Global Polymer Matrix Composites Market Size, Trends, and Analysis - Forecasts To 2026 By Product Type (Thermoset, Rubber, Thermoplastic), By End-Use Industry (Aerospace, Sporting Equipment, Automotive, Defense, Healthcare, Construction, Shipbuilding, Electrical and Electronics Industry, Mechanical Manufacturing), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

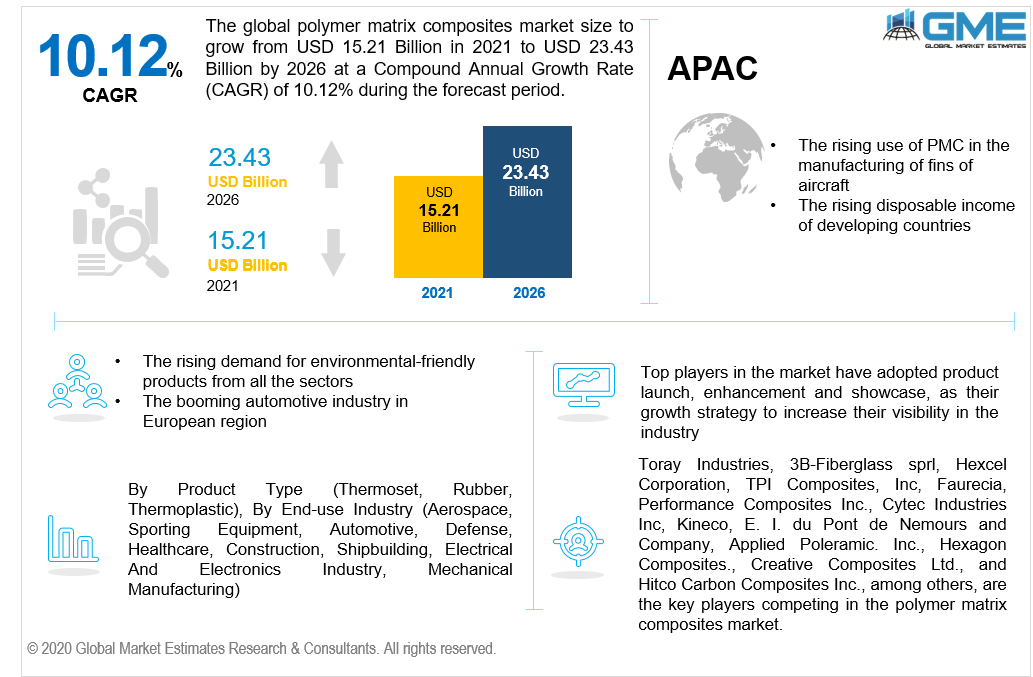

The global polymer matrix composites market is estimated to be USD 15.21 billion in 2021 and is expected to reach USD 23.43 billion by 2026, growing at a CAGR of 10.12%. Polymer matrix composites are prominently used in the manufacturing industries because of properties such as fracture toughness, greater strength and tensile stiffness, and lower costs than ceramic matrix composites.

The matrix polymer is also referred to as a binder since it holds the inclusions together. Carbon fibre composites, hybrid fibre composites, glass fibre composite material, or glass fibre reinforced plastics, are all forms of PMC named for the type of reinforced fibre used. The modulus and strength of reinforced fibres are significantly higher than that of the standard matrix material, which makes PMCs a better load-bearing material. As a result, the global PMC market is anticipated to develop at a substantial rate throughout the forecast period owing to increasing demand for PMCs.

Furthermore, the growing use of silicone-based composites in the fabrication of printed circuit boards and components that necessitate high heat and electrical resistance are some of the factors contributing to the growth of the global polymer matrix composites market. Various industries are looking for low-cost ways to increase material performance, which is fueling the growth of the PMC market.

The demand for PMCs from the car industry has fueled the growth of the market. PMC materials are used in automotive vehicles for hoses, tires, and various belts, as well as polymer matrix composite components in automotive bodies including bumpers, doors, body panels, and driveshaft. Furthermore, the rising adoption of PMC by the healthcare industry is also one of the key factors driving the growth of the market. PMC materials are also used in medical devices such as X-Ray couches, MRI scanners, medical implants, wheelchairs, orthopedic devices, and C Scanners, among others.

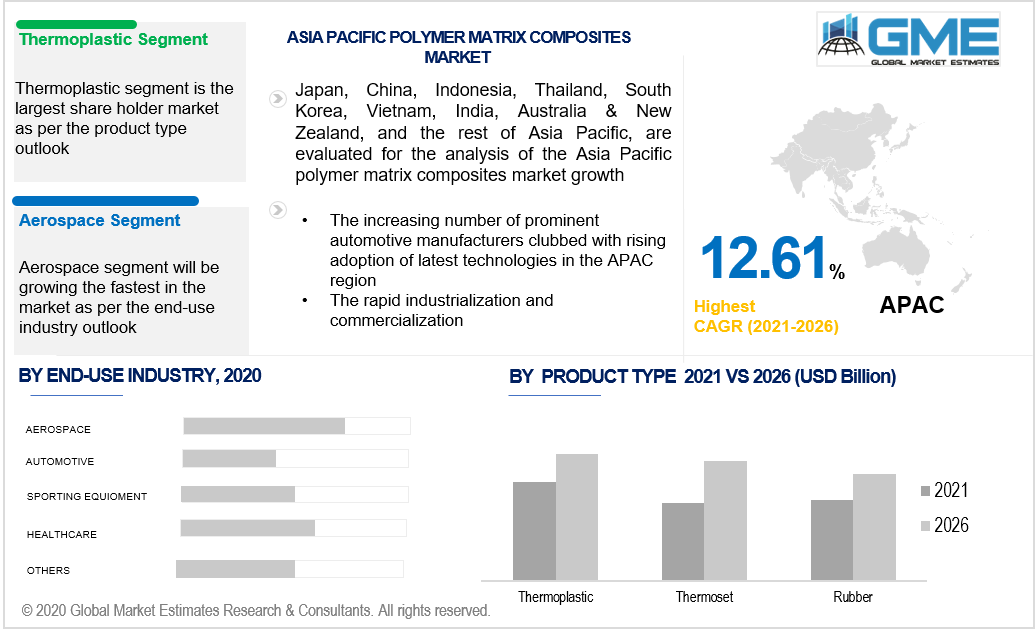

Based on the application the market can be segmented into aerospace, sporting equipment, automotive, defense, healthcare, construction, shipbuilding, electrical and electronic industry, and mechanical manufacturing. During the forecast period, the aerospace segment is expected to hold the largest share of the market and expand at the fastest pace due to its increasing use in the manufacturing of fins for civil aircraft, planes in satellites, antennas, rocket motor casing, and airframes of fighter aircraft, helicopters, and small aircraft.

Moreover, owing to its lightweight, high strength, multiple degrees of design freedom, and ease of processing and forming properties, fiber-reinforced polymer matrix composites are utilized as construction materials in high-performance sports gear including tennis rackets, baseball bats, and bicycle frames, among others.

Furthermore, the incorporation of small quantities of certain nanofillers can increase the electrical conductivity of a polymer with low density and excellent mechanical properties by orders of magnitude. Such polymer matrix composites materials can subsequently be used as components in electronics applications where the matrix polymer would be useless.

Based on type, the polymer matrix composites market can be segmented into thermoset, rubber, and thermoplastic. During the forecast period of 2021-2026, the thermoplastics segment is expected to dominate the market. Thermoplastics make up a modest portion of the PMC sector at the present. They are normally supplied as non - reactive solids (no chemical reactions occur throughout processing) and are formed using only heat and pressure. Thermoplastics, unlike thermosets, may usually be reheated and reformed into a different shape if desired.

Thermoset composites are extremely durable and low-maintenance, due to their inert chemical composition, stiff interlinking molecular structure, and resilience to ultraviolet and chemical attack.

North America holds a significant share in the polymer matrix composites market. Rapid technological developments and the adoption of PMC in the automotive, medical, aerospace, and defense industries, among others, are expected to propel the North American market throughout the forecast period of 2021 to 2026. The growing usage of PMC in such industries is due to their high-end flexibility and stiffness, which helps to reduce weight of the end product by 20-30% while also increasing range, payloads, and lowering fuel consumption. Moreover, the considerable rise of PMC in the North American market is due to recent advancements in stealth technology and all-weather operating aircraft in the military industry.

The APAC region is expected to grow at the fastest rate during the forecast period. Several factors that have been identified to drive the growth of the market are rising demand for lightweight passenger vehicles with improved fuel efficiency and government rules and regulations implement for requiring vehicle manufacturers to initiate carbon-reduction strategies for their newly launched vehicles.

Because of PMCs insulating characteristics and stiffness, the APAC region has experienced a boom in the building and construction sectors, which has generated demand for PMC.

Toray Industries, 3B-Fiberglass sprl, Hexcel Corporation, Arkema SA, Owens Corning, Teijin Limited, SAERTEX GmbH & Co. KG, Hexcel Corporation, TPI Composites, Inc, Faurecia, Performance Composites Inc., Enduro Composites, Inc., Cytec Industries Inc, Kineco, E. I. du Pont de Nemours and Company, Applied Poleramic. Inc., Hexagon Composites, Koninklijke Ten Cate N.V., Johnson Controls Inc., Creative Composites Ltd., and Hitco Carbon Composites Inc., among others, are the key players competing in the polymer matrix composites market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2019, Arkema SA’s subsidiary Bostik successfully acquired LIP Bygningsartikler AS (LIP). The company is recognized as the leading manufacturer of floor preparation solutions and tile adhesives. Through this acquisition, Bostik was be able to supply integrated, creative, and high-value-added solutions to its customers in northern European countries.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Polymer Matrix Composites Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.1 Product Type Overview

2.1.3 End-Use Industry Overview

Chapter 3 Global Polymer Matrix Composites Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Flourishing aerospace industry to propel the growth of the market

3.3.1.2 Growing demand for Polymer Matrix Composites from automotive sector

3.3.2 Industry Challenges

3.3.2.1 High cost associated with the PMC production process

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 End-Use Industry Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Polymer Matrix Composites Market, By Product Type

4.1 Product Type Outlook

4.2 Thermoset

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Rubber

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Thermoplastics

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Polymer Matrix Composites Market, By End-Use Industry

5.1 End-Use Industry Outlook

5.2 Aerospace

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Automotive

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Pharmaceuticals

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Sporting Equipment

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Defense

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

5.7 Healthcare

5.7.1 Market Size, By Region, 2020-2026 (USD Billion)

5.8 Construction

5.8.1 Market Size, By Region, 2020-2026 (USD Billion)

5.9 Shipbuilding

5.9.1 Market Size, By Region, 2020-2026 (USD Billion)

5.10 Electrical and Electronics Industry

5.10.1 Market Size, By Region, 2020-2026 (USD Billion)

5.11 Mechanical Manufacturing

5.10.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Global Polymer Matrix Composites Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Product Type, 2020-2026 (USD Billion)

6.2.3 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.3 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Product Type, 2020-2026 (USD Billion)

6.4.3 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.4.7.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Product Type, 2020-2026 (USD Billion)

6.5.3 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

6.6.3 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By End-Use Industry, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Toray Industries

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 InfoGraphic Analysis

7.3 3B-Fiberglass sprl.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 InfoGraphic Analysis

7.4 Hexcel Corporation

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 InfoGraphic Analysis

7.5 Arkema S.A.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 InfoGraphic Analysis

7.6 Owens Corning

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 InfoGraphic Analysis

7.7 Teijin Limited

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 InfoGraphic Analysis

7.8 TPI Composites, Inc

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 InfoGraphic Analysis

7.9 Creative Composites Ltd.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 InfoGraphic Analysis

7.10 Hitco Carbon Composites Inc

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 InfoGraphic Analysis

7.11 Enduro Composites, Inc.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 InfoGraphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 InfoGraphic Analysis

The Global Polymer Matrix Composites Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Polymer Matrix Composites Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS