Global Solvent Market Size, Trends, and Analysis - Forecasts To 2026 By Application (Paints & Coatings, Printing Inks, Pharmaceuticals, Cosmetic & Adhesives, Others), By Product (Alcohols, Esters, Ketones, Chlorinated, Hydrocarbons, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

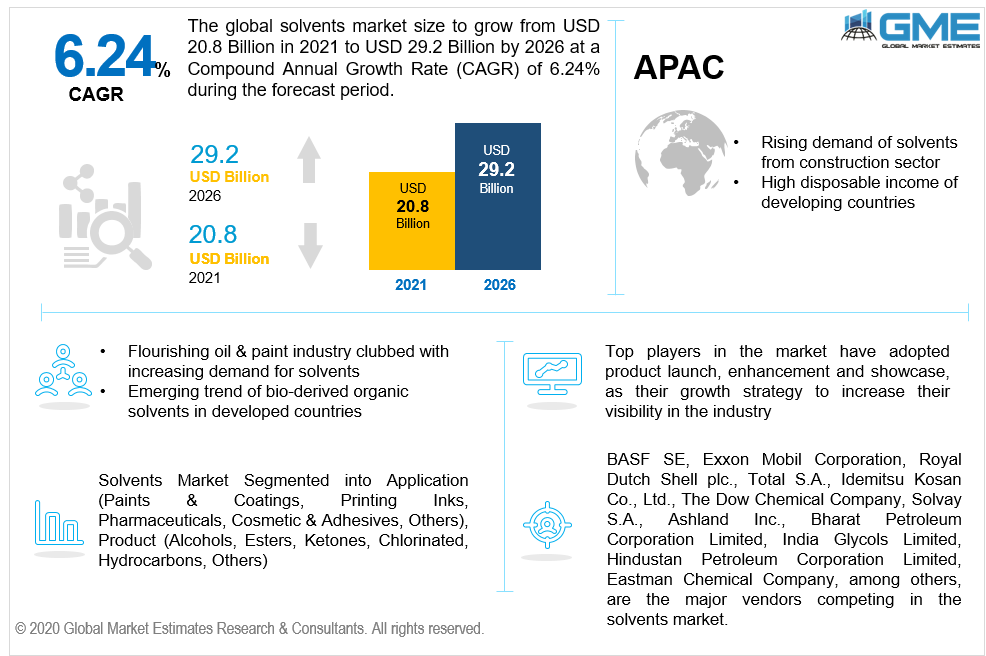

During the forecast period of 2021 to 2026, the solvent market is expected to reach USD 29.2 billion in 2026 from USD 20.8 billion in 2021 with a CAGR of 6.24%. The growth factors of the solvent market have been analyzed and studied in the report. Furthermore, the solvent market value or solvent market size has been analyzed based on the current industry trends. Factors such as increasing demand from home care, personal care, medicine, and pharmaceutical sector for conventional solvents, rising adoption of the use of solvents in automotive, construction, aircraft manufacturing, and shipbuilding, and paints & coatings applications will help the market grow rapidly.

However, owing to the impact of COVID-19 on the solvent market many of the sectors have shown a decline in demand for solvents due to market priority shift to essential and healthcare-related products. Hence, since 2020, the market is analyzed to show de-growth due to the impact of COVID-19 on the solvent market. On the contrary, the unlock system of lockdown will act as a catalyst to uplift the market and help achieve positive growth.

Volatile Organic Compounds (VOCs) are the principal elements of smog and are responsible for the formation of ground-level ozone and particulate matter. To reduce any health risks related to solvents, it is highly recommended that they be used with appropriate precautions. Global demand has been steadily increasing due to strong expansion in the construction sector, particularly in the Asia Pacific and Latin America's growing economies. In the paints and varnish market, however, there is a trend of adoption is changing from solvent-based products to environmentally friendly water-based alternatives. The solvent market trend is being stifled as a result of this development and hence can hamper the market growth.

Emerging economies are witnessing a high growth rate in terms of solvent adoption. In both developed and developing countries, advanced technologies and cutting-edge equipment, combined with the implementation of new systems, are driving demand for solvents. Paint and coatings manufacturers are the biggest users of solvents, followed by printing ink producers. These manufacturers have a strong base in Asian countries and hence will help the market grow rapidly. Chemical production, cooling circuits, dry cleaning, and deicers are all key applications of solvents in the Asian market.

The global supply chain disruption is projected to have a detrimental impact on the solvent market. Because solvents are utilized in paints and coatings applications in various industries, the market is strongly reliant on growth of construction, automobile, shipbuilding, and aviation sectors. Considering this factor, China is the one of the key markets from the APAC region. China is world's largest infrastructure and industrial hub. However, China's construction industry has been hampered by strict lockdown major provinces. Following which, paint and coatings demand has decreased drastically in the first quarter of 2020, leading to the negative impact of COVID-19 on the solvent market.

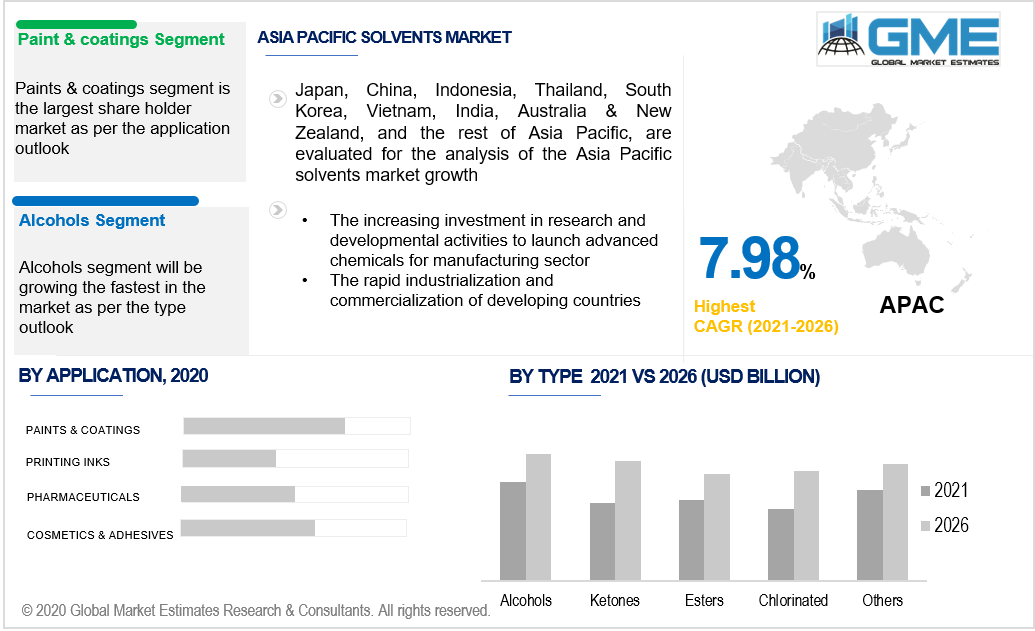

Based on the application, the market can be segmented into paints & coatings, printing inks, pharmaceuticals, cosmetics & adhesives. The paints and coatings application segment is expected to grow the fastest from 2021 to 2026, due to rising building & construction activity in emerging countries such as China, India, and Brazil. Paints and coatings use bio-based solvents to dissolve binders and pigments while maintaining uniformity. During the forecast period, the paints and coatings segment is anticipated to have the largest share, especially in the developing regions.

Ketones like MEK are commonly utilized in paints and coatings due to their ability to produce low viscosity solutions with high solid content. However, due to the implementation of environmental and sustainability regulatory policies restricting solvent-based paints and coatings, the demand for water-borne solvents is growing as an alternative to solvents and hampering the market growth.

Based on type, the market can be segmented into alcohols, esters, ketones, chlorinated, and hydrocarbons, among others. During the forecast period, the alcohol segment is expected to dominate the market in terms of revenue. The advent of soy oil and glycol-based solvents is expected to open enormous market opportunities for large players. Environmental regulators are increasingly scrutinizing VOC emissions from solvent-based paints and coatings, which has influenced the growth of ketones.

North America will hold a significant share in the global solvent market from 2021 to 2026. Green efforts taken by regulatory authorities are particularly driving the growth of the North American solvent market. Product demand is likely to be influenced by the introduction of bio-based solvent, as well as increased consumer awareness of the benefits of environmentally friendly products, during the forecast period.

The APAC region is expected to grow at the fastest rate during the forecast period in terms of volume and value. This is due to the region's growing demand for solvent from the agricultural chemicals, personal care & cosmetics, and home care categories. Presence of top solvent manufacturers in this region (such as BASF SE, Exxon Mobil Corporation, Royal Dutch Shell plc.) will also help the market grow rapidly from 2021 to 2026. Other reasons fueling the growth of the solvent market include growing urbanization, commercialization, flourishing agricultural industry and changing lifestyles. Furthermore, the availability of low-cost raw materials in the APAC region is projected to fuel the market's expansion.

BASF SE, Exxon Mobil Corporation, Royal Dutch Shell plc., Total S.A., Idemitsu Kosan Co., Ltd., The Dow Chemical Company, Solvay S.A., Ashland Inc., Bharat Petroleum Corporation Limited, India Glycols Limited, Hindustan Petroleum Corporation Limited, and Eastman Chemical Company, among others, are the key players competing in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2018, Royal Dutch Shell PLC commenced the operations of Nanhai Petrochemicals Complex in Huizhou, Guangdong Province, China. This helped the company increase its geographic footprint in the market.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Solvents Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.1 Product Overview

2.1.3 Application Overview

Chapter 3 Global Solvents Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for conventional solvents from personal care, home care sectors

3.3.1.2 Growing demand for solvents from paints & coatings industry

3.3.2 Industry Challenges

3.3.2.1 Limitations of ionic solvents

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Solvents Market, By Product

4.1 Product Outlook

4.2 Alcohols

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Ketones

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Esters

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Chlorinated

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Hydrocarbons

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Others

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Solvents Market, By Application

5.1 Application Outlook

5.2 Printing Inks

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Paints & Coatings

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Pharmaceuticals

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Cosmetics & Adhesives

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Solvents Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Product, 2020-2026 (USD Billion)

6.2.3 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Product, 2020-2026 (USD Billion)

6.3.3 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Product, 2020-2026 (USD Billion)

6.4.3 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Product, 2020-2026 (USD Billion)

6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Product, 2020-2026 (USD Billion)

6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 BASF SE

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 InfoGraphic Analysis

7.3 Exxon Mobil Corporation.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 InfoGraphic Analysis

7.4 Royal Dutch Shell PLC

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 InfoGraphic Analysis

7.5 Solvay S.A.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 InfoGraphic Analysis

7.6 Total S.A.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 InfoGraphic Analysis

7.7 Eastman Chemical Company

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 InfoGraphic Analysis

7.8 Idemitsu Kosan Co., Ltd.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 InfoGraphic Analysis

7.9 The Dow Chemical Company

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 InfoGraphic Analysis

7.10 Hindustan Petroleum Corporation Limited

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 InfoGraphic Analysis

7.11 India Glycols Limited

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 InfoGraphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 InfoGraphic Analysis

The Global Solvent Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Solvent Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS