Global Reprocessed Medical Devices Market Size, Trends & Analysis - Forecasts to 2028 By Product (Cardiovascular, Laparoscopic, Gastroenterology, General Surgery Devices, and Orthopedic Devices), By Type (Third-party Reprocessing and In-house Reprocessing), By End Use (Hospitals, Home Healthcare, and Others), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

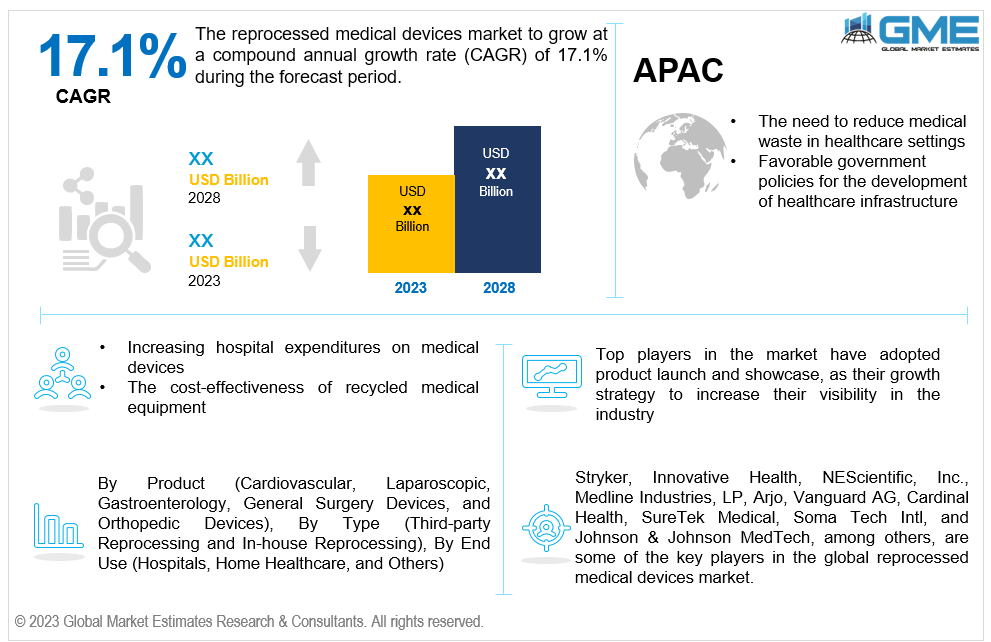

The global reprocessed medical devices market is projected to grow at a CAGR of 17.1% from 2023 to 2028.

Healthcare professionals can utilize reusable medical equipment to treat and diagnose several patients. These medical tools include endoscopes, stethoscopes, and surgical forceps. Such devices are reprocessed to remove tissue, blood, and other biological waste, inactivate infectious bacteria, and make them safe for various medical procedures. Reprocessing medical equipment also lowers greenhouse gas emissions, promotes a safer, cleaner, and more environmentally friendly healthcare system, and minimizes medical waste. Reprocessed medical equipment not only saves money for hospitals and the environment but also offers trustworthy patient care. Many third-party businesses, distributors, and product manufacturers are offering reprocessing programs for certain medical equipment as hospitals throughout the world search for ways to save expenses. This network is expanding in developing countries due to high unmet demand, which offers more opportunities for enterprises that recycle medical devices.

The need to reduce medical waste in healthcare settings, favorable government policies, and increasing hospital expenditures on medical devices are expected to support the growth of the market during the forecast period. Moreover, the cost-effectiveness of recycled medical equipment, growing applications of cardiovascular devices, and an increase in the adoption of single-use reprocessed devices are again propelling the growth of the market.

It is anticipated that supportive government initiatives to increase public knowledge of equipment reprocessing will provide lucrative market opportunities. A tight regulatory environment that prioritizes patient safety is also anticipated to enhance the market expansion for high-quality reprocessed devices, creating opportunities for future development. However, the risk of surgical site infections and strict laws governing medical device reprocessing procedures might limit the market expansion.

Medical device and equipment reprocessing has drawn a lot of interest recently, not just from healthcare organizations looking to save millions of dollars a year, but also from manufacturers who view it as a way to gain a sizable competitive edge. Reprocessed medical devices are typically 30% to 50% less expensive than their new counterparts, according to the Association of the Medical Devices Reprocessors (AMDR, US). As a result, medical device reprocessing has become one of the most widely used supply chain cost-reduction strategies among hospitals, surgical centers, and other healthcare facilities. This releases money for end users to make enhancements such as upgrading technology and enhancing healthcare quality. For instance, according to information published by the Association of Medical Device Reprocessors (AMDR), the usage of reprocessed medical equipment resulted in the diversion of 20.3 million pounds of medical waste in 2021. Major hospitals are also adopting different strategies to save capital expenditures by working with medical device recycling businesses.

Cleaning and sterilization procedures are now more effective and efficient thanks to advancements in reprocessing technology. These innovations include more effective inspection and quality control procedures, automated washing systems, and sterilization processes like hydrogen peroxide gas plasma. These developments improve the recycled devices' quality and safety.

The cardiovascular segment is expected to hold the largest share of the market. This is attributed to the increasing need for affordable cardiovascular surgery and therapies alternatives. Moreover, the FDA's increasing approval of these products drives the segment growth. Additionally, the introduction of inexpensive, single-use, and reprocessed cardiovascular devices increased usage, contributing to the overall segment growth.

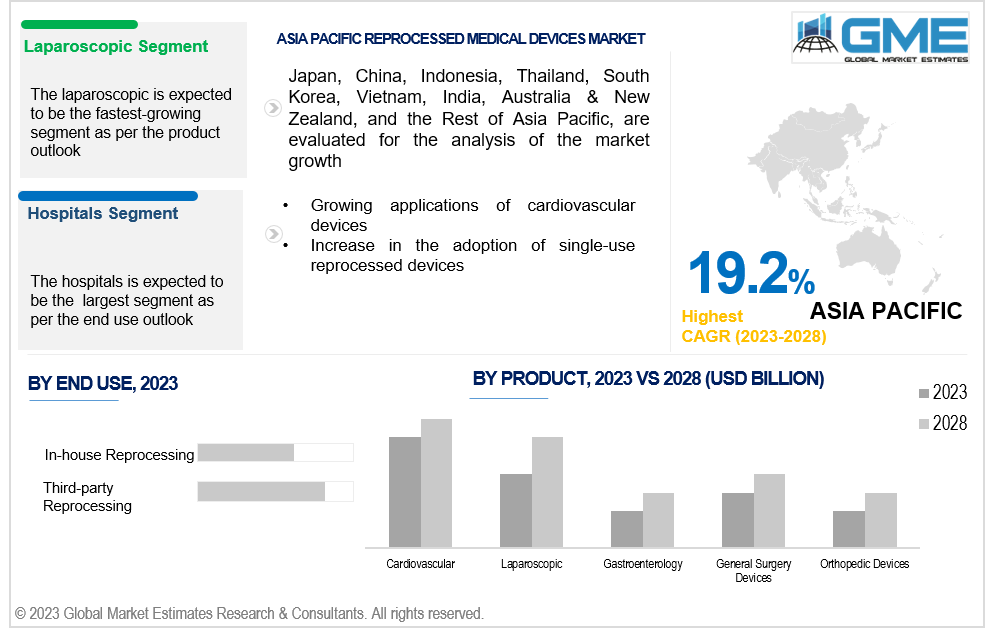

The laparoscopy segment is expected to be the fastest-growing segment in the market from 2023-2028. The enormous amount of trash created by using disposable instruments is causing the demand for reprocessed laparoscopic equipment. Increasing reprocessing product approvals for laparoscopy to meet the increasing demand for less invasive procedures will support the expansion of this segment in the near future.

The third-party reprocessing segment is expected to hold the largest share of the market. These third parties take abandoned medical equipment that would often be thrown away as medical waste and use different cleaning, sterilization, and refurbishing processes to make them fit for reuse. According to estimates, AMDR member firms serve hospitals and outpatient surgical centers by reprocessing various clinical equipment used in orthopedics, cardiology, and respiratory treatment.

The in-house reprocessing is anticipated to be the fastest-growing segment in the market from 2023-2028. Compared to buying new single-use devices for each surgery, healthcare organizations can save money by reprocessing in-house. Particularly for expensive equipment, reprocessing and reusing can drastically cut costs, leading to substantial cost savings over time. Healthcare institutions can have more control over the entire reprocessing process by creating an in-house reprocessing program. They can boost operational efficiency by streamlining the process, speeding up turnaround times, and ensuring that devices are easily reused.

The hospital segment is expected to hold the largest share of the market. This is due to the growing demand for reprocessed medical devices, which helps to cut down on the expense and medical waste production related to the original medical equipment. Healthcare leadership prioritizes the quality of reprocessed devices in addition to the environmental impacts since studies show that used medical equipment might be longer lasting than brand-new equipment.

Home healthcare is anticipated to be the fastest-growing segment in the market from 2023-2028. Reprocessed home medical equipment, such as orthopedic devices, patient monitoring systems, and external support devices, enhances patients' home mobility profiles. Additionally, there are fewer providers of home medical devices, which is expected to offer potential opportunities for reprocessed products to be used in home healthcare.

North America is expected to be the largest region in the market over the forecast period, owing to the high reprocessed medical device acceptance rates and supportive government efforts for market growth. Another important factor driving the growth of the regional market is a large number of industry participants with headquarters situated in North America.

Asia Pacific is predicted to witness the fastest growth during the forecast period. This is attributed to the rising need for lower healthcare costs, the developing economy, and the growing incidence of chronic illnesses in emerging economies like China and India.

Stryker, Innovative Health, NEScientific, Inc., Medline Industries, LP, Arjo, Vanguard AG, Cardinal Health, SureTek Medical, Soma Tech Intl, and Johnson & Johnson MedTech among others, are some of the key players in the global reprocessed medical devices market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3 GLOBAL REPROCESSED MEDICAL DEVICES MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL REPROCESSED MEDICAL DEVICES MARKET, BY PRODUCT

4.1 Introduction

4.2 Reprocessed Medical Devices Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Cardiovascular

4.4.1 Cardiovascular Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Laparoscopic

4.5.1 Laparoscopic Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Gastroenterology

4.6.1 Gastroenterology Market Estimates and Forecast, 2020-2028 (USD Million)

4.7 General Surgery Devices

4.7.1 General Surgery Devices Market Estimates and Forecast, 2020-2028 (USD Million)

4.8 Orthopedic Devices

4.8.1 Orthopedic Devices Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL REPROCESSED MEDICAL DEVICES MARKET, BY TYPE

5.1 Introduction

5.2 Reprocessed Medical Devices Market: Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Third-party Reprocessing

5.4.1 Third-party Reprocessing Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 In-house Reprocessing

5.5.1 In-house Reprocessing Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL REPROCESSED MEDICAL DEVICES MARKET, BY END USE

6.1 Introduction

6.2 Reprocessed Medical Devices Market: End Use Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Hospitals

6.4.1 Hospitals Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Home Healthcare

6.5.1 Home Healthcare Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Others

6.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL REPROCESSED MEDICAL DEVICES MARKET, BY REGION

7.1 Introduction

7.2 North America Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.1 By Product

7.2.2 By Type

7.2.3 By End Use

7.2.4 By Country

7.2.4.1 U.S. Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.1.1 By Product

7.2.4.1.2 By Type

7.2.4.1.3 By End Use

7.2.4.2 Canada Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.2.1 By Product

7.2.4.2.2 By Type

7.2.4.2.3 By End Use

7.2.4.3 Mexico Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.3.1 By Product

7.2.4.3.2 By Type

7.2.4.3.3 By End Use

7.3 Europe Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.1 By Product

7.3.2 By Type

7.3.3 By End Use

7.3.4 By Country

7.3.4.1 Germany Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.1.1 By Product

7.3.4.1.2 By Type

7.3.4.1.3 By End Use

7.3.4.2 U.K. Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.2.1 By Product

7.3.4.2.2 By Type

7.3.4.2.3 By End Use

7.3.4.3 France Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.3.1 By Product

7.3.4.3.2 By Type

7.3.4.3.3 By End Use

7.3.4.4 Italy Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.4.1 By Product

7.3.4.4.2 By Type

7.2.4.4.3 By End Use

7.3.4.5 Spain Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.5.1 By Product

7.3.4.5.2 By Type

7.2.4.5.3 By End Use

7.3.4.6 Netherlands Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.6.1 By Product

7.3.4.6.2 By Type

7.2.4.6.3 By End Use

7.3.4.7 Rest of Europe Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.7.1 By Product

7.3.4.7.2 By Type

7.2.4.7.3 By End Use

7.4 Asia Pacific Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.1 By Product

7.4.2 By Type

7.4.3 By End Use

7.4.4 By Country

7.4.4.1 China Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.1.1 By Product

7.4.4.1.2 By Type

7.4.4.1.3 By End Use

7.4.4.2 Japan Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.2.1 By Product

7.4.4.2.2 By Type

7.4.4.2.3 By End Use

7.4.4.3 India Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.3.1 By Product

7.4.4.3.2 By Type

7.4.4.3.3 By End Use

7.4.4.4 South Korea Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.4.1 By Product

7.4.4.4.2 By Type

7.4.4.4.3 By End Use

7.4.4.5 Singapore Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.5.1 By Product

7.4.4.5.2 By Type

7.4.4.5.3 By End Use

7.4.4.6 Malaysia Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.6.1 By Product

7.4.4.6.2 By Type

7.4.4.6.3 By End Use

7.4.4.7 Thailand Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7.1 By Product

7.4.4.7.2 By Type

7.4.4.7.3 By End Use

7.4.4.8 Indonesia Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.8.1 By Product

7.4.4.8.2 By Type

7.4.4.8.3 By End Use

7.4.4.9 Vietnam Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.9.1 By Product

7.4.4.9.2 By Type

7.4.4.9.3 By End Use

7.4.4.10 Taiwan Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.10.1 By Product

7.4.4.10.2 By Type

7.4.4.10.3 By End Use

7.4.4.11 Rest of Asia Pacific Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.11.1 By Product

7.4.4.11.2 By Type

7.4.4.11.3 By End Use

7.5 Middle East and Africa Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.1 By Product

7.5.2 By Type

7.5.3 By End Use

7.5.4 By Country

7.5.4.1 Saudi Arabia Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.1.1 By Product

7.5.4.1.2 By Type

7.5.4.1.3 By End Use

7.5.4.2 U.A.E. Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.2.1 By Product

7.5.4.2.2 By Type

7.5.4.2.3 By End Use

7.5.4.3 Israel Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.3.1 By Product

7.5.4.3.2 By Type

7.5.4.3.3 By End Use

7.5.4.4 South Africa Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.4.1 By Product

7.5.4.4.2 By Type

7.5.4.4.3 By End Use

7.5.4.5 Rest of Middle East and Africa Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.5.1 By Product

7.5.4.5.2 By Type

7.5.4.5.2 By End Use

7.6 Central & South America Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.1 By Product

7.6.2 By Type

7.6.3 By End Use

7.6.4 By Country

7.6.4.1 Brazil Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.1.1 By Product

7.6.4.1.2 By Type

7.6.4.1.3 By End Use

7.6.4.2 Argentina Eaporative Air Cooler Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.2.1 By Product

7.6.4.2.2 By Type

7.6.4.2.3 By End Use

7.6.4.3 Chile Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.3.1 By Product

7.6.4.3.2 By Type

7.6.4.3.3 By End Use

7.6.4.4 Rest of Central & South America Reprocessed Medical Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.4.1 By Product

7.6.4.4.2 By Type

7.6.4.4.3 By End Use

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Stryker

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Innovative Health

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 NEScientific, Inc.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Medline Industries, LP.

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Arjo

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 CARDINAL HEALTH

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 SureTek Medical

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Soma Tech Intl

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Johnson & Johnson MedTech

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Vanguard AG

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Mllion)

2 Cardiovascular Market, By Region, 2020-2028 (USD Mllion)

3 Laparoscopic Market, By Region, 2020-2028 (USD Mllion)

4 Gastroenterology Market, By Region, 2020-2028 (USD Mllion)

5 General Surgery Devices Market, By Region, 2020-2028 (USD Mllion)

6 Orthopedic Devices Market, By Region, 2020-2028 (USD Mllion)

7 Global Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Mllion)

8 Third-party Reprocessing Market, By Region, 2020-2028 (USD Mllion)

9 In-house Reprocessing Market, By Region, 2020-2028 (USD Mllion)

10 Global Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Mllion)

11 Hospitals Market, By Region, 2020-2028 (USD Mllion)

12 Home Healthcare Market, By Region, 2020-2028 (USD Mllion)

13 Others Market, By Region, 2020-2028 (USD Mllion)

14 Regional Analysis, 2020-2028 (USD Mllion)

15 North America Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

16 North America Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

17 North America Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

18 North America Reprocessed Medical Devices Market, By Country, 2020-2028 (USD Million)

19 U.S Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

20 U.S Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

21 U.S Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

22 Canada Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

23 Canada Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

24 Canada Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

25 Mexico Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

26 Mexico Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

27 Mexico Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

28 Europe Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

29 Europe Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

30 Europe Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

31 Germany Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

32 Germany Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

33 Germany Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

34 UK Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

35 UK Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

36 UK Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

37 France Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

38 France Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

39 France Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

40 Italy Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

41 Italy Reprocessed Medical Devices Market, By T Type Type, 2020-2028 (USD Million)

42 Italy Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

43 Spain Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

44 Spain Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

45 Spain Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

46 Rest Of Europe Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

47 Rest Of Europe Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

48 Rest of Europe Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

49 Asia Pacific Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

50 Asia Pacific Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

51 Asia Pacific Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

52 Asia Pacific Reprocessed Medical Devices Market, By Country, 2020-2028 (USD Million)

53 China Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

54 China Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

55 China Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

56 India Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

57 India Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

58 India Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

59 Japan Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

60 Japan Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

61 Japan Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

62 South Korea Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

63 South Korea Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

64 South Korea Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

65 Middle East and Africa Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

66 Middle East and Africa Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

67 Middle East and Africa Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

68 Middle East and Africa Reprocessed Medical Devices Market, By Country, 2020-2028 (USD Million)

69 Saudi Arabia Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

70 Saudi Arabia Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

71 Saudi Arabia Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

72 UAE Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

73 UAE Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

74 UAE Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

75 Central & South America Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

76 Central & South America Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

77 Central & South America Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

78 Central & South America Reprocessed Medical Devices Market, By Country, 2020-2028 (USD Million)

79 Brazil Reprocessed Medical Devices Market, By Product, 2020-2028 (USD Million)

80 Brazil Reprocessed Medical Devices Market, By Type, 2020-2028 (USD Million)

81 Brazil Reprocessed Medical Devices Market, By End Use, 2020-2028 (USD Million)

82 Stryker: Products & Services Offering

83 Innovative Health: Products & Services Offering

84 NEScientific, Inc.: Products & Services Offering

85 Medline Industries, LP.: Products & Services Offering

86 Arjo: Products & Services Offering

87 CARDINAL HEALTH: Products & Services Offering

88 SureTek Medical : Products & Services Offering

89 Soma Tech Intl: Products & Services Offering

90 Johnson & Johnson MedTech, Inc: Products & Services Offering

91 Vanguard AG: Products & Services Offering

92 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Reprocessed Medical Devices Market Overview

2 Global Reprocessed Medical Devices Market Value From 2020-2028 (USD Mllion)

3 Global Reprocessed Medical Devices Market Share, By Product (2022)

4 Global Reprocessed Medical Devices Market Share, By Type (2022)

5 Global Reprocessed Medical Devices Market Share, By End Use (2022)

6 Global Reprocessed Medical Devices Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Reprocessed Medical Devices Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Reprocessed Medical Devices Market

11 Impact Of Challenges On The Global Reprocessed Medical Devices Market

12 Porter’s Five Forces Analysis

13 Global Reprocessed Medical Devices Market: By Product Scope Key Takeaways

14 Global Reprocessed Medical Devices Market, By Product Segment: Revenue Growth Analysis

15 Cardiovascular Market, By Region, 2020-2028 (USD Mllion)

16 Laparoscopic Market, By Region, 2020-2028 (USD Mllion)

17 Gastroenterology Market, By Region, 2020-2028 (USD Mllion)

18 General Surgery Devices Market, By Region, 2020-2028 (USD Mllion)

19 Orthopedic Devices Market, By Region, 2020-2028 (USD Mllion)

20 Global Reprocessed Medical Devices Market: By Type Scope Key Takeaways

21 Global Reprocessed Medical Devices Market, By Type Segment: Revenue Growth Analysis

22 Third-party Reprocessing Market, By Region, 2020-2028 (USD Mllion)

23 In-house Reprocessing Market, By Region, 2020-2028 (USD Mllion)

24 Global Reprocessed Medical Devices Market: By End Use Scope Key Takeaways

25 Global Reprocessed Medical Devices Market, By End Use Segment: Revenue Growth Analysis

26 Hospitals Market, By Region, 2020-2028 (USD Mllion)

27 Home Healthcare Market, By Region, 2020-2028 (USD Mllion)

28 Others Market, By Region, 2020-2028 (USD Mllion)

29 Regional Segment: Revenue Growth Analysis

30 Global Reprocessed Medical Devices Market: Regional Analysis

31 North America Reprocessed Medical Devices Market Overview

32 North America Reprocessed Medical Devices Market, By Product

33 North America Reprocessed Medical Devices Market, By Type

34 North America Reprocessed Medical Devices Market, By End Use

35 North America Reprocessed Medical Devices Market, By Country

36 U.S. Reprocessed Medical Devices Market, By Product

37 U.S. Reprocessed Medical Devices Market, By Type

38 U.S. Reprocessed Medical Devices Market, By End Use

39 Canada Reprocessed Medical Devices Market, By Product

40 Canada Reprocessed Medical Devices Market, By Type

41 Canada Reprocessed Medical Devices Market, By End Use

42 Mexico Reprocessed Medical Devices Market, By Product

43 Mexico Reprocessed Medical Devices Market, By Type

44 Mexico Reprocessed Medical Devices Market, By End Use

45 Four Quadrant Positioning Matrix

46 Company Market Share Analysis

47 Stryker: Company Snapshot

48 Stryker: SWOT Analysis

49 Stryker: Geographic Presence

50 Innovative Health: Company Snapshot

51 Innovative Health: SWOT Analysis

52 Innovative Health: Geographic Presence

53 NEScientific, Inc.: Company Snapshot

54 NEScientific, Inc.: SWOT Analysis

55 NEScientific, Inc.: Geographic Presence

56 Medline Industries, LP.: Company Snapshot

57 Medline Industries, LP.: Swot Analysis

58 Medline Industries, LP.: Geographic Presence

59 Arjo: Company Snapshot

60 Arjo: SWOT Analysis

61 Arjo: Geographic Presence

62 CARDINAL HEALTH: Company Snapshot

63 CARDINAL HEALTH: SWOT Analysis

64 CARDINAL HEALTH: Geographic Presence

65 SureTek Medical : Company Snapshot

66 SureTek Medical : SWOT Analysis

67 SureTek Medical : Geographic Presence

68 Soma Tech Intl: Company Snapshot

69 Soma Tech Intl: SWOT Analysis

70 Soma Tech Intl: Geographic Presence

71 Johnson & Johnson MedTech, Inc.: Company Snapshot

72 Johnson & Johnson MedTech, Inc.: SWOT Analysis

73 Johnson & Johnson MedTech, Inc.: Geographic Presence

74 Vanguard AG: Company Snapshot

75 Vanguard AG: SWOT Analysis

76 Vanguard AG: Geographic Presence

77 Other Companies: Company Snapshot

78 Other Companies: SWOT Analysis

79 Other Companies: Geographic Presence

The Global Reprocessed Medical Devices Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Reprocessed Medical Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS