Global Precious Metals Market Size, Trends & Analysis - Forecasts to 2026 By Product (Gold, Silver, Platinum Group Metals (PGM), Palladium, Others), By Application (Automotive, Electronics, Jewellery, Chemicals, Industrial, Investment, Others), By Region (North America, Asia Pacific, Central and South America, Europe, and the Middle East and North Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

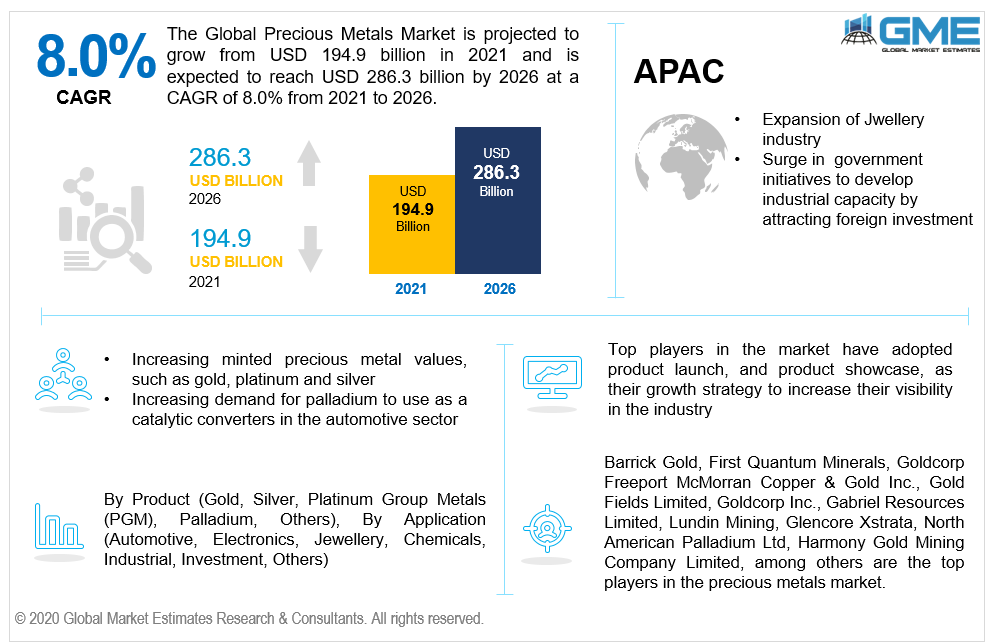

The global precious metals market is projected to grow from USD 194.9 billion in 2021 and is expected to reach USD 286.3 billion by 2026 at a CAGR of 8.0% from 2021 to 2026.

Precious metals are rare and valuable and are indispensable to the modern lives due to their excellent properties such as high thermal conductivity, higher melting and boiling points, physiochemical resistance, potential to catalyse chemical reactions, and electro - optic qualities. Precious metals are employed in a variety of applications in low quantity, and are frequently clubbed with other substances to form alloys or chemicals such as oxides.

Gold and silver, the most well-known precious metals, have been utilised since long time in the market. Roughly 10-15% of gold is employed in a variety of application mainly due to its unique qualities. Moreover, due to its corrosion resistance and static-free electrical properties, these metals are used in ~1.5 billion smartphones and tablets which are sold each year.

Platinum has played a major role as a catalytic converter for vehicles, vans, and tankers, and also has its major involvement in the industrial application area.

Rising minted precious metal values, such as gold and silver, and increasing awareness regarding solid investment schemes are expected to be the prime factors for the market to grow exponentially. Furthermore, rising demand for palladium as a catalytic converter in the automotive sector is likely to drive market expansion. Demand for these metals in jewellery industry is likely to emerge as an influential factor for the industry growth during the forecast period.

Moreover, the market is expanding as a result of changing lifestyle and increasing disposable income among consumers.

Aside from that, in response to rising environment problems, major market players across many industry verticals are spending huge capital amount in repurposing the precious metals, which can then be used to manufacture cardiovascular pacemakers and artificial cochlear. Hence, increasing demand for precious metals from the medical device industry is expected to have a positive impact on the market.

As the pandemic hit the economy, gold, and silver market took a huge hit to the downside. Nonetheless, in response to the escalating number of cases of the coronavirus disease (COVID-19), administrations in several countries had declared total lockdown as a precautionary step to battle the outbreak. This interrupted supply routes and resulted in production lines to halt, giving rise to supply shortages and spike in raw materials.

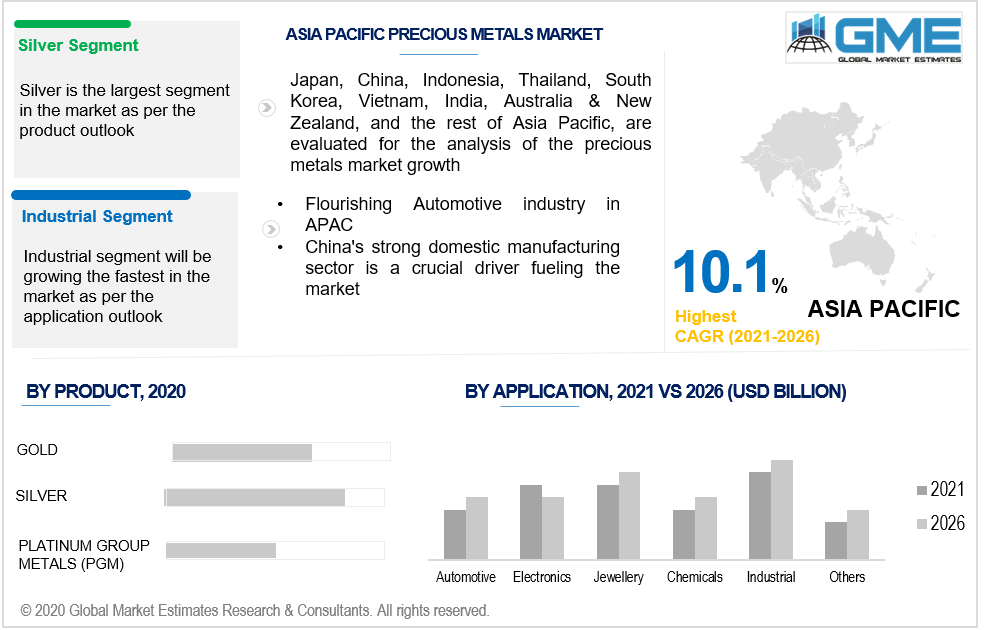

Based on the product, the market is segmented into gold, silver, platinum group metals (PGM), palladium, and other precious metals. The market for silver is expected to have the largest share during the forecast period. This is mainly due to its widespread application in the manufacturing and jewellery industry, along with its low cost price in the market. In comparison to other precious metals, silver continues to profit the global expansionary monetary and fiscal policy.

During the forecast period, the PGM component segment is expected to grow at a slower rate than other metals. The slump in automobile vehicle production has affected platinum and palladium demand to a drastic level. The onset of global pandemic has projected to curtail vehicle output even further. Hence, this has resulted in low consumption for auto catalyst, which is expected to have negative impact on the PGM product segment in the market.

Based on the application, the market is segmented into automotive, electronics, jewellery, chemicals, industrial, investment, others. The market for industrial segment is expected to have the largest share during the forecast period.

This is attributable to the expansion of the electrical and electronics sector. The most well-known metals, such as gold and silver, are employed in a wide range of industrial applications too. Furthermore, due to the unique qualities of precious metals, they have become an essential part in most of the industries. Due to their resistance to corrosion and mutability, they are valuable not only in the Jwellery industry, but also in other industries and manufacturing setups.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (UAE, Saudi Arabia, Rest of MEA) and Central & South America (Brazil, Peru, Chile, and Rest of CSA).

The APAC region is expected to hold the lion’s share of the global revenue generated in the market. The government across the APAC region is expanding its industrial capacity by attracting foreign investment for industries such as chemical, energy, automotive, and construction, among others. As a result, during the forecast period, there would be a rapid surge in consumer attraction in precious metals.

India is projected to play a vital role in boosting the global precious metals market growth. Furthermore, China is analyzed to be the top country in the market. The country is the world's largest producer and consumer of gold and other precious metals. China's strong domestic manufacturing sector is a crucial driver fuelling the growth of the APAC market.

During the forecast period, the Central & South American region is expected to grow rapidly.

The high production volume of silver in Mexico, as well as a strong manufacturing base in the other countries of CSA, are projected to drive precious metals market during the forecast period of 2021 to 2026.

Barrick Gold, First Quantum Minerals, Goldcorp Freeport McMorran Copper & Gold Inc., Gold Fields Limited, Goldcorp Inc., Gabriel Resources Limited, Lundin Mining, Glencore Xstrata, North American Palladium Ltd, Harmony Gold Mining Company Limited, among others are the top players in the precious metals market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Precious Metals Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Precious Metals Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing minted precious metal values

3.3.2 Industry Challenges

3.3.2.1 COVID-19 impact on metals and raw materials

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Precious Metals Market, By Product

4.1 Product Outlook

4.2 Gold

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Silver

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Platinum Group Metals (PGM)

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Palladium

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Others

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Precious Metals Market, By Application

5.1 Application Outlook

5.2 Automotive

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Electronics

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Jewellery

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Chemicals

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Industrial

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

5.7 Investment

5.7.1 Market Size, By Region, 2020-2026 (USD Billion)

5.8 Others

5.8.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Precious Metals Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Product, 2020-2026 (USD Billion)

6.2.3 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Product, 2020-2026 (USD Billion)

6.3.3 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Product, 2020-2026 (USD Billion)

6.4.3 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.7.2 Market size, By Application, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Product, 2020-2026 (USD Billion)

6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Product, 2020-2026 (USD Billion)

6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Barrick Gold

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 First Quantum Minerals

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Goldcorp Freeport McMorran Copper & Gold Inc

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Gold Fields Limited

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Goldcorp Inc

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Gabriel Resources Limited

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Lundin Mining

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Glencore Xstrata

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Precious Metals Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Precious Metals Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS