Global SPECT & SPECT-CT Market Size, Trends & Analysis - Forecasts to 2026 By Product Type (Standalone SPECT System, Hybrid SPECT (SPECT-CT & SPECT-PET) System), By Application (Oncology, Cardiology, Neurology, Other Applications), By Type of Radioisotopes (Tc-99m, Ra-223, Ga-66, I-123, Other Types of Radioisotopes), By End-User (Hospitals & Multi-specialty Clinics, Diagnostic Imaging Center, Research & Academic Institutes, Other End-Users), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

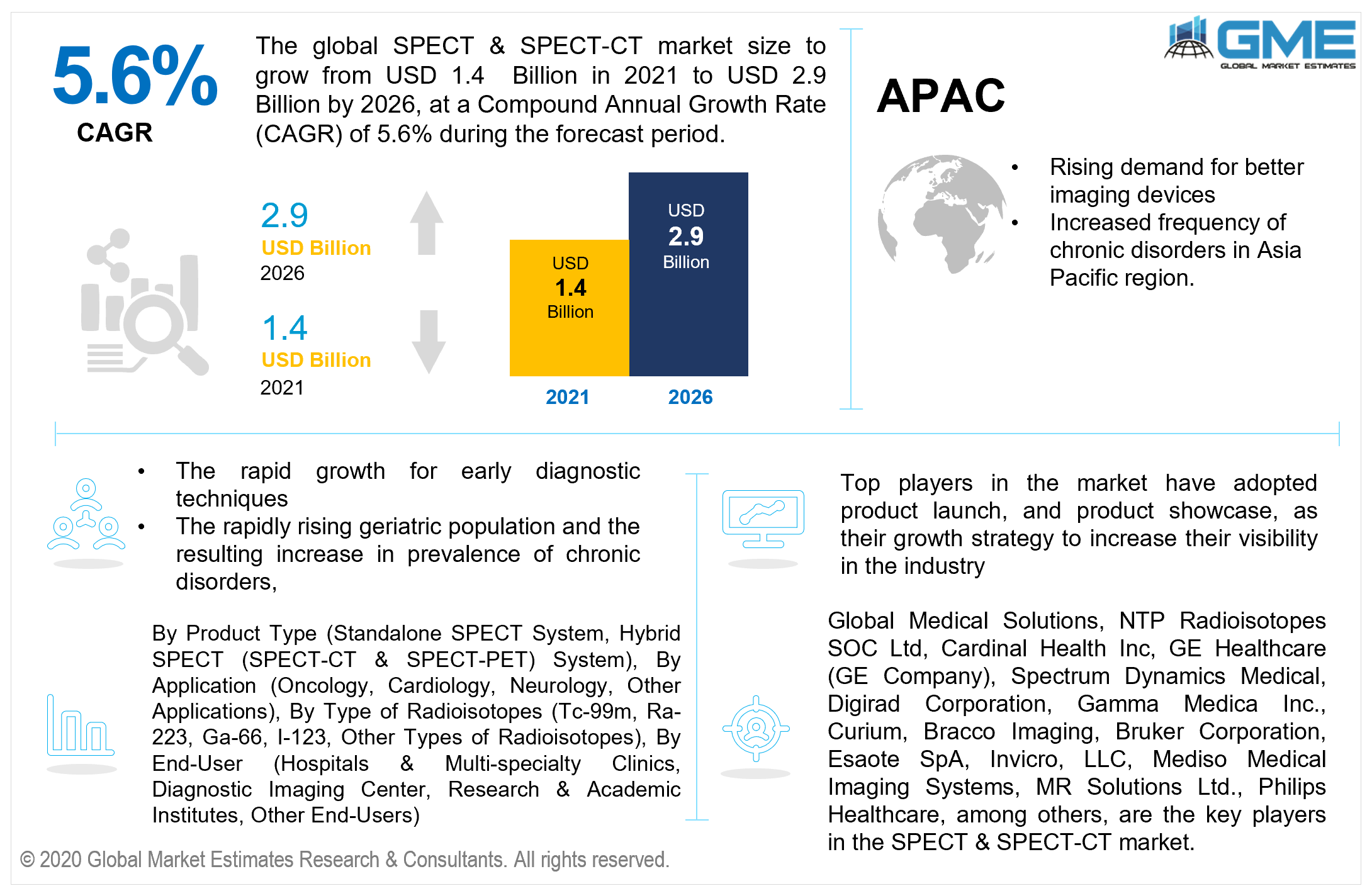

The Global SPECT & SPECT-CT Market is projected to grow from USD 1.4 billion in 2021 to USD 2.9 billion by 2026 at a CAGR value of 5.6% from 2021 to 2026. The single-photon Emission Computed Tomography (SPECT) technique is used to assess pathological conditions using functional and metabolic data from organs and cells. The anger gamma camera is utilized in the majority of SPECT systems, which normally include two detectors that circle the patient. In the imaging diagnostics realm, the employment of hybrid equipment and fusion procedures is becoming increasingly important.

Rapid growth for early diagnostic techniques, broadening the scope of therapeutic trials, rapidly rising geriatric population and the resulting increase in the prevalence of chronic disorders, technological innovations in the medical diagnostic industry, and the boost to investments, financing, and subsidies by public-private organizations are all driving the market forward during the forecast period.

Moreover, academic hospitals and universities' increasing need for comprehensive imaging techniques to deliver sophisticated training is expected to have a significant impact on market growth during the forecast period. Furthermore, advancements in digital and communications technologies have accelerated the advancement of diagnostic devices. In most diagnostics labs and hospitals, new imaging methods that disclose more anatomical features are accessible.

The integration of X-ray computed tomography (CT) with SPECT has lately identified as a significant diagnostic tool in computed tomography, where structural details can help distinguish between functional and metabolic data. In addition, dual-modality systems and epithelial systems are becoming increasingly popular as a way to improve the diagnostic capability of the equipment. PET/CT has seen increased use in recent years, mainly due to the fact that the functionality and microstructural correlative pictures generated by this technology enhance diagnostic performance, and this is one of the aspects that could stymie the SPECT equipment market's growth.

The pandemic of COVID-19 has had both positive and bad effects on the market. Hospitals, particularly small-scale hospitals and imaging centers, have extremely limited purchasing capability. Manufacturing companies have also been affected by the pandemic. Companies are making do with a little workforce. Furthermore, due to modern packaging rules and country-imposed lockout procedures, the turnaround time for delivering products and services is hampered. All of these variables are wreaking havoc on the Single Photon Emission Computed Tomography (SPECT) Market's manufacturing and supply chain.

However, the technological constraints of independent imaging modalities discourage researchers from purchasing them, limiting their market expansion. SPECT has a low detection sensitivity, and CT has poor soft-tissue contrast, therefore it provides less information about functional qualities and exposes doctors and patients to radiation.

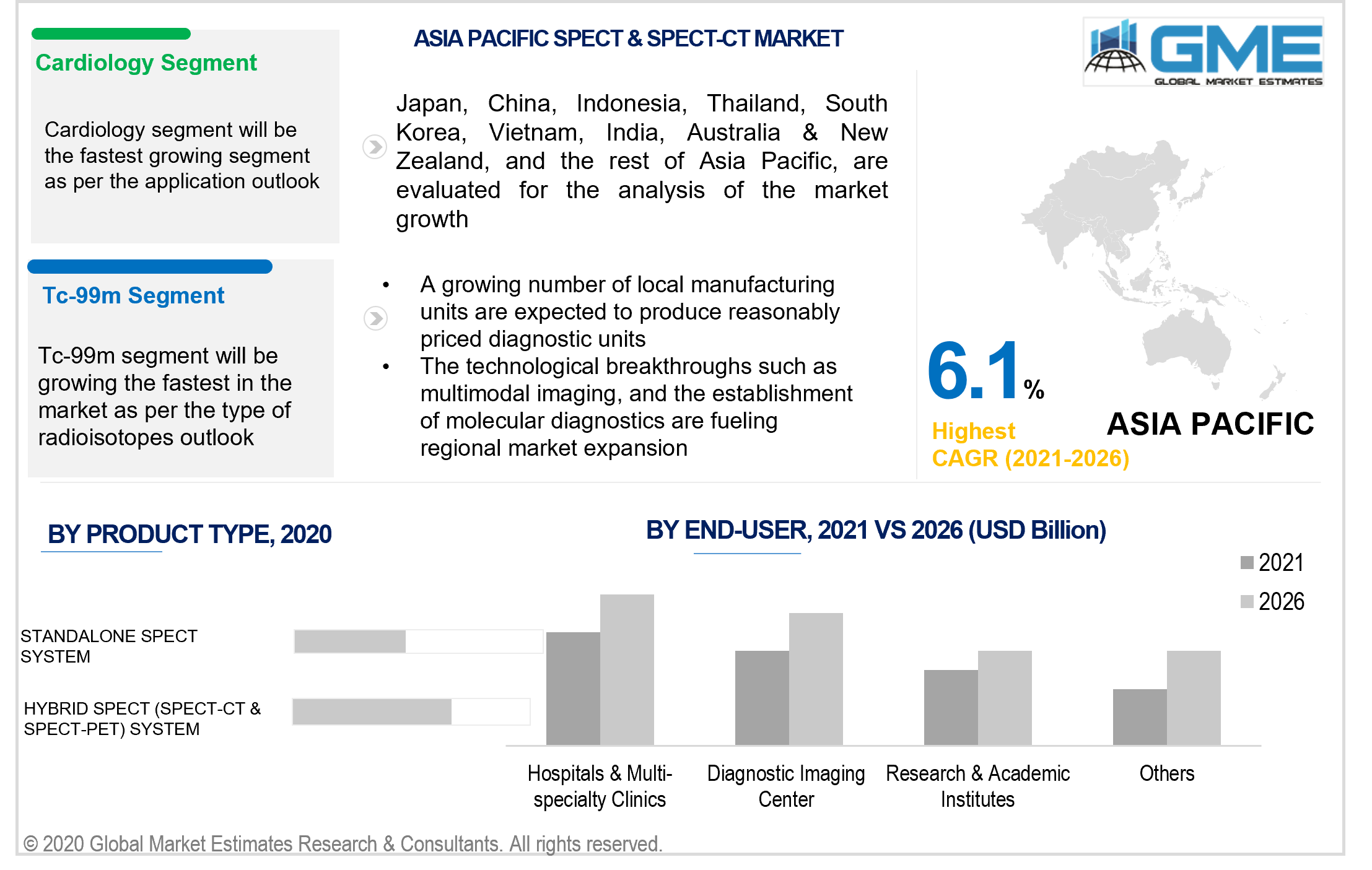

Based on the product type, the market is segmented into standalone SPECT system and hybrid SPECT (SPECT-CT & SPECT-PET) system. The hybrid SPECT (SPECT-CT & SPECT-PET) system segment is expected to have the largest share in the market during the forecast period. The enhanced localization, the capability to distinguish physiologic from pathologic processes and uncover previously undetected disease, and the opportunity for a change in care in some patients are all contributing to the growth. Owing to more exact anatomical lesions identification, hybrid SPECT/CT imaging provides more clinical utility than SPECT imaging alone.

Based on the application, the market is segmented into oncology, cardiology, neurology, and other applications. The application of SPECT & SPECT-CT for cardiology is expected to have the largest share in the market during the forecast period. SPECT is mostly used in cardiology to determine coronary artery disease and identify whether or not a heart attack has occurred. A non-invasive nuclear imaging test for the heart is a SPECT scan. It creates images of your heart by injecting radioactive tracers into your bloodstream. SPECT detects portions of the cardiac muscle with insufficient blood flow in comparison to those with normal flow. Restricted blood flow could indicate that coronary arteries are restricted or that a person has had a heart attack.

Based on the type of radioisotopes, the market is divided into Tc-99m, Ra-223, Ga-66, I-123, and other types of radioisotopes. The TC-99m segment is anticipated to have the largest share in the market during the forecast period. Owing to its versatility, technetium 99m (TC-99m) is the most extensively used imaging agent. The substantial half-life of this radioactive material is its main advantage. Various medical examinations can be completed in 6 hours. It also is brief enough for the 99mTc to be removed from the system without harming it.

Based on end-use, the market is segmented into hospitals & multi-specialty clinics, diagnostic imaging centers, research & academic institutes, and other end-users. The hospitals & multi-specialty clinics segment is anticipated to have the largest share in the market during the forecast period. The industry is being driven by rising demand for better imaging modalities and the integration of surgical suits with imaging technology. Teaching hospitals in certain wealthy countries have seen a considerable increase in demand for these modalities when compared to general or specialty hospitals. Intense pressure and rising acceptance of world-class hospital facilities are expected to fuel segment expansion in the future years.

Based on region, the market can be broken into various regions such as North America, Europe, Central, and South America, the Middle East and Africa, and Asia Pacific regions. The North American region is expected to have a lion’s share in the market during the forecast period. The presence of a large variety of industry operators in the area, as well as the regularity with which types of products are released, both contribute to regional market growth. The region also has a significant uptake of current, high-priced neuroimaging procedures due to aspects such as attractive remuneration scenarios and patient trundled awareness. This ensures a faster payback for expensive diagnostics and suites.

The Asia-Pacific region is also expected to become the dominant region during the forecast period because of the increased demand for better imaging devices and the rising frequency of chronic disorders In the Asia Pacific region. Japan is the major segment for SPECT and SPECT-CT in the Asia Pacific. The presence of industrial behemoths in South Korea and Japan is projected to have a major impact on regional market growth. A growing handful of local production plants are planned to create moderately priced diagnostic devices, helping to fill a gap in the region's premium, neglected market. In addition, technological breakthroughs such as multimodal imaging, the launch of new radionuclides for diagnostics, and the establishment of molecular diagnostics are fueling regional market expansion.

Global Medical Solutions, NTP Radioisotopes SOC Ltd, Cardinal Health Inc, GE Healthcare (GE Company), Spectrum Dynamics Medical, Digirad Corporation, Gamma Medica Inc., Curium, Bracco Imaging, Bruker Corporation, Esaote SpA, Invicro, LLC, Mediso Medical Imaging Systems, MR Solutions Ltd., Philips Healthcare, among others, are the key players in the SPECT & SPECT-CT market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 SPECT & SPECT-CT Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Product Type Overview

2.1.4 End-User Overview

2.1.5 Type of Radioisotopes Overview

2.1.6 Regional Overview

Chapter 3 SPECT & SPECT-CT Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rapid growth for early diagnostic techniques and the broadening scope of therapeutic trials

3.3.2 Industry Challenges

3.3.2.1 Technological constraints of independent imaging modalities

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 End-User Growth Scenario

3.4.3 Product Type Growth Scenario

3.4.4 Type of Radioisotopes Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 SPECT & SPECT-CT Market, By Application

4.1 Application Outlook

4.2 Oncology

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Cardiology

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Neurology

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Other Applications

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 SPECT & SPECT-CT Market, By Product Type

5.1 Product Type Outlook

5.2 Standalone SPECT System

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Hybrid SPECT (SPECT-CT & SPECT-PET) System

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 SPECT & SPECT-CT Market, By End-User

6.1 Hospitals & Multi-specialty Clinics

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Diagnostic Imaging Center

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Research & Academic Institutes

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Other End-Users

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 SPECT & SPECT-CT Market, By Type of Radioisotopes

7.1 Tc-99m

7.1.1 Market Size, By Region, 2020-2026 (USD Billion)

7.2 Ra-223

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Ga-66

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

7.4 I-123

7.4.1 Market Size, By Region, 2020-2026 (USD Billion)

7.5 Other Types of Radioisotopes

7.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 SPECT & SPECT-CT Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Application, 2020-2026 (USD Billion)

8.2.3 Market Size, By Product Type, 2020-2026 (USD Billion)

8.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.5 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.2.4.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.3 Market Size, By Product Type, 2020-2026 (USD Billion)

8.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.5 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.3 Market Size, By Product Type, 2020-2026 (USD Billion)

8.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.5 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Product Type, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.3 Market Size, By Product Type, 2020-2026 (USD Billion)

8.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.5 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.3 Market Size, By Product Type, 2020-2026 (USD Billion)

8.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.5 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By Types of Radioisotopes, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Product Type, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By Type of Radioisotopes, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Global Medical Solutions

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 NTP Radioisotopes SOC Ltd

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Cardinal Health Inc

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 GE Healthcare (GE Company)

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Spectrum Dynamics Medical

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Digirad Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Gamma Medica Inc

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Bracco Imaging

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Bruker Corporation

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Esaote SpA

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Invicro, LLC

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Mediso Medical Imaging Systems

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

9.14 MR Solutions Ltd

9.14.1 Company Overview

9.14.2 Financial Analysis

9.14.3 Strategic Positioning

9.14.4 Info Graphic Analysis

9.15 Philips Healthcare

9.15.1 Company Overview

9.15.2 Financial Analysis

9.15.3 Strategic Positioning

9.15.4 Info Graphic Analysis

9.16 Other Companies

9.16.1 Company Overview

9.16.2 Financial Analysis

9.16.3 Strategic Positioning

9.16.4 Info Graphic Analysis

The Global SPECT & SPECT-CT Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the SPECT & SPECT-CT Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS