Global Starch Blended Biodegradable Polymer Market Size, Trends & Analysis - Forecasts to 2026 By Polymer Type (Biodegradable Starch, Durable Starch), By Technology (Blow Molding, Extrusion, Injection Molding, and Others), By Application (Agriculture and Horticulture, Automotive and Transportation, Packaging & Bags, Food and Beverage, Building and Construction, Electrical & Electronics, Biomedical, Textile, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

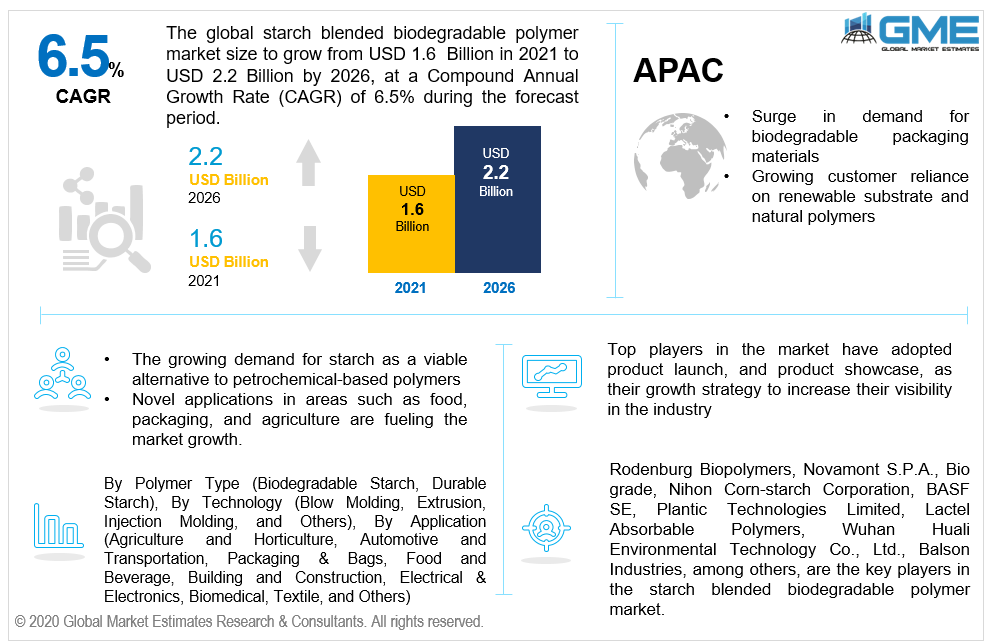

The global starch blended biodegradable polymer market is projected to grow from USD 1.6 billion in 2021 to USD 2.2 billion by 2026 at a CAGR value of 6.5% between 2021 to 2026.

Starch is a natural polymer with numerous distinctive features fit for packaging process. Some polymer composites are biodegradable and can be tailored specifically. As a result of utilizing a combination of starch and synthetic polymers, starch-based biodegradable polymers (SCBP) can be used in biomedical and environmental domains.

The rising utilization of starch as a reinforcement material in substances to improve the degradability of polymer-based products, and also the surge in demand for eco-friendly packaging components from both advanced and emerging economies, are key drivers behind the progress of starch-blended biodegradable polymers.

Furthermore, growing customer reliance on renewable substrate and natural polymers has resulted in the development of numerous alternatives to standard plastics, fuelling demand for starch-blended biodegradable polymers.

Owing to its cost efficiency and widespread accessibility, including its environment-conscious quality, starch has emerged as a potential substitute for petrochemical-based polymers. Also, due to its complete biodegradability, and recyclability, starch is regarded as a good choice for manufacturing sustainable materials, and novel applications in areas such as food, packaging, and agriculture are fuelling the market growth during the forecast period.

The unexpected start of the COVID-19 pandemic has fuelled the production of starch blended biodegradable polymers as they are utilized in the packaging industry. However, during the outbreak, there was a scarcity of raw materials, which caused mayhem. Raw material pricing volatility harmed the overall market for starch-based bioplastic films.

The competition for raw materials availability among various sectors is one of the biggest problems confronting the starch-based bioplastic film market. Corn, wheat, and tapioca are the most important raw materials for the production of starch worldwide, and they are also used in a variety of industries for a variety of applications, so the access of these raw materials and their prices for the production of starch is a major market bottleneck.

Another issue with starch-based blends is that starch and many polymers are incompatible, resulting in poor mechanical qualities for starch/polymer mixes in general. As a result, chemical strategies are considered.

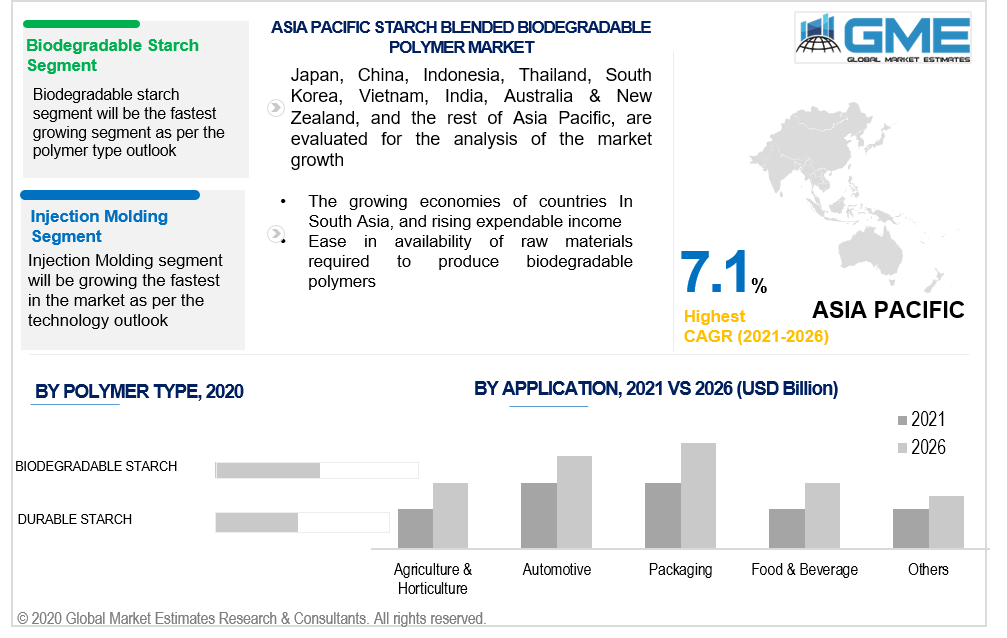

Based on the polymer type, the market is segmented into biodegradable starch and durable starch. The biodegradable starch segment is expected to have the largest share in the market during the forecast period. Food packaging and edible films are two of the most popular applications of starch-based biodegradable polymers in the food sector. Conventional food packaging materials, such as LDPE, are harmful to the environment and are difficult to dispose-off. Hence, starch-based biodegradable polymers are a viable option for food packaging, overcoming these drawbacks while retaining the benefits of standard packaging materials.

Based on the various technologies of starch blended biodegradable polymer that is available, the market is segmented into blow molding, extrusion, injection molding, and others. The injection molding segment is expected to hold the lion’s share of the market. Huge polymer molding is produced on a large scale at a low cost using the injection molding process.

Also, the increasing complexity of technological biodegradable polymer/bioplastic molding promotes the need for a multi-component injection molding method, propelling the growth of this segment.

Based on application, the market is segmented into agriculture and horticulture, automotive and transportation, packaging & bags, food and beverage, building and construction, electrical & electronics, biomedical, textile, and others. The packaging & bags segment is expected to have the largest share in the market during the forecast period. The package and bags sector consumes a large number of biodegradable materials. Secondly, the replacement of petroleum-based polymers in packaged foods such as cartons, wrap, mugs, and dinnerware are gaining traction, which is aiding the growth of the segment in the starch-blended biodegradable polymers market.

Based on region, the market can be broken into various regions such as North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and Rest of Europe), Central, and South America (Brazil and Rest of Central & South America), the Middle East and Africa (UAE, Saudi Arabia, and Rest of Middle East & Africa), and Asia Pacific (China, Japan, India, and Rest of Asia Pacific) regions.

The Asia Pacific region is expected to be the dominant region in the market during the forecast period followed by North America. The growing economies of countries In South Asian region, rising expendable income, cost efficiency, high availability of raw materials required to produce biodegradable polymers, and rapidly rising population are driving the growth of this market in the APAC region.

The North American region is expected to become the 2nd largest region during the forecast period and is expected to grow at the fastest growth rate among all regions. Rising adoption and understanding of the characteristics of starch and its application in eco-friendly packaging has resulted in the growth of the market in the United States, Canada, and Mexico. In addition, increased polymer consumption in the medicines and pharmaceuticals, fabrics, papers and corrugates, and livestock feed industries will drive growth soon.

Rodenburg Biopolymers, Novamont S.P.A., Bio grade, Nihon Corn-starch Corporation, BASF SE, Plantic Technologies Limited, Lactel Absorbable Polymers, Wuhan Huali Environmental Technology Co., Ltd., Balson Industries, among others, are the key players in the starch blended biodegradable polymer market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Starch Blended Biodegradable Polymer Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Technology Overview

2.1.4 Application Overview

2.1.6 Regional Overview

Chapter 3 Starch Blended Biodegradable Polymer Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing customer reliance on renewable substrate and natural polymers

3.3.2 End-User Challenges

3.3.2.1 High competition for raw materials availability among various sectors

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over End-User Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Starch Blended Biodegradable Polymer Market, By Type

4.1 Type Outlook

4.2 Biodegradable Starch

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Durable Starch

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Starch Blended Biodegradable Polymer Market, By Technology

5.1 Technology Outlook

5.2 Blow Molding

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Extrusion

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Injection Molding

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Others

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Starch Blended Biodegradable Polymer Market, By Application

6.1 Agriculture and Horticulture

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Automotive and Transportation

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Packaging & Bags

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Food and Beverage

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Building and Construction

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

6.6 Electrical & Electronics

6.6.1 Market Size, By Region, 2020-2026 (USD Billion)

6.7 Biomedical

6.7.1 Market Size, By Region, 2020-2026 (USD Billion)

6.8 Textile

6.8.1 Market Size, By Region, 2020-2026 (USD Billion)

6.9 Others

6.9.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Starch Blended Biodegradable Polymer Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.4 Market Size, By Application, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.4 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Type, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.4 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Technology, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Type, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.4 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.4 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Rodenburg Biopolymers

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 Novamont S.P.A

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 Biograde

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 Nihon Corn-starch Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 BASF SE

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 Plantic Technologies Limited

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 Lactel Absorbable Polymers

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Wuhan Huali Environmental Technology Co., Ltd

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.10 Balson Industries

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

The Global Starch Blended Biodegradable Polymer Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Starch Blended Biodegradable Polymer Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS