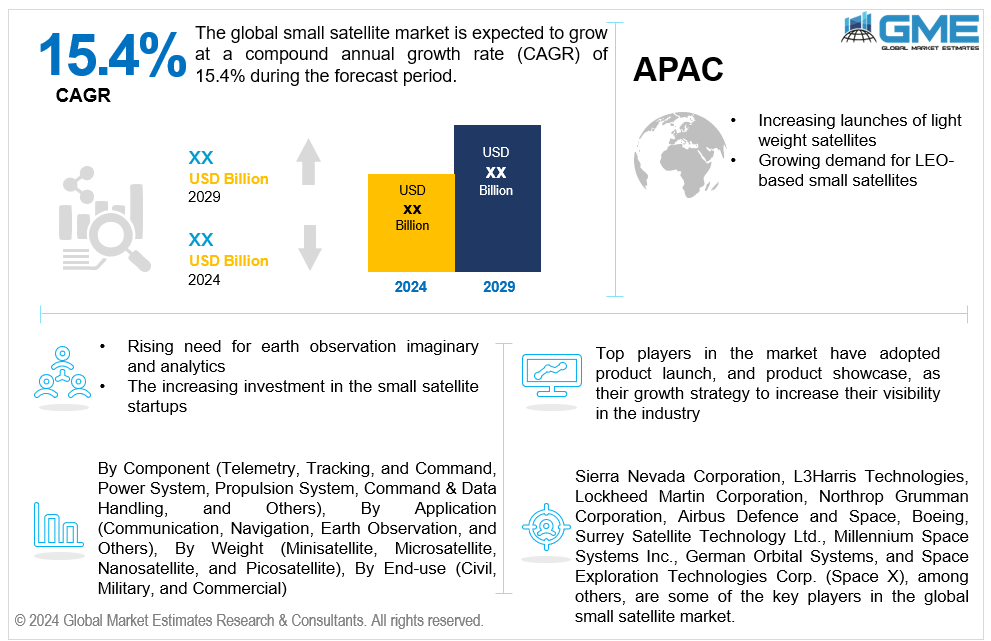

Global Small Satellite Market Size, Trends & Analysis - Forecasts to 2029 By Component (Telemetry, Tracking, and Command, Power System, Propulsion System, Command & Data Handling, and Others), By Application (Communication, Navigation, Earth Observation, and Others), By Weight (Minisatellite, Microsatellite, Nanosatellite, and Picosatellite), By End-use (Civil, Military, and Commercial), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global small satellite market is estimated to exhibit a CAGR of 15.4% from 2024 to 2029.

The primary factors propelling the market growth are the increasing launches of light weight satellites and growing demand for low earth orbit (LEO) based small satellites. Launch service providers are responding to the increasing demand by raising the frequency of missions and offering rideshare options, which allow multiple small satellites to utilize a single launching vehicle. This increased launch frequency reduces lead periods for satellite deployment and accelerates the rate of innovation in the small satellite sector. For instance, China launched a 12-kg student satellite from the Tiangong space station in December 2022. The satellite would support education in radio communication and earth imaging for students.

The rising need for earth observation imagery and analytics, along with the increasing investment in the small satellite start-ups, are expected to support the market growth. Small satellite startups frequently concentrate on offering commercial services like data analytics, communication, remote sensing, and Earth observation. The commercialization of space-based services is made possible by investments in these startups, creating new revenue streams and market potential. Small satellite start-ups boost demand and acceptance of small satellite technology globally by providing affordable solutions for various sectors. For instance, Blue Canyon Technologies announced a small satellite manufacturing plant in Colorado in August 2022. The company's production capacity was enhanced to 85 space vehicles annually by the new facility, solidifying the company's leadership in the industry.

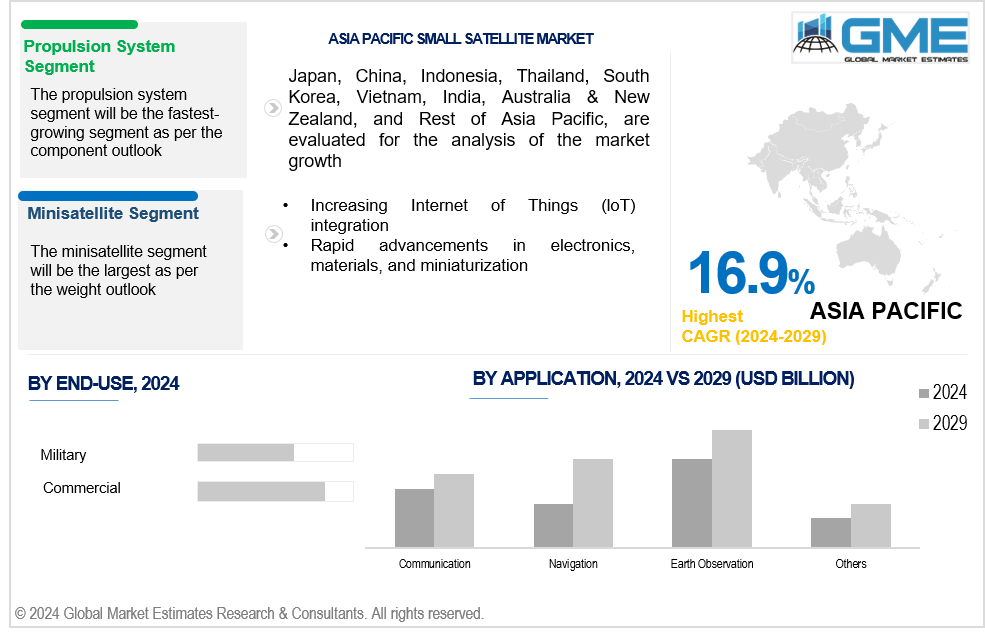

Increasing Internet of Things (loT) integration and rapid advancements in electronics, materials, and miniaturization propel market growth. The Internet of Things depends on networked devices for data transmission and the development of numerous applications in sectors, including agriculture, logistics, energy, transportation, and environmental monitoring. Small satellites efficiently give the Internet of Things devices worldwide connectivity, particularly in isolated or underdeveloped regions with inadequate terrestrial infrastructure. IoT-optimized small satellite constellations are being deployed in response to the growing need for worldwide connectivity.

Applications for small satellites in military and security, such as intelligence gathering, reconnaissance, surveillance, and missile warning systems, are growing in popularity. Small satellite technology presents opportunities for government and defense contractor investment to improve defense and national security capabilities. Additionally, due to the rising demand for small satellite launches, businesses can offer launch infrastructure, ridesharing options, and dedicated launch services. The expanding small satellite market can be supported by investments in spaceports, ground-based infrastructure, and launch vehicle development.

However, the short lifespan of small satellites and the shortage of small satellite dedicated launch vehicles hinder market growth.

The telemetry, tracking, and command segment is expected to hold the largest share of the market over the forecast period. Satellite telemetry, tracking, and command systems are essential for tracking the position and trajectory of spacecraft, transmitting commands to regulate their operations, and monitoring the health and state of the spacecraft. These operations guarantee satellites' safe and effective operation in orbit.

The propulsion system segment is expected to be the fastest-growing segment in the market from 2024-2029. Propulsion systems allow small satellites to manoeuvre in space, altering their orbits, adjusting their positions, and enabling them to perform various missions. As the demand for small satellites grows across diverse applications such as Earth observation, communication, and scientific research, the need for propulsion systems to enhance mission flexibility and efficiency also increases.

The earth observation segment is expected to hold the largest share of the market over the forecast period. High-resolution imagery and data are in high demand for various earth observation applications, such as forestry, agriculture, urban planning, environmental monitoring, disaster management, and climate change research. Small satellites provide an economical and flexible way to take regular, high-quality pictures of the Earth's surface, opening up a world of uses and allowing people to get fast, pertinent information.

The navigation segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The need for location-based services (LBS) is growing in several industries, including consumer electronics, telecommunications, logistics, transportation, and agriculture. Innovative LBS applications and services can be developed and implemented with the help of small satellites, which can supply precise and dependable positioning, navigation, and timing (PNT) data.

The minisatellite segment is expected to hold the largest share of the market over the forecast period. Compared to microsatellites and nanosatellites, minisatellites are larger and more adaptable, with an average weight of 100 to 500 kg. This enables them to carry out a variety of missions and carry a larger range of payloads.

The nanosatellite segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Nanosatellites are the smallest category of satellites, and their average weight ranges from 1 to 10 kg. Technological developments in miniaturization have made it possible to create more powerful nanosatellites while decreasing their dimensions, mass, and cost.

The commercial segment is expected to hold the largest share of the market over the forecast period. For commercial purposes, small satellites are a more affordable option than conventional larger satellites. Due to their often reduced development, manufacturing, and launch costs, companies with limited budgets can more easily acquire them. Deploying small satellites in constellations can achieve more coverage and redundancy at a fraction of the cost of bigger, single satellites.

The military segment is anticipated to be the fastest-growing segment in the market from 2024-2029. Armed forces can benefit from improved intelligence, surveillance, and reconnaissance (ISR), communications, navigation, and tactical support capabilities due to small satellites. They can be quickly and affordably deployed to give situational awareness and real-time information in various operational contexts, such as restricted or distant places.

North America is expected to be the largest region in the global market. Small satellite programs receive much support and financing from North American government organizations like NASA, the Department of Defense (DoD), and other federal agencies, which fuels the market growth. For instance, as of January 2022, the United States possesses 2,944 of the 4,852 artificial satellites that are currently in orbit above the Earth, according to the Union of Concerned Scientists.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The small satellite market in the Asia Pacific region is expanding due to the commercialization of space operations. Private businesses are investing in constellations of small satellites for various uses, such as global navigation, broadband internet services, and Earth observation. For instance, Beijing's municipal administration unveiled an action plan in February 2024 to promote the city's creative commercial space ecosystem during 2024 to 2029.

Sierra Nevada Corporation, L3Harris Technologies, Lockheed Martin Corporation, Northrop Grumman Corporation, Airbus Defence and Space, Boeing, Surrey Satellite Technology Ltd., Millennium Space Systems Inc., German Orbital Systems, and Space Exploration Technologies Corp. (Space X), among others, are some of the key players in the global small satellite market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2023, L3Harris Technologies declared that it received a USD 765 million contract from NASA to the National Oceanic and Atmospheric Administration to design and develop a next-generation, high-resolution imager for the Geostationary Extended Observation System.

In August 2023, the Space Development Agency (SDA) gave Lockheed Martin a firm-fixed-price order of roughly USD 816 million to manufacture 36 small satellites that will expand the agency's communications network.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL SMALL SATELLITE MARKET, BY APPLICATION

4.1 Introduction

4.2 Small Satellite Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Communication

4.4.1 Communication Market Estimates and Forecast, 2021-2029 (USD Billion)

4.5 Navigation

4.5.1 Navigation Market Estimates and Forecast, 2021-2029 (USD Billion)

4.6 Earth Observation

4.6.1 Earth Observation Market Estimates and Forecast, 2021-2029 (USD Billion)

4.7 Others

4.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Billion)

5 GLOBAL SMALL SATELLITE MARKET, BY COMPONENT

5.1 Introduction

5.2 Small Satellite Market: Component Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Telemetry, Tracking, and Command

5.4.1 Telemetry, Tracking, and Command Market Estimates and Forecast, 2021-2029 (USD Billion)

5.5 Power System

5.5.1 Power System Market Estimates and Forecast, 2021-2029 (USD Billion)

5.6 Propulsion System

5.6.1 Propulsion System Market Estimates and Forecast, 2021-2029 (USD Billion)

5.7 Command & Data Handling

5.7.1 Command & Data Handling Market Estimates and Forecast, 2021-2029 (USD Billion)

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Billion)

6 GLOBAL SMALL SATELLITE MARKET, BY WEIGHT

6.1 Introduction

6.2 Small Satellite Market: Weight Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Minisatellite

6.4.1 Minisatellite Market Estimates and Forecast, 2021-2029 (USD Billion)

6.5 Microsatellite

6.5.1 Microsatellite Market Estimates and Forecast, 2021-2029 (USD Billion)

6.6 Nanosatellite

6.6.1 Nanosatellite Market Estimates and Forecast, 2021-2029 (USD Billion)

6.7 Picosatellite

6.7.1 Picosatellite Market Estimates and Forecast, 2021-2029 (USD Billion)

7 GLOBAL SMALL SATELLITE MARKET, BY END-USE

7.1 Introduction

7.2 Small Satellite Market: End-use Scope Key Takeaways

7.3 Revenue Growth Analysis, 2023 & 2029

7.4 Civil

7.4.1 Civil Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5 Military

7.5.1 Military Market Estimates and Forecast, 2021-2029 (USD Billion)

7.6 Commercial

7.6.1 Commercial Market Estimates and Forecast, 2021-2029 (USD Billion)

8 GLOBAL SMALL SATELLITE MARKET, BY REGION

8.1 Introduction

8.2 North America Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.2.1 By Application

8.2.2 By Component

8.2.3 By Weight

8.2.4 By End-use

8.2.5 By Country

8.2.5.1 U.S. Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.2.5.1.1 By Application

8.2.5.1.2 By Component

8.2.5.1.3 By Weight

8.2.5.1.4 By End-use

8.2.5.2 Canada Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.2.5.2.1 By Application

8.2.5.2.2 By Component

8.2.5.2.3 By Weight

8.2.5.2.4 By End-use

8.2.5.3 Mexico Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.2.5.3.1 By Application

8.2.5.3.2 By Component

8.2.5.3.3 By Weight

8.2.5.3.4 By End-use

8.3 Europe Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.1 By Application

8.3.2 By Component

8.3.3 By Weight

8.3.4 By End-use

8.3.5 By Country

8.3.5.1 Germany Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.1.1 By Application

8.3.5.1.2 By Component

8.3.5.1.3 By Weight

8.3.5.1.4 By End-use

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.2.1 By Application

8.3.5.2.2 By Component

8.3.5.2.3 By Weight

8.3.5.2.4 By End-use

8.3.5.3 France Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.3.1 By Application

8.3.5.3.2 By Component

8.3.5.3.3 By Weight

8.3.5.3.4 By End-use

8.3.5.4 Italy Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.4.1 By Application

8.3.5.4.2 By Component

8.3.5.4.3 By Weight

8.3.5.4.4 By End-use

8.3.5.5 Spain Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.5.1 By Application

8.3.5.5.2 By Component

8.3.5.5.3 By Weight

8.3.5.5.4 By End-use

8.3.5.6 Netherlands Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.6.1 By Application

8.3.5.6.2 By Component

8.3.5.6.3 By Weight

8.3.5.6.4 By End-use

8.3.5.7 Rest of Europe Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.7.1 By Application

8.3.5.7.2 By Component

8.3.5.7.3 By Weight

8.3.5.7.4 By End-use

8.4 Asia Pacific Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.1 By Application

8.4.2 By Component

8.4.3 By Weight

8.4.4 By End-use

8.4.5 By Country

8.4.5.1 China Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.1.1 By Application

8.4.5.1.2 By Component

8.4.5.1.3 By Weight

8.4.5.1.4 By End-use

8.4.5.2 Japan Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.2.1 By Application

8.4.5.2.2 By Component

8.4.5.2.3 By Weight

8.4.5.2.4 By End-use

8.4.5.3 India Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.3.1 By Application

8.4.5.3.2 By Component

8.4.5.3.3 By Weight

8.4.5.3.4 By End-use

8.4.5.4 South Korea Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.4.1 By Application

8.4.5.4.2 By Component

8.4.5.4.3 By Weight

8.4.5.4.4 By End-use

8.4.5.5 Singapore Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.5.1 By Application

8.4.5.5.2 By Component

8.4.5.5.3 By Weight

8.4.5.5.4 By End-use

8.4.5.6 Malaysia Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.6.1 By Application

8.4.5.6.2 By Component

8.4.5.6.3 By Weight

8.4.5.6.4 By End-use

8.4.5.7 Thailand Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.7.1 By Application

8.4.5.7.2 By Component

8.4.5.7.3 By Weight

8.4.5.7.4 By End-use

8.4.5.8 Indonesia Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.8.1 By Application

8.4.5.8.2 By Component

8.4.5.8.3 By Weight

8.4.5.8.4 By End-use

8.4.5.9 Vietnam Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.9.1 By Application

8.4.5.9.2 By Component

8.4.5.9.3 By Weight

8.4.5.9.4 By End-use

8.4.5.10 Taiwan Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.10.1 By Application

8.4.5.10.2 By Component

8.4.5.10.3 By Weight

8.4.5.10.4 By End-use

8.4.5.11 Rest of Asia Pacific Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.11.1 By Application

8.4.5.11.2 By Component

8.4.5.11.3 By Weight

8.4.5.11.4 By End-use

8.5 Middle East and Africa Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.1 By Application

8.5.2 By Component

8.5.3 By Weight

8.5.4 By End-use

8.5.5 By Country

8.5.5.1 Saudi Arabia Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.5.1.1 By Application

8.5.5.1.2 By Component

8.5.5.1.3 By Weight

8.5.5.1.4 By End-use

8.5.5.2 U.A.E. Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.5.2.1 By Application

8.5.5.2.2 By Component

8.5.5.2.3 By Weight

8.5.5.2.4 By End-use

8.5.5.3 Israel Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.4.3.1 By Application

8.5.4.3.2 By Component

8.5.4.3.3 By Weight

8.5.5.3.4 By End-use

8.5.5.4 South Africa Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.5.4.1 By Application

8.5.5.4.2 By Component

8.5.5.4.3 By Weight

8.5.5.4.4 By End-use

8.5.5.5 Rest of Middle East and Africa Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.5.5.1 By Application

8.5.5.5.2 By Component

8.5.5.5.2 By Weight

8.5.5.5.4 By End-use

8.6 Central & South America Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.1 By Application

8.6.2 By Component

8.6.3 By Weight

8.6.4 By End-use

8.6.5 By Country

8.6.5.1 Brazil Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.5.1.1 By Application

8.6.5.1.2 By Component

8.6.5.1.3 By Weight

8.6.5.1.4 By End-use

8.6.5.2 Argentina Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.5.2.1 By Application

8.6.5.2.2 By Component

8.6.5.2.3 By Weight

8.6.5.2.4 By End-use

8.6.5.3 Chile Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.5.3.1 By Application

8.6.5.3.2 By Component

8.6.5.3.3 By Weight

8.6.5.5.4 By End-use

8.6.5.4 Rest of Central & South America Small Satellite Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.5.4.1 By Application

8.6.5.4.2 By Component

8.6.5.4.3 By Weight

8.6.5.4.4 By End-use

9 COMPETITIVE LANDCAPE

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.2.1 Market Leaders

9.2.2 Market Visionaries

9.2.3 Market Challengers

9.2.4 Niche Market Players

9.3 Vendor Landscape

9.3.1 North America

9.3.2 Europe

9.3.3 Asia Pacific

9.3.4 Rest of the World

9.4 Company Profiles

9.4.1 Sierra Nevada Corporation

9.4.1.1 Business Description & Financial Analysis

9.4.1.2 SWOT Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 L3Harris Technologies

9.4.2.1 Business Description & Financial Analysis

9.4.2.2 SWOT Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 Lockheed Martin Corporation

9.4.3.1 Business Description & Financial Analysis

9.4.3.2 SWOT Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4 Northrop Grumman Corporation

9.4.4.1 Business Description & Financial Analysis

9.4.4.2 SWOT Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 Airbus Defence and Space

9.4.5.1 Business Description & Financial Analysis

9.4.5.2 SWOT Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 BOEING

9.4.6.1 Business Description & Financial Analysis

9.4.6.2 SWOT Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 Surrey Satellite Technology Ltd.

9.4.7.1 Business Description & Financial Analysis

9.4.7.2 SWOT Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 Millennium Space Systems Inc.

9.4.8.1 Business Description & Financial Analysis

9.4.8.2 SWOT Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9 German Orbital Systems

9.4.9.1 Business Description & Financial Analysis

9.4.9.2 SWOT Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 Space Exploration Technologies Corp. (Space X)

9.4.10.1 Business Description & Financial Analysis

9.4.10.2 SWOT Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11 Other Companies

9.4.11.1 Business Description & Financial Analysis

9.4.11.2 SWOT Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10 RESEARCH METHODOLOGY

10.1 Market Introduction

10.1.1 Market Definition

10.1.2 Market Scope & Segmentation

10.2 Information Procurement

10.2.1 Secondary Research

10.2.1.1 Purchased Databases

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2 Primary Research

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.3 Primary Stakeholders

10.2.2.4 Discussion Guide for Primary Participants

10.2.3 Expert Panels

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4 Paid Local Experts

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3 Market Estimation

10.3.1 Top-Down Approach

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2 Bottom Up Approach

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4 Data Triangulation

10.4.1 Data Collection

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.4.3 Cluster Analysis

10.5 Analysis and Output

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

10.7.1 Research Assumptions

10.7.2 Research Limitations

LIST OF TABLES

1 Global Small Satellite Market, By Application, 2021-2029 (USD Billion)

2 Communication Market, By Region, 2021-2029 (USD Billion)

3 Navigation Market, By Region, 2021-2029 (USD Billion)

4 Earth Observation Market, By Region, 2021-2029 (USD Billion)

5 Others Market, By Region, 2021-2029 (USD Billion)

6 Global Small Satellite Market, By Component, 2021-2029 (USD Billion)

7 Telemetry, Tracking, and Command Market, By Region, 2021-2029 (USD Billion)

8 Power System Market, By Region, 2021-2029 (USD Billion)

9 Propulsion System Market, By Region, 2021-2029 (USD Billion)

10 Command & Data Handling Market, By Region, 2021-2029 (USD Billion)

11 Others Market, By Region, 2021-2029 (USD Billion)

12 Global Small Satellite Market, By Weight, 2021-2029 (USD Billion)

13 Minisatellite Market, By Region, 2021-2029 (USD Billion)

14 Microsatellite Market, By Region, 2021-2029 (USD Billion)

15 Nanosatellite Market, By Region, 2021-2029 (USD Billion)

16 Picosatellite Market, By Region, 2021-2029 (USD Billion)

17 Global Small Satellite Market, By END-USE, 2021-2029 (USD Billion)

18 Civil Market, By Region, 2021-2029 (USD Billion)

19 Military Market, By Region, 2021-2029 (USD Billion)

20 Commercial Market, By Region, 2021-2029 (USD Billion)

21 Regional Analysis, 2021-2029 (USD Billion)

22 North America Small Satellite Market, By Application, 2021-2029 (USD Billion)

23 North America Small Satellite Market, By Component, 2021-2029 (USD Billion)

24 North America Small Satellite Market, By Weight, 2021-2029 (USD Billion)

25 North America Small Satellite Market, By End-use, 2021-2029 (USD Billion)

26 North America Small Satellite Market, By Country, 2021-2029 (USD Billion)

27 U.S Small Satellite Market, By Application, 2021-2029 (USD Billion)

28 U.S Small Satellite Market, By Component, 2021-2029 (USD Billion)

29 U.S Small Satellite Market, By Weight, 2021-2029 (USD Billion)

30 U.S Small Satellite Market, By End-use, 2021-2029 (USD Billion)

31 Canada Small Satellite Market, By Application, 2021-2029 (USD Billion)

32 Canada Small Satellite Market, By Component, 2021-2029 (USD Billion)

33 Canada Small Satellite Market, By Weight, 2021-2029 (USD Billion)

34 CANADA Small Satellite Market, By End-use, 2021-2029 (USD Billion)

35 Mexico Small Satellite Market, By Application, 2021-2029 (USD Billion)

36 Mexico Small Satellite Market, By Component, 2021-2029 (USD Billion)

37 Mexico Small Satellite Market, By Weight, 2021-2029 (USD Billion)

38 mexico Small Satellite Market, By End-use, 2021-2029 (USD Billion)

39 Europe Small Satellite Market, By Application, 2021-2029 (USD Billion)

40 Europe Small Satellite Market, By Component, 2021-2029 (USD Billion)

41 Europe Small Satellite Market, By Weight, 2021-2029 (USD Billion)

42 europe Small Satellite Market, By End-use, 2021-2029 (USD Billion)

43 europe Small Satellite Market, By COUNTRY, 2021-2029 (USD Billion)

44 Germany Small Satellite Market, By Application, 2021-2029 (USD Billion)

45 Germany Small Satellite Market, By Component, 2021-2029 (USD Billion)

46 Germany Small Satellite Market, By Weight, 2021-2029 (USD Billion)

47 germany Small Satellite Market, By End-use, 2021-2029 (USD Billion)

48 UK Small Satellite Market, By Application, 2021-2029 (USD Billion)

49 UK Small Satellite Market, By Component, 2021-2029 (USD Billion)

50 UK Small Satellite Market, By Weight, 2021-2029 (USD Billion)

51 U.k Small Satellite Market, By End-use, 2021-2029 (USD Billion)

52 France Small Satellite Market, By Application, 2021-2029 (USD Billion)

53 France Small Satellite Market, By Component, 2021-2029 (USD Billion)

54 France Small Satellite Market, By Weight, 2021-2029 (USD Billion)

55 france Small Satellite Market, By End-use, 2021-2029 (USD Billion)

56 Italy Small Satellite Market, By Application, 2021-2029 (USD Billion)

57 Italy Small Satellite Market, By T Component Type, 2021-2029 (USD Billion)

58 Italy Small Satellite Market, By Weight, 2021-2029 (USD Billion)

59 italy Small Satellite Market, By End-use, 2021-2029 (USD Billion)

60 Spain Small Satellite Market, By Application, 2021-2029 (USD Billion)

61 Spain Small Satellite Market, By Component, 2021-2029 (USD Billion)

62 Spain Small Satellite Market, By Weight, 2021-2029 (USD Billion)

63 spain Small Satellite Market, By End-use, 2021-2029 (USD Billion)

64 Netherlands Small Satellite Market, By Application, 2021-2029 (USD Billion)

65 Netherlands Small Satellite Market, By Component, 2021-2029 (USD Billion)

66 Netherlands Small Satellite Market, By Weight, 2021-2029 (USD Billion)

67 Netherlands Small Satellite Market, By END-USE, 2021-2029 (USD Billion)

68 Rest Of Europe Small Satellite Market, By Application, 2021-2029 (USD Billion)

69 Rest Of Europe Small Satellite Market, By Component, 2021-2029 (USD Billion)

70 Rest of Europe Small Satellite Market, By Weight, 2021-2029 (USD Billion)

71 REST OF EUROPE Small Satellite Market, By End-use, 2021-2029 (USD Billion)

72 Asia Pacific Small Satellite Market, By Application, 2021-2029 (USD Billion)

73 Asia Pacific Small Satellite Market, By Component, 2021-2029 (USD Billion)

74 Asia Pacific Small Satellite Market, By Weight, 2021-2029 (USD Billion)

75 asia Small Satellite Market, By End-use, 2021-2029 (USD Billion)

76 Asia Pacific Small Satellite Market, By Country, 2021-2029 (USD Billion)

77 China Small Satellite Market, By Application, 2021-2029 (USD Billion)

78 China Small Satellite Market, By Component, 2021-2029 (USD Billion)

79 China Small Satellite Market, By Weight, 2021-2029 (USD Billion)

80 china Small Satellite Market, By End-use, 2021-2029 (USD Billion)

81 India Small Satellite Market, By Application, 2021-2029 (USD Billion)

82 India Small Satellite Market, By Component, 2021-2029 (USD Billion)

83 India Small Satellite Market, By Weight, 2021-2029 (USD Billion)

84 india Small Satellite Market, By End-use, 2021-2029 (USD Billion)

85 Japan Small Satellite Market, By Application, 2021-2029 (USD Billion)

86 Japan Small Satellite Market, By Component, 2021-2029 (USD Billion)

87 Japan Small Satellite Market, By Weight, 2021-2029 (USD Billion)

88 japan Small Satellite Market, By End-use, 2021-2029 (USD Billion)

89 South Korea Small Satellite Market, By Application, 2021-2029 (USD Billion)

90 South Korea Small Satellite Market, By Component, 2021-2029 (USD Billion)

91 South Korea Small Satellite Market, By Weight, 2021-2029 (USD Billion)

92 south korea Small Satellite Market, By End-use, 2021-2029 (USD Billion)

93 Singapore Small Satellite Market, By Application, 2021-2029 (USD Billion)

94 Singapore Small Satellite Market, By Component, 2021-2029 (USD Billion)

95 Singapore Small Satellite Market, By Weight, 2021-2029 (USD Billion)

96 Singapore Small Satellite Market, By End-use, 2021-2029 (USD Billion)

97 Thailand Small Satellite Market, By Application, 2021-2029 (USD Billion)

98 Thailand Small Satellite Market, By Component, 2021-2029 (USD Billion)

99 Thailand Small Satellite Market, By Weight, 2021-2029 (USD Billion)

100 Thailand Small Satellite Market, By End-use, 2021-2029 (USD Billion)

101 MALAYSIA Small Satellite Market, By Application, 2021-2029 (USD Billion)

102 MALAYSIA Small Satellite Market, By Component, 2021-2029 (USD Billion)

103 MALAYSIA Small Satellite Market, By Weight, 2021-2029 (USD Billion)

104 MALAYSIA Small Satellite Market, By End-use, 2021-2029 (USD Billion)

105 Vietnam Small Satellite Market, By Application, 2021-2029 (USD Billion)

106 Vietnam Small Satellite Market, By Component, 2021-2029 (USD Billion)

107 Vietnam Small Satellite Market, By Weight, 2021-2029 (USD Billion)

108 Taiwan Small Satellite Market, By Application, 2021-2029 (USD Billion)

109 Taiwan Small Satellite Market, By Component, 2021-2029 (USD Billion)

110 Taiwan Small Satellite Market, By Weight, 2021-2029 (USD Billion)

111 Taiwan Small Satellite Market, By End-use, 2021-2029 (USD Billion)

112 REST OF APAC Small Satellite Market, By Application, 2021-2029 (USD Billion)

113 REST OF APAC Small Satellite Market, By Component, 2021-2029 (USD Billion)

114 REST OF APAC Small Satellite Market, By Weight, 2021-2029 (USD Billion)

115 Rest of APAC Small Satellite Market, By End-use, 2021-2029 (USD Billion)

116 Middle East and Africa Small Satellite Market, By Application, 2021-2029 (USD Billion)

117 Middle East and Africa Small Satellite Market, By Component, 2021-2029 (USD Billion)

118 Middle East and Africa Small Satellite Market, By Weight, 2021-2029 (USD Billion)

119 MIDDLE EAST AND AFRICA Small Satellite Market, By End-use, 2021-2029 (USD Billion)

120 Middle East and Africa Small Satellite Market, By Country, 2021-2029 (USD Billion)

121 Saudi Arabia Small Satellite Market, By Application, 2021-2029 (USD Billion)

122 Saudi Arabia Small Satellite Market, By Component, 2021-2029 (USD Billion)

123 Saudi Arabia Small Satellite Market, By Weight, 2021-2029 (USD Billion)

124 saudi arabia Small Satellite Market, By End-use, 2021-2029 (USD Billion)

125 UAE Small Satellite Market, By Application, 2021-2029 (USD Billion)

126 UAE Small Satellite Market, By Component, 2021-2029 (USD Billion)

127 UAE Small Satellite Market, By Weight, 2021-2029 (USD Billion)

128 uae Small Satellite Market, By End-use, 2021-2029 (USD Billion)

129 Israel Small Satellite Market, By Application, 2021-2029 (USD Billion)

130 Israel Small Satellite Market, By Component, 2021-2029 (USD Billion)

131 Israel Small Satellite Market, By Weight, 2021-2029 (USD Billion)

132 Israel Small Satellite Market, By End-use, 2021-2029 (USD Billion)

133 South Africa Small Satellite Market, By Application, 2021-2029 (USD Billion)

134 South Africa Small Satellite Market, By Component, 2021-2029 (USD Billion)

135 South Africa Small Satellite Market, By Weight, 2021-2029 (USD Billion)

136 South Africa Small Satellite Market, By End-use, 2021-2029 (USD Billion)

137 REST OF MIDDLE EAST AND AFRICA Small Satellite Market, By Application, 2021-2029 (USD Billion)

138 REST OF MIDDLE EAST AND AFRICA Small Satellite Market, By Component, 2021-2029 (USD Billion)

139 REST OF MIDDLE EAST AND AFRICA Small Satellite Market, By Weight, 2021-2029 (USD Billion)

140 REST OF MIDDLE EAST AND AFRICA Small Satellite Market, By End-use, 2021-2029 (USD Billion)

141 Central & South America Small Satellite Market, By Application, 2021-2029 (USD Billion)

142 Central & South America Small Satellite Market, By Component, 2021-2029 (USD Billion)

143 Central & South America Small Satellite Market, By Weight, 2021-2029 (USD Billion)

144 CENTRAL & SOUTH AMERICA Small Satellite Market, By End-use, 2021-2029 (USD Billion)

145 Central & South America Small Satellite Market, By Country, 2021-2029 (USD Billion)

146 Brazil Small Satellite Market, By Application, 2021-2029 (USD Billion)

147 Brazil Small Satellite Market, By Component, 2021-2029 (USD Billion)

148 Brazil Small Satellite Market, By Weight, 2021-2029 (USD Billion)

149 brazil Small Satellite Market, By End-use, 2021-2029 (USD Billion)

150 Chile Small Satellite Market, By Application, 2021-2029 (USD Billion)

151 Chile Small Satellite Market, By Component, 2021-2029 (USD Billion)

152 Chile Small Satellite Market, By Weight, 2021-2029 (USD Billion)

153 Chile Small Satellite Market, By End-use, 2021-2029 (USD Billion)

154 Argentina Small Satellite Market, By Application, 2021-2029 (USD Billion)

155 Argentina Small Satellite Market, By Component, 2021-2029 (USD Billion)

156 Argentina Small Satellite Market, By Weight, 2021-2029 (USD Billion)

157 Argentina Small Satellite Market, By End-use, 2021-2029 (USD Billion)

158 REST OF CENTRAL AND SOUTH AMERICA Small Satellite Market, By Application, 2021-2029 (USD Billion)

159 REST OF CENTRAL AND SOUTH AMERICA Small Satellite Market, By Component, 2021-2029 (USD Billion)

160 REST OF CENTRAL AND SOUTH AMERICA Small Satellite Market, By Weight, 2021-2029 (USD Billion)

161 REST OF CENTRAL AND SOUTH AMERICA Small Satellite Market, By End-use, 2021-2029 (USD Billion)

162 Sierra Nevada Corporation: Products & Services Offering

163 L3Harris Technologies: Products & Services Offering

164 Lockheed Martin Corporation: Products & Services Offering

165 Northrop Grumman Corporation: Products & Services Offering

166 Airbus Defence and Space: Products & Services Offering

167 BOEING: Products & Services Offering

168 Surrey Satellite Technology Ltd.: Products & Services Offering

169 Millennium Space Systems Inc.: Products & Services Offering

170 German Orbital Systems: Products & Services Offering

171 Space Exploration Technologies Corp. (Space X): Products & Services Offering

172 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Small Satellite Market Overview

2 Global Small Satellite Market Value From 2021-2029 (USD Billion)

3 Global Small Satellite Market Share, By Application (2023)

4 Global Small Satellite Market Share, By Component (2023)

5 Global Small Satellite Market Share, By Weight (2023)

6 Global Small Satellite Market Share, By End-use (2023)

7 Global Small Satellite Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Small Satellite Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Small Satellite Market

12 Impact Of Challenges On The Global Small Satellite Market

13 Porter’s Five Forces Analysis

14 Global Small Satellite Market: By Application Scope Key Takeaways

15 Global Small Satellite Market, By Application Segment: Revenue Growth Analysis

16 Communication Market, By Region, 2021-2029 (USD Billion)

17 Navigation Market, By Region, 2021-2029 (USD Billion)

18 Earth Observation Market, By Region, 2021-2029 (USD Billion)

19 Others Market, By Region, 2021-2029 (USD Billion)

20 Global Small Satellite Market: By Component Scope Key Takeaways

21 Global Small Satellite Market, By Component Segment: Revenue Growth Analysis

22 Telemetry, Tracking, and Command Market, By Region, 2021-2029 (USD Billion)

23 Power System Market, By Region, 2021-2029 (USD Billion)

24 Propulsion System Market, By Region, 2021-2029 (USD Billion)

25 Command & Data Handling Market, By Region, 2021-2029 (USD Billion)

26 Others Market, By Region, 2021-2029 (USD Billion)

27 Global Small Satellite Market: By Weight Scope Key Takeaways

28 Global Small Satellite Market, By Weight Segment: Revenue Growth Analysis

29 Minisatellite Market, By Region, 2021-2029 (USD Billion)

30 Microsatellite Market, By Region, 2021-2029 (USD Billion)

31 Nanosatellite Market, By Region, 2021-2029 (USD Billion)

32 Picosatellite Market, By Region, 2021-2029 (USD Billion)

33 Global Small Satellite Market: By End-use Scope Key Takeaways

34 Global Small Satellite Market, By End-use Segment: Revenue Growth Analysis

35 Civil Market, By Region, 2021-2029 (USD Billion)

36 Military Market, By Region, 2021-2029 (USD Billion)

37 Commercial Market, By Region, 2021-2029 (USD Billion)

38 Regional Segment: Revenue Growth Analysis

39 Global Small Satellite Market: Regional Analysis

40 North America Small Satellite Market Overview

41 North America Small Satellite Market, By Application

42 North America Small Satellite Market, By Component

43 North America Small Satellite Market, By Weight

44 North America Small Satellite Market, By End-use

45 North America Small Satellite Market, By Country

46 U.S. Small Satellite Market, By Application

47 U.S. Small Satellite Market, By Component

48 U.S. Small Satellite Market, By Weight

49 U.S. Small Satellite Market, By End-use

50 Canada Small Satellite Market, By Application

51 Canada Small Satellite Market, By Component

52 Canada Small Satellite Market, By Weight

53 Canada Small Satellite Market, By End-use

54 Mexico Small Satellite Market, By Application

55 Mexico Small Satellite Market, By Component

56 Mexico Small Satellite Market, By Weight

57 Mexico Small Satellite Market, By End-use

58 Four Quadrant Positioning Matrix

59 Company Market Share Analysis

60 Sierra Nevada Corporation: Company Snapshot

61 Sierra Nevada Corporation: SWOT Analysis

62 Sierra Nevada Corporation: Geographic Presence

63 L3Harris Technologies: Company Snapshot

64 L3Harris Technologies: SWOT Analysis

65 L3Harris Technologies: Geographic Presence

66 Lockheed Martin Corporation: Company Snapshot

67 Lockheed Martin Corporation: SWOT Analysis

68 Lockheed Martin Corporation: Geographic Presence

69 Northrop Grumman Corporation: Company Snapshot

70 Northrop Grumman Corporation: Swot Analysis

71 Northrop Grumman Corporation: Geographic Presence

72 Airbus Defence and Space: Company Snapshot

73 Airbus Defence and Space: SWOT Analysis

74 Airbus Defence and Space: Geographic Presence

75 BOEING: Company Snapshot

76 BOEING: SWOT Analysis

77 BOEING: Geographic Presence

78 Surrey Satellite Technology Ltd.: Company Snapshot

79 Surrey Satellite Technology Ltd.: SWOT Analysis

80 Surrey Satellite Technology Ltd.: Geographic Presence

81 Millennium Space Systems Inc.: Company Snapshot

82 Millennium Space Systems Inc.: SWOT Analysis

83 Millennium Space Systems Inc.: Geographic Presence

84 German Orbital Systems: Company Snapshot

85 German Orbital Systems: SWOT Analysis

86 German Orbital Systems: Geographic Presence

87 Space Exploration Technologies Corp. (Space X): Company Snapshot

88 Space Exploration Technologies Corp. (Space X): SWOT Analysis

89 Space Exploration Technologies Corp. (Space X): Geographic Presence

90 Other Companies: Company Snapshot

91 Other Companies: SWOT Analysis

92 Other Companies: Geographic Presence

The Global Small Satellite Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Small Satellite Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS