Global Poultry Seasonings Market Size, Trends & Analysis - Forecasts to 2026 By Type (Capsicum, Pepper, Ginger, Coriander, Cumin, Cinnamon, Nutmeg & Mace, Cloves, Turmeric, Cardamom, and Others), By Nature (Organic and Conventional), By End-Use (Business to Business, Business to Consumer [Hypermarkets/ Supermarkets, Convenience Stores, Speciality Shops and Online Retail Stores]); By Region (North America, Europe, Asia Pacific, Middle East & Africa and Central South America), Company Market Share Analysis, and Competitor Analysis

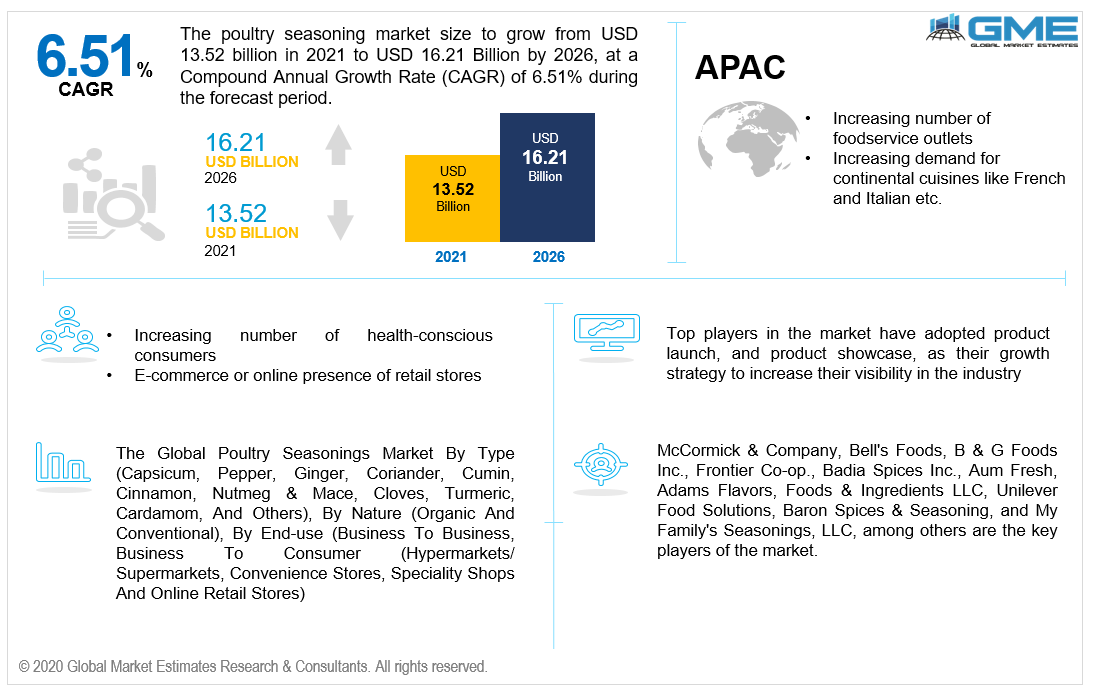

The global poultry seasonings market is projected to grow from USD 13.52 billion in 2021 to USD 16.21 billion in 2026 at a CAGR value of 6.51%.

The key drivers for market growth are increasing appetite for continental cuisines like French and Italian, rising health consciousness and high emphasis on using natural products along with the lifestyle food pattern changes. Moreover, these days people usually prefer to use spices that are less time-consuming and easy to use in the kitchen. Therefore, convenience and ease are too considered as the market drivers for the seasonings market.

The blend of spices is called poultry seasonings. The readymade and easily available stores usually are the major distribution channels for poultry seasonings. The mixture of spices consists of herbs like oregano, sage, ginger, thyme, marjoram, rosemary, nutmeg, and black pepper and is used extensively for food dishes that consist of chicken, duck, or turkey. This blend of seasonings contributes depth and taste to a huge variety of dishes which ranges from roasted veggies to grilled fish and chickens batter. Many brands provide a type of these spice mix through the amalgamation of different ingredients. Usually, sage and thyme are the core ingredients of the seasonings which most often, excludes salt, and helps in the preparation of the dish that is already cooked and salted. Hence, the rising number of players offering poultry seasonings, and increasing demand for herbs and spices across the globe will support the market growth.

The disrupted international trade and supply chain due to COVID-19 norms has affected the on-time delivery, which also affected the quality of the raw materials of spices. This limited the global production of poultry seasonings. Hence, these factors will pose a challenge for the market to grow from 2021 to 2026.

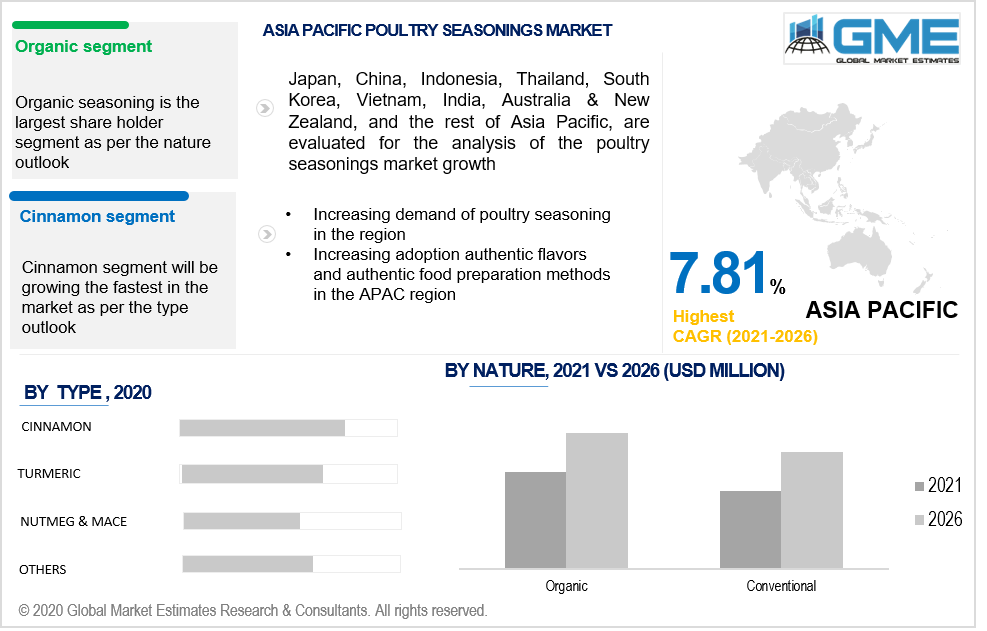

Based on the type of poultry seasonings, the market can be segregated into capsicum, pepper, ginger, coriander, cumin, cinnamon, nutmeg & mace, cloves, turmeric, cardamom, and others. Cinnamon is expected to be the largest shareholder in the market in terms of revenue during the forecast period. Cinnamon offers an expanded degree of insulin affectability in the human body and increasing immunity against any infections. Rising consumer awareness for healthy foods and ingredients is one of the major drivers of the poultry seasonings market. An increasing number of local players supplying cinnamons and related spices in developing countries will also contribute to the largest share of the market from 2021 to 2026.

By nature, the poultry seasonings market can be segmented into organic and conventional. Higher logistic expenses and production expense has led to a higher price bandwidth of the organic spices in comparison to the conventional ones. Hence, the organic poultry seasoning market is anticipated to develop at a higher CAGR value. Whereas the conventional poultry seasoning segment will be the largest shareholder in the market owing to rising health consciousness among individuals. The significant development in exotic cuisines supports the use of organic spices. Hence, the organic spices segment will be growing the fastest.

As per the end-user analysis, the poultry seasonings market can be classified into business to business, business to consumer (hypermarkets/ supermarkets, convenience stores, specialty shops, and online retail stores).

The business-to-consumer market segment is expected to grow at the highest CAGR during the forecast period. Consumers prefer to shop from online retail stores due to exciting discounts and offers, convenience, timely delivery and COVID-19 lockdown norms. Hence, the online retail store sub-segment is expected to hold the largest share of the poultry seasonings market during the forecast period.

As per the geographical analysis, the market of poultry seasoning can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America.

The Asia Pacific is anticipated to develop at a higher growth rate and is probably going to reflect exceptional development during the forecast period. Furthermore, the introduction of new and exotic seasonings, rising number of local suppliers and players, rising consumer disposable income, and flourishing F&B industry is anticipated to stimulate regional growth.

North America is likewise expected to contribute a huge share of the poultry seasonings market during the forecast period. In comparison to other regions, North America has the largest number of meat and poultry consumers.

McCormick & Company, Bell's Foods, B & G Foods Inc., Frontier Co-op., Badia Spices Inc., Aum Fresh, Adams Flavors, Foods & Ingredients LLC, Unilever Food Solutions, Baron Spices & Seasoning, and My Family's Seasonings, LLC, among others are the key players in the poultry seasonings market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Poultry Seasonings Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Nature Overview

2.1.3 Type Overview

2.1.4 End-Use Overview

2.1.5 Regional Overview

Chapter 3 Global Poultry Seasonings Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising number of health-conscious consumers

3.3.1.2 Rising demand for nutritional and protein-rich food products.

3.3.2 Industry Challenges

3.3.2.1 Adulteration of seasonings may obstruct market growth

3.4 Prospective Growth Scenario

3.4.1 Nature Growth Scenario

3.4.2 Type Growth Scenario

3.4.3 End-Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Poultry Seasonings Market, By Nature

4.1 Nature Outlook

4.2 Nature

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Conventional

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Poultry Seasonings Market, By Type

5.1 Type Outlook

5.2 Capsicum

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Pepper

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Ginger

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Coriander

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Cumin

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

5.7 Cinnamon

5.7.1 Market Size, By Region, 2020-2026 (USD Billion)

5.8 Nutmeg & Mace

5.8.1 Market Size, By Region, 2020-2026 (USD Billion)

5.9 Cloves

5.9.1 Market Size, By Region, 2020-2026 (USD Billion)

5.10 Turmeric

5.10.1 Market Size, By Region, 2020-2026 (USD Billion)

5.11 Cardamom

5.11.1 Market Size, By Region, 2020-2026 (USD Billion)

5.12 Others

5.12.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Poultry Seasonings Market, By End-Use

6.1 End-Use Outlook

6.2 Business to Business

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Business to Consumer

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3.1.1 Hypermarket/Supermarkets Market Size, By Region, 2020-2026 (USD Billion)

6.3.1.2 Convenience Stores Market Size, By Region, 2020-2026 (USD Billion)

6.3.1.3 Specialty Shops Market Size, By Region, 2020-2026 (USD Billion)

6.3.1.4 Online Retail Stores Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Poultry Seasonings Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Nature, 2020-2026 (USD Billion)

7.2.3 Market Size, By Type, 2020-2026 (USD Billion)

7.2.4 Market Size, By End-Use, 2020-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.2.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.2.5.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.2.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.2.6.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Nature, 2020-2026 (USD Billion)

7.3.3 Market Size, By Type, 2020-2026 (USD Billion)

7.3.4 Market Size, By End-Use, 2020-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.3.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.5.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.3.8.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.8.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2020-2026 (USD Billion)

7.4.2 Market Size, By Nature, 2020-2026 (USD Billion)

7.4.3 Market Size, By Type, 2020-2026 (USD Billion)

7.4.4 Market Size, By End-Use, 2020-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.4.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.5.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.4.8.2 Market size, By Type, 2020-2026 (USD Billion)

7.4.8.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.4.9.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.6.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Nature, 2020-2026 (USD Billion)

7.5.3 Market Size, By Type, 2020-2026 (USD Billion)

7.5.4 Market Size, By End-Use, 2020-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.5.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.5.5.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Nature, 2020-2026 (USD Billion)

7.6.3 Market Size, By Type, 2020-2026 (USD Billion)

7.6.4 Market Size, By End-Use, 2020-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.6.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.6.5.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By End-Use, 2020-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By Nature, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-Use, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 McCormick & Company.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Bell's Foods

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info-Graphic Analysis

8.4 B & G Foods Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info-Graphic Analysis

8.5 Frontier Co-op.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info-Graphic Analysis

8.6 Badia Spices Inc

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info-Graphic Analysis

8.7 Aum Fresh

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info-Graphic Analysis

8.8 Adams Flavors

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info-Graphic Analysis

8.9 Foods & Ingredients LLC

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.10 Unilever Food Solutions

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info-Graphic Analysis

8.11 Baron Spices & Seasoning

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info-Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info-Graphic Analysis

The Global Poultry Seasonings Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Poultry Seasonings Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS