Global Single Use Bioprocessing Market Size, Trends & Analysis - Forecasts to 2028 By Product Type (Simple & Peripheral Elements, Apparatus & Plants, and Work Equipment), By Workflow (Upstream Bioprocessing, Fermentation, and Downstream Bioprocessing), By End User Industry (Biopharmaceutical Manufacturers and Academic & Clinical Research Institutes), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

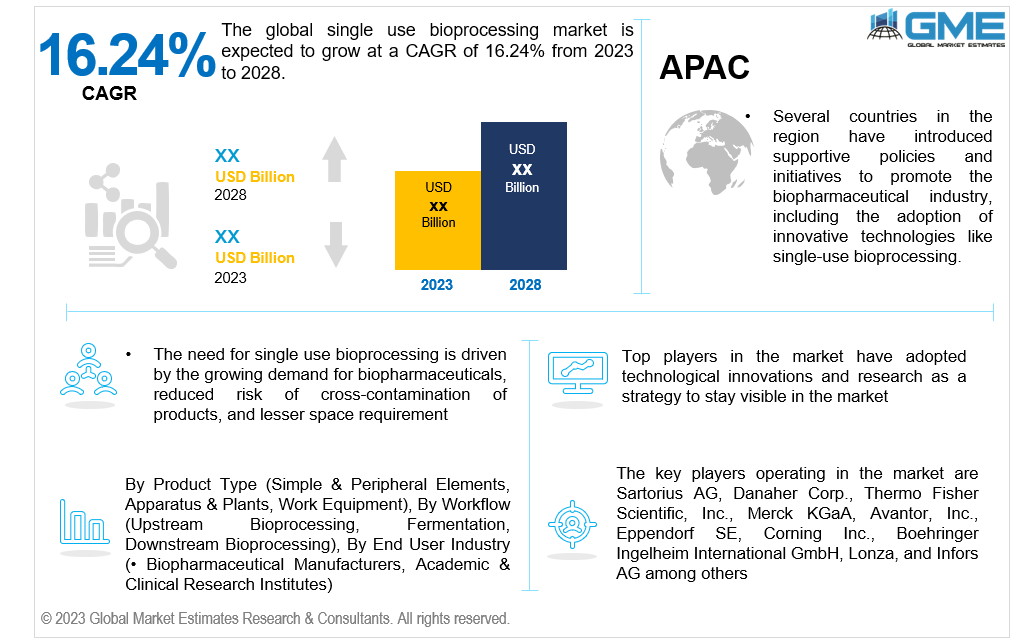

The global single use bioprocessing market is expected to grow at a CAGR of 16.24% from 2023 to 2028. The utilization of single-use bioprocessing products is increasing during the development of numerous biopharmaceuticals and drug stages. Single-use bioprocessing technology is becoming more popular due to rising biopharmaceutical demand over the past several years and increasing funding for the research and production of biologics such as monoclonal antibodies, vaccines, recombinant proteins, and others.

The key factors driving the market growth are rising demand for biopharmaceuticals, reduced risk of cross-contamination of products, and lesser space requirements.

More effective and adaptable production procedures are required as the market for biopharmaceutical goods such as monoclonal antibodies, vaccines, and cell treatments grows. Single-use bioprocessing has emerged as a practical option to fulfil this expanding need. Moreover, products about healthcare often risk contamination and the spreading of infections. Having single use products implies better cleaning and disposals. Single-use systems minimize the risk of cross-contamination between batches since disposable components are used and discarded after each use. This feature is particularly crucial for manufacturing sensitive biopharmaceutical products, such as vaccines and gene therapies. In addition, these products do not require a designated space that needs to be blocked at all times. Thus, that small area can serve multiple purposes, thereby improving the efficiency and capacity of the institution. Traditional stainless-steel bioprocessing equipment requires significant capital investment, maintenance, and cleaning, whereas single-use systems eliminate the need for cleaning and sterilization validation between batches, resulting in reduced costs.

Based on product type, the market is segmented into simple & peripheral elements, apparatus & plants and work equipment. The simple & peripheral elements segment is expected to hold largest share of the market. This segment growth is attributed to constant product innovations and the increasing importance of bioprocessing operations in the entire manufacturing process. These products have dominated the market for simple & peripheral elements. Most of the manufacturers offer tubing and connectors in a system, which is compliant with single-use bioprocessing equipment.

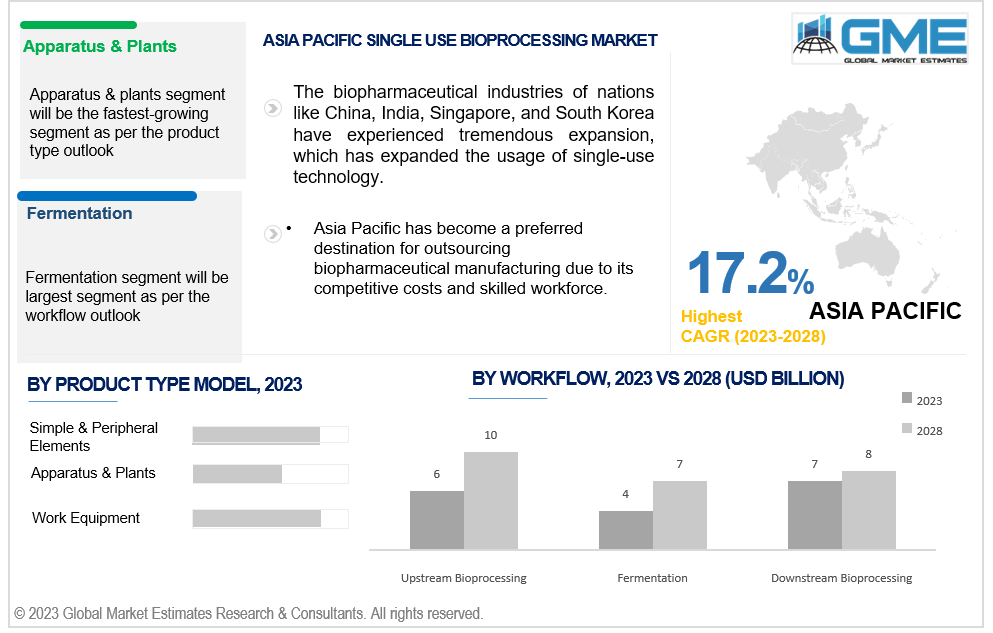

Moreover, the apparatus & plants segment is expected to witness the highest rate of growth in the forecast period. This is due to the bioprocessing industry's substantial penetration, which uses disposable bioreactors for cell culture and fermentation processes to produce biopharmaceuticals and disposable chromatography columns used for protein purification and separation processes.

Based on workflow, the market is segmented into upstream bioprocessing, fermentation, and downstream bioprocessing. Upstream bioprocessing segment held highest market in 2022. The growth is primarily attributed to technological innovations.

The fermentation segment is expected to witness highest growth rate during the forecast period. The growth is attributed to the fermentation process that provides optimal conditions for bioprocessing. Fermentation is a critical part of upstream bioprocessing, primarily for microbial-based biopharmaceuticals. It entails the carefully regulated development of microorganisms to provide required medicinal products, such as yeast or bacteria. Fermentation typically occurs inside bioreactors and involves closely monitored conditions like temperature, pH, and oxygen levels.

Based on end user industry, the market is segmented into biopharmaceutical manufacturers and academic & clinical research institutes. The biopharmaceutical industry is one of the primary end users of single-use bioprocessing technology and is expected to be the largest segment during the forecast period. These producers work on various biopharmaceutical projects, such as creating monoclonal antibodies, vaccines, cell and gene treatments, and other biologics. Major companies use single-use bioprocessing systems in the biopharmaceutical business to improve their manufacturing procedures, boost flexibility, and save costs. Single-use technology greatly benefits contract manufacturing firms (CMOs) and companies manufacturing specialized or customized remedies.

Another important end-use category for single-use bioprocessing products includes academic institutions and clinical research facilities, and this segment is expected to witness fastest growth over the forecast period. These organizations engage in biopharmaceutical-related research and development operations, frequently utilizing single-use devices for small-scale tests and pilot studies in the lab. In research contexts, single-use bioprocessing has various benefits, such as less contamination risk, simpler implementation, and shorter turnaround times for experimental setups.

North American is analysed to be the largest region in the global single use bioprocessing market during the forecast period. This is due to North America’s well-established biopharmaceutical industry, with numerous prominent companies engaged in the development and production of biologics. The region's strong focus on research and development in the biopharmaceutical sector is further fuelling demand for single-use bioprocessing in academic and research institutions.

Asia Pacific is also anticipated to be the fastest growing region across the global single use bioprocessing market. The biopharmaceutical industries of nations like China, India, Singapore, and South Korea have experienced tremendous expansion, which has further driven the usage of single-use technology. Several countries in the region have introduced supportive policies and initiatives to promote the biopharmaceutical industry, including the adoption of innovative technologies like single-use bioprocessing. Furthermore, Asia Pacific has become a preferred destination for outsourcing biopharmaceutical manufacturing due to its competitive costs and skilled workforce. Contract manufacturing organizations in Asia Pacific are adopting single-use bioprocessing to cater to the outsourcing demand and remain competitive.

The key players operating in the market are Sartorius AG, Danaher Corp., Thermo Fisher Scientific, Inc., Merck KGaA, Avantor, Inc., Eppendorf SE, Corning Inc., Boehringer Ingelheim International GmbH, Lonza, and Infors AG, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3 GLOBAL SINGLE USE BIOPROCESSING MARKET OUTLOOK

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL SINGLE USE BIOPROCESSING MARKET, BY PRODUCT TYPE

4.2 Single Use Bioprocessing Market: Product Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Simple & Peripheral Elements

4.4.1 Simple & Peripheral Elements Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5.1 Apparatus & Plants Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6.1 Work Equipment Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL SINGLE USE BIOPROCESSING MARKET, BY WORKFLOW

5.2 Single Use Bioprocessing Market: Workflow Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Upstream Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5.1 Fermentation Market Estimates and Forecast, 2020-2028 (USD Billion)

5.6.1 Downstream Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL SINGLE USE BIOPROCESSING MARKET, BY END USER

6.2 Single Use Bioprocessing Market: End User Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Biopharmaceutical Manufacturers

6.4.1 Biopharmaceutical Manufacturers Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5 Academic & Clinical Research Institutes

6.5.1 Academic & Clinical Research Institutes Market Estimates and Forecast, 2020-2028 (USD Billion)

7 GLOBAL SINGLE USE BIOPROCESSING MARKET, BY REGION

7.2 North America Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.1 U.S. Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.2 Canada Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.3 Mexico Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3 Europe Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.1 Germany Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.2 U.K. Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.3 France Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.4 Italy Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.5 Spain Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.6 Netherlands Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4 Asia Pacific Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.1 China Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.2 Japan Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.3 India Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.4 South Korea Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.5 Singapore Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.6 Malaysia Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.7 Thailand Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.8 Indonesia Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.9 Vietnam Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.10 Taiwan Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.1 Saudi Arabia Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.2 U.A.E. Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.3 Israel Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.4 South Africa Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.6.4.1 Brazil Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

7.6.4.2 Argentina Eaporative Air Cooler Market Estimates and Forecast, 2020-2028 (USD Billion)

7.6.4.3 Chile Single Use Bioprocessing Market Estimates and Forecast, 2020-2028 (USD Billion)

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.4.1.1 Business Description & Financial Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2.1 Business Description & Financial Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Thermo Fisher Scientific, Inc.

8.4.3.1 Business Description & Financial Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4.1 Business Description & Financial Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5.1 Business Description & Financial Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6.1 Business Description & Financial Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7.1 Business Description & Financial Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Boehringer Ingelheim International GmbH

8.4.8.1 Business Description & Financial Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9.1 Business Description & Financial Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10.1 Business Description & Financial Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11.1 Business Description & Financial Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9.1.2 Market Scope & Segmentation

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.4 Discussion Guide for Primary Participants

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

2 Simple & Peripheral Elements Market, By Region, 2020-2028 (USD Billion)

3 Apparatus & Plants Market, By Region, 2020-2028 (USD Billion)

4 Work Equipment Market, By Region, 2020-2028 (USD Billion)

5 Global Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

6 Upstream Bioprocessing Market, By Region, 2020-2028 (USD Billion)

7 Fermentation Market, By Region, 2020-2028 (USD Billion)

8 Downstream Bioprocessing Market, By Region, 2020-2028 (USD Billion)

9 Global Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

10 Biopharmaceutical Manufacturers Market, By Region, 2020-2028 (USD Billion)

11 Academic & Clinical Research Institutes Market, By Region, 2020-2028 (USD Billion)

12 Regional Analysis, 2020-2028 (USD Billion)

13 North America Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

14 North America Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

15 North America Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

16 North America Single Use Bioprocessing Market, By Country, 2020-2028 (USD Billion)

17 U.S Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

18 U.S Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

19 U.S Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

20 Canada Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

21 Canada Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

22 Canada Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

23 Mexico Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

24 Mexico Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

25 Mexico Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

26 Europe Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

27 Europe Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

28 Europe Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

29 Germany Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

30 Germany Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

31 Germany Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

32 UK Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

33 UK Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

34 UK Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

35 France Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

36 France Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

37 France Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

38 Italy Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

39 Italy Single Use Bioprocessing Market, By T End Use Type, 2020-2028 (USD Billion)

40 Italy Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

41 Spain Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

42 Spain Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

43 Spain Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

44 Rest Of Europe Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

45 Rest Of Europe Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

46 Rest of Europe Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

47 Asia Pacific Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

48 Asia Pacific Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

49 Asia Pacific Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

50 Asia Pacific Single Use Bioprocessing Market, By Country, 2020-2028 (USD Billion)

51 China Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

52 China Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

53 China Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

54 India Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

55 India Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

56 India Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

57 Japan Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

58 Japan Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

59 Japan Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

60 South Korea Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

61 South Korea Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

62 South Korea Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

63 Middle East and Africa Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

64 Middle East and Africa Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

65 Middle East and Africa Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

66 Middle East and Africa Single Use Bioprocessing Market, By Country, 2020-2028 (USD Billion)

67 Saudi Arabia Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

68 Saudi Arabia Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

69 Saudi Arabia Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

70 UAE Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

71 UAE Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

72 UAE Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

73 Central & South America Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

74 Central & South America Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

75 Central & South America Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

76 Central & South America Single Use Bioprocessing Market, By Country, 2020-2028 (USD Billion)

77 Brazil Single Use Bioprocessing Market, By Product Type, 2020-2028 (USD Billion)

78 Brazil Single Use Bioprocessing Market, By Workflow, 2020-2028 (USD Billion)

79 Brazil Single Use Bioprocessing Market, By End User, 2020-2028 (USD Billion)

80 Sartorius AG: Products & Services Offering

81 Danaher Corp..: Products & Services Offering

82 Thermo Fisher Scientific, Inc.: Products & Services Offering

83 Merck KGaA: Products & Services Offering

84 Avantor, Inc.: Products & Services Offering

85 EPPENDORF SE: Products & Services Offering

86 Corning Inc. : Products & Services Offering

87 Boehringer Ingelheim International GmbH: Products & Services Offering

88 Lonza: Products & Services Offering

89 Infors AG: Products & Services Offering

90 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Single Use Bioprocessing Market Overview

2 Global Single Use Bioprocessing Market Value From 2020-2028 (USD Billion)

3 Global Single Use Bioprocessing Market Share, By Product Type (2022)

4 Global Single Use Bioprocessing Market Share, By Workflow (2022)

5 Global Single Use Bioprocessing Market Share, By End User (2022)

6 Global Single Use Bioprocessing Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Single Use Bioprocessing Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Single Use Bioprocessing Market

11 Impact Of Challenges On The Global Single Use Bioprocessing Market

12 Porter’s Five Forces Analysis

13 Global Single Use Bioprocessing Market: By Product Type Scope Key Takeaways

14 Global Single Use Bioprocessing Market, By Product Type Segment: Revenue Growth Analysis

15 Simple & Peripheral Elements Market, By Region, 2020-2028 (USD Billion)

16 Apparatus & Plants Market, By Region, 2020-2028 (USD Billion)

17 Work Equipment Market, By Region, 2020-2028 (USD Billion)

18 Global Single Use Bioprocessing Market: By Workflow Scope Key Takeaways

19 Global Single Use Bioprocessing Market, By Workflow Segment: Revenue Growth Analysis

20 Upstream Bioprocessing Market, By Region, 2020-2028 (USD Billion)

21 Fermentation Market, By Region, 2020-2028 (USD Billion)

22 Downstream Bioprocessing Market, By Region, 2020-2028 (USD Billion)

23 Global Single Use Bioprocessing Market: By End User Scope Key Takeaways

24 Global Single Use Bioprocessing Market, By End User Segment: Revenue Growth Analysis

25 Biopharmaceutical Manufacturers Market, By Region, 2020-2028 (USD Billion)

26 Academic & Clinical Research Institutes Market, By Region, 2020-2028 (USD Billion)

27 Regional Segment: Revenue Growth Analysis

28 Global Single Use Bioprocessing Market: Regional Analysis

29 North America Single Use Bioprocessing Market Overview

30 North America Single Use Bioprocessing Market, By Product Type

31 North America Single Use Bioprocessing Market, By Workflow

32 North America Single Use Bioprocessing Market, By End User

33 North America Single Use Bioprocessing Market, By Country

34 U.S. Single Use Bioprocessing Market, By Product Type

35 U.S. Single Use Bioprocessing Market, By Workflow

36 U.S. Single Use Bioprocessing Market, By End User

37 Canada Single Use Bioprocessing Market, By Product Type

38 Canada Single Use Bioprocessing Market, By Workflow

39 Canada Single Use Bioprocessing Market, By End User

40 Mexico Single Use Bioprocessing Market, By Product Type

41 Mexico Single Use Bioprocessing Market, By Workflow

42 Mexico Single Use Bioprocessing Market, By End User

43 Four Quadrant Positioning Matrix

44 Company Market Share Analysis

45 Sartorius AG: Company Snapshot

46 Sartorius AG: SWOT Analysis

47 Sartorius AG: Geographic Presence

48 Danaher Corp..: Company Snapshot

49 Danaher Corp..: SWOT Analysis

50 Danaher Corp..: Geographic Presence

51 Thermo Fisher Scientific, Inc.: Company Snapshot

52 Thermo Fisher Scientific, Inc.: SWOT Analysis

53 Thermo Fisher Scientific, Inc.: Geographic Presence

54 Merck KGaA: Company Snapshot

55 Merck KGaA: Swot Analysis

56 Merck KGaA: Geographic Presence

57 Avantor, Inc.: Company Snapshot

58 Avantor, Inc.: SWOT Analysis

59 Avantor, Inc.: Geographic Presence

60 Eppendorf SE: Company Snapshot

61 Eppendorf SE: SWOT Analysis

62 Eppendorf SE: Geographic Presence

63 Corning Inc. : Company Snapshot

64 Corning Inc. : SWOT Analysis

65 Corning Inc. : Geographic Presence

66 Boehringer Ingelheim International GmbH: Company Snapshot

67 Boehringer Ingelheim International GmbH: SWOT Analysis

68 Boehringer Ingelheim International GmbH: Geographic Presence

69 Lonza.: Company Snapshot

70 Lonza.: SWOT Analysis

71 Lonza.: Geographic Presence

72 Infors AG: Company Snapshot

73 Infors AG: SWOT Analysis

74 Infors AG: Geographic Presence

75 Other Companies: Company Snapshot

76 Other Companies: SWOT Analysis

77 Other Companies: Geographic Presence

The Global Single Use Bioprocessing Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Single Use Bioprocessing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS