Global Salad Dressings & Mayonnaise Market Size, Trends & Analysis - Forecasts to 2026 By Product (Salad Dressings, Mayonnaise), By Application (Daily Use, Food Industry), By Region (North America, Europe, Asia Pacific, MEA, and CSA), End-User Landscape, Company Market Share Analysis, and Competitor Analysis

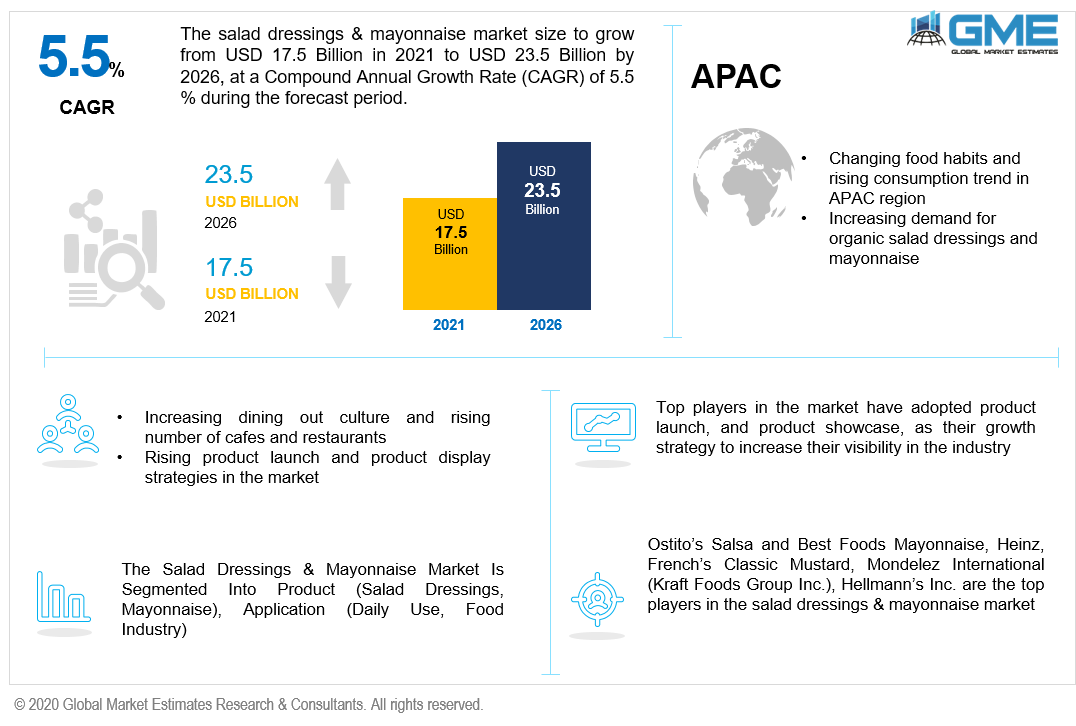

The global salad dressings & mayonnaise market size is projected to grow from USD 17.5 billion in 2021 to USD 23.5 billion by 2026 at a CAGR value of 5.5%. Some of the key driving factors that are accelerating the salad dressings & mayonnaise market are increasing dining out culture, increasing number of cafes and restaurants along with the rising efforts of food manufacturers to provide organic and natural salad dressing. People have become more and more health-conscious, and they are incorporating salads into their diets. Hence the salad dressing market is increasing with a rising trend of a healthy lifestyle in developed and developing countries.

Moreover, the increasing demand for organic salad dressing is expected to be fuelled by the rising propensity for continental cuisines, where organic salad dressing is used extensively. One of the major factors expected to drive the growth of the worldwide salad dressings and mayonnaise market in the forecast period is the growing trend of adopting salads, fast food, and soups. Increasing customer consciousness about the use of salad dressing and mayonnaise products is projected to fuel the demand in the market from 2021 to 2026.

Furthermore, key market players are entering the market by adopting attractive manufacturing and packaging techniques, which is also boosting the market. Increased demand for healthier food items like salads has resulted from health and obesity concerns, which is projected to benefit the salad dressing and mayonnaise market.

Salad dressings are salad side dishes that are made by incorporating condiments such as milk, sauces, nuts, and cheese to enhance the consumer's taste and flavour. Mayonnaise is a rich, thick sauce made from egg yolk, vinegar, milk, and lemon juice. It's used to make sandwiches or as a sauce. It often serves as a creamy accompaniment to salads and strengthens their flavour by its constituents, which adds a tasty flavour to the products and makes them taste yummy. Salad dressings and mayonnaise are segmented in this market research study into fluffy salad toppings, low-calorie pasta sauces, potato salad seasonings, and mayonnaise.

Mayonnaise and salad dressings are prepared liquid or semisolid foods, which are used to flavour food and mouthfeel to food. Mayonnaise is an oil-in-water solution that is not heat-treated but is stable due to low water action. Due to the higher water content of certain mayonnaise-like products and salad dressings, chemical preservatives are used to maintain shelf stability.

Fresh veggies, pickled vegetables or relish, fermented foods like vinegar or soy sauce, almonds, and canned or fresh fruit can all be used in salad dressings. Salad dressings are a perfect way to boost the salad's nutrient, mineral, and antioxidant content. Mayonnaise comes in a variety of colours, but it's most often white peach or light yellow. It may have a soft cream texture or a heavy gel texture. Mustard is also a popular ingredient in countries inspired by French culture, but it transforms the sauces into a dipping sauce with a different taste and serves as an extra emulsifier.

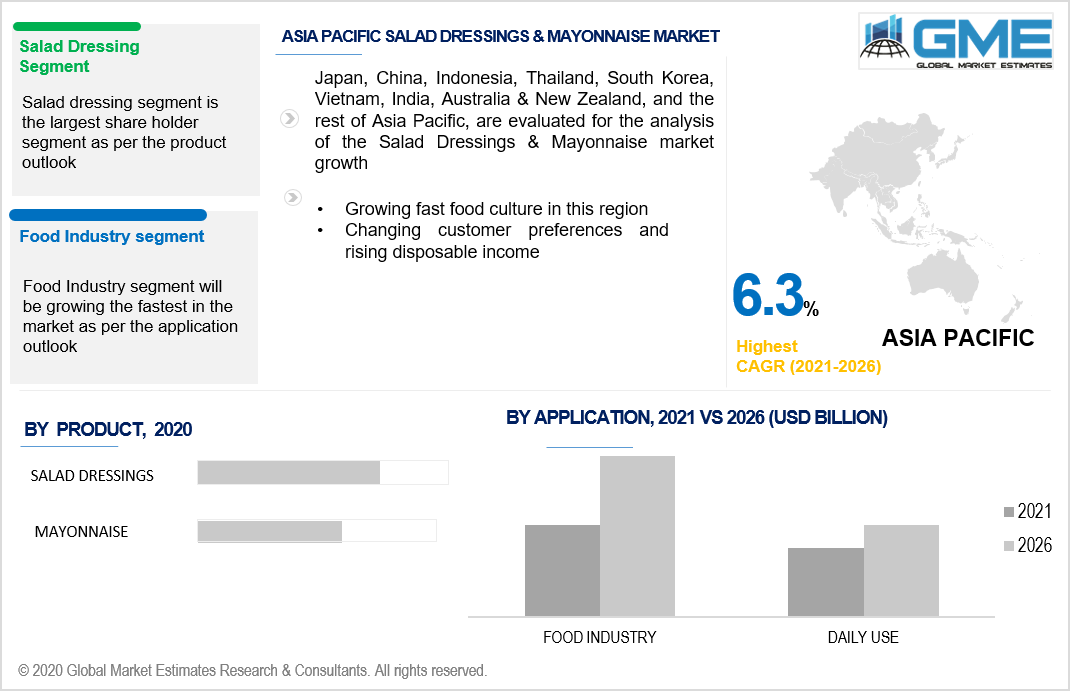

Based on the product type, the salad dressings & mayonnaise market can be segmented as salad dressings and mayonnaise. The salad dressing segment is likely to rise during the forecast period. Salad dressings made of oil expand in volume faster than reduced-fat dressings and cream-based dressings. Dressings with a cultural flavor profile are predicted to be in high demand. Salad dressings dependent on oil, which will accelerate value-driven growth over the expected era, have paved the way due to the incorporation of flavor technologies with higher-end additives. Hence, salad dressing will be having a larger share in the market than the other segment.

Based on the application, the salad dressings & mayonnaise market is divided into daily use and food industry. The food industry is analyzed to be the dominating segment in the market from 2021 to 2026. The salad dressings and mayonnaise used in the food industry have increased due to the increased customer preferences and changing food consumption trends. The market has witnessed launch of various types of salad dressing items and a variety of mayonnaise to fulfil the rising demand from the Asian countries and other third-world countries. Hence this segment will be rising during the forecast period of 2021 to 2026.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America.

North America and Europe are analyzed to be the top regional segments in terms of market value and revenue owing to the flourishing food industry. Another aspect that is expected to fuel the growth of the salad dressing and mayonnaise industry in North America is the emergence of a significant number of players and rising consumption and demand for salad dressing items.

Furthermore, the increasing attention of major players on expanding their global business in the Asian countries is expected to support market growth in the Asia Pacific segment. Besides that, one of the key reasons expected to encourage the development of the APAC demand for salad dressing and mayonnaise is the growing prevalence of fast food in developing economies. Changing customer-eating preferences and increasing disposable income are expected to fuel demand for salad dressings and mayonnaise in the APAC region during the forecast period.

Ostito’s Salsa and Best Foods Mayonnaise, McCormick, Campbell Soup Company, Dr. Oetker, Heinz, French’s Classic Mustard, Mondelez International (Kraft Foods Group Inc.), Hellmann’s Inc., KENKO Mayonnaise, and Unilever Plc, are the top players in the salad dressings & mayonnaise market.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2021, Unilever entered into collaboration with food-tech based company ENOUGH to bring new plant-based meat products to the market.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Salad Dressings and Mayonnaise Market Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Salad Dressings and Mayonnaise Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing demand and consumption of processed food products

3.3.2 Industry challenges

3.3.2.1 Lack of reach of key market players in third world countries

3.4 Prospective Growth Scenario

3.4.1 Product Overview

3.4.2 Application Overview

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Salad Dressings and Mayonnaise Market, By Application

4.1 Application Outlook

4.2 Daily Use

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Food Industry

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Global Salad Dressings and Mayonnaise Market, By Product

5.1 Product Outlook

5.2 Salad Dressings

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Mayonnaise

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Global Salad Dressings and Mayonnaise Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Billion)

6.2.2 Market Size, By Application, 2019-2026 (USD Billion)

6.2.3 Market Size, By Product, 2019-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Application, 2019-2026 (USD Billion)

6.2.4.2 Market Size, By Product, 2019-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Application, 2019-2026 (USD Billion)

6.2.5.2 Market Size, By Product, 2019-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Billion)

6.3.2 Market Size, By Application, 2019-2026 (USD Billion)

6.3.3 Market Size, By Product, 2019-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Application, 2019-2026 (USD Billion)

6.3.4.2 Market Size, By Product, 2019-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Application, 2019-2026 (USD Billion)

6.3.5.2 Market Size, By Product, 2019-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Application, 2019-2026 (USD Billion)

6.3.6.2 Market Size, By Product, 2019-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Application, 2019-2026 (USD Billion)

6.3.7.2 Market Size, By Product, 2019-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Application, 2019-2026 (USD Billion)

6.3.8.2 Market Size, By Product, 2019-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Application, 2019-2026 (USD Billion)

6.3.9.2 Market Size, By Product, 2019-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Billion)

6.4.2 Market Size, By Application, 2019-2026 (USD Billion)

6.4.3 Market Size, By Product, 2019-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Application, 2019-2026 (USD Billion)

6.4.4.2 Market Size, By Product, 2019-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Application, 2019-2026 (USD Billion)

6.4.5.2 Market Size, By Product, 2019-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Application, 2019-2026 (USD Billion)

6.4.6.2 Market Size, By Product, 2019-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Application, 2019-2026 (USD Billion)

6.4.7.2 Market size, By Product, 2019-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Application, 2019-2026 (USD Billion)

6.4.8.2 Market Size, By Product, 2019-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Billion)

6.5.2 Market Size, By Application, 2019-2026 (USD Billion)

6.5.3 Market Size, By Product, 2019-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Application, 2019-2026 (USD Billion)

6.5.4.2 Market Size, By Product, 2019-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Application, 2019-2026 (USD Billion)

6.5.5.2 Market Size, By Product, 2019-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Application, 2019-2026 (USD Billion)

6.5.6.2 Market Size, By Product, 2019-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Billion)

6.6.2 Market Size, By Application, 2019-2026 (USD Billion)

6.6.3 Market Size, By Product, 2019-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Application, 2019-2026 (USD Billion)

6.6.4.2 Market Size, By Product, 2019-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Application, 2019-2026 (USD Billion)

6.6.5.2 Market Size, By Product, 2019-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Application, 2019-2026 (USD Billion)

6.6.6.2 Market Size, By Product, 2019-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Ostito’s Salsa and Best Foods Mayonnaise

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info-Graphic Analysis

7.3 McCormick

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info-Graphic Analysis

7.4 Campbell Soup Company

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info-Graphic Analysis

7.5 Dr. Oetker

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info-Graphic Analysis

7.6 Heinz

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info-Graphic Analysis

7.7 French’s Classic Mustard

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info-Graphic Analysis

7.8 Mondelez International (Kraft Foods Group Inc.)

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info-Graphic Analysis

7.9 KENKO Mayonnaise

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info-Graphic Analysis

7.10 Unilever Plc

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info-Graphic Analysis

7.11 Hellmann’s Inc.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info-Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info-Graphic Analysis

The Global Salad Dressings & Mayonnaise Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Salad Dressings & Mayonnaise Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS