Global Radome Market Size, Trends & Analysis - Forecasts to 2026 By Offering (Products and Services), By Platform (Airborne, Ground, and Naval), By Application (Radar, Sonar, and Communication Antenna), By Frequency (HF/UHF/VHF-Band, L-Band, S-Band, C-Band, X-Band, KU-Band, KA-Band, and Multi-Band), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

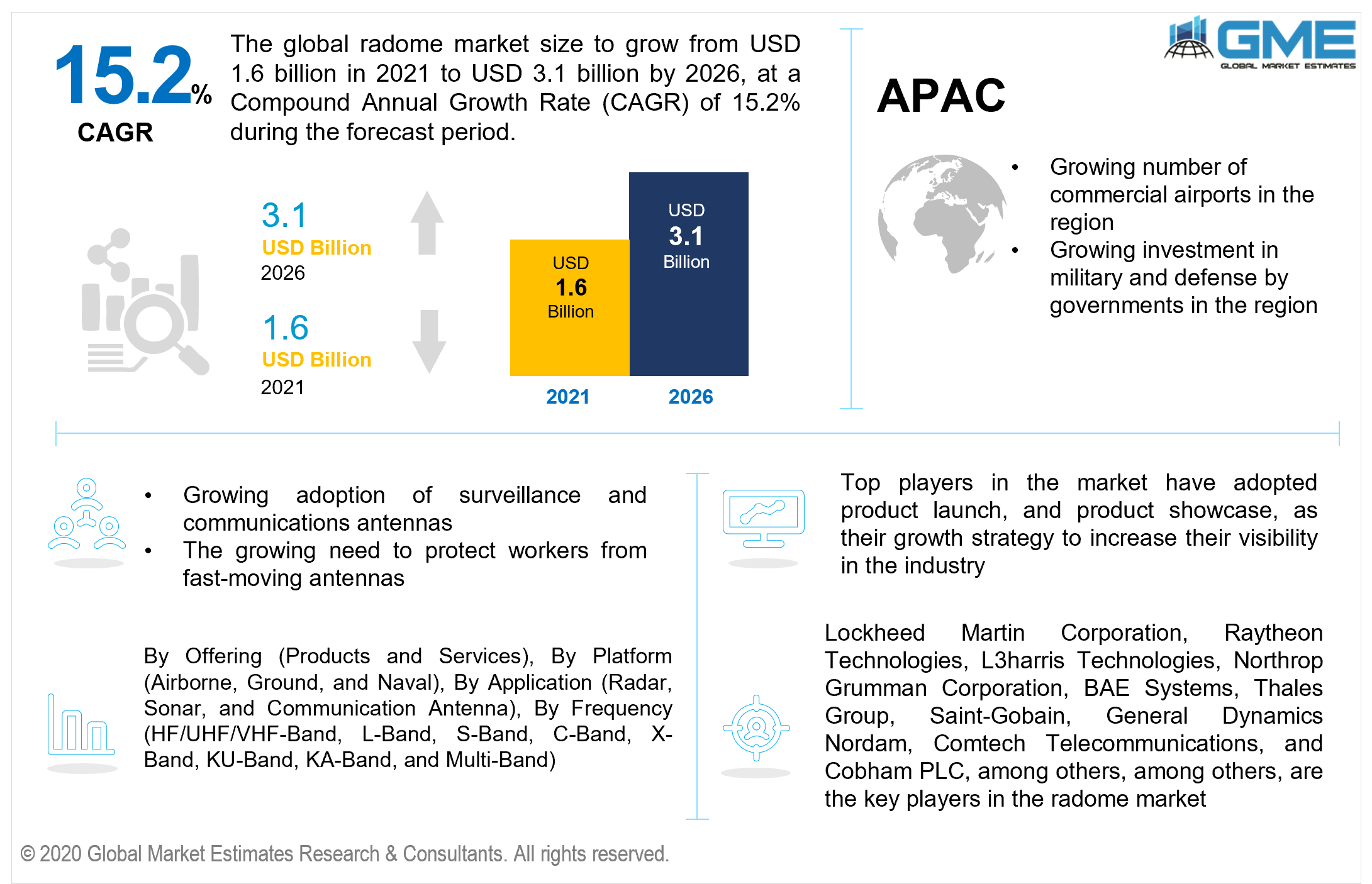

The global radome market is projected to grow from USD 1.6 billion in 2021 to USD 3.1 billion by 2026 at a CAGR value of 15.2% between 2021 to 2026. Radomes are used extensively in military applications and the aerospace industry. Radomes are used to protect people from fast-moving antennas. Hence, the growing number of antenna installments for surveillance and communication are expected to drive the market. Radomes are made of materials that have reduced or no signal loss while receiving and transmitting signals in order to protect the antennas from harsh weather conditions.

Advancements in the development of novel materials that are applicable for radome construction are expected to supplement the growth of the market. Governments across the globe are increasing their spending on the research and development of novel composite materials suitable for radomes. These composite materials offer low signal attenuation while offering flexibility and the necessary protection to antennas which makes them ideal for application in radomes.

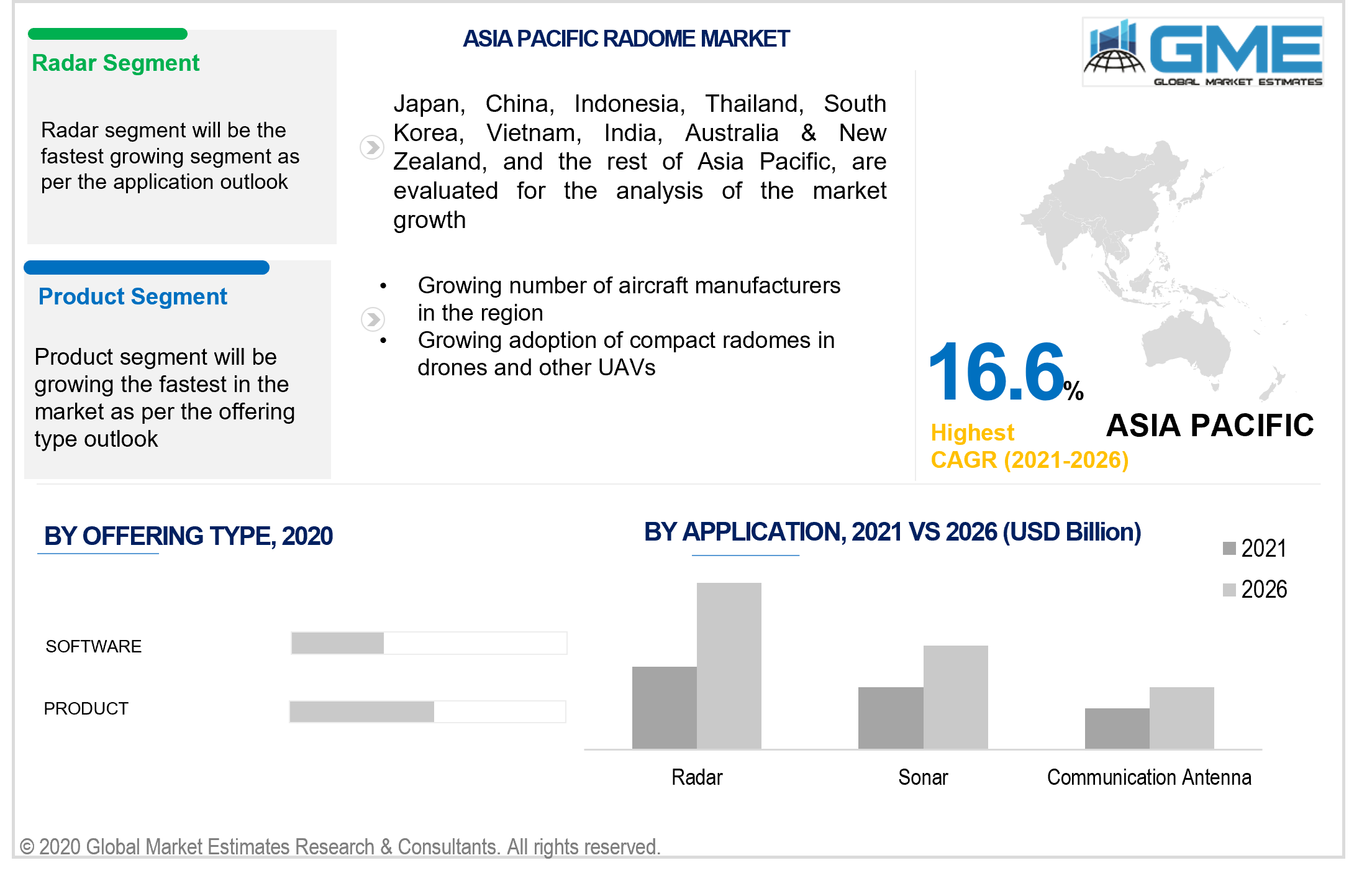

Radomes are present on aircraft-mounted antennas, ground antennas, and antennas use in naval fleets. The growing aircraft construction in the APAC region as governments invest heavily in aircraft manufacturing and the growing number of private manufacturers in the region are expected to contribute to the growing demand for radomes. Growing incidences of territorial disputes, terrorism, and political conflicts are increasing the demand for modern warfare solutions with advanced communication technologies.

The growing adoption of unmanned aerial vehicles (UAV) for military and civilian applications is also expected to supplement the growing demand for radomes. Compact radomes are developed for application in unmanned aerial vehicles with the help of novel composite materials. The growing intensity of research and development of carbon fiber-based radomes are also expected to stimulate the development of the radome market.

The COVID-19 pandemic has caused shutdowns and supply chain restrictions which has decreased the adoption and manufacturing of radomes and hence hampered the market to a great extent. Product launches and development of novel radomes have been delayed. The market is expected to mend itself and slowly return to pre-pandemic growth rates.

The market is restrained by the stringent regulations imposed on the aircraft industry for their parts. The development of novel radomes requires intensive testing and has to pass various regulatory requirements before they can be marketed which delays the launch of products. The development of radome alternatives like active electronically scanned arrays will restrain the growth of the market.

Based on the offering, the market is segmented into products and services. The products segment is expected to hold the dominant share of the revenues generated in the market and showcase better growth rates than the services segment. The growing demand for radomes from aircraft manufacturers and the development of novel compact radomes for use in unmanned aerial vehicles are two of the major driver of the products segment.

Based on the various platforms, the market is segmented into airborne, ground, and naval. The ground segment held the largest share of the revenues generated in the market. The naval segment will become the largest segment during the forecast period owing to its greater growth rate. The high demand for radomes due to a growing number of commercial airports, the need to protect workers from fast-moving antennas, a growing number of communication bases in areas with harsh weather conditions have been the major contributors to the dominance of the ground segment. The growing development of radomes with hydrophobic coatings that can protect antennas from water is expected to supplement the growth of the naval segment.

Based on the application, the market is segmented into radar, sonar, and communication antennas. The radar segment is expected to clutch the lion’s share of the market. Radar communication antennas can be highly affected by direct contact with harsh weather conditions. They require a great degree of protection with minimal signal attenuation to work efficiently. These factors have resulted in the large demand for radomes in radar applications. The growing investment by governments into the development of novel electronic warfare and defense systems and the need for information dissemination is expected to further the growth of the radar segment.

Based on the various frequencies, the market is segmented into HF/UHF/VHF-band, L-band, S-band, C-band, X-band, Ku-band, Ka-band, and multi-band. The Multi-Band segment is expected to hold the largest share of the revenues generated in the radome market and is expected to continue to do so during the forecast period. Multi-bands are used for the detection of moving objects. The growing adoption of automation in aircraft and naval ships, as well as the growing application of radomes in UAVs, have been the major drivers of the growth of the multi-band segment.

Based on region, the market can be broken into various regions such as North America, Europe, Central and South America, Middle East and Africa, and Asia Pacific regions. The North American region is expected to hold the dominant share of the market. The heavy investment by the governments in the region on defense and military applications, extensive R&D efforts into covert surveillance vehicles, and growing adoption of drones and other unmanned aerial vehicles have been the major drivers of the market in the North American region.

The APAC region is anticipated to become the largest market during the forecast period. The region’s growing aircraft manufacturing industry, a growing number of commercial airports, and growing investment in military technology are expected to supplement the rapid growth of the APAC market.

Lockheed Martin Corporation, Raytheon Technologies, L3harris Technologies, Northrop Grumman Corporation, BAE Systems, Thales Group, Saint-Gobain, General Dynamics Nordam, Comtech Telecommunications, and Cobham PLC, among others, are the key players in the radome market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Radome Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Offering Overview

2.1.3 Platform Overview

2.1.4 Application Overview

2.1.5 Frequency Overview

2.1.6 Regional Overview

Chapter 3 Radome Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements in the materials for radome applications

3.3.1.2 Growing number of aircraft manufacturers in the APAC region

3.3.2 Industry Challenges

3.3.2.1 Presence of radome alternatives and cost of instalment and maintenance of radomes

3.4 Prospective Growth Scenario

3.4.1 Offering Growth Scenario

3.4.2 Platform Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 Frequency Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Frequency Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Radome Market, By Offering

4.1 Offering Outlook

4.2 Products

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Software

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Radome Market, By Application

5.1 Application Outlook

5.2 Radar

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Sonar

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Communication Antenna

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Radome Market, By Platform

6.1 Platform Outlook

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Airborne

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Ground

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Naval

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Radome Market, By Frequency

7.1 Frequency Outlook

7.1.1 Market Size, By Region, 2020-2026 (USD Billion)

7.2 HF/UHF/VHF-Band

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 L-Band

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

7.4 L-Band

7.4.1 Market Size, By Region, 2020-2026 (USD Billion)

7.5 C-Band

7.5.1 Market Size, By Region, 2020-2026 (USD Billion)

7.6 C-Band

7.6.1 Market Size, By Region, 2020-2026 (USD Billion)

7.7 KU-Band

7.7.1 Market Size, By Region, 2020-2026 (USD Billion)

7.8 KA-Band

7.8.1 Market Size, By Region, 2020-2026 (USD Billion)

7.9 Multi-Band

7.9.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 Radome Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Offering, 2020-2026 (USD Billion)

8.2.3 Market Size, By Platform, 2020-2026 (USD Billion)

8.2.4 Market Size, By Application, 2020-2026 (USD Billion)

8.2.5 Market Size, By Frequency, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.2.6.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.2.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.2.6.3 Market Size, By Frequency, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Offering, 2020-2026 (USD Billion)

8.3.3 Market Size, By Platform, 2020-2026 (USD Billion)

8.3.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.5 Market Size, By Frequency, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Offering, 2020-2026 (USD Billion)

8.4.3 Market Size, By Platform, 2020-2026 (USD Billion)

8.4.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.5 Market Size, By Frequency, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Platform, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Offering, 2020-2026 (USD Billion)

8.5.3 Market Size, By Platform, 2020-2026 (USD Billion)

8.5.4 Market Size, By Application, 2020-2026 (USD Billion)

8.5.5 Market Size, By Frequency, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Offering, 2020-2026 (USD Billion)

8.6.3 Market Size, By Platform, 2020-2026 (USD Billion)

8.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.6.5 Market Size, By Frequency, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By Frequency, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Offering, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Platform, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By Frequency, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Lockheed Martin Corporation

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Raytheon Technologies

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 L3harris Technologies

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Northrop Grumman Corporation

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 BAE Systems

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Thales Group

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Saint-Gobain

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 General Dynamics Nordam

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Cobham PLC

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Radome Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Radome Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS