Global Shower Steamer Market Size, Trends & Analysis - Forecasts to 2026 By Raw Material (Essential Oils, Baking Soda, Scents, Citrus), By Fragrance (Rose, Lavender, Peppermint, Eucalyptus, Sandalwood), By Purpose (Aromatherapy/Stress Relief, Cold & Flu, Sinus), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Increasing consumer spending on aromatherapy products to improve mental health will drive the shower steamer cubes demand. These products are proven to enhance the user's sleep cycle, stress relief, and other health benefits related to congestion. The products are viable and provide eco-friendly solutions to improvise health and are a better alternative.

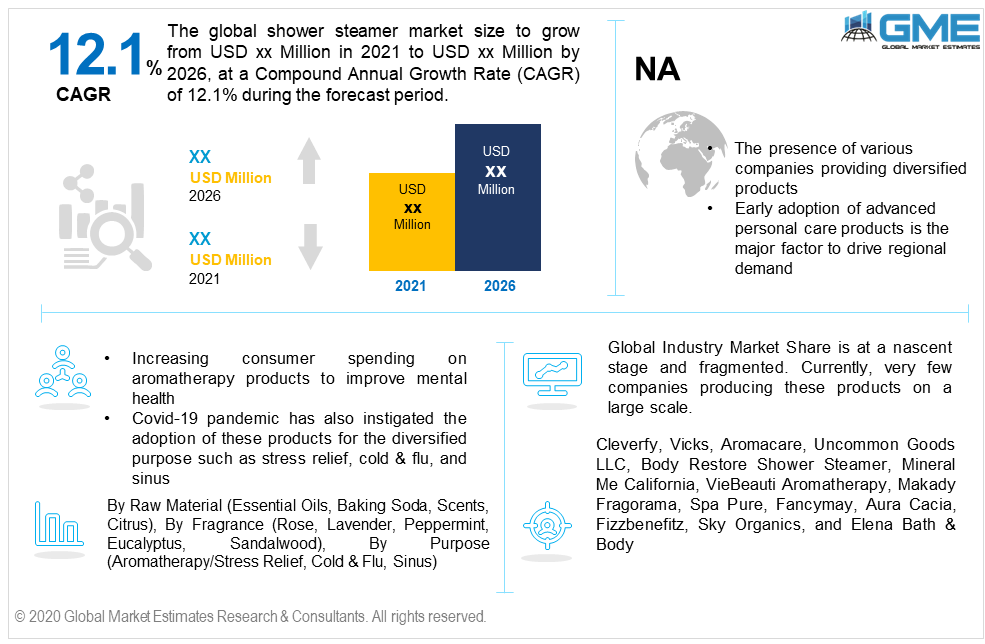

The global shower steamer market size is projected to witness more than 12.1% CAGR from 2021 to 2026, with North America leading the consumption. Changing market dynamics along with the introduction of medicated shower bombs from producers such as Vicks will open new avenues in the industry. Covid-19 pandemic has also instigated the adoption of these calming shower steamers for a diversified purpose such as stress relief, cold & flu, and sinus.

Essential oil, baking soda, scents, and citrus are the major raw materials used in the production process of these bath products. Annually, consumers expend a large sum of money on medications to relieve stress and cure the sleep cycle. These products are cost-effective, non-damaging, and safe for these problems. Essential oils are the major contributing raw material to produce these bath products. The other majorly used material is the scent to differentiate the product and purpose.

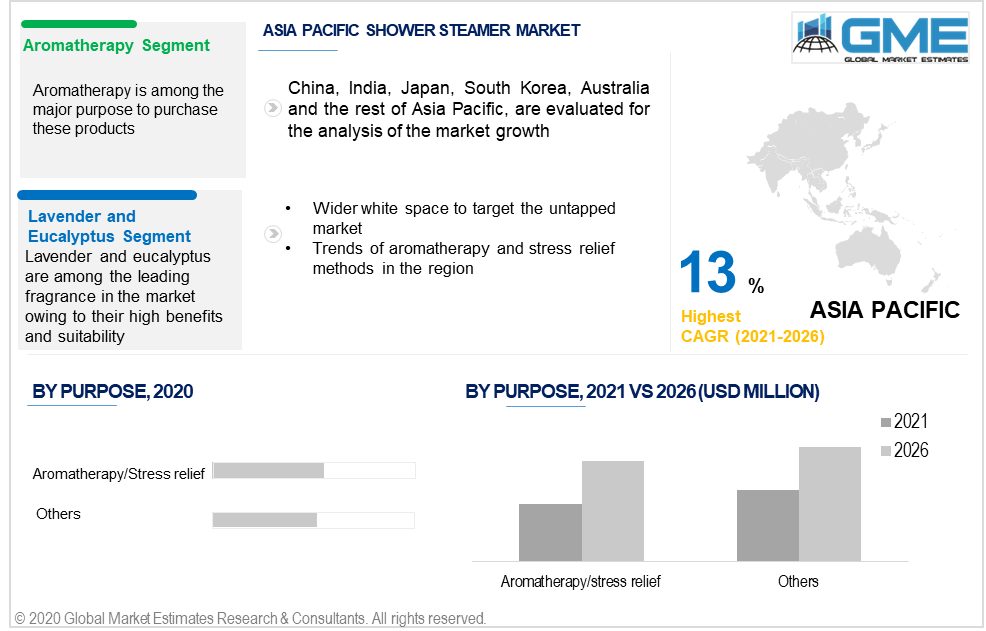

By fragrance, the market is categorized into rose, lavender, peppermint, eucalyptus, and sandalwood. Lavender and eucalyptus shower bombs are among the leading fragrance in the market owing to their high benefits and suitability. Stress relief, better sleep, and a long-lasting impact on user mood are the key success factors to drive penetration in this segment.

The sandalwood fragrance is still witnessing high demand from consumers preferring neutral and soothing fragrances. The increased necessity to introduce products that aid sleeping and stress relief will result in new blends and innovative fragrances in the coming years.

By purpose, the market is segregated into aromatherapy/stress relief, cold & flu, and sinus. Aromatherapy/stress relief dominated the purpose segment. Stress relief is among the major purpose to purchase these products. These naturally made bath bombs are proven to highly effective and purposeful. Changing lifestyles leading to increased stress levels in daily lives are the main cause to adopt these aromatherapy products.

The other potential purpose of these products is the cold & flu. These products help in relieving congestion and get rid of chest cramming. Increasing consumer consciousness to avoid the elongated cold and flu due to covid-19 has positively driven the demand for products, specially made for cold & flu purposes. Vicks has also launched its products focused on relieving congestion.

North America is projected to lead the consumption in the coming years. The presence of various companies providing diversified products along with early adoption of advanced personal care products is the major factor to drive regional demand. The U.S. is among the most potential country for these products due to consumer interest, acceptance, and affordability towards innovative personal care products. Also, the presence of numerous companies offering diversified and customized products to suit consumer choice will induce the demand.

The Asia Pacific Shower Steamer Market will witness significant gains during the forecast period. Wider white space to target the untapped market along with increasing consumer spending on self-care products will proliferate the regional demand. Trends of aromatherapy and stress relief methods are not new in the region, this impactful method is expected to positively influence the market growth. China, India, Japan, and South Korea will be the key revenue-generating countries in the coming years.

The European personal care products industry is highly influenced by natural and organically produced products which makes it highly lucrative. These bath bombs are eco-friendly, nonresidual, and organic. The region holds high potential for these self-healing and environment-friendly products. Thus, the commercialization of these products will open beneficial prospects in the region.

The global shower steamer industry market share is at a nascent stage and fragmented. Currently, very few companies are producing these products on a large scale. The majority of the producers are focusing on domestic demand and supplying locally. However, shifting industry dynamics along with increasing penetration of these products globally will positively influence the market growth.

Major notable industry players include Cleverfy, Vicks, Aromacare, Uncommon Goods LLC, Body Restore Shower Steamer, Mineral Me California, VieBeauti Aromatherapy, Makady Fragorama, Spa Pure, Fancymay, Aura Cacia, Fizzbenefitz, Sky Organics, and Elena Bath & Body.

Please note: This is not an exhaustive list of companies profiled in the report.

Collaboration with the retailers to increase shelf visibility along with selling products through online channels such as Amazon or their website is the key notable tactic witnessed in the industry.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Shower Steamer industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Raw material overview

2.1.3 Fragrance overview

2.1.4 Purpose overview

2.1.5 Regional overview

Chapter 3 Shower Steamer Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Production overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Shower Steamer Market, By Raw Material

4.1 Raw Material Outlook

4.2 Essential Oils

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Baking Soda

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Scents

4.4.1 Market size, by region, 2019-2026 (USD Million)

4.5 Citrus

4.5.1 Market size, by region, 2019-2026 (USD Million)

4.6 Others

4.6.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Shower Steamer Market, By Fragrance

5.1 Fragrance Outlook

5.2 Rose

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Lavender

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Peppermint

5.4.1 Market size, by region, 2019-2026 (USD Million)

5.5 Eucalyptus

5.5.1 Market size, by region, 2019-2026 (USD Million)

5.6 Sandalwood

5.6.1 Market size, by region, 2019-2026 (USD Million)

5.7 Others

5.7.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Shower Steamer Market, By Purpose

6.1 Purpose Outlook

6.2 Aromatherapy/Stress Relief

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Cold & Flu

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Sinus

6.4.1 Market size, by region, 2019-2026 (USD Million)

6.5 Others

6.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 Shower Steamer Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2019-2026 (USD Million)

7.2.2 Market size, by raw material, 2019-2026 (USD Million)

7.2.3 Market size, by fragrance, 2019-2026 (USD Million)

7.2.4 Market size, by purpose, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by raw material, 2019-2026 (USD Million)

7.2.5.2 Market size, by fragrance, 2019-2026 (USD Million)

7.2.5.3 Market size, by purpose, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by raw material, 2019-2026 (USD Million)

7.2.6.2 Market size, by fragrance, 2019-2026 (USD Million)

7.2.6.3 Market size, by purpose, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2019-2026 (USD Million)

7.3.2 Market size, by raw material, 2019-2026 (USD Million)

7.3.3 Market size, by fragrance, 2019-2026 (USD Million)

7.3.4 Market size, by purpose, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by raw material, 2019-2026 (USD Million)

7.2.5.2 Market size, by fragrance, 2019-2026 (USD Million)

7.2.5.3 Market size, by purpose, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market size, by raw material, 2019-2026 (USD Million)

7.3.6.2 Market size, by fragrance, 2019-2026 (USD Million)

7.3.6.3 Market size, by purpose, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by raw material, 2019-2026 (USD Million)

7.3.7.2 Market size, by fragrance, 2019-2026 (USD Million)

7.3.7.3 Market size, by purpose, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by raw material, 2019-2026 (USD Million)

7.3.8.2 Market size, by fragrance, 2019-2026 (USD Million)

7.3.8.3 Market size, by purpose, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2019-2026 (USD Million)

7.4.2 Market size, by raw material, 2019-2026 (USD Million)

7.4.3 Market size, by fragrance, 2019-2026 (USD Million)

7.4.4 Market size, by purpose, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by raw material, 2019-2026 (USD Million)

7.4.5.2 Market size, by fragrance, 2019-2026 (USD Million)

7.4.5.3 Market size, by purpose, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by raw material, 2019-2026 (USD Million)

7.4.6.2 Market size, by fragrance, 2019-2026 (USD Million)

7.4.6.3 Market size, by purpose, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market size, by raw material, 2019-2026 (USD Million)

7.4.7.2 Market size, by fragrance, 2019-2026 (USD Million)

7.4.7.3 Market size, by purpose, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by raw material, 2019-2026 (USD Million)

7.4.8.2 Market size, by fragrance, 2019-2026 (USD Million)

7.4.8.3 Market size, by purpose, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by raw material, 2019-2026 (USD Million)

7.4.9.2 Market size, by fragrance, 2019-2026 (USD Million)

7.4.9.3 Market size, by purpose, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market size, by country 2019-2026 (USD Million)

7.5.2 Market size, by raw material, 2019-2026 (USD Million)

7.5.3 Market size, by fragrance, 2019-2026 (USD Million)

7.5.4 Market size, by purpose, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by raw material, 2019-2026 (USD Million)

7.5.5.2 Market size, by fragrance, 2019-2026 (USD Million)

7.5.5.3 Market size, by purpose, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market size, by raw material, 2019-2026 (USD Million)

7.5.6.2 Market size, by fragrance, 2019-2026 (USD Million)

7.5.6.3 Market size, by purpose, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2019-2026 (USD Million)

7.6.2 Market size, by raw material, 2019-2026 (USD Million)

7.6.3 Market size, by fragrance, 2019-2026 (USD Million)

7.6.4 Market size, by purpose, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by raw material, 2019-2026 (USD Million)

7.6.5.2 Market size, by fragrance, 2019-2026 (USD Million)

7.6.5.3 Market size, by purpose, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by raw material, 2019-2026 (USD Million)

7.6.6.2 Market size, by fragrance, 2019-2026 (USD Million)

7.6.6.3 Market size, by purpose, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 Cleverfy

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 Vicks

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 Aromacare

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 Uncommon Goods LLC

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 Body Restore Shower Steamer

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 Mineral Me California

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 VieBeauti Aromatherapy

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 Inbria Aromatherapy

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 Makady Fragorama

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 Spa Pure

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 Fancymay

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 Aura Cacia

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 Fizzbenefitz

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 Sky Organics

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 Elena Bath & Body

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

The Global Shower Steamer Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Shower Steamer Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS