Saudi Arabia Construction Equipment Market Size, Trends & Analysis - Forecasts to 2028 By Machinery Type (Cranes, Earthmoving Equipment, Material Handling Equipment, Bulldozers, Dump Trucks, and Aerial Work Platform) and By Sector Type (Building, Infrastructure, and Energy), Competitive Landscape, Company Market Share Analysis, and End User Analysis

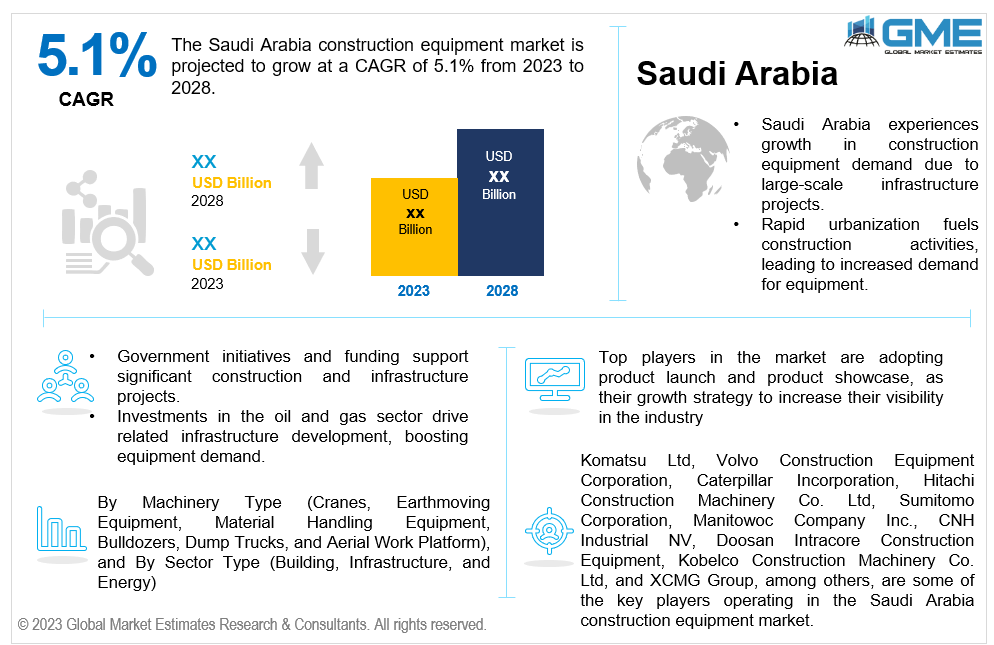

Saudi Arabia construction equipment market is projected to grow at a CAGR of 5.1% from 2023 to 2028.

The market growth is contributed by increasing construction projects in Saudi Arabia, driving the need for construction equipment. For example, NEOM is a futuristic mega-city project in Saudi Arabia. The city will be divided into 10 different zones, each serving a unique purpose. These include a floating port, a ski resort in the Sarwat Mountains, a mirrored city, luxury island destinations like Sindalah and Trojena, and the flagship city known as THE LINE. Whether supporting the logistics for construction, or maintaining supply chains, there is a need for advanced material handling equipment in NEOM city .

The government's commitment to large-scale construction projects, such as the ESKAN project and the construction of 1.5 million housing units, substantially boosts the construction sector. Government-led initiatives play an important role in stimulating economic activity and creating a demand for construction machinery.

The presence of reliable construction equipment suppliers in the Kingdom of Saudi Arabia (KSA) is crucial in meeting the increasing demand for machinery. Adopting advanced road construction equipment in Dammam and other regions enhances the efficiency of infrastructure development projects, contributing to the overall growth of the construction sector. For instance, Doosan Infracore has achieved a significant milestone by securing orders for 75 medium and large excavators from major customers in Saudi Arabia.

Increasing construction equipment leasing supports smaller construction businesses and new market entrants, contributing to market growth. Construction machinery leasing options in Jeddah, tower crane rental in Mecca, and earthmoving equipment rental in Riyadh and other key regions make it easier for businesses to access the needed equipment, fostering market accessibility and growth.

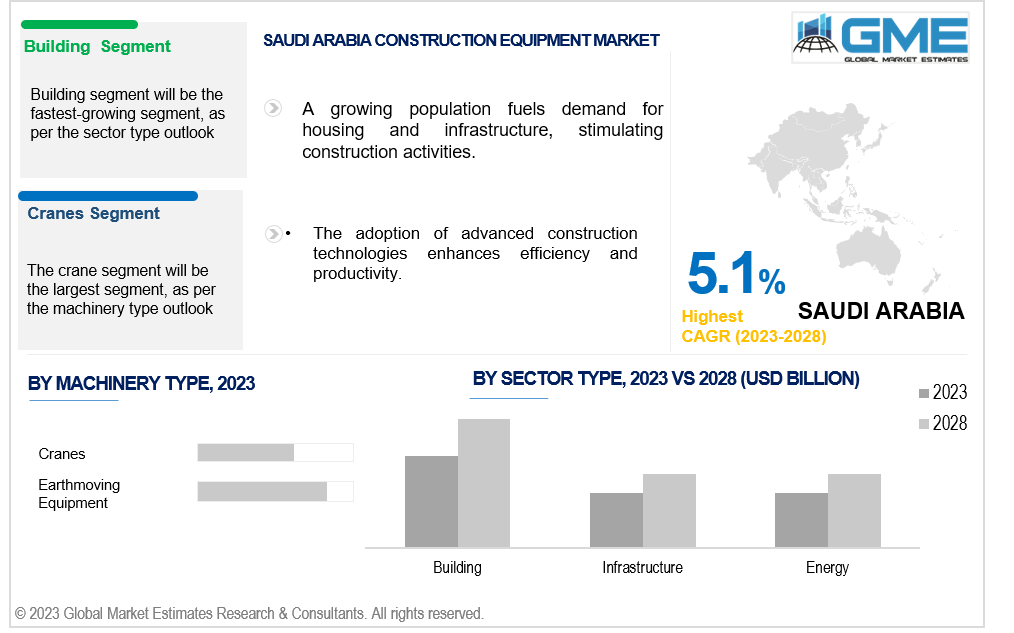

The cranes segment is expected to hold the largest share of the market over the forecast period. The segment's dominance is due to the extensive urban development and infrastructure projects in Saudi Arabia, driving demand for lifting equipment. The Line is a ground-breaking megaproject located in Tabuk, NEOM, Saudi Arabia. The broader NEOM initiative, aligned with Saudi Vision 2030, aims to diversify and boost the country's economy. Tower cranes, in particular, are poised for substantial growth, given their pivotal role in city and airport redevelopment. Significant players like XCMG, Liebherr, and Mammoet further contribute to Saudi Arabia's construction equipment market growth by offering heavy-lifting equipment such as crawler cranes.

The earthmoving equipment segment is expected to be the fastest-growing segment in the market from 2023-2028. The surge in construction projects, including expanding new railway lines, drives demand for earthmoving equipment such as loaders and excavators. The industry's focus on sustainable practices and green building construction also fosters a rising demand for energy-efficient equipment. Construction companies' commitment to minimizing emissions throughout the project lifecycle is compelling manufacturers to innovate and develop advanced, eco-friendly earthmoving machinery, contributing to the segment's rapid growth.

The energy segment is expected to hold the largest market share, attributed to the nation's extensive investment in infrastructure projects related to oil, gas, and renewable energy, which also results in growing demand for mining equipment in Saudi Arabia. With the Kingdom's commitment to diversifying its economy and expanding its energy capabilities, there is a heightened demand for construction equipment to support the development of refineries, pipelines, and power generation facilities. This sector's prominence is further underscored by Saudi Arabia's strategic position as a global energy player, necessitating significant investments in construction machinery to enhance and maintain its energy infrastructure, making it the largest segment in the market.

The building segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The growth is attributed to the growing Saudi building projects. Saudi Arabia is rapidly transforming its economy through the Vision 2030 project, diversifying beyond oil projects, with a focus on non-oil sector revenue and extensive megaprojects like Neom, Qiddiya, Al-Ula, and the Red Sea Project; substantial investments are driving construction activities. The government's commitment to Giga projects, including housing strategies like 'The Sakani program,' emphasizes the development of over 1.5 million homes, addressing housing shortages.

Komatsu Ltd, Volvo Construction Equipment Corporation, Caterpillar Incorporation, Hitachi Construction Machinery Co. Ltd, Sumitomo Corporation, Manitowoc Company Inc., CNH Industrial NV, Doosan Intracore Construction Equipment, Kobelco Construction Machinery Co. Ltd, and XCMG Group, among others, are some of the key players operating in the Saudi Arabia construction equipment market.

Please note: This is not an exhaustive list of companies profiled in the report.

In August 2023, XCMG Machinery, a leading construction machinery manufacturer, officially launched its subsidiary company in Saudi Arabia, signalling a strategic move to enhance its presence in the Middle East. The inauguration ceremony took place in Riyadh, focusing on establishing a comprehensive sales and service network to better cater to the local market's needs and contribute to Saudi Arabia's ongoing development initiatives.

In February 2023, the King Abdullah Financial District Development and Management Company (KAFD DMC) in Saudi Arabia and Sumitomo Corporation Middle East (SCME) signed a memorandum of understanding (MoU) to take advantage of Sumitomo's cutting-edge environmentally friendly coating solutions. The goal is to reduce the heat island effect on surfaces within Saudi Arabia's central financial hub, the King Abdullah Financial District (KAFD), the region's most significant mixed-use development.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 SAUDI ARABIA CONSTRUCTION EQUIPMENT MARKET, BY MACHINERY TYPE

4.1 Introduction

4.2 Saudi Arabia Construction Equipment Market: Machinery Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Cranes

4.4.1 Cranes Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Earthmoving Equipment

4.5.1 Earthmoving Equipment Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Material Handling Equipment

4.6.1 Material Handling Equipment Market Estimates and Forecast, 2020-2028 (USD Million)

4.7 Bulldozers

4.7.1 Bulldozers Market Estimates and Forecast, 2020-2028 (USD Million)

4.8 Dump Trucks

4.8.1 Dump Trucks Market Estimates and Forecast, 2020-2028 (USD Million)

4.9 Aerial Work Platform

4.9.1 Aerial Work Platform Market Estimates and Forecast, 2020-2028 (USD Million)

5 SAUDI ARABIA CONSTRUCTION EQUIPMENT MARKET, BY SECTOR TYPE

5.1 Introduction

5.2 Saudi Arabia Construction Equipment Market: Sector Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Building

5.4.1 Building Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Infrastructure

5.5.1 Infrastructure Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Energy

5.6.1 Energy Market Estimates and Forecast, 2020-2028 (USD Million)

6 SAUDI ARABIA CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY

6.1 Saudi Arabia Construction Equipment Market Estimates and Forecast, 2020-2028 (USD Million)

6.1.1 By Machinery Type

6.1.2 By Sector Type

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Komatsu Ltd

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Volvo Construction Equipment Corporation

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Caterpillar Incorporation

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Hitachi Construction Machinery Co. Ltd

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Sumitomo Corporation

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Manitowoc Company Inc.

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 CNH Industrial NV

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Doosan Intracore Construction Equipment

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Kobelco Construction Machinery Co. Ltd

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 XCMG Group

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Saudi Arabia Construction Equipment Market, By Machinery Type, 2020-2028 (USD Mllion)

2 Cranes Market, By Region, 2020-2028 (USD Mllion)

3 Earthmoving Equipment Market, By Region, 2020-2028 (USD Mllion)

4 Material Handling Equipment Market, By Region, 2020-2028 (USD Mllion)

5 Bulldozers Market, By Region, 2020-2028 (USD Mllion)

6 Dump Trucks Market, By Region, 2020-2028 (USD Mllion)

7 Aerial Work Platform Market, By Region, 2020-2028 (USD Mllion)

8 Saudi Arabia Construction Equipment Market, By Sector Type, 2020-2028 (USD Mllion)

9 Building Market, By Region, 2020-2028 (USD Mllion)

10 Infrastructure Market, By Region, 2020-2028 (USD Mllion)

11 Energy Market, By Region, 2020-2028 (USD Mllion)

12 Regional Analysis, 2020-2028 (USD Mllion)

13 Middle East and Africa Saudi Arabia Construction Equipment Market, By Machinery Type, 2020-2028 (USD Mllion)

14 Middle East and Africa Saudi Arabia Construction Equipment Market, By sector Type, 2020-2028 (USD Mllion)

15 Middle East and Africa Saudi Arabia Construction Equipment Market, By country, 2020-2028 (USD Mllion)

16 Saudi Arabia Saudi Arabia Construction Equipment Market, By Machinery Type, 2020-2028 (USD Mllion)

17 Saudi Arabia Saudi Arabia Construction Equipment Market, By Sector Type, 2020-2028 (USD Mllion)

18 Komatsu Ltd: Products & Services Offering

19 Volvo Construction Equipment Corporation: Products & Services Offering

20 Caterpillar Incorporation: Products & Services Offering

21 Hitachi Construction Machinery Co. Ltd: Products & Services Offering

22 Sumitomo Corporation: Products & Services Offering

23 MANITOWOC COMPANY INC.: Products & Services Offering

24 CNH Industrial NV : Products & Services Offering

25 Doosan Intracore Construction Equipment: Products & Services Offering

26 Kobelco Construction Machinery Co. Ltd, Inc: Products & Services Offering

27 XCMG Group: Products & Services Offering

28 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Saudi Arabia Construction Equipment Market Overview

2 Saudi Arabia Construction Equipment Market Value From 2020-2028 (USD Mllion)

3 Saudi Arabia Construction Equipment Market Share, By Machinery Type (2022)

4 Saudi Arabia Construction Equipment Market Share, By Sector Type (2022)

5 Technological Trends In Saudi Arabia Construction Equipment Market

6 Four Quadrant Competitor Positioning Matrix

7 Impact Of Macro & Micro Indicators On The Market

8 Impact Of Key Drivers On The Saudi Arabia Construction Equipment Market

9 Impact Of Challenges On The Saudi Arabia Construction Equipment Market

10 Porter’s Five Forces Analysis

11 Saudi Arabia Construction Equipment Market: By Machinery Type Scope Key Takeaways

12 Saudi Arabia Construction Equipment Market, By Machinery Type Segment: Revenue Growth Analysis

13 Cranes Market, By Region, 2020-2028 (USD Mllion)

14 Earthmoving Equipment Market, By Region, 2020-2028 (USD Mllion)

15 Material Handling Equipment Market, By Region, 2020-2028 (USD Mllion)

16 Bulldozers Market, By Region, 2020-2028 (USD Mllion)

17 Dump Trucks Market, By Region, 2020-2028 (USD Mllion)

18 Aerial Work Platform Market, By Region, 2020-2028 (USD Mllion)

19 Saudi Arabia Construction Equipment Market: By Sector Type Scope Key Takeaways

20 Saudi Arabia Construction Equipment Market, By Sector Type Segment: Revenue Growth Analysis

21 Building Market, By Region, 2020-2028 (USD Mllion)

22 Infrastructure Market, By Region, 2020-2028 (USD Mllion)

23 Energy Market, By Region, 2020-2028 (USD Mllion)

24 Country Segment: Revenue Growth Analysis

25 Four Quadrant Positioning Matrix

26 Company Market Share Analysis

27 Komatsu Ltd: Company Snapshot

28 Komatsu Ltd: SWOT Analysis

29 Komatsu Ltd: Geographic Presence

30 Volvo Construction Equipment Corporation: Company Snapshot

31 Volvo Construction Equipment Corporation: SWOT Analysis

32 Volvo Construction Equipment Corporation: Geographic Presence

33 Caterpillar Incorporation: Company Snapshot

34 Caterpillar Incorporation: SWOT Analysis

35 Caterpillar Incorporation: Geographic Presence

36 Hitachi Construction Machinery Co. Ltd: Company Snapshot

37 Hitachi Construction Machinery Co. Ltd: Swot Analysis

38 Hitachi Construction Machinery Co. Ltd: Geographic Presence

39 Sumitomo Corporation: Company Snapshot

40 Sumitomo Corporation: SWOT Analysis

41 Sumitomo Corporation: Geographic Presence

42 Manitowoc Company Inc.: Company Snapshot

43 Manitowoc Company Inc.: SWOT Analysis

44 Manitowoc Company Inc.: Geographic Presence

45 CNH Industrial NV : Company Snapshot

46 CNH Industrial NV : SWOT Analysis

47 CNH Industrial NV : Geographic Presence

48 Doosan Intracore Construction Equipment: Company Snapshot

49 Doosan Intracore Construction Equipment: SWOT Analysis

50 Doosan Intracore Construction Equipment: Geographic Presence

51 Kobelco Construction Machinery Co. Ltd, Inc.: Company Snapshot

52 Kobelco Construction Machinery Co. Ltd, Inc.: SWOT Analysis

53 Kobelco Construction Machinery Co. Ltd, Inc.: Geographic Presence

54 XCMG Group: Company Snapshot

55 XCMG Group: SWOT Analysis

56 XCMG Group: Geographic Presence

57 Other Companies: Company Snapshot

58 Other Companies: SWOT Analysis

59 Other Companies: Geographic Presence

The Saudi Arabia Construction Equipment Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Saudi Arabia Construction Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS