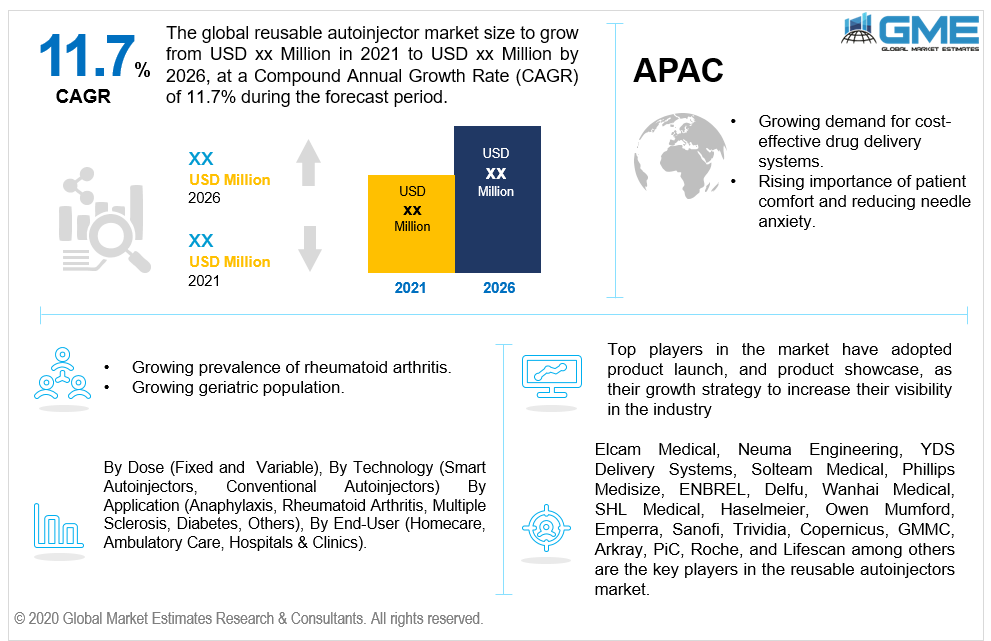

Global Reusable Autoinjectors Market Size, Trends & Analysis - Forecasts to 2026 By Dose (Fixed and Variable), By Technology (Smart Autoinjectors, Conventional Autoinjectors) By Application (Anaphylaxis, Rheumatoid Arthritis, Multiple Sclerosis, Diabetes, Others), By End-User (Homecare, Ambulatory Care, Hospitals & Clinics), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global reusable autoinjectors market is projected to grow at a CAGR value of 11.7% during the forecast period [2021 to 2026]. Reusable autoinjectors are becoming increasingly popular among patients suffering from diseases that require multiple injection doses in a day. The growing number of patients suffering from rheumatoid arthritis, multiple sclerosis, diabetes, and growth hormone ailments is one of the major drivers of the reusable autoinjectors market.

Reusable autoinjectors are becoming increasingly popular as they allow patients to inject their dose without any hesitation arising from a fear of the needle-based drug delivery system. Patient care and comfort are of utmost priority to caregivers and patients, devices like autoinjectors allow patients to administer their own doses without any medical training. Autoinjectors can be used anywhere without the fear of causing discomfort to the user and the people around the user. Reusable autoinjectors reduce the cost per injection for the user as the main body of the device does not have to be changed with every injection.

Reusable autoinjectors come with preloaded cartridges that allow patients to simply load the device and inject the drug. Reusable autoinjectors offer a greater degree of control and feedback to the user. The user can control the dosage through variable dose reusable autoinjectors. Growing technological advancements have made it possible for patients to visually observe their dosage and keep track of it. Smart reusable autoinjectors like the Aria+ autoinjector developed by Philips Medisize and Flexi-Q autoinjectors developed by Elcam have revolutionized the reusable autoinjectors market.

Smart reusable autoinjectors are capable of recording the dosage and injection data and storing it remotely through wireless networks. Such smart devices allow patients to track their dosage and allow healthcare providers to provide customized dosage plans that are easy for the patients to track and administer.

The reusable autoinjectors market is restrained by the growing prevalence of alternative drug delivery methods like nasal and oral drug delivery. Anxiety induced by usage of needles can be restrained to an extend by autoinjectors but cannot be fully alleviated, this is especially true for children and young adults which also serve as a restraint to the growth of the reusable autoinjectors market.

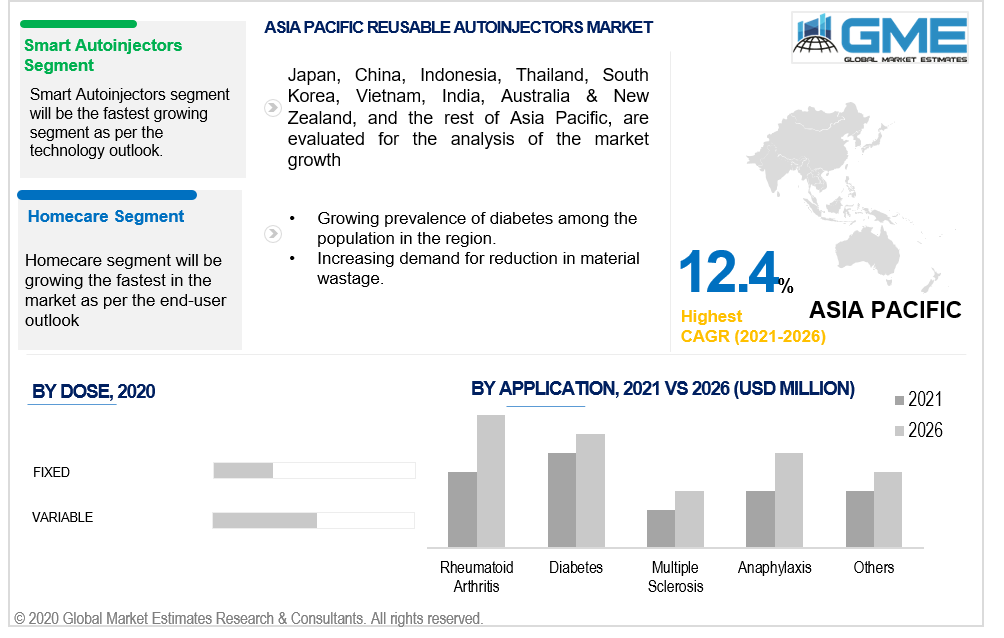

Based on the dosage, the reusable autoinjectors market can be segmented into fixed and variable doses. The variable dose segment held a dominant share of the reusable autoinjectors market. The variable dose segment is driven by its cost-effectiveness and greater control overdosage. Variable dose allows greater control to the user and allows them to follow their customized dosage plan as prescribed by the healthcare provider. Variable dose reusable autoinjectors also prevent the wastage of the drug-filled cartridge, thereby reducing the cost incurred by the user.

Reusable autoinjectors allow users to track their dosage while some also provide instructions for use visually as well as visual and audible feedback. Based on the technology employed in the autoinjector, the reusable autoinjectors market can be segmented into smart autoinjectors and conventional autoinjectors. Conventional autoinjectors held the bulk of the market owing to their larger market penetration. Smart autoinjectors are expected to grow at the fastest rate during the forecast period.

Smart autoinjectors offer greater control and monitoring of patient dosage information which can help healthcare providers and the user to better control and cure the disease. Smart autoinjectors are becoming increasingly popular as patients prefer the digitized availability of data and disease management plans on device-specific mobile apps.

Based on the various diseases that can be treated and managed by autoinjectors, the reusable autoinjectors market can be segmented as rheumatoid arthritis, multiple sclerosis, diabetes, anaphylaxis, and others. The rheumatoid arthritis autoinjectors market held the lion’s share of the market. Patients suffering from rheumatoid arthritis are often unable to inject their doses, autoinjectors allow them to self-administer their doses. With the growing number of rheumatoid arthritis cases in the world as the geriatric population rises, the rheumatoid arthritis segment is expected to continue holding its dominant share of the market.

Reusable autoinjectors are growing in demand and their market can be segmented based on the end-users of the device. Homecare, hospitals and clinics, and ambulatory services are the end-user-based segments. The homecare segment held the dominant share of the reusable autoinjectors market. Geriatric patients often require periodic drug doses through injections, reusable autoinjectors reduce the need for expert medical care to administer drug doses. Reusable autoinjectors also allow patients to self-administer medication and reduces the per injection costs. The growing geriatric population and the need for cheaper injections are the major drivers of the homecare segment.

Based on the geographical features of the reusable autoinjectors market, the market can be segmented into North America, Europe, South America, Middle East & Africa, and APAC regions. The North American region is expected to hold the largest share of the reusable autoinjectors market. The region has a large geriatric population that suffers from various ailments like rheumatoid arthritis and diabetes who are dependent on injections as their treatment therapy. The region’s extensive insurance plans have also contributed to the growth of the reusable autoinjectors market in the region. Technological advancements by the vendors especially the production of smart reusable autoinjectors have led to the dominance of the North American region.

The APAC region is expected to witness the fastest growth rate among all regions, a growing number of diabetic patients and the increasing prevalence of rheumatoid arthritis are expected to result in the growth of the reusable autoinjectors market in the region.

Elcam Medical, Neuma Engineering, YDS Delivery Systems, Solteam Medical, Phillips Medisize, ENBREL, Delfu, Wanhai Medical, SHL Medical, Haselmeier, Owen Mumford, Emperra, Sanofi, Trividia, Copernicus, GMMC, Arkray, PiC, Roche, and Lifescan among others are the key players in the reusable autoinjectors market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Reusable Autoinjectors Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Dose Overview

2.1.3 Technology Overview

2.1.4 Application Overview

2.1.5 End-User Overview

2.1.6 Regional Overview

Chapter 3 Reusable Autoinjectors Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for sustainable products with reduced materials wastage

3.3.1.2 Growing prevalence of rheumatoid arthritis

3.3.2 Industry Challenges

3.3.2.1 Growing number of alternative drug delivery systems

3.4 Prospective Growth Scenario

3.4.1 Dose Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Reusable Autoinjectors Market, By Dose

4.1 Dose Outlook

4.2 Fixed

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Variable

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Reusable Autoinjectors Market, By Application

5.1 Application Outlook

5.2 Anaphylaxis

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Rheumatoid Arthritis

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Multiple Sclerosis

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Diabetes

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Other

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Reusable Autoinjectors Market, By Technology

6.1 Smart Autoinjectors

6.1.1 Market Size, By Region, 2020-2026 (USD Million)

6.2 Conventional Autoinjectors

6.2.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 7 Reusable Autoinjectors Market, By End-User

7.1 Homecare

7.1.1 Market Size, By Region, 2020-2026 (USD Million)

7.2 Ambulatory Care

7.2.1 Market Size, By Region, 2020-2026 (USD Million)

7.3 Hospitals & Clinics

7.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 8 Reusable Autoinjectors Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Million)

8.2.2 Market Size, By Dose, 2020-2026 (USD Million)

8.2.3 Market Size, By Technology, 2020-2026 (USD Million)

8.2.4 Market Size, By Application, 2020-2026 (USD Million)

8.2.5 Market Size, By End-User, 2020-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Dose, 2020-2026 (USD Million)

8.2.4.2 Market Size, By Technology, 2020-2026 (USD Million)

8.2.4.3 Market Size, By Application, 2020-2026 (USD Million)

8.2.4.4 Market Size, By End-User, 2020-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Dose, 2020-2026 (USD Million)

8.2.7.2 Market Size, By Technology, 2020-2026 (USD Million)

8.2.7.3 Market Size, By Application, 2020-2026 (USD Million)

8.2.7.4 Market Size, By End-User, 2020-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Million)

8.3.2 Market Size, By Dose, 2020-2026 (USD Million)

8.3.3 Market Size, By Technology, 2020-2026 (USD Million)

8.3.4 Market Size, By Application, 2020-2026 (USD Million)

8.3.5 Market Size, By End-User, 2020-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Dose, 2020-2026 (USD Million)

8.3.6.2 Market Size, By Technology, 2020-2026 (USD Million)

8.3.6.3 Market Size, By Application, 2020-2026 (USD Million)

8.3.6.4 Market Size, By End-User, 2020-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Dose, 2020-2026 (USD Million)

8.3.7.2 Market Size, By Technology, 2020-2026 (USD Million)

8.3.7.3 Market Size, By Application, 2020-2026 (USD Million)

8.3.7.4 Market Size, By End-User, 2020-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Dose, 2020-2026 (USD Million)

8.3.8.2 Market Size, By Technology, 2020-2026 (USD Million)

8.3.8.3 Market Size, By Application, 2020-2026 (USD Million)

8.3.8.4 Market Size, By End-User, 2020-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Dose, 2020-2026 (USD Million)

8.3.9.2 Market Size, By Technology, 2020-2026 (USD Million)

8.3.9.3 Market Size, By Application, 2020-2026 (USD Million)

8.3.9.4 Market Size, By End-User, 2020-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Dose, 2020-2026 (USD Million)

8.3.10.2 Market Size, By Technology, 2020-2026 (USD Million)

8.3.10.3 Market Size, By Application, 2020-2026 (USD Million)

8.3.10.4 Market Size, By End-User, 2020-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Dose, 2020-2026 (USD Million)

8.3.11.2 Market Size, By Technology, 2020-2026 (USD Million)

8.3.11.3 Market Size, By Application, 2020-2026 (USD Million)

8.3.11.4 Market Size, By End-User, 2020-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Million)

8.4.2 Market Size, By Dose, 2020-2026 (USD Million)

8.4.3 Market Size, By Technology, 2020-2026 (USD Million)

8.4.4 Market Size, By Application, 2020-2026 (USD Million)

8.4.5 Market Size, By End-User, 2020-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Dose, 2020-2026 (USD Million)

8.4.6.2 Market Size, By Technology, 2020-2026 (USD Million)

8.4.6.3 Market Size, By Application, 2020-2026 (USD Million)

8.4.6.4 Market Size, By End-User, 2020-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Dose, 2020-2026 (USD Million)

8.4.7.2 Market Size, By Technology, 2020-2026 (USD Million)

8.4.7.3 Market Size, By Application, 2020-2026 (USD Million)

8.4.7.4 Market Size, By End-User, 2020-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Dose, 2020-2026 (USD Million)

8.4.8.2 Market Size, By Technology, 2020-2026 (USD Million)

8.4.8.3 Market Size, By Application, 2020-2026 (USD Million)

8.4.8.4 Market Size, By End-User, 2020-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Dose, 2020-2026 (USD Million)

8.4.9.2 Market size, By Technology, 2020-2026 (USD Million)

8.4.9.3 Market Size, By Application, 2020-2026 (USD Million)

8.4.9.4 Market Size, By End-User, 2020-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Dose, 2020-2026 (USD Million)

8.4.10.2 Market Size, By Technology, 2020-2026 (USD Million)

8.4.10.3 Market Size, By Application, 2020-2026 (USD Million)

8.4.10.4 Market Size, By End-User, 2020-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Million)

8.5.2 Market Size, By Dose, 2020-2026 (USD Million)

8.5.3 Market Size, By Technology, 2020-2026 (USD Million)

8.5.4 Market Size, By Application, 2020-2026 (USD Million)

8.5.5 Market Size, By End-User, 2020-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Dose, 2020-2026 (USD Million)

8.5.6.2 Market Size, By Technology, 2020-2026 (USD Million)

8.5.6.3 Market Size, By Application, 2020-2026 (USD Million)

8.5.6.4 Market Size, By End-User, 2020-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Dose, 2020-2026 (USD Million)

8.5.7.2 Market Size, By Technology, 2020-2026 (USD Million)

8.5.7.3 Market Size, By Application, 2020-2026 (USD Million)

8.5.7.4 Market Size, By End-User, 2020-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Dose, 2020-2026 (USD Million)

8.5.8.2 Market Size, By Technology, 2020-2026 (USD Million)

8.5.8.3 Market Size, By Application, 2020-2026 (USD Million)

8.5.8.4 Market Size, By End-User, 2020-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Million)

8.6.2 Market Size, By Dose, 2020-2026 (USD Million)

8.6.3 Market Size, By Technology, 2020-2026 (USD Million)

8.6.4 Market Size, By Application, 2020-2026 (USD Million)

8.6.5 Market Size, By End-User, 2020-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Dose, 2020-2026 (USD Million)

8.6.6.2 Market Size, By Technology, 2020-2026 (USD Million)

8.6.6.3 Market Size, By Application, 2020-2026 (USD Million)

8.6.6.4 Market Size, By End-User, 2020-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Dose, 2020-2026 (USD Million)

8.6.7.2 Market Size, By Technology, 2020-2026 (USD Million)

8.6.7.3 Market Size, By Application, 2020-2026 (USD Million)

8.6.7.4 Market Size, By End-User, 2020-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Dose, 2020-2026 (USD Million)

8.6.8.2 Market Size, By Technology, 2020-2026 (USD Million)

8.6.8.3 Market Size, By Application, 2020-2026 (USD Million)

8.6.8.4 Market Size, By End-User, 2020-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Elcam Medical

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 YDS Delivery Systems

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Solteam Medical

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Phillips Medisize

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 ENBREL

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Delfu

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Owen Mumford

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 SHL Medical

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Haselmeier

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Reusable Autoinjectors Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Reusable Autoinjectors Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS