Global Rheumatoid Arthritis Therapeutics Market Size, Trends & Analysis - Forecasts to 2026 By Product (Biologics, Non-Biologics, Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), Synthetic Disease-Modifying Antirheumatic Drugs, Other), Sales Channel (Prescription, OTC), By Route of Administration (Oral, Parenteral), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

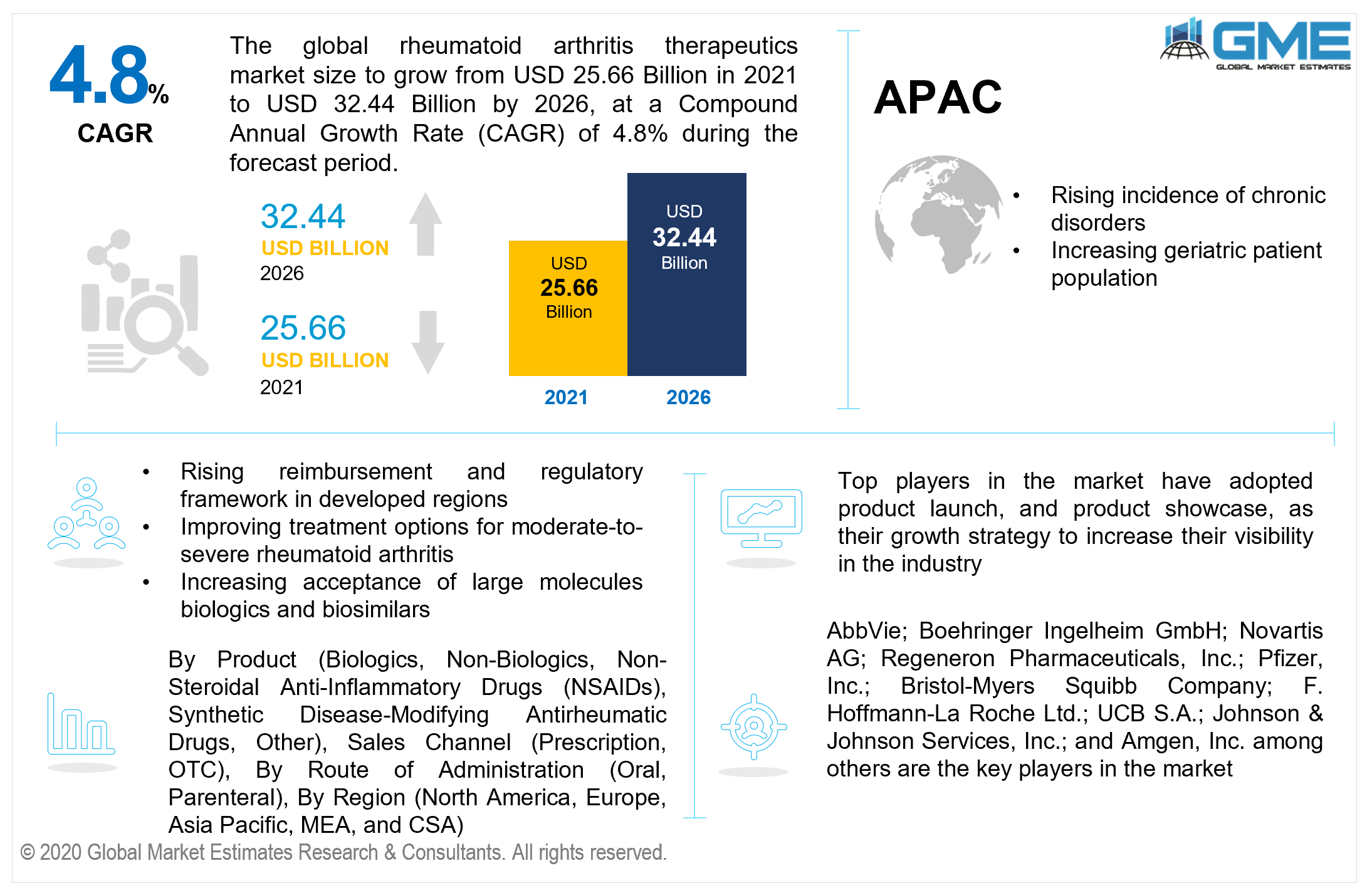

The global rheumatoid arthritis therapeutics market is estimated to be valued at USD 25.66 billion in 2021 and is projected to reach USD 32.44 billion by 2026 at a CAGR of 4.8%. The key drivers which contribute to the market expansion include the increasing prevalence of chronic diseases, growing joint deformities, soaring need for advanced treatment solutions, growing inflammatory diseases, increasing emergence of biologics, a growing proportion of individuals suffering from autoimmune disorders, mounting demand & desire for novel therapeutics, continually evolving medical facilities, growing geriatric population, increasing technological advancements, expanding government initiatives, rising legal governance alignment, and increasing research and development.

The upsurge in rheumatoid arthritis preponderance, a spike in demand for rheumatoid arthritis medications, patent expiration and the admittance of biosimilar medications, spurt in the geriatric population, boost in implementation of mainstream DMARDs, and government programs to spread consciousness for rheumatoid arthritis symptomatology are the main considerations driving development in the rheumatoid arthritis drugs market.

Furthermore, advancements in sophisticated biologics, an increase in healthcare spending, an uptick in purchasing power, and the availability of top-notch drugs for impoverished and middle-class households worldwide are a few of the aspects that attribute to the market's proliferation. Nevertheless, medication adverse effects and the exorbitant prices of biological DMARD therapeutics are foreseen to be major global market constraints. On the other hand, a resurgence in understanding concerning incipient screening and therapeutic interventions of rheumatoid arthritis is expected to provide significant growth opportunities for the rheumatoid arthritis drugs market throughout the forecast period.

The COVID-19 outbreak has had a significant impact on the overall market. According to the Lancet Rheumatology 2020, patients with rheumatoid arthritis who become infected with COVID-19 are at an elevated risk of cultivating extreme side effects and supplemental comorbidities. Some DMARDs generally utilized to classify rheumatoid arthritis, including hydroxychloroquine, are being studied as eventual COVID-19 therapies. Furthermore, other commonly utilized therapeutics, including biologics targeting interleukin (IL)-6 (sarilumab, tocilizumab) and IL-1 (anakinra), are being evaluated in COVID-19 patient populations. Thus, COVID-19 disease increased growth prospects for rheumatoid arthritis medication producers throughout the forecast period.

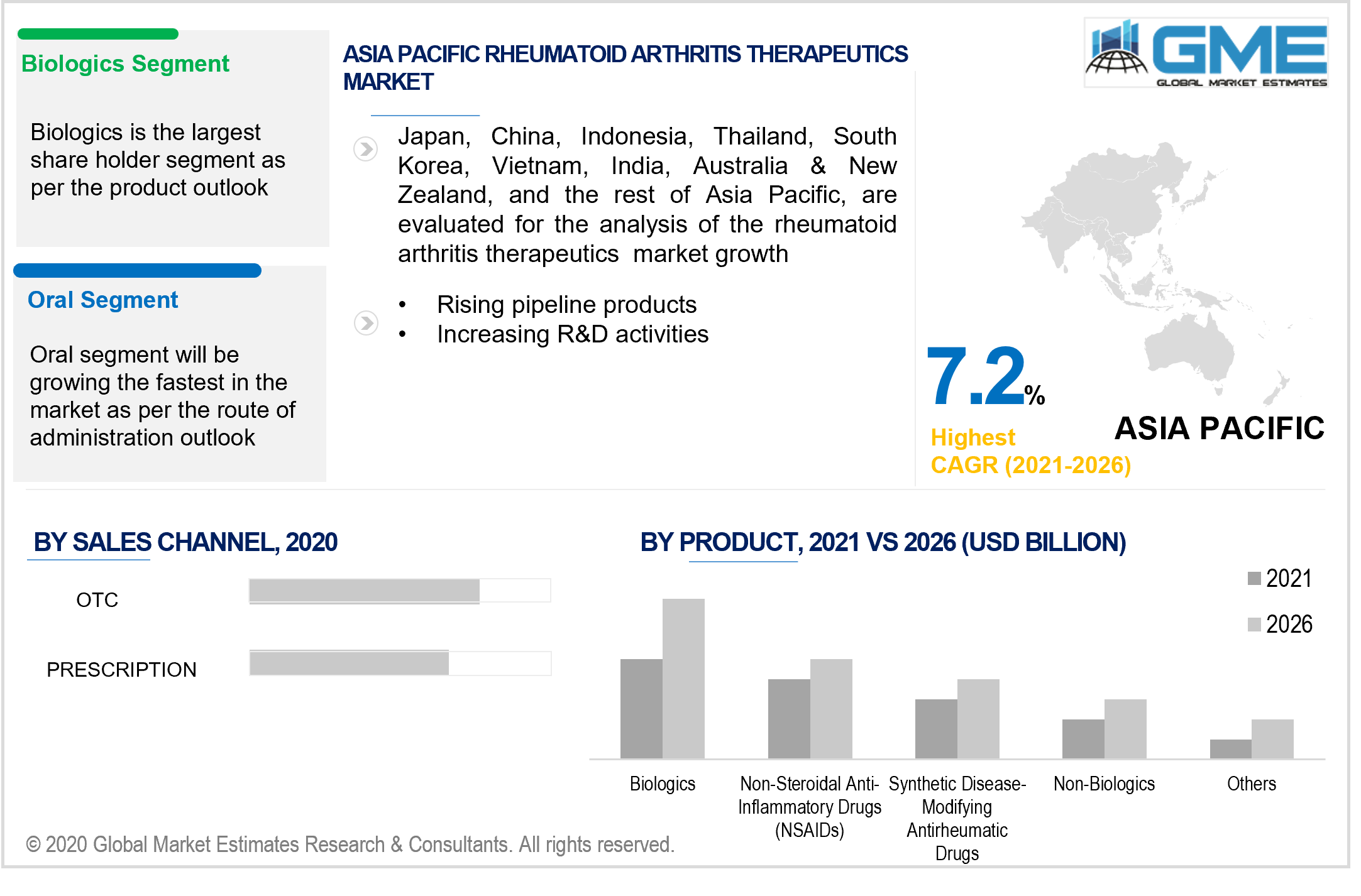

Based on product, the market is segmented into biologics, non-biologics, non-steroidal anti-inflammatory drugs (NSAIDs), synthetic disease-modifying antirheumatic drugs, and others.

During the forecast period, the market for biologics is estimated to predominate. As he biologics products are derived from the genes and modified proteins that target the infection and eradicate the infection than the others. Growing biologics studies, increasing technology, FDA approvals, soaring research and developments, the launch of new products, rising awareness about biologics, and burgeoning adoption of these products are the major drivers of this market.

During the forecast period, the biosimilar market is also estimated to grow at the fastest rate due to the provision of cost-effective nature, increasing adoption of these products, and growing awareness about biosimilars.

Based on the sales channel, the market is segmented into prescription and OTC.

During the forecast period, the market for OTC is estimated to predominate due to increasing chronic diseases, a rising proportion of key players initiating product launches, soaring demand for vitamin supplements & weight loss products, growing desire for novel therapeutics, rising geriatric population, increasing technological advancements, burgeoning affordability of advanced therapeutics, rapidly changing lifestyles, unhealthy diet habits, rising inclination towards weight loss.

During the forecast period, the market for prescriptions is estimated to grow at a lucrative rate due to increasing chronic diseases like obesity, cardiovascular diseases, cancer, and many more. Additionally, rising pipeline products, growing generic population, continual technology developments, growing orphan drugs, increasing rare diseases will drive this segment.

Based on the mode of the route of administration, the market is segmented into oral and parenteral.

During the forecast period, the market for oral drugs has resulted in a higher prevalence than the others. The oral route of administration is preferred against the other modes of drug management because it provides numerous advantages such as hygiene, the convenience of uptake, no discomfort throughout the administration, and adaptability to a wide range of medications.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, UAE, and Rest of MEA) and Central South America (Brazil, Argentina, and Rest of CSA).

During the forecast period, North America accounts for the largest market share due to the existence of sophisticated healthcare facilities, rising inflammatory diseases, increasing autoimmune disorders, soaring incidence of cancer, other chronic diseases & infections, rising geriatric population, increasing skin disorders, growing awareness among people, soaring demand for treatment for skin disorders, rising incidence of genetic disabilities, increasing proportion of key players collaborating for new innovative products according to the demand from the patients.

The Asia Pacific market is foreseen to report the highest CAGR, owing to the growing impact of chronic diseases & viral infections, rising inflammatory diseases, increasing autoimmune disorders, rising expenditure likely on healthcare, continually altering lifestyle preferences, soaring inclination towards advanced therapy, and booming investments in R&D. Moreover, increasing volume of accidents, increasing cases of genetic disease, increasing level of demographics opting unhealthy diet habits, rapidly changing lifestyles, rising prevalence of climatic changes, are the major drivers due to which the Asia Pacific market is anticipated to develop at the fastest pace during the forecast period.

AbbVie; Boehringer Ingelheim GmbH; Novartis AG; Regeneron Pharmaceuticals, Inc.; Pfizer, Inc.; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd.; UCB S.A.; Johnson & Johnson Services, Inc.; and Amgen, Inc. are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Rheumatoid Arthritis Therapeutics Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Sales Channel Overview

2.1.4 Route of Administration Overview

2.1.5 Regional Overview

Chapter 3 Rheumatoid Arthritis Therapeutics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Well-Defined Reimbursement And Regulatory Framework In Developed Regions

3.3.1.2 Improving Treatment Options For Moderate-To-Severe Rheumatoid Arthritis

3.3.2 Industry Challenges

3.3.2.1 Patent Expiration Of Blockbuster Drugs

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Sales Channel Growth Scenario

3.4.3 Route of Administration Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.7 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Rheumatoid Arthritis Therapeutics Market, By Product

4.1 Product Outlook

4.2 Biologics

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Non-Biologics

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Non-Steroidal Anti-Inflammatory Drugs

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Synthetic Disease-Modifying Antirheumatic Drugs

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Other

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Rheumatoid Arthritis Therapeutics Market, By Sales Channel

5.1 Sales Channel Outlook

5.2 Prescription

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 OTC

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Rheumatoid Arthritis Therapeutics Market, By Route of Administration

6.1 Route of Administration Outlook

6.2 Oral

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Parenteral

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Rheumatoid Arthritis Therapeutics Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Product, 2019-2026 (USD Million)

7.2.3 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.2.4 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.2.5.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.2.6.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Product, 2019-2026 (USD Million)

7.3.3 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.3.4 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.5.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.3.5.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.3.6.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.3.7.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.3.8.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.3.9.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.3.10.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Million)

7.4.2 Market Size, By Product, 2019-2026 (USD Million)

7.4.3 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.4.4 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.4.5.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.4.6.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.4.7.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.8.2 Market size, By Sales Channel, 2019-2026 (USD Million)

7.4.8.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.4.9.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Product, 2019-2026 (USD Million)

7.5.3 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.5.4 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.5.5.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.5.6.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.5.7.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.7 MEA

7.7.1 Market Size, By Country 2019-2026 (USD Million)

7.7.2 Market Size, By Product, 2019-2026 (USD Million)

7.7.3 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.7.4 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.7.5 Saudi Arabia

7.7.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.7.5.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.7.5.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.7.6 UAE

7.7.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.7.6.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.7.6.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

7.7.7 South Africa

7.7.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.7.7.2 Market Size, By Sales Channel, 2019-2026 (USD Million)

7.7.7.3 Market Size, By Route of Administration, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 AbbVie

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Boehringer Ingelheim GmbH

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Novartis AG

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Regeneron Pharmaceuticals, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Pfizer, Inc

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Bristol-Myers Squibb Company

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 F. Hoffmann-La Roche Ltd

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 UCB S.A

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Johnson & Johnson Services, Inc

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Amgen, Inc.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Rheumatoid Arthritis Therapeutics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Rheumatoid Arthritis Therapeutics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS