Global Smart Electric Drive Market, Trends & Analysis - Forecasts to 2026 By Vehicle Type (PC, CV, 2W), By Component (EV Battery, Power Electronics, E-Brake Booster, Inverter, Motor), By Application (E-Axle, Wheel Drive), By Drive (FWD, RWD, AWD), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

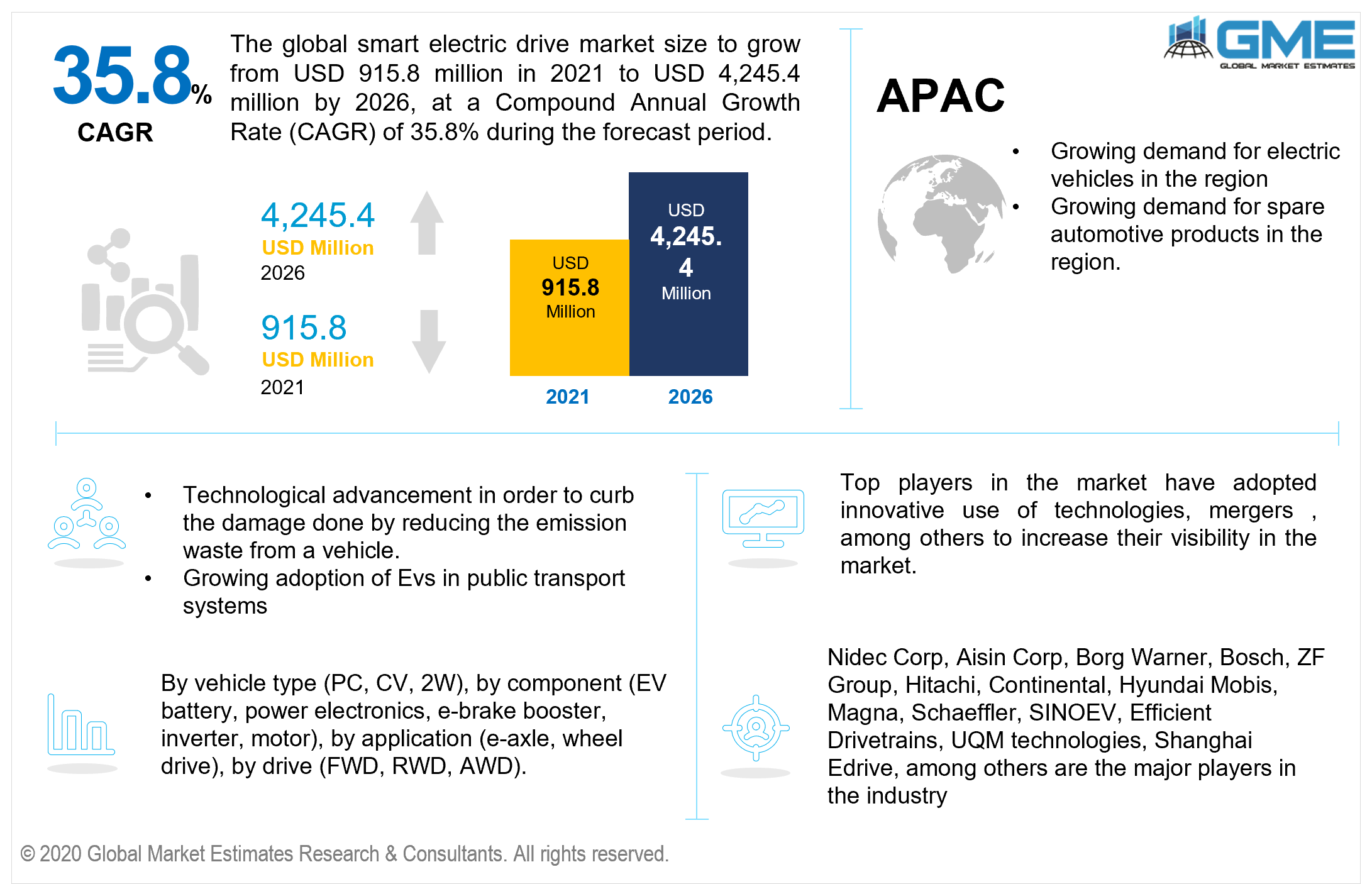

The global smart electric drive market is projected to grow from USD 915.8 million in 2021 to USD 4,245.4 million by 2026 at a CAGR value of 35.8% between 2021 to 2026. Using electricity as a form of mobility in vehicles instead of traditional petrol or diesel can be considered as an electric charge for the vehicle.

Smart electric vehicles are the future of the automotive industry in the years to come. The electric vehicle revolution is speeding up, but it can only go so far without the necessary infrastructure and technology. The increasing level of air pollution has been a cause of concern for government organizations across the globe. The transport industry is the major contributor to this cause and various steps are being taken to protect the environment by promoting the use of electric vehicles.

Technological advancement will be a major driving factor for the electric drive market. Rising prices of fossil fuels such as petrol and diesel will act as an added advantage for the market. Comparing the EV market to the other fuel alternatives available in the market, it is more efficient and provides low operating costs. Another important factor would be the environmental hazards caused due to the use of conventional fuels, many countries are coming up with innovative ways and technologies to curb the damage done by reducing the emission waste from a vehicle.

Smart electric drive systems are costly even though the prices for the vehicles have reduced over the years. The use of high-end e-axles in the car increases the price of the vehicle by 10-12% which makes it a market restraint. As of now electric trucks used for transportation purposes are in demand, however, the availability of charging stations remains a problem for many and would be a restraint that could hamper the growth of the electric drive market in developing countries.

The COVID-19 pandemic has had a significant impact on major EV stakeholders across the globe and low supply has also caused a serious disruption in the EV market. However, the increasing demand for electric vehicles and various measures taken by governments to protect the environment would provide a boost for the smart electric drive market in the coming years.

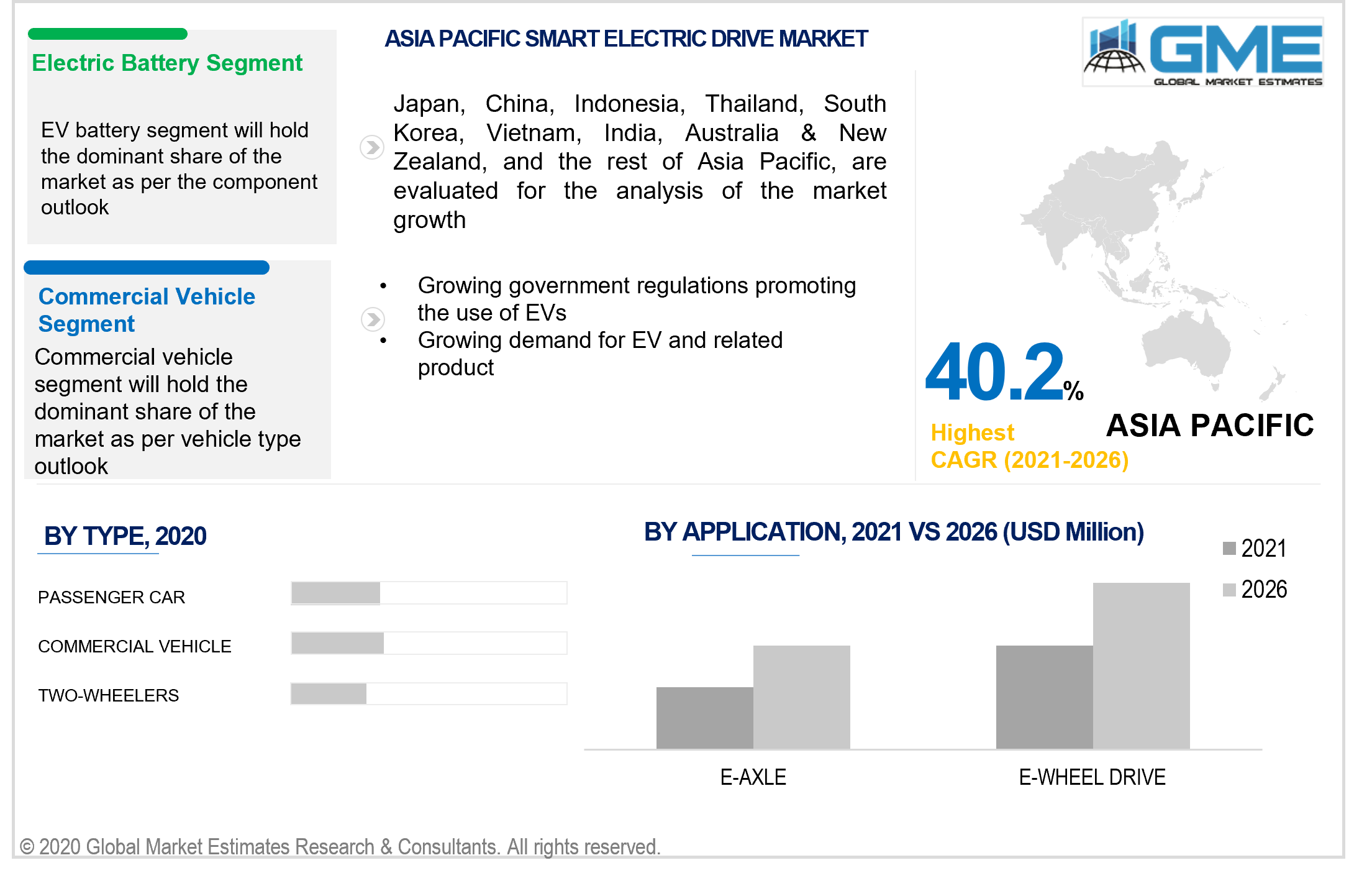

Based on the type of product, the market can be segmented into passenger cars, commercial vehicles, and 2-wheelers. The commercial vehicle segment is expected to witness the highest growth rate in the smart electric drive market. Major transportation and logistics players in the market adopt electric vehicles at the forefront of the operations which further helps to increase cost-efficiency. Various initiatives and tax subsidies provided by the government would be another advantage for the commercial vehicle segment in the years to come.

Based on the various components, the market is segmented into EV battery, electric motor, inverter system, e-break booster, and power electronics. EV batteries are estimated to own more than 40% of the market share and dominate in the coming years. As companies rush into the rapidly growing EV industry, resources are being put to use which would ensure the batteries are more efficient, more affordable, and more widely available.

Based on end-user, the smart electric drive market can be segmented into E-axle and E-wheel drive. E-axle is a compact, cost-attractive electric drive solution for battery-electric vehicle and hybrid applications. The E-axle market is expected to witness significant growth during the forecast period as the demand for electric vehicles would increase multifold. APAC market would be a major market for manufacturing of E-axle products mainly due to large demand from this region.

Based on wheel drive, the market is segmented into FWD (Front-wheel-drive), RWD (Rear wheel drive), and AWD (All-wheel drive). The all-wheel-drive market is expected to witness the highest growth as per wheel drive segment mainly because it helps to increase the mileage of HEV’s and has impacted the market positively. The main objective of the AWD system is to boost acceleration and provide traction on difficult terrains. AWD market is expected to witness a growth of 30% in the forecasted period.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (UAE, Saudi Arabia, Rest of MEA) and Central & South America (Brazil, Peru, Chile, and Rest of CSA).

The European regional market is projected to lead the global market after the North American region, contributing the second highest market share in the forecasted period mainly due to the rapid technological advancement of batteries and plug-in hybrid and hybrid vehicles across the region.

APAC region is expected to witness rapid growth in the coming years majorly due to increased demand for electric vehicles in the region followed by technological advancement it would witness in the coming years. APAC region has been the hub for the manufacturing of batteries and other components used in electric cars and is expected to grow further with the help of governing bodies as they look to provide subsidies and other tax redemption to companies which would further help to improve the economy and the environmental conditions.

Nidec Corp, Aisin Corp, Borg Warner, Bosch, ZF Group, Hitachi, Continental, Hyundai Mobis, Magna, Schaeffler, SINOEV, Efficient Drivetrains, UQM technologies, Shanghai Edrive, among others are the major players in the industry.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Smart Electric Drive Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Vehicle Type Overview

2.1.3 Component Overview

2.1.4 Application Overview

2.1.5 Drive Overview

2.1.6 Regional Overview

Chapter 3 Smart Electric Drive Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements in the electric vehicle production

3.3.1.2 Growing demand in the APAC region

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate charging stations and low batter charge duration

3.4 Prospective Growth Scenario

3.4.1 Vehicle Type Growth Scenario

3.4.2 Component Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 Drive Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Drive Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Smart Electric Drive Market, By Vehicle Type

4.1 Vehicle Type Outlook

4.2 Passenger Cars

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Commercial Vehicles

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 2-Wheeler Vehicles

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Smart Electric Drive Market, By Application

5.1 Application Outlook

5.2 EV Battery

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Electric Motor

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Invertor

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 E Break Booster

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Power Electronics

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Smart Electric Drive Market, By Component

6.1 E-Axle

6.1.1 Market Size, By Region, 2020-2026 (USD Million)

6.2 E-Wheel Drive

6.2.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 7 Smart Electric Drive Market, By Drive

7.1 FWD

7.1.1 Market Size, By Region, 2020-2026 (USD Million)

7.2 RWD

7.2.1 Market Size, By Region, 2020-2026 (USD Million)

7.3 AWD

7.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 8 Smart Electric Drive Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Million)

8.2.2 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.2.3 Market Size, By Component, 2020-2026 (USD Million)

8.2.4 Market Size, By Application, 2020-2026 (USD Million)

8.2.5 Market Size, By Drive, 2020-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.2.4.2 Market Size, By Component, 2020-2026 (USD Million)

8.2.4.3 Market Size, By Application, 2020-2026 (USD Million)

Market Size, By Drive, 2020-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.2.7.2 Market Size, By Component, 2020-2026 (USD Million)

8.2.7.3 Market Size, By Application, 2020-2026 (USD Million)

8.2.7.4 Market Size, By Drive, 2020-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Million)

8.3.2 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.3.3 Market Size, By Component, 2020-2026 (USD Million)

8.3.4 Market Size, By Application, 2020-2026 (USD Million)

8.3.5 Market Size, By Drive, 2020-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.3.6.2 Market Size, By Component, 2020-2026 (USD Million)

8.3.6.3 Market Size, By Application, 2020-2026 (USD Million)

8.3.6.4 Market Size, By Drive, 2020-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.3.7.2 Market Size, By Component, 2020-2026 (USD Million)

8.3.7.3 Market Size, By Application, 2020-2026 (USD Million)

8.3.7.4 Market Size, By Drive, 2020-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.3.8.2 Market Size, By Component, 2020-2026 (USD Million)

8.3.8.3 Market Size, By Application, 2020-2026 (USD Million)

8.3.8.4 Market Size, By Drive, 2020-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.3.9.2 Market Size, By Component, 2020-2026 (USD Million)

8.3.9.3 Market Size, By Application, 2020-2026 (USD Million)

8.3.9.4 Market Size, By Drive, 2020-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.3.10.2 Market Size, By Component, 2020-2026 (USD Million)

8.3.10.3 Market Size, By Application, 2020-2026 (USD Million)

8.3.10.4 Market Size, By Drive, 2020-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.3.11.2 Market Size, By Component, 2020-2026 (USD Million)

8.3.11.3 Market Size, By Application, 2020-2026 (USD Million)

8.3.11.4 Market Size, By Drive, 2020-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Million)

8.4.2 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.4.3 Market Size, By Component, 2020-2026 (USD Million)

8.4.4 Market Size, By Application, 2020-2026 (USD Million)

8.4.5 Market Size, By Drive, 2020-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.4.6.2 Market Size, By Component, 2020-2026 (USD Million)

8.4.6.3 Market Size, By Application, 2020-2026 (USD Million)

8.4.6.4 Market Size, By Drive, 2020-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.4.7.2 Market Size, By Component, 2020-2026 (USD Million)

8.4.7.3 Market Size, By Application, 2020-2026 (USD Million)

8.4.7.4 Market Size, By Drive, 2020-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.4.8.2 Market Size, By Component, 2020-2026 (USD Million)

8.4.8.3 Market Size, By Application, 2020-2026 (USD Million)

8.4.8.4 Market Size, By Drive, 2020-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.4.9.2 Market size, By Component, 2020-2026 (USD Million)

8.4.9.3 Market Size, By Application, 2020-2026 (USD Million)

8.4.9.4 Market Size, By Drive, 2020-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.4.10.2 Market Size, By Component, 2020-2026 (USD Million)

8.4.10.3 Market Size, By Application, 2020-2026 (USD Million)

8.4.10.4 Market Size, By Drive, 2020-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Million)

8.5.2 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.5.3 Market Size, By Component, 2020-2026 (USD Million)

8.5.4 Market Size, By Application, 2020-2026 (USD Million)

8.5.5 Market Size, By Drive, 2020-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.5.6.2 Market Size, By Component, 2020-2026 (USD Million)

8.5.6.3 Market Size, By Application, 2020-2026 (USD Million)

8.5.6.4 Market Size, By Drive, 2020-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.5.7.2 Market Size, By Component, 2020-2026 (USD Million)

8.5.7.3 Market Size, By Application, 2020-2026 (USD Million)

8.5.7.4 Market Size, By Drive, 2020-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.5.8.2 Market Size, By Component, 2020-2026 (USD Million)

8.5.8.3 Market Size, By Application, 2020-2026 (USD Million)

8.5.8.4 Market Size, By Drive, 2020-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Million)

8.6.2 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.6.3 Market Size, By Component, 2020-2026 (USD Million)

8.6.4 Market Size, By Application, 2020-2026 (USD Million)

8.6.5 Market Size, By Drive, 2020-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.6.6.2 Market Size, By Component, 2020-2026 (USD Million)

8.6.6.3 Market Size, By Application, 2020-2026 (USD Million)

8.6.6.4 Market Size, By Drive, 2020-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.6.7.2 Market Size, By Component, 2020-2026 (USD Million)

8.6.7.3 Market Size, By Application, 2020-2026 (USD Million)

8.6.7.4 Market Size, By Drive, 2020-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Vehicle Type, 2020-2026 (USD Million)

8.6.8.2 Market Size, By Component, 2020-2026 (USD Million)

8.6.8.3 Market Size, By Application, 2020-2026 (USD Million)

8.6.8.4 Market Size, By Drive, 2020-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Nidec Corp

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Aisin Corp

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Borg Warner

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Bosch

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 ZF Group

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Hitachi

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Continental

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Hyundai Mobis

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Magna

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Smart Electric Drive Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Smart Electric Drive Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS