Global Point of Care Diagnostics Market Size, Trends & Analysis - Forecasts to 2026 By Product (Glucose Monitoring Products, Cardiometabolic Monitoring Products, Infectious Disease Testing Products, Coagulation Monitoring Products, Pregnancy & Fertility Testing Products, Fecal Occult Testing Products, Hematology Testing Products, Tumor/Cancer Marker Testing Products, Urinalysis Testing Products, Drugs-of-abuse Testing Products, Cholesterol Testing Products, and Other POC Products), By Platform (Lateral Flow Assays, Immunoassays, Microfluidics, Molecular Diagnostics and Dipsticks), By Mode of Purchase (Prescription, Over The Counter (OTC)), By End-User (Outpatient & Ambulatory Care Facilities, Hospitals & Critical Care Centers, Home Care Settings, and Other End Users), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

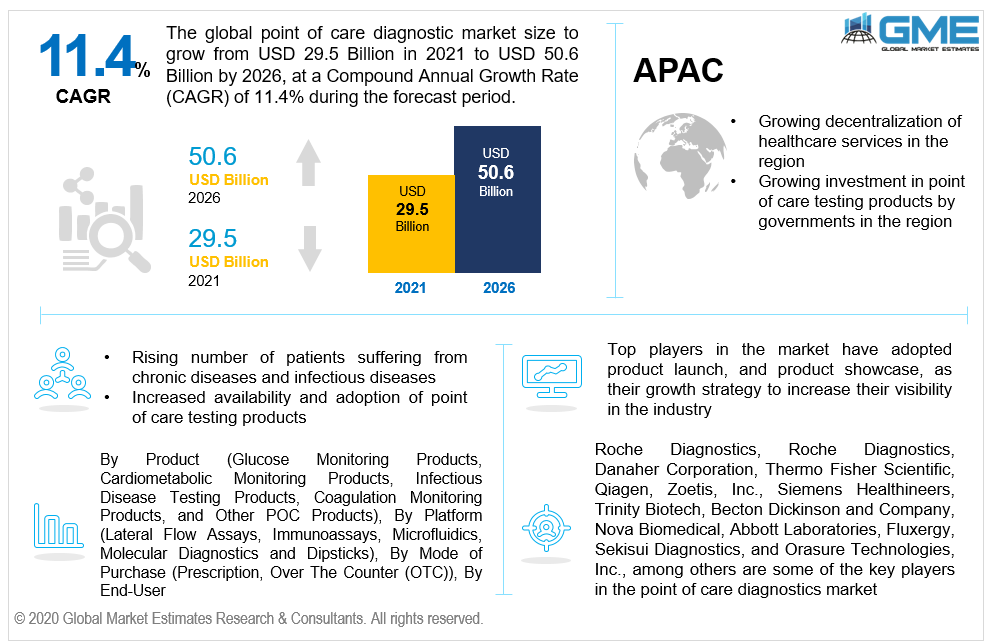

The global point of care diagnostics market size is projected to grow from USD 29.5 billion in 2021 to USD 50.6 billion by 2026 at a CAGR value of 11.4%. Technological advancements in diagnostic medicine have been the major driver of the POC diagnostics market. These technological advancements in point of care testing have significantly reduced the time it takes for patients to receive the necessary medical attention. The reduction in patient care time allows healthcare providers to effectively manage infectious diseases and prevent their spread. This has prompted governments across the globe to invest in point of care testing technology.

The increased spending by governments on point of care diagnostics in developing and underdeveloped nations have contributed to the growth of the POC diagnostics market size. The current point of care diagnostics market opportunities and technology trends points towards increasing the availability of completely decentralized diagnostic services through the use of online platforms. The increasing incidences of infectious disease outbreaks have increased the need for point of care diagnostic testing contributing to the growth of the point of care diagnostic market. The point of care diagnostics market trends points towards a growing adoption of rapid COVID-19 tests and antigen-based malaria testing. These tests can be carried out with a single drop of saliva, urine, or whole blood by a healthcare professional in minutes. The COVID-19 tests are carried out using membrane-based test strips.

Technological advancements like lab-on-a-chip technology have played a crucial role in the point-of-care diagnostics market trends and growth drivers. Lab-on-a-chip technology allows healthcare providers to conduct tests like PCR and ELISA at the point of care. Diseases like acute coronary syndrome, diabetes, and carpal tunnel syndrome have become easier and cheaper to test through point of care testing equipment in recent years. Point of care diagnostic testing is being increasingly used in developed nations across Europe and North America to decentralize the healthcare system. This will inevitably lead to the POC diagnostics market value mushrooming during the forecast period.

The point of care diagnostics market report includes extensive secondary and primary researched data and info along with end-user perception analysis, trend analysis and market size analysis. The point of care diagnostics market trends and growth drivers are mentioned in detail with exclusive data points and infographics.

The point of care diagnostic market is restrained by the lack of awareness of point of care diagnostic technology among frontline healthcare providers and their unfamiliarity with procedures like preparing the patient for sample collection and calibration of the testing equipment. Stringent and complex government regulations on POC testing kits by regulatory bodies like the FDA delay the ability of manufacturers to release new products in the market.

Point of care diagnostics manufacturers offers various products to test different diseases. Based on products, the POC diagnostics market can be segmented as glucose monitoring products, cardiometabolic monitoring products, infectious disease testing products, coagulation monitoring products, pregnancy & fertility testing products, fecal occult testing products, hematology testing products, tumor/cancer marker testing products, urinalysis testing products, drugs-of-abuse testing products, cholesterol testing products, and Other POC products.

The glucose monitoring products segment monopolized the largest share of the point of care diagnostics market. The growing demand from patients for glucose testing from the comforts of their homes has contributed to the dominance of the point of care diagnostic market. The other drivers that have contributed to the large share of the glucose segment have been the adoption of new technologies in glucose testing and the growing number of diabetic patients.

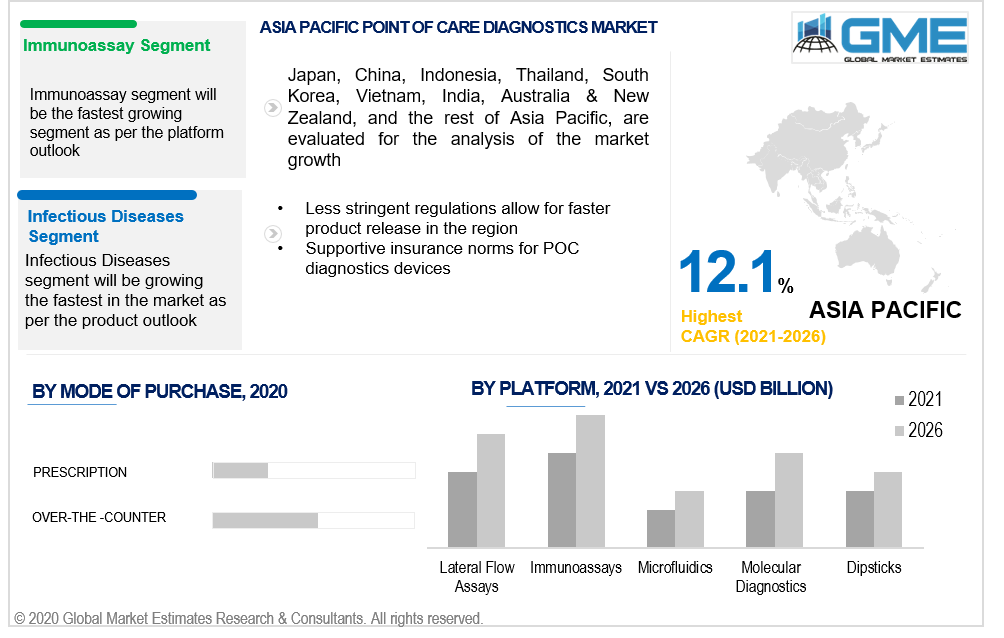

The point of care diagnostics market is segmented as over-the-counter (OTC) and prescription segments based on the mode of purchases available to the consumer. The over-the-counter segment is expected to account for the lion’s share of the point of care diagnostic market. The increasing prevalence of infectious diseases and the growing awareness of point of care testing kits among the general public have been the major drivers of the over-the-counter segment.

Based on the platforms through which point of care testing can be carried out, the POC diagnostics market can be segmented as lateral flow assays, immunoassays, microfluidics, molecular diagnostics and dipsticks. The growing adoption of lateral flow assays among healthcare providers is expected to result in the segment becoming the fastest-growing segment during the forecast period.

Based on the end-users of the point of care diagnostic products, the market can be segmented as outpatient & ambulatory care facilities, hospitals & critical care centers, home care settings, and other end users. The hospitals & critical care centers segment is expected to monopolize the point of care diagnostics market revenue while also showing the fastest growth rate among both segments.

The growing geriatric population and the growing number of patients suffering from chronic diseases and infectious diseases have been the major drivers of the hospitals and clinics segment. Point of care diagnostic products allow healthcare providers to quickly diagnose patients and provide them with the necessary treatment, combined with POC testing becoming cheaper has led to the increased adoption of point of care diagnostics in the hospitals and clinics segment.

Based on the geographical analysis of the point of care diagnostics market, the market is segmented as North America, Europe, Latin American, Middle East & Africa, and Asia Pacific regions. The North American region monopolized the POC diagnostics market by revenue. The growing push for decentralization of healthcare services in the region has been the major driver of the point of care diagnostic market especially the US point of care diagnostics market. The presence of a large number of the key players in the point of care diagnostics market has allowed a greater penetration of POC diagnostic products in the region.

The APAC region held the fastest growth rate among all regions. The growing support from governments in the region to adopt the point of care testing kits especially to mitigate the spread of COVID-19 have been the major drivers of the point of care diagnostics market in the region. Favorable government regulations and a growing insurance market have been some of the major drivers of the point of care diagnostics market India.

Roche Diagnostics, Danaher Corporation, Thermo Fisher Scientific, Qiagen, Zoetis, Inc., Siemens Healthineers, Trinity Biotech, Becton Dickinson and Company, Nova Biomedical, Abbott Laboratories, Fluxergy, Sekisui Diagnostics, and Orasure Technologies, Inc., among others are some of the key players in the point of care diagnostics market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Point of Care Diagnostics Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Platform Overview

2.1.4 End-User Overview

2.1.5 Mode of Purchase Overview

2.1.6 Regional Overview

Chapter 3 Point of Care Diagnostics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technological advancements in the point of care testing products like lab-on-chips

3.3.1.2 Growing decentralization of healthcare services

3.3.2 Industry Challenges

3.3.2.1 Lack of knowledge on point of care product among healthcare providers

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Platform Growth Scenario

3.4.3 End-User Growth Scenario

3.4.4 Mode of Purchase Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Mode of Purchase Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Point of Care Diagnostics Market, By Product

4.1 Product Outlook

4.2 Glucose Monitoring Products

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Infectious Diseases Testing Products

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Coagulation Monitoring Devices

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Cardiometabolic Monitoring Products

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Cholesterol Testing Products

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

4.7 Pregnancy & Fertility Testing Products

4.7.1 Market Size, By Region, 2019-2026 (USD Million)

4.8 Fecal Occult Testing Products

4.8.1 Market Size, By Region, 2019-2026 (USD Million)

4.9 Hematology Testing Products

4.9.1 Market Size, By Region, 2019-2026 (USD Million)

4.10 Tumor/Cancer Marker Testing Products

4.10.1 Market Size, By Region, 2019-2026 (USD Million)

4.11 Urinalysis Testing Products

4.11.1 Market Size, By Region, 2019-2026 (USD Million)

4.12 Drugs-of-abuse Testing Products

4.12.1 Market Size, By Region, 2019-2026 (USD Million)

4.13 Other POC Products

4.13.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Point of Care Diagnostics Market, By End-User

5.1 End-User Outlook

5.2 Hospitals & Critical Care Centers

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Home Care Settings

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Outpatient & Ambulatory Care Facilities

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Other End Users

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Point of Care Diagnostics Market, By Platform

6.1 Immunoassays

6.1.1 Market Size, By Region, 2019-2026 (USD Million)

6.2 Microfluidics

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Molecular Diagnostics

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Lateral Flow Assays

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

6.5 Dipsticks

6.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Point of Care Diagnostics Market, By Mode of Purchase

7.1 Prescription-Based Testing Products

7.1.1 Market Size, By Region, 2019-2026 (USD Million)

7.2 Over-The-Counter

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Point of Care Diagnostics Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2019-2026 (USD Million)

8.2.2 Market Size, By Product, 2019-2026 (USD Million)

8.2.3 Market Size, By Platform, 2019-2026 (USD Million)

8.2.4 Market Size, By End-User, 2019-2026 (USD Million)

8.2.5 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.2.4.2 Market Size, By Platform, 2019-2026 (USD Million)

8.2.4.3 Market Size, By End-User, 2019-2026 (USD Million)

8.24.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Platform, 2019-2026 (USD Million)

8.2.7.3 Market Size, By End-User, 2019-2026 (USD Million)

8.2.7.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2019-2026 (USD Million)

8.3.2 Market Size, By Product, 2019-2026 (USD Million)

8.3.3 Market Size, By Platform, 2019-2026 (USD Million)

8.3.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.5 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Platform, 2019-2026 (USD Million)

8.3.6.3 Market Size, By End-User, 2019-2026 (USD Million)

8.3.6.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Platform, 2019-2026 (USD Million)

8.3.7.3 Market Size, By End-User, 2019-2026 (USD Million)

8.3.7.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Platform, 2019-2026 (USD Million)

8.3.8.3 Market Size, By End-User, 2019-2026 (USD Million)

8.3.8.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Platform, 2019-2026 (USD Million)

8.3.9.3 Market Size, By End-User, 2019-2026 (USD Million)

8.3.9.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Platform, 2019-2026 (USD Million)

8.3.10.3 Market Size, By End-User, 2019-2026 (USD Million)

8.3.10.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Platform, 2019-2026 (USD Million)

8.3.11.3 Market Size, By End-User, 2019-2026 (USD Million)

8.3.11.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2019-2026 (USD Million)

8.4.2 Market Size, By Product, 2019-2026 (USD Million)

8.4.3 Market Size, By Platform, 2019-2026 (USD Million)

8.4.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.5 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Platform, 2019-2026 (USD Million)

8.4.6.3 Market Size, By End-User, 2019-2026 (USD Million)

8.4.6.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Platform, 2019-2026 (USD Million)

8.4.7.3 Market Size, By End-User, 2019-2026 (USD Million)

8.4.7.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Platform, 2019-2026 (USD Million)

8.4.8.3 Market Size, By End-User, 2019-2026 (USD Million)

8.4.8.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.9.2 Market size, By Platform, 2019-2026 (USD Million)

8.4.9.3 Market Size, By End-User, 2019-2026 (USD Million)

8.4.9.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Platform, 2019-2026 (USD Million)

8.4.10.3 Market Size, By End-User, 2019-2026 (USD Million)

8.4.10.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2019-2026 (USD Million)

8.5.2 Market Size, By Product, 2019-2026 (USD Million)

8.5.3 Market Size, By Platform, 2019-2026 (USD Million)

8.5.4 Market Size, By End-User, 2019-2026 (USD Million)

8.5.5 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Platform, 2019-2026 (USD Million)

8.5.6.3 Market Size, By End-User, 2019-2026 (USD Million)

8.5.6.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Platform, 2019-2026 (USD Million)

8.5.7.3 Market Size, By End-User, 2019-2026 (USD Million)

8.5.7.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Platform, 2019-2026 (USD Million)

8.5.8.3 Market Size, By End-User, 2019-2026 (USD Million)

8.5.8.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2019-2026 (USD Million)

8.6.2 Market Size, By Product, 2019-2026 (USD Million)

8.6.3 Market Size, By Platform, 2019-2026 (USD Million)

8.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.6.5 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Platform, 2019-2026 (USD Million)

8.6.6.3 Market Size, By End-User, 2019-2026 (USD Million)

8.6.6.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Platform, 2019-2026 (USD Million)

8.6.7.3 Market Size, By End-User, 2019-2026 (USD Million)

8.6.7.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Platform, 2019-2026 (USD Million)

8.6.8.3 Market Size, By End-User, 2019-2026 (USD Million)

8.6.8.4 Market Size, By Mode of Purchase, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Becton Dickinson and Company

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Siemens Healthineers

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Qiagen

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Thermo Fisher Scientific

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Danaher Corporation

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Roche Diagnostics

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Fluxergy

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Sekisui Diagnostics

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Orasure Technologies Inc.

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Point of Care Diagnostics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Point of Care Diagnostics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS