Global Small Molecule Innovator CDMO Market Size, Trends & Analysis - Forecasts to 2028 By Product Type (Small Molecule API and Small Molecule Drug Product [Oral Solid Dose, Semi-solid Dose, Liquid Dose, and Others]), By Stage Type (Preclinical, Clinical [Phase I, Phase II, and Phase III], and Commercial), By Customer Type (Pharmaceutical and Biotechnology), By Therapeutic Area (Cardiovascular Disease, Oncology, Respiratory Disorders, Neurology, Metabolic Disorders, Infectious Diseases, and Others), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), End User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

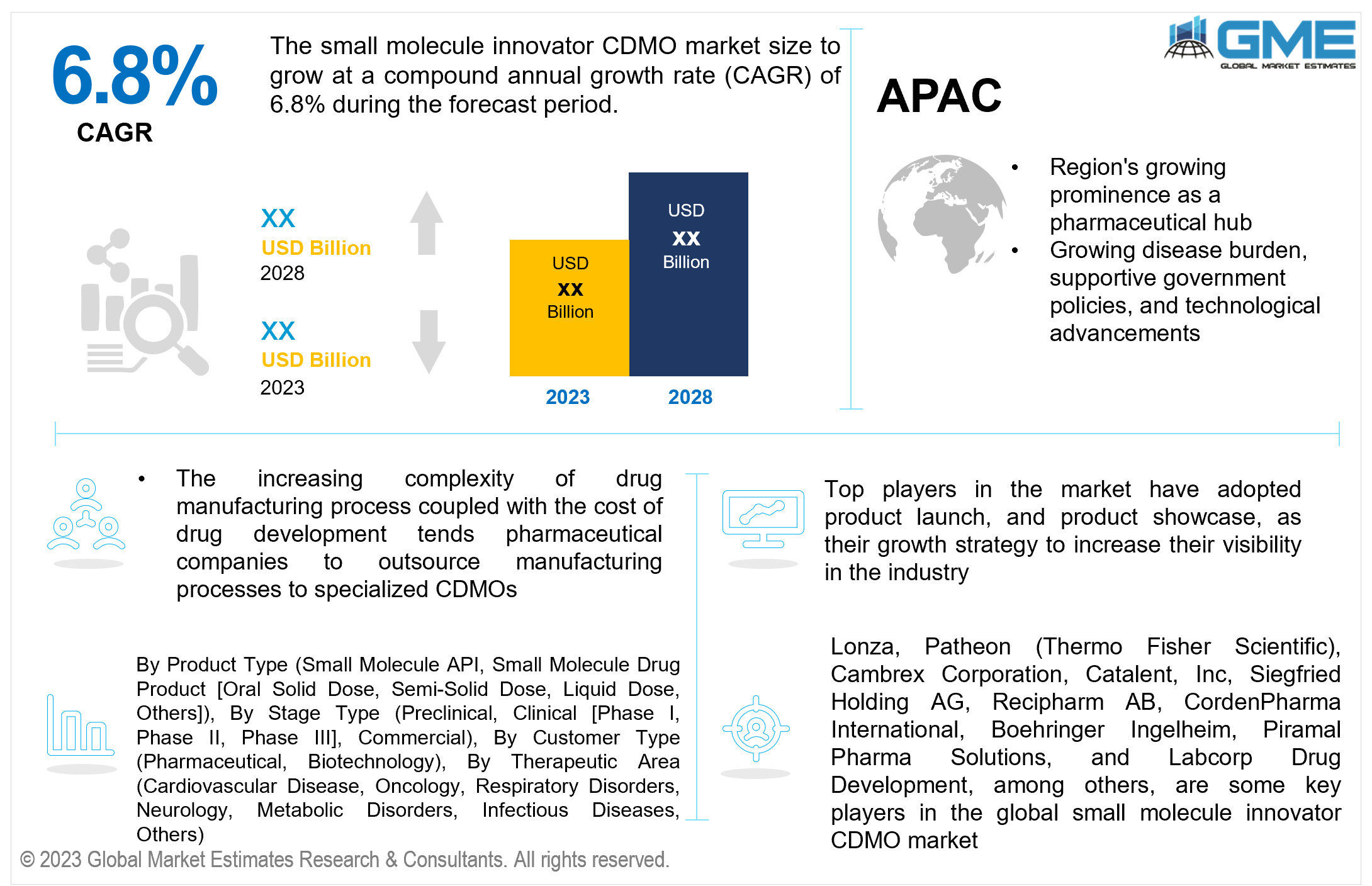

The global small molecule innovator CDMO market is projected to grow at a CAGR of 6.8% from 2023 to 2028. The small molecule innovator contract development and manufacturing organization (CDMO) market is primarily driven by the rising demand for innovative small molecule drugs to address various chronic diseases and conditions.

The rising burden of diseases such as cancer, cardiovascular diseases, and others is driving drug developer for rapid market launch of their drug candidates, while maintaining product efficacy, resulting in increased demand for CDMOs’ services for drug development. These organizations offer expertise, state-of-the-art facilities, and a streamlined approach to accelerate the drug development process, making them lucrative partners for pharmaceutical companies.

Furthermore, the complexities and high costs associated with small-molecule drug development have encouraged pharmaceutical companies to focus on their core competencies, while outsourcing manufacturing and development tasks to CDMOs. This enables them to optimize their resources, reduce time-to-market, and achieve cost efficiencies.

In addition, the continual advancement of technologies and manufacturing capabilities within the CDMO sector is further fuelling its growth. Small molecule innovator CDMOs invest heavily in advanced equipment, process automation, and quality control systems, ensuring they meet stringent regulatory requirements while maintaining high production standards.

Moreover, the emerging trend of personalized medicine and targeted therapies significantly contributing to the rising demand for small molecule innovator CDMOs. The increasing demand for customised treatment approaches as per the individual patient's needs is also fuelling the need for flexible and agile manufacturing partners.

Moreover, the dynamic nature of the pharmaceutical industry with frequent patent expirations and rapid changes in drug pipelines, has led to an increase in the outsourcing of small molecule manufacturing. CDMOs offer pharmaceutical companies the flexibility to scale production up or down based on market demands, reducing the risk associated with fixed internal manufacturing capacities.

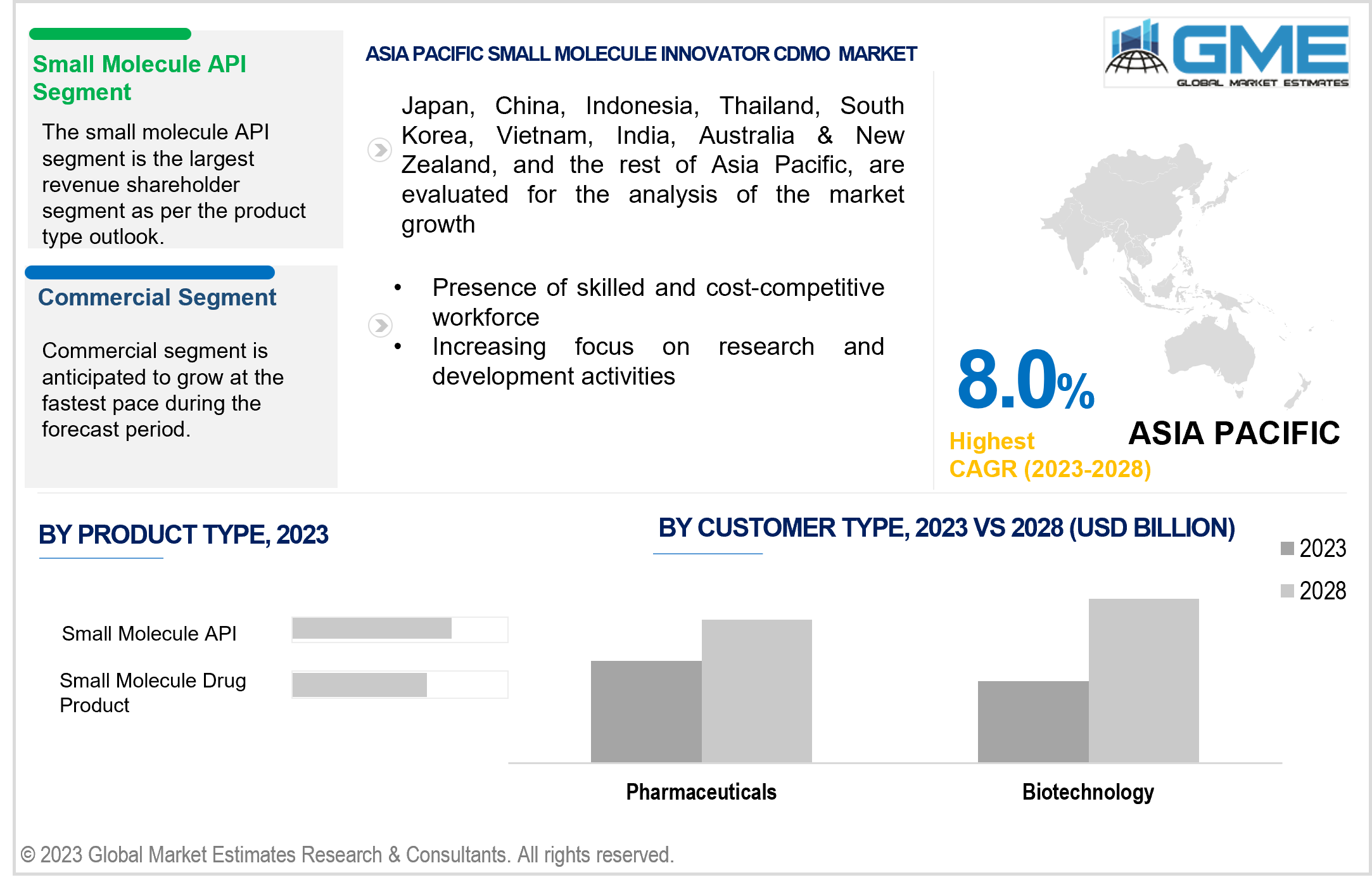

The small molecule API segment is anticipated to be the largest segment in the market from 2023-2028. Small molecule APIs remain the cornerstone of many pharmaceutical products, contributing to their continued significance in the market. This has led pharmaceutical companies to outsource API production, as there is a growing emphasis on the precision and efficiency of APIs. Furthermore, contract manufacturers are making significant investments in cutting-edge technologies and advanced manufacturing processes to advance API synthesis. The confluence of the above-articulated factors has notably driven the growth of this segment in the 2022 market.

Nonetheless, CDMOs are increasingly adopting innovative techniques to optimize drug product formulation and improve bioavailability, resulting in the remarkable growth of this market in the small-molecule drug product segment. Moreover, drug-developing companies are increasingly partnering with CDMOs for tailored solutions to meet their specific drug formulation requirements and dosage forms, thereby driving segment growth.

Considering the complexity of the stage, coupled with the high number of drug molecules in this stage, the clinical segment dominated the 2022 global small molecule innovator CDMO market and is expected to exhibit a high growth rate during the forecast period of 2023 to 2028. The prime factor for this segment growth is a surge in alliances between CDMOs and small molecule innovators in the clinical stage of drug development.

These partnership aims to leverage manufacturing capabilities, regulatory expertise, and quality assurance systems of CDMOs to ensure a seamless transition from preclinical to clinical development. In addition, there is a notable focus on optimizing manufacturing processes, cost-efficiency, and scalability to meet the rising demands for clinical trial materials.

Pharmaceutical companies segment is analyzed to be the largest segment in the market. This is mainly due to the increasing reliance of drug developers on CDMOs to outsource their drug development and manufacturing processes. Furthermore, small market players are often surrounded by budget and resource constraints-related challenges. The complexities involved in bringing new drugs to market have propelled emerging as well as well-established pharmaceutical companies to seek specialized expertise and resources offered by CDMOs. This helps them streamline their manufacturing processes and focus on core competencies such as research and commercialization.

On the other hand, biotechnology sector, which is often characterized by its innovative and cutting-edge research, is witnessing a notable surge in demand for contract services and is analyzed to be the fastest growing segment. Biotech companies are increasingly exploring the capabilities of CDMOs to accelerate the development of their small molecule therapies. Collaboration with contract service providers helps biotechnology companies with access to advanced technologies, state-of-the-art facilities, and regulatory expertise that can be otherwise been challenging to establish in-house.

The oncology segment accounted for maximum revenue share in the 2022 global market, and is expected to retain its dominance during the forecast period. This is owing to oncology being recognized as the focal point for the major pharmaceutical companies, with over 1,700 clinical molecules under clinical investigation for cancer treatments. Furthermore, the trend towards a personalized treatment approach, which involves customised treatment plans as per the genetic profiles of individual patients, has notably influenced the cancer drug development landscape.

The increasing focus on personalized medicine and targeted therapies has propelled pharmaceutical companies to enter into partnerships with CDMOs to expedite their development of novel small molecule oncology drugs, thus meeting the market demands.

Furthermore, the CDMO services market for cardiovascular disease (CVDs) is projected to have a high CAGR during the forecast period of 2023 to 2028. CVDs remain a leading cause of mortality worldwide, prompting drug-developing companies to invest enormously in the development of innovative drugs to address various heart-related conditions such as heart failure, hypertension, and atherosclerosis.

North America accounted for the largest revenue share in 2022 in the global small molecule innovator CDMO market. The growth is primarily attributed to the continuous expansion of the pharmaceutical & biotechnology space in the region, which fuels demand for CDMO services. As these domains strive to develop novel therapeutics, they seek external expertise and manufacturing capabilities to accelerate their drug development processes.

Furthermore, the increasing complexity and specialization of drug molecules is further driving the need for sophisticated manufacturing technologies and facilities. Small molecule innovators require CDMOs with advanced capabilities to handle intricate chemistry and formulation challenges, leading to a surge in demand for specialized CDMO services in the region.

On the other hand, Asia Pacific is anticipated to exhibit a higher growth rate during the forecast period. This is primarily because the region has emerged as a hub for pharmaceutical manufacturing due to its favourable regulatory environment, lower production costs, and abundant skilled labour force. This has attracted global pharmaceutical companies to outsource their small molecule drug development and production activities to Asia Pacific-based CDMOs, thereby boosting the market growth.

In addition, the increasing prevalence of chronic diseases and rising demand for novel & personalized therapeutics have spurred the need for efficient and agile drug development processes in the region.

Lonza, Patheon (Thermo Fisher Scientific), Cambrex Corporation, Catalent, Inc, Siegfried Holding AG, Recipharm AB, CordenPharma International, Boehringer Ingelheim, Piramal Pharma Solutions, and Labcorp Drug Development, among others, are some of the key players operating in the global small molecule innovator CDMO market.

Please note: This is not an exhaustive list of companies profiled in the report.

These companies continue to expand their services and enter into new outsourcing agreements with the market end users. For instance, in October 2022, Societal CDMO announced to enter two new contract development and manufacturing service agreements with new customers. Under the agreement terms, the company would offer services for various analytical methods, formulation, technical transfer, manufacturing, and packaging for novel therapeutics. Similarly, in November 2022, Terumo Pharmaceutical Solutions announced an expansion of its CDMO services for parenteral drugs for customers based out of Japan. These initiatives are anticipated to greatly influence the market revenue growth in the coming years.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL SMALL MOLECULE INNOVATOR CDMO MARKET MARKET, BY PRODUCT TYPE

4.2 Small Molecule Innovator CDMO Market market: Technology Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Small Molecule API Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Small Molecule Drug Product

4.5.1 Small Molecule Drug Product Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Oral Solid Dose Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 Semi-solid Dose Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 Liquid Dose Market Estimates and Forecast, 2020-2028 (USD Million)

4.8.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL SMALL MOLECULE INNOVATOR CDMO MARKET MARKET, BY STAGE TYPE

5.2 Small Molecule Innovator CDMO Market market: Stage Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 PreClinical Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 ClinicalMarket Estimates and Forecast, 2020-2028 (USD Million)

5.5.1.1.1 Phase I Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1.2.1 Phase II Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1.3.1 Phase III Market Estimates and Forecast, 2020-2028 (USD Million)

5.6.1 Commercial Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL SMALL MOLECULE INNOVATOR CDMO MARKET MARKET, BY THERAPEUTIC AREA

6.2 Small Molecule Innovator CDMO Market: Therapeutic Area Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Cardiovascular Diseases Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 Oncology Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 Respiratory Disorders Market Estimates and Forecast, 2020-2028 (USD Million)

6.7.1 Neurology Market Estimates and Forecast, 2020-2028 (USD Million)

6.8.1 Metabolic Disorders Market Estimates and Forecast, 2020-2028 (USD Million)

6.9.1 Infectious Diseases Market Estimates and Forecast, 2020-2028 (USD Million)

6.10.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

7. GLOBAL SMALL MOLECULE INNOVATOR CDMO MARKET MARKET, BY CUSTOMER TYPE

7.2 Small Molecule Innovator CDMO Market: Customer Type Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4.1 Pharmaceuticals Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.1 Biotechnology Market Estimates and Forecast, 2020-2028 (USD Million)

8 GLOBAL SMALL MOLECULE INNOVATOR CDMO MARKET MARKET, BY REGION

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.4.10.3 By Therapeutic Area

8.4.4.11.3 By Therapeutic Area

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.4.1.1 Business Description & Financial Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 Patheon (Thermo Fisher Scientific)

9.4.2.1 Business Description & Financial Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3.1 Business Description & Financial Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4.1 Business Description & Financial Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5.1 Business Description & Financial Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6.1 Business Description & Financial Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 CORDENPHARMA INTERNATIONAL

9.4.7.1 Business Description & Financial Analysis

9.4.7.3 Products & Services Offered

9.4.7.4 Strategic Alliances between Business Partners

9.4.8.1 Business Description & Financial Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9 Piramal Pharma Solutions

9.4.9.1 Business Description & Financial Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 Labcorp Drug Development

9.4.10.1 Business Description & Financial Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11.1 Business Description & Financial Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10.1.2 Market Scope & SegOrchidtation

10.2 Information ProcureOrchidt

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.4 Discussion Guide for Primary Participants

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Small Molecule Innovator CDMO Market market, By Product Type, 2020-2028 (USD Mllion)

2 SMALL MOLECULE API Market, By Region, 2020-2028 (USD Mllion)

3 SMALL MOLECULE DRUG PRODUCT Market, By Region, 2020-2028 (USD Mllion)

4 Global Small Molecule Innovator CDMO Market market, By Stage Type, 2020-2028 (USD Mllion)

5 PreClinical Market, By Region, 2020-2028 (USD Mllion)

6 Clinical Market, By Region, 2020-2028 (USD Mllion)

7 Phase I Market, By Region, 2020-2028 (USD Mllion)

8 Phase II Market, By Region, 2020-2028 (USD Mllion)

9 Phase III Market, By Region, 2020-2028 (USD Mllion)

10 Commercial Market, By Region, 2020-2028 (USD Mllion)

11 Global Small Molecule Innovator CDMO Market market, By Therapeutic Area, 2020-2028 (USD Mllion)

12 Cardiovascular Diseases Market Market, By Region, 2020-2028 (USD Mllion)

13 Oncology Market Market, By Region, 2020-2028 (USD Mllion)

14 Respiratory disorders Market, By Region, 2020-2028 (USD Mllion)

15 Neurology Market Market, By Region, 2020-2028 (USD Mllion)

16 metabolic disorders Market, By Region, 2020-2028 (USD Mllion)

17 infectious disorders Market, By Region, 2020-2028 (USD Mllion)

18 others Market, By Region, 2020-2028 (USD Mllion)

19 Global Small Molecule Innovator CDMO Market, By customer type, 2020-2028 (USD Mllion)

20 pharmaceuticals Market, By Region, 2020-2028 (USD Mllion)

21 biotechnology Market, By Region, 2020-2028 (USD Mllion)

22 Regional Analysis, 2020-2028 (USD Mllion)

23 North America Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

24 North America Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

25 North America Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

26 North America Small Molecule Innovator CDMO MARKET , By Country, 2020-2028 (USD Million)

27 U.S Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

28 U.S Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

29 U.S Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

30 Canada Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

31 Canada Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

32 Canada Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

33 Mexico Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

34 Mexico Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

35 Mexico Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

36 Europe Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

37 Europe Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

38 Europe Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

39 Germany Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

40 Germany Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

41 Germany Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

42 U.K. Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

43 U.K. Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

44 U.K. Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

45 France Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

46 France Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

47 France Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

48 Italy Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

49 Italy Small Molecule Innovator CDMO MARKET , By Stage Type Type, 2020-2028 (USD Million)

50 Italy Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

51 Spain Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

52 Spain Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

53 Spain Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

54 Rest Of Europe Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

55 Rest Of Europe Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

56 Rest of Europe Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

57 Asia Pacific Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

58 Asia Pacific Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

59 Asia Pacific Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

60 Asia Pacific Small Molecule Innovator CDMO MARKET , By Country, 2020-2028 (USD Million)

61 China Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

62 China Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

63 China Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

64 India Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

65 India Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

66 India Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

67 Japan Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

68 Japan Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

69 Japan Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

70 South Korea Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

71 South Korea Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

72 South Korea Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

73 Middle East and Africa Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

74 Middle East and Africa Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

75 Middle East and Africa Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

76 Middle East and Africa Small Molecule Innovator CDMO MARKET , By Country, 2020-2028 (USD Million)

77 Saudi Arabia Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

78 Saudi Arabia Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

79 Saudi Arabia Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

80 UAE Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

81 UAE Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

82 UAE Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

83 Central & South America Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

84 Central & South America Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

85 Central & South America Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

86 Central & South America Small Molecule Innovator CDMO MARKET , By Country, 2020-2028 (USD Million)

87 Brazil Small Molecule Innovator CDMO MARKET , By Product Type, 2020-2028 (USD Million)

88 Brazil Small Molecule Innovator CDMO MARKET , By Stage Type, 2020-2028 (USD Million)

89 Brazil Small Molecule Innovator CDMO MARKET , By Therapeutic Area, 2020-2028 (USD Million)

90 Lonza: Products & Services Offering

91 Patheon (Thermo Fisher Scientific): Products & Services Offering

92 CAMBREX CORPORATION : Products & Services Offering

93 Catalent, Inc: Products & Services Offering

94 Siegfried Holding AG: Products & Services Offering

95 RECIPHARM AB: Products & Services Offering

96 CORDENPHARMA INTERNATIONAL: Products & Services Offering

97 Boehringer Ingelheim: Products & Services Offering

98 Piramal Pharma Solutions: Products & Services Offering

99 Labcorp Drug Development: Products & Services Offering

100 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Small Molecule Innovator CDMO Market Overview

2 Global Small Molecule Innovator CDMO Market Value From 2020-2028 (USD Mllion)

3 Global Small Molecule Innovator CDMO Market Share, By Product Type (2022)

4 Global Small Molecule Innovator CDMO Market Share, By Stage Type (2022)

5 Global Small Molecule Innovator CDMO Market Share, By Therapeutic Area (2022)

6 Global Small Molecule Innovator CDMO Market , By Region (Asia Pacific Market)

7 Technological Trends In Global Small Molecule Innovator CDMO Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Small Molecule Innovator CDMO MARKET

11 Impact Of Challenges On The Global Small Molecule Innovator CDMO MARKET

12 Porter’s Five Forces Analysis

13 Global Small Molecule Innovator CDMO Market : By Product Type Scope Key Takeaways

14 Global Small Molecule Innovator CDMO Market , By Product Type Segment: Revenue Growth Analysis

15 Small Molecule API Market, By Region, 2020-2028 (USD Mllion)

16 Small Molecule Drug Product Market, By Region, 2020-2028 (USD Mllion)

17 Global Small Molecule Innovator CDMO Market : By Stage Type Scope Key Takeaways

18 Global Small Molecule Innovator CDMO Market , By Stage Type Segment: Revenue Growth Analysis

19 PreClinical Market, By Region, 2020-2028 (USD Mllion)

20 Clinical Market, By Region, 2020-2028 (USD Mllion)

21 Phase I Market, By Region, 2020-2028 (USD Mllion)

22 Phase II Market, By Region, 2020-2028 (USD Mllion)

23 Phase III Market, By Region, 2020-2028 (USD Mllion)

24 Commercial Market, By Region, 2020-2028 (USD Mllion)

25 Global Small Molecule Innovator CDMO Market: By Therapeutic Area Scope Key Takeaways

26 Global Small Molecule Innovator CDMO Market, By Therapeutic Area Segment: Revenue Growth Analysis

27 Cardiovascular Diseases Market Market, By Region, 2020-2028 (USD Mllion)

28 Oncology Market, By Region, 2020-2028 (USD Mllion)

29 Respiratory Disorders Market, By Region, 2020-2028 (USD Mllion)

30 Neurology Market, By Region, 2020-2028 (USD Mllion)

31 Metabolic Disorders Market, By Region, 2020-2028 (USD Mllion)

32 Infectious Disorders Market, By Region, 2020-2028 (USD Mllion)

33 Others Market, By Region, 2020-2028 (USD Mllion)

34 Global Small Molecule Innovator CDMO market: By Customer Type Scope Key Takeaways

35 Global Small Molecule Innovator CDMO market, By Customer Type Segment: Revenue Growth Analysis

36 Pharmaceuticals Market, By Region, 2020-2028 (USD Mllion)

37 Biotechnology Market, By Region, 2020-2028 (USD Mllion)

38 Regional Segment: Revenue Growth Analysis

39 Global Small Molecule Innovator CDMO Market : Regional Analysis

40 North America Small Molecule Innovator CDMO Market Overview

41 North America Small Molecule Innovator CDMO Market, By Product Type

42 North America Small Molecule Innovator CDMO Market, By Stage Type

43 North America Small Molecule Innovator CDMO Market, By Therapeutic Area

44 North America Small Molecule Innovator CDMO Market , By Country

45 U.S. Small Molecule Innovator CDMO Market , By Product Type

46 U.S. Small Molecule Innovator CDMO Market , By Stage Type

47 U.S. Small Molecule Innovator CDMO Market , By Therapeutic Area

48 Canada Small Molecule Innovator CDMO Market , By Product Type

49 Canada Small Molecule Innovator CDMO Market , By Stage Type

50 Canada Small Molecule Innovator CDMO Market , By Therapeutic Area

51 Mexico Small Molecule Innovator CDMO Market , By Product Type

52 Mexico Small Molecule Innovator CDMO Market , By Stage Type

53 Mexico Small Molecule Innovator CDMO Market , By Therapeutic Area

54 Four Quadrant Positioning Matrix

55 Company Market Share Analysis

56 Lonza: Company Snapshot

57 Lonza: SWOT Analysis

58 Lonza: Geographic Presence

59 Patheon (Thermo Fisher Scientific): Company Snapshot

60 Patheon (Thermo Fisher Scientific): SWOT Analysis

61 Patheon (Thermo Fisher Scientific): Geographic Presence

62 Cambrex Corporation : Company Snapshot

63 Cambrex Corporation: SWOT Analysis

64 Cambrex Corporation: Geographic Presence

65 Catalent, Inc: Company Snapshot

66 Catalent, Inc: Swot Analysis

67 Catalent, Inc: Geographic Presence

68 Siegfried Holding AG: Company Snapshot

69 Siegfried Holding AG: SWOT Analysis

70 Siegfried Holding AG: Geographic Presence

71 RECIPHARM AB: Company Snapshot

72 RECIPHARM AB: SWOT Analysis

73 RECIPHARM AB: Geographic Presence

74 Cordenpharma International : Company Snapshot

75 Cordenpharma International: SWOT Analysis

76 Cordenpharma International: Geographic Presence

77 Boehringer Ingelheim: Company Snapshot

78 Boehringer Ingelheim: SWOT Analysis

79 Boehringer Ingelheim: Geographic Presence

80 Piramal Pharma Solutions: Company Snapshot

81 Piramal Pharma Solutions: SWOT Analysis

82 Piramal Pharma Solutions: Geographic Presence

83 Labcorp Drug Development: Company Snapshot

84 Labcorp Drug Development: SWOT Analysis

85 Labcorp Drug Development: Geographic Presence

86 Other Companies: Company Snapshot

87 Other Companies: SWOT Analysis

88 Other Companies: Geographic Presence

The Global Small Molecule Innovator CDMO Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Small Molecule Innovator CDMO Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS