Global Polystyrene Market Size, Trends & Analysis - Forecasts to 2026 By Type (General Purpose Polystyrene (GPPS), High Impact Polystyrene (HIPS), Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Others), By Application (Rigid Packaging, Flexible Packaging, Seating, HVAC Insulation, Others), By End-User (Packaging, Electronics, Building & Construction, Consumer Goods & Appliances, Others); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis; By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis.

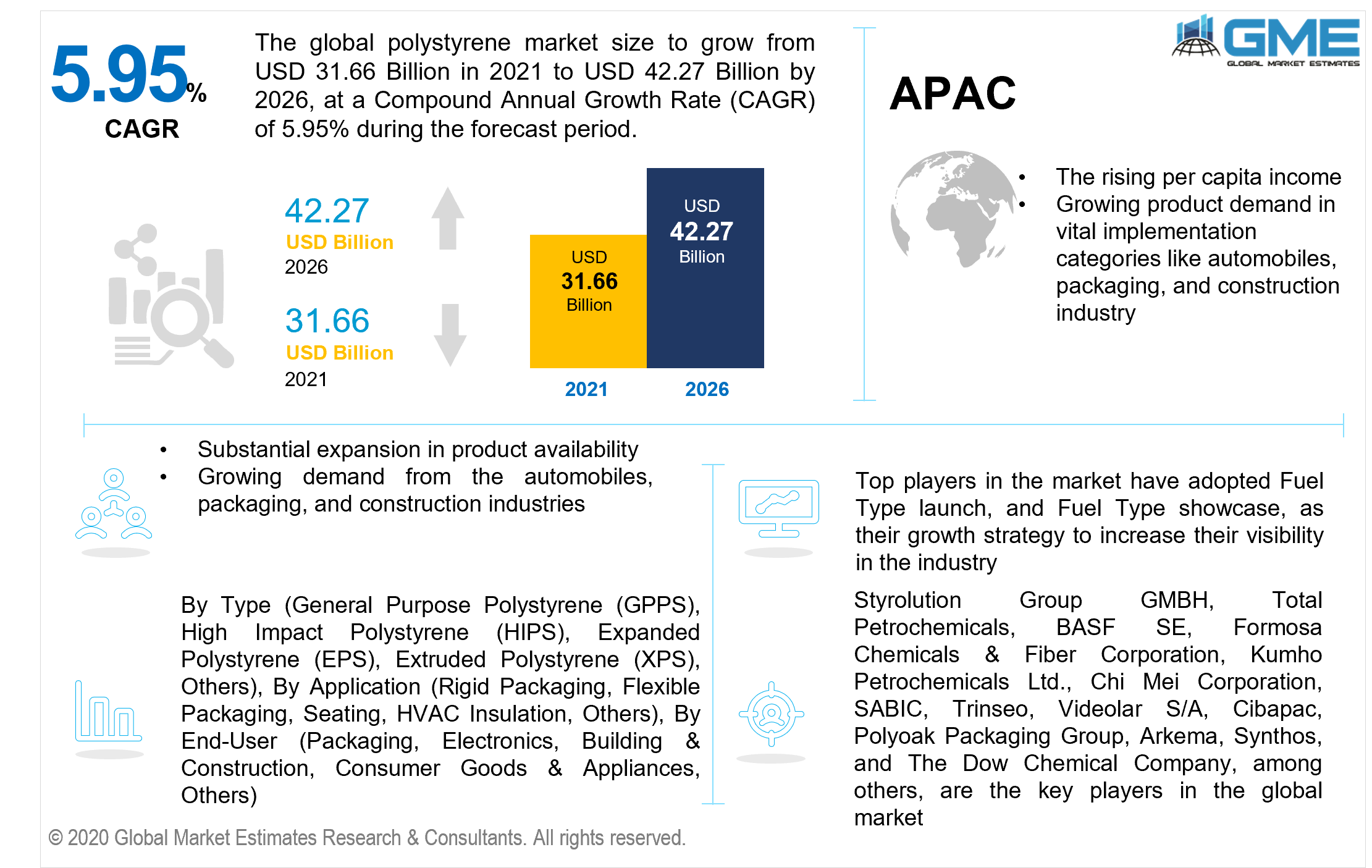

The global polystyrene market is estimated to be valued at USD 31.66 billion in 2021 and is projected to reach USD 42.27 billion by 2026 at a CAGR of 5.95%. Over the forecast period, global polystyrene market growth will be fueled by rising demand for renewable and compact alternatives that provide extraordinary lifespan as well as elevated thermal insulation. Urbanization, combined with technological advances, is driving the expansion of the electronics and packaging industrial sectors. Furthermore, emerging industries including consumer goods, pharmaceutical products, and safeguards are boosting the polystyrene market size. The rising per capita income in many regions has also culminated in the evolving middle-class purchasing more packaged products. The increased popularity of finished goods has increased the utilization of polystyrene for packaging, propelling the polystyrene market share.

Furthermore, rising shopper demand for strong commercial and residential structures that can withstand substantial changes in the extrinsic climatic conditions is expected to increase the global polystyrene market size over the forecast period. The burgeoning implications of socioeconomic etiologies, including improving the perception of community ecological accountability, boosting comprehension of physical wellness, and ramping up innovations in corporate social responsibility, are driving the uptick in the green building trend. These aforementioned factors will have a positive effect on the global polystyrene market.

The growing requirement for cold chain packaging in the pharmaceutical sector to improve product protection and preserve the quality of packaged goods in the F&B industry through transit is expected to drive market expansion. Furthermore, improvements in the frozen food business sector in developed markets such as the United States and Japan are foreseen to broaden the context of polystyrene in the packaging sector throughout the forecast period.

The growing importance of insulating materials in the building and construction sectors of developed countries such as China and India is expected to reinforce the use of high-quality polymeric materials. Furthermore, improved expenditure on enhancing the lifespan of housing developments and apartment establishments in outrageous exogenous ecological scenarios is expected to trigger market demand for polystyrene.

Heavy metal modification for composite materials, on the contrary, is presumed to drive demand advancement during the forecast period. Restrictive constraints on plastic materials are a significant market restriction. Government agencies and regulatory agencies primarily quantify and regulate the hazards associated with the manufacture and use of polystyrene. Crude oil market volatility has a considerable impact on the price of raw materials, further hindering manufacturing operations. The market's advancement is thus hampered by the fluctuation of crude oil prices.

The polystyrene market overview shows that the increased utilization of expandable polystyrene (EPS) in HVAC insulation frameworks is one of the main determinants likely to drive the advancement of the market during the forecast period. Besides that, the widening thermal insulation market is expected to drive the proliferation of the market. Furthermore, increased polystyrene penetration in the electronics and appliances industries is expected to shield the market's expansion. On the other contrary, the surge in raw material fluctuation prices is expected to stymie the development of the market over the forecast period.

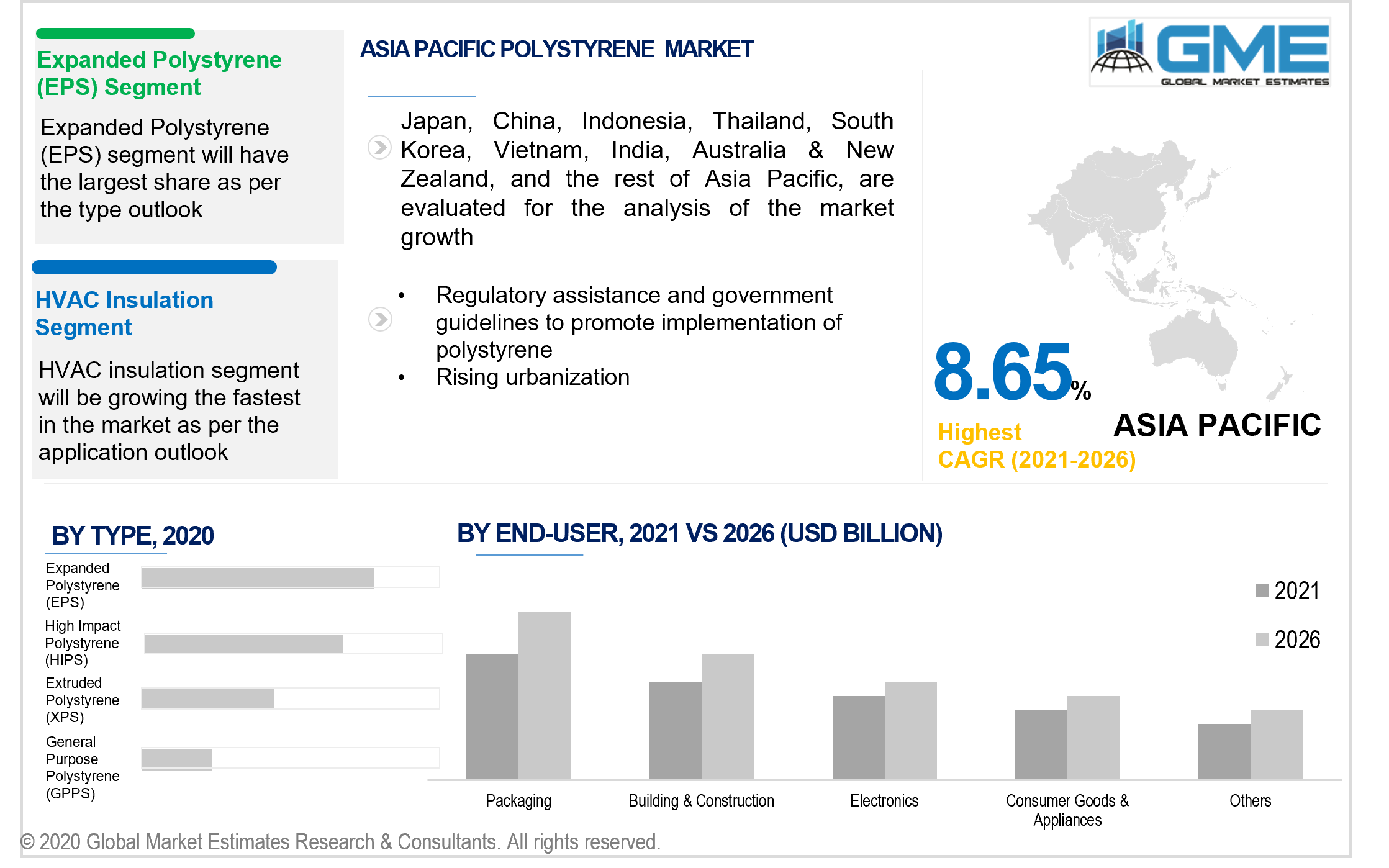

Depending on the type, the market is categorized as general purpose polystyrene (GPPS), high impact polystyrene (HIPS), expanded polystyrene (EPS), extruded polystyrene (XPS), and others. The EPS segment is expected to account for the largest share of market share. This is due to EPS' exceptional thermal and mechanical qualities, ease of recycling, and non-corrosive attributes. Increased demand for EPS in the automotive, electronics, and building & construction industries will contribute to the segment's rapid growth.

The High impact polystyrene (HIPS) segment is foreseen to grow at the highest CAGR because it is exclusively used in food packaging, industrial packaging, and consumer packaging. Since these industries are flourishing in both developed and developing economies, the High impact polystyrene (HIPS) segment will witness steady growth throughout the forecast period.

Depending on the application, the market is categorized as HVAC insulation, rigid packaging, seating, flexible packaging, and others. HVAC insulation is expected to dominate because polystyrene foam insulation can have favorable energy and air emissions rewards when utilized in residential properties. Furthermore, they are long-lasting, energy-efficient, simple to deploy, compact, renewable, prevent air infiltration, and economically viable. It comes in a multitude of densities, thicknesses, and sizes and encompasses no CFC, HCFC, or HFC formaldehyde.

The phenomenal development of flexible packaging globally can be attributed to technological advancement, ecological concerns, and appealing economics. Because of the increased emphasis on sustainable practices, conventional rigid packaging alternatives are being replaced by groundbreaking and more viable flexible packaging. Flexible packaging is foreseen to gain popularity as a credible and cost-effective alternative due to the rising market supply for customer-friendly offerings and enhanced product safeguards.

Depending on the end-user, the market is categorized as packaging, building and construction, electronics, consumer goods and appliances, and others. Packaging has emanated as the market's pioneering application. Polystyrene is extensive utilized in food, digital devices, retail, and consumer products packaging. They are prioritized in packaging because they are lightweight and provide exquisite insulation and climate susceptibility.

During the forecast period, the building and construction segment is expected to grow at the fastest CAGR. EPS is a novel construction material that contributes to the structure and architectural integrity of many structures. EPS is now widely used as thermal insulation. It provides increased energy efficiency, better ambient ecosystem quality, and increased durability. As a result, EPS is progressively being utilized in the construction sector.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central South America (Brazil, Argentina, and Rest of Central and South America). The Asia Pacific regional market is expected to account for the majority of revenue throughout the forecast period. Owing to growing product demand in vital implementation categories like automobiles, packaging, and construction in developing countries such as China and India, the area is expected to expand at the fastest CAGR during the forecast period. The construction industry in the Asia Pacific region is the fastest-growing market in the world. Rising urbanization and discretionary income, as well as legislative campaigns including “Housing for All” in India, are propelling the APAC construction industry forward throughout the forecast period.

Recently, Asia Pacific has seen rapid growth in the construction sector, accompanied by sustainable economic development. For the polystyrene market in India, the soaring urbanization process, combined with infrastructure improvements, presents remunerative development prospects. Furthermore, the advancement of the food and beverage sector, particularly in China, is favorable. Regulatory assistance and government guidelines encouraging private investment are also foreseen to be expansion drivers for the Asia Pacific region market throughout the forecast period.

Europe holds the market's second-largest share, attributed to increased demand from the automobiles, packaging, and construction industries. Because of its dynamic perks and ease of molding and frame creation, the product has implementations in a variety of industrial sectors. Green building design projects have seen a substantial expansion in product availability in the European market in recent years, attributed to their exquisite environmental benefits, which can provide a strengthened indoor landscape, maximized energy efficiency, and augmented longevity. This will lead to steady growth in the European market throughout the forecast period.

This growth can be ascribed to a rebound in European construction operations. The incorporation of standards and procedures for compact products in end-use industries has resulted in an accelerated increase in demand in the European area. Furthermore, in this area, key manufacturing companies and investors are shifting away from conventional plastics and toward recyclable materials. These aforementioned factors will aid in the growth of the European market throughout the forecast period.

Styrolution Group GMBH, Total Petrochemicals, BASF SE, Formosa Chemicals & Fiber Corporation, Kumho Petrochemicals Ltd., Chi Mei Corporation, SABIC, Trinseo, Videolar S/A, Cibapac, Polyoak Packaging Group, Arkema, Synthos, and The Dow Chemical Company, among others, are the key players in the global market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2020, Total Petrochemicals, Intraplás, and Yoplait announced a collaboration to utilize chemically reprocessed polystyrene in yogurt pots. The trial, led by Total in collaboration with Intraplás and Yoplait, identified chemical sustainability in France as a viable avenue for recycling polystyrene.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Polystyrene Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 End-User Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 Global Polystyrene Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing Demand for Sustainable And Lightweight Solutions

3.3.1.2 Rising Technological Developments

3.3.1.3 Growing Adoption of Environmentally Friendly Materials

3.3.2 Industry Challenges

3.3.2.1 Fluctuating Raw Material Prices

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 End-User Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Polystyrene Market, By Type

4.1 Type Outlook

4.2 General Purpose Polystyrene (GPPS)

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 High Impact Polystyrene (HIPS)

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Expanded Polystyrene (EPS)

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Extruded Polystyrene (XPS)

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global Polystyrene Market, By End-User

5.1 End-User Outlook

5.2 Packaging

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Electronics

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Building & Construction

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Consumer Goods & Appliances

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global Polystyrene Market, By Application

6.1 Application Outlook

6.2 Rigid Packaging

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Flexible Packaging

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Seating

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.5 HVAC Insulation

6.5.1 Market Size, By Region, 2016-2026 (USD Million)

6.6 Others

6.6.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Global Depth Filtration Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Million)

7.2.2 Market Size, By Type, 2016-2026 (USD Million)

7.2.3 Market Size, By End-User, 2016-2026 (USD Million)

7.2.4 Market Size, By Application, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.2.5.2 Market Size, By End-User, 2016-2026 (USD Million)

7.2.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.2.6.2 Market Size, By End-User, 2016-2026 (USD Million)

7.2.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Million)

7.3.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.3 Market Size, By End-User 2016-2026 (USD Million)

7.3.4 Market Size, By Application, 2016-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.5.2 Market Size, By End-User, 2016-2026 (USD Million)

7.3.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.6.2 Market Size, By End-User, 2016-2026 (USD Million)

7.3.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.7.2 Market Size, By End-User, 2016-2026 (USD Million)

7.3.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.8.2 Market Size, By End-User, 2016-2026 (USD Million)

7.3.8.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.9.2 Market Size, By End-User, 2016-2026 (USD Million)

7.3.9.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.10.2 Market Size, By End-User, 2016-2026 (USD Million)

7.3.10.3 Market Size, By Application, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2016-2026 (USD Million)

7.4.2 Market Size, By Type, 2016-2026 (USD Million)

7.4.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4.4 Market Size, By Application, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.5.2 Market Size, By End-User, 2016-2026 (USD Million)

7.4.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.6.2 Market Size, By End-User, 2016-2026 (USD Million)

7.4.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.7.2 Market Size, By End-User, 2016-2026 (USD Million)

7.4.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.8.2 Market size, By End-User, 2016-2026 (USD Million)

7.4.8.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.9.2 Market Size, By End-User, 2016-2026 (USD Million)

7.4.9.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Million)

7.5.2 Market Size, By Type, 2016-2026 (USD Million)

7.5.3 Market Size, By End-User, 2016-2026 (USD Million)

7.5.4 Market Size, By Application, 2016-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.5.5.2 Market Size, By End-User, 2016-2026 (USD Million)

7.5.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.5.6.2 Market Size, By End-User, 2016-2026 (USD Million)

7.5.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.5.7.2 Market Size, By End-User, 2016-2026 (USD Million)

7.5.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Million)

7.6.2 Market Size, By Type, 2016-2026 (USD Million)

7.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.6.4 Market Size, By Application, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.6.5.2 Market Size, By End-User, 2016-2026 (USD Million)

7.6.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.6.6.2 Market Size, By End-User, 2016-2026 (USD Million)

7.6.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.6.7.2 Market Size, By End-User, 2016-2026 (USD Million)

7.6.7.3 Market Size, By Application, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Styrolution Group GMBH

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Total Petrochemicals

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 BASF SE

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Formosa Chemicals & Fiber Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Kumho Petrochemicals Ltd.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Chi Mei Corporation

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 SABIC

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Trinseo

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Videolar S/A

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Cibapac

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Polyoak Packaging Group

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Arkema

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Synthos

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

8.15 The Dow Chemical Company

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Info Graphic Analysis

8.16 Other Companies

8.16.1 Company Overview

8.16.2 Financial Analysis

8.16.3 Strategic Positioning

8.16.4 Info Graphic Analysis

The Global Polystyrene Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Polystyrene Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS