Global Poultry Keeping Machinery Market Size, Trends & Analysis - Forecasts to 2026 By Product Type (Feeding, Drinking, Climate Control, Incubator Equipment, Hatchery Equipment, Egg Collection, Handling & Management Equipment, Broiler Harvesting & Slaughtering, Residue & Waste Management, and Others), By End-Users (Farm and Poultry Factory), By Application (Feeding Chicken, Feeding Duck and Feeding Geese), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

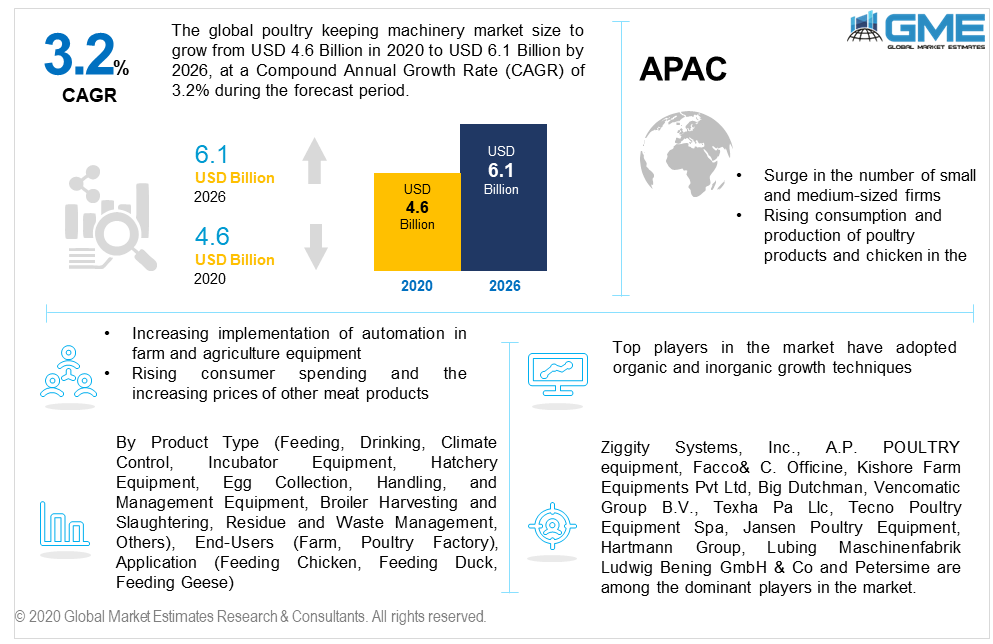

The global poultry keeping machinery market generated more than USD 4.6 billion in 2020 and is anticipated to be valued over USD 6.1 billion by 2026, growing at a CAGR of 3.2%.

The market is predicted to develop due to the increasing implementation of automation in farm and agriculture equipment. Other factors such as rising demand for technically sophisticated products, better establishment of battery cages for poultry keeping, expanding meat-consuming population, and booming population concern on animal conservation would thrust the poultry-keeping machinery market forward throughout the projected timeframe.

Furthermore, rising consumer spending and the increasing prices of other meat products such as beef and pork are among some of the primary forces propelling the worldwide poultry-keeping machinery market forward. Secondly, the use of poultry-keeping machinery has resulted in notable benefits such as increased productivity and lower reared-bird mortality. These advantageous features are projected to drive up demand for poultry-keeping equipment around the world. In the foreseeable future, rising incidences of bird diseases and rigorous laws and standards related to the importation of chicken products are expected to stifle market expansion.

Drinking, feeding, incubator equipment, climate control, egg collection, hatchery equipment, broiler harvesting and slaughtering, handling and management equipment, residue, waste management, and others such as vaccination, flooring, scales, nest, and cages are among some of the types of equipment obtainable under this market.

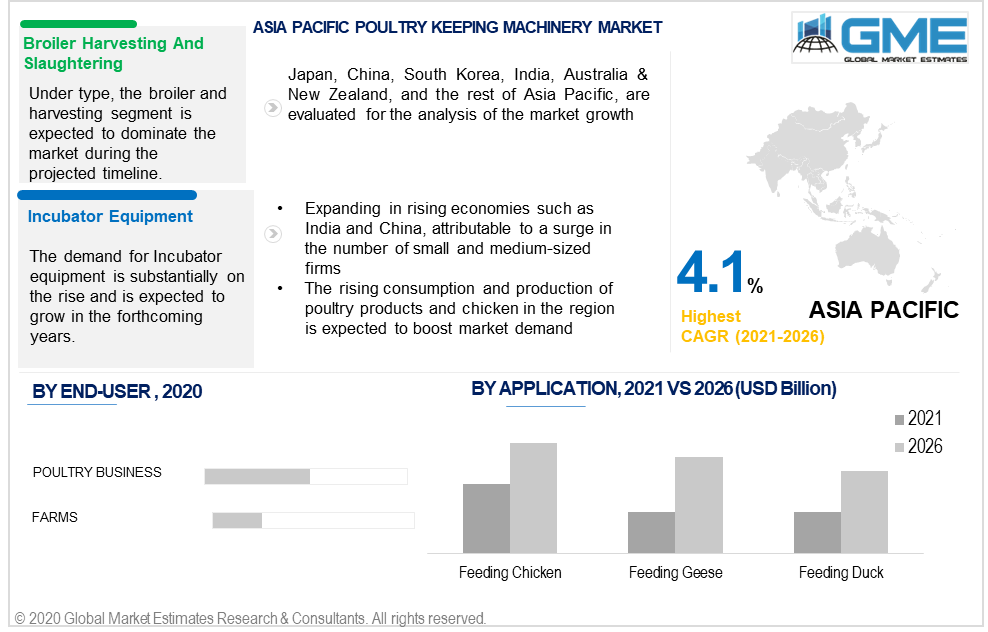

The broiler harvesting and slaughtering section of poultry-keeping machinery are projected to be the market's most successful item. This segment's rise can largely be attributable to its swift and inexpensive operation, which results in less agony throughout the slaughtering process. Aside from that, the worldwide poultry-keeping machinery market is directly influenced by an increase in the number of poultry farms, which is expected to increase demand for poultry-keeping machinery over the forecast period.

Incubation equipment is widely utilized throughout this stage of the egg development process, from huge industrial hatcheries to tiny local businesses, to offer a simulated stable environment for chicks to mature inside eggs and enhance egg safety. This segment is also rapidly growing significantly during the projected period.

Farms and poultry business are the two kinds of end-users in the poultry-keeping machinery market.

The demand for poultry products, among other meats, has been driven by changing worldwide diet and food consumption habits, as well as a growing desire for affordable and protein-rich meat products. Other factors such as expanding demand for scientifically advanced products, rising prevalence of battery cages for poultry raising, expanding meat-consuming community, and booming population awareness on the welfare of animals will enable poultry production to grow significantly faster.

The poultry-keeping machinery market is split into three application segments: feeding chicken, feeding duck, and feeding geese.

Overall, it could be seen that with the surge in demand for animal protein, poultry meat has become a more cost-effective and accessible source of protein. As a result, poultry meat is likely to remain a step ahead of replacements such as beef and pork in terms of intake and consumption. Poultry meat will continue to be in high demand in the market due to its cost-effectiveness and high protein content, propelling the market growth for poultry-keeping machinery.

With a CAGR of 4.1 percent and a market share of 37.8 percent, the Asia Pacific region dominated the market with China, Japan, and India being the prominent countries with substantial growth prospects.

The poultry farming equipment market is expanding in rising economies such as India and China, attributable to a surge in the number of small and medium-sized firms, which is strengthening the poultry farming equipment industry. Due to the rising consumption and production of poultry products and chicken, the region is predicted to maintain an ideal prospect for manufacturers and suppliers of broiler harvesting and dispatching apparatus.

Over the forecast period, the North American poultry-keeping machinery market is estimated to rise at a greater value expansion rate of 3.5 percent, accounting for a revenue market share of 27.6 percent. Due to factors such as the high implementation of innovations, growing demands for poultry products, and the rise of new entrants with innovative goods, poultry farm machinery is widely used in North America.

Ziggity Systems, Inc., A.P. Poultry Equipment, Facco & C. Officine, Kishore Farm Equipments Pvt. Ltd., Big Dutchman, Vencomatic Group B.V., Texha PA LLC, Tecno Poultry Equipment SPA, Jansen Poultry Equipment, Hartmann Group, Lubing Maschinenfabrik Ludwig Bening GmbH & Co., and Petersime, are among the dominant players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Poultry Keeping Machinery Industry overview, 2021-2026

2.1.1 Industry overview

2.1.2 Product Type overview

2.1.3 End-User overview

2.1.4 Application overview

2.1.5 Regional overview

Chapter 3 Poultry Keeping Machinery Industry Trends

3.1 Market segmentation

3.2 Industry background, 2021-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2021

3.11.1 Company positioning overview, 2021

Chapter 4 Poultry Keeping Machinery Market, By Product Type

4.1 Product Type Outlook

4.2 Feeding

4.2.1 Market size, by region, 2021-2026 (USD Billion)

4.3 Drinking

4.3.1 Market size, by region, 2021-2026 (USD Billion)

4.4 Climate Control

4.4.1 Market size, by region, 2021-2026 (USD Billion)

4.5 Incubator Equipment

4.5.1 Market size, by region, 2021-2026 (USD Billion)

4.6 Hatchery Equipment

4.6.1 Market size, by region, 2021-2026 (USD Billion)

4.7 Egg Collection, Handling, and Management Equipment

4.7.1 Market size, by region, 2021-2026 (USD Billion)

4.8 Broiler Harvesting and Slaughtering

4.8.1 Market size, by region, 2021-2026 (USD Billion)

4.9 Residue and Waste Management

4.9.1 Market size, by region, 2021-2026 (USD Billion)

4.10 Others

4.10.1 Market size, by region, 2021-2026 (USD Billion)

Chapter 5 Poultry Keeping Machinery Market, By End-User

5.1 End-User Outlook

5.2 Farm

5.2.1 Market size, by region, 2021-2026 (USD Billion)

5.3 Poultry Factory

5.3.1 Market size, by region, 2021-2026 (USD Billion)

Chapter 6 Poultry Keeping Machinery Market, By Application

6.1 Application Outlook

6.2 Feeding Chicken

6.2.1 Market size, by region, 2021-2026 (USD Billion)

6.3 Feeding Duck

6.3.1 Market size, by region, 2021-2026 (USD Billion)

6.4 Feeding Geese

6.4.1 Market size, by region, 2021-2026 (USD Billion)

Chapter 7 Poultry Keeping Machinery Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by Country, 2021-2026 (USD Billion)

7.2.2 Market size, by Product Type, 2021-2026 (USD Billion)

7.2.3 Market size, by End-User, 2021-2026 (USD Billion)

7.2.4 Market size, by Application, 2021-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.2.5.2 Market size, by End-User, 2021-2026 (USD Billion)

7.2.5.3 Market size, by Application, 2021-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.2.6.2 Market size, by End-User, 2021-2026 (USD Billion)

7.2.6.3 Market size, by Application, 2021-2026 (USD Billion)

7.2.7 Mexico

7.2.7.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.2.7.2 Market size, by End-User, 2021-2026 (USD Billion)

7.2.7.3 Market size, by Application, 2021-2026 (USD Billion)

7.3 Europe

7.3.1 Market size, by Country, 2021-2026 (USD Billion)

7.3.2 Market size, by Product Type, 2021-2026 (USD Billion)

7.3.3 Market size, by End-User, 2021-2026 (USD Billion)

7.3.4 Market size, by Application, 2021-2026 (USD Billion)

7.3.5 Germany

7.2.5.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.2.5.2 Market size, by End-User, 2021-2026 (USD Billion)

7.2.5.3 Market size, by Application, 2021-2026 (USD Billion)

7.3.6 Spain

7.3.6.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.3.6.2 Market size, by End-User, 2021-2026 (USD Billion)

7.3.6.3 Market size, by Application, 2021-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.3.7.2 Market size, by End-User, 2021-2026 (USD Billion)

7.3.7.3 Market size, by Application, 2021-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.3.8.2 Market size, by End-User, 2021-2026 (USD Billion)

7.3.8.3 Market size, by Application, 2021-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market size, by Country, 2021-2026 (USD Billion)

7.4.2 Market size, by Product Type, 2021-2026 (USD Billion)

7.4.3 Market size, by End-User, 2021-2026 (USD Billion)

7.4.4 Market size, by Application, 2021-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.4.5.2 Market size, by End-User, 2021-2026 (USD Billion)

7.4.5.3 Market size, by Application, 2021-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.4.6.2 Market size, by End-User, 2021-2026 (USD Billion)

7.4.6.3 Market size, by Application, 2021-2026 (USD Billion)

7.4.7 Malaysia

7.4.7.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.4.7.2 Market size, by End-User, 2021-2026 (USD Billion)

7.4.7.3 Market size, by Application, 2021-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.4.8.2 Market size, by End-User, 2021-2026 (USD Billion)

7.4.8.3 Market size, by Application, 2021-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.4.9.2 Market size, by End-User, 2021-2026 (USD Billion)

7.4.9.3 Market size, by Application, 2021-2026 (USD Billion)

7.5 Central & South America

7.5.1 Market size, by Country, 2021-2026 (USD Billion)

7.5.2 Market size, by Product Type, 2021-2026 (USD Billion)

7.5.3 Market size, by End-User, 2021-2026 (USD Billion)

7.5.4 Market size, by Application, 2021-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.5.5.2 Market size, by End-User, 2021-2026 (USD Billion)

7.5.5.3 Market size, by Application, 2021-2026 (USD Billion)

7.5.6 Argentina

7.5.6.1 Market size, by Product Type , 2021-2026 (USD Billion)

7.5.6.2 Market size, by End-User, 2021-2026 (USD Billion)

7.5.6.3 Market size, by Application, 2021-2026 (USD Billion)

7.6 MEA

7.6.1 Market size, by Country, 2021-2026 (USD Billion)

7.6.2 Market size, by Product Type , 2021-2026 (USD Billion)

7.6.3 Market size, by End-User, 2021-2026 (USD Billion)

7.6.4 Market size, by Application, 2021-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.6.5.2 Market size, by End-User, 2021-2026 (USD Billion)

7.6.5.3 Market size, by Application, 2021-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.6.6.2 Market size, by End-User, 2021-2026 (USD Billion)

7.6.6.3 Market size, by Application, 2021-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market size, by Product Type, 2021-2026 (USD Billion)

7.6.7.2 Market size, by End-User, 2021-2026 (USD Billion)

7.6.7.3 Market size, by Application, 2021-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2021

8.2 Facco & C. Officine

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Infographic analysis

8.3 Ziggity Systems, Inc.

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Infographic analysis

8.4 Kishore Farm Equipment’s Pvt Ltd

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Infographic analysis

8.5 A.P. POULTRY EQUIPMENTS

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Infographic analysis

8.6 TECNO POULTRY EQUIPMENT Spa

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Infographic analysis

8.7 Big Dutchman

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Infographic analysis

8.8 Jansen Poultry Equipment

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Infographic analysis

8.9 Vencomatic Group B.V.

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Infographic analysis

8.10 HARTMANN GROUP

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Infographic analysis

8.11 TEXHA PA LLC

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Infographic analysis

8.12 Petersime, GARTECH

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Infographic analysis

8.13 LUBING Maschine n fabrik Ludwig Bening GmbH & Co. KG

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Infographic analysis

8.14 Salmet

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Infographic analysis

8.15 Henan Jinfeng Poultry Equipment Co, Ltd.

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Infographic analysis

The Global Poultry Keeping Machinery Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Poultry Keeping Machinery Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS