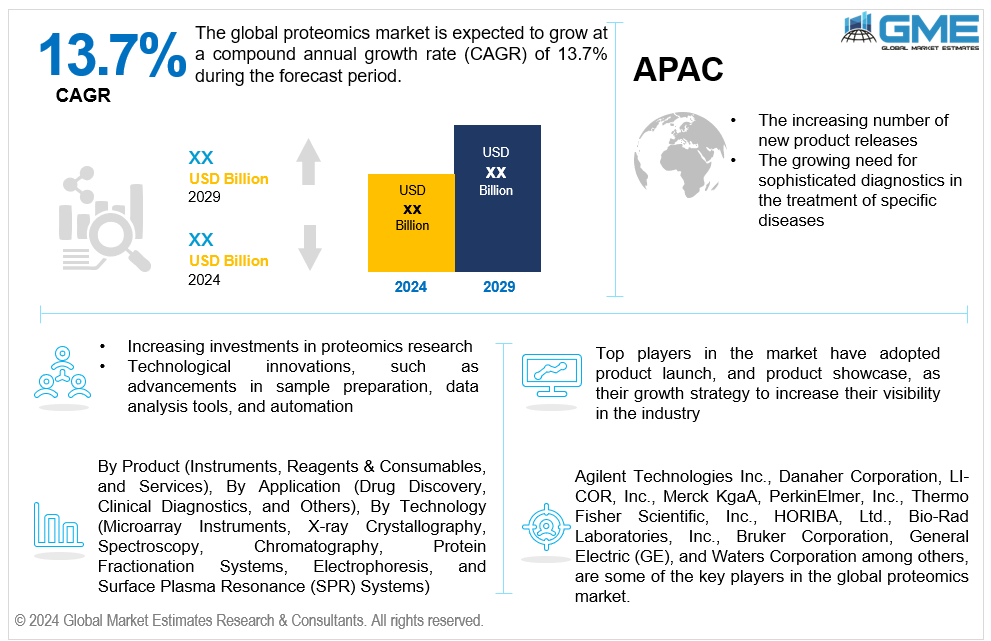

Global Proteomics Market Size, Trends & Analysis - Forecasts to 2029 By Product (Instruments, Reagents & Consumables, and Services), By Application (Drug Discovery, Clinical Diagnostics, and Others), By Technology (Microarray Instruments, X-ray Crystallography, Spectroscopy, Chromatography, Protein Fractionation Systems, Electrophoresis, and Surface Plasma Resonance (SPR) Systems), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global proteomics market is estimated to exhibit a CAGR of 13.7% from 2024 to 2029.

The primary factors propelling the market growth are the increasing number of new product releases and the growing need for sophisticated diagnostics in the treatment of specific diseases. Continuous improvements in mass spectrometry and chromatography, two methods used in protein analysis, led to the creation of increasingly precise, sensitive, and high-throughput proteomics instruments. Additionally, companies are offering proteomics platforms seamless integration with bioinformatics technologies, giving researchers access to extensive data analysis tools. The significance of incorporating bioinformatics software and tools into proteomics procedures is growing. Proteomics experiments are more effective overall when bioinformatics makes data interpretation, processing, and visualization easier. For instance, in June 2022, researchers at the Indian Institute of Science (IISc) in Bangalore created a unique class of synthetic peptides, or mini-proteins, claiming to have the potential to neutralize viruses like SARS-CoV-2.

Increasing investments in proteomics research and technological innovations, such as advancements in sample preparation, data analysis tools, and automation are driving the market growth. Proteomic technologies have witnessed significant advancements in sample preparation methods. Proteins from complicated biological samples are efficiently extracted, purified, and fractionated due to improved sample preparation techniques. As a result, further proteomic analyses are anticipated to be more sensitive and accurate. Moreover, the exponential growth of proteomic data necessitates using bioinformatics solutions and sophisticated data processing tools. Large datasets produced by proteomic technologies can be processed, managed, and interpreted by researchers due to advancements in data analysis tools and algorithms. This facilitates precise protein identification, measurement, and functional annotation. For instance, Bruker Corporation introduced the new timsTOF HT system in June 2022, marking the progression of the ground-breaking 4D Multiomics timsTOF platform.

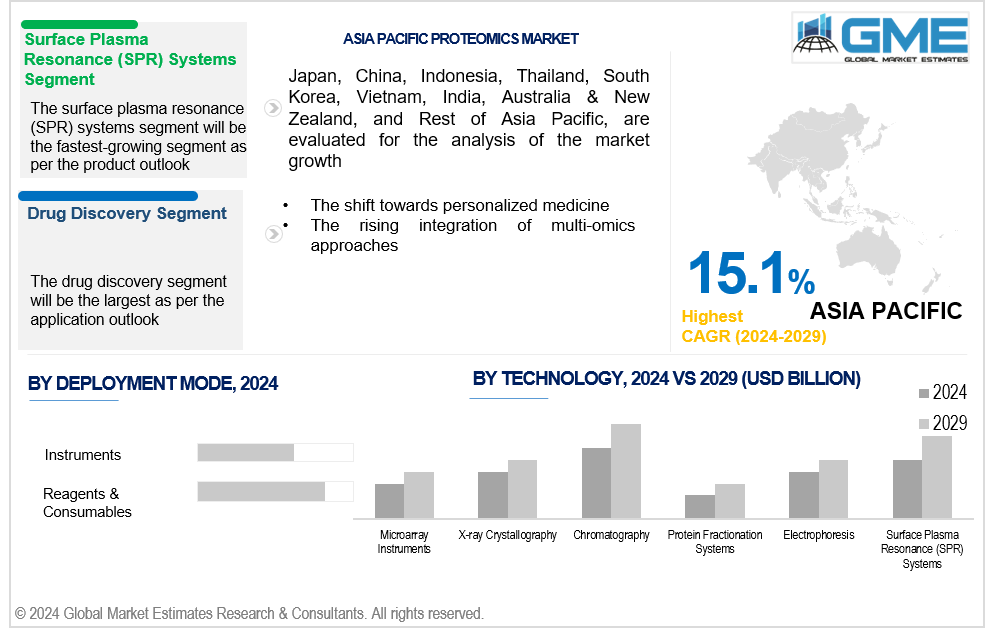

The shift towards personalized medicine and the rising integration of multi-omics approaches propels market growth. Finding biomarkers for different diseases is greatly aided by proteomics. These biomarkers can indicate the onset, course, or responsiveness to therapy for a disease. Proteomic technologies play a vital role in identifying and validating biomarkers for patient stratification since personalized medicine seeks to customize treatments to specific patient features. Additionally, measuring the amount of proteins present in biological samples is crucial for determining the molecular causes of diseases and assessing the effectiveness of treatments. As proteomic methods allow for accurate protein quantification, researchers and medical professionals can evaluate the molecular efficacy of treatments.

To enhance sustainable agriculture practices, proteomic techniques and technologies for crop breeding, disease resistance screening, and environmental stress tolerance testing can be created. Additionally, continuous advancements in proteomics technologies, such as mass spectrometry, protein microarrays, and bioinformatics, create opportunities for developing innovative solutions with enhanced sensitivity, specificity, and throughput.

However, the high costs of proteomics instruments and the shortage of skilled professionals hinder market growth.

The reagents & consumables segment is expected to hold the largest share of the market over the forecast period. In proteomic investigations, consumables and reagents are used in sample preparation, separation, and detection, among other processes. They are used in a variety of areas of study, including medication development, personalized medicine, and the identification of disease biomarkers. The wide array of uses supports the ongoing need for consumables and reagents. Furthermore, consumables and reagents are necessary for effective protein extraction, purification, and fractionation from complicated biological materials.

The instruments segment is expected to be the fastest-growing segment in the market from 2024-2029. The instrument segment is witnessing growth due to increased acceptance and growing recognition of their benefits in proteomics research, such as the capacity to detect low-abundance proteins and analyze complex samples.

The drug discovery segment is expected to hold the largest share of the market over the forecast period. In drug discovery, proteome profiling, a thorough examination of every protein produced in a biological sample, is essential for identifying and validating targets. Proteomic technologies help researchers find possible therapeutic targets by providing insights into the patterns of protein expression associated with diseases. Moreover, proteomics is used in drug discovery to maximize potential therapeutic prospects and lead molecules. Researchers can evaluate possible therapeutic agents' efficacy and safety by examining how medicines and proteins interact.

The clinical diagnostics segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The performance and usability of clinical mass spectrometry platforms are enhanced by continuous advancements in mass spectrometry technology, including advancements in instruments and data analysis tools. These advancements facilitate the integration of mass spectrometry-based proteomics into routine clinical diagnostic workflows.

The chromatography segment is expected to hold the largest share of the market over the forecast period. Complex protein mixtures can be separated and fractionated with the help of chromatography. Liquid chromatography (LC) and similar techniques allow the separation of individual proteins or peptides according to their physicochemical characteristics, such as hydrophobicity, charge, or size. Additionally, improved peak capacity and better separation of complicated protein mixtures are possible with multidimensional chromatography, which uses many separation dimensions. This method is especially useful for extensive proteomics research.

The surface plasma resonance (SPR) systems segment is anticipated to be the fastest-growing segment in the market from 2024-2029. Protein interactions can be found with great sensitivity and specificity using surface plasmon resonance (SPR) systems. Real-time studies of protein-protein, protein-small molecule, and protein-DNA interactions are made possible by this approach, which offers insightful information on a variety of biological processes.

North America is expected to be the largest region in the global market. The increasing launches of new proteomic technologies are a significant driver for the proteomics market in the North American region. Improved analytical capabilities, such as higher sensitivity, resolution, and throughput, are frequently provided by new proteomic technologies. For instance, Platinum, a cutting-edge single-molecule protein sequencing platform, was introduced by protein sequencing company Quantum-Si in December 2022.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Regional market growth is driven by an increasing number of Asian nations prioritizing investment in life sciences research and innovation, especially China, Japan, South Korea, and India. Moreover, proteomics and related research and development (R&D) are receiving significant funding from government initiatives, universities, and private companies. For instance, in November 2021, the Indian government's Department of Biotechnology awarded the University of Hyderabad USD 60 million in funding to study the tomato proteome.

Agilent Technologies Inc., Danaher Corporation, LI-COR, Inc., Merck KgaA, PerkinElmer, Inc., Thermo Fisher Scientific, Inc., HORIBA, Ltd., Bio-Rad Laboratories, Inc., Bruker Corporation, General Electric (GE), and Waters Corporation, among others, are some of the key players in the global proteomics market.

Please note: This is not an exhaustive list of companies profiled in the report.

In August 2022, to further research in protein-protein interactions (PPIs) and metaproteomics applications, Bruker Corporation introduced the new nanoElute 2 nano-LC, MetaboScape, and TASQ 2023 software supporting fluxomics, and the most recent developments in PaSER intelligent acquisition.

In December 2020, Thermo Fisher Scientific Inc. acquired Phitonex, Inc. Through the acquisition, Thermo Fisher was able to provide enhanced flow cytometry and image multiplexing capabilities in response to changing client demands in the field of protein and cell analysis research through Phitonex's product line.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL PROTEOMICS MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL PROTEOMICS MARKET, BY PRODUCT

4.1 Introduction

4.2 Proteomics Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Instruments

4.4.1 Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Reagents & Consumables

4.5.1 Reagents & Consumables Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Services

4.6.1 Services Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL PROTEOMICS MARKET, BY APPLICATION

5.1 Introduction

5.2 Proteomics Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Drug Discovery

5.4.1 Drug Discovery Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Clinical Diagnostics

5.5.1 Clinical Diagnostics Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Others

5.6.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL PROTEOMICS MARKET, BY TECHNOLOGY

6.1 Introduction

6.2 Proteomics Market: Technology Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Microarray Instruments

6.4.1 Microarray Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 X-ray Crystallography

6.5.1 X-ray Crystallography Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Chromatography

6.6.1 Chromatography Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Spectroscopy

6.7.1 Spectroscopy Market Estimates and Forecast, 2021-2029 (USD Million)

6.8 Protein Fractionation Systems

6.8.1 Protein Fractionation Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.9 Electrophoresis

6.9.1 Electrophoresis Market Estimates and Forecast, 2021-2029 (USD Million)

6.10 Surface Plasma Resonance (SPR) Systems

6.10.1 Surface Plasma Resonance (SPR) Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL PROTEOMICS MARKET, BY REGION

7.1 Introduction

7.2 North America Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Product

7.2.2 By Application

7.2.3 By Technology

7.2.4 By Country

7.2.4.1 U.S. Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Product

7.2.4.1.2 By Application

7.2.4.1.3 By Technology

7.2.4.2 Canada Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Product

7.2.4.2.2 By Application

7.2.4.2.3 By Technology

7.2.4.3 Mexico Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Product

7.2.4.3.2 By Application

7.2.4.3.3 By Technology

7.3 Europe Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Product

7.3.2 By Application

7.3.3 By Technology

7.3.4 By Country

7.3.4.1 Germany Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Product

7.3.4.1.2 By Application

7.3.4.1.3 By Technology

7.3.4.2 U.K. Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Product

7.3.4.2.2 By Application

7.3.4.2.3 By Technology

7.3.4.3 France Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Product

7.3.4.3.2 By Application

7.3.4.3.3 By Technology

7.3.4.4 Italy Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Product

7.3.4.4.2 By Application

7.2.4.4.3 By Technology

7.3.4.5 Spain Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Product

7.3.4.5.2 By Application

7.2.4.5.3 By Technology

7.3.4.6 Netherlands Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Product

7.3.4.6.2 By Application

7.2.4.6.3 By Technology

7.3.4.7 Rest of Europe Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Product

7.3.4.7.2 By Application

7.2.4.7.3 By Technology

7.4 Asia Pacific Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Product

7.4.2 By Application

7.4.3 By Technology

7.4.4 By Country

7.4.4.1 China Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Product

7.4.4.1.2 By Application

7.4.4.1.3 By Technology

7.4.4.2 Japan Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Product

7.4.4.2.2 By Application

7.4.4.2.3 By Technology

7.4.4.3 India Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Product

7.4.4.3.2 By Application

7.4.4.3.3 By Technology

7.4.4.4 South Korea Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Product

7.4.4.4.2 By Application

7.4.4.4.3 By Technology

7.4.4.5 Singapore Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Product

7.4.4.5.2 By Application

7.4.4.5.3 By Technology

7.4.4.6 Malaysia Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Product

7.4.4.6.2 By Application

7.4.4.6.3 By Technology

7.4.4.7 Thailand Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Product

7.4.4.7.2 By Application

7.4.4.7.3 By Technology

7.4.4.8 Indonesia Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Product

7.4.4.8.2 By Application

7.4.4.8.3 By Technology

7.4.4.9 Vietnam Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Product

7.4.4.9.2 By Application

7.4.4.9.3 By Technology

7.4.4.10 Taiwan Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Product

7.4.4.10.2 By Application

7.4.4.10.3 By Technology

7.4.4.11 Rest of Asia Pacific Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Product

7.4.4.11.2 By Application

7.4.4.11.3 By Technology

7.5 Middle East and Africa Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Product

7.5.2 By Application

7.5.3 By Technology

7.5.4 By Country

7.5.4.1 Saudi Arabia Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Product

7.5.4.1.2 By Application

7.5.4.1.3 By Technology

7.5.4.2 U.A.E. Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Product

7.5.4.2.2 By Application

7.5.4.2.3 By Technology

7.5.4.3 Israel Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Product

7.5.4.3.2 By Application

7.5.4.3.3 By Technology

7.5.4.4 South Africa Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Product

7.5.4.4.2 By Application

7.5.4.4.3 By Technology

7.5.4.5 Rest of Middle East and Africa Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Product

7.5.4.5.2 By Application

7.5.4.5.2 By Technology

7.6 Central and South America Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Product

7.6.2 By Application

7.6.3 By Technology

7.6.4 By Country

7.6.4.1 Brazil Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Product

7.6.4.1.2 By Application

7.6.4.1.3 By Technology

7.6.4.2 Argentina Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Product

7.6.4.2.2 By Application

7.6.4.2.3 By Technology

7.6.4.3 Chile Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Product

7.6.4.3.2 By Application

7.6.4.3.3 By Technology

7.6.4.4 Rest of Central and South America Proteomics Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Product

7.6.4.4.2 By Application

7.6.4.4.3 By Technology

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Agilent Technologies Inc.

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Danaher Corporation

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 LI-COR, Inc.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Merck KgaA, PerkinElmer, Inc.

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Thermo Fisher Scientific, Inc.

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 HORIBA, LTD.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Bio-Rad Laboratories, Inc.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Bruker Corporation

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 General Electric (GE)

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Waters Corporation

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Proteomics Market, By Product, 2021-2029 (USD Mllion)

2 Instruments Market, By Region, 2021-2029 (USD Mllion)

3 Reagents & Consumables Market, By Region, 2021-2029 (USD Mllion)

4 Services Market, By Region, 2021-2029 (USD Mllion)

5 Global Proteomics Market, By Application, 2021-2029 (USD Mllion)

6 Drug Discovery Market, By Region, 2021-2029 (USD Mllion)

7 Clinical Diagnostics Market, By Region, 2021-2029 (USD Mllion)

8 Others Market, By Region, 2021-2029 (USD Mllion)

9 Global Proteomics Market, By Technology, 2021-2029 (USD Mllion)

10 Microarray Instruments Market, By Region, 2021-2029 (USD Mllion)

11 X-ray Crystallography Market, By Region, 2021-2029 (USD Mllion)

12 Chromatography Market, By Region, 2021-2029 (USD Mllion)

13 Spectroscopy Market, By Region, 2021-2029 (USD Mllion)

14 Protein Fractionation Systems Market, By Region, 2021-2029 (USD Mllion)

15 Electrophoresis Market, By Region, 2021-2029 (USD Mllion)

16 Surface Plasma Resonance (SPR) Systems Market, By Region, 2021-2029 (USD Mllion)

17 Regional Analysis, 2021-2029 (USD Mllion)

18 North America Proteomics Market, By Product, 2021-2029 (USD Million)

19 North America Proteomics Market, By Application, 2021-2029 (USD Million)

20 North America Proteomics Market, By Technology, 2021-2029 (USD Million)

21 North America Proteomics Market, By Country, 2021-2029 (USD Million)

22 U.S Proteomics Market, By Product, 2021-2029 (USD Million)

23 U.S Proteomics Market, By Application, 2021-2029 (USD Million)

24 U.S Proteomics Market, By Technology, 2021-2029 (USD Million)

25 Canada Proteomics Market, By Product, 2021-2029 (USD Million)

26 Canada Proteomics Market, By Application, 2021-2029 (USD Million)

27 Canada Proteomics Market, By Technology, 2021-2029 (USD Million)

28 Mexico Proteomics Market, By Product, 2021-2029 (USD Million)

29 Mexico Proteomics Market, By Application, 2021-2029 (USD Million)

30 Mexico Proteomics Market, By Technology, 2021-2029 (USD Million)

31 Europe Proteomics Market, By Product, 2021-2029 (USD Million)

32 Europe Proteomics Market, By Application, 2021-2029 (USD Million)

33 Europe Proteomics Market, By Technology, 2021-2029 (USD Million)

34 Europe Proteomics Market, By Country 2021-2029 (USD Million)

35 Germany Proteomics Market, By Product, 2021-2029 (USD Million)

36 Germany Proteomics Market, By Application, 2021-2029 (USD Million)

37 Germany Proteomics Market, By Technology, 2021-2029 (USD Million)

38 U.K Proteomics Market, By Product, 2021-2029 (USD Million)

39 U.K Proteomics Market, By Application, 2021-2029 (USD Million)

40 U.K Proteomics Market, By Technology, 2021-2029 (USD Million)

41 France Proteomics Market, By Product, 2021-2029 (USD Million)

42 France Proteomics Market, By Application, 2021-2029 (USD Million)

43 France Proteomics Market, By Technology, 2021-2029 (USD Million)

44 Italy Proteomics Market, By Product, 2021-2029 (USD Million)

45 Italy Proteomics Market, By application, 2021-2029 (USD Million)

46 Italy Proteomics Market, By Technology, 2021-2029 (USD Million)

47 Spain Proteomics Market, By Product, 2021-2029 (USD Million)

48 Spain Proteomics Market, By Application, 2021-2029 (USD Million)

49 Spain Proteomics Market, By Technology, 2021-2029 (USD Million)

50 Netherlands Proteomics Market, By Product, 2021-2029 (USD Million)

51 Netherlands Proteomics Market, By Application, 2021-2029 (USD Million)

52 Netherlands Proteomics Market, By Technology, 2021-2029 (USD Million)

53 Rest Of Europe Proteomics Market, By Product, 2021-2029 (USD Million)

54 Rest Of Europe Proteomics Market, By Application, 2021-2029 (USD Million)

55 Rest of Europe Proteomics Market, By Technology, 2021-2029 (USD Million)

56 Asia Pacific Proteomics Market, By Product, 2021-2029 (USD Million)

57 Asia Pacific Proteomics Market, By Application, 2021-2029 (USD Million)

58 Asia Pacific Proteomics Market, By Technology, 2021-2029 (USD Million)

59 Asia Pacific Proteomics Market, By Country, 2021-2029 (USD Million)

60 China Proteomics Market, By Product, 2021-2029 (USD Million)

61 China Proteomics Market, By Application, 2021-2029 (USD Million)

62 China Proteomics Market, By Technology, 2021-2029 (USD Million)

63 India Proteomics Market, By Product, 2021-2029 (USD Million)

64 India Proteomics Market, By Application, 2021-2029 (USD Million)

65 India Proteomics Market, By Technology, 2021-2029 (USD Million)

66 Japan Proteomics Market, By Product, 2021-2029 (USD Million)

67 Japan Proteomics Market, By Application, 2021-2029 (USD Million)

68 Japan Proteomics Market, By Technology, 2021-2029 (USD Million)

69 South Korea Proteomics Market, By Product, 2021-2029 (USD Million)

70 South Korea Proteomics Market, By Application, 2021-2029 (USD Million)

71 South Korea Proteomics Market, By Technology, 2021-2029 (USD Million)

72 malaysia Proteomics Market, By Product, 2021-2029 (USD Million)

73 malaysia Proteomics Market, By Application, 2021-2029 (USD Million)

74 malaysia Proteomics Market, By Technology, 2021-2029 (USD Million)

75 Thailand Proteomics Market, By Product, 2021-2029 (USD Million)

76 Thailand Proteomics Market, By Application, 2021-2029 (USD Million)

77 Thailand Proteomics Market, By Technology, 2021-2029 (USD Million)

78 Indonesia Proteomics Market, By Product, 2021-2029 (USD Million)

79 Indonesia Proteomics Market, By Application, 2021-2029 (USD Million)

80 Indonesia Proteomics Market, By Technology, 2021-2029 (USD Million)

81 Vietnam Proteomics Market, By Product, 2021-2029 (USD Million)

82 Vietnam Proteomics Market, By Application, 2021-2029 (USD Million)

83 Vietnam Proteomics Market, By Technology, 2021-2029 (USD Million)

84 Taiwan Proteomics Market, By Product, 2021-2029 (USD Million)

85 Taiwan Proteomics Market, By Application, 2021-2029 (USD Million)

86 Taiwan Proteomics Market, By Technology, 2021-2029 (USD Million)

87 Rest of Asia Pacific Proteomics Market, By Product, 2021-2029 (USD Million)

88 Rest of Asia Pacific Proteomics Market, By Application, 2021-2029 (USD Million)

89 Rest of Asia Pacific Proteomics Market, By Technology, 2021-2029 (USD Million)

90 Middle East and Africa Proteomics Market, By Product, 2021-2029 (USD Million)

91 Middle East and Africa Proteomics Market, By Application, 2021-2029 (USD Million)

92 Middle East and Africa Proteomics Market, By Technology, 2021-2029 (USD Million)

93 Middle East and Africa Proteomics Market, By Country, 2021-2029 (USD Million)

94 Saudi Arabia Proteomics Market, By Product, 2021-2029 (USD Million)

95 Saudi Arabia Proteomics Market, By Application, 2021-2029 (USD Million)

96 Saudi Arabia Proteomics Market, By Technology, 2021-2029 (USD Million)

97 UAE Proteomics Market, By Product, 2021-2029 (USD Million)

98 UAE Proteomics Market, By Application, 2021-2029 (USD Million)

99 UAE Proteomics Market, By Technology, 2021-2029 (USD Million)

100 Israel Proteomics Market, By Product, 2021-2029 (USD Million)

101 Israel Proteomics Market, By Application, 2021-2029 (USD Million)

102 Israel Proteomics Market, By Technology, 2021-2029 (USD Million)

103 South Africa Proteomics Market, By Product, 2021-2029 (USD Million)

104 South Africa Proteomics Market, By Application, 2021-2029 (USD Million)

105 South Africa Proteomics Market, By Technology, 2021-2029 (USD Million)

106 Rest of Middle East and Africa Proteomics Market, By Product, 2021-2029 (USD Million)

107 Rest of Middle East and Africa Proteomics Market, By Application, 2021-2029 (USD Million)

108 Rest of Middle East and Africa Proteomics Market, By Technology, 2021-2029 (USD Million)

109 Central and South America Proteomics Market, By Product, 2021-2029 (USD Million)

110 Central and South America Proteomics Market, By Application, 2021-2029 (USD Million)

111 Central and South America Proteomics Market, By Technology, 2021-2029 (USD Million)

112 Central and South America Proteomics Market, By Country, 2021-2029 (USD Million)

113 Brazil Proteomics Market, By Product, 2021-2029 (USD Million)

114 Brazil Proteomics Market, By Application, 2021-2029 (USD Million)

115 Brazil Proteomics Market, By Technology, 2021-2029 (USD Million)

116 Argentina Proteomics Market, By Product, 2021-2029 (USD Million)

117 Argentina Proteomics Market, By Application, 2021-2029 (USD Million)

118 Argentina Proteomics Market, By Technology, 2021-2029 (USD Million)

119 Chile Proteomics Market, By Product, 2021-2029 (USD Million)

120 Chile Proteomics Market, By Application, 2021-2029 (USD Million)

121 Chile Proteomics Market, By Technology, 2021-2029 (USD Million)

122 Rest of Central and South America Proteomics Market, By Product, 2021-2029 (USD Million)

123 Rest of Central and South America Proteomics Market, By Application, 2021-2029 (USD Million)

124 Rest of Central and South America Proteomics Market, By Technology, 2021-2029 (USD Million)

125 Agilent Technologies Inc.: Products & Services Offering

126 Danaher Corporation: Products & Services Offering

127 LI-COR, Inc.: Products & Services Offering

128 Merck KgaA, PerkinElmer, Inc.: Products & Services Offering

129 Thermo Fisher Scientific, Inc.: Products & Services Offering

130 HORIBA, LTD.: Products & Services Offering

131 Bio-Rad Laboratories, Inc. : Products & Services Offering

132 Bruker Corporation: Products & Services Offering

133 General Electric (GE), Inc: Products & Services Offering

134 Waters Corporation: Products & Services Offering

135 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Proteomics Market Overview

2 Global Proteomics Market Value From 2021-2029 (USD Mllion)

3 Global Proteomics Market Share, By Product (2023)

4 Global Proteomics Market Share, By Application (2023)

5 Global Proteomics Market Share, By Technology (2023)

6 Global Proteomics Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Proteomics Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Proteomics Market

11 Impact Of Challenges On The Global Proteomics Market

12 Porter’s Five Forces Analysis

13 Global Proteomics Market: By Product Scope Key Takeaways

14 Global Proteomics Market, By Product Segment: Revenue Growth Analysis

15 Instruments Market, By Region, 2021-2029 (USD Mllion)

16 Reagents & Consumables Market, By Region, 2021-2029 (USD Mllion)

17 Services Market, By Region, 2021-2029 (USD Mllion)

18 Global Proteomics Market: By Application Scope Key Takeaways

19 Global Proteomics Market, By Application Segment: Revenue Growth Analysis

20 Drug Discovery Market, By Region, 2021-2029 (USD Mllion)

21 Clinical Diagnostics Market, By Region, 2021-2029 (USD Mllion)

22 Others Market, By Region, 2021-2029 (USD Mllion)

23 Global Proteomics Market: By Technology Scope Key Takeaways

24 Global Proteomics Market, By Technology Segment: Revenue Growth Analysis

25 Microarray Instruments Market, By Region, 2021-2029 (USD Mllion)

26 X-ray Crystallography Market, By Region, 2021-2029 (USD Mllion)

27 Chromatography Market, By Region, 2021-2029 (USD Mllion)

28 Spectroscopy Market, By Region, 2021-2029 (USD Mllion)

29 Protein Fractionation Systems Market, By Region, 2021-2029 (USD Mllion)

30 Electrophoresis Market, By Region, 2021-2029 (USD Mllion)

31 Surface Plasma Resonance (SPR) Systems Market, By Region, 2021-2029 (USD Mllion)

32 Regional Segment: Revenue Growth Analysis

33 Global Proteomics Market: Regional Analysis

34 North America Proteomics Market Overview

35 North America Proteomics Market, By Product

36 North America Proteomics Market, By Application

37 North America Proteomics Market, By Technology

38 North America Proteomics Market, By Country

39 U.S. Proteomics Market, By Product

40 U.S. Proteomics Market, By Application

41 U.S. Proteomics Market, By Technology

42 Canada Proteomics Market, By Product

43 Canada Proteomics Market, By Application

44 Canada Proteomics Market, By Technology

45 Mexico Proteomics Market, By Product

46 Mexico Proteomics Market, By Application

47 Mexico Proteomics Market, By Technology

48 Four Quadrant Positioning Matrix

49 Company Market Share Analysis

50 Agilent Technologies Inc.: Company Snapshot

51 Agilent Technologies Inc.: SWOT Analysis

52 Agilent Technologies Inc.: Geographic Presence

53 Danaher Corporation: Company Snapshot

54 Danaher Corporation: SWOT Analysis

55 Danaher Corporation: Geographic Presence

56 LI-COR, Inc.: Company Snapshot

57 LI-COR, Inc.: SWOT Analysis

58 LI-COR, Inc.: Geographic Presence

59 Merck KgaA, PerkinElmer, Inc.: Company Snapshot

60 Merck KgaA, PerkinElmer, Inc.: Swot Analysis

61 Merck KgaA, PerkinElmer, Inc.: Geographic Presence

62 Thermo Fisher Scientific, Inc.: Company Snapshot

63 Thermo Fisher Scientific, Inc.: SWOT Analysis

64 Thermo Fisher Scientific, Inc.: Geographic Presence

65 HORIBA, LTD.: Company Snapshot

66 HORIBA, LTD.: SWOT Analysis

67 HORIBA, LTD.: Geographic Presence

68 Bio-Rad Laboratories, Inc. : Company Snapshot

69 Bio-Rad Laboratories, Inc. : SWOT Analysis

70 Bio-Rad Laboratories, Inc. : Geographic Presence

71 Bruker Corporation: Company Snapshot

72 Bruker Corporation: SWOT Analysis

73 Bruker Corporation: Geographic Presence

74 General Electric (GE), Inc.: Company Snapshot

75 General Electric (GE), Inc.: SWOT Analysis

76 General Electric (GE), Inc.: Geographic Presence

77 Waters Corporation: Company Snapshot

78 Waters Corporation: SWOT Analysis

79 Waters Corporation: Geographic Presence

80 Other Companies: Company Snapshot

81 Other Companies: SWOT Analysis

82 Other Companies: Geographic Presence

The Global Proteomics Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Proteomics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS