Global Server Market Size, Trends & Analysis - Forecasts to 2026 By Product (Micro, Blade, Open Computer Project, Tower, and Rack), By Vertical (Energy, BFSI, Government & Defense, Healthcare, IT & Telecom, and Others), By Channel (Systems Integrator, Direct, Reseller, and Others), By Enterprise Size (Micro, Small, Medium, and Large); By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

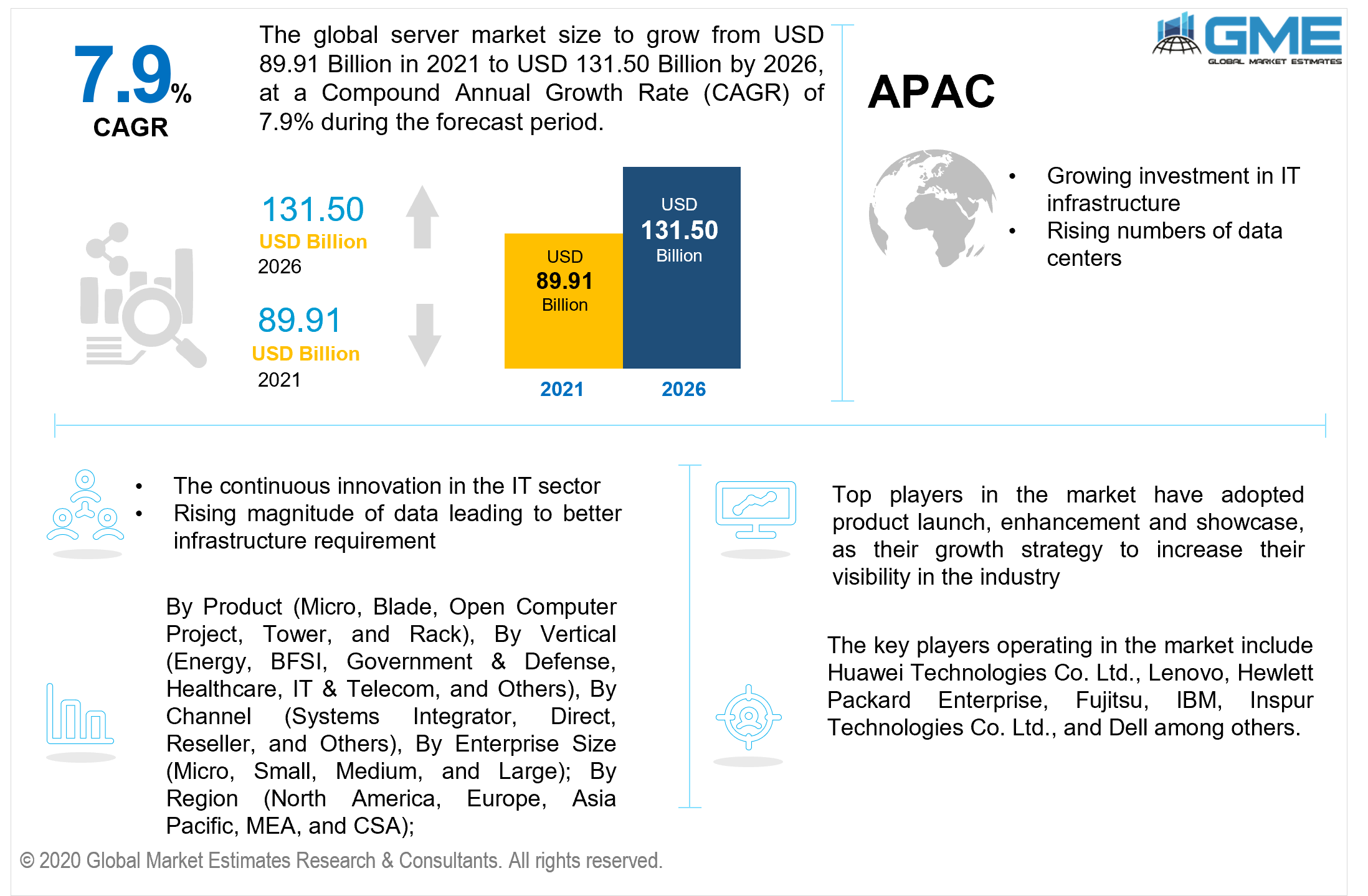

The global server market is estimated to be valued at USD 89.91 billion in 2021 and is projected to reach USD 131.50 billion by 2026 at a CAGR of 7.9%. The main features which will lead to growth in the market are growing innovation in the market, rising number of data centers, increasing magnitude of data leading to better infrastructure requirements for processing speed, storage, as well as security, and rising dependency on data for daily work.

Server demand is expected to rise significantly over the forecast period, attributable to an expanding emphasis on the comprehensive updating of IT infrastructure around the globe. The increasing use of data analytics by businesses to better comprehend consumer preferences has culminated in an increase in the use of IT network infrastructure. Moreover, the deployment of 5G networks, as well as technological advances including the Internet of Things (IoT), cloud services, and virtualization, are foreseen to drive demand for high-performance computing servers.

The demand of the global market is growing and going faster as a result of increased creativity, technologies, and accessibility to supply. The increase in trademark and patent registration submissions year on year demonstrates it. This need for creativity is fuelling the growth of the IT sector, which in turn is fuelling the growth of the sector. Along with better accessibility to internet-related resources, as well as pandemic lockdown enforced by policymakers around the world, demand for data centers has enhanced. According to the report, the COVID-19 disease outbreak has greatly boosted internet traffic. This has culminated in boosting the need for data centers and subsequently the need for servers.

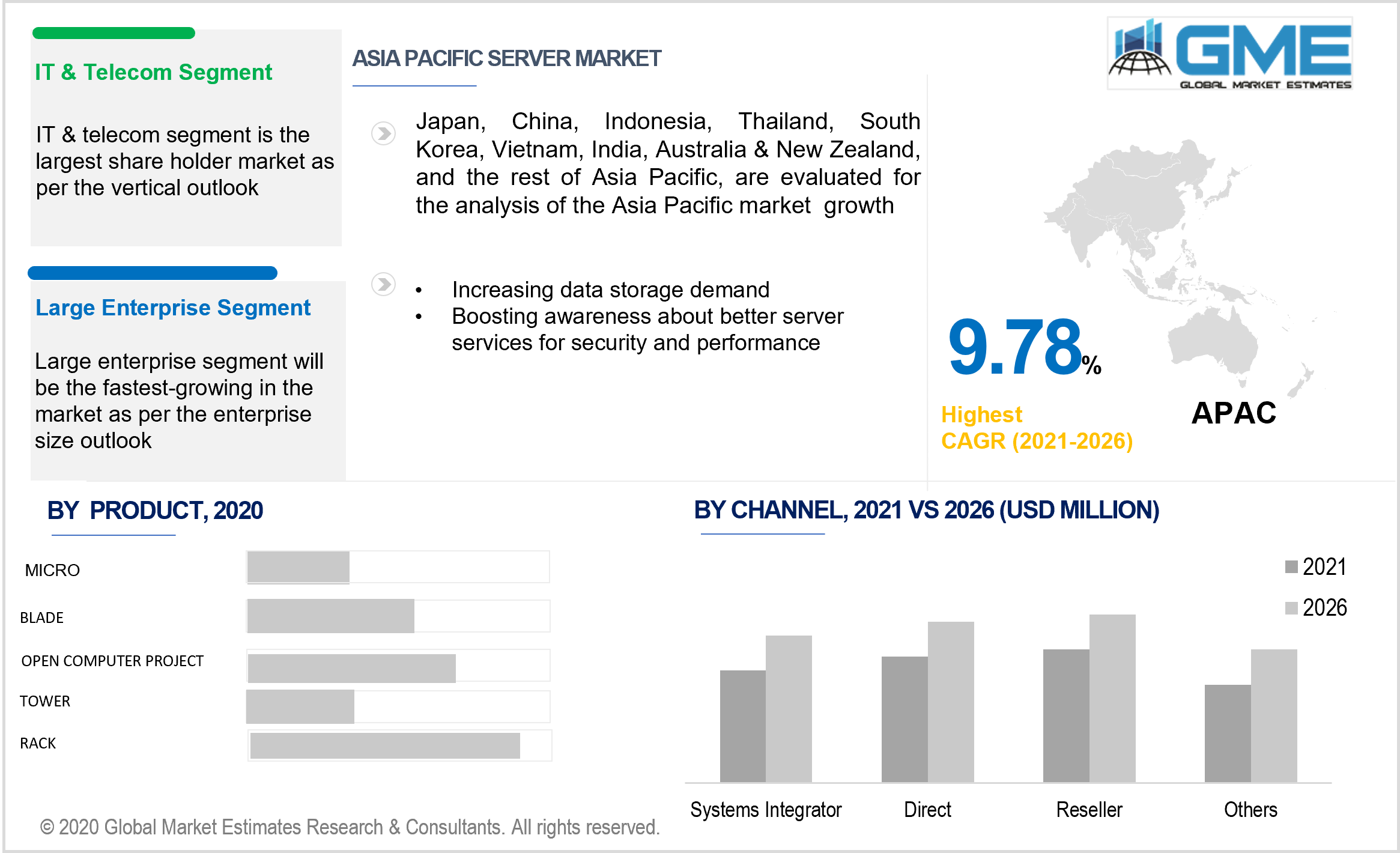

Depending on the product, the market is categorized as micro, blade, open computer project, tower, and rack. The dominating segment in the market is predicted to be the rack. The factors driving this growth are flexibility of use provided by the rack, suitability of such products for high as well as low computing requirements, rapid cooling due to design, low space occupation on the floor, and the increasing number of data centers.

Depending on the vertical, the market is categorized as energy, BFSI, government & defense, healthcare, IT & telecom, and others. IT & telecom is anticipated to be the fastest-growing as well as the dominating segment. The growth of this category is due to an increase in network connections, strong global adoption of smartphones, the advent of new technologies such as the launch of 5G, and a growing reliance on technology for everyday work.

Depending on the channel, the market is categorized as systems integrator, direct, reseller, and others. The reseller is forecasted to be the dominating segment in the market. The factors responsible for this domination are the cost-effectiveness of the segment for customers as well as sellers, the freedom of choosing the customized design, and the growing need for servers in data centers.

Depending on the enterprise size, the market is categorized as micro, small, medium, and large. The large enterprise segment is predicted to witness dominance in the market. The rising investment in the IT infrastructure by large enterprises, growing connection for a customized and better product with service providers, growing innovation in the market, and the increasing magnitude of data leading to better infrastructure requirements for processing speed, storage, as well as security are the factors driving the growth of this segment.

Having suitable IT infrastructure management measures in place allows for improved productivity, increased availability, and rapid resolution of a variety of issues that could occur. A managed IT infrastructure is critical as it provides structure and power over a wide range of technological activities including hardware, software, and networking in both physical and virtual environments, which is particularly essential for large organizations because the data they produce and address is massive.

The North American market is foreseen to account for the largest revenue share. The existence of numerous data center and cloud service companies in the area have crafted North America into the biggest hosting market, with innumerable specialized servers located throughout the area. Significant cloud service providers are also based in North America. These corporations are spending heavily on the development of massive data centers for elevated processing power and supplemental data management, potentially fueling market expansion. Moreover, progressions in aspects including 5G, IoT, and edge computing are presumed to propel the regional market during the forecast period.

The Asia Pacific region is projected to be the fastest-growing market. The rising investment in IT infrastructure by developing nations, growing data centers in many countries due to numerous smart city development projects, and soaring data storage consumption is expected to grow as a result of the widespread use of mobile wallets, social media platforms, and web facilities. Thus, these aforementioned factors are responsible for this robust growth.

IT sector in the region is witnessing decent growth which is leading to innovations in services as well as products in the region with better server services availability. Cloud service providers, as well as web conferencing service providers, have made major contributions to computing and data center offerings in the area as a result of the advent of a digital market world. As a result, the demand for servers is increasing, leading to the market's growth.

Huawei Technologies Co. Ltd., Lenovo, Hewlett Packard Enterprise, Fujitsu, IBM, Inspur Technologies Co. Ltd., and Dell, among others, are a few of the major players in the server market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2021: Lenovo introduced 8 new ThinkSystem servers designed for current workflows such as artificial intelligence, cloud, virtual desktop infrastructure, and advanced analytics. Lenovo's servers are all driven by Intel Xeon processors, with Nvidia GPUs on a few of them.

In March 2021: Dell has released seven new servers. With AMD and Intel Chips, it is among the most important server releases in time. Dell Technologies has launched many of the latest PowerEdge servers targeted at supplying customers with the best price-performance and volume of work servers available.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Server Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Vertical Overview

2.1.4 Channel Overview

2.1.5 Enterprise Size Overview

2.1.6 Regional Overview

Chapter 3 Global Server Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Expanding Emphasis On The Comprehensive Updating Of IT Infrastructure

3.3.1.2 Growing Technological Advancements

3.3.2 Industry Challenges

3.3.2.1 Increasing Competition Between Oems And Original Design Manufacturers (Odms).

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Vertical Growth Scenario

3.4.3 Channel Growth Scenario

3.4.4 Enterprise Size Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Server Market, By Product

4.1 Product Outlook

4.2 Micro

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Blade

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Open Computer Project

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Tower

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Rack

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Server Market, By Vertical

5.1 Vertical Outlook

5.2 Energy

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 BFSI

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Government & Defense

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Healthcare

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 IT & Telecom

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

5.7 Others

5.7.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Server Market, By Channel

6.1 Channel Outlook

6.2 Systems Integrator

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Direct

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Reseller

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

6.5 Others

6.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Server Market, By Enterprise Size

7.1 Enterprise Size Outlook

7.2 Micro

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.3 Small

7.3.1 Market Size, By Region, 2019-2026 (USD Million)

7.4 Medium

7.4.1 Market Size, By Region, 2019-2026 (USD Million)

7.5 Large

7.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Global Server Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country, 2019-2026 (USD Million)

8.2.2 Market Size, By Product, 2019-2026 (USD Million)

8.2.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.2.4 Market Size, By Channel, 2019-2026 (USD Million)

8.2.5 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.2.6.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.2.6.3 Market Size, By Channel, 2019-2026 (USD Million)

8.2.6.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.2.7.3 Market Size, By Channel, 2019-2026 (USD Million)

8.2.7.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country, 2019-2026 (USD Million)

8.3.2 Market Size, By Product, 2019-2026 (USD Million)

8.3.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.4 Market Size, By Channel, 2019-2026 (USD Million)

8.3.5 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Channel, 2019-2026 (USD Million)

8.3.6.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Channel, 2019-2026 (USD Million)

8.3.7.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Channel, 2019-2026 (USD Million)

8.3.8.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Channel, 2019-2026 (USD Million)

8.3.9.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Channel, 2019-2026 (USD Million)

8.3.10.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Channel, 2019-2026 (USD Million)

8.3.11.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country, 2019-2026 (USD Million)

8.4.2 Market Size, By Product, 2019-2026 (USD Million)

8.4.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.4 Market Size, By Channel, 2019-2026 (USD Million)

8.4.5 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Channel, 2019-2026 (USD Million)

8.4.6.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Channel, 2019-2026 (USD Million)

8.4.7.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Channel, 2019-2026 (USD Million)

8.4.8.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.9.2 Market size, By Vertical, 2019-2026 (USD Million)

8.4.9.3 Market size, By Channel, 2019-2026 (USD Million)

8.4.9.4 Market size, By Enterprise Size, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Channel, 2019-2026 (USD Million)

8.4.10.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country, 2019-2026 (USD Million)

8.5.2 Market Size, By Product, 2019-2026 (USD Million)

8.5.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.5.4 Market Size, By Channel, 2019-2026 (USD Million)

8.5.5 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Channel, 2019-2026 (USD Million)

8.5.6.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Channel, 2019-2026 (USD Million)

8.5.7.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Channel, 2019-2026 (USD Million)

8.5.8.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country, 2019-2026 (USD Million)

8.6.2 Market Size, By Product, 2019-2026 (USD Million)

8.6.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.6.4 Market Size, By Channel, 2019-2026 (USD Million)

8.6.5 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Channel, 2019-2026 (USD Million)

8.6.6.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Channel, 2019-2026 (USD Million)

8.6.7.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Channel, 2019-2026 (USD Million)

8.6.8.4 Market Size, By Enterprise Size, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Huawei Technologies Co. Ltd.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Lenovo

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Hewlett Packard Enterprise

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Fujitsu

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 IBM

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Inspur Technologies Co. Ltd.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Dell

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Other Companies

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

The Global Server Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Server Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS