Global Secondary Water and Wastewater Treatment Equipment Market Size, Trends, and Analysis - Forecasts to 2026 By Technology (Activated Sludge, Sludge Treatment, Others), By Application (Municipal, Industrial), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Competitive Landscape Company Market Share Analysis, and Competitor Analysis

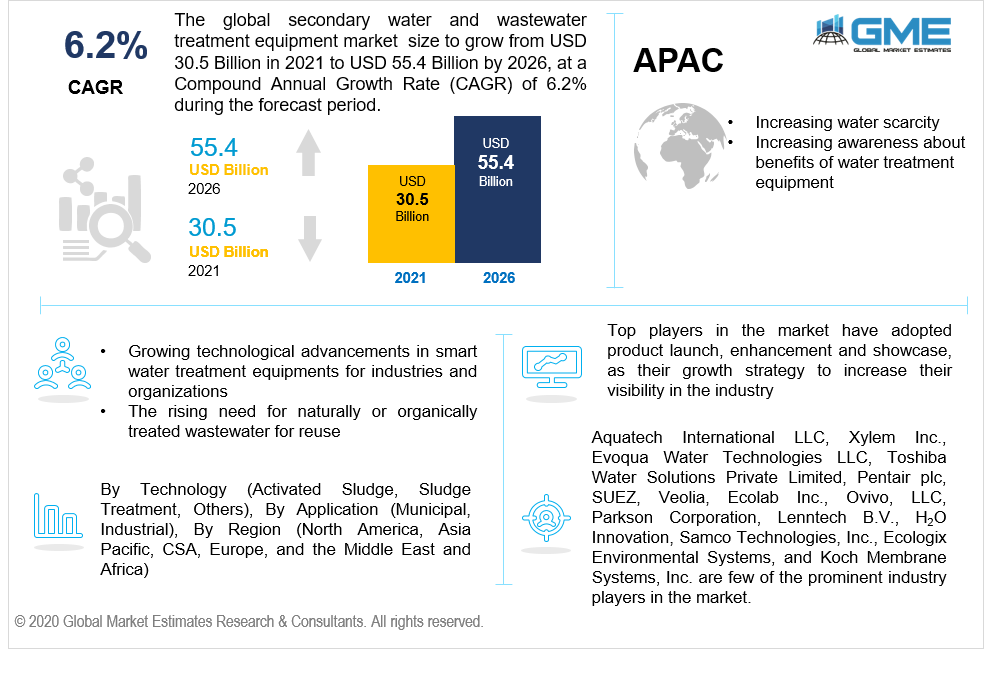

The global secondary water and wastewater treatment equipment market size will grow from USD 30.5 billion in 2021 to USD 55.4 billion in 2026 with a CAGR of 6.2%. The prime factors helping the market grow rapidly are increasing demand for wastewater treatment machines at government organizations, industries, and chemical manufacturing sites, increasing water pollution levels in developing regions like India, Malaysia, China, Japan, Korea, etc., rising issue of water scarcity, and increasing need for freshwater resources due to rapidly growing urbanization, and increasing government regulations to treat wastewater from small scale and large scale industrial sites.

Moreover, growing technological advancements in the field of wastewater treatment, the rising need for naturally or organically treated wastewater for reuse, and growing investors, and developing infrastructure are some of the other factors driving the demand for secondary water and wastewater treatment equipment in the market from 2021 to 2026.

Studies show that out of the total 3% fresh water available for consumption on the planet earth, 2.5% is out of human reach to access and consume as it is locked in the form of a glacier, surrounding atmosphere, or in underground soil. Hence, only 0.5% of the total freshwater available on earth has human access. Against this backdrop, according to the World Resource Institute, every day, on average, approximately 30 gallons of water unknowingly gets wasted by every individual living across the world. With such a massive water wastage rate, approximately half a billion of the world population face extreme water scarcity, and the most prominent areas facing these scarcity issues are, ironically, the developed and urban large scale cities.

In order to prevent the world population from facing a severe water shortage and subsequently try to achieve environmental sustainability, secondary water, and wastewater treatment is extremely essential. Wastewater treatment is a procedure to filter and remove all the contaminated materials and particles from the wastewater or the sewage and transform it in a way that can be led back to the water flows, further which it can be recycled and cleaned for other utilities.

Traditional methods or wastewater treatment equipment were used, where the respective authorities build massive outdoor facilities for the water treatment procedures. However, these traditional methods were not much successful among the society pertaining to the reasons like extremely awful smell/ odor, and the wastewater treatment created a very unhygienic sight and area. Besides being unpleasant to maintain, these wastewater treatment methods required huge investments to build massive infrastructure that can transform the contaminated water into reusable one. These traditional wastewater treatment equipment did not prove to be the best sustainable and economical option for the investors. These massive wastewater treatment facilities used up a lot of energy and caused difficulties in operations.

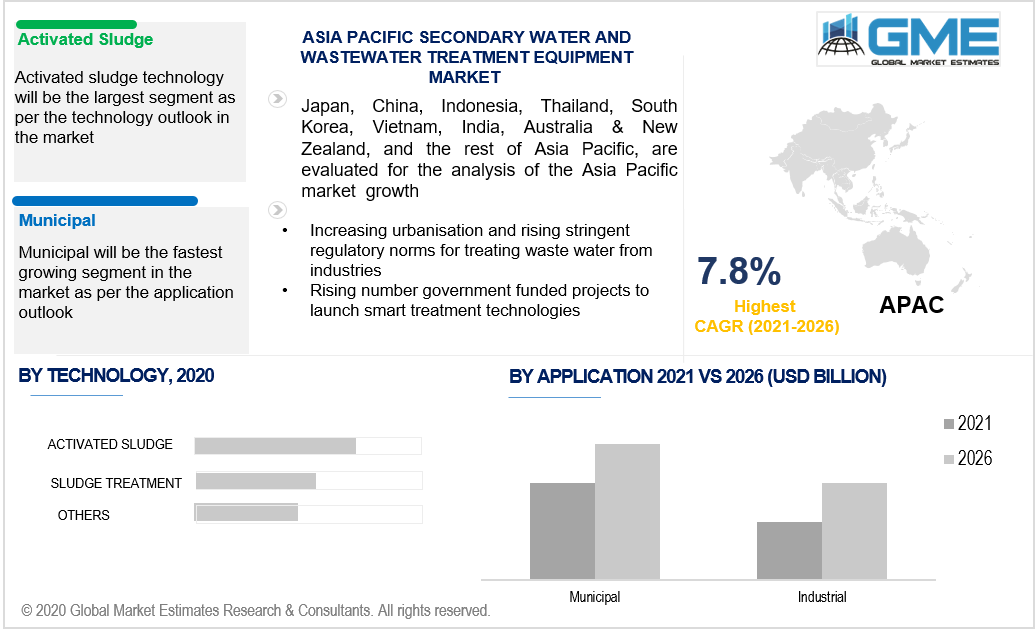

Based on technology outlook, the market can be segmented into activated sludge, sludge treatment, others. Activated sludge technology is highly incorporated in the secondary water and wastewater treatment equipment and hence has bagged the top position in the market in terms of market size/share. This kind of technology into the wastewater treatment systems adds no extra cost to the investors in their installation process. The resulting effluent generated from utilizing this technology has high quality and can be reused for other utilities without any doubt or risk.

Based on the application outlook, the market can be segmented into municipal, and industrial. The municipal segment is the largest segment owing to the increasing demand for secondary water and wastewater treatment machines and devices. With the growing urban cities, urban planning, and urban infrastructure, the respective municipals are making excessive efforts to bring in wastewater treatment systems to enable the reuse of water. India has almost 11 of its top, largest, and urbanized cities that have the most and high-risk water scarcity issues compared to the rest of the places in the country.

As per the geographical analysis, the secondary water and wastewater treatment equipment market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) has marked its dominance in the secondary water and wastewater treatment equipment market. Asia Pacific region is considered to have high water consumption as well as water wastage rates. 11 of the largest 20 urban cities in the country like India are under extreme water stress due to improperly managed and treated wastewater. Governmental organizations at all levels have been investing huge funds into wastewater treatments. Major countries and cities across the Asia Pacific region are installing wastewater treatment systems in all the newly constructed urban infrastructures to abide by the new laws and rules imposed by the government. Countries like China and Japan have also been extensively promoting and encouraging organizations in authority and various industries to install secondary water and wastewater treatment equipment. On the other hand, the North America regional segment will be the largest segment in the market owing to high awareness and stringent regulatory norms pertaining to wastewater monitoring management.

Aquatech International LLC, Xylem Inc., Evoqua Water Technologies LLC, Toshiba Water Solutions Private Limited, Pentair plc, SUEZ, Veolia, Ecolab Inc., Ovivo, LLC, Parkson Corporation, Lenntech B.V., H2O Innovation, Samco Technologies, Inc., Ecologix Environmental Systems, and Koch Membrane Systems, Inc. are key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Secondary Water and Wastewater Treatment Equipment Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Technology Overview

2.1.4 Regional Overview

Chapter 3 Secondary Water and Wastewater Treatment Equipment Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology advancement in Secondary Water and Wastewater Treatment Equipment

3.3.2 Industry Challenges

3.3.2.1 Lack of awareness and implementation of waste water treatment protocols in developing regions

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Secondary Water and Wastewater Treatment Equipment Market, By Application

4.1 Application Outlook

4.2 Municipal

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Industrial

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Secondary Water and Wastewater Treatment Equipment Market, By Technology

5.1 Technology Outlook

5.2 Activated Sludge

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Sludge Treatment

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Others

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Secondary Water and Wastewater Treatment Equipment Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Application, 2020-2026 (USD Million)

6.2.3 Market Size, By Technology, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Application, 2020-2026 (USD Million)

6.2.4.2 Market Size, By Technology, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Application, 2020-2026 (USD Million)

6.2.5.2 Market Size, By Technology, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.3 Market Size, By Technology, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Application, 2020-2026 (USD Million)

6.3.4.2 Market Size, By Technology, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Application, 2020-2026 (USD Million)

6.3.5.2 Market Size, By Technology, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Application, 2020-2026 (USD Million)

6.3.6.2 Market Size, By Technology, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Application, 2020-2026 (USD Million)

6.3.7.2 Market Size, By Technology, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Application, 2020-2026 (USD Million)

6.3.8.2 Market Size, By Technology, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Application, 2020-2026 (USD Million)

6.3.9.2 Market Size, By Technology, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.3 Market Size, By Technology, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Application, 2020-2026 (USD Million)

6.4.4.2 Market Size, By Technology, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Application, 2020-2026 (USD Million)

6.4.5.2 Market Size, By Technology, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Application, 2020-2026 (USD Million)

6.4.6.2 Market Size, By Technology, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Application, 2020-2026 (USD Million)

6.4.7.2 Market size, By Technology, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Application, 2020-2026 (USD Million)

6.4.8.2 Market Size, By Technology, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.3 Market Size, By Technology, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Application, 2020-2026 (USD Million)

6.5.4.2 Market Size, By Technology, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Application, 2020-2026 (USD Million)

6.5.5.2 Market Size, By Technology, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Application, 2020-2026 (USD Million)

6.5.6.2 Market Size, By Technology, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.3 Market Size, By Technology, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Application, 2020-2026 (USD Million)

6.6.4.2 Market Size, By Technology, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Application, 2020-2026 (USD Million)

6.6.5.2 Market Size, By Technology, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Application, 2020-2026 (USD Million)

6.6.6.2 Market Size, By Technology, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Aquatech International LLC

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Xylem Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Evoqua Water Technologies LLC

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Toshiba Water Solutions Private Limited

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Pentair PLC

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 SUEZ

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Veolia

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Ecolab Inc

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Secondary Water and Wastewater Treatment Equipment Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Secondary Water and Wastewater Treatment Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS