Global Portable Seizure Monitoring Devices Market Size, Trends & Analysis – Forecasts to 2027 By Product Type (Bed Monitors, Video Monitors, Wearable Watches & Bracelets, Mattress Devices, Anti-Suffocation Pillows, Others), By Type of Connectivity (Android Devices, iOS Devices), By End-User (Hospitals, Ambulatory Surgery Centres & Clinics, Neurology Centres, Diagnostic Centres, Home Care Settings), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

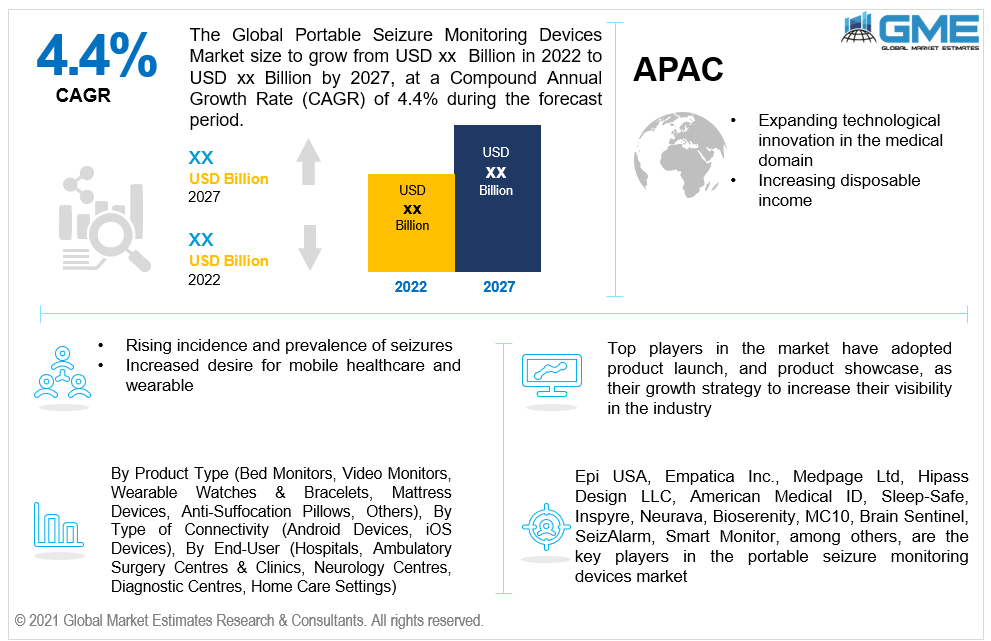

The global portable seizure monitoring devices market is projected to grow at a CAGR value of 4.4% from 2022 to 2027.

A seizure alert device, often known as seizure alarms or seizure monitors, is an electrical component that can detect seizures in people who have epilepsy or other neurological diseases. The rising incidence and prevalence of seizures, increased desire for mobile healthcare and wearable, growing preference for constant monitoring, and rise in awareness of neurodegenerative diseases, especially epileptic seizures, are all factors driving market expansion during the forecast period.

According to World Health Organization's 2018 health survey, epilepsy ranked as the second major cause of death worldwide, contributing to around 9.6 million deaths in 2018, and in a clinical environment, electroencephalography (EEG) combined with video surveillance is the gold standard for identifying and diagnosing many neurologic conditions, including epilepsy.

The capacity of these devices to allow patients to live regular lives while being monitored for physiological activity, as well as rising health-care costs and recent advancements in the technology of small bio-sensing devices, are all driving market expansion.

Various factors such as developments in surgery production techniques, expanding use of effective medical therapy in developed countries, and growing incidence of neurological illnesses are likely to fuel market expansion over the forecast period.

Furthermore, in high-income countries, the heightened risk of pervasive infectious diseases such as malaria and neurocysticercosis, the increased prevalence of traffic congestion and birth-related concussions, variability in healthcare technology, and the accessibility of precautionary health programs and obtainable treatment are also driving the market growth.

Epilepsy is among the most prevalent neurological illnesses, with an incidence rate of 40–70 per 100,000 in adults and 41–187 per 100,000 in adolescents, and it is most prevalent in rural and poor areas. Seizure detection technologies allow clinicians to more realistically modify therapy by providing accurate seizure measurements.

Seizure prediction devices may also inform patients and families when a seizure is about to happen, boosting patient and family trust and enhancing the quality of life, pushing the market growth.

COVID-19 has posed a significant challenge to the medical and healthcare communities in recent months, pushing them to their limits. Despite the constraints of COVID-19, the digital transformation of the healthcare business has made significant progress. Artificial intelligence and machine learning (AI/ML) advancements will improve the pharmaceutical and medical device sectors, allowing them to diagnose diseases faster and quicker, treat diseases more accurately, and engage patients more efficiently.

A reliable seizure detection device could potentially offer clinicians more accurate seizure frequency statistics than patients' journal entries or memory, which could help change pharmaceutical composition and dose, as well as clinical outcomes. However, obstacles such as product recall and cost capping regulations in several emerging markets could stifle the seizure detection devices market's growth.

Based on the product type, the portable seizure monitoring devices market is segmented into bed monitors, video monitors, wearable watches & bracelets, mattress devices, anti-suffocation pillows, and others.

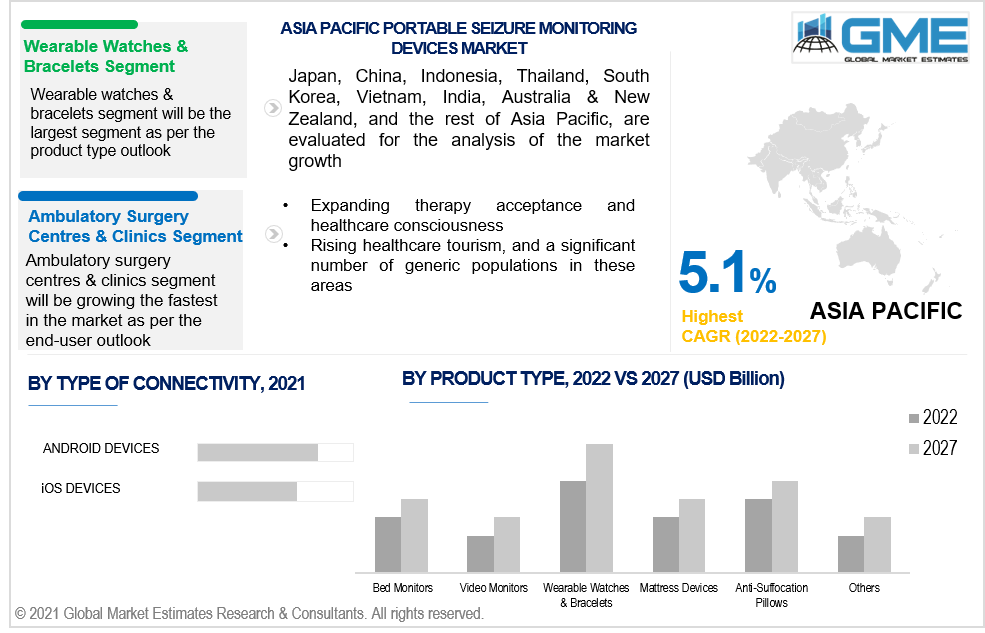

The wearable watches & bracelets segment is expected to grow the fastest in the portable seizure monitoring devices market from 2022 to 2027. Emergency medical personnel can immediately identify a person with epilepsy and notify emergency contacts if patients are wearing watches and bracelets. There are a variety of seizure alert gadgets on the market from conventional metal bands to soft silicone bracelets. Some people also wear "epilepsy" necklaces in the style of dog tags. Emergency personnel may be directed to a wallet card with a person's medication list using these attachments.

Based on the end-user, the portable seizure monitoring devices market is segmented into hospitals, ambulatory surgery centers & clinics, neurology centers, diagnostic centers, and home care settings.

The ambulatory surgical center's segment is expected to hold a larger share as compared to other segments. This dominance is significant because, when surgeries are conducted in an ASC configuration, surgeries are quite often shorter, recovery appears to be considerably quicker, the infection rate is half that of hospitals, and outpatient surgery expenditures are often lesser since there are no hospital room prosecutions or associated hospital fees.

Android devices and iOS devices are the segmentation based on the type of connectivity. The android devices segment is expected to grow the fastest in the portable seizure monitoring devices market from 2022 to 2027.

Clinical tests at prominent medical institutes have proven the potential of smartphones to detect and alarm upon recurrent shaking motions similar to that caused by epileptic seizures. In terms of medical applications, healthcare apps have shown promise in a variety of areas, including fast access to health references and periodicals, as well as inbuilt features such as monitoring, personalized diaries, and calculator. There are already over 31,000 fitness and health applications provided by online app stores, and this number is projected to continue to grow in the future.

As per the geographical analysis, the portable seizure monitoring devices market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico), will have a dominant share in the portable seizure monitoring devices market from 2022 to 2027. Over the forecast period, favourable government regulations, laws, and medical advancements infrastructure, as well as increased FDA certifications, will drive market expansion.

Moreover, the Asia-Pacific region is expected to be the fastest-growing segment in the portable seizure monitoring devices market during the forecast period. Expanding technological innovation in the medical domain, increasing disposable income, expanding therapy acceptance and healthcare consciousness, rising healthcare tourism, and a significant number of generic populations in these areas have complemented market expansion.

Epi USA, Empatica Inc., Medpage Ltd, Hipass Design LLC, American Medical ID, Sleep-Safe, Inspyre, Neurava, Bioserenity, MC10, Brain Sentinel, SeizAlarm, Smart Monitor, among others, are the key players in the portable seizure monitoring devices market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Portable Seizure Monitoring Devices Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 Type of Connectivity Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Portable Seizure Monitoring Devices Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increased desire for mobile healthcare and wearable

3.3.2 Type of Connectivity Challenges

3.3.2.1 Product recall and cost capping regulations in several emerging markets

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 Type of Connectivity Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Type of Connectivity Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Portable Seizure Monitoring Devices Market, By Type of Connectivity

4.1 Type of Connectivity Outlook

4.2 Android Devices

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 iOS Devices

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Portable Seizure Monitoring Devices Market, By Product Type

5.1 Product Type Outlook

5.2 Bed Monitors

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Video Monitors

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Wearable Watches & Bracelets

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 Mattress Devices

5.5.1 Market Size, By Region, 2022-2027 (USD Billion)

5.6 Anti-Suffocation Pillows

5.6.1 Market Size, By Region, 2022-2027 (USD Billion)

5.7 Others

5.7.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Portable Seizure Monitoring Devices Market, By End-User

6.1 Hospitals

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Ambulatory Surgery Centres & Clinics

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Neurology Centres

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

6.4 Diagnostic Centres

6.4.1 Market Size, By Region, 2022-2027 (USD Billion)

6.5 Home Care Settings

6.5.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Nuclear Imaging Equipment Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2022-2027 (USD Billion)

7.2.2 Market Size, By Product Type, 2022-2027 (USD Billion)

7.2.3 Market Size, By End-User, 2022-2027 (USD Billion)

7.2.4 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.2.4.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.2.4.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.2.7.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.2.7.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2022-2027 (USD Billion)

7.3.2 Market Size, By Product Type, 2022-2027 (USD Billion)

7.3.3 Market Size, By End-User, 2022-2027 (USD Billion)

7.3.4 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.3.6.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.3.6.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.3.9.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.3.9.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.3.10.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.3.10.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.3.11.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.3.11.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2022-2027 (USD Billion)

7.4.2 Market Size, By Product Type, 2022-2027 (USD Billion)

7.4.3 Market Size, By End-User, 2022-2027 (USD Billion)

7.4.4 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.4.6.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.4.6.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.4.9.2 Market size, By End-User, 2022-2027 (USD Billion)

7.4.9.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.4.10.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.4.10.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2022-2027 (USD Billion)

7.5.2 Market Size, By Product Type, 2022-2027 (USD Billion)

7.5.3 Market Size, By End-User, 2022-2027 (USD Billion)

7.5.4 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.5.6.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.5.6.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2022-2027 (USD Billion)

7.6.2 Market Size, By Product Type, 2022-2027 (USD Billion)

7.6.3 Market Size, By End-User, 2022-2027 (USD Billion)

7.6.4 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.6.6.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.6.6.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Product Type, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By End-User, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Type of Connectivity, 2022-2027 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2022

8.2 Epi USA

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 Empatica Inc

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 Medpage Ltd

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 Hipass Design LLC

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 American Medical ID

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 Sleep-Safe

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 Inspyre

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Neurava

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.10 Bioserenity

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

The Global Portable Seizure Monitoring Devices Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Portable Seizure Monitoring Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS