Global Rigid Foam Market Size, Trends & Analysis - Forecasts to 2028 By Type (Polyurethane, Polystyrene, Polyethylene, Polypropylene, and Polyvinyl Chloride), By End-use Industry (Building & Construction, Appliances, Packaging, Automobile, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

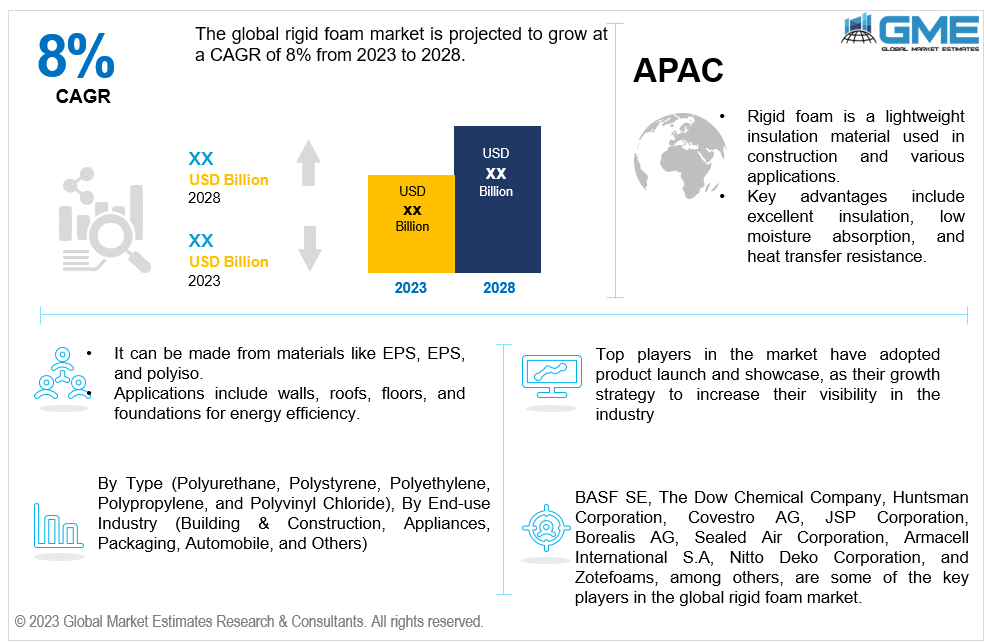

The global rigid foam market is projected to grow at a CAGR of 8% from 2023 to 2028.

Rigid foam is a type of insulation material that is frequently used in construction and other applications to provide structural support and thermal insulation. This lightweight material's closed-cell foam is made from extruded polystyrene (EPS), expanded polystyrene (EPS), and polyisocyanurate (polyiso). Rigid foam insulation boards are known for their high insulating properties, low moisture absorption, and resistance to heat transfer. They are often used in walls, roofs, floors, and foundations to improve energy efficiency and reduce heat loss or gain.

Increasing construction activities, energy efficiency regulation and sustainability initiatives, growing awareness of energy conservation, industrial growth and demand for cold chain logistics, automotive and aerospace industries and technology advancement and product innovation are the major drivers fuelling the growth of the rigid foam market.

In the construction industry, rigid foam is frequently used for insulation in residential, commercial, and industrial structures. The growth of the construction sector, driven by urbanization, population growth, and infrastructure development, creates a demand for rigid foam insulation materials.

Government regulations and policies promoting energy-efficient buildings and sustainability drive the demand for rigid foam insulation excellent thermal insulation properties are offered by rigid foam materials, which aid in lowering energy use and greenhouse gas emissions.

The demand for rigid foam insulation is being fuelled by rising awareness among consumers and businesses of the value of energy efficiency and lowering carbon footprints. This is particularly significant in regions with extreme climates, where insulation plays a crucial role in maintaining indoor comfort while minimizing energy consumption.

Rigid foam materials find applications in automotive and aerospace industries for lightweighting, sound insulation, and thermal management. As these industries continue to innovate and focus on fuel efficiency, safety, and comfort, the demand for rigid foam products increases.

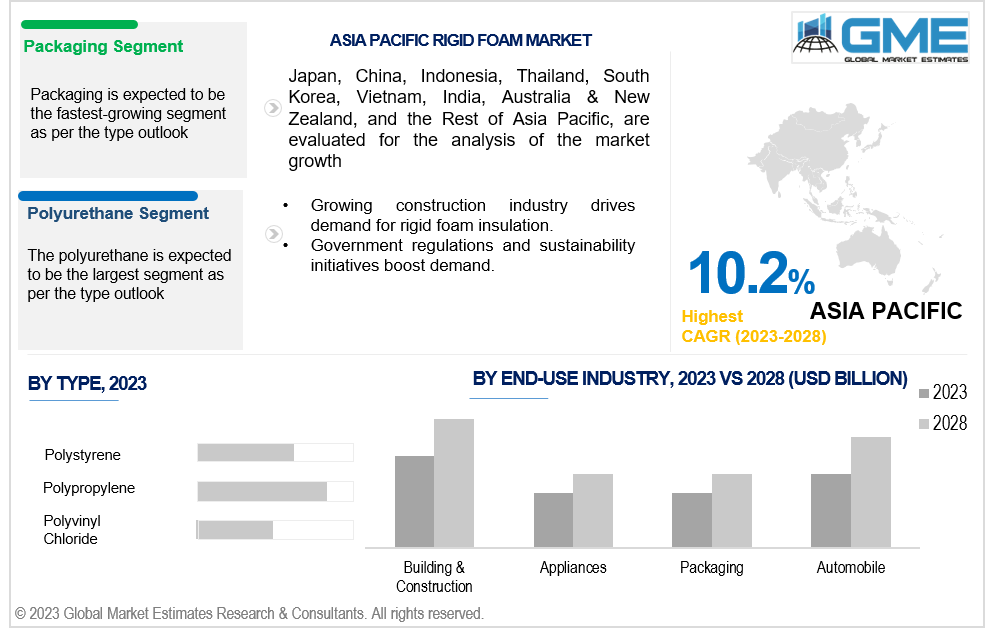

Polyurethane foam segment is expected to hold the largest share in the market. Polyurethane foam is widely utilized in the refrigeration, construction, and packaging industries due to its exceptional insulation properties and dimensional stability. Its high thermal resistance and low thermal conductivity make it an ideal choice for insulating refrigeration units, buildings, and packaging materials. Additionally, its ability to maintain its shape and structural integrity over time ensures long-term effectiveness and reliability in various applications. Polyvinyl Chloride is the fastest growing segment in the market from 2023- 2028. The growth of this market is influenced by various factors such as market demand, technological advancements, regulatory environment, consumer preferences, and industry dynamic

Packaging is anticipated to be the fastest-growing segment in the market from 2023-2028. The combination of the emergence of e-commerce, the rising need for eco-friendly packaging options, and the packaging sector's ongoing technological advancements. Technologies like smart packaging and active packaging, which provide functionalities such as product tracking, temperature control, and freshness indicators, are gaining traction in various sectors, further driving the growth of the packaging segment.

Building and construction segment is expected to hold the largest share of the market due to a various factors. Firstly, the construction industry is witnessing notable growth on a global scale, driven by factors such as population expansion, urbanization, and infrastructure development. As new structures are being erected and existing ones are being renovated, there is a substantial requirement for building and construction materials and products. This increased demand stems from the need to meet the construction industry's diverse requirements in terms of structural components, finishes, and other building elements. Additionally, the increasing focus on energy efficiency, and the favourable properties and benefits offered by plastic-based materials in terms of durability, insulation, sustainability, and design possibilities are further propelling the segment growth.

North America is expected to be the largest region in the market. The key reasons boosting the market is that this region experiences a high level of construction activities, including residential, commercial, and infrastructure projects, contributing to a substantial market size for rigid foam. Technological advancements and product innovations in rigid foam materials are often driven by research and development activities in North America. The region's focus on innovation and advanced manufacturing techniques helps propel the growth and market dominance of the North America region in the rigid foam market.

Asia Pacific is predicted to witness rapid growth during the forecast period. Region's robust economic growth and rapid urbanization are driving significant construction and infrastructure projects. In applications like residential, commercial, and industrial buildings, this generates a significant demand for rigid foam insulation materials. The rising population, increasing urbanization, and the need for energy-efficient solutions further fuel the demand for rigid foam in the construction sector. Technology is advancing, and there are more investments in the area. The creation of rigid foam materials with enhanced performance traits, such as improved thermal insulation, fire resistance, and environmental sustainability, is one example of this. The market is growing as a result of these technological developments and investments because more businesses and manufacturers are using these cutting-edge materials for their applications.

BASF SE, The Dow Chemical Company, Huntsman Corporation, Covestro AG, JSP Corporation, Borealis AG, Sealed Air Corporation, Armacell International S.A, Nitto Deko Corporation, and Zotefoams, among others, are some of the key players in the global rigid foam market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4.2 Rigid Foam: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Polyurethane Foam Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5.1 Polystyrene Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6.1 Polypropylene Foam Market Estimates and Forecast, 2020-2028 (USD Billion)

4.7.1 Polyethylene Foam Market Estimates and Forecast, 2020-2028 (USD Billion)

4.8.1 Polyvniyl Chloride Foam Market Estimates and Forecast, 2020-2028 (USD Billion)

4.9.1 Other Foam Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL RIGID FOAM, BY END-USE INDUSTRY

5.2 Rigid Foam: Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Building & Construction Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5.1 Appliances Market Estimates and Forecast, 2020-2028 (USD Billion)

5.6.1 Packaging Market Estimates and Forecast, 2020-2028 (USD Billion)

5.7 Automobile

5.7.1 Automative Market Estimates and Forecast, 2020-2028 (USD Billion)

5.8.1 Other Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL RIGID FOAM, BY REGION

6.2 North America Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.1 U.S. Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.2 Canada Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.3 Mexico Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.3 Europe Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.1 Germany Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.2 U.K. Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.3 France Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.4 Italy Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.5 Spain Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.6 Netherlands Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.7 Rest of Europe Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.4 Asia Pacific Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.1 China Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.2 Japan Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.3 India Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.4 South Korea Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.5 Singapore Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.6 Malaysia Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.7 Thailand Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.8 Indonesia Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.9 Vietnam Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.10 Taiwan Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.10.2 By End-use Industry

6.4.3.11 Rest of Asia Pacific Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.11.2 By End-use Industry

6.5 Middle East and Africa Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.1 Saudi Arabia Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.2 U.A.E. Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.3 Israel Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.4 South Africa Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.5 Rest of Middle East and Africa Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.6 Central & South America Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.1 Brazil Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.2 Argentina Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.3 Chile Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.3 Rest of Central & South America Rigid Foam Estimates and Forecast, 2020-2028 (USD Billion)

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.4.1.1 Business Description & Financial Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 The Dow Chemical Company

7.4.2.1 Business Description & Financial Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3.1 Business Description & Financial Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4.1 Business Description & Financial Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5.1 Business Description & Financial Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6.1 Business Description & Financial Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7.1 Business Description & Financial Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Armacell International S.A

7.4.8.1 Business Description & Financial Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9.1 Business Description & Financial Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10.1 Business Description & Financial Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11.1 Business Description & Financial Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8.1.2 Market Scope & SegPolystyrenetation

8.2 Information ProcurePolystyrenet

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.4 Discussion Guide for Primary Participants

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Rigid Foam, By TYPE, 2020-2028 (USD Mllion)

2 Polyurethane Foam Market, By Region, 2020-2028 (USD Mllion)

3 Polystyrene Foam Market, By Region, 2020-2028 (USD Mllion)

4 Polypropylene Foam Market, By Region, 2020-2028 (USD Mllion)

5 Polyetheylene Market Foam MArket, By Region, 2020-2028 (USD Mllion)

6 Polyviyl Chloride foam Market, By Region, 2020-2028 (USD Mllion)

7 Global Rigid Foam, By end-use industry, 2020-2028 (USD Mllion)

8 Building & Construction Market, By Region, 2020-2028 (USD Mllion)

9 Appliances Market, By Region, 2020-2028 (USD Mllion)

10 Packaging Market, By Region, 2020-2028 (USD Mllion)

11 Automobile Market, By Region, 2020-2028 (USD Mllion)

12 other Market, By Region, 2020-2028 (USD Mllion)

13 Regional Analysis, 2020-2028 (USD Mllion)

14 North America Rigid Foam, By Type, 2020-2028 (USD Mllion)

15 North America Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

16 U.S. Rigid Foam, By Type, 2020-2028 (USD Mllion)

17 U.S. Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

18 Canada Rigid Foam, By Type, 2020-2028 (USD Mllion)

19 Canada Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

20 Mexico Rigid Foam, By Type, 2020-2028 (USD Mllion)

21 Mexico Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

22 Europe Rigid Foam, By Type, 2020-2028 (USD Mllion)

23 Europe Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

24 Germany Rigid Foam, By Type, 2020-2028 (USD Mllion)

25 Germany Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

26 U.K. Rigid Foam, By Type, 2020-2028 (USD Mllion)

27 U.K. Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

28 France Rigid Foam, By Type, 2020-2028 (USD Mllion)

29 France Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

30 Italy Rigid Foam, By Type, 2020-2028 (USD Mllion)

31 Italy Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

32 Spain Rigid Foam, By Type, 2020-2028 (USD Mllion)

33 Spain Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

34 Netherlands Rigid Foam, By Type, 2020-2028 (USD Mllion)

35 Netherlands Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

36 Rest Of Europe Rigid Foam, By Type, 2020-2028 (USD Mllion)

37 Rest Of Europe Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

38 Asia Pacific Rigid Foam, By Type, 2020-2028 (USD Mllion)

39 Asia Pacific Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

40 China Rigid Foam, By Type, 2020-2028 (USD Mllion)

41 China Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

42 Japan Rigid Foam, By Type, 2020-2028 (USD Mllion)

43 Japan Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

44 India Rigid Foam, By Type, 2020-2028 (USD Mllion)

45 India Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

46 South Korea Rigid Foam, By Type, 2020-2028 (USD Mllion)

47 South Korea Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

48 Singapore Rigid Foam, By Type, 2020-2028 (USD Mllion)

49 Singapore Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

50 Thailand Rigid Foam, By Type, 2020-2028 (USD Mllion)

51 Thailand Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

52 Malaysia Rigid Foam, By Type, 2020-2028 (USD Mllion)

53 Malaysia Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

54 Indonesia Rigid Foam, By Type, 2020-2028 (USD Mllion)

55 Indonesia Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

56 Vietnam Rigid Foam, By Type, 2020-2028 (USD Mllion)

57 Vietnam Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

58 Taiwan Rigid Foam, By Type, 2020-2028 (USD Mllion)

59 Taiwan Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

60 Rest of APAC Rigid Foam, By Type, 2020-2028 (USD Mllion)

61 Rest of APAC Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

62 Middle East & Africa Rigid Foam, By Type, 2020-2028 (USD Mllion)

63 Middle East & Africa Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

64 Saudi Arabia Rigid Foam, By Type, 2020-2028 (USD Mllion)

65 Saudi Arabia Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

66 UAE Rigid Foam, By Type, 2020-2028 (USD Mllion)

67 UAE Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

68 Israel Rigid Foam, By Type, 2020-2028 (USD Mllion)

69 Israel Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

70 South Africa Rigid Foam, By Type, 2020-2028 (USD Mllion)

71 South Africa Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

72 Rest Of Middle East and Africa Rigid Foam, By Type, 2020-2028 (USD Mllion)

73 Rest Of Middle East and Africa Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

74 Central & South America Rigid Foam, By Type, 2020-2028 (USD Mllion)

75 Central & South America Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

76 Brazil Rigid Foam, By Type, 2020-2028 (USD Mllion)

77 Brazil Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

78 Chile Rigid Foam, By Type, 2020-2028 (USD Mllion)

79 Chile Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

80 Argentina Rigid Foam, By Type, 2020-2028 (USD Mllion)

81 Argentina Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

82 Rest Of Central & South America Rigid Foam, By Type, 2020-2028 (USD Mllion)

83 Rest Of Central & South America Rigid Foam, By End-use Industry, 2020-2028 (USD Mllion)

84 BASF SE: Products & Services Offering

85 The Dow Chemical Company: Products & Services Offering

86 Huntsman Corporation: Products & Services Offering

87 Covestro AG: Products & Services Offering

88 JSP Corporation: Products & Services Offering

89 BOREALIS AG: Products & Services Offering

90 Sealed Air Corporation : Products & Services Offering

91 Armacell International S.A: Products & Services Offering

92 Nitto Deko Corporation, Inc: Products & Services Offering

93 Zotefoams: Products & Services Offering

94 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Rigid Foam Overview

2 Global Rigid Foam Value From 2020-2028 (USD Mllion)

3 Global Rigid Foam Share, By Type (2022)

4 Global Rigid Foam Share, By End-use Industry (2022)

5 Global Rigid Foam, By Region (Asia Pacific Market)

6 Technological Trends In Global Rigid Foam

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Rigid Foam

10 Impact Of Challenges On The Global Rigid Foam

11 Porter’s Five Forces Analysis

12 Global Rigid Foam: By Type Scope Key Takeaways

13 Global Rigid Foam, By Type: Revenue Growth Analysis

14 Polyurethane Foam Market, By Region, 2020-2028 (USD Mllion)

15 Polystyrene Foam Market, By Region, 2020-2028 (USD Mllion)

16 Polypropylene Foam Market, By Region, 2020-2028 (USD Mllion)

17 Polyetheylene Foam Market, By Region, 2020-2028 (USD Mllion)

18 Polyviyl Chloride Foam Market, By Region, 2020-2028 (USD Mllion)

19 Global Rigid Foam: By End-use Industry Scope Key Takeaways

20 Global Rigid Foam, By End-use Industry: Revenue Growth Analysis

21 Building & Construction Market, By Region, 2020-2028 (USD Mllion)

22 Appliances Market, By Region, 2020-2028 (USD Mllion)

23 Packaging Market, By Region, 2020-2028 (USD Mllion)

24 Automobile Market, By Region, 2020-2028 (USD Mllion)

25 Other Market, By Region, 2020-2028 (USD Mllion)

26 Regional Segment: Revenue Growth Analysis

27 Global Rigid Foam: Regional Analysis

28 North America Rigid Foam Overview

29 North America Rigid Foam, By Type

30 North America Rigid Foam, By End-use Industry

31 North America Rigid Foam, By Country

32 U.S. Rigid Foam, By Type

33 U.S. Rigid Foam, By End-use Industry

34 Canada Rigid Foam, By Type

35 Canada Rigid Foam, By End-use Industry

36 Mexico Rigid Foam, By Type

37 Mexico Rigid Foam, By End-use Industry

38 Four Quadrant Positioning Matrix

39 Company Market Share Analysis

40 BASF SE: Company Snapshot

41 BASF SE: SWOT Analysis

42 BASF SE: Geographic Presence

43 The Dow Chemical Company: Company Snapshot

44 The Dow Chemical Company: SWOT Analysis

45 The Dow Chemical Company: Geographic Presence

46 Huntsman Corporation: Company Snapshot

47 Huntsman Corporation: SWOT Analysis

48 Huntsman Corporation: Geographic Presence

49 Covestro AG: Company Snapshot

50 Covestro AG: Swot Analysis

51 Covestro AG: Geographic Presence

52 JSP Corporation: Company Snapshot

53 JSP Corporation: SWOT Analysis

54 JSP Corporation: Geographic Presence

55 BOREALIS AG: Company Snapshot

56 BOREALIS AG: SWOT Analysis

57 BOREALIS AG: Geographic Presence

58 Sealed Air Corporation : Company Snapshot

59 Sealed Air Corporation : SWOT Analysis

60 Sealed Air Corporation : Geographic Presence

61 Armacell International S.A: Company Snapshot

62 Armacell International S.A: SWOT Analysis

63 Armacell International S.A: Geographic Presence

64 Nitto Deko Corporation, Inc.: Company Snapshot

65 Nitto Deko Corporation, Inc.: SWOT Analysis

66 Nitto Deko Corporation, Inc.: Geographic Presence

67 Zotefoams: Company Snapshot

68 Zotefoams: SWOT Analysis

69 Zotefoams: Geographic Presence

70 Other Companies: Company Snapshot

71 Other Companies: SWOT Analysis

72 Other Companies: Geographic Presence

The Global Rigid Foam Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Rigid Foam Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS