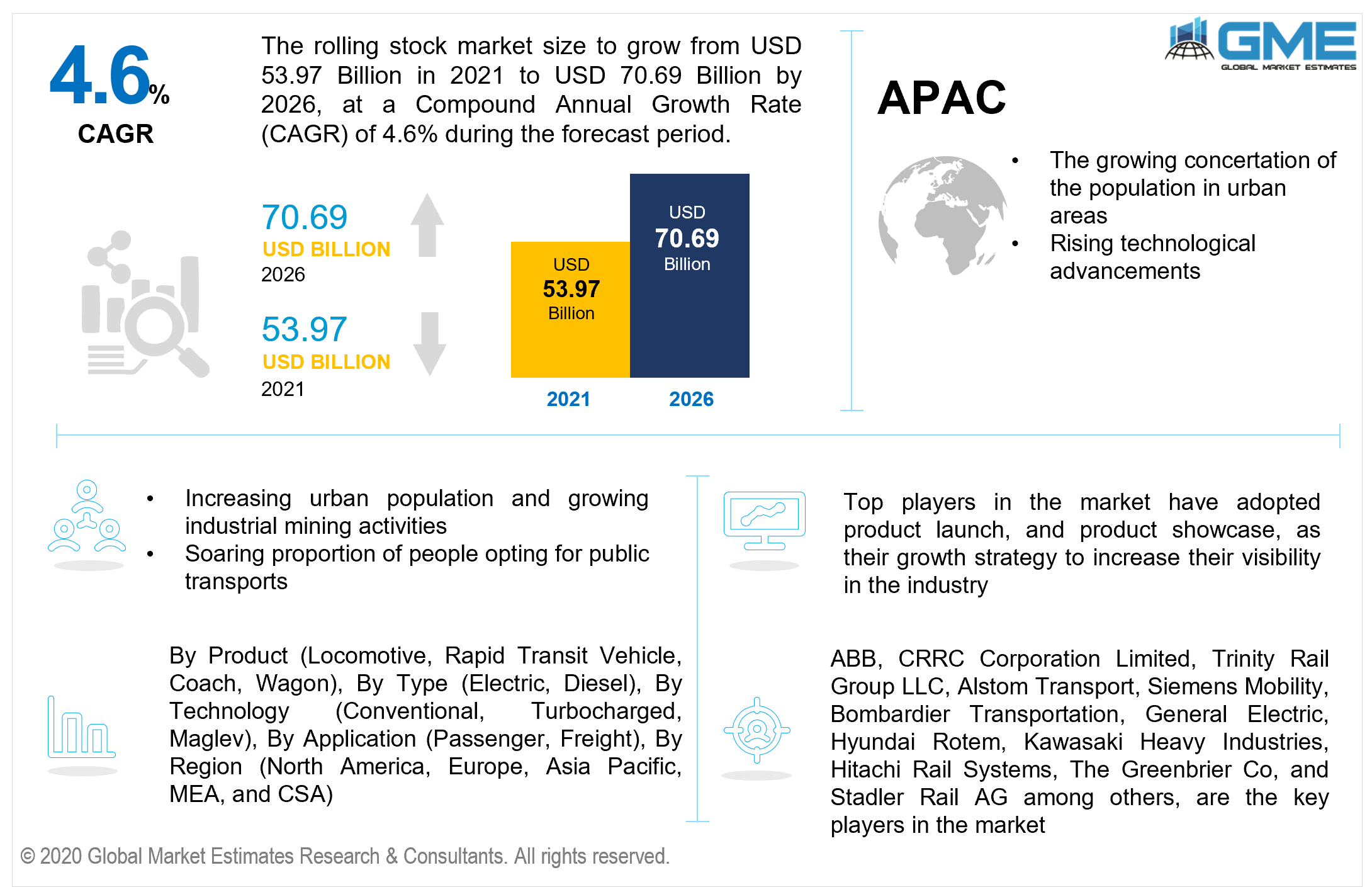

Global Rolling Stock Market Size, Trends & Analysis - Forecasts to 2026 By Product (Locomotive, Rapid Transit Vehicle, Coach, Wagon), By Type (Electric, Diesel), By Technology (Conventional, Turbocharged, Maglev), By Application (Passenger, Freight), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

The global rolling stock market is estimated to be valued at USD 53.97 billion in 2021 and is projected to reach USD 70.69 billion by 2026 at a CAGR of 4.6%. The global rolling stock market forecast indicates that such transit options have made it easier to travel around different locations, with advantages including cost-effectiveness, dependability, and comfort level. Rapid urbanization, traffic congestion, burgeoning ecological considerations, and technological breakthroughs are foreseen to drive demand during the forecast period. Because such product shipments have longer lead times and must last for a protracted period, strenuous research and advancement are required to produce reliable trains. Thus, various corporations and governments are actively participating in this market to render the inexpensive and safest mode of commuting that is more convenient.

The increasing concentration of people in cities is foreseen to enhance the requirement for rail vehicles. Furthermore, because of speedier transportation and contentment, travelers prefer high-speed trains to mainstream trains. As a result, many governments are investing in railways and commuter trains in order to increase the use of public transport rails. Respective governments are enacting strict guidelines and rules in order to increase the utilization of these transit modes. Thus, the global rolling stock market size is presumed to witness an uptick over the forecast period.

The expanding metropolitan demographic and industrial resource extraction operations around the globe, which have propelled the requirements for accelerated commuter trains, local passenger trains, and fast subway trains, are the vital considerations supporting the global market. People are progressively choosing public transportation as a means of transportation because it lessens on-road congestion and offers a time-saving, convenient, and cost-effective option. Furthermore, big data and analytics breakthroughs have aided industrial Original Equipment Manufacturers (OEMs) and distributors in streamlining their operational activities and providing multichannel alternatives, real-time surveillance, and predictive maintenance implementations to these target customers.

Besides this, technological progressions including magnetic levitation trains (Maglev Trains), the use of the Internet of things in communication systems, signaling, technology, and improving onboard travel experience have catalyzed the global market's growth. Companies are offering more sophisticated solutions to further minimize energy usage, which is replenishing the market expansion.

The high capital investment required for research operations is restricting the advancement of players in the market and also revenue growth. Nonetheless, expanding interventions to strengthen rail architecture and facilities for customers, including proposing speedier, secure, and more comfortable services, are establishing opportunities for the market.

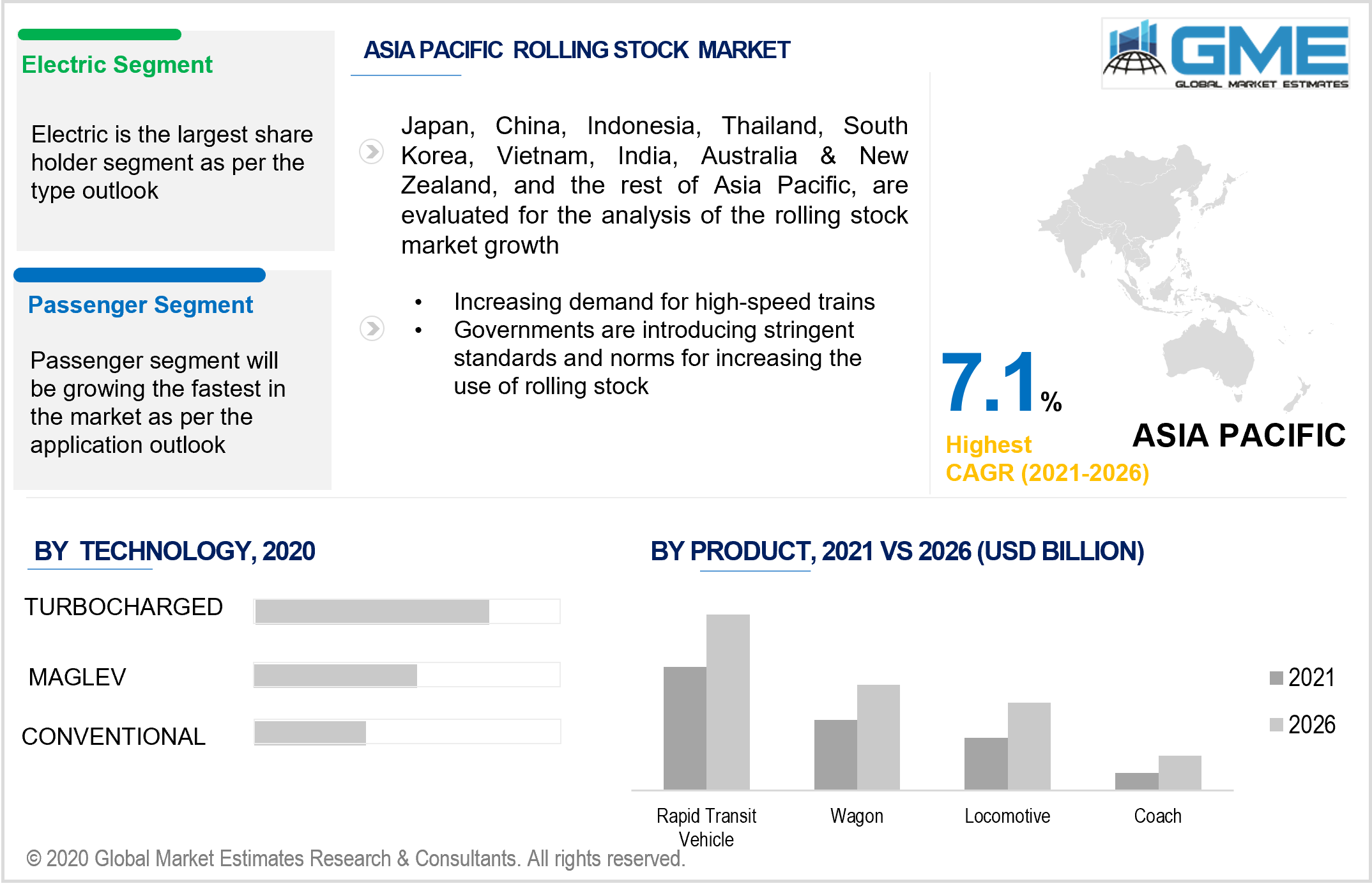

Based on the product, the market is categorized as locomotives, rapid transit vehicles, coaches, and wagons. Due to the high-speed and augmented comfortability functionalities of these trains, the rapid transit vehicle segment is presumed to predominate over the forecast period. Furthermore, the requirement for fully automatic trains and magnetic levitation trains among public transport system end-users is foreseen to rise throughout the forecast period.

Rail wagons are being used for goods mass transit in a multitude of sectors because they are cost-effective and dependable. Numerous corporations and governments around the world are currently investing heavily in replacing their conventional product lines. The most pervasive wagon types for transporting goods are car carrier wagons, flat wagons, hopper wagons, and tank wagons, among several others.

Based on the type, the market is categorized as diesel and electric. The diesel segment is foreseen to predominate. In certain areas, diesel trains are widely utilized for the transportation of bulk goods. They are extensively used for the transportation of goods in sectors such as oil and gas, mining, and industrial production due to their functionalities, including cost-effectiveness and high-torque engines. To meet the growing demand for sophisticated rail vehicles, producers are designing turbocharged diesel vehicles.

The electric segment is presumed to be the fastest-growing segment due to rewards including lessened environmental damage and increased vehicle performance. Electric trains are more environmentally friendly and emit less carbon monoxide than diesel trains. Furthermore, the growing consciousness of ecological pollution is empowering the utilization of electric trains for transportation.

Based on the technology, the market is categorized as conventional, turbocharged, and maglev. The turbocharged segment is foreseen to predominate. The growing demand for faster commute services with higher protection standards is propelling the turbocharged locomotive segment forward. It is coherent with both contemporary small medium-speed diesel and gas engines, as well as large high-speed diesel and gas engines. It has better fuel economy and efficiency. It is lightweight, cost-effective, and robust, and it reduces the amount of power mandated for high-speed propulsion.

Based on the application, the market is categorized as passenger and freight. The passenger segment is foreseen to predominate. The global clamor for passenger rail has been steadily expanding. Furthermore, because passenger rails are the most popular public transportation system, they are less expensive than roadways. Because of their faster means of transportation, commuter trains, metros, and high-speed train services are the most popular passenger rails.

Rail freight is the cornerstone of the logistics system and is utilized to transfer goods to their desired location. Rail freight is used extensively in the automobile industry, oil and gas, mining, and construction sectors. Furthermore, the use of GPS tracking systems and the incorporation of sophisticated technologies have enhanced the performance of these vehicles.

The Asia Pacific region is expected to dominate the market during the forecast period due to the widespread use of rail vehicles for passenger and cargo transportation. Furthermore, the domestic market's expansion can be ascribed to increased investments in the subway and electric railways in economies including China, India, Taiwan, and many others. The Asia Pacific market is also expected to grow at the fastest rate in terms of revenue, attributable to increased infrastructure advancement in the transport sector and an increase in legislative campaigns for the improvement of such train networks in this area's developing countries.

The North American market is foreseen to be one of the most prominent markets. This is due to the involvement of major producers, as well as an increase in the proportion of industrial sectors choosing to use such trains over other modes of transportation.

ABB, CRRC Corporation Limited, Trinity Rail Group LLC, Alstom Transport, Siemens Mobility, Bombardier Transportation, General Electric, Hyundai Rotem, Kawasaki Heavy Industries, Hitachi Rail Systems, The Greenbrier Co, and Stadler Rail AG among others, are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Rolling Stock Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Type Overview

2.1.4 Technology Overview

2.1.5 Application Overview

2.1.6 Regional Overview

Chapter 3 Global Rolling Stock Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Expanding Demand For An Energy-Efficient Transport System

3.3.1.2 Growing Use Of Rail-Lines

3.3.2 Industry Challenges

3.3.2.1 Capital Intensive Rolling Stock

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Type Growth Scenario

3.4.3 Technology Growth Scenario

3.4.4 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Rolling Stock Market, By Product

4.1 Product Outlook

4.2 Locomotive

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Rapid Transit Vehicle

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Coach

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Wagon

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Rolling Stock Market, By Type

5.1 Type Outlook

5.2 Electric

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Diesel

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Rolling Stock Market, By Technology

6.1 Technology Outlook

6.2 Conventional

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Turbocharged

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Maglev

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Rolling Stock Market, By Application

7.1 Application Outlook

7.2 Passenger

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.3 Freight

7.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Global Rolling Stock Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country, 2019-2026 (USD Million)

8.2.2 Market Size, By Product, 2019-2026 (USD Million)

8.2.3 Market Size, By Type, 2019-2026 (USD Million)

8.2.4 Market Size, By Technology, 2019-2026 (USD Million)

8.2.5 Market Size, By Application, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.2.6.2 Market Size, By Type, 2019-2026 (USD Million)

8.2.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.2.6.4 Market Size, By Application, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Type, 2019-2026 (USD Million)

8.2.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.2.7.4 Market Size, By Application, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country, 2019-2026 (USD Million)

8.3.2 Market Size, By Product, 2019-2026 (USD Million)

8.3.3 Market Size, By Type, 2019-2026 (USD Million)

8.3.4 Market Size, By Technology, 2019-2026 (USD Million)

8.3.5 Market Size, By Application, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Type, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.6.4 Market Size, By Application, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Type, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.7.4 Market Size, By Application, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Type, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.8.4 Market Size, By Application, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Type, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.9.4 Market Size, By Application, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Type, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.10.4 Market Size, By Application, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Type, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.11.4 Market Size, By Application, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country, 2019-2026 (USD Million)

8.4.2 Market Size, By Product, 2019-2026 (USD Million)

8.4.3 Market Size, By Type, 2019-2026 (USD Million)

8.4.4 Market Size, By Technology, 2019-2026 (USD Million)

8.4.5 Market Size, By Application, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Type, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.6.4 Market Size, By Application, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Type, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.7.4 Market Size, By Application, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Type, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.8.4 Market Size, By Application, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.9.2 Market size, By Type, 2019-2026 (USD Million)

8.4.9.3 Market size, By Technology, 2019-2026 (USD Million)

8.4.9.4 Market size, By Application, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Type, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.10.4 Market Size, By Application, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country, 2019-2026 (USD Million)

8.5.2 Market Size, By Product, 2019-2026 (USD Million)

8.5.3 Market Size, By Type, 2019-2026 (USD Million)

8.5.4 Market Size, By Technology, 2019-2026 (USD Million)

8.5.5 Market Size, By Application, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Type, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.5.6.4 Market Size, By Application, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Type, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.5.7.4 Market Size, By Application, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Type, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.5.8.4 Market Size, By Application, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country, 2019-2026 (USD Million)

8.6.2 Market Size, By Product, 2019-2026 (USD Million)

8.6.3 Market Size, By Type, 2019-2026 (USD Million)

8.6.4 Market Size, By Technology, 2019-2026 (USD Million)

8.6.5 Market Size, By Application, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Type, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.6.6.4 Market Size, By Application, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Type, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.6.7.4 Market Size, By Application, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Type, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.6.8.4 Market Size, By Application, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 ABB

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 CRRC Corporation Limited

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Trinity Rail Group LLC

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Alstom Transport

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Siemens Mobility

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Bombardier Transportation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 General Electric

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Hyundai Rotem

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Kawasaki Heavy Industries

7.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Hitachi Rail Systems

7.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 The Greenbrier Co

7.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Stadler Rail AG

7.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

9.14 Other Companies

7.14.1 Company Overview

9.14.2 Financial Analysis

9.14.3 Strategic Positioning

9.14.4 Info Graphic Analysis

The Global Rolling Stock Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Rolling Stock Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS