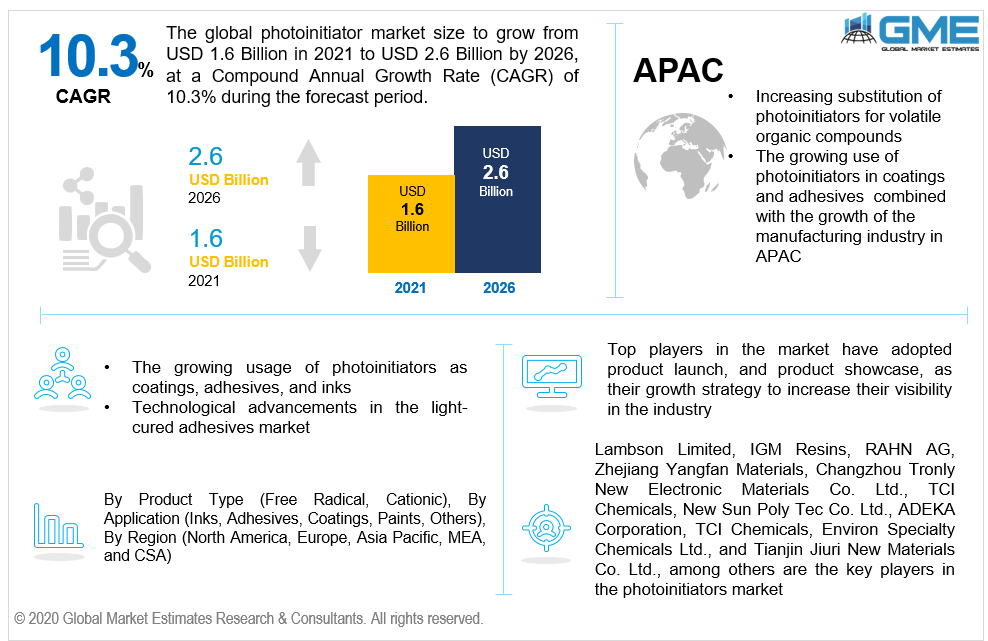

Global Photoinitiator Market Size, Trends & Analysis - Forecasts to 2026 By Product Type (Free Radical, Cationic), By Application (Inks, Adhesives, Coatings, Paints, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global photoinitiator market size is projected to grow from USD 1.6 billion in 2021 to USD 2.6 billion by 2026 at a CAGR value of 10.3% from 2021-2026. The global photoinitiator market is driven by the stability of photoinitiators and their wide range of light that can be absorbed. Their stability offers greater durability for coatings, adhesives, and inks made from photoinitiators.

Technological advancements in the field of light-cured adhesives is another driver of the global photoinitiator market. Photoinitiator technology has come a long way in recent years, the use of photoinitiators for coatings in the electrical assembly industry has increased. The growing consumer electronics market is expected to further increase the demand for photoinitiators during the forecast period. Photoinitiators release a cation, anion, or a free radical when exposed to light from the visible to ultraviolet spectrum. The released reactive species cross-links with oligomers and monomers resulting in a cross-linked polymer that has desirable protective properties and is used to create coatings, adhesives, and dental restoratives that are photo-curable.

The growing automation market is expected to have an impact on the demand for coatings and adhesives which will inadvertently lead to an increase in the demand for photoinitiators. The growing demand for specifically customized products and the growth of the 3D printing market are expected to have a positive impact on the growth of the photoinitiators market. The growing adoption of photoinitiators in 3D printing is expected to provide lucrative growth opportunities for photoinitiator vendors during the forecast period. Photoinitiators are also used in industries like packaging dental products, among other industries. The growing application of photoinitiators is expected to further drive the global photoinitiator market. Photoinitiators can be used as substitutes for volatile organic compounds. These compounds are complex and cannot be broken down easily and can cause severe damage to the human body if ingested directly. These volatile organic compounds are insoluble in water and remain suspended in water if they are not disposed of properly. The environmental and health hazards associated with volatile organic compounds have prompted manufacturers to switch to photoinitiators for their needs.

Photoinitiators are water-soluble in the presence of oligomers and monomers which leads to minimal to no environmental impact. The environmental benefits associated with the use of photoinitiators for creating coatings, inks, and adhesives are also expected to have a positive impact on the global photoinitiator market.

While the photoinitiators themselves might not be harmful to the environment, the synthesis of photoinitiators requires chemicals that are harmful to human life. These chemicals can have an impact on reproductive health and are carcinogenic in nature which has prompted them to be banned or heavy restrictions on their use in many countries in Europe and North America. The regulations for the handling of these chemicals are much less stringent for many countries in the APAC region. The stricter regulations placed on these chemicals have increased the cost of production of photoinitiators in the North American and European region which limits the growth of the market in these regions. There is a growing demand for water-soluble photoinitiators as substitutes for volatile organic compounds, especially in the adhesives and coatings market. The industry is also limited by uneven exposure to light which can result in defects in the finished product. Uneven lighting across the photoinitiators can cause some photoinitiator molecules to not release the reactive species which can reduce the overall performance of the coating or adhesive as it will not be able to form a more complex cross-linked polymer.

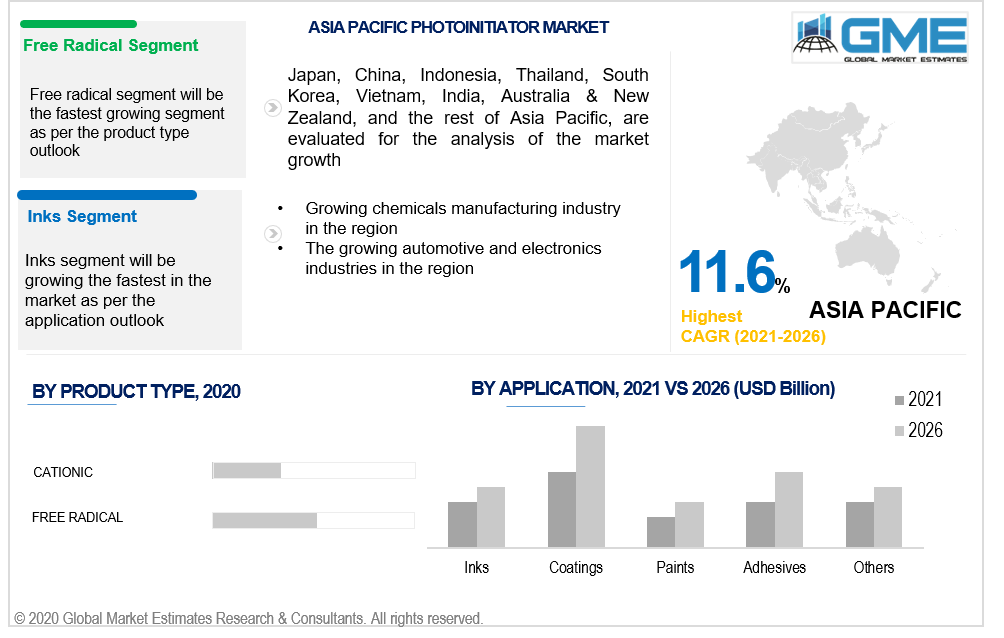

Based on the reactive species released by the photoinitiator on exposure to light, the market can be fragmented into free radical and cationic segments. The free radical segment is expected to clutch the lion’s share of the market during the forecast period. The growing use of free radical-based photoinitiators in various industries like medical, electronics, and printing is the major driver of the free radical segment. The free radical segment is also expected to log a faster growth rate than the cationic segment during the forecast period. Cationic photoinitiators are better for coating applications but are more expensive than free radical photoinitiators. The growing demand for photoinitiators in adhesive and printing applications is expected to further increase the demand for free radical photoinitiators.

Based on the various applications of photoinitiators, the market can be divided into inks, paints, coatings, adhesives, and others. The coatings segment is expected to grasp the biggest chunk of the photoinitiator market during the forecast period. Photoinitiator coatings are becoming increasingly popular for coating applications in the medical, electronics, carpentry and wood industry, and the automotive industry. The inks segment is envisaged to log significantly higher growth rates than the other segments during the forecast period. Growing demand for customized printing, graphics, and LED ink curing is expected to be the major driver of the inks segment during the forecast period.

The photoinitiators market can be categorized geographically as North America, Central & South America, Europe, Middle East & Africa, and Asia Pacific regions. The APAC region held the dominant market position over the other regions and is expected to register faster growth rates during the forecast period. The growing number of automotive industries, electronics industry, and packaging industry in the region is the major driver of the photoinitiators market in the APAC region. The less stringent rules and regulations on chemical handling required for photoinitiator synthesis are also expected to have a positive impact on the photoinitiator market in the APAC region during the forecast period.

Lambson Ltd., IGM Resins, RAHN AG, Zhejiang Yangfan Materials, Changzhou Tronly New Electronic Materials Co. Ltd., TCI Chemicals, New Sun Poly Tec Co. Ltd., ADEKA Corporation, TCI Chemicals, Environ Speciality Chemicals Ltd., and Tianjin Jiuri New Materials Co. Ltd, among others are the key players in the photoinitiators market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Photoinitiator Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Photoinitiator Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Substitution of volatile organic compounds with photoinitiators

3.3.2 Industry Challenges

3.3.2.1 Stringent regulations on chemicals used in photoinitiator synthesis

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Photoinitiator Market, By Product Type

4.1 Product Type Outlook

4.2 Free Radical

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Cationic

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Photoinitiator Market, By Application

5.1 Application Outlook

5.2 Inks Regulators

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Coatings

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Paints

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Adhesives

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Photoinitiator Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Product Type, 2020-2026 (USD Million)

6.2.3 Market Size, By Application, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Product Type, 2020-2026 (USD Million)

6.3.3 Market Size, By Application, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Product Type, 2020-2026 (USD Million)

6.4.3 Market Size, By Application, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.4.7.2 Market size, By Application, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Product Type, 2020-2026 (USD Million)

6.5.3 Market Size, By Application, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Product Type, 2020-2026 (USD Million)

6.6.3 Market Size, By Application, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Product Type, 2020-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Lambson Ltd.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 IGM Resins

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 RAHN AG

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Zhejiang Yangfan Materials

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Changzhou Tronly New Electronic Materials Co. Ltd.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 TCI Chemicals

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 New Sun Poly Tec Co. Ltd.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 ADEKA Corporation

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Photoinitiator Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Photoinitiator Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS