.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.5.5.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.5.6 Rest of Central & South America

6.5.6.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.5.6.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.6 Middle East & Africa

6.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.6.2 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.6.5 Saudi Arabia

6.6.5.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.6.5.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.6.6 United Arab Emirates

6.6.6.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.6.6.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.6.7 South Africa

6.6.7.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.6.67.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

6.5.8 Rest of Middle East & Africa

6.5.8.1 Market Estimates & Forecast Analysis, By Pharmaceutical Type, 2019-2027 (USD Billion)

6.5.8.2 Market Estimates & Forecast Analysis, By Service, 2019-2027 (USD Billion)

Chapter 7 Competitive Analysis

7.1 Key Global Players, Recent Developments & their Impact on the Industry

7.2 Four Quadrant Competitor Positioning Matrix

7.2.1 Key Innovators

7.2.2 Market Leaders

7.2.3 Emerging Players

7.2.4 Market Challengers

7.3 Vendor Landscape Analysis

7.4 Service Landscape Analysis

7.5 Company Market Share Analysis, 2021

Chapter 8 Company Profile Analysis

8.1 Pacific BioLabs

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Strategic Initiatives

8.1.4 Product Benchmarking

8.2 Eurofins Scientific

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Initiatives

8.2.4 Product Benchmarking

8.3 Charles River Laboratories

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Initiatives

8.3.4 Product Benchmarking

8.4 Boston Analytical

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Initiatives

8.4.4 Product Benchmarking

8.5 Tepnel Pharma Services Limited

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Initiatives

8.5.4 Product Benchmarking

8.6 SGS SA.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Initiatives

8.6.4 Product Benchmarking

8.7 STERIS.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Initiatives

8.6.4 Product Benchmarking

8.8 Intertek Group PLC

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Initiatives

8.7.4 Product Benchmarking

8.9 Pace Analytical Life Sciences

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Initiatives

8.8.4 Product Benchmarking

8.10 PPD Inc.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Initiatives

8.10.4 Product Benchmarking

8.11 Q Laboratories

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Initiatives

8.11.4 Product Benchmarking

8.11 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Initiatives

8.12.4 Product Benchmarking

List of Tables

1 Technological Advancements In Pharmaceutical Raw Material Testing & Analytics Market

2 Global Pharmaceutical Raw Material Testing & Analytics Market: Key Market Drivers

3 Global Pharmaceutical Raw Material Testing & Analytics Market: Key Market Challenges

4 Global Pharmaceutical Raw Material Testing & Analytics Market: Key Market Opportunities

5 Global Pharmaceutical Raw Material Testing & Analytics Market: Key Market Restraints

6 Global Pharmaceutical Raw Material Testing & Analytics Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

8 Small Molecules: Global Pharmaceutical Raw Material Testing & Analytics Market, By Region, 2019-2027 (USD Billion)

9 Large Molecules: Global Pharmaceutical Raw Material Testing & Analytics Market, By Region, 2019-2027 (USD Billion)

10 Global Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

11 Physicochemical Properties Testing: Global Pharmaceutical Raw Material Testing & Analytics Market, By Region, 2019-2027 (USD Billion)

12 Identity and Purity Testing: Global Pharmaceutical Raw Material Testing & Analytics Market, By Region, 2019-2027 (USD Billion)

13 Others: Global Pharmaceutical Raw Material Testing & Analytics Market, By Region, 2019-2027 (USD Billion)

14 Regional Analysis: Global Pharmaceutical Raw Material Testing & Analytics Market, By Region, 2019-2027 (USD Billion)

15 North America: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

16 North America: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

17 North America: Pharmaceutical Raw Material Testing & Analytics Market, By Country, 2019-2027 (USD Billion)

18 U.S: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

19 U.S: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

20 Canada: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

21 Canada: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

22 Mexico: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

23 Mexico: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

24 Europe: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

25 Europe: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

26 Europe: Pharmaceutical Raw Material Testing & Analytics Market, By Country, 2019-2027 (USD Billion)

27 Germany: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

28 Germany: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

29 UK: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

30 UK: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

31 France: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

32 France: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

33 Italy: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

34 Italy: Pharmaceutical Raw Material Testing & Analytics Market, By Service Ype, 2019-2027 (USD Billion)

35 Spain: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

36 Spain: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

37 Rest Of Europe: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

38 Rest Of Europe: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

39 Asia Pacific: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

40 Asia Pacific: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

41 Asia Pacific: Pharmaceutical Raw Material Testing & Analytics Market, By Country, 2019-2027 (USD Billion)

42 China: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

43 China: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

44 India: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

45 India: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

46 Japan: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

47 Japan: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

48 South Korea: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

49 South Korea: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

50 Middle East & Africa: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

51 Middle East & Africa: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

52 Middle East & Africa: Pharmaceutical Raw Material Testing & Analytics Market, By Country, 2019-2027 (USD Billion)

53 Saudi Arabia: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

54 Saudi Arabia: Pharmaceutical Raw Material Testing & Analytics Market, By Platform, 2019-2027 (USD Billion)

55 UAE: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

56 UAE: Pharmaceutical Raw Material Testing & Analytics Market, By Platform, 2019-2027 (USD Billion)

57 Central & South America: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

58 Central & South America: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

59 Central & South America: Pharmaceutical Raw Material Testing & Analytics Market, By Country, 2019-2027 (USD Billion)

60 Brazil: Pharmaceutical Raw Material Testing & Analytics Market, By Pharmaceutical Type, 2019-2027 (USD Billion)

61 Brazil: Pharmaceutical Raw Material Testing & Analytics Market, By Service, 2019-2027 (USD Billion)

62 Pacific BioLabs: Products Offered

63 Eurofins Scientific: Products Offered

64 Charles River Laboratories Boston Analytical: Products Offered

65 Boston Analytical: Products Offered

66 Tepnel Pharma Services Limited: Products Offered

67 SGS SA.: Products Offered

68 STERIS.: Products Offered

69 Intertek Group PLC Products Offered

70 Pace Analytical Life Sciences: Products Offered

71 PPD Inc.: Products Offered

72 Q Laboratories: Products Offered

73 Other Companies: Products Offered

List of Figures

1. Global Pharmaceutical Raw Material Testing & Analytics Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Pharmaceutical Raw Material Testing & Analytics Market: Penetration & Growth Prospect Mapping

7. Global Pharmaceutical Raw Material Testing & Analytics Market: Value Chain Analysis

8. Global Pharmaceutical Raw Material Testing & Analytics Market Drivers

9. Global Pharmaceutical Raw Material Testing & Analytics Market Restraints

10. Global Pharmaceutical Raw Material Testing & Analytics Market Opportunities

11. Global Pharmaceutical Raw Material Testing & Analytics Market Challenges

12. Key Pharmaceutical Raw Material Testing & Analytics Market Manufacturer Analysis

13. Global Pharmaceutical Raw Material Testing & Analytics Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Pacific BioLabs: Company Snapshot

16. Pacific BioLabs: Swot Analysis

17. Eurofins Scientific: Company Snapshot

18. Eurofins Scientific: Swot Analysis

19. Charles River Laboratories Boston Analytical: Company Snapshot

20. Charles River Laboratories Boston Analytical: Swot Analysis

21. Boston Analytical: Company Snapshot

22. Boston Analytical: Swot Analysis

23. SGS SA.: Company Snapshot

24. SGS SA.: Swot Analysis

25. Tepnel Pharma Services Limited: Company Snapshot

26. Tepnel Pharma Services Limited: Swot Analysis

27. STERIS.: Company Snapshot

28. STERIS.: Swot Analysis

29. Intertek Group PLC Company Snapshot

30. Intertek Group PLC Swot Analysis

31. Pace Analytical Life Sciences: Company Snapshot

32. Pace Analytical Life Sciences: Swot Analysis

33. PPD Inc.: Company Snapshot

34. PPD Inc.: Swot Analysis

35. Q Laboratories: Company Snapshot

36. Q Laboratories: Swot Analysis

37. Other Companies: Company Snapshot

38. Other Companies: Swot Analysis

The Global Pharmaceutical Raw Material Testing & Analytics Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Pharmaceutical Raw Material Testing & Analytics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS