Global Rhodium Market, Trends & Analysis - Forecasts to 2026 By Product Type (Alloys, Metals and Compounds), By Application (Catalysis, Jewellery Making, Platinum and Palladium Alloying and others), By Source (Mineral Source/PGM Mining), By End User (Automotive, Electricals, Chemical, Glass and Others), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

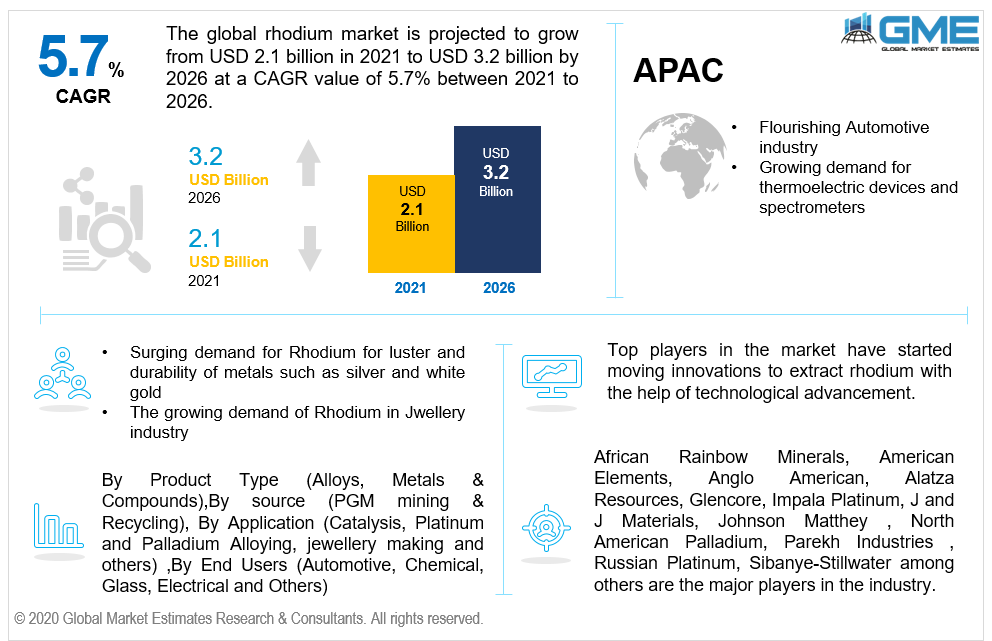

The global rhodium market is projected to grow from USD 2.1 billion in 2021 to USD 3.2 billion by 2026 at a CAGR value of 5.7% between 2021 to 2026.

Rhodium is considered to be extraordinarily rare, silver-white, and chemically inert transition metal. It is one of the least available metals in the world and is also comparatively expensive to known metals such as gold and silver. One of the major uses of rhodium is to produce catalysts which helps to reduce waste gases that harm human beings. These waste gases are exhausted from cars and motorbikes and other vehicles. Major producer of rhodium globally is South Africa-which has inherited more than 50% share of the production market, followed by Russia-which has about 6% share. Whereas U.S. & Canada have about 2.3% shares which is then followed by the mines in Zimbabwe.

Rising demand for rhodium from automotive and soldering industries contributes largely to the market’s growth. Rhodium plays a vital role as a catalyst for the automotive industry. Moreover, with the increasing demand for thermoelectric devices and spectrometers, the demand for rhodium is ought to be rising. Since it is very difficult to process rhodium synthetically the market is analyzed to face challenges during the forecast period.

With the augmentation of Covid-19, the market was hard hit due to hampered prices of the precious metals. The automotive industry was hit hard owing to the repercussions of lockdown norms. Rhodium was one of the prime metals to be used in the catalytic converters for cars. The market for rhodium too had to face the backlash and witnessed a downfall. However, with ease in the lockdown norms, the market is expected to grow at a steady pace.

Based on the type of product, the market is segmented into alloys, metals and compounds. Rhodium as an alloy agent is used for hardening and improving the corrosion resistance of platinum and platinum based products. Because of its silvery-white, hard, and corrosion-resistant metal, rhodium is vastly used in the jewellery industry. Hence, the alloy version of the product holds the largest share in the market.

Based on the source, the market is segmented into mineral source/PGM mining and recycling. Globally, there are only 50-70 tons of rhodium available which makes it rare and there are only a few mines located in South Africa, Zimbabwe among other countires. The process to extract rhodium is extremely difficult and time consuming. Rhodium’s source via recycling process is very extreme and difficult as it requires a lot of time consumption. Wire, sheet, rods, foils and tubes are some of the products which have rhodium content. Other items of jewellery and electrodes, tongs, loops also have rhodium content to a limited extent. Hence, the mineral source/ PGM mining source is the largest segment in the market.

Based on application, the market is classified into catalysis, jewellery making, platinum and palladium alloying, and others. Rhodium is used to enhance the lustre and durability of metals such as silver and white golds. Secondly, rhodium catalysis the reactions of pollutants to convert them into harmless substances. Hence, the catalysis segment holds the largest share in the market.

Based on end user, the rhodium market can be segmented into automotive, chemical, glass, electrical and others. The automotive segment holds the largest share of the market and is expected to continue the trend during the forecast period. Emission of nitrogen oxide by cars, motorbikes and other vehicles is a known hazard to the environment and rhodium limits and lowers the same and helps in offering a sustainable solution. The demand for rhodium is soaring in the industry majorly to meet the rising and stringent emission norms layed by the government.

Based on region, the market can be segmented into North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, and Rest of Europe), Central & South America (Brazil and Rest of Central & South America), Middle East and Africa (UAE, Saudi Arabia and Rest of Middle East & Africa), and Asia Pacific (China, Japan, India and Rest of Asia Pacific).

The North American region is expected to hold the lion’s share of the revenues generated in the market. Rhodium, is majorly used in automotive catalytic converters to meet strict emission norms layed by the government. The automotive industry of the U.S. is expanding rapidly and hence the market for rhodium is ought to be the largest for North America. Besides, Canada and Mexico too have committed to reducing their toxic emissions and hence have come up with stringent norms to tackle air pollution.

Growing number of research & development pertaining to the use of rhodium in new industrial areas in Europe and Japan is further expected to drive the demand for rhodium in the market. However, the South African subcontinent would witness a steady growth during the forecast period.

Asia Pacific region is estimated to be the fastest growing segment in the market owing to the rapid growth in the glass and glass products industry clubbed with increasing demand for precious metals. Moreover, the market is witnessing a rapid growth in the number of automotive users, which in turn is supporting the demand for rhodium.

African Rainbow Minerals, American Elements, Anglo American, Atlatsa Resources, Glencore, Impala Platinum, J and J Materials, Johnson Matthey , North American Palladium, Parekh Industries , Russian Platinum, Sibanye-Stillwater among others are the key players of the rhodium market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Rhodium Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Rhodium Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.4 COVID-19 Influence over Industry Growth

3.5 Porter’s Analysis

3.6 PESTEL Analysis

3.7 Value Chain & Supply Chain Analysis

3.8 Regulatory Framework

3.9 Technology Overview

3.10 Market Share Analysis, 2020

Chapter 4 Rhodium Market, By Product Type

4.1 Product Type Outlook

4.2 Alloys

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Metals

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Compounds

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Rhodium Market, By Application

5.1 Application Outlook

5.2 Catalysis

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Jewellery Making

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Platinum and Palladium Alloying

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Others

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Rhodium Market, By End User

6.1 End User Outlook

6.2 Automotive

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Chemical

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Glass

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Electrical Products

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

6.6 Others

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Rhodium Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4 U.S.

7.2.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.5 Canada

7.2.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.4 Germany

7.3.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.5 UK

7.3.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6 France

7.3.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7 Italy

7.3.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.8 Spain

7.3.8.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9 Russia

7.3.9.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.4 China

7.4.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.5 India

7.4.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6 Japan

7.4.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7 Australia

7.4.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.7.2 Market size, By Application, 2020-2026 (USD Billion)

7.4.8 South Korea

7.4.8.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.4 Brazil

7.5.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.5 Mexico

7.5.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6 Argentina

7.5.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.4 Saudi Arabia

7.6.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.5 UAE

7.6.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6 South Africa

7.6.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 African Rainbow Minerals

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 American Elements

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Anglo American

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Glencore

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Impala Platinum

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 J and J Materials

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Russian Platinum

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

8.9 Other Companies

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

The Global Rhodium Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Rhodium Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS