Global Stainless-steel Fittings and Valves Market Size, Trends & Analysis - Forecasts to 2029 By Product Type (Valves, Tube Fitting, Pipe Fitting, Single Ferrule, Double Ferrule, and Others), By Application (Industrial, Chemical Industries, Semiconductor, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

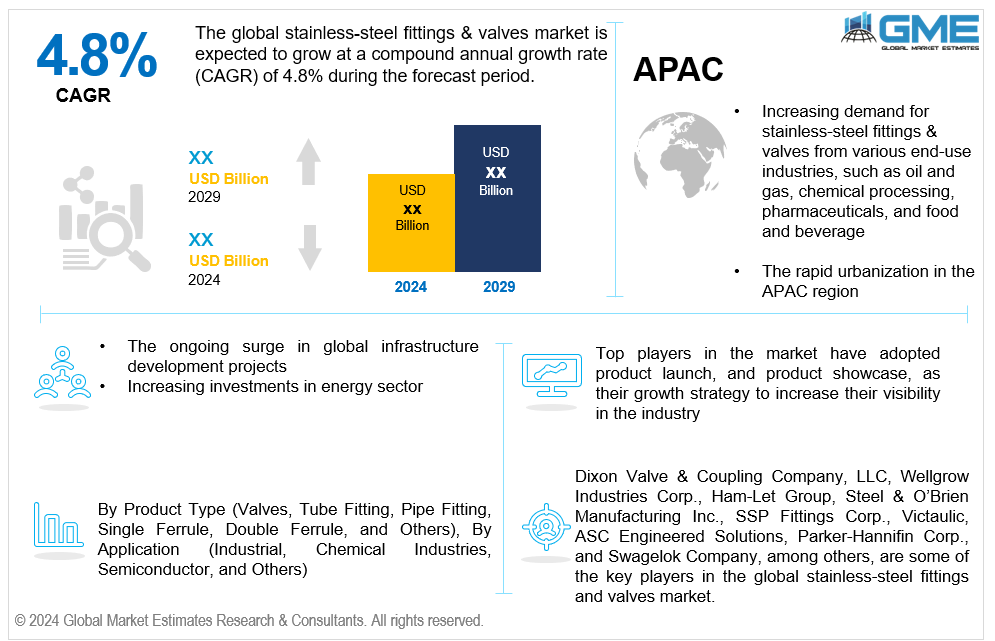

The global stainless-steel fittings and valves market is projected to grow from USD 1,323.14 million in 2023 and is expected to reach USD 1,750.17 million by 2029 at a CAGR of 4.8% from 2024 to 2029.

The global stainless-steel fittings and valves market is experiencing significant growth driven primarily by increasing demand from various end-use industries. Industries such as oil and gas, chemical processing, water treatment, pharmaceuticals, and food and beverage heavily rely on stainless-steel components due to their exceptional corrosion resistance, durability, and reliability. In the oil and gas sector, stainless-steel fittings and valves are essential in ensuring the integrity and safety of pipelines, refineries, and offshore platforms. The harsh operating conditions, including exposure to corrosive fluids and high temperatures, necessitate using high-quality stainless-steel components to maintain operational efficiency and minimize downtime. Similarly, stainless-steel fittings and valves are essential for handling corrosive chemicals and maintaining process integrity in chemical processing plants. In the water treatment industry, stainless-steel fittings and valves are widely employed in purification systems, desalination plants, and wastewater treatment facilities. Moreover, in the pharmaceutical and food and beverage industries, stainless-steel fittings and valves are preferred for their hygienic properties and ease of cleaning. They are utilized in critical applications such as product processing, packaging, and sterilization, where maintaining purity and preventing contamination are paramount.

The ongoing surge in global infrastructure development projects and rapid urbanization is a major driver for the growth of the stainless-steel fittings and valves market. Stainless steel stands out as a preferred material in construction applications, including building structures, bridges, tunnels, and water treatment facilities, due to its exceptional combination of strength, corrosion resistance, and aesthetic appeal. As governments and private sectors invest in large-scale infrastructure initiatives to support economic growth and improve quality of life, the need for stainless-steel fittings and valves is anticipated to increase. As urban populations expand and cities undergo transformation, the demand for infrastructure solutions escalates.

The growing emphasis on sustainability presents a significant opportunity for the global stainless-steel fittings and valve market. As industries worldwide increasingly prioritize environmental responsibility, stainless-steel emerges as an eco-friendly alternative to traditional materials. With its durability, corrosion resistance, and recyclability, stainless-steel aligns well with sustainability goals. The inherent longevity of stainless-steel fittings and valves reduces the need for frequent replacements, minimizing waste and conserving resources. Additionally, stainless-steel's resistance to corrosion extends product lifecycles, further reducing environmental impact. Moreover, stainless-steel's recyclability allows for the recovery and reuse of materials, promoting a circular economy and reducing the reliance on virgin resources. Manufacturers can leverage these sustainability benefits to appeal to environmentally conscious consumers and businesses, expanding market opportunities. Furthermore, as governments implement stringent regulations and standards regarding environmental sustainability, stainless-steel fittings, and valves offer a compliant solution that meets or exceeds requirements. By positioning themselves as providers of sustainable solutions, companies in the stainless-steel fittings and valves market can differentiate themselves and capitalize on the growing demand for environmentally friendly products.

However, the stainless-steel fittings and valves market is particularly impacted by raw material price instability. Manufacturers face pressure to adapt to fluctuating costs while maintaining profitability and competitiveness. Developing robust cost management and risk mitigation strategies is imperative for long-term sustainability and growth in this sector.

The valves segment is expected to hold the largest share of the market over the forecast period. Numerous industries, including oil and gas, chemical, water treatment, pharmaceutical, and power generation, use valves in various applications. They are vital parts of many industrial processes as they regulate the flow of gases, liquids, or slurries in pipelines. Valves are essential to guarantee the effective and safe functioning of industrial systems. They control pressure, temperature, and fluid levels, prevent backflow, and isolate equipment for upkeep or repairs.

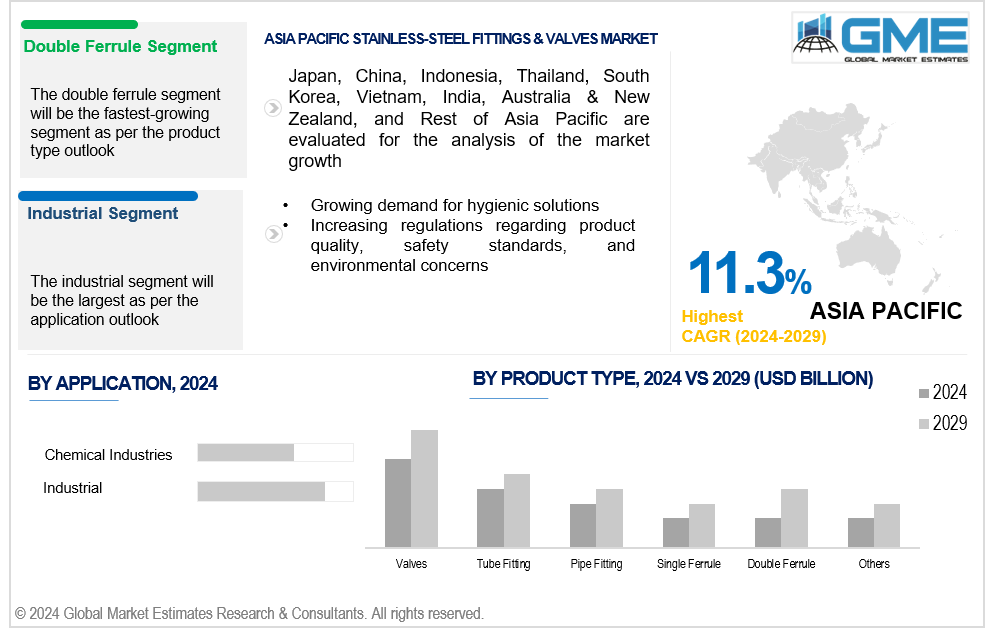

The double ferrule segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Double ferrule fittings provide superior sealing compared to single ferrule fittings, making them ideal for applications where leakage prevention is critical. Additionally, double ferrule fittings typically offer easier installation and require fewer components than other types. This can result in cost savings and increased efficiency for end users.

The industrial segment is anticipated to be the largest and fastest-growing segment in the market over the forecast period. Stainless steel fittings and valves are widely used in industrial sectors like oil and gas, chemical processing, power generation, water treatment, and petrochemicals. These industries rely on stainless-steel components due to their strength, resistance to corrosion, and capacity to endure challenging operating environments. Fittings and valves are essential parts of industrial pipelines and process systems that regulate the flow of gases, liquids, and steam. They are crucial in controlling flow rates, temperature, and pressure to keep industrial processes operating safely and effectively.

The chemical industries segment is expected to hold the second-largest market share from 2024 to 2029. As stainless-steel fittings and valves have a high level of corrosion resistance, they are perfect for use in chemical processing facilities where workers frequently come into contact with corrosive materials. They provide longevity and safety in chemical applications since they are resistant to corrosive conditions and severe chemicals without degrading.

North America is expected to be the second-largest region in the global stainless-steel fittings & valves market. The region has a developed industrial sector that includes businesses that use a lot of stainless-steel fittings and valves, including oil and gas, chemical processing, water treatment, and power generation. High-grade stainless-steel goods are in high demand due to the strong presence of these industries and stringent safety and quality regulations.

The Asia Pacific (APAC) is anticipated to be the largest and fastest-growing region in the global stainless-steel fittings & valves market. APAC includes rapidly expanding economies heavily industrializing, urbanizing, and developing their infrastructure, including China, India, Japan, and South Korea. To support infrastructure projects, industrial processes, and urban development initiatives, these nations' expanding industrial sectors, which include manufacturing, oil and gas extraction, chemical processing, water treatment, and construction, create a significant demand for stainless-steel fittings and valves.

Dixon Valve & Coupling Company, LLC, Wellgrow Industries Corp., Ham-Let Group, Steel & O’Brien Manufacturing Inc., SSP Fittings Corp., Victaulic, ASC Engineered Solutions, Brennan Industries Inc., Parker-Hannifin Corp., and Swagelok Company, among others, are some of the key players in the global stainless-steel fittings and valves market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2024, Utility Coatings & Fabrication, Inc. (UCF), based in West Jordan, Utah, was acquired by Victaulic. The acquisition expands the company's capacity for large-diameter piping solutions, fabrication, and coatings and linings capabilities, which helps the company grow in the infrastructure, waterworks, energy, and commercial construction markets.

In February 2024, Ward Manufacturing was acquired by ASC Engineered Solutions from Proterial America, Ltd., a division of Proterial, Ltd. Ward manufactures fittings, nipples, and the corrugated stainless-steel tubing system known as WARDFlex, among other pipe joining components.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL STAINLESS-STEEL FITTINGS AND VALVES MARKET, BY Product Type

4.1 Introduction

4.2 Stainless-steel Fittings and Valves Market: Product Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Valves

4.4.1 Valves Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Tube Fitting

4.5.1 Tube Fitting Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Pipe Fitting

4.6.1 Pipe Fitting Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Single Ferrule

4.7.1 Single Ferrule Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Double Ferrule

4.8.1 Double Ferrule Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Others

4.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL STAINLESS-STEEL FITTINGS AND VALVES MARKET, BY APPLICATION

5.1 Introduction

5.2 Stainless-steel Fittings and Valves Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Industrial

5.4.1 Industrial Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Chemical Industries

5.5.1 Chemical Industries Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Semiconductor

5.6.1 Semiconductor Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL STAINLESS-STEEL FITTINGS AND VALVES MARKET, BY REGION

6.1 Introduction

6.2 North America Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Product Type

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Product Type

6.2.3.1.2 By Application

6.2.3.2 Canada Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Product Type

6.2.3.2.2 By Application

6.2.3.3 Mexico Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Product Type

6.2.3.3.2 By Application

6.3 Europe Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Product Type

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Product Type

6.3.3.1.2 By Application

6.3.3.2 U.K. Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Product Type

6.3.3.2.2 By Application

6.3.3.3 France Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Product Type

6.3.3.3.2 By Application

6.3.3.4 Italy Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Product Type

6.3.3.4.2 By Application

6.3.3.5 Spain Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Product Type

6.3.3.5.2 By Application

6.3.3.6 Netherlands Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Product Type

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Product Type

6.3.3.6.2 By Application

6.4 Asia Pacific Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Product Type

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Product Type

6.4.3.1.2 By Application

6.4.3.2 Japan Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Product Type

6.4.3.2.2 By Application

6.4.3.3 India Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Product Type

6.4.3.3.2 By Application

6.4.3.4 South Korea Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Product Type

6.4.3.4.2 By Application

6.4.3.5 Singapore Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Product Type

6.4.3.5.2 By Application

6.4.3.6 Malaysia Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Product Type

6.4.3.6.2 By Application

6.4.3.7 Thailand Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Product Type

6.4.3.6.2 By Application

6.4.3.8 Indonesia Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Product Type

6.4.3.7.2 By Application

6.4.3.9 Vietnam Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Product Type

6.4.3.8.2 By Application

6.4.3.10 Taiwan Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Product Type

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Product Type

6.4.3.11.2 By Application

6.5 Middle East and Africa Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Product Type

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Product Type

6.5.3.1.2 By Application

6.5.3.2 U.A.E. Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Product Type

6.5.3.2.2 By Application

6.5.3.3 Israel Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Product Type

6.5.3.3.2 By Application

6.5.3.4 South Africa Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Product Type

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Product Type

6.5.3.5.2 By Application

6.6 Central and South America Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Product Type

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Product Type

6.6.3.1.2 By Application

6.6.3.2 Argentina Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Product Type

6.6.3.2.2 By Application

6.6.3.3 Chile Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Product Type

6.6.3.3.2 By Application

6.6.3.3 Rest of Central and South America Stainless-steel Fittings and Valves Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Product Type

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Dixon Valve & Coupling Company, LLC

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Wellgrow Industries Corp.

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Ham-Let Group

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Steel & O’Brien Manufacturing Inc.

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 SSP Fittings Corp.

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 VICTAULIC

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 ASC Engineered Solutions

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Brennan Industries Inc.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Parker-Hannifin Corp.

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Swagelok Company

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

2 Valves Market, By Region, 2021-2029 (USD Mllion)

3 Tube Fitting Market, By Region, 2021-2029 (USD Mllion)

4 Pipe Fitting Market, By Region, 2021-2029 (USD Mllion)

5 Single Ferrule Market, By Region, 2021-2029 (USD Mllion)

6 Double Ferrule Market, By Region, 2021-2029 (USD Mllion)

7 Others Market, By Region, 2021-2029 (USD Mllion)

8 Global Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

9 Industrial Market, By Region, 2021-2029 (USD Mllion)

10 Chemical Industries Market, By Region, 2021-2029 (USD Mllion)

11 Semiconductor Market, By Region, 2021-2029 (USD Mllion)

12 Others Market, By Region, 2021-2029 (USD Mllion)

13 Regional Analysis, 2021-2029 (USD Mllion)

14 North America Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

15 North America Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

16 North America Stainless-steel Fittings and Valves Market, By COUNTRY, 2021-2029 (USD Mllion)

17 U.S. Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

18 U.S. Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

19 Canada Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

20 Canada Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

21 Mexico Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

22 Mexico Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

23 Europe Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

24 Europe Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

25 EUROPE Stainless-steel Fittings and Valves Market, By COUNTRY, 2021-2029 (USD Mllion)

26 Germany Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

27 Germany Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

28 U.K. Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

29 U.K. Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

30 France Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

31 France Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

32 Italy Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

33 Italy Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

34 Spain Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

35 Spain Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

36 Netherlands Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

37 Netherlands Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

38 Rest Of Europe Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

39 Rest Of Europe Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

40 Asia Pacific Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

41 Asia Pacific Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

42 ASIA PACIFIC Stainless-steel Fittings and Valves Market, By COUNTRY, 2021-2029 (USD Mllion)

43 China Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

44 China Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

45 Japan Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

46 Japan Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

47 India Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

48 India Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

49 South Korea Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

50 South Korea Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

51 Singapore Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

52 Singapore Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

53 Thailand Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

54 Thailand Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

55 Malaysia Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

56 Malaysia Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

57 Indonesia Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

58 Indonesia Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

59 Vietnam Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

60 Vietnam Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

61 Taiwan Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

62 Taiwan Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

63 Rest of APAC Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

64 Rest of APAC Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

65 Middle East and Africa Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

66 Middle East and Africa Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

67 MIDDLE EAST & ADRICA Stainless-steel Fittings and Valves Market, By COUNTRY, 2021-2029 (USD Mllion)

68 Saudi Arabia Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

69 Saudi Arabia Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

70 UAE Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

71 UAE Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

72 Israel Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

73 Israel Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

74 South Africa Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

75 South Africa Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

76 Rest Of Middle East and Africa Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

77 Rest Of Middle East and Africa Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

78 Central and South America Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

79 Central and South America Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

80 CENTRAL AND SOUTH AMERICA Stainless-steel Fittings and Valves Market, By COUNTRY, 2021-2029 (USD Mllion)

81 Brazil Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

82 Brazil Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

83 Chile Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

84 Chile Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

85 Argentina Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

86 Argentina Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

87 Rest Of Central and South America Stainless-steel Fittings and Valves Market, By Product Type, 2021-2029 (USD Mllion)

88 Rest Of Central and South America Stainless-steel Fittings and Valves Market, By Application, 2021-2029 (USD Mllion)

89 Dixon Valve & Coupling Company, LLC: Products & Services Offering

90 Wellgrow Industries Corp.: Products & Services Offering

91 Ham-Let Group: Products & Services Offering

92 Steel & O’Brien Manufacturing Inc.: Products & Services Offering

93 SSP Fittings Corp.: Products & Services Offering

94 VICTAULIC: Products & Services Offering

95 ASC Engineered Solutions : Products & Services Offering

96 Brennan Industries Inc.: Products & Services Offering

97 Parker-Hannifin Corp., Inc: Products & Services Offering

98 Swagelok Company: Products & Services Offering

99 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Stainless-steel Fittings and Valves Market Overview

2 Global Stainless-steel Fittings and Valves Market Value From 2021-2029 (USD Mllion)

3 Global Stainless-steel Fittings and Valves Market Share, By Product Type (2023)

4 Global Stainless-steel Fittings and Valves Market Share, By Application (2023)

5 Global Stainless-steel Fittings and Valves Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Stainless-steel Fittings and Valves Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Stainless-steel Fittings and Valves Market

10 Impact Of Challenges On The Global Stainless-steel Fittings and Valves Market

11 Porter’s Five Forces Analysis

12 Global Stainless-steel Fittings and Valves Market: By Product Type Scope Key Takeaways

13 Global Stainless-steel Fittings and Valves Market, By Product Type Segment: Revenue Growth Analysis

14 Valves Market, By Region, 2021-2029 (USD Mllion)

15 Tube Fitting Market, By Region, 2021-2029 (USD Mllion)

16 Pipe Fitting Market, By Region, 2021-2029 (USD Mllion)

17 Single Ferrule Market, By Region, 2021-2029 (USD Mllion)

18 Double Ferrule Market, By Region, 2021-2029 (USD Mllion)

19 Others Market, By Region, 2021-2029 (USD Mllion)

20 Global Stainless-steel Fittings and Valves Market: By Application Scope Key Takeaways

21 Global Stainless-steel Fittings and Valves Market, By Application Segment: Revenue Growth Analysis

22 Industrial Market, By Region, 2021-2029 (USD Mllion)

23 Chemical Industries Market, By Region, 2021-2029 (USD Mllion)

24 Semiconductor Market, By Region, 2021-2029 (USD Mllion)

25 Others Market, By Region, 2021-2029 (USD Mllion)

26 Global Stainless-steel Fittings and Valves Market: Regional Analysis

27 North America Stainless-steel Fittings and Valves Market Overview

28 North America Stainless-steel Fittings and Valves Market, By Product Type

29 North America Stainless-steel Fittings and Valves Market, By Application

30 North America Stainless-steel Fittings and Valves Market, By Country

31 U.S. Stainless-steel Fittings and Valves Market, By Product Type

32 U.S. Stainless-steel Fittings and Valves Market, By Application

33 Canada Stainless-steel Fittings and Valves Market, By Product Type

34 Canada Stainless-steel Fittings and Valves Market, By Application

35 Mexico Stainless-steel Fittings and Valves Market, By Product Type

36 Mexico Stainless-steel Fittings and Valves Market, By Application

37 Four Quadrant Positioning Matrix

38 Company Market Share Analysis

39 Dixon Valve & Coupling Company, LLC: Company Snapshot

40 Dixon Valve & Coupling Company, LLC: SWOT Analysis

41 Dixon Valve & Coupling Company, LLC: Geographic Presence

42 Wellgrow Industries Corp.: Company Snapshot

43 Wellgrow Industries Corp.: SWOT Analysis

44 Wellgrow Industries Corp.: Geographic Presence

45 Ham-Let Group: Company Snapshot

46 Ham-Let Group: SWOT Analysis

47 Ham-Let Group: Geographic Presence

48 Steel & O’Brien Manufacturing Inc.: Company Snapshot

49 Steel & O’Brien Manufacturing Inc.: Swot Analysis

50 Steel & O’Brien Manufacturing Inc.: Geographic Presence

51 SSP Fittings Corp.: Company Snapshot

52 SSP Fittings Corp.: SWOT Analysis

53 SSP Fittings Corp.: Geographic Presence

54 VICTAULIC: Company Snapshot

55 VICTAULIC: SWOT Analysis

56 VICTAULIC: Geographic Presence

57 ASC Engineered Solutions : Company Snapshot

58 ASC Engineered Solutions : SWOT Analysis

59 ASC Engineered Solutions : Geographic Presence

60 Brennan Industries Inc.: Company Snapshot

61 Brennan Industries Inc.: SWOT Analysis

62 Brennan Industries Inc.: Geographic Presence

63 Parker-Hannifin Corp., Inc.: Company Snapshot

64 Parker-Hannifin Corp., Inc.: SWOT Analysis

65 Parker-Hannifin Corp., Inc.: Geographic Presence

66 Swagelok Company: Company Snapshot

67 Swagelok Company: SWOT Analysis

68 Swagelok Company: Geographic Presence

69 Other Companies: Company Snapshot

70 Other Companies: SWOT Analysis

71 Other Companies: Geographic Presence

The Global Stainless-steel Fittings and Valves Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Stainless-steel Fittings and Valves Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS