Global Savory Ingredients Market Size, Trends & Analysis - Forecasts to 2026 By Product (Yeast Extracts, Hydrolyzed Vegetable Proteins (HVP), Hydrolyzed Animal Proteins (HAP), Monosodium Glutamate (MSG), Nucleotides, Others), By Application (Food, Pet Food), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

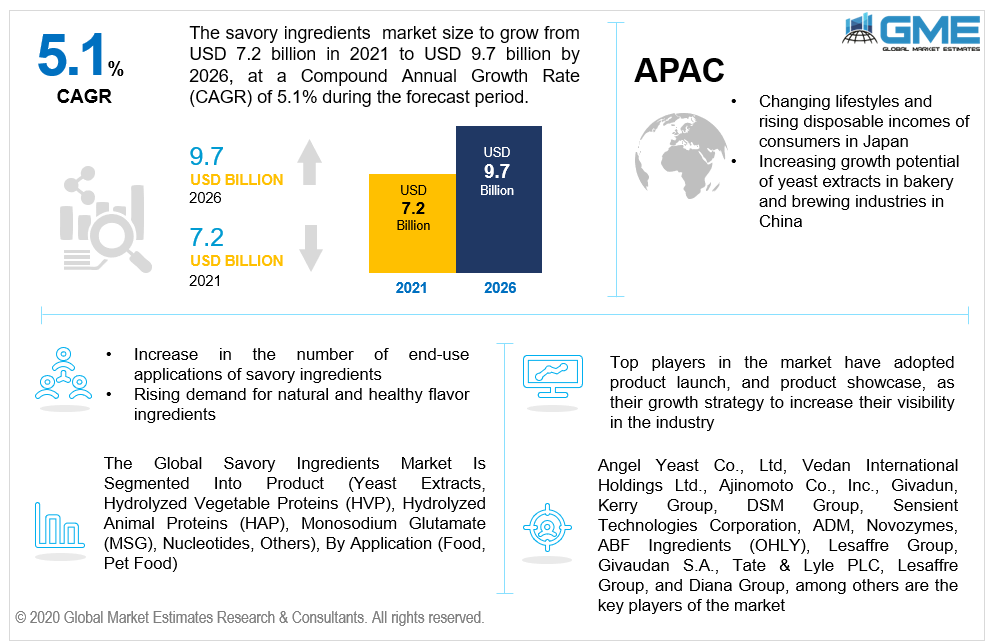

The global savory ingredients market will grow from USD 7.2 billion in 2021, to USD 9.7 billion in 2026 projected with a CAGR value of 5.1% from 2021 to 2026. Savory ingredients are flavour enhancers that have features that allow them to change the flavour of food without adding any additional flavors.

The shift in customer preference for organic goods due to rising health concerns and the rising awareness of negative effects from artificial food chemicals are contributing significantly to the market's growth. Consumer feeding habits have changed as a result of rising disposable income coupled with busy lifestyles, resulting in a shift in consumption patterns of convenience meals to save time usually spent on food preparation. Savory additives are flavour enhancers that change the taste of food items during processing to increase product quality and shelf life. These food additives contribute to the improvement of the fragrance, flavor, and taste of food products. These substances impart a natural aromatic taste and are commonly used in the manufacture of quick meals, meat products, nutritious food, and spices.

Furthermore, because these ingredients are inexpensive, they are frequently used in the food processing sector to make packaged food items, which is likely to drive market growth. The surge in popularity of clean label goods is mostly due to an increase in consumer health concerns and an increase in consumer understanding of the health advantages of clean ingredient-based food items.

Organically grown food is more likely to be seen as a healthier and more nutritious option by consumers than conventionally grown foods. The shift in customer preference for organic goods due to health concerns and the avoidance of negative effects from artificial chemicals contributes significantly to the market's growth.

Furthermore, awareness of the medicinal benefits of organic food, together with advancements in organic cultivating techniques, are expected to boost the desire for natural nutrition and beverages, hence increasing the need for natural-based savory components such as yeast extract and starch. Increased discretionary money necessitates a higher level of life.

Convenience foods help to balance work life and stress-related challenges by reducing meal preparation time. These ingredients are used to improve the flavour and scent of food items. Consumption of ready-to-eat and ready-to-cook items is increasing as a result of a more busy lifestyle and greater disposable income. Furthermore, because savory ingredients are inexpensive, food makers frequently utilize them as thickening agents, stabilizers, and emulsifiers in a variety of food items. It also contributes to the enhancement of a food product's overall flavour.

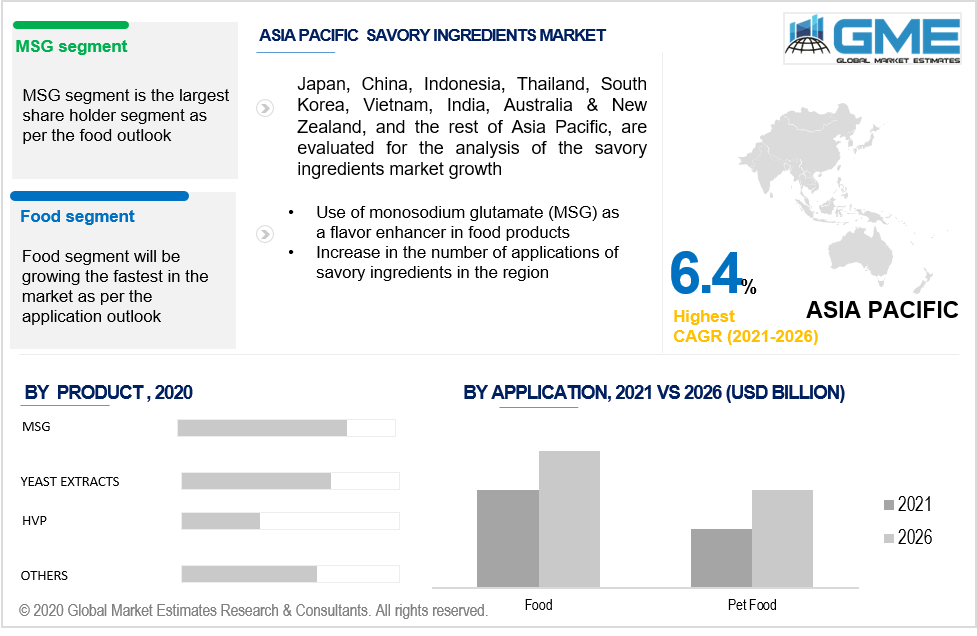

Based on the products the market is divided into yeast extracts, hydrolyzed vegetable proteins (HVP), hydrolyzed animal proteins (HAP), & monosodium glutamate (MSG). Monosodium glutamate is estimated to hold the largest market share and is also projected to expand at the fastest CAGR during the forecast period. This is due to MSG's low cost and wide range of applications in food and feed.

Despite the fact that it has no taste, it is commonly added to food to enhance the salty or sweet flavor. MSG is commonly used to season processed foods such as soy sauce, ready-to-eat meals, snacks, sausages, preserved fish, ketchup, soups, mayonnaise, gravies, and other seafood. The increasing disposable income is expected to support the growth of the market throughout the forecast period.

Based on the application, the market is segregated into food, and pet food. Food goods with low prices, such as curries, soups, sausages, and pasta, are expected to drive market demand in the future years. The pet food business is expected to develop at a rapid CAGR due to the increasing number of low-cost companies catering to this market. The growing knowledge of the advantages and convenience that pet food provides is expected to drive demand for savory ingredients in pet food. Hydrolyzed animal proteins are expected to become increasingly popular in the animal feed and pet food industries in the over the forecast timeframe.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America.

The APAC region is expected to hold the largest share in the market during the forecast period. There are large investments made in the manufacturing industries, which will drive the market for different industries majorly in the market over the forecast period. Growing applications and manufacturing facilities in Europe are likely to drive market demand throughout the projected period. The increasing use of savory ingredients in the animal feed and pet food industries is likely to boost future growth. Moreover, the Asia Pacific region is also expected to grow the fastest during the forecast period. This region's growth is being driven by the rising consumption of ready-to-eat foods.

Angel Yeast Co., Ltd, Vedan International Holdings Ltd., Ajinomoto Co., Inc., Givadun, Kerry Group, DSM Group, Sensient Technologies Corporation, ADM, Novozymes, ABF Ingredients (OHLY), Lesaffre Group, Givaudan S.A., Tate & Lyle PLC, Lesaffre Group, and Diana Group, among others are the major manufacturers of the market and are working on various marketing strategies, including R&D activities, a growing number of collaborations, awareness programs, technological progress, geographical expansion, and the launching of new products, to increase their market share.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2020, Kerry Group established its new regional development and food manufacturing plant In Georgia, Rome. This new plant will allow the company to serve better to its European customers, enhance manufacturing capacity, and expand its geographic reach.

In December 2019, Angel Yeast Co., Ltd introduced its new flavor-enhancing solutions for plant-based food and beverages in Europe. This product launch aided the company in strengthening its portfolio and expanding its European consumer base.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Savory Ingredients Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.1 Product Overview

2.1.3 Application Overview

Chapter 3 Global Savory Ingredients Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increase in the number of end-use applications of savory ingredients

3.3.2 Industry Challenges

3.3.2.1 Consumer awareness about the ill-effects of flavor enhancers

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Savory Ingredients Market, By Product

4.1 Product Outlook

4.2 Yeast Extracts

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Hydrolyzed Vegetable Proteins (HVP)

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Hydrolyzed Animal Proteins (HAP)

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Monosodium Glutamate (MSG)

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Nucleotides

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Others

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Savory Ingredients Market, By Application

5.1 Application Outlook

5.2 Pet Food

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Food

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Global Savory Ingredients Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Product, 2020-2026 (USD Billion)

6.2.3 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Product, 2020-2026 (USD Billion)

6.3.3 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Product, 2020-2026 (USD Billion)

6.4.3 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Product, 2020-2026 (USD Billion)

6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Product, 2020-2026 (USD Billion)

6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Angel Yeast Co., Ltd

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 InfoGraphic Analysis

7.3 Vedan International Holdings Ltd.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 InfoGraphic Analysis

7.4 Hexcel Corporation

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 InfoGraphic Analysis

7.5 Ajinomoto Co., Inc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 InfoGraphic Analysis

7.6 Givadun

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 InfoGraphic Analysis

7.7 Kerry Group

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 InfoGraphic Analysis

7.8 DSM Group

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 InfoGraphic Analysis

7.9 Sensient Technologies Corporation

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 InfoGraphic Analysis

7.10 ADM

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 InfoGraphic Analysis

7.11 Tate & Lyle PLC.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 InfoGraphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 InfoGraphic Analysis

The Global Savory Ingredients Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Savory Ingredients Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS