Global Single-use Upstream Bioprocessing Market Size, Trends & Analysis - Forecasts to 2027 By Product (Single-use Bioreactors, Single-use Mixers, Single-use Media Bags, Single-use Filters, Single-use Sampling Systems, Single-use Connectors), By Scale (Preclinical/Clinical, Commercial), By End-Use (Biopharmaceutical Manufacturer, CMOs & CROs, Academic & Clinical Research Institutes), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

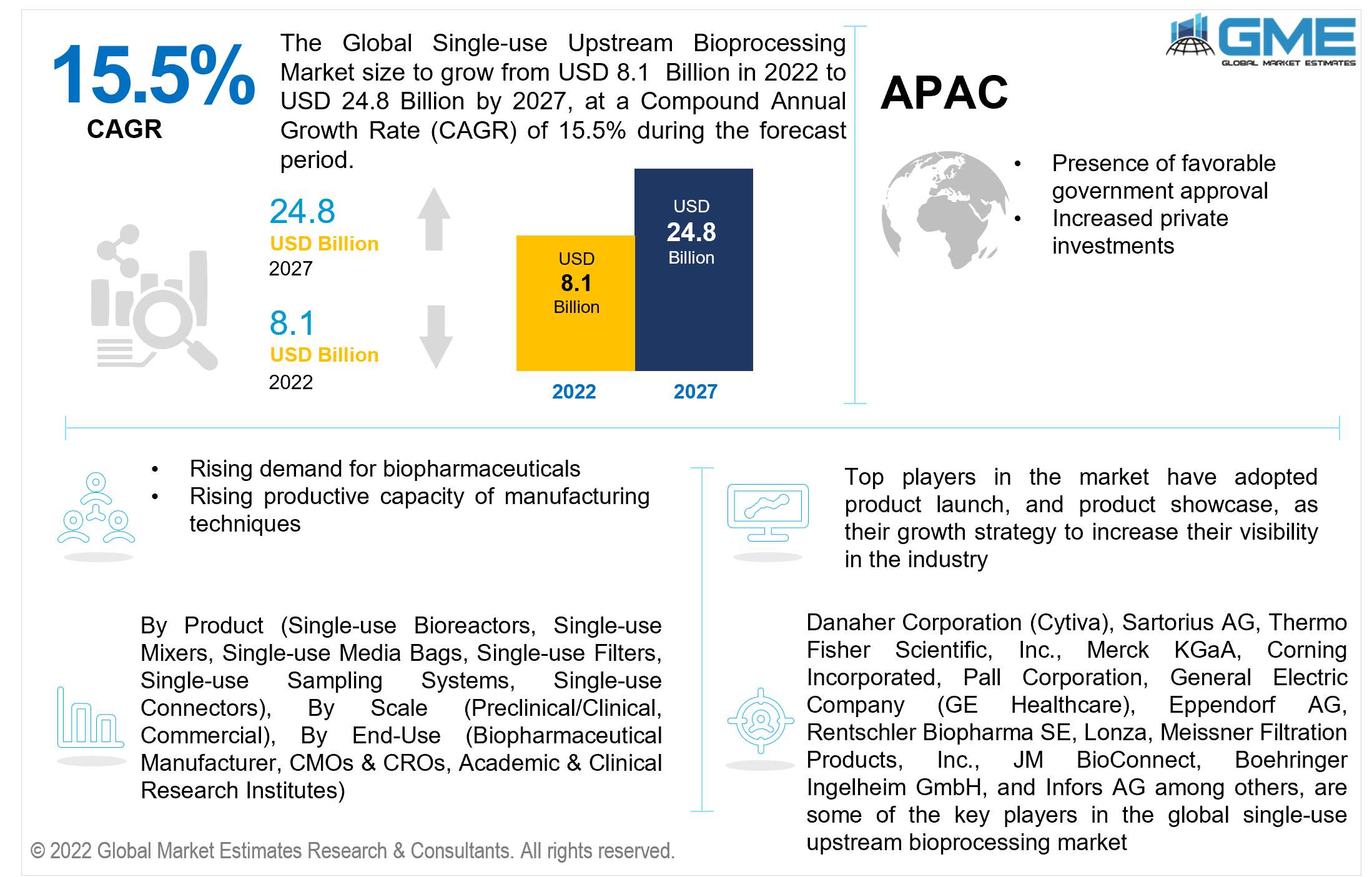

The Global Single-use Upstream Bioprocessing Market is projected to grow from USD 8.1 Billion in 2022 to USD 24.8 Billion by 2027 at a CAGR value of 15.5% from 2022 to 2027.

The primary goal of upstream manufacturing is to establish the conditions required for cells to produce the desired protein. These therapeutic proteins, antibiotics, hormones, enzymes, amino acids, blood replacements, and alcohol are all produced via biomanufacturing for medical purposes. Massive advancements in upstream processing over the past ten years have led to the creation of contemporary fed-batch methods that can provide 10g/L of mAb or more.

A small number of prospective medicines in the pipeline, the patent expiration of blockbuster molecules, and the rising demand for biologics have compelled businesses to adopt cutting-edge technologies like single-use bioprocessing methods, which are affordable and speed up the production process.

The primary pillars of upstream development that have contributed to the general advancement in the field include better cell culture medium, more sophisticated feeding tactics, more durable cell lines, and bioreactor control suited for particular uses.

The market is expanding due to factors such as rising demand for biopharmaceuticals and the significant role that single-use bioprocessing systems play in lowering the investment costs and R&D expenses involved with the manufacturing process of biologics.

Other factors driving the market expansion include a rising productive capacity of manufacturing techniques, elimination of redundant processes, direct savings in terms of low costs of labor and materials, and less energy demand and water use.

For example, relative to a stainless-steel reactor configuration, biopharmaceutical manufacturing facilities that embraced single-use technology saw a 46% decrease in overall water usage. Additionally, compared to stainless-steel reactors, single-use plants have a CO2 balance that is 35% more favorable. In the upcoming years, single-use bioprocessing systems are anticipated to become more popular due to these benefits.

Single-use systems can also significantly lower labor costs, speed up batch changeover, and facilitate product switching. For instance, the quick turnaround time for single-use bioreactors might enable the production of around 19 batches per year compared to a plant using stainless steel reactors which currently produces 15 monoclonal antibodies (Mab) batches annually. Studies reveal that typical stainless-steel systems have substantially greater testing, verification, and operation cost than single-use systems.

Additionally, factors such as the requirement for no clean-in-place and steam-in-place (CIP/SIP) operations, the need to decrease upfront costs, shorter production change-over times between batches, significantly boost production process, and minimize the risk of cross-contamination between samples, as well as simplified piping and instrumentation procedures, are making a significant contribution to market growth.

Workflows in the worldwide healthcare industry have been affected by the COVID-19 epidemic. Numerous companies, including parts of the healthcare industry, have been forced to temporarily close their doors due to the pandemic. However, the COVID-19 pandemic had a good overall effect on the market's major players in single-use bioprocessing.

In response to the recent coronavirus pandemic, numerous biopharmaceutical companies quickly created vaccinations. The clinical and commercialized manufacturing platforms mostly utilize single-use systems and equipment when these development initiatives have passed the experimental phases. Since the majority of the top COVID-19 vaccine initiatives employ novel techniques like mRNA, DNA vaccines, and plasmids, these platforms are generally constructed using single-use methods, which has increased demand for single-use bioprocessing.

The conflict between Russia and Ukraine is causing tremors among medication exporters and is probably going to hurt pharmaceutical firms and the overall volume of shipments this fiscal year. Since Russia and Ukraine are significant CIS export destinations, the new exports may encounter logistical and financial difficulties.

Additionally, interruptions in the production cycle at factories, higher pricing for the raw materials required to package drugs, and an increase in the cost of the aluminum foil used to package drugs are some additional variables affecting the pharmaceutical business as a result of the conflict.

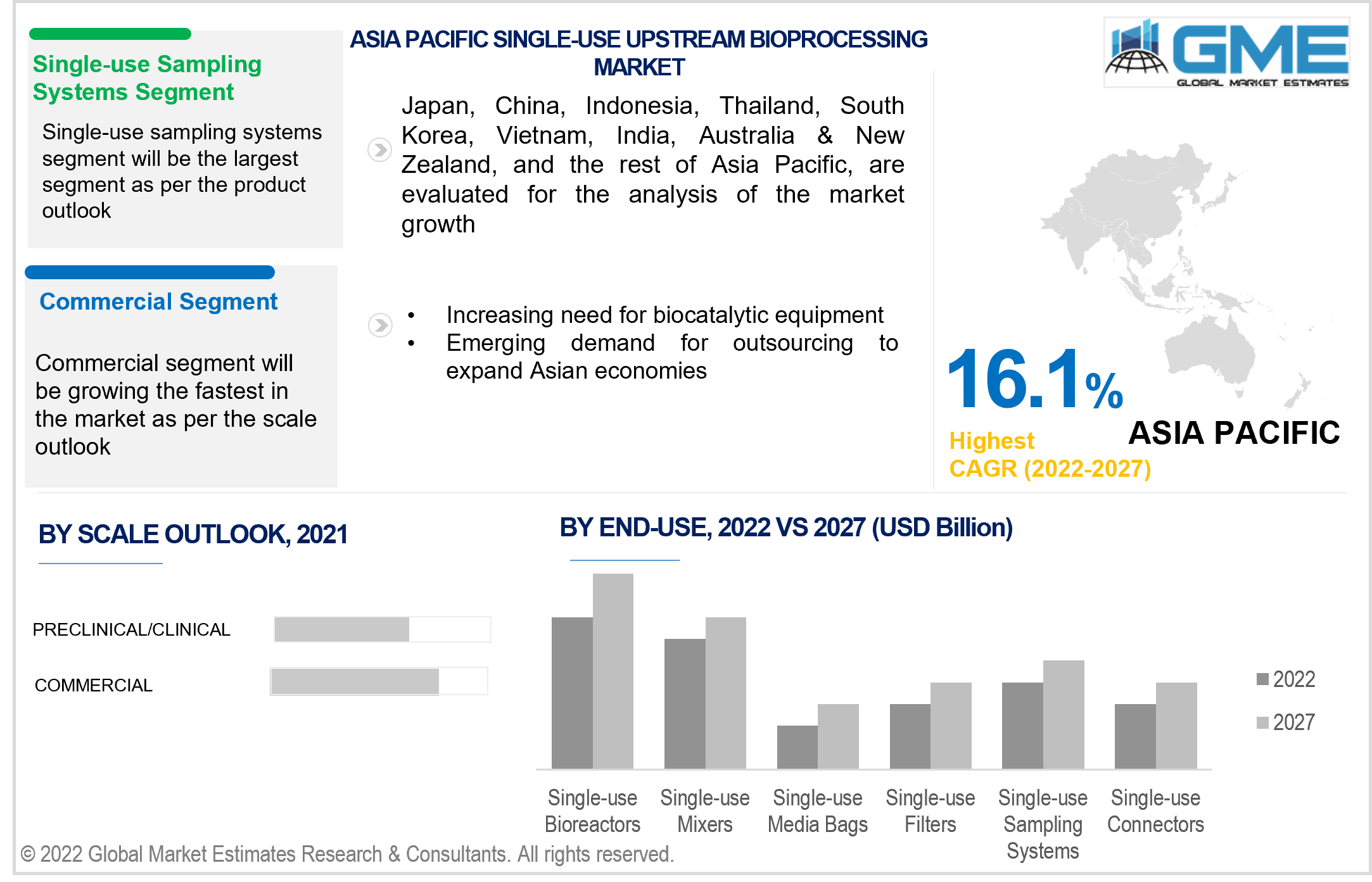

Single-use sampling systems are expected to be the most prominent single-use upstream bioprocessing market segment from 2022 to 2027. Cross-contamination risk elimination, operator exposure risk reduction, quicker setup and interchange time, quicker verification and validating periods, and increased network design flexibility are all contributing aspects to the segment's growth.

On the other hand, single-use connectors are expected to be the fastest-growing segment in the market. Manufacturers of biopharmaceutical products can increase production efficiencies, accelerate supply chain efficiency, and lower expenses with the help of durable and simple-to-use single-use connections from CPC.

Commercial scaling is expected to be the most prominent single-use upstream bioprocessing market segment from 2022 to 2027. The benefits of scaling, such as lower risks of product quality deterioration at high scales and easier creation of a standardized procedure that can be used in several markets and geographies, are driving category expansion. As firms create more medications for orphan indications, the necessity for multiproduct settings is growing. As an alternative, the concept permits concurrent manufacturing of many medicines in the same facility.

Preclinical/clinical scale of operation is expected to be the fastest-growing segment in the market. Preclinical techniques can speed up and enhance the results of drug development for biologics. Target identification, effectiveness, mechanism of action (MoA), and to some extent toxicity/safety are other important outcomes of preclinical investigations.

Biopharmaceutical Manufacturer is the most prominent Single-use Upstream Bioprocessing market segment from 2022 to 2027. The biopharmaceutical manufacturing sector has greatly benefited from the disposables' rising popularity among contract manufacturers. Many bio manufacturers have started investing in enhancing their production capabilities through installing biodegradable machinery to catch pace with shifting consumer needs for bioprocessing operations.

On the other hand, CMOs & CROs are expected to be the fastest-growing segment in the market. The important stakeholders' growing investments in the pharmacological sector to promote operational efficiency have prompted the bio producers to put more emphasis on outsourcing. The need for contract-based services has increased as a result of biopharma businesses starting to outsource the capital- and resource-intensive processes and, in some cases, the entire supply chain of biomanufacturing.

North America (the United States, Canada, and Mexico) will dominate the single-use upstream bioprocessing market from 2022 to 2027. The region's dominance has been greatly influenced by the growing biopharmaceutical R&D as well as the existence of large-scale pharmaceutical and biotechnology facilities in the area.

The United States is expected to have the lion's share in the North American single-use upstream bioprocessing market. The introduction of novel single-use bioprocessing technologies in developed economies like the U.S. and Canada, the rising senior demographic, and the growing preference for bioactive molecules are all major factors driving market expansion in this region.

Moreover, the Asia-Pacific region is expected to be the fastest-growing single-use upstream bioprocessing market segment during the forecast period. The increasing need for biocatalytic equipment, such as membrane-based microbiological testing and laboratory filtration systems, among many others, is substantially boosting the market growth in this area.

China is expected to hold the largest share in the Asia Pacific single-use upstream bioprocessing market. There are several variables driving market expansion, including the presence of favorable government approval, increased private investments, a growing aging population, emerging demand for outsourcing to expand Asian economies, and the availability of a qualified workforce in these nations which are driving regional market demand over the forecast period.

Danaher Corporation (Cytiva), Sartorius AG, Thermo Fisher Scientific, Inc., Merck KGaA, Corning Incorporated, Pall Corporation, General Electric Company (GE Healthcare), Eppendorf AG, Rentschler Biopharma SE, Lonza, Meissner Filtration Products, Inc., JM BioConnect, Boehringer Ingelheim GmbH, and Infors AG among others, are some of the key players in the global single-use upstream bioprocessing market.

Please note: This is not an exhaustive list of companies profiled in the report.

The global single-use upstream bioprocessing market has observed several strategic alliances between key players to launch new products with added functionalities and maintain revenue share & profitability. Organic and inorganic growth strategies adopted by small players have been the highlight of this market.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’sInternal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources: Annual Reports, Investor Presentation, Press Release, SEC Filling, Company Blogs & Website

1.3.4.2 Secondary Data Sources: World Health Organization (WHO), Pan American Health Organization (PAHO), Research Journal of Biotechnology, Elsevier, Journal of Biotech Research

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7Market Model

1.9.1 Model Details

1.9.1.1 Top-Down Approach

1.9.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Product Outlook

2.3 Scale Outlook

2.4 End-Use Outlook

2.5 Regional Outlook

Chapter 3 Global Single-use Upstream Bioprocessing Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Single-use Upstream Bioprocessing Market

3.4 Metric Data on Healthcare Industry

3.5 Market Driver Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Single-use Upstream Bioprocessing Market: Product Trend Analysis

4.1 Product: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Single-use Bioreactors

4.2.1 Market Estimates & Forecast Analysis of Single-use Bioreactors Segment, By Region, 2019-2027(USD Billion)

4.3 Single-use Mixers

4.3.1 Market Estimates & Forecast Analysis of Single-use Mixers Segment, By Region, 2019-2027(USD Billion)

4.4 Single-use Media Bags

4.4.1 Market Estimates & Forecast Analysis of Single-use Media Bags Segment, By Region, 2019-2027(USD Billion)

4.5 Single-use Filters

4.5.1 Market Estimates & Forecast Analysis of Single-use Filters Segment, By Region, 2019-2027(USD Billion)

4.6 Single-use Sampling Systems

4.6.1 Market Estimates & Forecast Analysis of Single-use Sampling Systems Segment, By Region, 2019-2027(USD Billion)

4.7 Single-use Connectors

4.7.1 Market Estimates & Forecast Analysis of Single-use Connectors Segment, By Region, 2019-2027(USD Billion)

4.8 Others

4.8.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027(USD Billion)

Chapter 5 Single-use Upstream Bioprocessing Market: Scale Trend Analysis

5.1 Scale: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Preclinical/Clinical

5.2.1 Market Estimates & Forecast Analysis of Preclinical/Clinical Segment, By Region, 2019-2027(USD Billion)

5.3 Commercial

5.3.1 Market Estimates & Forecast Analysis of Commercial Segment, By Region, 2019-2027(USD Billion)

Chapter 6 Single-use Upstream Bioprocessing Market: End-use Trend Analysis

6.1 End-use: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

6.2 Biopharmaceutical Manufacturer

6.2.1 Market Estimates & Forecast Analysis of Biopharmaceutical Manufacturer End-use Segment, By Region, 2019-2027(USD Billion)

6.3 CMOs & CROs

6.3.1 Market Estimates & Forecast Analysis of CMOs & CROs End-use Segment, By Region, 2019-2027(USD Billion)

6.4 Academic & Clinical Research Institutes

6.4.1 Market Estimates & Forecast Analysis of Academic & Clinical Research Institutes End-use Segment, By Region, 2019-2027(USD Billion)

Chapter 7 Single-use Upstream Bioprocessing Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027(USD Billion)

7.2.2 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.2.3 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.2.4 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.2.5 U.S.

7.2.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.2.5.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.2.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.2.6 Canada

7.2.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.2.6.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.2.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.2.7 Mexico

7.2.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.2.7.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027 (USD Billion)

7.2.7.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.3 Europe

7.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027(USD Billion)

7.3.2 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.3.3 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.3.4 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.3.5 Germany

7.3.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.3.5.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.3.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.3.6 UK

7.3.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.3.6.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.3.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.3.7 France

7.3.7.1 Market Estimates & Forecast Analysis, By Product Typ, 2019-2027(USD Billion)

7.3.7.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.3.7.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.3.8 Russia

7.3.8.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.3.8.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.3.8.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.3.9 Italy

7.3.9.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.3.9.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.3.9.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.3.10 Spain

7.3.10.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.3.11 Rest of Europe

7.3.11.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.11.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027 (USD Billion)

7.3.11.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027(USD Billion)

7.4.2 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.4.3 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.4.4 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.4.5 China

7.4.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.4.5.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.4.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.4.6 India

7.4.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.4.6.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.4.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.4.7 Japan

7.4.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.4.7.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.4.7.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.4.8 Australia

7.4.8.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.4.8.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.4.8.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.4.9 South Korea

7.4.9.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.4.9.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.4.9.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.3.10 Rest of Asia Pacific

7.3.10.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027 (USD Billion)

7.3.10.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

7.5 Central & South America

7.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027(USD Billion)

7.5.2 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.5.3 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.5.4 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.5.5 Brazil

7.5.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.5.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.5.6 Rest of Central & South America

7.5.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.5.6.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.5.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.6 Middle East & Africa

7.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027(USD Billion)

7.6.2 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.6.3 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.6.4 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.6.5.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.6.5.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.6.6 United Arab Emirates

7.6.6.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.6.6.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.6.6.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.6.7 South Africa

7.6.7.1 Market Estimates & Forecast Analysis, By Product, 2019-2027(USD Billion)

7.6.7.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027(USD Billion)

7.6.7.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027(USD Billion)

7.5.8 Rest of Middle East & Africa

7.5.8.1 Market Estimates & Forecast Analysis, By Product, 2019-2027 (USD Billion)

7.5.8.2 Market Estimates & Forecast Analysis, By Scale, 2019-2027 (USD Billion)

7.5.8.3 Market Estimates & Forecast Analysis, By End-use, 2019-2027 (USD Billion)

Chapter 8 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 End-User Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 9 Company Profile Analysis

9.1 Danaher Corporation (Cytiva)

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Product Benchmarking

9.2 Sartorius AG

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Product Benchmarking

9.3 Thermo Fisher Scientific, Inc.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Product Benchmarking

9.4 Merck KGaA

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Product Benchmarking

9.5 Corning Incorporated

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Product Benchmarking

9.6 Pall Corporation

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Product Benchmarking

9.7 General Electric Company (GE Healthcare)

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Product Benchmarking

9.8 Eppendorf AG

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.8.4 Product Benchmarking

9.9 Rentschler Biopharma SE

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Product Benchmarking

9.10 Other Companies

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Initiatives

9.10.4 Product Benchmarking

List of Tables

1 Technological Advancements in Single-use Upstream Bioprocessing Market

2 Global Single-use Upstream Bioprocessing Market: Key Market Drivers

3 Global Single-use Upstream Bioprocessing Market: Key Market Challenges

4 Global Single-use Upstream Bioprocessing Market: Key Market Opportunities

5 Global Single-use Upstream Bioprocessing Market: Key Market Restraints

6 Global Single-use Upstream Bioprocessing Market Estimates & Forecast Analysis, 2019-2027(USD Billion)

7 Global Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

8 Single-use Bioreactors: Global Single-use Upstream Bioprocessing Market, By Region, 2019-2027(USD Billion)

9 Single-use Mixers: Global Single-use Upstream Bioprocessing Market, By Region, 2019-2027(USD Billion)

10 Single-use Media Bags: Global Single-use Upstream Bioprocessing Market, By Region, 2019-2027(USD Billion)

11 Single-use Sampling Systems: Global Single-use Upstream Bioprocessing Market, By Region, 2019-2027(USD Billion)

12 Single-use Connectors: Global Single-use Upstream Bioprocessing Market, By Region, 2019-2027(USD Billion)

13 Others: Global Single-use Upstream Bioprocessing Market, By Region, 2019-2027(USD Billion)

14 Global Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

15 Preclinical/Clinical: Global Single-use Upstream Bioprocessing Market, By Region, 2019-2027(USD Billion)

16 Commercial: Global Single-use Upstream Bioprocessing Market, By Region, 2019-2027(USD Billion)

17 Global Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

18 CMOs & CROs: Global Single-use Upstream Bioprocessing Market, By Region, 2019-2027(USD Billion)

19 Biopharmaceutical Manufacturer: Global Single-use Upstream Bioprocessing Market, By Region, 2019-2027(USD Billion)

20 Academic & Clinical Research Institutes: Global Single-use Upstream Bioprocessing Market, By Region, 2019-2027(USD Billion)

21 Regional Analysis: Global Single-use Upstream Bioprocessing Market, By Region, 2019-2027(USD Billion)

22 North America: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

23 North America: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

24 North America: Single-use Upstream Bioprocessing Market, By End-use , 2019-2027(USD Billion)

25 North America: Single-use Upstream Bioprocessing Market, By Country, 2019-2027(USD Billion)

26 U.S: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

27 U.S: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027 (USD Billion)

28 U.S: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

29 Canada: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

30 Canada: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

31 Canada: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

32 Mexico: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

33 Mexico: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

34 Mexico: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

35 Europe: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

36 Europe: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

37 Europe: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

38 Europe: Single-use Upstream Bioprocessing Market, By Country, 2019-2027(USD Billion)

39 Germany: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

40 Germany: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

41 Germany: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

42 UK: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

43 UK: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

44 UK: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

45 France: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

46 France: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

47 France: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

48 Italy: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

49 Italy: Single-use Upstream Bioprocessing Market, By T Scale Ype, 2019-2027(USD Billion)

50 Italy: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

51 Spain: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

52 Spain: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

53 Spain: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

54 Rest Of Europe: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

55 Rest Of Europe: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

56 Rest Of Europe: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

57 Asia Pacific: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

58 Asia Pacific: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

59 Asia Pacific: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

60 Asia Pacific: Single-use Upstream Bioprocessing Market, By Country, 2019-2027(USD Billion)

61 China: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

62 China: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

63 China: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

64 India: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

65 India: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

66 India: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

67 Japan: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

68 Japan: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

69 Japan: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

70 South Korea: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

71 South Korea: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

72 South Korea: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

73 Middle East & Africa: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

74 Middle East & Africa: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

75 Middle East & Africa: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

76 Middle East & Africa: Single-use Upstream Bioprocessing Market, By Country, 2019-2027(USD Billion)

77 Saudi Arabia: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

78 Saudi Arabia: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

79 Saudi Arabia: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

80 UAE: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

81 UAE: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

82 UAE: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

83 Central & South America: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

84 Central & South America: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

85 Central & South America: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

86 Central & South America: Single-use Upstream Bioprocessing Market, By Country, 2019-2027(USD Billion)

87 Brazil: Single-use Upstream Bioprocessing Market, By Product, 2019-2027(USD Billion)

88 Brazil: Single-use Upstream Bioprocessing Market, By Scale, 2019-2027(USD Billion)

89 Brazil: Single-use Upstream Bioprocessing Market, By End-use, 2019-2027(USD Billion)

90 Danaher Corporation (Cytiva): Products Offered

91 Sartorius AG: Products Offered

92 Thermo Fisher Scientific, Inc.: Products Offered

93 Merck KGaA: Products Offered

94 Pall Corporation: Products Offered

95 Corning Incorporated: Products Offered

96 General Electric Company (GE Healthcare): Products Offered

97 Eppendorf AG: Products Offered

98 Rentschler Biopharma SE: Products Offered

99 Lonza: Products Offered

100 Other Companies: Products Offered

List of Figures

1. Global Single-use Upstream Bioprocessing Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Single-use Upstream Bioprocessing Market: Penetration & Growth Prospect Mapping

7. Global Single-use Upstream Bioprocessing Market: Value Chain Analysis

8. Global Single-use Upstream Bioprocessing Market Drivers

9. Global Single-use Upstream Bioprocessing Market Restraints

10. Global Single-use Upstream Bioprocessing Market Opportunities

11. Global Single-use Upstream Bioprocessing Market Challenges

12. Key Single-use Upstream Bioprocessing Market Manufacturer Analysis

13. Global Single-use Upstream Bioprocessing Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Danaher Corporation (Cytiva): Company Snapshot

16. Danaher Corporation (Cytiva): Swot Analysis

17. Sartorius AG: Company Snapshot

18. Sartorius AG: Swot Analysis

19. Thermo Fisher Scientific, Inc.: Company Snapshot

20. Thermo Fisher Scientific, Inc.: Swot Analysis

21. Merck KGaA: Company Snapshot

22. Merck KGaA: Swot Analysis

23. Pall Corporation: Company Snapshot

24. Pall Corporation: Swot Analysis

25. General Electric Company (GE Healthcare): Company Snapshot

26. General Electric Company (GE Healthcare): Swot Analysis

27. Eppendorf AG: Company Snapshot

28. Eppendorf AG: Swot Analysis

29. Rentschler Biopharma SE: Company Snapshot

30. Rentschler Biopharma SE: Swot Analysis

31. Corning Incorporated: Company Snapshot

32. Corning Incorporated: Swot Analysis

33. Lonza: Company Snapshot

34. Lonza: Swot Analysis

35. Other Companies: Company Snapshot

36. Other Companies: Swot Analysis

The Global Single-use Upstream Bioprocessing Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Single-use Upstream Bioprocessing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS