Global Polyurethane Coating Market Size, Trends & Analysis - Forecasts to 2026 By Type (Solvent-Borne, Water-Borne, Spray, Powder, and Others), By End-Use (Automotive & Transportation, Aerospace, Wood & Furniture, Construction, Industrial, Textile, Electrical & Electronics, and Others); By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis.

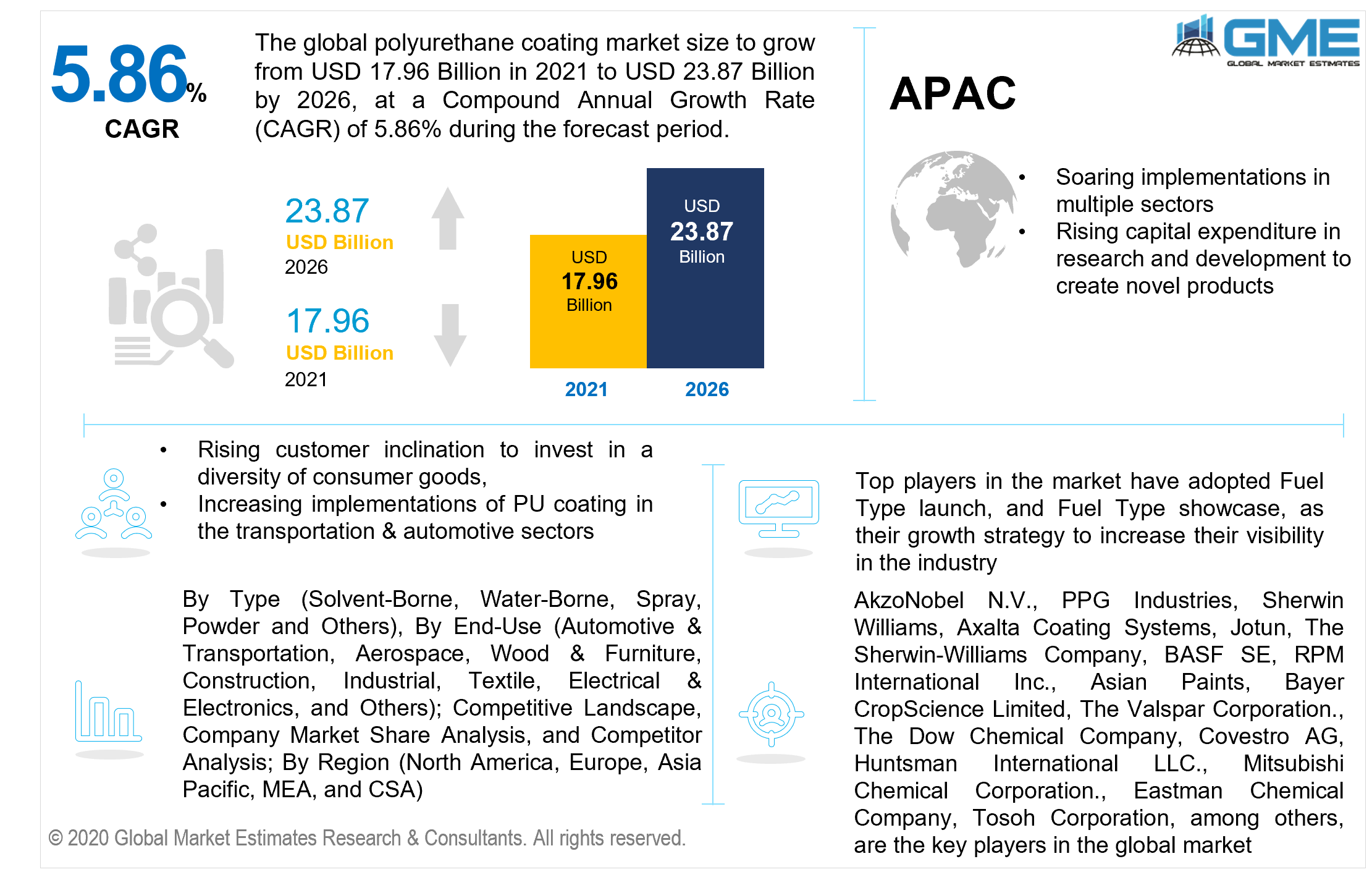

The global polyurethane coating market is estimated to be valued at USD 17.96 billion in 2021 and is projected to reach USD 23.87 billion by 2026 at a CAGR of 5.86%. Rising customer inclination to invest in a diversity of consumer goods, soaring economic growth, and skyrocketing implementations from the transportation & automotive sectors, will catalyze the overall market expansion. Growing utilization of the coating owing to its anti-corrosion characteristics, and enlargement of the wood coating sector will presumably expedite the advancement of the market during the forecast period. On the contrary, surging demand for water-borne PU coating, as well as technological innovation, will provide numerous prospects for the development of the market during the forecast period.

According to the United Nations (UN), growth in the population through 2050 will create a clear requirement for building and construction around the world in sequence to meet infrastructural necessities. Water-borne coatings appear to be widely utilized for abrasion resistance, chemical resistance, and weathering across both interior and exterior coatings. According to the Institution of Civil Engineers (ICE), the intensity of construction throughput will increase by 85 percent by 2030, amounting to USD 15.5 trillion globally. As a result, there will be a steady requirement for such coatings in the building and construction sector.

Globally, people can now avail themselves of cost-effective wood flooring due to a boost in disposable incomes. Such coatings are utilized in wooden flooring because they have been shown to preserve the texture of the wood, which degrades over a period owing to water-rot. Furthermore, wood flooring is utilized in a few retail stores and supermarket chains. Nevertheless, fluctuations in raw material costs, as well as the cost-intensive essence of emerging innovations, are probable to stymie the expansion of the market during the forecast period. However, the widespread use of wooden floors and ceilings in residences and commercial structures around the world is fueling the growth of the market.

The aerospace industry is expanding, primarily in North America and some Asia Pacific nations including, China and India. When such coatings are utilized for aircraft, they impart survivability and barrier properties to ultraviolet (UV) light, precipitation, and chemical products that can be harmful to the aircraft's structure. Furthermore, PUC safeguards aircraft from the corrosive environment by decreasing oxidative stress and tingling of the aluminum skin. The increased manufacturing of aircraft to meet the predictable necessity of commuting in the long term will considerably encourage the market.

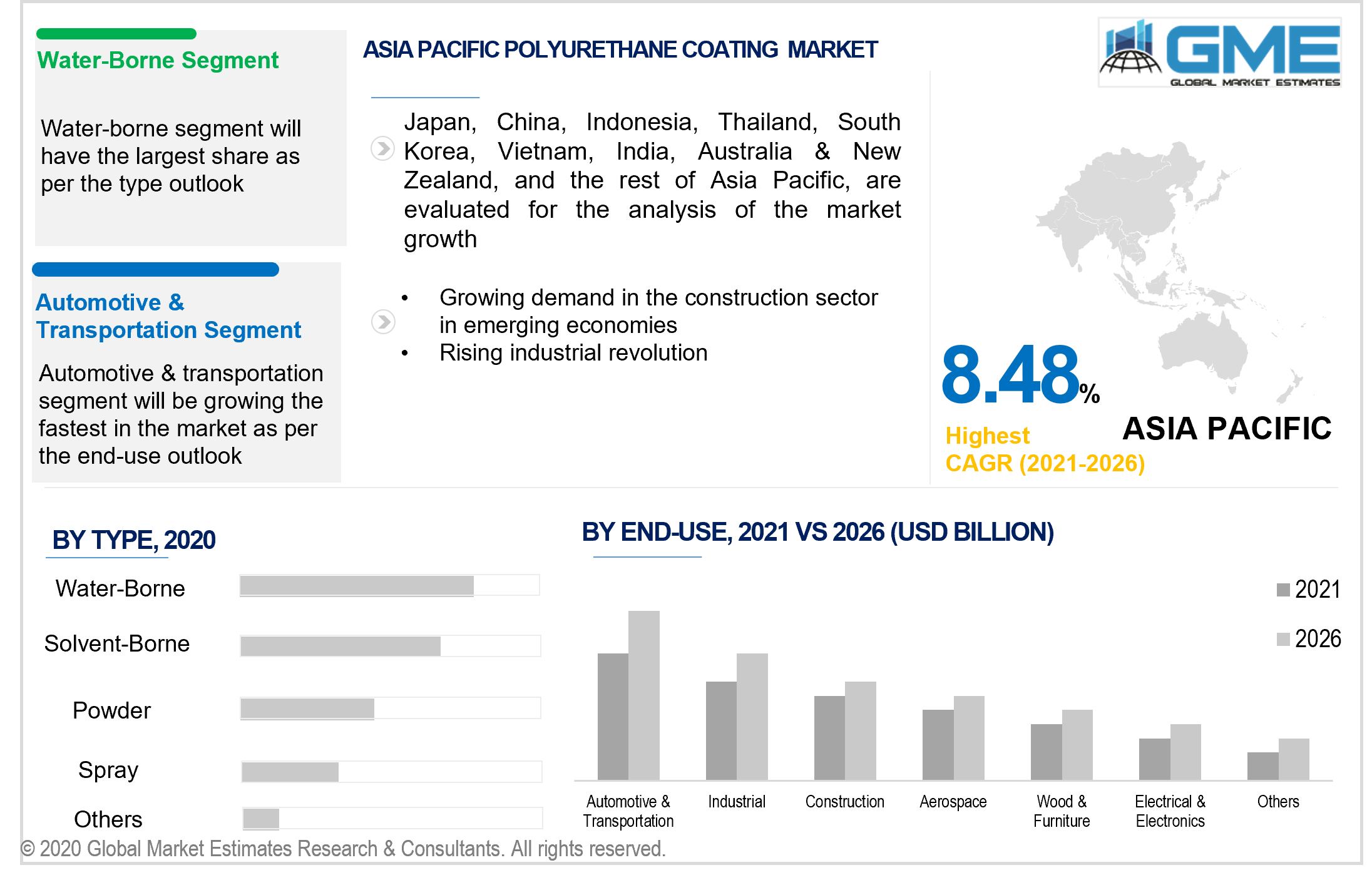

Depending on the type, the market is categorized as solvent-borne, water-borne, spray, powder, and others. The water-borne segment is foreseen to predominate. Waterborne polyurethanes not only provide the elevated performance that contemporary implementations require, but they also have no remnant free isocyanate and a low odor, rendering them secure and simpler to utilize than the available substitutes.

The rationale for the pervasive application of waterborne polyurethane adhesives and coatings is straightforward: Formulators are continuously under influence to produce high-performance items that are safer for the ecosystem and the customer. Waterborne polyurethanes are one of the few categories of goods that can produce outcomes in both aspects when contrasted to solvent-based polyurethanes.

Some unique properties of waterborne polyurethanes are high tensile strength, chemical resistance, high elongation, UV resistance, low-temperature flexibility, water resistance, abrasion resistance, impact resistance, low odor, mar-resistant, alkali resistant, non-flammable, highly compatible with acrylic emulsions, and low VOC's. This leads to the supremacy of the waterborne polyurethane segment.

Depending on the end-use, the market is categorized as automotive & transportation, aerospace, wood & furniture, construction, industrial, textile, electrical & electronics, and others. The Automotive & transportation segment is foreseen to predominate. Polyurethane coatings are primarily used in the automotive and transportation industries, specifically ships and automobiles. PU coating is widely used in the automotive sector owing to its anti-corrosion properties, which allow automotive parts to be subjected to harsh environments.

The PU coating, in conjunction with its anti-corrosion properties, gives the vehicle's outer sheath a glossy finish, longevity, and mechanical strength. These coatings are typically used to glaze windshields and window frames, reduce fogging, and increase strength. Furthermore, while offering an architectural and aesthetically appealing color, coating automotive electronic components can safeguard against premature mechanical or thermal malfunction.

Due to soaring implementations in multiple sectors such as aviation, construction, automobiles, and many others, Asia Pacific dominates the polyurethane coating market, particularly in China, India, and Japan. Furthermore, the market will gain traction throughout the forecast period as a result of surging spending power and superlative economic development in the Asia Pacific area. With people's purchasing power expanding, producers are raising their capital expenditure in research and development to create novel, groundbreaking product lines.

Furthermore, rising demand in the construction sector in emerging economies including India, Indonesia, and Thailand is foreseen to ignite demand for the area's market throughout the forecast period. The Asia Pacific area's market share is presumed to increase more as the industrial revolution accelerates and government expenditure in the manufacturing sector increases. The expansion of PU coating in the Asia Pacific area is also fueled by the rise of electric vehicles in China, as well as the expansion of the area's overall automotive sector.

North America is the world's second-largest polyurethane coatings market, trailing only Asia-Pacific. The United States leads the market in this area owing to a significant expansion in the construction and automotive industries. Furthermore, this expansion is due to the flourishing chemical industry that offers elevated growth prospects to the market through North America's industrialized nations. In addition, a significant percentage of technology development is being made by various market players in a quest to be ready to fulfill the rising prospective end-use industries demands.

AkzoNobel N.V., PPG Industries, Sherwin Williams, Axalta Coating Systems, Jotun, The Sherwin-Williams Company, BASF SE, RPM International Inc., Asian Paints, Bayer CropScience Limited, The Valspar Corporation, The Dow Chemical Company, Covestro AG, Huntsman International LLC, Mitsubishi Chemical Corporation, Eastman Chemical Company, Tosoh Corporation, among others, are the key players in the global market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Polyurethane Coating Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 End-Use Overview

2.1.4 Regional Overview

Chapter 3 Global Polyurethane Coating Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in the PU Industry

3.3.1.2 The Expansion of the Building & Construction Industry

3.3.2 Industry Challenges

3.3.2.1 Fluctuations In Raw Material Costs

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 End-Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Polyurethane Coating Market, By Type

4.1 Type Outlook

4.2 Solvent-Borne

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Water-Borne

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Spray

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Powder

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Polyurethane Coating Market, By End-Use

5.1 End-Use Outlook

5.2 Automotive & Transportation

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Aerospace

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Wood & Furniture

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Construction

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Industrial

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

5.7 Textile

5.7.1 Market Size, By Region, 2019-2026 (USD Million)

5.8 Electrical & Electronics

5.8.1 Market Size, By Region, 2019-2026 (USD Million)

5.9 Others

5.9.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Polyurethane Coating Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Type, 2019-2026 (USD Million)

6.2.3 Market Size, By End-Use, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.5.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Type, 2019-2026 (USD Million)

6.3.3 Market Size, By End-Use, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.5.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.6.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.7.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.8.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.9.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Type, 2019-2026 (USD Million)

6.4.3 Market Size, By End-Use, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.4.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.5.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.6.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.7.2 Market size, By End-Use, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.8.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Type, 2019-2026 (USD Million)

6.5.3 Market Size, By End-Use, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.4.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.5.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.6.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Type, 2019-2026 (USD Million)

6.6.3 Market Size, By End-Use, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.4.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.5.2 Market Size, By End-Use, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.6.2 Market Size, By End-Use, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 AkzoNobel N.V.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 PPG Industries

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Sherwin Williams

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Axalta Coating Systems

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Jotun

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 The Sherwin-Williams Company

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 BASF SE

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 RPM International Inc.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Asian Paints

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Bayer CropScience Limited

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 The Valspar Corporation

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 The Dow Chemical Company

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Covestro AG

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Huntsman International LLC

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

7.16 Mitsubishi Chemical Corporation

7.16.1 Company Overview

7.16.2 Financial Analysis

7.16.3 Strategic Positioning

7.16.4 Info Graphic Analysis

7.17 Eastman Chemical Company

7.17.1 Company Overview

7.17.2 Financial Analysis

7.17.3 Strategic Positioning

7.17.4 Info Graphic Analysis

7.18 Tosoh Corporation

7.18.1 Company Overview

7.18.2 Financial Analysis

7.18.3 Strategic Positioning

7.18.4 Info Graphic Analysis

7.19 Other Companies

7.19.1 Company Overview

7.19.2 Financial Analysis

7.19.3 Strategic Positioning

7.19.4 Info Graphic Analysis

The Global Polyurethane Coating Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Polyurethane Coating Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS