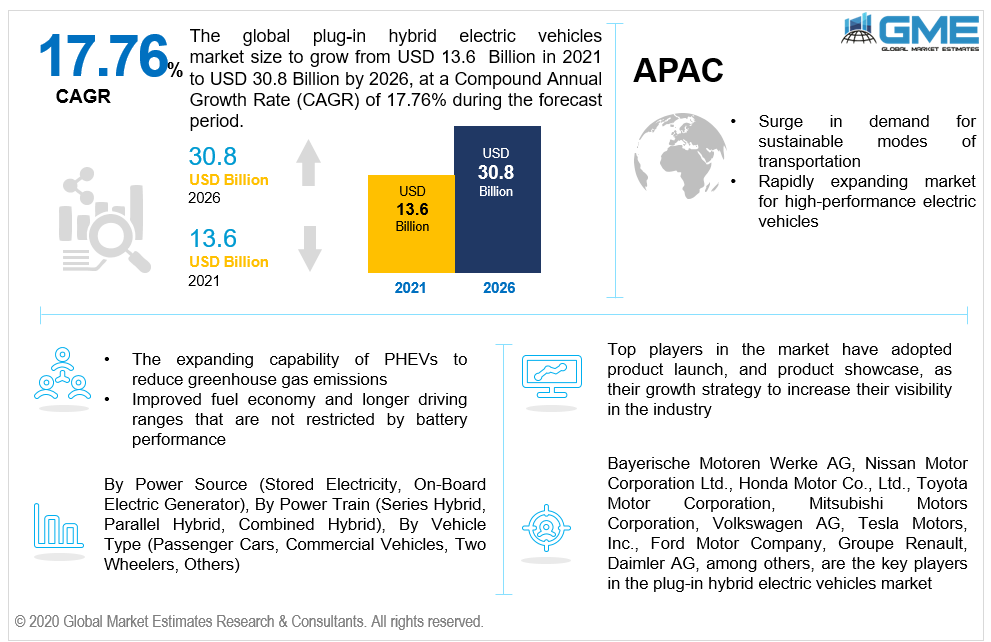

Global Plug-In Hybrid Electric Vehicles Market Size, Trends & Analysis - Forecasts to 2026 By Power Source (Stored Electricity, On-Board Electric Generator), By Power Train (Series Hybrid, Parallel Hybrid, Combined Hybrid), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two Wheelers, Others (Golf Cart, etc.)), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global plug-in hybrid electric vehicles market is projected to grow from USD 13.6 billion in 2021 to USD 30.8 billion by 2026 at a CAGR value of 13.1% between 2021 to 2026.

With nearly 600 million vehicles on the road as of 2021, 800 million additional individuals are predicted to drive cars globally over the next four decades. It is analyzed that light-duty cars have consumed around 23% of the overall 32 million barrels of oil per day, and this figure is predicted to rise to 77 million barrels per day by 2030. This utter reliance on on-road mobility on the unsustainable resource of fossil fuels has been a major concern.

According to a World Health Organization (WHO) study, more than 2 million premature deaths occur as a result of carbon emissions and the usage of petroleum-based cars, creating severe havoc and spurring the academic and commercial spheres to seek viable alternatives.

To surmount such obstacles and transition to more sustainable, affordable, and environmentally friendly forms of transportation, plug-in hybrid vehicle innovation has been manufacturer’s prime product in the market. Plug-in hybrid electric vehicles (PHEVs) provide a fuel-efficient option by combining an electric motor-based transmission with a traditional internal combustion engine (ICE) to save fuel consumption and automobile exhaust. These PHEV advantages have spurred automakers to manufacture hybrid vehicles, the majority of which are now available in Canada.

The expanding capability of PHEVs to reduce greenhouse gas emissions, with improved fuel economy and longer driving ranges that are not restricted by battery performance, is boosting the market growth. Additionally, mounting concerns about climate change, urban air pollution, and reliance on crude oil prices are some of the other factors fuelling market expansion.

PHEVs are predicted to have lower maintenance costs than hydrogen fuel-cell and internal combustion (IC) vehicles over the next decades. By 2025, 100 new PHEV models will be introduced, with an anticipated 3.7 million vehicles worldwide. This points to a revolutionary boom for the worldwide plug-in hybrid electric vehicle market, which is primarily driven by factors such as customer attractiveness to much more alluring alternative-fuel automobiles.

The COVID-19 epidemic impacted the automobile sector, negatively. The launch of Plug-in Hybrid Electric Vehicles was impeded as a result of the impact. As showrooms shut their doors and businesses ceased output, the global economy suffered tremendously. Since only essential activities were authorized during the lockdown period, the market for commercial vehicles has been severely impacted. Nevertheless, with the global rollout of vaccinations, and rising concern of environmental pollution, the plug-in hybrid electric vehicles market is on the rise.

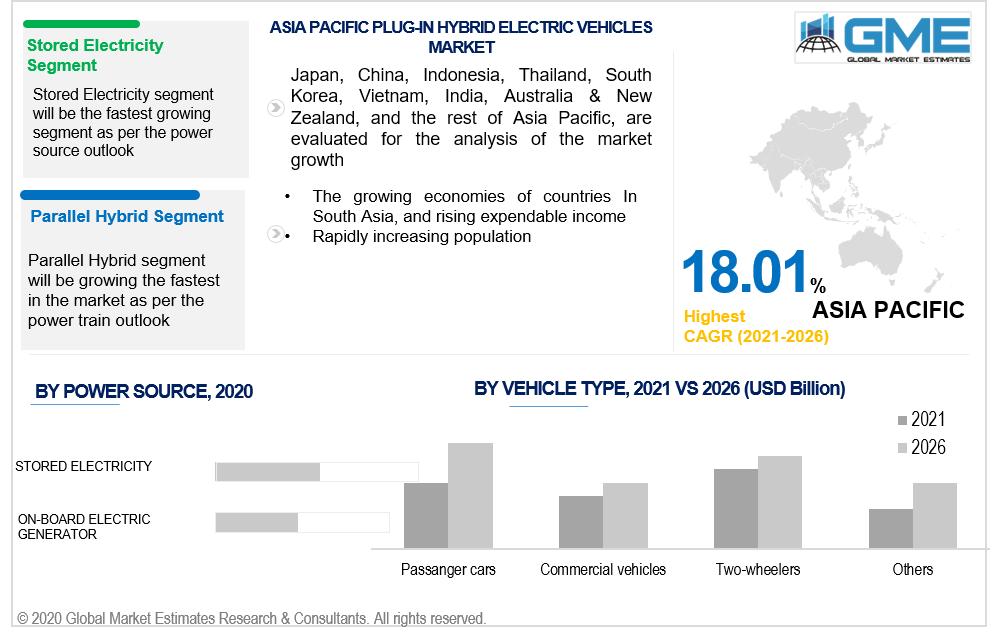

Based on the power source, the market is segmented into stored electricity and onboard electric generator. The stored electricity segment is expected to have the largest share in the market during the forecast period. The expansion of the EV sector has significant ramifications for the power system. EVs will consume a rising amount of energy, necessitating increased generating operation and, as a result, a rise in generation fuel consumption and air emissions. As a result, using stored electricity to replace the existing method reduces the amount of T&D capacity required on-peak to supply the EV charging portion of overall peak demand.

Furthermore, the storage is charged using low-cost, off-peak electricity when generation fuel use and air emissions are at their lowest (on a per-kilowatt-hour basis).

Based on power trains, the market is divided into series hybrid, parallel hybrid, and combined hybrid. The parallel hybrid segment is estimated to have the largest share in the market during the forecast period. The usage of energy recovery systems, as well as the lower cost of micro and moderate hybrids when compared to PHEVs, will increase demand for parallel hybrids.

Based on vehicle type, the market is segmented into passenger cars, commercial vehicles, two-wheelers, others (golf carts, etc.). The demand for passenger cars is estimated to have the largest share during the forecast period. This is owing to its low cost, compact size, the convenience of use, and family friendliness. This is also attributable to substantial support from the government for passenger EVs around the world.

Based on region, the market can be broken into various regions such as North America, Europe, Central, and South America, the Middle East and Africa, and Asia Pacific regions.

The Asia Pacific region is expected to be the dominant the market during the forecast period followed by North America. China has become the largest automobile market in the Asia Pacific, as well as the main market for high-performance electric vehicles due to increased supply for eco-friendly and sustainable modes of transportation China had the greatest number of highway-legal plug-in passenger cars as of December 2020, accounting for more than 40 percent of the global plug-in car fleet that are being used. China likewise leads the rollout of electric buses and plug-in light commercial vehicles, with over 98 percent and 65 percent of the global fleet, respectively.

The North American region is also expected to become the dominant region during the forecast period. The European Union, as well as various major, national, and regional authorities around Europe, aggressively promote the use of plug-in electric vehicles.

Bayerische Motoren Werke AG, Nissan Motor Corporation Ltd., Honda Motor Co., Ltd., Toyota Motor Corporation, Mitsubishi Motors Corporation, Volkswagen AG, Tesla Motors, Inc., Ford Motor Company, Groupe Renault, Daimler AG, among others, are the key players in the plug-in hybrid electric vehicles market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Plug-In Hybrid Electric Vehicles Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Power Source Overview

2.1.3 Power Train Overview

2.1.4 Vehicle Type Overview

2.1.6 Regional Overview

Chapter 3 Plug-In Hybrid Electric Vehicles Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The expanding capability of PHEVs to reduce greenhouse gas emissions

3.3.2 End-User Challenges

3.3.2.1 Lack of awareness regarding PHEV technology

3.4 Prospective Growth Scenario

3.4.1 Power Source Growth Scenario

3.4.2 Power Train Growth Scenario

3.4.3 Vehicle Type Growth Scenario

3.5 COVID-19 Influence over End-User Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-Use Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Plug-In Hybrid Electric Vehicles Market, By Power Source

4.1 Power Source Outlook

4.2 Stored Electricity

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 On-Board Electric Generator

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Plug-In Hybrid Electric Vehicles Market, By Power Train

5.1 Power Train Outlook

5.2 Series Hybrid

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Parallel Hybrid

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Combined Hybrid

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Plug-In Hybrid Electric Vehicles Market, By Vehicle Type

6.1 Passenger Cars

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Commercial Vehicles

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Two Wheelers

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Others (Golf Cart, etc.)

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Plug-In Hybrid Electric Vehicles Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Power Source, 2020-2026 (USD Billion)

7.2.3 Market Size, By Power Train, 2020-2026 (USD Billion)

7.2.4 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Power Source, 2020-2026 (USD Billion)

7.3.3 Market Size, By Power Train, 2020-2026 (USD Billion)

7.3.4 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Power Source, 2020-2026 (USD Billion)

7.4.3 Market Size, By Power Train, 2020-2026 (USD Billion)

7.4.4 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Power Train, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Power Source, 2020-2026 (USD Billion)

7.5.3 Market Size, By Power Train, 2020-2026 (USD Billion)

7.5.4 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Power Source, 2020-2026 (USD Billion)

7.6.3 Market Size, By Power Train, 2020-2026 (USD Billion)

7.6.4 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Power Source, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Power Train, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Vehicle Type, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Bayerische Motoren Werke AG

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 Nissan Motor Corporation Ltd

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 Honda Motor Co., Ltd

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 Toyota Motor Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 Mitsubishi Motors Corporation

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 Volkswagen AG

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 Tesla Motors, Inc

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Ford Motor Company

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.10 Groupe Renault

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

The Global Plug-In Hybrid Electric Vehicles Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Plug-In Hybrid Electric Vehicles Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS