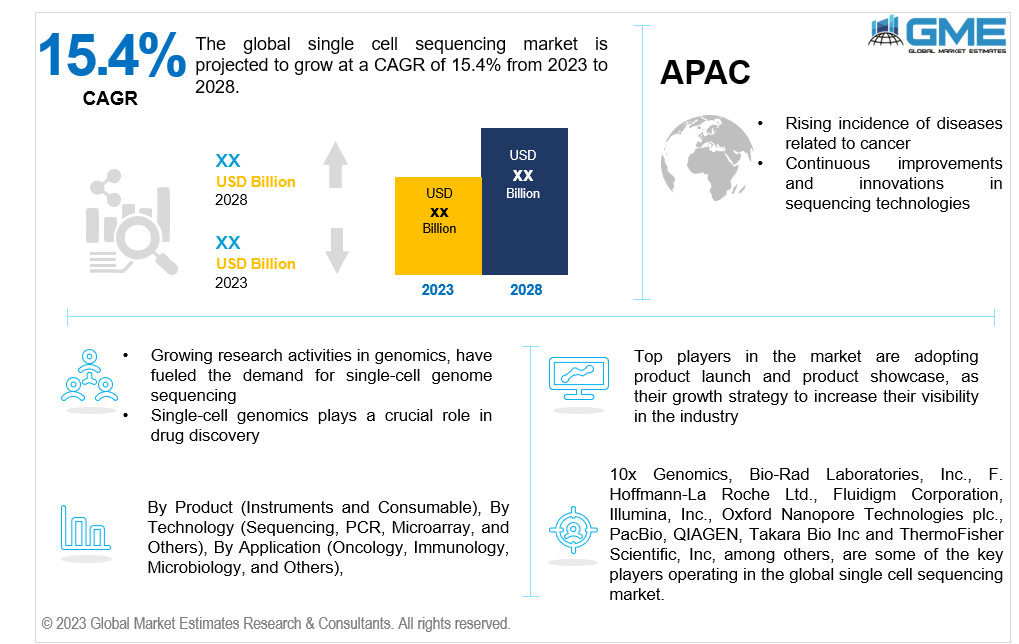

Global Single Cell Sequencing Market Size, Trends & Analysis - Forecasts to 2028 By Product (Instruments and Consumables), By Technology (Sequencing, PCR, Microarray, and Others), By Application (Oncology, Immunology, Microbiology, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global single cell sequencing market is projected to grow at a compound annual growth rate of 15.4% from 2023 to 2028.

Ongoing advancements in sequencing technologies, such as next-generation sequencing (NGS), have played a crucial role in the growth of single-cell sequencing. Improved accuracy, efficiency, and reduced costs make single-cell sequencing more accessible. Single-cell sequencing is particularly valuable in cancer research, where cell heterogeneity is challenging. Researchers use this technology to analyze tumour genetic and molecular diversity, leading to more personalized treatment approaches.

The rising incidence of diseases is anticipated to increase the number of investments in research applications for novel technologies related to single cell sequencing. In a September 2020 article titled 'United States Tax Dollars Funded Every New Pharmaceutical in the Last Decade,' it was revealed that there are 2.2 million research publications on biological drugs, 21% of which received funding from the National Institutes of Health (NIH), amounting to over USD 230 billion. This substantial funding in the biotechnology sector promotes research and the utilization of polymerase chain reaction (PCR) devices, including single-cell sequencing, thereby propelling market growth.

Partnerships among academic institutions, research entities, and biotechnology firms play a pivotal role in advancing and bringing to market single-cell sequencing technologies. Such collaborations are instrumental in fostering innovation and stimulating growth within the market. In January 2020, there was a collaboration between Illumina and Danyel Biotech with the Weizmann Institute of Science in Israel. The Weizmann Institute, known for its pioneering work in single-cell genomics, integrated Illumina's technology to advance research in this rapidly growing field. The institute is using Illumina's next-generation sequencing (NGS) technology, specifically the NovaSeq 6000 system, to advance research in single-cell genomics. This technology enables scientists to explore the interactions of individual cells, especially those within the immune system, with both healthy tissue and tumour cells. The installation of the new system not only bolstered genomic research capabilities within the Weizmann Institute but also contributed to the expansion of genomic research in Israel.

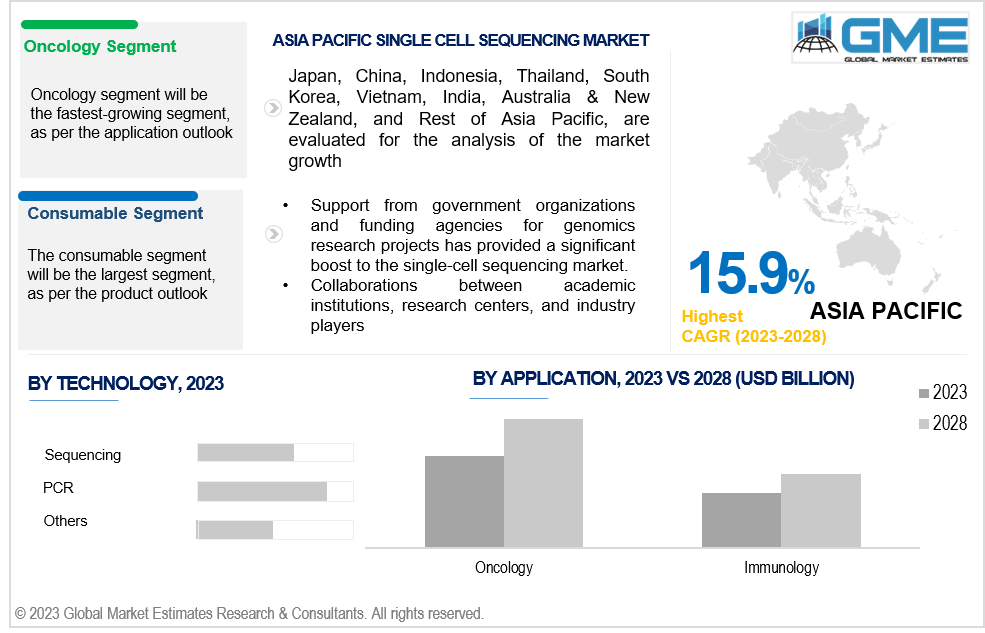

Based on product, the market is segmented into instruments and consumables Instruments segment is anticipated to be the fastest-growing segment in the market from 2023-2028. This is attributable to the rapid evolution and acceptance of cutting-edge instruments and solutions meticulously manufactured to align with the ever-evolving landscape of healthcare technology.

As an example, in 2017, Illumina, Inc. and Bio-Rad Laboratories collaboratively introduced the Illumina Bio-Rad Single-Cell Sequencing Solution. The Single-Cell Sequencing Solution is designed for deep analysis of gene expression in individual cells, allowing researchers to understand their functions within complex tissues. The goal is to facilitate high-throughput sequencing of thousands of individual cells, which was traditionally a challenging, costly, and time-consuming process.

Consumable’s segment is expected to hold the largest market share over the forecast period. This is attributed to several factors, including researchers' preference for consumables in single-cell analysis techniques, the rising demand for associated consumables, and the recurrent nature of consumable purchases when compared to instruments.

Sequencing segment is anticipated to be the fastest-growing segment in the market from 2023-2028. This is attributed to the advancements in the sequencing technologies. For instance, in March 2023, scientists at ETH Zurich employed an innovative approach utilizing single-cell genome sequencing to examine the DNA of two distinct T-cells acquired simultaneously. Through this sequencing method, they identified 28 somatic mutations that distinguished two T-cells and detected alterations in mitochondrial DNA. This novel method implies that it holds the potential to enable researchers to explore the diverse effects of somatic mutations in a range of diseases.

PCR segment is expected to hold the largest share of the market. The growth of the segment is contributed by the initiatives taken by market players and collaborations for introduction of new product launches. For instance, in June 2020, Stilla Technologies introduced the 'six-color Prism,' one of the world's pioneering six-color digital PCR instruments. This cutting-edge system finds broad applications in areas such as oncology, infectious disease research, gene therapy, disease monitoring, and food testing.

The immunology segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Single-cell sequencing allows researchers to analyse individual cells, providing a more granular understanding of the complex immune responses. This is particularly crucial in understanding how different immune cells respond to pathogens, vaccines, or diseases. Advances in single-cell sequencing technologies, such as droplet-based methods and improved bioinformatics tools, have made it more feasible to analyse large numbers of individual cells efficiently.

The oncology segment is expected to hold the largest share of the market. This is attributed to the rising incidence of prostate, colorectal, and breast cancers. According to the World Health Organization, cancer will account for 2.26 million new cases of breast cancer and 1.41 million new cases of prostate cancer worldwide in 2020. Rise in cancer cases contributes to the single cell sequencing market growth.

North America is expected to be the largest region in the global market. The primary reasons boosting the market growth in this region include growing incidence of cancer and chronic diseases in the region. Additionally, new product launches and the robust research and development initiatives in the healthcare industry undertaken by North American market players is playing a pivotal role in securing this leading position. Additionally, it is projected that the establishment of genomic clinics in the region will accelerate market expansion. For instance, in October 2021, Takara Bio USA, Inc., a subsidiary of Takara Bio Inc., launched the SMART-Seq Pro kit, which was designed to work with the ICELL8 cx Single-Cell System. This automated single-cell RNA-seq technology enables scientists to concurrently capture comprehensive transcriptome data from more than 1,500 single cells. This innovative solution is applicable to various sample types, encompassing large and fragile adult cardiomyocytes.

Asia Pacific is predicted to witness rapid growth during the forecast period. The regional market growth is due to the increasing number of elderly individuals, contributing to a higher incidence of chronic diseases. Moreover, substantial progress in healthcare infrastructure is anticipated, spurred by the economic development efforts of emerging countries such as India, Indonesia, and Vietnam among others in the region.

10x Genomics, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., Fluidigm Corporation, Illumina, Inc., Oxford Nanopore Technologies plc., PacBio, QIAGEN, Takara Bio Inc, and Thermo Fisher Scientific, Inc, among others, are some of the key players operating in the global single cell sequencing market.

Please note: This is not an exhaustive list of companies profiled in the report.

In October 2022, Oxford Nanopore Technologies PLC entered into a partnership with 10x Genomics aimed at refining the workflow for achieving complete transcript sequencing within single reads on Oxford Nanopore devices. This partnership aimed to simplify the single-cell sequencing process, making it accessible to any laboratory.

In March 2022, Sengenics announced the launch of the i-Ome Protein Array Kit for commercial use. This kit features slide-based, high-density protein microarrays containing over 1,600 immobilized, full-length, and properly folded human proteins.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL SINGLE CELL SEQUENCING MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL SINGLE CELL SEQUENCING MARKET, BY PRODUCT

4.1 Introduction

4.2 Single Cell Sequencing Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Instruments

4.4.1 Instruments Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Consumables

4.5.1 Consumables Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL SINGLE CELL SEQUENCING MARKET, BY TECHNOLOGY

5.1 Introduction

5.2 Single Cell Sequencing Market: Technology Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Sequencing

5.4.1 Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 PCR

5.5.1 PCR Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Microarray

5.6.1 Microarray Market Estimates and Forecast, 2020-2028 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL SINGLE CELL SEQUENCING MARKET, BY APPLICATION

6.1 Introduction

6.2 Single Cell Sequencing Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Oncology

6.4.1 Oncology Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Immunologyz

6.5.1 Immunologyz Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Microbiology

6.6.1 Microbiology Market Estimates and Forecast, 2020-2028 (USD Million)

6.7 Others

6.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL SINGLE CELL SEQUENCING MARKET, BY REGION

7.1 Introduction

7.2 North America Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.1 By Product

7.2.2 By Technology

7.2.3 By Application

7.2.4 By Country

7.2.4.1 U.S. Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.1.1 By Product

7.2.4.1.2 By Technology

7.2.4.1.3 By Application

7.2.4.2 Canada Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.2.1 By Product

7.2.4.2.2 By Technology

7.2.4.2.3 By Application

7.2.4.3 Mexico Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.3.1 By Product

7.2.4.3.2 By Technology

7.2.4.3.3 By Application

7.3 Europe Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.1 By Product

7.3.2 By Technology

7.3.3 By Application

7.3.4 By Country

7.3.4.1 Germany Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.1.1 By Product

7.3.4.1.2 By Technology

7.3.4.1.3 By Application

7.3.4.2 U.K. Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.2.1 By Product

7.3.4.2.2 By Technology

7.3.4.2.3 By Application

7.3.4.3 France Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.3.1 By Product

7.3.4.3.2 By Technology

7.3.4.3.3 By Application

7.3.4.4 Italy Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.4.1 By Product

7.3.4.4.2 By Technology

7.2.4.4.3 By Application

7.3.4.5 Spain Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.5.1 By Product

7.3.4.5.2 By Technology

7.2.4.5.3 By Application

7.3.4.6 Netherlands Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.6.1 By Product

7.3.4.6.2 By Technology

7.2.4.6.3 By Application

7.3.4.7 Rest of Europe Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.7.1 By Product

7.3.4.7.2 By Technology

7.2.4.7.3 By Application

7.4 Asia Pacific Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.1 By Product

7.4.2 By Technology

7.4.3 By Application

7.4.4 By Country

7.4.4.1 China Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.1.1 By Product

7.4.4.1.2 By Technology

7.4.4.1.3 By Application

7.4.4.2 Japan Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.2.1 By Product

7.4.4.2.2 By Technology

7.4.4.2.3 By Application

7.4.4.3 India Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.3.1 By Product

7.4.4.3.2 By Technology

7.4.4.3.3 By Application

7.4.4.4 South Korea Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.4.1 By Product

7.4.4.4.2 By Technology

7.4.4.4.3 By Application

7.4.4.5 Singapore Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.5.1 By Product

7.4.4.5.2 By Technology

7.4.4.5.3 By Application

7.4.4.6 Malaysia Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.6.1 By Product

7.4.4.6.2 By Technology

7.4.4.6.3 By Application

7.4.4.7 Thailand Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7.1 By Product

7.4.4.7.2 By Technology

7.4.4.7.3 By Application

7.4.4.8 Indonesia Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.8.1 By Product

7.4.4.8.2 By Technology

7.4.4.8.3 By Application

7.4.4.9 Vietnam Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.9.1 By Product

7.4.4.9.2 By Technology

7.4.4.9.3 By Application

7.4.4.10 Taiwan Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.10.1 By Product

7.4.4.10.2 By Technology

7.4.4.10.3 By Application

7.4.4.11 Rest of Asia Pacific Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.11.1 By Product

7.4.4.11.2 By Technology

7.4.4.11.3 By Application

7.5 Middle East and Africa Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.1 By Product

7.5.2 By Technology

7.5.3 By Application

7.5.4 By Country

7.5.4.1 Saudi Arabia Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.1.1 By Product

7.5.4.1.2 By Technology

7.5.4.1.3 By Application

7.5.4.2 U.A.E. Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.2.1 By Product

7.5.4.2.2 By Technology

7.5.4.2.3 By Application

7.5.4.3 Israel Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.3.1 By Product

7.5.4.3.2 By Technology

7.5.4.3.3 By Application

7.5.4.4 South Africa Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.4.1 By Product

7.5.4.4.2 By Technology

7.5.4.4.3 By Application

7.5.4.5 Rest of Middle East and Africa Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.5.1 By Product

7.5.4.5.2 By Technology

7.5.4.5.2 By Application

7.6 Central and South America Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.1 By Product

7.6.2 By Technology

7.6.3 By Application

7.6.4 By Country

7.6.4.1 Brazil Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.1.1 By Product

7.6.4.1.2 By Technology

7.6.4.1.3 By Application

7.6.4.2 Argentina Eaporative Air Cooler Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.2.1 By Product

7.6.4.2.2 By Technology

7.6.4.2.3 By Application

7.6.4.3 Chile Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.3.1 By Product

7.6.4.3.2 By Technology

7.6.4.3.3 By Application

7.6.4.4 Rest of Central and South America Single Cell Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.4.1 By Product

7.6.4.4.2 By Technology

7.6.4.4.3 By Application

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 10x Genomics

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Bio-Rad Laboratories, Inc.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 F. Hoffmann-La Roche Ltd.s

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Fluidigm Corporation

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Illumina, Inc.

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Oxford Nanopore Technologies plc.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 PacBio

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 QIAGEN

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Takara Bio Inc

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Thermo Fisher Scientific, Inc.

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Single Cell Sequencing Market, By Product, 2020-2028 (USD Mllion)

2 Instruments Market, By Region, 2020-2028 (USD Mllion)

3 Consumables Market, By Region, 2020-2028 (USD Mllion)

4 Global Single Cell Sequencing Market, By Technology, 2020-2028 (USD Mllion)

5 Sequencing Market, By Region, 2020-2028 (USD Mllion)

6 PCR Market, By Region, 2020-2028 (USD Mllion)

7 Microarray Market, By Region, 2020-2028 (USD Mllion)

8 Others Market, By Region, 2020-2028 (USD Mllion)

9 Global Single Cell Sequencing Market, By Application, 2020-2028 (USD Mllion)

10 Oncology Market, By Region, 2020-2028 (USD Mllion)

11 Immunologyz Market, By Region, 2020-2028 (USD Mllion)

12 Microbiology Market, By Region, 2020-2028 (USD Mllion)

13 Others Market, By Region, 2020-2028 (USD Mllion)

14 Regional Analysis, 2020-2028 (USD Mllion)

15 North America Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

16 North America Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

17 North America Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

18 North America Single Cell Sequencing Market, By Country, 2020-2028 (USD Million)

19 U.S Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

20 U.S Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

21 U.S Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

22 Canada Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

23 Canada Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

24 Canada Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

25 Mexico Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

26 Mexico Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

27 Mexico Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

28 Europe Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

29 Europe Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

30 Europe Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

31 Germany Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

32 Germany Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

33 Germany Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

34 U.K Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

35 U.K Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

36 U.K Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

37 France Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

38 France Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

39 France Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

40 Italy Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

41 Italy Single Cell Sequencing Market, By End Use , 2020-2028 (USD Million)

42 Italy Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

43 Spain Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

44 Spain Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

45 Spain Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

46 Rest Of Europe Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

47 Rest Of Europe Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

48 Rest of Europe Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

49 Asia Pacific Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

50 Asia Pacific Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

51 Asia Pacific Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

52 Asia Pacific Single Cell Sequencing Market, By Country, 2020-2028 (USD Million)

53 China Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

54 China Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

55 China Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

56 India Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

57 India Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

58 India Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

59 Japan Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

60 Japan Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

61 Japan Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

62 South Korea Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

63 South Korea Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

64 South Korea Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

65 Middle East and Africa Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

66 Middle East and Africa Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

67 Middle East and Africa Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

68 Middle East and Africa Single Cell Sequencing Market, By Country, 2020-2028 (USD Million)

69 Saudi Arabia Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

70 Saudi Arabia Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

71 Saudi Arabia Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

72 UAE Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

73 UAE Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

74 UAE Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

75 Central and South America Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

76 Central and South America Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

77 Central and South America Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

78 Central and South America Single Cell Sequencing Market, By Country, 2020-2028 (USD Million)

79 Brazil Single Cell Sequencing Market, By Product, 2020-2028 (USD Million)

80 Brazil Single Cell Sequencing Market, By Technology, 2020-2028 (USD Million)

81 Brazil Single Cell Sequencing Market, By Application, 2020-2028 (USD Million)

82 10x Genomics: Products & Services Offering

83 Bio-Rad Laboratories, Inc.: Products & Services Offering

84 F. Hoffmann-La Roche Ltd.s: Products & Services Offering

85 Fluidigm Corporation: Products & Services Offering

86 Illumina, Inc.: Products & Services Offering

87 OXFORD NANOPORE TECHNOLOGIES PLC.: Products & Services Offering

88 PacBio : Products & Services Offering

89 QIAGEN: Products & Services Offering

90 Takara Bio Inc, Inc: Products & Services Offering

91 Thermo Fisher Scientific, Inc.: Products & Services Offering

92 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Single Cell Sequencing Market Overview

2 Global Single Cell Sequencing Market Value From 2020-2028 (USD Mllion)

3 Global Single Cell Sequencing Market Share, By Product (2022)

4 Global Single Cell Sequencing Market Share, By Technology (2022)

5 Global Single Cell Sequencing Market Share, By Application (2022)

6 Global Single Cell Sequencing Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Single Cell Sequencing Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Single Cell Sequencing Market

11 Impact Of Challenges On The Global Single Cell Sequencing Market

12 Porter’s Five Forces Analysis

13 Global Single Cell Sequencing Market: By Product Scope Key Takeaways

14 Global Single Cell Sequencing Market, By Product Segment: Revenue Growth Analysis

15 Instruments Market, By Region, 2020-2028 (USD Mllion)

16 Consumables Market, By Region, 2020-2028 (USD Mllion)

17 Global Single Cell Sequencing Market: By Technology Scope Key Takeaways

18 Global Single Cell Sequencing Market, By Technology Segment: Revenue Growth Analysis

19 Sequencing Market, By Region, 2020-2028 (USD Mllion)

20 PCR Market, By Region, 2020-2028 (USD Mllion)

21 Microarray Market, By Region, 2020-2028 (USD Mllion)

22 Others Market, By Region, 2020-2028 (USD Mllion)

23 Global Single Cell Sequencing Market: By Application Scope Key Takeaways

24 Global Single Cell Sequencing Market, By Application Segment: Revenue Growth Analysis

25 Oncology Market, By Region, 2020-2028 (USD Mllion)

26 Immunologyz Market, By Region, 2020-2028 (USD Mllion)

27 Microbiology Market, By Region, 2020-2028 (USD Mllion)

28 Others Market, By Region, 2020-2028 (USD Mllion)

29 Regional Segment: Revenue Growth Analysis

30 Global Single Cell Sequencing Market: Regional Analysis

31 North America Single Cell Sequencing Market Overview

32 North America Single Cell Sequencing Market, By Product

33 North America Single Cell Sequencing Market, By Technology

34 North America Single Cell Sequencing Market, By Application

35 North America Single Cell Sequencing Market, By Country

36 U.S. Single Cell Sequencing Market, By Product

37 U.S. Single Cell Sequencing Market, By Technology

38 U.S. Single Cell Sequencing Market, By Application

39 Canada Single Cell Sequencing Market, By Product

40 Canada Single Cell Sequencing Market, By Technology

41 Canada Single Cell Sequencing Market, By Application

42 Mexico Single Cell Sequencing Market, By Product

43 Mexico Single Cell Sequencing Market, By Technology

44 Mexico Single Cell Sequencing Market, By Application

45 Four Quadrant Positioning Matrix

46 Company Market Share Analysis

47 10x Genomics: Company Snapshot

48 10x Genomics: SWOT Analysis

49 10x Genomics: Geographic Presence

50 Bio-Rad Laboratories, Inc.: Company Snapshot

51 Bio-Rad Laboratories, Inc.: SWOT Analysis

52 Bio-Rad Laboratories, Inc.: Geographic Presence

53 F. Hoffmann-La Roche Ltd.s: Company Snapshot

54 F. Hoffmann-La Roche Ltd.s: SWOT Analysis

55 F. Hoffmann-La Roche Ltd.s: Geographic Presence

56 Fluidigm Corporation: Company Snapshot

57 Fluidigm Corporation: Swot Analysis

58 Fluidigm Corporation: Geographic Presence

59 Illumina, Inc.: Company Snapshot

60 Illumina, Inc.: SWOT Analysis

61 Illumina, Inc.: Geographic Presence

62 Oxford Nanopore Technologies plc.: Company Snapshot

63 Oxford Nanopore Technologies plc.: SWOT Analysis

64 Oxford Nanopore Technologies plc.: Geographic Presence

65 PacBio : Company Snapshot

66 PacBio : SWOT Analysis

67 PacBio : Geographic Presence

68 QIAGEN: Company Snapshot

69 QIAGEN: SWOT Analysis

70 QIAGEN: Geographic Presence

71 Takara Bio Inc, Inc.: Company Snapshot

72 Takara Bio Inc, Inc.: SWOT Analysis

73 Takara Bio Inc, Inc.: Geographic Presence

74 Thermo Fisher Scientific, Inc.: Company Snapshot

75 Thermo Fisher Scientific, Inc.: SWOT Analysis

76 Thermo Fisher Scientific, Inc.: Geographic Presence

77 Other Companies: Company Snapshot

78 Other Companies: SWOT Analysis

79 Other Companies: Geographic Presence

The Global Single Cell Sequencing Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Single Cell Sequencing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS