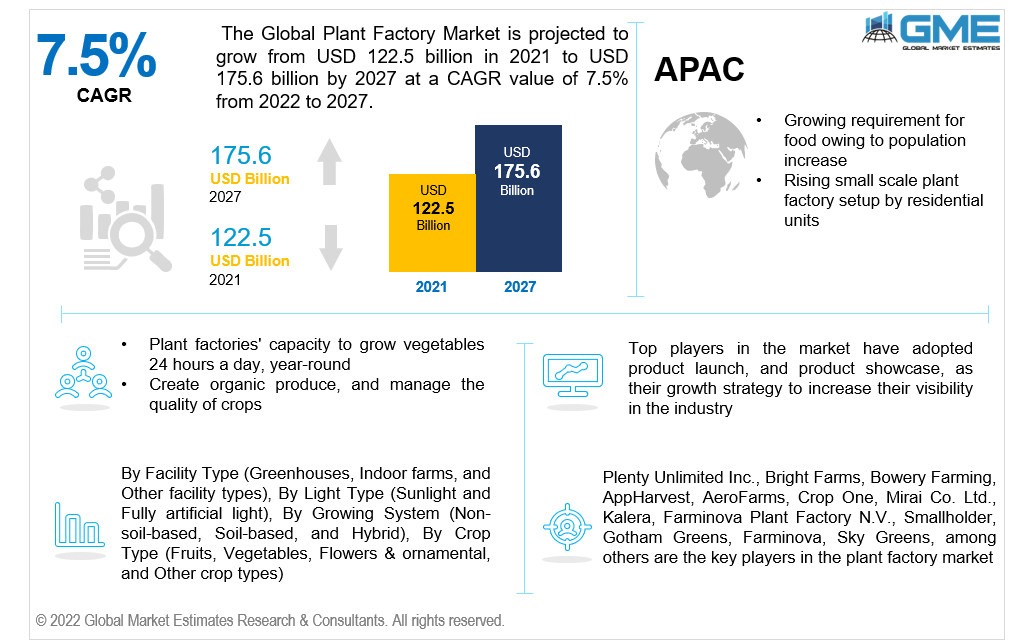

Global Plant Factory Market Size, Trends & Analysis - Forecasts to 2027 By Facility Type (Greenhouses, Indoor farms, and Other facility types), By Light Type (Sunlight and Fully artificial light), By Growing System (Non-soil-based, Soil-based, and Hybrid), By Crop Type (Fruits, Vegetables, Flowers & ornamental, and Other crop types), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global plant factory market is projected to grow from USD 122.5 billion in 2022 to USD 175.6 billion by 2027 at a CAGR value of 7.5% from 2022 to 2027.

Plant Factory is a new industry that aims to use industrial automation and bioinformatics to turn crop production into a completely new model. A plant factory is expected to achieve maximum yield, harvesting density, and financial impact by artificially controlling the plant growth environment. As experts respond to increasing worries about food security, more technical and economic investments are being made in the plant factory concept.

Plant factories will show to be a critical component in ensuring a sustainable future for all with an anticipated 9 billion people to feed by 2050.

Plant factories' capacity to grow vegetables 24 hours a day, year-round, create organic produce, and manage the quality of crops is propelling market expansion. Additionally, the increased production of larger yields compared to traditional agricultural approaches owing to expanding harvesting intervals, and the ability to remove the usage of pesticides and synthetic maturation chemicals, leading to substantially better vegetable products are also driving the market growth.

Advantages such as complete closure, low environmental impact, decreased plant crop management, irrigation, and fertilizer conservation, and pesticide-free cultivation resulting in reduced industrial effluent to the ecosystem all contribute to the growth during the forecast period.

Furthermore, factors such as the potential of plant factories to be suitable for regional food manufacturing in congested and elevated urban areas around the world to facilitate fast shipments of fresh fruit and vegetables, the capacity to inculcate plants through hydroponic systems where roots are immersed in the nutrients lowering stormwater runoff, and the opportunity to expand crop production to meet consumer needs and enhance agricultural output are propelling the market growth.

In the near term, plant factories are seen as the upcoming engines of economic growth since they could be used for a wide range of purposes, including overcoming limitations in the agroecosystem, supplying stable food supply and separation from polluted sites, and minimizing resource efficiency, thereby boosting the market growth.

Furthermore, real-time plant health surveillance, an optimum regulation of the growth environment, and anticipatory and adaptable crop operation and maintenance are some of the other aspects driving market expansion.

Despite challenging circumstances, plant factory enterprises around the world have continued to function. Multiple disruptions, such as fiscal limits, supply disruptions due to immigration limitations, and labor shortages, have all influenced service delivery.

Plant factories are emerging as a viable replacement for agricultural output reductions linked to climate change. However, due to the lack of understanding of photosynthesis in plants, efficient crop output is not accomplished, and limited adoption cases to expensive initial capital and maintenance costs.

Furthermore, plant factories are not uniform in their basic performance, therefore a standardized and cost-effective method for launch and diffusion is required.

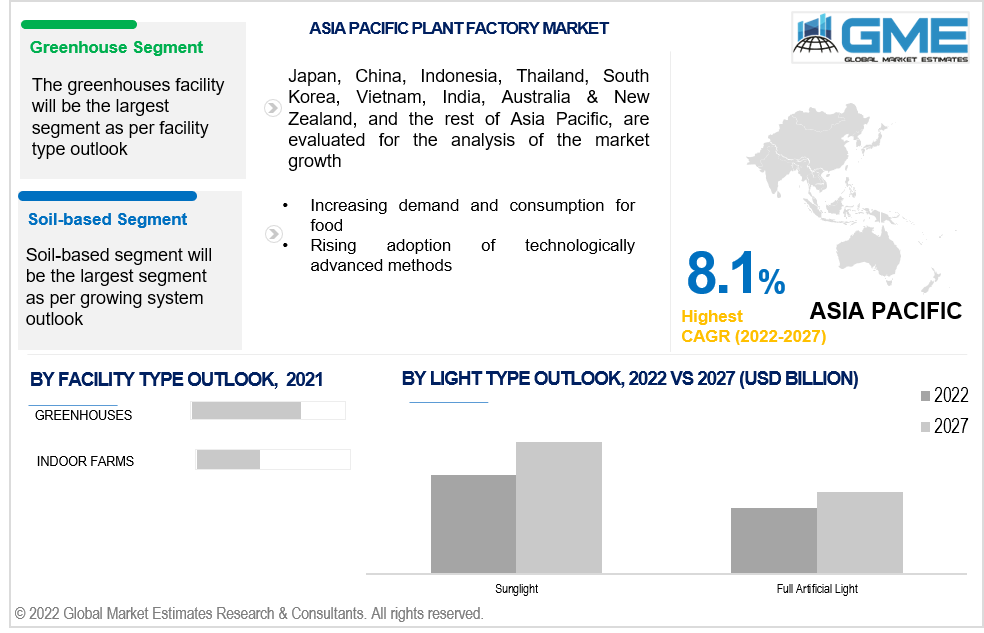

Based on the facility type, the market is segmented into greenhouses, indoor farms, and other facility types (container farms and water culture farms). The greenhouses facility segment is expected to grow the fastest in the plant factory market from 2022 to 2027.

The government's expanding attempts to set up greenhouse facilities in respective countries, as well as farmers' increased knowledge and use of greenhouse facilities, particularly for crops that demand a controlled environment, are all supporting segment growth.

Based on the light type, the plant factory market is segmented into sunlight and full artificial light. The fully artificial light segment is expected to grow the fastest in the plant factory market from 2022 to 2027.

To grow vegetables in greenhouses, plant manufacturers primarily rely on sunshine, with artificial light as an additional source of light and air-conditioning technology used in the summer. Fully artificial light-type plant factories have been given more emphasis in research and development due to their ability to enable agricultural output in locales with extreme temperature fluctuations and in compact spaces, making them ideal for cultivation.

Based on the growing system, the plant factory market has been segmented as non-soil-based, soil-based, and hybrid. The non-soil-based segment is expected to hold a larger share as compared to other segments. Soilless farming saves water, acreage, and insecticides, all of which increase the likelihood of overflow on a farm. In an environment where plants grown in controlled conditions have become the norm, soilless growth is nearly always the best option.

Based on the crop type, the plant factory market has been segmented into fruits, vegetables, flower & ornamental, and other crop types (plantation and forage crops). The vegetable segment is expected to hold a larger share as compared to other segments.

Plant-cultured vegetables are delicious and profitable crops that differ from those grown in the wild. Lettuce cultivated in plant factories is generally described as greener, smoother, and more flavorful, making it ideal for the children and elderly. In establishing the worth of vegetables, health is also a critical consideration. The number of viable bacteria in plant factory veggies is often quite minimal, ranging from 1/100 to 1/1000 of that found in vegetables grown outdoor.

As per the geographical analysis, the plant factory market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico), will have a dominant share in the plant factory market from 2022 to 2027. North America (the United States, Canada, and Mexico) region is expected to be the dominant force in the market during the forecast period. The rising demand for organic food, growing research and development for implementing advanced technologies, and the establishment of greenhouse facilities are driving market growth in this region.

Moreover, the Asia-Pacific region is expected to be the fastest-growing segment in the plant factory market during the forecast period. The growing requirement for food owing to population increase, increasing small scale plant factory setup by residential units, rising demand for sustainable urban agriculture, and boosting harvests using sophisticated growing techniques such as CEA and hydroponics are some of the factors contributing to market growth in this region.

Plenty Unlimited Inc., Bright Farms, Bowery Farming, AppHarvest, AeroFarms, Crop One, Mirai Co. Ltd., Kalera, Farminova Plant Factory N.V., Smallholder, Gotham Greens, Farminova, Sky Greens, among others are the key players in the plant factory market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Plant Factory Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Facility Type Overview

2.1.3 Light Type Overview

2.1.4 Growing System Overview

2.1.5 Crop Type Overview

2.1.6 Regional Overview

Chapter 3 Plant Factory Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Ability to remove the usage of pesticides and synthetic maturation chemicals

3.3.1.2 Higher yield compared to conventional techniques

3.3.2 Industry Challenges

3.3.2.1 High capital investment and high initial set-up cost

3.4 Prospective Growth Scenario

3.4.1 Facility Type Growth Scenario

3.4.2 Light Type Growth Scenario

3.4.3 Growing System Growth Scenario

3.4.4 Crop Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Plant Factory Market, By Facility Type

4.1 Facility Type Outlook

4.2 Greenhouses

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Indoor farms

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Other facility types (container farms and water culture farms)

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Plant Factory Market, By Growing System

5.1 Growing System Outlook

5.2 Non-soil-based

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Soil-based

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Hybrid

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Plant Factory Market, By Light Type

6.1 Sunlight

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Full artificial light

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Plant Factory Market, By Crop Type

7.1 Fruits

7.1.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Vegetables

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.3 Flower & ornamental

7.3.1 Market Size, By Region, 2022-2027 (USD Billion)

7.4 Other crop types (plantation and forage crops)

7.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 8 Plant Factory Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2022-2027 (USD Billion)

8.2.2 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.2.3 Market Size, By Light Type, 2022-2027 (USD Billion)

8.2.4 Market Size, By Growing System, 2022-2027 (USD Billion)

8.2.5 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.2.4.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.2.4.3 Market Size, By Growing System, 2022-2027 (USD Billion)

Market Size, By Crop Type, 2022-2027 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.2.7.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.2.7.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.2.7.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2022-2027 (USD Billion)

8.3.2 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.3.3 Market Size, By Light Type, 2022-2027 (USD Billion)

8.3.4 Market Size, By Growing System, 2022-2027 (USD Billion)

8.3.5 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.3.6.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.3.6.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.3.6.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.3.7.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.3.7.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.3.7.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.3.8.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.3.8.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.3.8.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.3.9.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.3.9.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.3.9.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.3.10.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.3.10.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.3.10.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.3.11.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.3.11.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.3.11.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2022-2027 (USD Billion)

8.4.2 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.4.3 Market Size, By Light Type, 2022-2027 (USD Billion)

8.4.4 Market Size, By Growing System, 2022-2027 (USD Billion)

8.4.5 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.4.6.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.4.6.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.4.6.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.4.7.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.4.7.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.4.7.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.4.8.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.4.8.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.4.8.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.4.9.2 Market size, By Light Type, 2022-2027 (USD Billion)

8.4.9.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.4.9.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.4.10.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.4.10.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.4.10.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2022-2027 (USD Billion)

8.5.2 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.5.3 Market Size, By Light Type, 2022-2027 (USD Billion)

8.5.4 Market Size, By Growing System, 2022-2027 (USD Billion)

8.5.5 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.5.6.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.5.6.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.5.6.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.5.7.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.5.7.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.5.7.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.5.8.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.5.8.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.5.8.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2022-2027 (USD Billion)

8.6.2 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.6.3 Market Size, By Light Type, 2022-2027 (USD Billion)

8.6.4 Market Size, By Growing System, 2022-2027 (USD Billion)

8.6.5 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.6.6.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.6.6.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.6.6.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.6.7.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.6.7.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.6.7.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Facility Type, 2022-2027 (USD Billion)

8.6.8.2 Market Size, By Light Type, 2022-2027 (USD Billion)

8.6.8.3 Market Size, By Growing System, 2022-2027 (USD Billion)

8.6.8.4 Market Size, By Crop Type, 2022-2027 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Plenty Unlimited Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Bright Farms

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Bowery Farming

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 AppHarvest

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 AeroFarms

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Crop One

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Mirai Co. Ltd

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Gotham Greens

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Sky Greens

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Plant Factory Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Plant Factory Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS