Global Smart Contracts Market Size, Trends & Analysis - Forecasts to 2028 By Platform (Ethereum, Cardano, BNB Chain, Polkadot, and Others), By Blockchain Type (Public, Private, and Hybrid), By Contract Type (Smart Legal Contracts, Decentralized Autonomous Organizations, and Application Logic Contracts), By Enterprise Size (Small and Medium Enterprises and Large Enterprises), By End-use (BFSI, Retail, Healthcare, Real Estate, Logistics, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

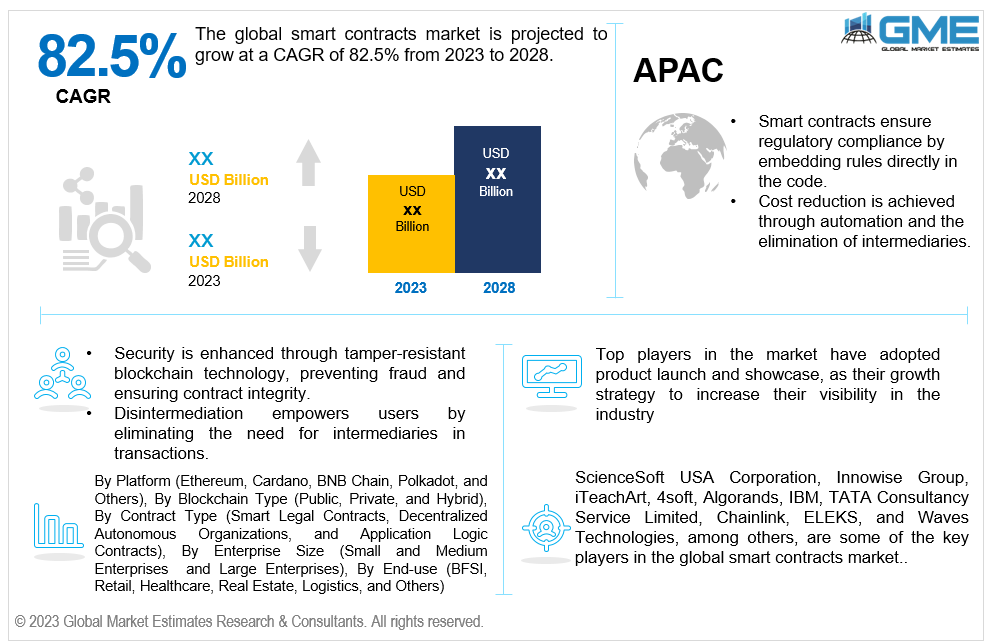

The global smart contracts market is projected to grow at a CAGR of 82.5% from 2023 to 2028.

Smart contracts are contracts that are written directly into code and can execute themselves automatically. They don't need intermediaries like lawyers or brokers to ensure compliance and facilitate transactions. Instead, they use blockchain technology, like Ethereum, to enforce the terms and conditions of the contract. Once a smart contract is on the blockchain, it becomes secure, transparent, and unchangeable.

The smart contract market is growing on account of advantages such as transparency and trust offered by blockchain technology. People can see and verify the terms of the contract on the blockchain, which builds trust between parties. Smart contracts also help with regulatory compliance because they can include the necessary rules directly in the code. Another driver is disintermediation and empowerment. Smart contracts allow individuals and organizations to interact and transact directly without intermediaries. The smart contract makes service more accessible, lowers barriers to entry, and enables new business models.

Efforts to establish interoperability and standards for smart contracts across different blockchains are also driving their adoption. This means different smart contract systems can work together smoothly and communicate with each other. Cost reduction is another factor fuelling the market growth. By automating contract execution and removing intermediaries, smart contracts can reduce the costs associated with complex transactions and multiple parties.

Finally, smart contracts provide security and fraud prevention. The use of blockchain technology and cryptographic techniques makes them resistant to tampering and fraud, ensuring the integrity and authenticity of the contract. Overall, the demand for smart contracts is driven by their ability to provide transparency, trust, regulatory compliance, disintermediation, interoperability, cost reduction, and security.

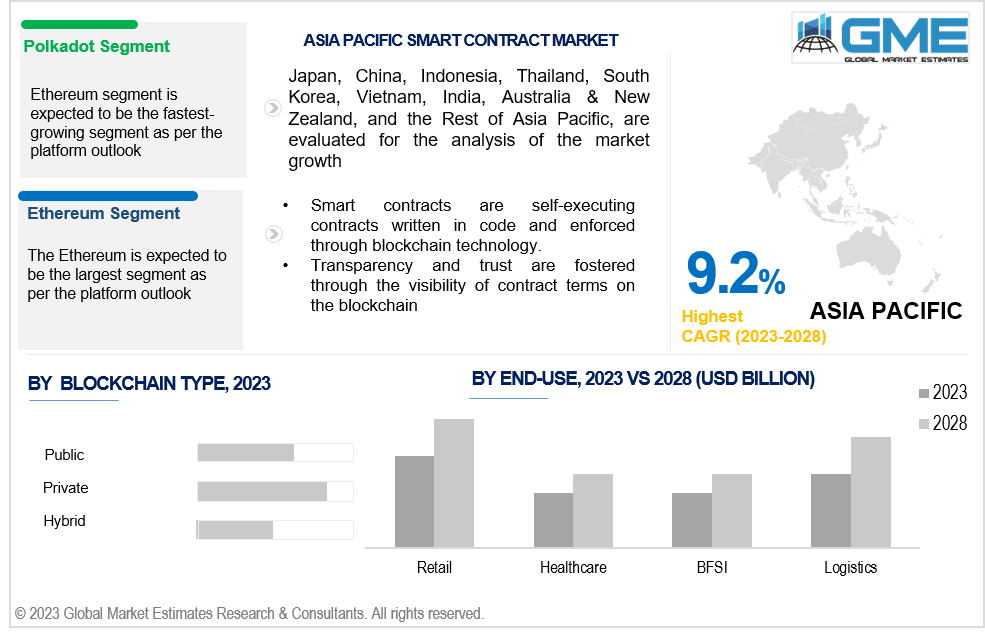

Ethereum is expected to hold the largest share of the market. The substantial and engaged developer community of Ethereum has played a significant role in the platform's expansion and advancement. This community has created numerous valuable tools and frameworks that simplify the process of developing and implementing smart contracts on the Ethereum platform.

Polkadot is expected to be the fastest-growing segment in the market from 2023-2028. The expansion of this segment is driven by, its ability to handle increasing amounts of work or transactions. It allows the exchange of data, asset and transactions between different blockchains, enhancing the overall efficiency and functionality of the organization. It can process many transactions at once by dividing the network into smaller parts called shards. These shards work together under a central relay chain, ensuring transactions are processed accurately and quickly.

The public is expected to hold the largest share of the market. The reason behind the segment’s growth is that it operates in a decentralized manner and is open for anyone to join and take part in. They employ consensus mechanisms, such as proof-of-stake or proof-of-work, to maintain security, and all participants have equal access and privileges within the network. Moreover, the transactions and smart contracts executed on public blockchains are transparent, enabling anyone to access and examine them.

The private is anticipated to be the fastest-growing segment in the market from 2023-2028. The demand for private blockchains is increasing because they are preferred by businesses and organizations seeking enhanced privacy and security for their sensitive data and transactions. Private blockchains offer enhanced control over network security as they are operated by a single entity. Moreover, they can be customized to fulfil specific business requirements, allowing the creation of unique solutions that are not feasible on public blockchains.

The decentralized autonomous organization is expected to be the largest segment in the market. Decentralized autonomous organizations (DAOs) provide an inclusive environment for global developers and users to engage and contribute. This inclusivity fosters innovation and facilitates economic growth by leveraging the diverse talents and ideas of participants worldwide. Its design aims to decentralize ownership, management, and decision-making authority by distributing them among a network of participants instead of consolidating them under a single entity. This decentralized nature enhances security and resistance to censorship, ensuring that all decisions are reached through consensus among the participants.

The application logic contract is anticipated to be the fastest-growing segment in the market from 2023-2028. It enables devices to operate securely and autonomously, bringing advantages like increased automation, reduced transaction costs, and scalability. These contracts can be seamlessly integrated with existing systems like enterprise resource planning (ERP), streamlining and automating various business processes.

Large enterprise segment is expected to hold the largest share of the market. These enterprises look for more resources to invest in advanced technologies including smart contracts. Furthermore, they can provide training to their employees to ensure effective utilization of these solutions. Smart contracts contribute to compliance by automating tasks and mitigating the potential for mistakes caused by human involvement.

Small and medium enterprise is anticipated to be the fastest-growing segment in the market from 2023-2028. The growth of the segment is driven by the cost-effectiveness and increased efficiency provided by smart contracts to small and medium enterprises. Smart contracts automate processes, reducing costs for these businesses. With limited resources, the cost-effectiveness of smart contracts is highly beneficial. Smart contracts also enhance efficiency by automating manual tasks, minimizing errors, and accelerating transaction speed.

The BFSI is expected to hold the largest share of the market. The utilization of smart contract technology enhances the efficiency, security, and transparency of financial transactions, which will lead to innovation in the BFSI industry. They are also integrating smart contracts with existing systems like payment processors and banking systems. This integration streamlines industry processes and lowers expenses by reducing the reliance on manual intervention and intermediaries.

Retail is anticipated to be the fastest-growing segment in the market from 2023-2028. The rising demand for smart contracts can be attributed to the adoption of new technologies and increasing market competition. Smart contracts enable all stakeholders in the supply chain to access and validate product information, such as origin, quality, and movement. This creates a transparent and tamper-proof record of the supply chain. By reducing the risk of fraud, counterfeiting, and unethical practices, this transparency promotes compliance with regulations and industry standards, leading to improved trust and integrity within the supply chain ecosystem.

North America is expected to be the largest region in the market. North America is an emerging market for smart contracts as there is a presence of emerging smart contract providers, such as IBM, iTechArt and many others. The region’s early embrace of blockchain technology and the supportive startup environment have led to the emergence of numerous startups that focuses on smart contracts in the region. As a result, companies have gained an advantage in the smart contracts industry, establishing their leadership in the market.

Asia Pacific is predicted to witness rapid growth during the forecast period. This is ascribed to factors such as the increasing adoption of blockchain technology. Asia Pacific countries are actively investing in technologies such as blockchain and its application, including smart contracts. In some Asia Pacific countries, the government has acknowledged the potential of smart contracts in sectors like supply chain management, real estate, and e-commerce. This recognition has encouraged the growth of startups focusing on smart contracts and attracted investments in the country's blockchain technology adoption

ScienceSoft USA Corporation, Innowise Group, iTeachArt, 4soft, Algorands, IBM, TATA Consultancy Service Limited, Chainlink, ELEKS and, Waves Technologies, among others, are some of the key players in the global smart contracts market.

Please note: This is not an exhaustive list of companies profiled in the report

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Enterprise Size Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL SMART CONTRACTS MARKET, BY PLATFORM

4.1 Introduction

4.2 Smart Contracts Market: Platform Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Ethereum

4.4.1 Ethereum Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5 Cardano

4.5.1 Cardano Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6 BNB Chain

4.6.1 BNB Chain Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6 Polkadot

4.6.1 Polkadot Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6 Other

4.6.1 Other Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL SMART CONTRACTS MARKET, BY BLOCKCHAIN TYPE

5.1 Introduction

5.2 Smart Contracts Market: Blockchain Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Public

5.4.1 Public Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5 Private

5.5.1 Private Market Estimates and Forecast, 2020-2028 (USD Billion)

5.6 Hybrid

5.6.1 Hybrid Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL SMART CONTRACTS MARKET, BY CONTRACT TYPE

6.1 Introduction

6.2 Smart Contracts Market: Contract Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Smart Legal Contracts

6.4.1 Smart Legal Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5 Decentralized Autonomous Organizations

6.5.1 Decentralized Autonomous Organizations Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6 Application Logic Contract

6.6.1 Application Logic Contract Market Estimates and Forecast, 2020-2028 (USD Billion)

7 GLOBAL SMART CONTRACTS MARKET, BY ENTERPRISE SIZE

7.1 Introduction

7.2 Smart Contracts Market: Enterprise Size Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4 Small and Medium Enterprises

7.4.1 Small and Medium Enterprises Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5 Large Enterprise

7.5.1 Large Enterprise Market Estimates and Forecast, 2020-2028 (USD Billion)

8 GLOBAL SMART CONTRACTS MARKET, BY END-USE

8.1 Introduction

8.2 Smart Contracts Market: End-use Scope Key Takeaways

8.3 Revenue Growth Analysis, 2022 & 2028

8.4 BFSI

8.4.1 BFSI Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5 Retail

8.5.1 Retail Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6 Healthcare

8.6.1 Healthcare Market Estimates and Forecast, 2020-2028 (USD Billion)

8.7 Real Estate

8.7.1 Real Estate Market Estimates and Forecast, 2020-2028 (USD Billion)

8.8 Logistics

8.8.1 Logistics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.9 Other

8.9.1 Other Market Estimates and Forecast, 2020-2028 (USD Billion)

9 GLOBAL SMART CONTRACTS MARKET, BY REGION

9.1 Introduction

9.2 North America Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.2.1 By Platform

9.2.2 By Blockchain Type

9.2.3 By Contract Type

9.2.4 By Enterprise Size

9.2.5 By End-use

9.2.6 By Country

9.2.6.1 U.S. Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.2.6.1.1 By Platform

9.2.6.1.2 By Blockchain Type

9.2.6.1.3 By Contract Type

9.2.6.1.4 By Enterprise Size

9.2.6.1.5 By End-use

9.2.6.2 Canada Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.2.6.2.1 By Platform

9.2.6.2.2 By Blockchain Type

9.2.6.2.3 By Contract Type

9.2.6.2.4 By Enterprise Size

9.2.6.2.5 By End-use

9.2.6.3 Mexico Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.2.6.3.1 By Platform

9.2.6.3.2 By Blockchain Type

9.2.6.3.3 By Contract Type

9.2.6.3.4 By Enterprise Size

9.2.6.3.5 By End-use

9.3 Europe Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.3.1 By Platform

9.3.2 By Blockchain Type

9.3.3 By Contract Type

9.3.4 By Enterprise Size

9.3.5 By End-use

9.3.6 By Country

9.3.6.1 Germany Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.3.6.1.1 By Platform

9.3.6.1.2 By Blockchain Type

9.3.6.1.3 By Contract Type

9.3.6.1.4 By Enterprise Size

9.3.6.1.5 By End-use

9.3.6.2 U.K. Presered Flowers Market Estimates and Forecast, 2020-2028 (USD Billion)

9.3.6.2.1 By Platform

9.3.6.2.2 By Blockchain Type

9.3.6.2.3 By Contract Type

9.3.6.2.4 By Enterprise Size

9.3.6.2.5 By End-use

9.3.6.3 France Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.3.6.3.1 By Platform

9.3.6.3.2 By Blockchain Type

9.3.6.3.3 By Contract Type

9.3.6.3.4 By Enterprise Size

9.3.6.3.5 By End-use

9.3.6.4 Italy Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.3.6.4.1 By Platform

9.3.6.4.2 By Blockchain Type

9.3.6.4.3 By Contract Type

9.3.6.4.4 By Enterprise Size

9.3.6.4.5 By End-use

9.3.6.5 Spain Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.3.6.5.1 By Platform

9.3.6.5.2 By Blockchain Type

9.3.6.5.3 By Contract Type

9.3.6.5.4 By Enterprise Size

9.3.6.5.5 By End-use

9.3.6.6 Netherlands Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.3.6.6.1 By Platform

9.3.6.6.2 By Blockchain Type

9.3.6.6.3 By Contract Type

9.3.6.6.4 By Enterprise Size

9.3.6.6.5 By End-use

9.3.6.7 Rest of Europe Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.3.6.7.1 By Platform

9.3.6.7.2 By Blockchain Type

9.3.6.7.3 By Contract Type

9.3.6.7.4 By Enterprise Size

9.3.6.7.5 By End-use

9.4 Asia Pacific Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.4.1 By Platform

9.4.2 By Blockchain Type

9.4.3 By Contract Type

9.4.4 By Enterprise Size

9.4.5 By End-use

9.4.6 By Country

9.4.6.1 China Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.4.6.1.1 By Platform

9.4.6.1.2 By Blockchain Type

9.4.6.1.3 By Contract Type

9.4.6.1.4 By Enterprise Size

9.4.6.1.5 By End-use

9.4.6.2 Japan Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.4.6.2.1 By Platform

9.4.6.2.2 By Blockchain Type

9.4.6.2.3 By Contract Type

9.4.6.2.4 By Enterprise Size

9.4.6.2.5 By End-use

9.4.6.3 India Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.4.6.3.1 By Platform

9.4.6.3.2 By Blockchain Type

9.4.6.3.3 By Contract Type

9.4.6.3.4 By Enterprise Size

9.4.6.3.5 By End-use

9.4.6.4 South Korea Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.4.6.4.1 By Platform

9.4.6.4.2 By Blockchain Type

9.4.6.4.3 By Contract Type

9.4.6.4.4 By Enterprise Size

9.4.6.4.5 By End-use

9.4.6.5 Singapore Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.4.6.5.1 By Platform

9.4.6.5.2 By Blockchain Type

9.4.6.5.3 By Contract Type

9.4.6.5.4 By Enterprise Size

9.4.6.5.5 By End-use

9.4.6.6 Malaysia Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.4.6.6.1 By Platform

9.4.6.6.2 By Blockchain Type

9.4.6.6.3 By Contract Type

9.4.6.6.4 By Enterprise Size

9.4.6.6.5 By End-use

9.4.6.7 Thailand Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.4.6.7.1 By Platform

9.4.6.7.2 By Blockchain Type

9.4.6.7.3 By Contract Type

9.4.6.7.4 By Enterprise Size

9.4.6.7.5 By End-use

9.4.6.8 Indonesia Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.4.6.8.1 By Platform

9.4.6.8.2 By Blockchain Type

9.4.6.8.3 By Contract Type

9.4.6.8.4 By Enterprise Size

9.4.6.8.5 By End-use

9.4.6.9 Vietnam Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.4.6.9.1 By Platform

9.4.6.9.2 By Blockchain Type

9.4.6.9.3 By Contract Type

9.4.6.9.4 By Enterprise Size

9.4.6.9.5 By End-use

9.4.6.10 Taiwan Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.4.6.10.1 By Platform

9.4.6.10.2 By Blockchain Type

9.4.6.10.3 By Contract Type

9.4.6.10.4 By Enterprise Size

9.4.6.10.5 By End-use

9.4.6.11 Rest of Asia Pacific Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.4.6.11.1 By Platform

9.4.6.11.2 By Blockchain Type

9.4.6.11.3 By Contract Type

9.4.6.11.4 By Enterprise Size

9.4.6.11.5 By End-use

9.5 Middle East and Africa Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.5.1 By Platform

9.5.2 By Blockchain Type

9.5.3 By Contract Type

9.5.4 By Enterprise Size

9.5.5 By End-use

9.5.6 By Country

9.5.6.1 Saudi Arabia Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.5.6.1.1 By Platform

9.5.6.1.2 By Blockchain Type

9.5.6.1.3 By Contract Type

9.5.6.1.4 By Enterprise Size

9.5.6.1.5 By End-use

9.5.6.2 U.A.E. Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.5.6.2.1 By Platform

9.5.6.2.2 By Blockchain Type

9.5.6.2.3 By Contract Type

9.5.6.2.4 By Enterprise Size

9.5.6.12.5 By End-use

9.5.6.3 Israel Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.5.4.3.1 By Platform

9.5.4.3.2 By Blockchain Type

9.5.4.3.3 By Contract Type

9.5.6.3.4 By Enterprise Size

9.5.6.3.5 By End-use

9.5.6.4 South Africa Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.5.6.4.1 By Platform

9.5.6.4.2 By Blockchain Type

9.5.6.4.3 By Contract Type

9.5.6.4.4 By Enterprise Size

9.5.6.4.5 By End-use

9.5.6.5 Rest of Middle East and Africa Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.5.6.5.1 By Platform

9.5.6.5.2 By Blockchain Type

9.5.6.5.2 By Contract Type

9.5.6.5.4 By Enterprise Size

9.5.6.5.5 By End-use

9.6 Central & South America Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.6.1 By Platform

9.6.2 By Blockchain Type

9.6.3 By Contract Type

9.6.4 By Enterprise Size

9.6.5 By End-use

9.6.6 By Country

9.6.6.1 Brazil Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.6.6.1.1 By Platform

9.6.6.1.2 By Blockchain Type

9.6.6.1.3 By Contract Type

9.6.6.1.4 By Enterprise Size

9.6.6.1.5 By End-use

9.6.6.2 Argentina Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.6.6.2.1 By Platform

9.6.6.2.2 By Blockchain Type

9.6.6.2.3 By Contract Type

9.6.6.2.4 By Enterprise Size

9.6.6.2.5 By End-use

9.6.6.3 Chile Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.6.6.3.1 By Platform

9.6.6.3.2 By Blockchain Type

9.6.6.3.3 By Contract Type

9.6.6.3.4 By Enterprise Size

9.6.6.3.5 By End-use

9.6.6.4 Rest of Central & South America Smart Contracts Market Estimates and Forecast, 2020-2028 (USD Billion)

9.6.6.4.1 By Platform

9.6.6.4.2 By Blockchain Type

9.6.6.4.3 By Contract Type

9.6.6.4.4 By Enterprise Size

9.6.6.4.5 By End-use

10 COMPETITIVE LANDCAPE

10.1 Company Market Share Analysis

10.2 Four Quadrant Positioning Matrix

10.2.1 Market Leaders

10.2.2 Market Visionaries

10.2.3 Market Challengers

10.2.4 Niche Market Players

10.3 Vendor Landscape

10.3.1 North America

10.3.2 Europe

10.3.3 Asia Pacific

10.3.4 Rest of the World

10.4 Company Profiles

10.4.1 ScienceSoft USA Corporation

10.4.1.1 Business Description & Financial Analysis

10.4.1.2 SWOT Analysis

10.4.1.3 Poducts & Services Offered

10.4.1.4 Strategic Alliances between Business Partners

10.4.2 Innowise Group

10.4.2.1 Business Description & Financial Analysis

10.4.2.2 SWOT Analysis

10.4.2.3 Poducts & Services Offered

10.4.2.4 Strategic Alliances between Business Partners

10.4.3 ITechArt

10.4.3.1 Business Description & Financial Analysis

10.4.3.2 SWOT Analysis

10.4.3.3 Poducts & Services Offered

10.4.3.4 Strategic Alliances between Business Partners

10.4.4 4soft

10.4.4.1 Business Description & Financial Analysis

10.4.4.2 SWOT Analysis

10.4.4.3 Poducts & Services Offered

10.4.4.4 Strategic Alliances between Business Partners

10.4.5 Algorand

10.4.5.1 Business Description & Financial Analysis

10.4.5.2 SWOT Analysis

10.4.5.3 Poducts & Services Offered

10.4.5.4 Strategic Alliances between Business Partners

10.4.6 IBM

10.4.6.1 Business Description & Financial Analysis

10.4.6.2 SWOT Analysis

10.4.6.3 Poducts & Services Offered

10.4.6.4 Strategic Alliances between Business Partners

10.4.7 TATA Consultancy Services Limited

10.4.7.1 Business Description & Financial Analysis

10.4.7.2 SWOT Analysis

10.4.7.3 Poducts & Services Offered

10.4.7.4 Strategic Alliances between Business Partners

10.4.8 Chainlink

10.4.8.1 Business Description & Financial Analysis

10.4.8.2 SWOT Analysis

10.4.8.3 Poducts & Services Offered

10.4.8.4 Strategic Alliances between Business Partners

10.4.9 ELEKS

10.4.9.1 Business Description & Financial Analysis

10.4.9.2 SWOT Analysis

10.4.9.3 Poducts & Services Offered

10.4.9.4 Strategic Alliances between Business Partners

10.4.10 Waves Technologies

10.4.10.1 Business Description & Financial Analysis

10.4.10.2 SWOT Analysis

10.4.10.3 Poducts & Services Offered

10.4.10.4 Strategic Alliances between Business Partners

10.4.10 Others

10.4.10.1 Business Description & Financial Analysis

10.4.10.2 SWOT Analysis

10.4.10.3 Poducts & Services Offered

10.4.10.4 Strategic Alliances between Business Partners

11 RESEARCH METHODOLOGY

11.1 Market Introduction

11.1.1 Market Definition

11.1.2 Market Scope & SegCardanotation

11.2 Information ProcureCardanot

11.2.1 Secondary Research

11.2.1.1 Purchased Databases

11.2.1.2 GMEs Internal Data Repository

11.2.1.3 Secondary Resources & Third Party Perspectives

11.2.1.4 Company Information Sources

11.2.2 Primary Research

11.2.2.1 Various Types of Respondents for Primary Interviews

11.2.2.2 Number of Interviews Conducted throughout the Research Process

11.2.2.3 Primary Stakeholders

11.2.2.4 Discussion Guide for Primary Participants

11.2.3 Expert Panels

11.2.3.1 Expert Panels Across 30+ Industry

11.2.4 Paid Local Experts

11.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

11.3 Market Estimation

11.3.1 Top-Down Approach

11.3.1.1 Macro-Economic Indicators Considered

11.3.1.2 Micro-Economic Indicators Considered

11.3.2 Bottom Up Approach

11.3.2.1 Company Share Analysis Approach

11.3.2.2 Estimation of Potential End-use Sales

11.4 Data Triangulation

11.4.1 Data Collection

11.4.2 Time Series, Cross Sectional & Panel Data Analysis

11.4.3 Cluster Analysis

11.5 Analysis and Output

11.5.1 Inhouse AI Based Real Time Analytics Tool

11.5.2 Output From Desk & Primary Research

11.6 Research Assumptions & Limitations

11.7.1 Research Assumptions

11.7.2 Research Limitations

LIST OF TABLES

1 Global Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

2 Ethereum Market, By Region, 2020-2028 (USD Billion)

3 Cardano Market, By Region, 2020-2028 (USD Billion)

4 BNB Chain Market, By Region, 2020-2028 (USD Billion)

5 Polkadot Market, By Region, 2020-2028 (USD Billion)

6 Other Market, By Region, 2020-2028 (USD Billion)

7 Global Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

8 Public Market, By Region, 2020-2028 (USD Billion)

9 Private Market, By Region, 2020-2028 (USD Billion)

10 Hybrid Market, By Region, 2020-2028 (USD Billion)

11 Global Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

12 Smart Legal Contracts Market, By Region, 2020-2028 (USD Billion)

13 Decentralized Autonomous Organizations Market, By Region, 2020-2028 (USD Billion)

14 Application Logic Contract Market, By Region, 2020-2028 (USD Billion)

15 Global Smart Contracts Market, By ENTERPRISE SIZE , 2020-2028 (USD Billion)

16 Small and Medium Enterprises Market, By Region, 2020-2028 (USD Billion)

17 Large Enterprise Market, By Region, 2020-2028 (USD Billion)

18 Global Smart Contracts Market, By End-use, 2020-2028 (USD Billion)

19 BFSI Market, By Region, 2020-2028 (USD Billion)

20 Retail Market, By Region, 2020-2028 (USD Billion)

21 Healthcare Market, By Region, 2020-2028 (USD Billion)

22 Real Estate Market, By Region, 2020-2028 (USD Billion)

23 Logistics Market, By Region, 2020-2028 (USD Billion)

24 Other Market, By Region, 2020-2028 (USD Billion)

25 Regional Analysis, 2020-2028 (USD Billion)

26 North America Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

27 North America Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

28 North America Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

29 North America Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

30 North America Smart Contracts Market, By Country, 2020-2028 (USD Billion)

31 North America Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

32 U.S Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

33 U.S Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

34 U.S Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

35 U.S Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

36 U.S America Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

37 Canada Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

38 Canada Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

39 Canada Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

40 CANADA Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

41 CANADA Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

42 Mexico Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

43 Mexico Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

44 Mexico Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

45 mexico Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

46 MEXICO Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

47 Europe Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

48 Europe Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

49 Europe Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

50 europe Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

51 EUROPE Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

52 EUROPE Smart Contracts Market, By country, 2020-2028 (USD Billion)

53 Germany Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

54 Germany Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

55 Germany Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

56 germany Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

57 GERMANY Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

58 UK Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

59 UK Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

60 UK Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

61 U.k Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

62 U.K Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

63 France Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

64 France Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

65 France Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

66 france Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

67 FRANCE Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

68 Italy Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

69 Italy Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

70 Italy Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

71 italy Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

72 ITALY Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

73 Spain Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

74 Spain Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

75 Spain Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

76 spain Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

77 SPAIN Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

78 Rest Of Europe Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

79 Rest Of Europe Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

80 Rest of Europe Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

81 REST OF EUROPE Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

82 REST OF EUROPE Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

83 Asia Pacific Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

84 Asia Pacific Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

85 Asia Pacific Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

86 asia Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

87 Asia Pacific Smart Contracts Market, By Country, 2020-2028 (USD Billion)

88 ASIA PACIFIC Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

89 China Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

90 China Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

91 China Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

92 china Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

93 CHINA Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

94 India Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

95 India Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

96 India Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

97 india Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

98 INDIA Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

99 Japan Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

100 Japan Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

101 Japan Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

102 japan Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

103 JAPAN Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

104 South Korea Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

105 South Korea Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

106 South Korea Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

107 south korea Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

108 SOUTH KOREA Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

109 Middle East and Africa Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

110 Middle East and Africa Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

111 Middle East and Africa Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

112 MIDDLE EAST and AFRICA Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

113 Middle East and Africa Smart Contracts Market, By Country, 2020-2028 (USD Billion)

114 MIDDLE EAST and AFRICA Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

115 Saudi Arabia Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

116 Saudi Arabia Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

117 Saudi Arabia Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

118 saudi arabia Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

119 SAUDI ARABIA Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

120 UAE Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

121 UAE Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

122 UAE Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

123 uae Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

124 UAE Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

125 Central & South America Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

126 Central & South America Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

127 Central & South America Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

128 CENTRAL & SOUTH AMERICA Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

129 Central & South America Smart Contracts Market, By Country, 2020-2028 (USD Billion)

130 CENTRAL & SOUTH AMERICA Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

131 Brazil Smart Contracts Market, By Platform, 2020-2028 (USD Billion)

132 Brazil Smart Contracts Market, By Blockchain Type, 2020-2028 (USD Billion)

133 Brazil Smart Contracts Market, By Contract Type, 2020-2028 (USD Billion)

134 brazil Smart Contracts Market, By Enterprise Size , 2020-2028 (USD Billion)

135 BRAZIL Smart Contracts Market, By END-USE, 2020-2028 (USD Billion)

136 ScienceSoft USA Corporation: PRODUCTS & SERVICES OFFERING

137 Innowise Group: PRODUCTS & SERVICES OFFERING

138 ITechArt: PRODUCTS & SERVICES OFFERING

139 4soft: PRODUCTS & SERVICES OFFERING

140 Algorand: PRODUCTS & SERVICES OFFERING

141 IBM: PRODUCTS & SERVICES OFFERING

142 TATA Consultancy Services Limited : PRODUCTS & SERVICES OFFERING

143 Chainlink: PRODUCTS & SERVICES OFFERING

144 ELEKS, Inc: PRODUCTS & SERVICES OFFERING

145 Waves Technologies: PRODUCTS & SERVICES OFFERING

146 Others: PRODUCTS & SERVICES OFFERING

LIST OF FIGURES

1 Global Smart Contracts Market Overview

2 Global Smart Contracts Market Value From 2020-2028 (USD Billion)

3 Global Smart Contracts Market Share, By Platform (2022)

4 Global Smart Contracts Market Share, By Blockchain Type (2022)

5 Global Smart Contracts Market Share, By Contract Type (2022)

6 Global Smart Contracts Market Share, By Enterprise Size (2022)

7 Global Smart Contracts Market Share, By End-use (2022)

8 Global Smart Contracts Market, By Region (Asia Pacific Market)

9 Technological Trends In Global Smart Contracts Market

10 Four Quadrant Competitor Positioning Matrix

11 Impact Of Macro & Micro Indicators On The Market

12 Impact Of Key Drivers On The Global Smart Contracts Market

13 Impact Of Challenges On The Global Smart Contracts Market

14 Porter’s Five Forces Analysis

15 Global Smart Contracts Market: By Platform Scope Key Takeaways

16 Global Smart Contracts Market, By Platform Segment: Revenue Growth Analysis

17 Ethereum Market, By Region, 2020-2028 (USD Billion)

18 Cardano Market, By Region, 2020-2028 (USD Billion)

19 BNB Chain Market, By Region, 2020-2028 (USD Billion)

20 Polkadot Market, By Region, 2020-2028 (USD Billion)

21 Other Market, By Region, 2020-2028 (USD Billion)

22 Global Smart Contracts Market: By Blockchain Type Scope Key Takeaways

23 Global Smart Contracts Market, By Blockchain Type Segment: Revenue Growth Analysis

24 Public Market, By Region, 2020-2028 (USD Billion)

25 Private Market, By Region, 2020-2028 (USD Billion)

26 Hybrid Market, By Region, 2020-2028 (USD Billion)

27 Global Smart Contracts Market: By Contract Type Scope Key Takeaways

28 Global Smart Contracts Market, By Contract Type Segment: Revenue Growth Analysis

29 Smart Legal Contracts Market, By Region, 2020-2028 (USD Billion)

30 Decentralized Autonomous Organizations Market, By Region, 2020-2028 (USD Billion)

31 Application Logic Contract Market By Region, 2020-2028 (USD Billion)

32 Global Smart Contracts Market: By Enterprise Size Scope Key Takeaways

33 Global Smart Contracts Market, By Enterprise Size Segment: Revenue Growth Analysis

34 Small and Medium Enterprises Market, By Region, 2020-2028 (USD Billion)

35 Global Smart Contracts Market: By End-use Scope Key Takeaways

36 Global Smart Contracts Market, By End-use Segment: Revenue Growth Analysis

37 BFSI Market, By Region, 2020-2028 (USD Billion)

38 Retail Market, By Region, 2020-2028 (USD Billion)

39 Healthcare Market, By Region, 2020-2028 (USD Billion)

40 Real Estate Market, By Region, 2020-2028 (USD Billion)

41 Logistics Market, By Region, 2020-2028 (USD Billion)

42 Other Market, By Region, 2020-2028 (USD Billion)

43 Regional Segment: Revenue Growth Analysis

44 Global Smart Contracts Market: Regional Analysis

45 North America Smart Contracts Market Overview

46 North America Smart Contracts Market, By Platform

47 North America Smart Contracts Market, By Blockchain Type

48 North America Smart Contracts Market, By Contract Type

49 North America Smart Contracts Market, By Enterprise Size

50 North America Smart Contracts Market, By End-use

51 North America Smart Contracts Market, By Country

52 U.S. Smart Contracts Market, By Platform

53 U.S. Smart Contracts Market, By Blockchain Type

54 U.S. Smart Contracts Market, By Contract Type

55 U.S. Smart Contracts Market, By Enterprise Size

56 U.S. Smart Contracts Market, By End-use

57 Canada Smart Contracts Market, By Platform

58 Canada Smart Contracts Market, By Blockchain Type

59 Canada Smart Contracts Market, By Contract Type

60 Canada Smart Contracts Market, By Enterprise Size

61 Canada Smart Contracts Market, By End-use

62 Mexico Smart Contracts Market, By Platform

63 Mexico Smart Contracts Market, By Blockchain Type

64 Mexico Smart Contracts Market, By Contract Type

65 Mexico Smart Contracts Market, By Enterprise Size

66 Mexico Smart Contracts Market, By End-use

67 Four Quadrant Positioning Matrix

68 Company Market Share Analysis

69 ScienceSoft USA Corporation: Company Snapshot

70 ScienceSoft USA Corporation: SWOT Analysis

71 ScienceSoft USA Corporation: Geographic Presence

72 Innowise Group: Company Snapshot

73 Innowise Group: SWOT Analysis

74 Innowise Group: Geographic Presence

75 ITechArt: Company Snapshot

76 ITechArt: SWOT Analysis

77 ITechArt: Geographic Presence

78 4soft: Company Snapshot

79 4soft: Swot Analysis

80 4soft: Geographic Presence

81 Algorand: Company Snapshot

82 Algorand: SWOT Analysis

83 Algorand: Geographic Presence

84 IBM: Company Snapshot

85 IBM: SWOT Analysis

86 IBM: Geographic Presence

87 TATA Consultancy Services Limited : Company Snapshot

88 TATA Consultancy Services Limited : SWOT Analysis

89 TATA Consultancy Services Limited : Geographic Presence

90 Chainlink: Company Snapshot

91 Chainlink: SWOT Analysis

92 Chainlink: Geographic Presence

93 ELEKS, Inc.: Company Snapshot

94 ELEKS, Inc.: SWOT Analysis

95 ELEKS, Inc.: Geographic Presence

96 Waves Technologies: Company Snapshot

97 Waves Technologies: SWOT Analysis

98 Waves Technologies: Geographic Presence

99 Others: Company Snapshot

100 Others: SWOT Analysis

101 Others: Geographic Presence

The Global Smart Contracts Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Smart Contracts Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS